CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

In April 2025, Stellantis announced its “Freedom of Choice” employee pricing program for Jeep, Ram, Dodge, and other brands sold in the U.S. The name sounds empowering, especially during a time of uncertainty around tariffs and rising vehicle costs.

But here’s the fine print: employee pricing cannot be combined with any other offers. Car shoppers can choose the offer that works best for them, and rarely does that turn out to be employee pricing.

We reviewed Stellantis’ current incentives and compared employee pricing savings to the brand’s traditional financing and cash offers. The verdict? In most cases, you’ll save more by skipping employee pricing entirely.

Jeep, Ram, Dodge, and Chrysler shoppers have reportedly been told by dealers that this month’s employee pricing offer roughly equates to 5% below dealer invoice pricing, plus a $200 administrative fee. Using our free Dealer Invoice Price calculator, we did some simple math to estimate what buyers will end up paying with the “Freedom of Choice” employee pricing offer.

Here’s our closest estimation of how much you can save with Stellantis employee pricing compared to the best manufacturer incentives:

| Model | Estimated Employee Pricing Savings | Savings From Other Offers |

| Ram 1500 | $1,700 – $5,800 | Up to $10,500 |

| Jeep Grand Cherokee | $900 – $1,800 | Up to $7,000 |

| Jeep Wrangler | $800 – $1,200 | $4,000 – $6,000 |

| Jeep Compass | $500 – $700 | Up to $7,500 |

| Dodge Durango | $1,200 – $1,500 | $1,000 |

When we look at the best available incentives, we see exactly why employee pricing is rarely the better offer:

The bottom line: The other incentives usually beat employee pricing by thousands—especially if you qualify as a current lessee.

There’s one notable exception: the Dodge Durango. With only $1,000 in cash available through traditional incentives, employee pricing of $1,200 to $1,500 may offer a slight edge.

However, this is the exception, not the rule. On every other top-selling Stellantis model we analyzed, employee pricing resulted in smaller savings than the cash or APR offers already on the table.

Stellantis wants to frame this promotion as a win for buyers—but in practice, it’s a strategic move to repackage existing discounts under a new label. And with auto tariffs now in effect, automakers are under pressure to maintain demand as affordability takes a hit.

Here’s the current context:

Not really — at least, not for most buyers. This promotion is about reshaping perception more than reducing prices. The idea of paying “what the employees pay” sounds like a deal. But when it’s your money on the line, the only numbers that matter are how much you’ll actually save.

Before you head to the dealership:

👉 Take these car buying cheat sheets with you to the dealership!

And remember , you can always have us negotiate the best deal on your behalf. We’re simply here to help!

When Ford announced its “From America. For America.” employee pricing campaign in April 2025, it sounded like a patriotic win for car shoppers. After all, employee pricing has long been viewed as a golden ticket to deep discounts, especially as tariffs threaten to send prices higher. And in June, Ford has decided to extend employee pricing through Fourth of July weekend.

But is it really the deal it seems to be?

We dug into the numbers, comparing Ford’s employee pricing offers to last month’s manufacturer incentives and actual dealer invoice prices. The result? Some Ford shoppers may actually save less with this flashy promotion than they could have with traditional offers. Let’s break it down.

To determine if Ford’s employee pricing offer is indeed a good deal, it helps to take a look back at previous incentives. Here’s what Ford was offering in March 2025:

Now compare that to the Ford’s employee pricing offers this month:

| Model | Employee Pricing |

| Ford F-150 Lightning | $4,800 off MSRP |

| Ford Mustang Mach-E | $2,115 off |

| Ford Edge | $1,650 off |

| Ford Explorer | $3,000 off |

| Ford Expedition | $4,200 off |

| Ford F-150 | $3,100 off |

| Ford Bronco | $1,800 off |

| Ford Mustang | $2,350 off |

At first glance, those look like solid discounts, and in some cases they are. But there’s more to the story. These discounts are straight from Ford’s Employee pricing page. Ford does not share savings for higher trims, which is what most buyers are looking for.

👉 Luckily, we have an easy way for you to see roughly what you’d pay with employee pricing. For any Ford model and trim, see the Dealer Invoice Price with our free tool to get a ballpark estimate of employee pricing.

There are a few standout models where April’s deals actually beat what was available in March. However, these models share something in common: Most of these are the slower-selling Fords on the lineup in 2025:

Why these stand out: Ford is combining employee pricing with financing offers on slow-selling or heavily incentivized models. That can stack up to serious savings—but only for a select few models.

For other Ford models, employee pricing offers less value than what was available just last month.

Here’s how much less you’d save with employee pricing compared to previous incentives back in March:

| Model | Employee Pricing Savings (vs. March) |

| Ford Expedition | $3,285 less |

| Ford F-150 | $1,252 less |

| Ford Bronco | $1,464 less |

| Ford Mustang | $914 less |

Why the difference? These models lost their low-interest APR offers. Employee pricing only lowers the sticker price—but if you’re financing, the interest savings from March made a bigger impact on your total cost.

Ford’s employee pricing campaign is designed to sound impressive—especially during a time when several Ford models are impacted by tariffs. But from a buyer’s standpoint, it’s more of a marketing rebrand than a true price drop.

In early April, the Trump administration’s 25% tariff on imported vehicles officially took effect, sending shockwaves through the auto industry. While Ford assembles many of its models in the U.S., the brand still relies on imported components—and foreign-built models like the Mustang Mach-E are now more expensive to bring in. Faced with rising cost pressure and public concern about affordability, Ford launched its “From America. For America.” employee pricing campaign to frame itself as the patriotic, price-friendly choice.

But look past the headlines, and the math tells a different story:

In short, ongoing tariffs are putting pressure on Ford’s pricing and inventory strategy, and this employee pricing rollout is less about passing along massive savings to buyers—and more about staying competitive in a shifting market. It’s a convenient narrative, but the real savings vary widely by model, and in some cases, buyers would have been better off last month.

Before you sign on the dotted line, know what a great deal actually looks like. The best way to do that?

See how employee pricing compares to what others are really paying—and to what the dealer paid. You might find that the “discount” isn’t much of a discount at all.

Another smart tip? Always look at the total cost of ownership, not just the sticker price. Getting stuck with an unreliable car that’s costly to insure can cost you thousands of dollars added transportation costs!

The campaign appears to be as much about marketing and managing inventory in the face of rising tariffs and high stock levels as it is about providing genuine discounts. To determine if the “employee pricing” is truly a good deal, potential buyers should compare it against dealer invoice prices and consider the total cost of ownership, rather than relying solely on the advertised savings.

As always, buyers who do their homework and compare invoice prices, financing offers, and available incentives come out ahead. Luckily, we’ve got the tools for you to make an empowered purchase, whether you’re shopping Ford’s employee pricing offers or any other vehicle.

![10 Cars with the Lowest Cost of Ownership [2025 Data]](https://caredge.com/wp-content/uploads/2024/07/2024-07-11_The-Hidden-Costs-of-Owning-a-Car_Blog-Header-Image_1920x1080_v1-1080x675.jpg)

Looking for a car that won’t drain your wallet over time? With rising prices and high interest rates still making headlines in 2025, keeping an eye on total cost of ownership is more important than ever. From depreciation and insurance to fuel and maintenance, CarEdge Research has identified the ten cars with the lowest five-year cost to own. These models aren’t just affordable upfront—they’re built to save you money in the long run.

Predicted 5-Year Total Cost of Ownership: $29,686

Starting MSRP with Destination Fees: $24,915

Predicted 5-Year Depreciation: – $5,164

Known for its great fuel economy and excellent reliability, the Corolla is a favorite among city drivers and commuters alike. In 2025, the Corolla is available as both a sedan and hatchback. Low depreciation and high resale value keep it among the top budget-friendly choices. One stand out for the Corolla: depreciation, or the lack thereof. The Corolla sees the least depreciation of any new car on sale today.

See Toyota Corolla Cost of Ownership Data

Predicted 5-Year Total Cost of Ownership: $31,581

Starting MSRP with Destination Fees: $21,650

Predicted 5-Year Depreciation: – $7,460

The Hyundai Venue is one of the most affordable crossovers you can buy in 2025. This subcompact SUV is popular for its unique exterior styling, surprisingly roomy interior, and value-packed trim levels. With a starting price of just $21,650, the Venue is one of the last truly affordable cars in America.

See Hyundai Venue Cost of Ownership Data

Predicted 5-Year Total Cost of Ownership: $33,356

Starting MSRP with Destination Fees: $25,400

Predicted 5-Year Depreciation: – $8,572

The Honda Civic continues to be one of the most well-rounded compact cars on the market. With excellent fuel economy, top-tier safety ratings, and a reputation for long-term reliability, it’s no surprise the Civic ranks among the cars with the lowest total ownership costs.

See Honda Civic Cost of Ownership Data

Predicted 5-Year Total Cost of Ownership: $33,392

Starting MSRP with Destination Fees: $23,165

Predicted 5-Year Depreciation: – $9,963

The all-new Kia K4 replaces the outgoing Forte and brings sharper looks and more tech to the compact sedan segment. It’s already gaining traction as one of the best values in 2025. An electric version of the K4 is on the way for 2026, but the gas-powered model offers exceptional affordability today. We don’t expect the electric companion to start under $30,000 when it arrives.

See Kia K4 Cost of Ownership Data

Predicted 5-Year Total Cost of Ownership: $33,425

Starting MSRP with Destination Fees: $22,730

Predicted 5-Year Depreciation: – $8,828

The Nissan Sentra is a budget-friendly compact sedan known for its overall value for the low price. It may fly under the radar, but the Sentra deserves more fans with some of the lowest five-year costs in the segment.

See Nissan Sentra Cost of Ownership Data

Predicted 5-Year Total Cost of Ownership: $33,547

Starting MSRP with Destination Fees: $24,780

Predicted 5-Year Depreciation: – $9,062

Standard all-wheel drive and a reputation for durability help the Subaru Impreza stand out in a sea of compact sedans. Following the discontinuation of the Legacy, the Impreza is now Subaru’s only mainstream sedan. For drivers in colder climates, it’s an unbeatable value.

See Subaru Impreza Cost of Ownership Data

Predicted 5-Year Total Cost of Ownership: $35,005

Starting MSRP with Destination Fees: $23,220

Predicted 5-Year Depreciation: – $9,334

Redesigned for 2025, the Nissan Kicks brings a bold new look, updated tech, and more space to the compact crossover market. It’s a popular pick for first-time buyers and those wanting SUV practicality without the SUV price. Despite the upgrades, it remains one of the cheapest cars to own over five years.

See Nissan Kicks Cost of Ownership Data

Predicted 5-Year Total Cost of Ownership: $35,108

Starting MSRP with Destination Fees: $23,460

Predicted 5-Year Depreciation: – $9,271

A household name for decades, the Toyota Corolla sedan is known for bulletproof reliability and low operating costs. With strong resale value and minimal maintenance expenses, the Corolla continues to be one of the safest bets for anyone looking to save money over time.

See Toyota Corolla Cost of Ownership Data

Predicted 5-Year Total Cost of Ownership: $35,337

Starting MSRP with Destination Fees: $18,337

Predicted 5-Year Depreciation: – $9,562

The Nissan Versa remains America’s cheapest new car—at least for a little while longer. Nissan has announced the Versa will be discontinued after the 2025 model year. Known for its simplicity and low cost of entry, the Versa still offers one of the lowest costs of ownership of any new car on sale.

See Nissan Versa Cost of Ownership Data

Predicted 5-Year Total Cost of Ownership: $36,460

Starting MSRP with Destination Fees: $21,895

Predicted 5-Year Depreciation: – $11,863

Completely reimagined in 2024, the Chevrolet Trax has quickly become one of Chevy’s best sellers. With SUV looks, compact car pricing, and great standard tech, the Trax is ideal for drivers who want more for less. Its low price and fuel efficiency help keep five-year ownership costs impressively low.

See Chevrolet Trax Cost of Ownership Data

What was officially the cheapest new car on sale in America has been discontinued following the 2024 model year. Starting at just $18,015, the Mirage was so bare bones that it appears to have been too cheap for most budget buyers, who tended to opt for better equipped models in the $20,000 – $25,000 price range. Mitsubishi sold fewer than 30,000 of the Mirage in all of 2024.

As of April 2025, 5,000 new Mirages remain on dealership lots nationwide. It’s worth noting that the Mirage has a 5-year cost to own of just $30,325. However, due to its discontinuation and dwindling inventory, we omitted it from the official top 10.

On a similar note, the Kia Forte would’ve made this list if it hadn’t already been replaced by the Kia K4. Just 288 new Fortes are left unsold as of April. If you’re lucky enough to drive one home, expect a low cost of ownership of just $33,910 over the first five years of ownership.

It’s easy to focus on MSRP when shopping for a new car, but the sticker price only tells part of the story. Insurance, maintenance, and depreciation can quietly add thousands to your total cost over time, even for a new car. Every model on this list proves that affordable ownership is still possible in 2025, but only if you make a smart purchase.

Whether you’re shopping new or used, don’t just ask what a car costs today—ask what it’ll cost you tomorrow. For deeper insights, explore cost of ownership and depreciation data for every model at CarEdge Research.

On April 9, President Trump announced a 90-day pause on most reciprocal tariffs, marking a temporary shift in U.S. trade strategy. However, there was one glaring exception: automotive tariffs remain firmly in place.

At a White House press conference, Treasury Secretary Scott Bessent confirmed that the pause does not apply to sectoral tariffs like those affecting the auto industry. That means the 25% duty on imported vehicles that took effect on April 3, along with steel and aluminum levies, are still being enforced.

With the pause on reciprocal tariffs, many consumers and analysts are wondering what would happen if auto tariffs were next on the chopping block. Let’s be clear: as of April 9, auto tariffs are NOT paused. But as trade negotiations continue, it’s worth exploring how a change in that policy might impact car prices, inventory, and the broader market.

Despite the current uncertainty, automakers are preparing for the 2026 model year. Some, like Honda (with the new 2026 Passport) and Porsche (with the upcoming 911), have already announced higher prices for 2026 models.

Why does that matter? Because automakers plan MSRPs months—even years—in advance. And tariff policy plays a big role in those decisions. Even American brands are affected. The higher the tariff burden on imported components or vehicles, the higher the MSRP is likely to be, even for U.S.-assembled cars that rely on global supply chains.

The continued enforcement of auto tariffs through this summer and beyond means automakers will build 2026 pricing with the uncertain trade environment in mind. Simply put, consumers should expect higher prices as automakers set prices for next year’s models.

See Every Car and Truck Manufactured in the U.S.

A few European automakers have already reacted decisively: Audi and Jaguar Land Rover have paused all shipments of new vehicles from its European factories to the United States. Neither automaker has any production in the United States. Both Audi and JLR import 100% of their U.S. lineup from overseas plants.

If auto tariffs continue without a pause or significant reduction, we can expect to see additional overseas auto brands pausing shipments to the U.S. market.

It hasn’t happened yet. Despite the big news on April 9, 2025 that most reciprocal tariffs are paused for 90 days, it’s important for car buyers to understand that these developments do not impact tariffs on new car imports. But, what if trade negotiations do result in a pause in the weeks or months ahead?

If the U.S. were to pause auto tariffs, we’d likely see a rush of vehicles into the American market from automakers looking to take advantage of the window before tariffs return. Luxury car brands would scramble to send inventory to the U.S. market as quickly as possible.

European automakers would move fastest: brands like BMW, Mercedes-Benz, and Volkswagen Group (including Audi and Porsche) would likely prioritize North American shipments.

For example, neither Audi nor Porsche produce any of their models in North America. Every vehicle sold here is shipped in from Europe. If tariffs were lifted, even temporarily, these brands would scramble to flood the market with inventory. Cargo ships full of luxury SUVs and sports cars could hit American shores within weeks.

Asian automakers have a large manufacturing presence in the U.S. these days, but we’d see plenty of imported models arrive at ports as quickly as a cargo ship can cross 5,000 miles of the Pacific Ocean. Automakers with manufacturing facilities in Canada and Mexico have been partly shielded by the USMCA agreement, but we’d likely see a rush of those vehicles into the United States, too.

With so many vehicles arriving on U.S. shores, it’s possible that new car prices may soften due to a temporary buildup of imported cars. Whether or not prices would meaningfully fall would depend on the scale and duration of a future tariff pause.

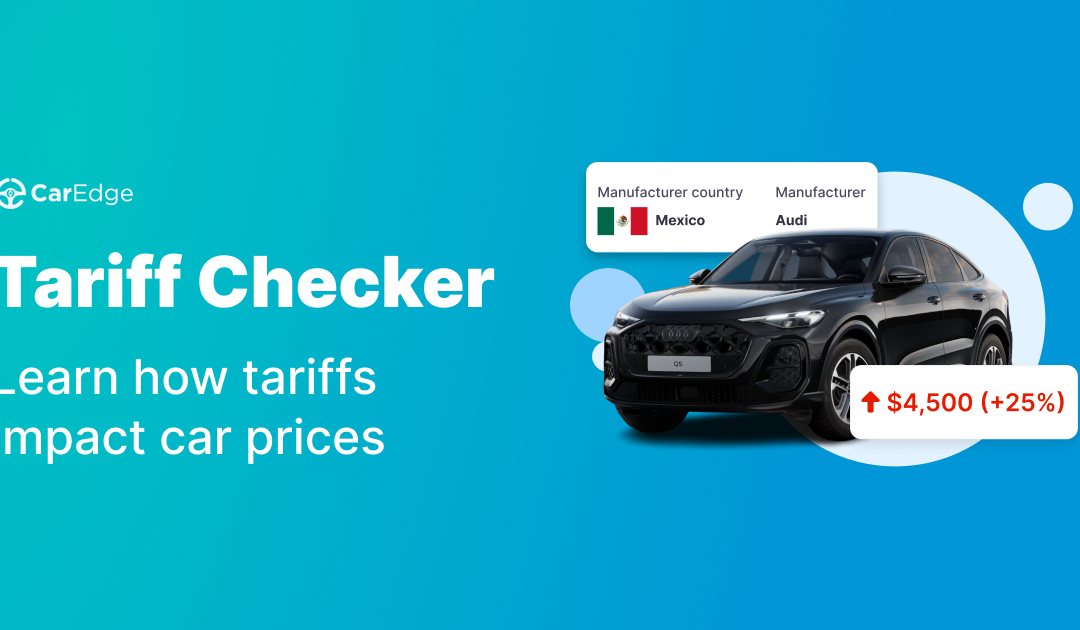

👉 Free Auto Tariff Checker: See if your next car is impacted

A temporary pause in U.S. auto tariffs would send ripples across the global car market. Here’s what we might see:

– Short-term inventory surge: European and Asian automakers could ship in as many vehicles as possible during the pause. This could temporarily ease tight inventory for luxury models in the U.S.

– Price volatility: If OEMs believe tariffs might return soon, they may still keep MSRPs high to account for risk. However, dealers may offer temporary discounts to move sudden surpluses.

– Trade policy whiplash: Repeated changes to tariff policy make long-term planning difficult for both automakers and car buyers. This uncertainty trickles down to prices, supply chain strategies, and even where vehicles are manufactured.

– Pressure on U.S. brands: If imports flood the market, U.S. automakers might respond with better deals or financing to stay competitive.

While most reciprocal tariffs have been paused, auto tariffs remain fully in effect as of April 9. This has real implications for car pricing and availability, especially for luxury imports.

If you’re in the market for a car, especially a European model, pay close attention to trade news. A sudden policy shift could bring a wave of new inventory — or trigger another round of price hikes.

For now, the best thing you can do is stay informed and shop smart. Use tools like CarEdge’s Free Car Buyer’s Guide and local car market insights to track local inventory and get the best deal, no matter what direction trade winds blow.

Looking for a great deal on a new car or truck this spring? Some of the biggest automaker discounts we’ve seen all year are here in April, with up to $10,500 off MSRP on full-size trucks, SUVs, and EVs. We’ve rounded up the 10 best cash discounts available right now, with savings that could make a serious dent in your out-the-door price. Keep in mind that most of these offers expire at the end of the month, so if you see something you like, act fast.

Don’t shop without your personal buyer’s guide (100% Free)

April Savings: Up to $10,500 cash allowance with V6 engine

Offer valid through: 4/30/2025

Ram is back with a huge cash offer this month, and a headline-making employee pricing offer. Current FCA US lessees can qualify for up to $10,500 in total cash savings when financing a 2025 Ram 1500 equipped with the V6. With summer truck season around the corner, this might be one of the best opportunities all year on a full-size truck.

Compare Ram 1500 depreciation, cost of ownership, and more

April Savings: $10,500 customer cash (cannot be combined with financing)

Offer valid through: 4/30/2025

Dodge is having a tough time convincing fans of muscle cars that the electric Charger is worth a test drive. Demand didn’t really slow, it never picked up to begin with. The 2024 Charger Daytona is available with a $10,500 cash allowance in April. Prefer to finance? You can choose 0% APR for 72 months plus $3,000 bonus cash instead.

See Dodge Charger listings in your city

April Savings: $10,000 for current FCA lessees, or 0% APR for 72 months

Offer valid through: 4/30/2025

The Dodge Hornet continues to be a hot discount target. Why? Stellantis still has nearly 4,000 2024s to sell in April. Buyers can get up to $10,000 in bonus cash or opt for interest-free financing for 72 months. It’s important to consider the Hornet’s poor value rating before you buy.

Before you buy: Compare Dodge Hornet cost of ownership ratings

April Savings: $8,000 cash for Trailhawk 4xe and above

Offer valid through: 4/30/2025

Jeep is offering big savings on its plug-in hybrid Grand Cherokee, with up to $8,000 in bonus cash available. If you’re more into financing, 0% APR for 72 months is also on the table. April is a smart time to buy this efficient SUV with off-road capability. However, don’t expect resale value to hold up.

Compare Jeep Grand Cherokee depreciation, cost of ownership, and more

April Savings: $7,000 for competitive brand owners; $5,000 + 0% APR for others

Offer valid through: 4/30/2025

Jeep is offering aggressive conquest bonuses on the Wagoneer. If you currently drive a non-FCA vehicle, you can get $7,000 in cash with this conquest incentive. Prefer to finance? Opt for 0% APR and $5,000 bonus cash. Either way, you’ll get luxury-level comfort in a full-size SUV.

See discounted Jeep Wagoneer listings in your city

April Savings: $6,450 for current FCA lessees

Offer valid through: 4/30/2025

The 2024 Durango is now offered with Employee Pricing For All, and on top of that, Stellantis is stacking up to $6,450 in bonus cash for lessees. However, this is only a good deal if you don’t mind the depreciation and sketchy reliability.

Compare Dodge Durango listings near you

April Savings: $7,850 total value for current GMC/Buick lessees

Offer valid through: 4/30/2025

The 2025 Sierra 1500 is available with $6,500 purchase allowance and an additional $1,350 engine credit for the TurboMax configuration. Truck buyers looking to stick with GM will find this one of the most competitive offers this month.

👉 See the rest of the best truck deals in April

Compare GMC Sierra 1500 depreciation, cost of ownership, and more

April Savings: $7,500 retail bonus cash

Offer valid through: 4/30/2025

Hyundai is offering $7,500 in retail bonus cash on its best-selling EV. While it’s not stackable with financing, this brings the IONIQ 5 into a much more competitive price bracket — especially for those missing out on the federal EV tax credit. It’s unclear how much longer federal EV incentives will last, but at least the 2025 IONIQ 5 will qualify for the time being, as it’s manufactured in Georgia.

See Hyundai IONIQ 5 depreciation, cost of ownership, and more

April Savings: $5,000 customer cash

Offer valid through: 4/30/2025

With auto tariffs hitting luxury brands hard, Audi is stepping up incentives. The SQ5 quattro now comes with a $5,000 customer cash bonus. That’s real money off a high-performance luxury SUV with trademark Audi refinement.

Compare Audi SQ5 listings in your city

April Savings: $3,000 off MSRP

Offer valid through: 4/30/2025

The GMC Terrain is one of the most affordable SUVs in its class, and this month’s $3,000 cash allowance makes it even more enticing. Note: this offer can’t be combined with financing or leasing. Be wary of high expected depreciation for the Terrain.

👉 Compare GMC Terrain depreciation, cost of ownership, and more

April deals feature surprisingly large cash discounts, especially considering mounting automotive tariffs. Several factors are driving these hefty incentives this spring:

At CarEdge, we help you make the most of these opportunities. Check out our cost-of-ownership tools, local market insights, and expert negotiation help to maximize your savings. If one of these offers looks good to you, don’t wait — these deals will expire at the end of the month!