CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

What if I told you that auto dealerships are one of the largest political forces in the United States? To dealerships both big and small, business is about a lot more than selling cars. There are 17,968 new car dealerships in the United States, a figure that has grown at the same time that vehicle inventory has plummeted, and new car prices have skyrocketed. As the price of a new vehicle rises out of reach for millions more American consumers, many are reporting all-time record profits.

How did dealerships come to exert such a massive influence on the economy and politics of the United States? To find out, we’ll take the backroads of America to bring this fascinating story of power and influence into the spotlight. Nine out of ten American households own a car, and 55% of autos are purchased at a dealership. This is the tale of how we got here.

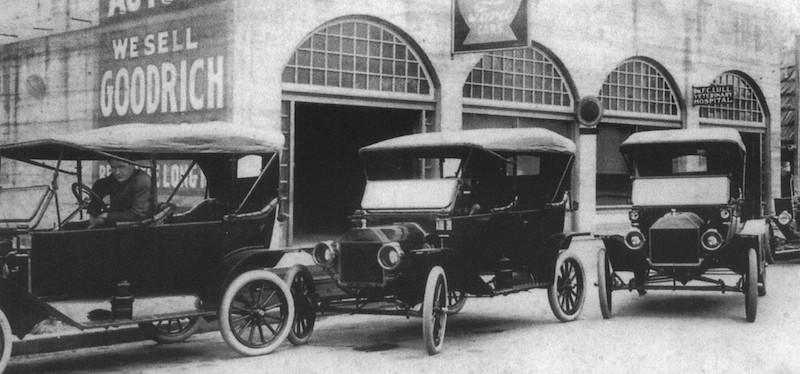

As the automotive industry was born in the late nineteenth and early twentieth centuries, automakers faced a dilemma. They had figured out how to engineer and produce a transformative product, but how would they deliver and service these first automobiles? Better yet, who would educate the consumer about vehicle ownership?

It’s important to remember that automakers were selling what they called ‘horseless carriages’ to customers at the time. The majority of the population knew nothing of internal combustion engines. In the first and second decades of the twentieth century, automobile adoption picked up pace. How would an ordered vehicle get to a customer’s hands? Who would service these ‘motor carriages’? Would the customer foot the bill for repairs, or would the automaker offer a warranty? These are just a few of the questions up for debate when the car dealer distribution model was conceived.

It took a few decades for the logistics of car distribution to get worked out. Not everyone was on the same page, and some pushed for solutions modeled after other industries. In fact, some early ideas sound ludicrous to us today. Many early auto industry players advocated for a mail order service modeled after the successes of Sears & Roebuck and Montgomery Ward. But that left too many questions unanswered for a young industry that was eager to get it right. Despite the world-changing invention at hand, automakers still feared their own demise. Considering how few of the early automakers have persisted to this day, their fears were not unfounded.

The first dealership in the United States was established in 1898 by William E. Metzger, who sold Oldsmobiles in Detroit. Over the next two decades, the dealership model rose to prominence, slowly overcoming competing automobile sales models. In 1917, the now-famous National Auto Dealers Association (NADA) was established with the goal of giving car dealers a voice in Washington.

Today, the NADA is a nationally-recognized industry and political force that represents over 16,000 auto dealers nationwide. However, one of America’s most powerful lobbies had humble beginnings rooted in the turmoil of a wartime economy.

The NADA was founded in 1917 when a group of dealers set out to change the way Congress viewed the emerging automobile industry. Thirty dealers from state and local associations succeeded in convincing Congress that cars weren’t ‘luxuries’ as they had been classified in the federal tax code. By convincing lawmakers that cars were vital to the economy, the group prevented the conversion of young automobile manufacturing facilities into wartime factories. The so-called ‘luxury tax’ that had been levied on cars was reduced from 5 percent to 3 percent.

In essence, the NADA has been lobbying since the very beginning. And they’re good at it. From 1919 to the present day, the group spearheaded hundreds of legislative priorities that served the interest of the ever-growing number of car dealers in the United States.

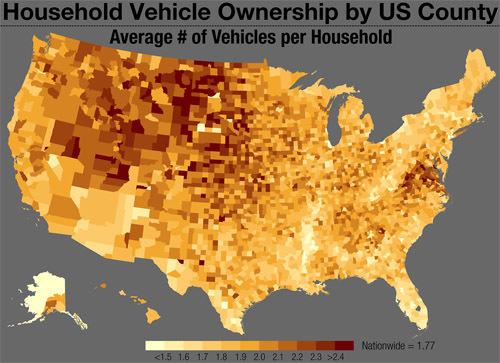

In American car culture, cars are central to the economy and most of our day-to-day lives. In 2020, 91% of American households owned at least one car, a figure that continues to grow. Where do the 276 million registered vehicles in the U.S. come from? Tesla and Rivian aside, it’s almost always from a local dealer.

State dealer associations are prominent organizations around the country. The Florida Automobile Dealers Association has over 1,000 dealer members, and dozens of other states have associations of similar size. Political action begins at the grassroots level, and this is where state dealer associations flex their muscle.

State auto dealer associations provide networking opportunities for professionals, a regional dealer support system, and a venue for working out solutions to challenges. There’s also the unified political voice that lobbies at the local, state and nationwide levels. Lobbying costs money, both in the form of employing professional lobbyists, and in lawmaker donations. I’ll scratch your back if you scratch mine? Dealer industry associations have shown time and time again that their lobbyists achieve the desired outcome more often than not.

A recent example of what’s possible at the state level comes in the form of an emerging legislative push that’s troubling for any electric vehicle owner or prospective buyer. In 2022, bills were introduced in both Oklahoma and West Virginia that would ban over-the-air (OTA) updates. Why? Car dealer lobbying groups are doing their best to keep drivers returning to dealer service centers for repairs. Tesla’s pioneering OTA updates have revolutionized everything from performance upgrades via wifi to recall fixes from the comfort of home.

Why would dealership lobbying groups have a bone to pick with OTA updates? Service center visits account for nearly half of total dealership revenue, with some locations relying heavily on service to stay profitable. The electrification of the auto industry is here, and resistance to OTA updates is just a sign of what could be around the corner.

Online car sales have disrupted the industry over the past decade, with the likes of Carvana and Vroom seemingly coming out of nowhere. Their entrance hasn’t been without problems. Carvana is under pressure for repeatedly failing to transfer vehicle titles in a timely manner. The solution? A Florida state senator took the time to hand-craft legislation to simply remove the requirement to provide the title at all. If that’s not motivated by state-level dealer lobbying, I don’t know what is.

Over 1.2 million Americans are employed at the nearly 18,000 franchised car dealerships and 60,000 independent dealerships in the United States. The power of dealerships is very much rooted in the economy of the nation. However, this power is not evenly distributed. In many communities, particularly in small-town America, dealerships have an oversized role in the local economy.

Jim Lardner, spokesperson for Americans for Financial Reform, told David Dayen of The Intercept that communities sometimes even rely on the economic powerhouse of locally owned and operated dealerships. “They sponsor Little League teams. Their advertising dollars are crucial to local newspapers and broadcasters. When they talk, lawmakers don’t just listen — they have a hard time hearing anybody else or looking at facts.”

As is often the case, with more economic power comes the appetite for political power. Sure, probably not for the sake of power itself, but to have a say in the rules of the game.

The National Auto Dealers Association has delivered $35 million to members of Congress since 2022. The NADA maintains a large lobbying operation in DC, one that costs $3 million a year to operate. The power of dealers is not limited to the doings of the NADA and state-level associations. In a recent election cycle, 372 of 435 members of the House of Representatives received campaign contributions (money) from auto dealers. 57 out of 100 senators could say the same.

On a national level, the NADA has collaborated with the Alliance of Automobile Manufacturers and even the American Financial Services Association to push favorable legislation. In 2015, a rare bipartisan bill was a textbook example. The bipartisan bill amounted to a stand-down order to the Consumer Financial protection Bureau (CFPB). Shouldn’t lawmakers be standing up for the consumer, not the opposite?

It gets worse. The CFPB was established in 2011 to protect consumers to promote “transparency and consumer choice and prevent abusive and deceptive financial practices. It was partially in response to what we all went through in the 2008 financial crisis. When the CFPB was created, a special provision was added last-minute just for nervous dealers. This provision, which is enshrined in CFPB regulations, says that the agency itself can NOT directly monitor dealerships. As David Daley notes in his wonderful piece in The Intercept, “the CFPB can only fine the lenders who finance car purchases, not the dealers who make the markups”.

This is one of many examples of auto dealers wielding their power to influence laws and regulations in their favor. The secret to their success is something called legislative riders. Riders are provisions or ‘add-ons’ that can be added to a bill last-minute, often with hopes of its controversial aspects being buried in the hundreds or thousands of pages of more newsworthy text. The West Virginia OTA ban that was proposed and later removed is one such example. It was conveniently tucked into a much larger pro-dealer bill.

Record new and used car prices from 2021 to 2023 soured consumer sentiment. Dealer markups regularly reached beyond $10,000, and more car buyers turned to Tesla and other direct-to-consumer automakers to steer clear of the dealership experience. Nine out of ten Tesla buyers cite the no-hassle direct-to-consumer sales model as a major factor in their buying decision. Now, legacy automakers are testing the waters too.

In 2022, Ford made headlines with the announcement that it would split into two new companies under the Ford Motor Company umbrella: Ford Blue for combustion sales, and Ford Model e for electric vehicle sales.

Ford Model e transforms Ford’s electric vehicles sales model to something between direct-to-consumer and the traditional dealership model. There will be no-haggle set pricing, online ordering, but dealers will continue with a role as delivery, test drive and service centers. If you haven’t connected the dots, Ford is taking a few big steps away from the past century of traditional dealership sales. Will other automakers follow?

Mercedes-Benz and BMW are beginning to test what they call agency sales in Europe. Essentially, it’s the same concept as Ford’s Model e business model. Are the floodgates opening in the push to direct-to-consumer sales? We’ll know soon enough.

Car dealerships are powerful economic and political forces in America. The birth of American car culture parallel to the rise of the dealership lobby was no coincidence. However, times are changing. Can dealers lobby their way out of an industry that is evolving at breakneck speed? What will buying a vehicle look like a decade from now? Unknowns abound, but one thing is for sure: the salespeople out front are eagerly awaiting your arrival.

You don’t have to spend one hundred grand to purchase an electric vehicle with great range in 2022. EVs aren’t cheap, but with fuel savings taken into account, the electric lifestyle starts to sound a lot more appealing. There’s a saying in electric mobility: range is king. That’s especially true for frequent road-trippers and those who live in one of America’s remaining charging deserts. These are the electric vehicles with the most range in 2022.

Note: We’ve decided to place an emphasis on affordable electric vehicles with the most range. Affordability is a moving target in 2022’s crazy auto market, but in the realm of EVs, we’ve defined ‘affordable’ as EVs under $65,000. If you’re in the market for luxury, we’ve got those covered too.

Range: 358 miles

Price: $57,190 with destination

Max charging speed: 250 kW (20-80% in 20 minutes, adding 214 miles of range)

0-60 mph (fun factor):

Federal EV tax credit qualification: No, credits were exhausted. Learn about EV incentives here.

See our full review of the 2022 Tesla Model 3 Long Range here.

Range: 270 miles

Price: $49,800 with destination

Max charging speed: 250 kW (20-80% in 20 minutes, adding 214 miles of range)

0-60 mph (fun factor): 6.8 seconds

Federal EV tax credit qualification: Yes, learn more about EV incentives here.

See our full review of the Polestar 2 here.

Range: 272 miles

Price: $48,190 with destination

Max charging speed: 150 kW (20-80% in 20 minutes, adding 163 miles of range)

0-60 mph (fun factor): 5.8 seconds

Federal EV tax credit qualification: No, credits were exhausted. Learn about EV incentives here.

See our full review of the 2022 Tesla Model 3 here.

Range: 259 miles

Price: $26,595 with destination (most affordable EV available today)

Max charging speed: 55 kW (adding 100 miles of range in 30 minutes, or 200 miles of range in 75 minutes)

0-60 mph (fun factor): 6.8 seconds

Federal EV tax credit qualification: No, credits were exhausted. Learn about EV incentives here.

See our full review of the Chevrolet Bolt here.

Here’s our list of the cheapest electric cars available today

Range: 330 miles

Price: $64,190 with destination

Max charging speed: 250 kW (adding 100 miles of range in 30 minutes, or 200 miles of range in 75 minutes)

0-60 mph (fun factor): 4.8 seconds

Federal EV tax credit qualification: No, credits were exhausted. Learn about EV incentives here.

See our full review of the Tesla Model Y here.

Range: 310 miles

Price: $42,155 with destination

Max charging speed: 235 kW (15-80% in 20 minutes, adding 217 miles of range in 18 minutes)

0-60 mph (fun factor): 7.3 seconds

Federal EV tax credit qualification: Yes, learn more about EV incentives here.

See our full review of the Kia EV6 here.

Range: 303 miles

Price: $45,295 with destination

Max charging speed: 235 kW (15-80% in 20 minutes, adding 197 miles of range in 18 minutes)

0-60 mph (fun factor): 7.5 seconds

Federal EV tax credit qualification: Yes, learn more about EV incentives here.

See our full review of the Hyundai IONIQ 5 here.

Range: 314 miles

Price: $53,550 with destination

Max charging speed: 150 kW (10-80% in 45 minutes, adding 220 miles of range)

0-60 mph (fun factor): 6.1 seconds

Federal EV tax credit qualification: Yes, learn more about EV incentives here.

See our full review of the Ford Mustang Mach-E here.

Range: 312 miles

Price: $64,185 with destination

Max charging speed: 190 kW (adding 195 miles of range in 30 minutes)

0-60 mph (fun factor): 6.4 seconds

Federal EV tax credit qualification: No, credits were exhausted. Learn about EV incentives here.

See our full review of the Cadillac Lyriq here.

See the latest EV availability and wait times for EVERY model

There are now three electric pickup trucks on American roads, but buying one is easier said than done. Everyone wants one, and wait lists extend months and in some cases, years. We’ve decided to include electric trucks that are not yet available for purchase, so long as specs have been released and reservations or orders can be placed today.

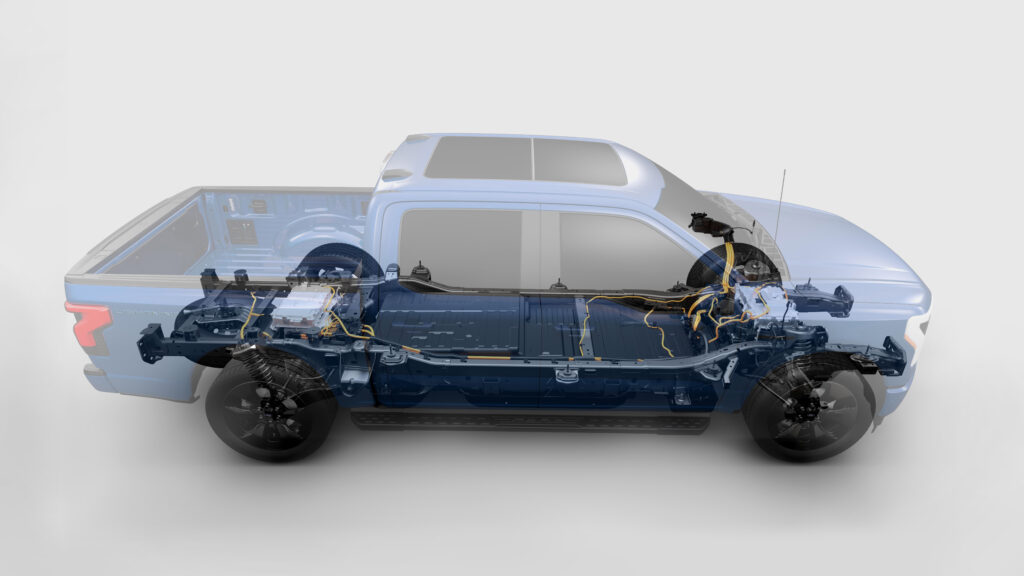

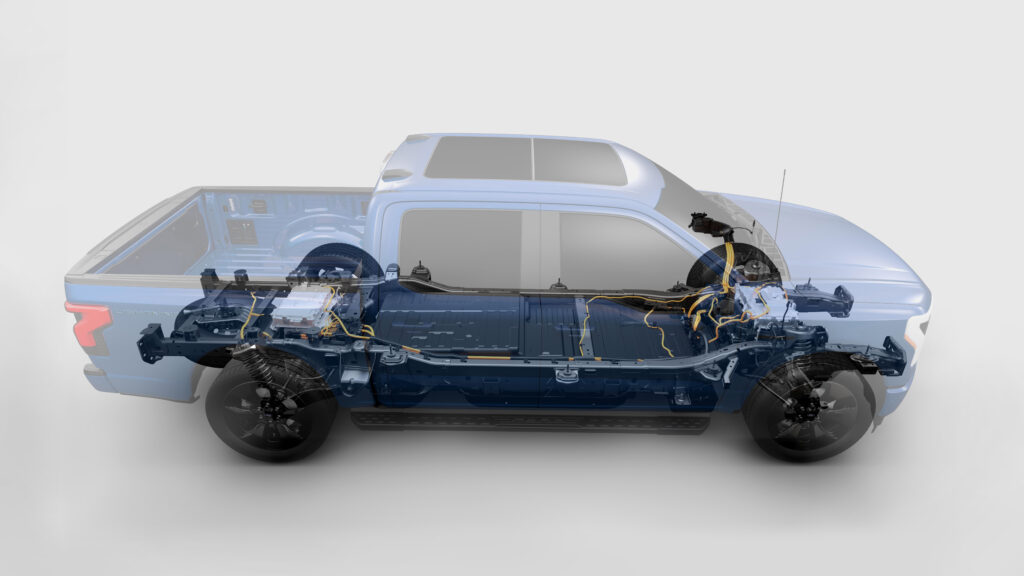

Range: 320 miles

Price: $72,474

Max charging speed: 130 kW (15-80% in 40 minutes)

0-60 mph (fun factor): estimated 4.5 seconds

Federal EV tax credit qualification: Yes, learn more about EV incentives here.

See our full review of the F-150 Lightning here.

Range: Estimated 400 miles

Price: $42,000 – $100,000+

Max charging speed: 350 kW (adding 100 miles of range in 10 minutes)

0-60 mph (fun factor): N/A

Federal EV tax credit qualification: No, credits were exhausted. Learn about EV incentives here.

See our full review of the Silverado EV here.

Range: 314 miles

Price: $80,000 – $100,000+

Max charging speed: 220 kW (10-80% in 40 minutes)

0-60 mph (fun factor): 3.0 seconds

Federal EV tax credit qualification: Yes, learn more about EV incentives here.

Learn more about Rivian’s R1T and R1S full-size SUV.

Range: 516 miles

Price: $139,000

Max charging speed: 300 kW (adding 300 miles of range in 20 minutes)

0-60 mph (fun factor): 2.6 seconds

Federal EV tax credit qualification: Yes, learn more about EV incentives here.

See our full review of the Lucid Air here.

Range: 405 miles

Price: $101,990

Max charging speed: 250 kW (adding 200 miles of range in 15 minutes)

0-60 mph (fun factor): 3.1 seconds

Federal EV tax credit qualification: No, credits were exhausted. Learn about EV incentives here.

Range: 350 miles

Price: $139,000

Max charging speed: 200 kW (adding 200 miles of range in 20 minutes)

0-60 mph (fun factor): 5.5 seconds

Federal EV tax credit qualification: Yes, learn more about EV incentives here.

See our full review of the Mercedes EQS here.

What does the future hold? Not necessarily more range, surprisingly. Many auto analysts expect range for relatively affordable EVs to settle in around the 250-350 mile range. Why? Battery shortages loom on the horizon. Raw materials are in high demand, and there are only so many places on Earth to get lithium, cobalt and other materials.

Should you buy an EV now or wait? If you can find what you want for MSRP or very close to it, it just might be the right time to buy or lease. All signs point towards higher EV prices for 2023 and 2024 model years.

Just a few months ago, Ford shook up the automotive industry and ignited rumors that brought anxiety for Ford dealers. Ford’s announcement to separate all-electric and internal combustion engine (ICE) sales was seen as a nod to Tesla, and a threat to the dealership model. Direct-to-consumer sales are in the works for the maker of the top-selling vehicle in America, and others are warming up to the idea. Who’s next?

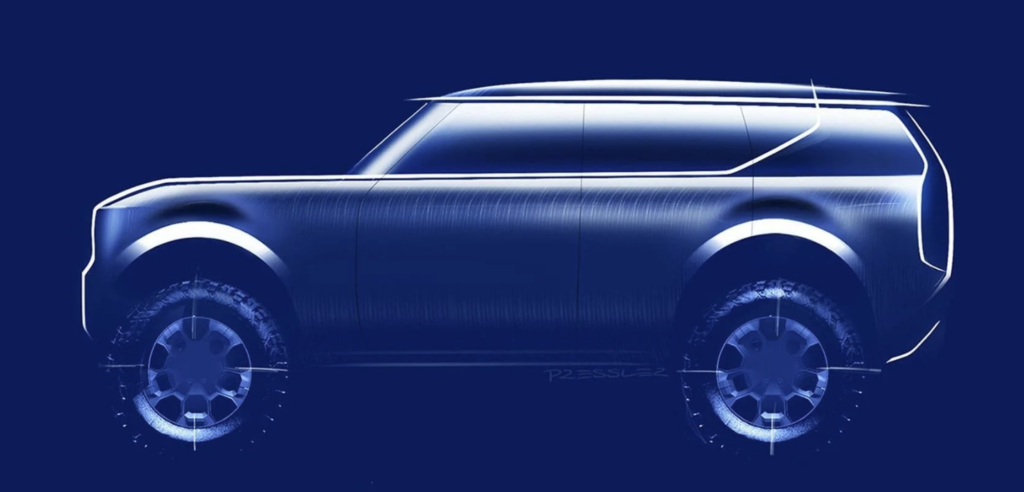

Months later, other automakers have been cornered into taking a stance with regards to the future of their franchise dealership relationship. Volkswagen’s surprise revival of the Scout brand is the latest headline to force this conversation to the forefront. Mercedes, BMW and MINI are considering similar moves. What does it all mean for the consumer? Are car dealerships going away, or is the auto industry going through an inevitable transition?

Is the Golden Age of Dealerships Coming to an End?

In 2023, there are nearly 18,000 car dealerships in the United States. Despite all of the talk from automakers over the last several months, this figure has risen by 0.6% since last year. Take into account that dealer consolidations are also changing the game, 2023 is shaping up to be a turning point for dealerships.

I don’t think anyone saw this coming. Last year, Volkswagen announced that it intends to revive the legendary Scout brand as an all-electric line of pickup trucks and SUVs. Volkswagen was already a leading force in the electrification of the industry, and has seen success with the ID.4 crossover in America. The revived VW Scout brand isn’t going to be a niche product with low sales volume. Scout will aim for 250,000 annual sales in America, with the first vehicles arriving off production lines in just four year’s time.

While overlanding enthusiasts were serving up plenty of skepticism for VW’s Scout ambitions, Volkswagen dealers were having a bit of a freak-out. Automotive News journalist Larry Vellequette said that the move was “enough to roil hundreds of U.S. dealers of the automaker’s eponymous brand over the last few weeks like nothing since the German automaker’s costly diesel emissions scandal.” Such a bold claim isn’t made lightly considering the long-lasting impacts of the 2015 dieselgate scandal.

Volkswagen of America CEO Scott Keogh told Automotive News what he was able to share publicly.

“Everything that I know has been reported and you have reported it,” Keogh said. “First and foremost, Scout is and always was a unique and distinctly American brand — big-time Americana — so it won’t be operated through the Volkswagen brand. In fact, it won’t be operated through Volkswagen Group of America. It will be operated independently.”

National Automobile Dealer Association CEO Mike Stanton reached out to Keogh in a letter. The letter urged VW of America to “quickly and clearly communicate Scout’s distribution plan to your dealers who have made significant investments to support VW’s business model and transformation to electrification.”

Stanton warned that “the longer your dealers go without information and answers to their questions, the more that speculation will fill the void.”

Concerns are amplified at the state level, too. North Carolina Automobile Dealers Association President Robert Glaser told Automotive News that “despite repeated assurances throughout the years by Volkswagen that its dealers are ‘partners’ in advancing and promoting VW products, this announcement produced instant dismay and concern among all VW dealers.”

Clearly, if Volkswagen wasn’t considering a direct-to-consumer sales model for at least some of their brands, they would have reassured their dealers swiftly. Now, all dealers can do is speculate and hope for the best.

One might approach comparisons between the U.S. and European automotive industries with reluctancy, but we’ve seen the connection time and time again. Take Mercedes-Benz for example. When Mercedes announced it would begin enabling level 3 autonomous driving under certain conditions in Germany, most dismissed it as a European experiment. Not even Tesla had pulled that off. Just months later, Mercedes-Benz shared their goal of bringing level 3 autonomy to American roads, where it will complement the dazzling new EQS electric luxury sedan.

Now, Mercedes has announced their intention to downsize their dealership network in Europe, and to a lesser extent elsewhere, for now. In the automaker’s homeland of Germany, Mercedes says that 15 to 20 percent of its dealers will be effectively let go. Globally, they plan to cut 10 percent of their dealerships. Right now, Mercedes says that there are no plans for ‘dealer consolidation’ in America.

Why is Mercedes-Benz cutting dealers from the brand? One of their fiercest and most recent competitors has risen to fame by adopting direct-to-consumer sales, and they want a bigger piece of the DTC pie. Tesla has managed to achieve 14% EV market share in Europe in just a decade, already having surpassed Mercedes when it comes to electric vehicles sales.

Consumers are REALLY tired of haggling with salespeople at dealerships. Tesla has shown that there are alternatives. Therefore, Mercedes-Benz is pursuing a direct-to-consumer “agency” sales model. They believe 80 percent of European sales will be direct-to-consumer by 2025.

In the dealer agency model, automakers invoice customers directly, and dealers receive a fixed fee for every vehicle sold.

Ford’s bold Model e plan doesn’t cut dealers outright. Instead, Ford Model e re-envisions the role of dealers as delivery centers for online sales. It sounds like BMW Group is a fan of Ford’s plan.

BMW Group executive Pieter Nota confirmed that both BMW and MINI are looking hard at pursuing an agency model in which authorized dealers are transitioned into a delivery and customer experience role. Nota told Automotive News that talks are underway.

“We are currently talking with our European dealers about a move to a genuine agency model,” Nota told Automotive News Europe.

Back in March, Germany’s Autohaus magazine reported that BMW plans to end MINI’s authorized dealer system in Europe in 2024 before doing the same for BMW in 2026.

Ford’s Model e plans aside, dealers continue to have a strong grip on auto sales in America. Tesla is the face of DTC sales in the U.S. for the time being. However, the tides are turning. It’s only a matter of time before European automakers bring their “agency” sales models to the U.S. Direct-to-consumer sales equal higher profits for automakers, and they’re not going to pass up the opportunity for some extra cash, especially as the costs of electrifying their lineups are approaching one trillion dollars. In other words, it’s not “if”, but “when”.

Until charging stations are commonplace, owning an electric vehicle will require more planning and preparation than one would expect for a day’s drive. Range is the new MPG, however real-world range isn’t easy to pin down. When the U.S. EPA provides official range ratings, the figures are based on vehicles driving in controlled environments on a predetermined track. EV ownership is full of nuances, and one of the greatest is the affect of weather on range. Let’s explore how electric vehicles perform in cold weather, hot weather, rain and wind.

Cold weather reduces EV range, but how much depends on how toasty you keep the cabin. Sub-freezing temperatures reduce range by between 12% and 30%, but that’s without the climate control on to warm the cabin. Data from AAA found that once the heater is turned on, EV range can drop by as much as 41%. Some real-world tests have found range losses closer to 50% with below-zero temperatures. That’s not good if you travel long distances across the northern states or the Interior West. More on specific impacts below.

Yes, hot weather does reduce EV range. According to research conducted by AAA, hot temperatures don’t have quite as great of an impact as cold temperatures, but it’s still noticeable. In temperatures of 95 degrees Fahrenheit and the air conditioning on, driving range decreases by 17% on average.

A 17% drop in range would mean that a Model Y normally rated for 330 miles on a charge would get closer to 273 miles. Not too big of a deal. For electric vehicles with less EPA-rated range, it matters more. The standard range 2022 Nissan Leaf normally gets 150 miles on a charge, but that would drop to 124 miles in 95-degree weather. Ouch.

Rain, snow and anything else falling from the sky does lower EV range. Why? It creates drag, and EV efficiency is all about aerodynamics. The heavier the rain, the greater the impact on range, even if temperatures are perfect for battery performance.

Speaking of which, what is the ideal temperature for electric vehicle battery performance? Geotab’s analysis of data from 4,200 EVs found that 70 degrees Fahrenheit (21.5 Celsius) is ideal for battery performance. That’s not only perfect for maximum range, it’s great weather all around. Learn more in Geotab’s full report.

Similarly, wind’s impacts on electric vehicle range have to do with drag. Drag is in essence aerodynamic friction. Your fancy new electric car can’t slide through the air so efficiently with friction working on it.

Wind can work against you or for you. With a steady tailwind pushing you along, it’s common to exceed range expectations even on the highway. When there’s a substantial headwind, range drops, and sometimes by quite a lot. The impacts of wind on EV range are much more noticeable at highway speeds. It’s possible to gain or lose up to 20% of expected range depending on wind direction.

Temperature impacts battery performance differently depending on battery type and overall vehicle engineering. Features such as a heat pump, advanced battery preconditioning and even heated seats are just some of the many ways that engineers can do their best to optimize EV performance in suboptimal weather.

EV data specialists at Recurrent looked at data from all of the popular electric vehicle models. They found that EV range in hot and cold weather varies widely from one make and model to another.

Here’s how some of America’s most popular electric vehicles are affected by cold weather and summer heat.

| Make | Model | Rated Range | Real-World Range (70 deg F) | Cold Weather Range Loss |

|---|---|---|---|---|

| Tesla | Model 3 | 353 miles | 339 miles | 335 miles (-5% from rated range) |

| Tesla | Model Y | 330 miles | 320 miles | 323 miles (-2% from rated range) |

| Tesla | Model S | 405 miles | 397 miles | 380 miles (-6% from rated range) |

| Tesla | Model X | 351 miles | 326 miles | 326 miles (-7% from rated range) |

| Ford | Mustang Mach-E | 305 miles | 284 miles | 198 miles (-35% from rated range) |

| Chevrolet | Bolt | 259 miles | 254 miles | 171 miles (-34% from rated range) |

| Nissan | Leaf | 226 miles | 237 miles | 205 miles (-9% from rated range) |

| Hyundai | Kona | 258 miles | 288 miles | 240 miles (-7% from rated range) |

| Audi | e-tron | 222 miles | 224 miles | 206 miles (-7% from rated range) |

For a full breakdown of Recurrent’s findings, check out their 2021 report here.

The U.S. Department of Energy says that vehicles powered by traditional internal combustion engines (ICE) also suffer efficiency losses as a result of hot and cold weather. ICE vehicles are especially impacted by hot weather due to air conditioning power requirements. The Department of Energy estimates that ICE vehicles lose about 25% of their typical fuel economy when operating with air conditioning on high settings.

One major difference between EVs and ICE vehicles is the affect of cold weather. Electric vehicles use quite a bit of energy to run the heater, whereas ICE vehicles redirect heat generated by the engine and therefore avoid significant effects on efficiency.

Although EV charging stations are becoming commonplace around major cities, many interstate highways have sparse charging infrastructure. Until charging stations are more reliable and easier to find, driving an EV in cold and hot weather will complicate EV ownership and delay EV adoption. A national charging network is on the way, and public fast-charging networks are growing quickly. With EV market share soaring every month, it’s imperative that we find solutions to this seasonal challenge that affects millions.

We hear it all the time: electric cars save you money. Electricity is cheaper than gas, EVs require less maintenance, and incentives abound. However, there’s no hiding the fact that electric vehicles are expensive, especially the models with the best range, performance and charge rates. To shed light on the reality of electric vehicle savings, we dug deep into the data. How long does it take to break even when buying an EV? We were surprised with what we found.

The X4 is one of the most direct competitors to the 2022 Tesla Model Y, the best selling electric vehicle in America. Although Tesla models no longer qualify for the federal EV tax credit, the cost of the BMW X4 and high fuel consumption make this an interesting comparison.

| Model | MSRP | Price Difference | Incentives | Fuel Economy | Range | Time to Refuel | Cost to Refuel ($5.00/gal or $0.14 per kWh) | Annual Fuel Cost (15,000 miles) | Average Annual Maintenance Cost | Time to Break Even |

|---|---|---|---|---|---|---|---|---|---|---|

| BMW X4 xDrive30i | $51,800 | -- | 24 MPG | 413 miles | 5 min | $86.00 | $3123 | $228 | ||

| Tesla Model Y Long Range | $62,990 | +$11,190 | State and local only | 3.8 mi/kWh (125 MPGe) | 330 miles | 20 to 30 min | $10.50 | $477 | $77 | 4 years |

Pickup trucks get the worst fuel economy. It’s just a matter of physics; the shape of a truck is not aerodynamic, and they’re often heavy. The F-150 Lightning weighs 35% more than the gas-powered F-150. So you would think that the time to break even would be shorter when buying an electric truck over the combustion equivalent.

This side-by-side comparison highlights the importance of price parity for EVs. When EVs are similarly priced to ICE vehicles, the cost of ownership savings are crystal clear. But what about when the electric version costs over $25,000 more out the door? Have a look for yourself.

| Model | MSRP | Price Difference | Incentives | Fuel Economy | Range | Time to Refuel | Cost to Refuel ($5.00/gal or $0.14 per kWh) | Annual Fuel Cost (15,000 miles) | Average Annual Maintenance Cost | Time to Break Even |

|---|---|---|---|---|---|---|---|---|---|---|

| Ford F-150 Platinum 4WD 3.5 | $62,070 | -- | 20 MPG | 520 miles | 5 min | $130.00 | $3750 | $228 | ||

| Ford F-150 Lightning Platinum | $90,874 | +$28,804 | Fed, state and local | 2.1 mi/kWh (70 MPGe) | 320 miles | 45 min | $18.34 | $860 | $77 | 9.5 yrs (7 yrs with tax credit) |

Toyota sells nearly half a million RAV4s every year. Will things change now that Toyota has launched its first fully-electric vehicle? The all-new bZ4X lacks the range and charging speed to compete with the best in 2022’s electric segment, but how does it stack up to the popular RAV4 hybrid? How long would it take to break even when paying a premium for the electric bZ4X?

| Model | MSRP | Price Difference | Incentives | Fuel Economy | Range | Time to Refuel | Cost to Refuel ($5.00/gal or $0.14 per kWh) | Annual Fuel Cost (15,000 miles) | Average Annual Maintenance Cost | Time to Break Even |

|---|---|---|---|---|---|---|---|---|---|---|

| Toyota RAV4 XLE Hybrid | $30,545 | -- | 40 MPG | 580 miles | 5 min | $72.50 | $1,875 | $228 | ||

| Toyota bZ4X XLE FWD | $42,000 | +$11,455 | Fed, state and local | 3.5 mi/kWh (119 MPGe) | 252 miles | 1 hour | $10.19 | $606 | $77 | 8 years (2.7 yrs with tax credit) |

Subaru’s first EV is built on the same electric platform as the new Toyota bZ4X. Subaru is known for being Earth-friendly, but is the new Solterra EV friendly to your wallet? With range and charging figures more akin to 2015’s standards than today’s best EVs, the Subaru Solterra is off-road capable, but a tough sell for those who truly venture off the beaten path.

| Model | MSRP | Price Difference | Incentives | Fuel Economy | Range | Time to Refuel | Cost to Refuel ($5.00/gal or $0.14 per kWh) | Annual Fuel Cost (15,000 miles) | Annual Maintenance Cost | Time to Break Even |

|---|---|---|---|---|---|---|---|---|---|---|

| Subaru Forester base | $25,395 | -- | 29 MPG | 481 miles | 5 min | $83.00 | $2,588 | $228 | ||

| Subaru Solterra Premium | $46,220 | +$20,825 | Fed, state and local | 3.1 mi/kWh (104 MPGe) | 228 miles | 1 hour | $9.97 | $677 | $77 | 10 years (6.5 yrs with tax credit) |

The Hyundai IONIQ 5 won big at the 2022 World Car Awards, but is it a winner for your wallet? It all depends on how much you drive, and how long you plan to keep the vehicle. The Hyundai Santa Fe just received a total makeover, and its price remains much lower than the IONIQ 5’s. Still, EVs are super efficient and electricity is cheap. Just how long would it take to break even when buying an IONIQ 5 EV instead of the more affordable Santa Fe crossover?

Disclaimer: I own a Hyundai IONIQ 5 Limited AWD, and it’s awesome.

| Model | MSRP | Price Difference | Incentives | Fuel Economy | Range | Time to Refuel | Cost to Refuel ($5.00/gal or $0.14 per kWh) | Annual Fuel Cost (15,000 miles) | Average Annual Maintenance Cost | Time to Break Even |

|---|---|---|---|---|---|---|---|---|---|---|

| Hyundai Santa Fe SEL | $27,875 | -- | 26 MPG | 489 miles | 5 min | $94.00 | $2,883 | $228 | ||

| Hyundai IONIQ 5 SEL RWD | $45,900 | +$18,005 | Fed, state and local | 3.4 mi/kWh (114 MPGe) | 303 miles | 20 to 30 min | $10.15 | $502 | $77 | 7 years (4.2 yrs with tax credit) |

In many states and localities, thousands of dollars of additional incentives are available. Colorado, Connecticut, Delaware, Maryland and California are just some of the states with very generous EV incentives. State and local incentives can reduce the time to break even considerably. For example, in Delaware, buyers of the Hyundai IONIQ 5 will break even versus the Santa Fe in just 3.5 years with the federal EV tax credit and state rebates factored in.

Conversely, for car buyers who can’t take advantage of the federal EV tax credit or any state incentives, it will take many more years to reap the full savings of switching to an electric vehicle. In the case of the new Ford F-150 Lightning, it could take up to 8 years to break even without any incentives, assuming 15,000 miles per year of driving.

Check this out >>> The North Carolina Clean Energy Technology Center’s DSIRE database is the BEST one-stop resource for all EV incentives. Plus, you’ll see what solar power incentives are available in your area too.

The difference between driving 10,000 miles per year and 20,000 miles per year is massive when it comes to realizing the savings of driving an EV. The average American driver travels about 14,000 miles per year in their vehicle. Simply put, long-distance commuters, frequent travelers and fleet operators will see the greatest cost savings of going electric.

With the 2023 Ford F-150 Lightning, a driver who travels 15,000 miles per year and can take advantage of the full $7,500 federal EV tax credit should expect to break even versus a combustion F-150 in 7 years. However, if they drive 25,000 miles per year, the break even period narrows to just 4 years. After that, they will be saving roughly $4,000 every year in fuel and maintenance costs. Clearly, EVs make more sense as a long-term purchase.

The maintenance figures included in this cost comparison is sourced from We Predict, a Michigan-based data analysis company. They dug deep into automotive maintenance data and found that during the first three years of vehicle ownership, the average annual maintenance for an electric vehicle is just $77. And based on personal experience, that’s likely for new tires (EVs are MUCH heavier).

During the same period, combustion vehicles average $228 in annual maintenance, with most of the costs in the first few years going towards oil changes and the like.

We may be underestimating the maintenance savings associated with going electric when comparing luxury brands. For example, BMW is notorious for costly maintenance. Opting for a Tesla Model Y over a BMW will likely result in even greater maintenance savings, and therefore a reduced break-even period.

As of early June 2022, the average gas price in the United States is $4.87 per gallon. In California, it’s $6.34. Nevada, Hawaii, Washington, Oregon and Illinois all have gas prices much higher than the national average. In these states, EV drivers will see even greater fuel savings.

Let’s take a closer look at an example of someone purchasing a Hyundai IONIQ 5 in California. We’ll assume that the consumer qualifies for the full $7,500 EV tax credit and the $2,500 state rebate for a zero-emissions vehicle. They drive 15,000 miles per year. At gas prices of $6.34 per gallon, the break even point for the IONIQ 5 versus the Hyundai Santa Fe arrives in just 2.5 years, versus 4 years for the rest of the nation. That figure includes the 59% higher residential electricity rates in California.

What can we learn from this EV cost of ownership comparison? The specifics of your situation matter.

These are the most important questions to ask when deciding whether or not it makes sense to buy an EV in 2022. Have questions? Let us know in the comments, or better yet join the CarEdge family at caredge.kinsta.cloud/community. You can also reach me at [email protected]. We’d love to hear from you.