CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Electric trucks are not cheap, and some of them are just downright expensive. Are the fuel savings and power worth the extra cost? This resource features every electric truck’s pricing and range in 2024. Which electric pickups are you interested in? There will be more to choose from in just a few years’ time.

| Make | Model | Release Date | Starting Price | Fully-Optioned | Range |

|---|---|---|---|---|---|

| Chevrolet | Silverado EV | early 2024 | $52,000 | $106,895 | up to 450 miles |

| Ford | F-150 Lightning | available now | $49,995 | $91,995 | 240 - 320 miles |

| GMC | Hummer EV | available now | $86,645 | $112,595 | 329 miles |

| GMC | Sierra EV | early 2024 (Denali) | $52,000+ | $107,000 | up to 400 miles |

| Rivian | R1T | available now | $73,000 | $105,000 | 314 - 400 miles |

| RAM | 1500 REV | 2025 | N/A | N/A | 350-500 miles |

| Tesla | Cybertruck | 2024 | $60,990 | $99,990 | 250-340 miles |

First, here are a few things you should know about charging an electric pickup (or any EV for that matter):

| Make | Model | Fast-Charging Times | Notes |

|---|---|---|---|

| Chevrolet | Silverado EV | Add 100 miles in 10 minutes | Expect to add 300 miles of range in 30 minutes |

| Ford | F-150 Lightning | Add 200 miles in 40 minutes | The Lightning charges to 80% quickly, but slows considerably after. |

| GMC | Hummer EV | Add 100 miles in 10 minutes | Expect to add 300 miles of range in 30 minutes |

| GMC | Sierra EV | Add 100 miles in 10 minutes | Expect to add 300 miles of range in 30 minutes |

| Rivian | R1T | Add 200 miles in 35 minutes | The R1T accepts up to 220 KW of power, which is above average |

| Tesla | Cybertruck | "Recover up to 136 miles in 15 minutes" | Announced in 2019, the Cybertruck has been delayed to 2024 |

| RAM | 1500 REV | Add 110 miles in 10 minutes | 350-500 miles of range; coming late 2024 |

In 2022, the Inflation Reduction Act was signed into law, and with it came a complete revamp of federal EV incentives. Here’s a brief summary of the biggest changes to tax credits for electric trucks in 2024:

Just months after the Federal Trade Commission (FTC) took legal action against Koons Kia and Napleton dealerships, the FTC has reached a high-dollar settlement with the DC-area’s Passport Automotive Group. The FTC found evidence that Passport Auto Group dealerships were routinely deceiving consumers by forcing thousands of dollars in illegal junk fees onto car prices and for discriminating against Black and Latino consumers with higher financing costs and fees.

Passport, its president, Everett Hellmuth, and its vice president, Jay Klein, will pay more than $3.3 million to settle the FTC’s lawsuit. The settlement money will be used to refund impacted consumers.

Passport Automotive Group operates nine dealerships in 2022:

“With this action against Passport and its top executives, the Commission is continuing its crackdown on junk fees and discriminatory practices that harm Black and Latino consumers,” said Samuel Levine, Director of the FTC’s Bureau of Consumer protection. “As families struggle with rising prices, companies that think they can hit consumers with hidden fees should think again.”

The FTC has been on a roll in 2022. This summer, the FTC proposed a new set of rules that would ban specific anti-consumer sales practices that are commonly employed at car dealerships. Dealer lobbies were furious.

The FTC’s investigation found that at Passport dealerships, Black and Latino consumers paid on average $235 to $291 more in interest than non-Latino white consumers did. It also alleges that Black and Latino consumers were charged an extra fee 42 percent more often.

The FTC announced that it is taking the following enforcement actions:

The Commission vote to file the complaint was 4-1. Interestingly, one Commission member, Noah Joshua Phillips, voted no on the motion.

In 2018, the FTC alleged that Passport Auto Group issued fake “urgent recall” notices to consumers to lure them to visit dealerships. According to the FTC, the vast majority of the vehicles covered by the notices did not have open recalls.

Will Passport Auto Group’s second run-in with the FTC be enough to put an end to deceptive, anti-consumer practices? $3.3 million is quite the hefty fine.

Koons Kia Fined $1 Million by Maryland Attorney General for Fake Fees

Interest rates are rising, and inflation is at record highs, but deals can still be had when buying a new car. Every month, the team at CarEdge pores over the latest offers from every automaker. The result is a one-stop resource to share the very best new car deals with you.

Not finding what you’re looking for? We’ve included links to each automaker’s website. Check back frequently, as this living page will be updated regularly.

Check out these other CarEdge car buying resources:

The Best Auto Loan Rates Right Now

The Best Lease Deals This Months

These 5 Brands Are Negotiable Right Now

Finance Buick SUVs (Encore, Envision, Enclave) at 3.99% APR for 72 months.

Buick Encore: $179 per month for 24 months with $5,449 due at signing

Buick Envision: $279 per month for 24 months with $3,739 due at signing

Cadillac CT4: $439 per month for 36 months with $3,749 due

Cadillac XT4: $379 per month for 36 months with $3,579 due at signing

See Cadillac listings near you.

Best Chevrolet financing offer:

2.99% APR for 60 months for the Silverado 1500, Colorado and Equinox.

Chevrolet lease deals:

Chevrolet Trailblazer: $259 per month for 24 months with $3,109 due at signing

Chevrolet Blazer: $279 per month for 24 months with $2,369 due at signing

Silverado 1500 Crew Cab 4WD LT: $399 for 36 months with $3,579 due at signing

See details on Chevrolet deals.

Chrysler Pacifica Hybrid: $599 per month for 39 months with $5,499 due at signing

See details on Chrysler deals.

In February, Ford is advertising 3.9% APR for 60 months for select models

Learn more about Ford deals at Ford.com.

Best GMC financing offer:

2.99% APR for the GMC Sierra 1500

3.9% APR for the GMC Terrain

GMC lease offers:

GMC Acadia: $289 per month for 24 months with $2,309 due at signing

GMC Terrain: $279 per month for 24 months with $3,949 due at signing

Best Honda financing offers:

Honda Pilot, Passport, Ridgeline: 1.9% APR for 24 – 48 months

Best Honda lease offers:

Honda Civic: $269 per month for 36 months with $3,399 due

Honda CR-V: $349 per month for 36 months with $4,499 due

Hyundai lease offers this month are good, but the amount due at signing has increased this month.

Hyundai Venue: $151 per month with $3,281 due

Hyundai Elantra: $219 per month with $3,299 due

Hyundai Kona: $209 per month with $3,999 due

Hyundai Tucson: $279 per month with $3,999 due

Hyundai Santa Fe: $269 per month with $3,999 due

See details on Hyundai lease and finance deals.

Jeep leases are attractive in February.

Jeep Wrangler: $409 per month for 42 months with $5,099 due at signing

Jeep Compass: $347 per month for 42 months with $3,799 due at signing

Best Kia financing offer:

2.9% APR for 48 months

Kia Forte

Kia Sorento (2022)

Kia Soul

Best Kia lease offers:

Kia Sportage: $279/month for 36 months with $3,499 due

Kia Seltos: $249/month for 36 months with $3,320 due

See details on Kia deals at Kia.com.

3.49% APR for 48 months for the RX.

$2,000 lease cash for select RX styles.

ES 250 AWD: $509/month for 39 months with $3,999 due

See details on Lexus deals at lexus.com.

Best Mazda financing offer:

2.49% APR for 36 months + NO payments for 90 days

Best Mazda lease offers:

Mazda CX-30: $239 per month for 24 months with $2,999 due at signing.

Mazda CX-5: $299 per month for 33 months with $3,499 due at signing.

See details on Mazda deals at Mazdausa.com.

0.0% APR for 36 months

1.9% APR for 36 months

Nissan Altima: $199 per month for 18 months with $2,309 due

Nissan Leaf: $269 per month for 36 months with $5,259 due

Nissan Rogue (AWD): $299 per month for 36 months with $3,459 due Nissan Murano (FWD): $299/month for 24 months with $2,099 due

Learn more about Nissan deals here.

4.9% APR for 72 months and no payments for 90 days for the Ram 1500 and Ram 2500

$4,000 cash allowance for Ram 1500

Lease: Ram 1500: $309/month for 42 months, $5,499 due

Learn more about Ram deals at Ramtrucks.com.

Best Subaru financing offers:

2.9% – 3.9% APR for 48 months for these models:

The best Subaru leases:

Subaru Outback: $345 per month for 36 months with $3,515 due

Subaru Ascent: $359 per month for 36 months with $3,259 due

Best Toyota financing offers:

2.99% APR for 60 months

3.49% APR for 48 months

Toyota Corolla Cross: $331 per month for 39 months with $2,976 due

Toyota RAV4: $413 per month for 36 months with $3,063 due

Toyota Highlander: $393 per month for 39 months with $4,053 due

Learn more about Toyota deals here.

With interest rates rising and inflation putting pressure on automakers and their dealer networks, the only thing that could bring better new car deals would be plummeting demand. We’ve seen signs of weakening demand and higher new car inventory, but nothing considered drastic. Expect auto loan interest rates to climb in 2023. The best car deals in February won’t last.

These are the 5 car brands you CAN negotiate right now!

Thinking about factory ordering? These are the latest wait times our community is reporting.

These are the most marked-up new cars in 2022

Looking for something else? Visit our blog, or consult 1:1 with a real CarEdge Auto Expert to get customized help with your car deal. It could save you thousands!

After reaching record highs in June, gas prices fell by 25% by September. Now, gas prices are on the rise again. Why are gas prices going up? Blame supply and demand. However, there’s a bit more to the story this time around.

In June, crude oil prices had climbed to $120 per barrel as the war in Ukraine complicated operations and oil exports for Russia, the world’s third-largest oil producer. In 2021, imports from Russia accounted for 8% of all U.S. petroleum imports. As Russia’s military invaded Ukraine, the United States decided to ban all Russian oil and gas imports.

Oil prices climbed, and the national average topped out at $5.01 for a gallon of gas. To relieve supply shortages, the U.S. decided to release 180 million barrels of crude oil from the nation’s Strategic Petroleum Reserves in July. Oil prices fell, and gas prices dropped at the quickest pace ever.

But gas prices are now more than twenty cents higher than September lows. As of the time of this writing, the national average price for a gallon of gasoline is $3.92. See today’s gas prices at AAA. With crude oil prices increasing almost daily, $4 gas prices are likely to return.

Why are gas prices going up? On October 5, the world’s largest oil cartel decided to cut oil production for no reason other than to prop up prices.

In early October, OPEC+ announced that it would cut daily oil output by 2 million barrels. Globally, roughly 80 million barrels of oil are produced each day, but the markets decided this is a lot more than a drop in the bucket.

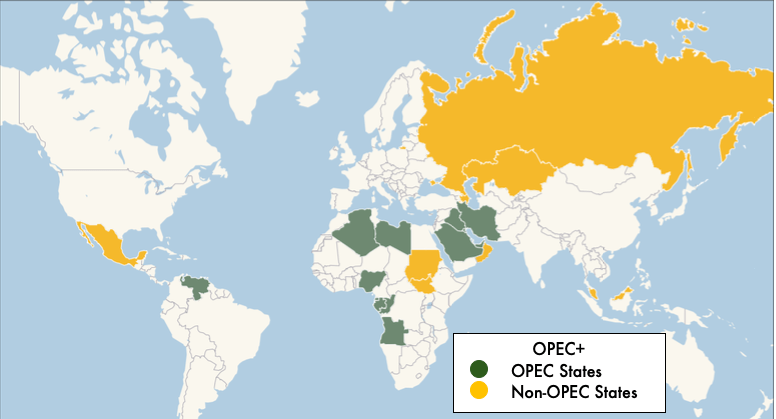

OPEC+ refers to the 13 nations in the Organization of Petroleum Exporting Countries (OPEC) and 11 non-OPEC partner countries. The OPEC+ group was created in 2016 with the stated goal of working together to adjust crude oil production to bring stability to the oil market. In other words, OPEC+ exists to keep global crude oil prices where they want them.

OPEC+ countries hold 90% of the world’s proven crude oil reserves. With such power of the market, they have the capability to disrupt or enhance the supply of crude oil. Global oil markets pay close attention to the actions of OPEC+.

The OPEC+ oil cartel consists of the following oil-producing nations.

OPEC core members:

Algeria, Angola, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, the Republic of the Congo, Saudi Arabia, the United Arab Emirates and Venezuela.

OPEC+ members:

Azerbaijan, Bahrain, Brunei, Equatorial Guinea, Kazakhstan, Russia, Mexico, Malaysia, South Sudan, Sudan and Oman

In order for gas prices to go down, either oil supply will have to increase, or demand will have to decrease. With just one month before the Thanksgiving travel holiday, demand is likely to increase in the weeks ahead, driving prices towards $4 per gallon.

If oil demand follows pre-pandemic historical trends, we could see softening demand from January to April. Peak oil demand is historically during summer and holiday travel months, with weaker demand in the winter and spring. Unless the government and domestic producers can find a way to bring down prices before then, that might be the next time gas prices drop back below current levels.

The United States meets 65% of its oil demand through domestic production. Ten years ago, 40% of America’s oil consumption was supplied domestically. The U.S. is producing more oil than ever before, but it continues to export millions of barrels to other countries. Regulators are surely looking into how they could send more domestic oil to American refineries.

We created a special resource to help drivers save money on fuel expenses. These are the top ways you can save on gas:

See our full guide to maximizing fuel savings. You can save hundreds of dollars with a few simple tricks!

Right now is a tough time to be in the market for a new or used vehicle, but remember to consider fuel economy next time you’re shopping for a new ride. For the average commuter, the difference between 25 MPG and 45 MPG can be over $1,000 per year in fuel savings.

Thinking of going all-electric? These are the best electric cars on the market for under $50,000.

Judging from the price, the Polestar 3 is going after BMW and Mercedes-Benz rather than Tesla.

On October 12, Polestar revealed its third model, aptly named the Polestar 3. A lot has changed for the brand since the arrival of the Polestar 2, a smash-hit that propelled the Volvo-owned brand to mainstream success. At last, a Polestar SUV is here. Here’s every detail about the Polestar 3’s price, range, release date. We’ll even delve into the messy EV tax credits!

Polestar plans to launch one new electric vehicle per year, starting with Polestar 3 – the company’s first electric SUV. The Polestar 3 premiered on October 12, and you can watch the official unveiling here. The Polestar 4 is expected to follow in 2023 as a smaller electric performance SUV coupe.

In 2024, the Polestar 5 electric performance 4-door GT will launch as the production version of the Polestar Precept unveiled in 2020.

The new Polestar 3 will be the first of the brand’s models to be manufactured in the United States. Polestar will build the Polestar 3 at Volvo’s factory in Charleston, South Carolina starting in 2023. The 3 will be made alongside the Volvo EX90, the electric sibling to the Volvo XC90. However, the price is above the price cap in the revised EV tax credit, so it will not be eligible.

Fresh off the successes of Polestar’s first mass-market EV, the Polestar 2, the brand is ready to step into America’s most competitive vehicle segment, that of the almighty crossover SUVs. Here’s what Polestar has shared so far:

The Long-Range Dual Motor Polestar 3 has an EPA-estimated range of 300 miles. The Performance Package drops range to 270 miles. That’s excellent for an SUV, and is just shy of the Tesla Model Y’s 330 miles of range.

Battery capacity is 111 kilowatt-hours (kWh).

The Polestar 3 can charge from 10% to 80% in 30 minutes at a DC fast charger. That would translate to about 210 miles of range added in 30 minutes. That is slightly better than the industry average in 2023.

At a level 2 charger (the kind typically installed at home), the Polestar 3 can charge from empty to 100% in 11 hours. Remember, it charges overnight while you sleep so this is rarely a concern.

The Polestar 3 starts at $83,900 for the base Long-Range Dual Motor version. The Long-Range Dual Motor with Performance package starts at $89,900.

The Polestar 3’s price is far above America’s best-selling EV, the Tesla Model Y. Right now, the Model Y starts at $67,190 with destination fees.

In Polestar’s early marketing campaign for the 3, the brand has made it crystal clear that this is a premium SUV. Expect premium prices.

See the best electric cars for families in 2023

The Polestar 3 will be made in America, but the price means it’s not eligible for the new EV tax credit, which has a cap of $80,000. See EV tax credit requirements and amounts.

The Polestar 3 Performance package costs an additional $6,600. The Performance pack increases horsepower to 517 HP, upgrades to 22″ wheels, and gets the gold accents the Polestar brand is known for.

Interior upgrades include ventilated Nappa leather seats sourced ethically, black ash deco, and massaging seats.

The 2024 Polestar 3 will compete with a growing list of premium electric crossovers. These are the top contenders for the electric luxury market heading into 2023.

Preorders for the Polestar 3 are open now. Deliveries will begin in late 2023, according to the automaker.

Let us know, what do you think about the Polestar 3? Is it worth a price of $83,900? I expect this to remain relatively low volume because of the price alone. Polestar seems to be competing with BMW and Mercedes rather than the big EV leader Tesla.

Check out the fastest-growing EV forum online! You’ll find expert advice and a sense of community that makes navigating car buying and ownership easier and a whole lot more interesting. We hope to see you there!