CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

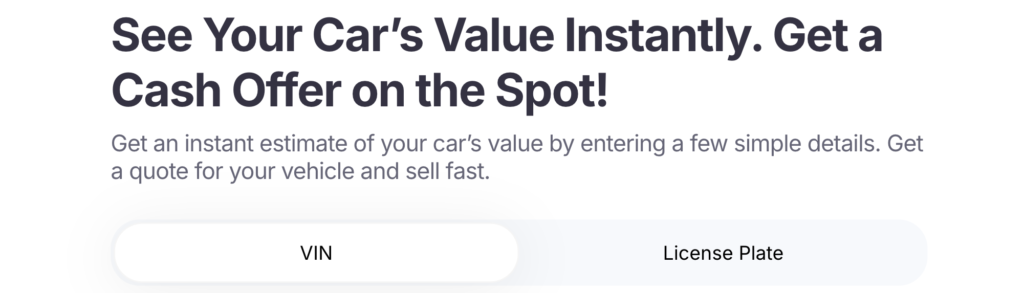

As if buying a car wasn’t tricky enough, the equation becomes even more complex when the topic of your trade-in comes into play. If you’re like one of the millions of car buyers each year that trades-in their car at the time of purchase, you’re most likely wondering, “when do I bring up the trade-in during the negotiation process so that I get the best deal?”

Well, fortunately for you, we’re going to discuss when to bring up your trade-in (and more) today. If you’re less interested in reading about how to navigate your trade-in, you can watch the YouTube video above. If you prefer to read, then continue on below, over the next few minutes we’ll explain exactly how to approach your trade-in during the car buying process.

Without further ado, let’s dive in!

First and foremost you need to recognize that buying a car and trading-in a car are two separate transactions, and each should be treated as such. Negotiating a car purchase, and selling your existing vehicle are independent of each other, however dealers will diligently try to combine the two into one “deal.” Why? Because when you’re working two transactions at once there are more opportunities to generate profits (if you’re a dealer), and lose focus (if you’re the consumer).

Why should you approach the trade-in process and the negotiation of a vehicle purchase as two separate events? It’s simple, by focusing on selling your car for the greatest amount of money possible, you’ll sell your car for more, and by focusing on negotiating the best possible out-the-door price on the vehicle you’re purchasing, you’ll get the best deal possible. Attempting to combine the two simply muddies the waters and allows the dealer the opportunity to “pull a fast one” on you.

Since your purchase and your trade-in are two separate transactions, you should turn your focus to negotiating the best possible out-the-door price. If you’re unfamiliar with the term “out-the-door price” then I highly suggest you read our guide here, or listen to this podcast episode on out-the-door price (or watch the video above). We created a 100% free out-the-door price calculator that you can access at any time as well to get an estimate for what the OTD price will be on any car you’re interested in.

To negotiate the best out-the-door price you’ll want to follow all of the best practices in the resources above, as well as what we outline in Deal School. For example, if you know how long a vehicle has been on a dealer’s lot, what the local market days supply is, and more, you’ll be able to negotiate a better out-the-door price.

Once you have agreed to terms with the dealer on the vehicle’s total price, you should then transition the conversation to your trade-in, and here’s how to approach that …

My recommendation is simple: get as many competitive quotes for your trade-in as possible before engaging with the dealer. For example, you should get a quote from CarEdge, and any other applicable major used car dealers in your area before discussing your trade-in with the dealer you are going to buy the car from.

It is important to understand that most car dealers will lowball you on their initial trade-in offer. This should come as no surprise. Dealerships are incentivized to purchase your vehicle for as little as possible so that when they sell it to another car buyer they maximize their profit. Your objective is the opposite. You want the greatest amount possible when you sell your vehicle, and the only way you’ll get that is if you get multiple quotes from a handful of dealers in your area.

Another option worth considering is also selling your car to a private party, however if you’re objective is to trade-in the vehicle (and there are financial reasons why you’d want to do this), then getting offers from private parties won’t really help your cause. The point of getting multiple quotes from other dealers is to have leverage with the dealer where you are purchasing your new vehicle, and a verbal offer from a private party isn’t much of a negotiating chip.

Once you have these quotes you can move on to the next phase of the negotiation process.

At this point it’s clear that the trade-in of your existing vehicle, and the negotiation of the new vehicle you are purchasing are two separate events. First you should negotiate a fair out-the-door price, and then bring up competitive quotes from other dealers to purchase your car.

Now, let’s say the dealer makes a compelling offer, but they don’t match the highest offer you’ve received from another dealer. What do you do? Which offer do you take? You need to understand the sales tax benefit of trading a car in versus selling it.

The trade-in sales tax benefit is different in each state, so please double-check with your local tax codes before signing any documents, however in the state of California, the District of Columbia, Hawaii, Kentucky, Michigan, Montana, Oregon, and Virginia there is no sales-tax benefit from trading in your vehicle.

Update for 2022: In Michigan, you can reduce the taxable value of your new car by up to $8,000 and reduce your sales tax by up to $480.

Update for 2022: In Arkansas you can sell your vehicle private party and still retain a sales tax basis benefit.

This means that if you trade-in your vehicle you will not receive any sales tax credit applied to the purchase of your next vehicle. In all other states (again double-check with your local tax codes) you receive a sales tax credit applied to the price of the new vehicle you are purchasing.

For example:

In this scenario it would make more sense to trade-in your vehicle so long as the dealer is offering you an amount that is within $1,200 of your highest direct-sale offer.

Some things in life are worth checking twice. For example, when you leave your home it isn’t a bad idea to double check that you locked the door. Checking twice can save you a lot of headache, right? The same principle applies when purchasing a used car, and it’s exactly why you need to consider getting a pre-purchase inspection (PPI) on any used car you’re thinking of buying.

We’ve recorded countless videos for our YouTube channel talking about pre-purchase inspections and their importance. The long and short of it is that pre-purchase car inspections are 100% necessary for used car purchases. If you’re buying a used car, you need to get a pre-purchase inspection on it first, no ifs, ands, buts, or maybes.

Let’s dive into the details of what a PPI includes.

Simply put, a pre-purchase inspection is a vehicle inspection that occurs in advance of a vehicle sale. There are no set parameters for what constitutes a pre-purchase inspection (that is to say there isn’t a universally accepted “checklist” of things that a mechanic needs to review to complete the inspection).

Pre-purchase inspections (commonly referred to as PPIs) are simply a mechanical review of a vehicle in advance of a sale.

As the name suggests, you should get a PPI conducted in advance of purchasing a vehicle. Specifically you should have a PPI conducted the same day, or within a few days of taking delivery of a vehicle.

The last thing you want to do is have a pre-purchase inspection conducted only to have an issue crop up a few days later unexpectedly. Taking ownership as quickly as possible after your PPI is conducted is a best practice.

Our auto experts are ready to help you buy a car confidently. Join CarEdge+ for full access to everything we offer!

There are a few options for where you can get a pre-purchase inspection completed. First and foremost, if you have family or friends who are auto mechanics, ask them to help. If not, fallback to your trusted local mechanic. If you don’t have a local mechanic who can help (or if you’re buying the vehicle from out of state), consider using a national service like Lemon Squad.

We recommend Lemon Squad because they have been in business for a decade and have an “A” rating with the Better Business Bureau. We don’t get compensated for saying that, we simply think they’re a viable option if you don’t have a trusted family member, friend, or local mechanic.

It’s important to keep in mind that there is no universally accepted “checklist” for what is inspected during a PPI. That being said, there are a few things your mechanic will absolutely pay attention to. Specifically they’ll inspect:

At the end of the day each mechanic will have a slightly different pre-purchase inspection process. Bear in mind that most mechanics will find at least one thing that should be done on the car. Remember, it’s their job to find things and make you aware of them!

A PPI is similar to a home inspection on a house. You want your mechanic to be thorough (just like you want the home inspector to be thorough), and so you’d almost be disappointed if there wasn’t anything wrong with the car (or the house). Keep this in mind when you receive the pre-purchase inspection report. Your mechanic will make you aware of what is really important, and what is lower priority.

If your mechanic charges you more than a couple hundred dollars for the pre-purchase inspection, you may want to ask them a few questions. Depending on the vehicle, a PPI should range anywhere from $100 to $300.

Considering the vehicle you’re thinking of purchasing is most likely worth tens of thousands of dollars, the investment upfront in a PPI is well worth it. The headache you save, and the peace of mind you gain makes a pre-purchase inspection a worthy investment.

Do you have other questions about pre-purchase car inspections? If so, let us know in the comments down below.

Trust is at the crux of any human interaction. Whether you’re navigating the aisles at the grocery store, having a conversation with your significant other, or interacting with your boss at work, trust plays a critical role in how we approach each and every aspect of our life. Seemingly, there is no trust in a car dealership (not between the customer and the salesperson, and not even between the salesperson and the sales manager). For decades now, car salespeople have constantly gone to “talk my manager” for permission to negotiate during the sales process.

This tactic, paired with countless other dealer antics is very frustrating for customers. If you’re unfamiliar with your salesperson saying “let me go check with my manager,” you’re lucky! If you’re not, it means you’ve certainly spent countless hours at a dealership before being frustrated and disappointed that the process is so drawn out.

Today I wanted to provide some insight into why salespeople have to go talk to their managers to ask them questions when negotiating with a customer, and what really happens behind the scenes. If you prefer to watch instead, consider clicking on the video above.

It’s important to recognize that car dealerships have been operating in a similar manner for nearly one hundred years. The manufacturer to dealership model has been in place since before you were born, and the tactics and strategies dealers deploy to maximize profits are ingrained in dealership culture.

Traditional dealership culture is anti-consumer — that is to say most dealerships operate in a way that isn’t transparent, friendly, or buyer oriented. Dealers are tasked with one primary goal: maximize profits, and in that quest, a lot of antiquated practices have become the reality of the car buying process.

The way dealerships are structured from a staff perspective is worth noting. There is an owner (either a mom and pop owner, or a big corporation), and then below them are the staff. There is a General Manager, a New Car Sales Manager, and a Used Car Sales Manager, and below them are the salespeople.

The structure may be different depending on each organization, but generally speaking, this is the typical formation of a dealership’s sales staff.

If you’re thinking about buying a car, you might enjoy this article: Buy or Lease: How to Decide For Your Next Automobile

The New Car Sales Manager is responsible for (and their pay is tied to) how much gross profit the dealership makes in any given month off of new car sales. That means that the managers goal is to work with their salespeople to get the most profit out of every new car deal.

Now that you know that, it should be clear how the “let me go talk to my manager” tactic came to be. Managers don’t trust their salespeople to maximize profits. Instead, they fear that salespeople will jump right to the bottom line number right after shaking hands (or I guess elbow bumping) their prospective customer.

Most sales managers operate out of fear. Their compensation is directly tied to how much gross profit the dealership generates on any given month, and the idea of giving up “control” to salespeople to be able to make their own independent decisions during the negotiation process is a foreign concept to them. Instead, sales managers typically try to retain as much control over the process as possible, and that’s why you see salespeople frequently doting to the sales managers office.

This control dynamic is ironic, however. Car buyers don’t want to be dragged into some strange power struggle between a salesperson and a sales manager. Instead, they simply want to deal with the actual decision maker from the start.

This makes sense considering most buyers research their purchase for 14 hours or more. To then be stuck at a dealership negotiating with a salesperson who really can’t make a final decision, only to drag on the process even more … It’s no wonder that buying a car can be a tiring event.

The construct of “let me go ask my manager” also allows sales managers to mitigate their fear of becoming irrelevant. As many car dealerships pivot towards one price selling, sales managers fear that they won’t be able to retain their roles within the dealership.

Everything in life starts with trust, but in the car dealership it also starts with control. Antiquated training has led to salespeople and sales management staff being reliant on the concept of “whoever has control wins.” This “us” versus “them” mentality is not pleasant for anyone involved, but as a car buyer it is important you understand just how deeply it is rooted within the dealership.

For example:

As you can see, trust is lacking across the board, and when that’s the case, getting anything done at a dealership comes to a standstill.

So what really happens when the salesperson goes to talk to the sales manager? The sales manager quizzes the salesperson to better understand how likely the customer is to make their purchase today.

If it’s likely they can close the deal today, the sales manager will work the salesperson to retain as much margin in the deal as possible. If the deal feels shaky, the sales manager might coach the salesperson to negotiate a slightly lower price to see if they can move the needle.

At the end of the day in the sales manager’s office the word they are most concerned about is “now”. “How likely are they to make the deal now?” Everything is about getting the deal done today, and it’s not only the sales managers responsibility to coach the salesperson to get the deal done now, but also with the most gross profit possible.

So there you have it, that’s what really happens when the salesperson goes to “talk to the manager.” Is it frustrating and annoying when it happens? Absolutely. Do you now understand why it happens? I hope so. Patterns of behavior that have been in place for decades will take time to erode. Let’s hope that this one goes away in the not too distant future.

For many, buying a car is the second most expensive purchase they’ll ever make. Buying a depreciating asset (a vehicle) for tens of thousands of dollars is a major financial commitment. If you’ve ever asked yourself, “How much should I spend on a car?” You’re not alone. Knowing how much you should spend on a car is an age old question, and one that we’re going to address today with the 10% rule.

If you search online, you’ll find many different opinions on how much you should spend on a car. There is no “right” answer, and there is no “wrong” answer. At the end of the day, you have to make a decision that you feel comfortable with.

That being said, we do have some advice we’d recommend you follow. We’re here to help you learn about the 10% rule, and how it helps you determine how much you should spend on your next car.

First things first, to determine how much you should spend on a car, you need to assess your financial situation. This means auditing your monthly gross income. How much gross (before taxes) income do you make each month?

I say monthly income on purpose, because most car buyers are shopping for a monthly payment that meets their budget. This is as good a time as ever to mention that if you can afford to buy a car in cash, and you intend to keep it for decades, please do that. That is the most financially responsible car buying decision you can make (i.e. no interest payments).

Having said that, most of us aren’t in a position to pay for a car in cash upfront, and most of us want a little variety when it comes to what vehicle we’re driving in (we’ll get a different car in two or three years). If that’s you, then start this exercise by analyzing your monthly gross income.

Write that number down, we’re going to come back to it.

Are you buying a car because you need transport from point “a” to point “b,” or are you getting a car to make a statement?

I remember when I worked at an Acura dealership in the early 2000’s and a customer came in and purchased an Acura RL in the top trim. This was an expensive and luxurious car. The same day this customer took home his new car he came back. Why? Because his wife wanted him to buy a Lexus instead. To her, the Acura didn’t portray the image she wanted to her neighbors (it wasn’t “showy” enough).

In this case, the “why” behind purchasing a car was to make a material statement, not to simply get from point “a” to point “b.”

If you’re trying to make a statement, it’s my strong recommendation you figure out a cheaper, more fiscally responsible way to make that statement. Consider buying a watch, a house, a painting … literally anything other than a car — they simply lose value too quickly.

Buying a car entails a lot more than making a monthly car payment. Insurance, gas, maintenance, depreciation, the list goes on and on. If you’ve ever owned a car before, you know just how expensive it is. Plus, insurance costs are rising quickly.

That being said, it’s critically important to consider the total cost of ownership when thinking, “How much should I spend on a car?” Your monthly car payment should include:

When you factor each of these items into your monthly car payment you see that a $500/mo car payment is actually $1,000/mo. And this is where the 10% comes in. I counseled all of my clients over 43 years to consider spending 10% of their gross income on their car.

That means that if you make $60,000 per year ($5,000 per month), you can aim for up to $500 per month to go towards your car payment. That doesn’t mean you can afford any car that has a monthly payment of $500, it means the combined cost of the payment, the insurance, and the maintenance (I purposefully leave out depreciation from the 10% rule because if I included it you wouldn’t be able to afford a car) all needs to be $500 or less.

Some personal finance gurus suggest that you can afford to spend much more than 10% of your gross income on a car, and banks will even loan you the money you need to purchase a car so long as your debt to income ratio is below 40%. The 10% rule isn’t a commandment, it’s simply a suggestion. Spending more than 10% of your monthly gross income on a depreciating asset is a tough pill to swallow, but for some it’s worth it.

I highly recommend you consider leasing a car instead of buying it. Leasing has some distinct advantages compared to purchasing; mainly you know exactly what you are signing up for. The cost of depreciation and maintenance are built into the lease, whereas when you buy a car outright neither of those factors are known.

The 10% rule applies to leasing. For example, I am retired (sort of), and my monthly income is a bit more than $4,000. My Mini Cooper lease is $380/mo, and when you factor in insurance and gas costs, I am just a bit over the 10% rule. Just like you, I’m human, and I want things that I can’t necessarily afford. In this case, I made the conscious decision to bump the 10% rule to 12%, and I am happy.

👉 Our (free) Consumer Guide to Leasing

Leasing allows for a certain level of cost certainty since most lease terms are in the 36 to 48 month range and most cars are under warranty for most, or all of that time. Some brands even include free scheduled maintenance during your lease term, essentially making the monthly payment and the cost of fuel and your insurance premium your total car expenses. Trust me, cost certainty is a beautiful thing, once you experience it you will wonder how you ever lived without it.

Ultimately how much you spend on a car comes down to how much money you are willing to set aside on a monthly basis. Additionally, always remember that when you buy a car, it will lose value. These are not investments.

How do you play it smart then? My recommendation is that you follow the 10% rule. It’s fair, it’s reasonable, and it’s not overly constrictive. Plus, when you drive somewhere in your new car, if you follow the 10% rule, you’ll still have some money in your pocket to pay for things when you get there!

You can drive a really nice car, and you might not be able to afford to enjoy the other aspects of your life. Or, you could drive an inexpensive car and you can afford all kinds of things, but you hate what you drive. My suggestion is to find a balance that allows you to do both, and for many people who ask themselves “How much should I spend on a car?” The 10% rule does the trick.

Have you ever wondered how much dealers pay for used cars? As if buying a car wasn’t tricky enough, the used car market is somehow even more mysterious than the new car market. As I always like to say, “no two used cars are the same,” and for that very reason, used car pricing is not an exact science.

Unlike new vehicles, used cars don’t have a Manufacturer’s Suggested Retail Price (MSRP), nor a Monroney label that tells you exactly how much each component of the vehicle costs (or at least should cost). When you buy a used car, the price is generally set by a computer algorithm that looks at what other dealers have listed similar used cars for sale, and then suggests an amount to the dealer.

Like I’ve talked about in the past, as a general rule of thumb, dealers mark up their used car inventory a few thousand dollars over their cost. This is far from a hard and fast rule however, as some used cars have been known to net dealers five figures (or more) in profit.

Today I want to focus on a technique you can use to estimate a dealer’s cost to own a particular used car. Let’s dive in!

Before we get too into the weeds on how much dealers pay for used cars, I want to take a moment to share with you the four ways car dealers source their used car inventory. By this point you are familiar with the concept of a Used Car Manager. This is the staff member who is responsible for all used car sales at a dealership. They’ll source their inventory from four places:

The two primary sources are customer trade-ins and wholesale dealer auctions. Some dealers also get used cars directly from wholesalers, and occasionally dealerships have been known to “swap” aging units from one store to another to see if the other dealer has better luck selling the car.

For our purposes we’ll be focusing on estimating how much dealers pay for used cars from trade-in and auctions, since those are the two highest volume sources of inventory.

There are certain costs associated with preparing a used vehicle for sale, aka getting it “retail ready.” Some costs are only associated with used vehicles purchased at auction, and don’t apply to trade-ins, but other costs are fixed, regardless of where they were sourced.

Every vehicle a dealer sells must pass the state’s vehicle worthiness inspection. Fees associated with this inspection are non negotiable and differ from state to state. You can look up what a state inspection costs in your state to get an idea of what it costs a dealer, but on average we can say it’s around $80 per vehicle.

Every used vehicle incurs some sort of reconditioning. Reconditioning is industry jargon for repairs and maintenance. Nearly all dealerships perform some type of reconditioning because it allows them to sell the vehicle at a higher price than if they sold it entirely “as is.” Dealers also like reconditioning their vehicles, because they are able to increase their revenues. What do I mean?

As a round number you can estimate with, a dealer will spend $1,500 (and sometimes a lot more) to recondition a used vehicle.

Dealers also must pay for a full detail of a used car before selling it. This typically is billed at $100 (or more) for a used car.

As the name suggests, this fee is associated with vehicles purchased at dealer auctions. Although each auction house charges a different price, a general rule of thumb is that a used car costs around $400 to buy from an auction.

When a dealer buys a used car in a different region, they need to pay a transporter to get the vehicle back to their storefront. This amount varies widely, and will change depending on the number of vehicles being shipped and the distance traveled.

Let’s walk through an example of how you can calculate an estimate as to how much a dealer paid for a used car. We’ll use a 2022 Toyota Camry LE listed for $15,995 to start. Get ready, you’re about to have a much better understanding of how much dealer pay for used cars.

The first thing you’ll want to do is locate the Kelley Blue Book trade-in value. Simply go to KBB, enter the vehicle information, and identify the low-end number they show.

In this case, the value is $14,791.00. Now, that’s not the actual price the dealer paid to get this car. If they sourced this car via a trade-in it’s likely they offered $13,000, or maybe $13,500. However if the dealer bought it at auction it’s likely it was 10% less than the KBB suggested value.

If the dealer bought this car at auction for $12,000, they then incurred $400 in auction fees, and $300 to transport it to their dealership. Add in $80 for the state inspection, and a conservative $1,500 in reconditioning work, plus $100 for the detail.

We’re up to $13,791.90 in cost for the dealer.

There is then one other factor we need to consider, which is called protected against commission (PAC). PAC is profit built into every car deal that is not commissionable to a salesperson. Dealers add in at least $500 in PAC on used cars, some more. This goes towards paying for non-revenue producing employees.

Now we are up to $14,291.90 in cost for this Camry LE that is listed for sale at $15,995.

If the vehicle was traded-in rather than bought at auction we can estimate that the dealer paid $14,971.00 to get it retail ready. As you can see, not a lot of margin is built into this price.

Tired of navigating the used car market and dealership hassles? We’re glad you found us! I’d like to share some free car buying tools with you.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!