CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Spring car buying season is here, and many shoppers are heading to dealerships with their tax refunds in hand, ready to make a down payment on a used car. According to a recent survey by Talker Research, Americans expect to receive an average refund of $1,700 this year. With the average price of a used car sitting at $25,128 in March 2025, a solid down payment can help offset high borrowing costs.

However, used car shoppers are facing an unpleasant reality: the highest used car loan rates in over 40 years. Rising interest rates are making monthly payments significantly more expensive in 2025, tightening budgets for many buyers. Before financing a used car this spring, it’s crucial to understand how today’s high APRs will impact your loan – and what steps you can take to minimize costs. Here’s what to expect and how to protect your wallet.

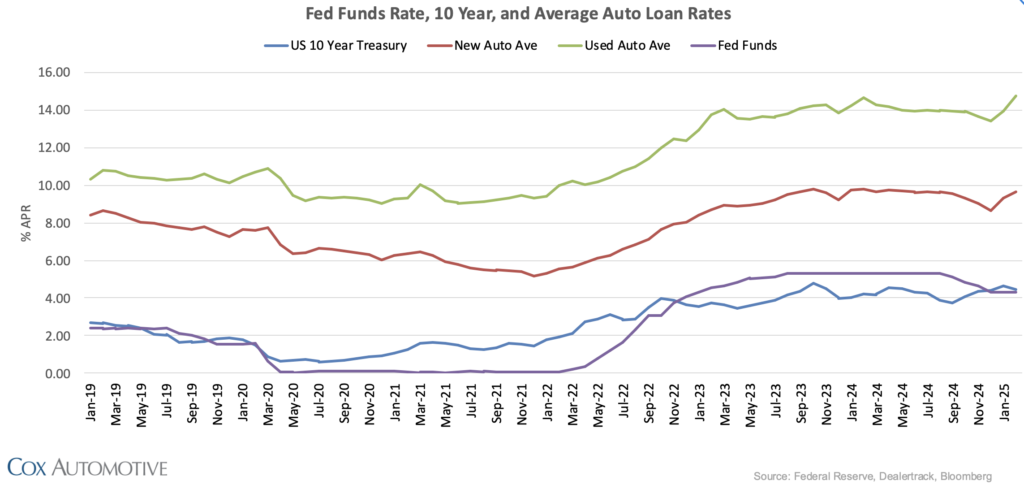

Over the past year, used car prices have fluctuated but have generally trended lower. While this is good news for buyers, the cost of financing remains a major hurdle. Used car loan rates have surged to levels not seen since the early 1980s.

After a brief dip in December, interest rates jumped sharply in January and February. According to Cox Automotive, the average used car loan rate in March 2025 is now 14.73% APR. For comparison, new car rates sit at 9.69% APR on average.

For buyers with lower credit scores, the situation is even worse. Many subprime borrowers are being offered rates close to 20% APR – adding thousands of dollars in interest over the life of a loan.

It’s hard to fathom just how much high interest rates can quickly add up, adding thousands of dollars to the total cost of owning a car. Consider the following real-world example: A $25,000 used car loan financed for 72 months at a 15% APR interest rate will accumulate $13,000 in total loan interest over 72 months. For buyers with bad credit, a 20% APR loan rate would push the interest paid above $18,000 for the same loan amount. Buying a car at all starts to lose its appeal with rates at these levels.

Several factors are keeping borrowing costs elevated in 2025:

While the overall rate environment isn’t favorable, car buyers can take steps to secure the best financing possible. Here’s how:

Check Your Credit Score Before Shopping: Your credit score plays a major role in determining your interest rate. Scores above 700 typically secure the best rates, while subprime borrowers (below 600) face the steepest costs. Your debt-to-income ratio is also a key consideration.

Get Pre-Approved by a Credit Union or Local Bank: Credit unions often offer lower rates than dealership financing. Getting pre-approved also gives you negotiating power when discussing financing options with dealers.

Make a Larger Down Payment: The more cash you put down, the less you have to borrow – reducing your interest charges over time. With tax refunds arriving, consider using that money to increase your down payment.

Choose a Shorter Loan Term: A 36- or 48-month loan will come with a lower interest rate than a 72- or 84-month loan. While monthly payments will be higher, you’ll save money on interest in the long run.

Avoid Add-Ons That Increase Loan Costs: Extended warranties, service contracts, and dealer add-ons can be financed into your loan, but this increases the total amount borrowed – and the interest you’ll pay.

👉 Before you commit to a used car with a high APR, drivers with good credit should check out the Best New Car Financing Incentives This Month. For well-qualified buyers, there are plenty of low-APR and even zero percent APR deals out there!

Take our free car buyer’s guide with you to save more and buy with confidence.

With used car loan rates at historic highs, some drivers may be better off repairing their current vehicle rather than financing a new one.

If your car is paid off or close to being paid off, investing in repairs can be far cheaper than taking on a high-interest loan. Consider getting a repair estimate before deciding whether to trade in or keep your car.

Always consider the total cost of ownership before buying any car. Use these free cost of ownership tools to see the numbers – you might be shocked at what you find!

👉 The Best Used Cars Under $10,000

Used car prices are coming down slowly, but financing costs remain a major challenge in 2025. With average used car loan rates nearing 15% APR for the first time in 40 years, shoppers need to be strategic about where they finance and how much they borrow.

If you’re planning to buy a used car this spring, use tools like CarEdge’s Free Car Buying Guide to compare financing options and find the most negotiable deals. Knowledge is your best tool to fight back against high borrowing costs. Don’t head to the dealership without a plan!

If you’re in the market for a new car or truck, possible price hikes should be on your radar. In 2025, 25% automotive tariffs are officially here. In a shift from previous tariffs, the new auto tariffs apply to all vehicles imported into the United States. However, cars imported from Mexico, Canada, and China are likely to be most impacted due to the complexity of North American supply chains. Here’s what car buyers should know as spring car buying season gets underway.

Several of the most popular new cars and trucks sold in the U.S. are manufactured or partly assembled in Canada, Mexico, and China. However, the impacts of tariffs on the U.S. auto industry are much more wide reaching than it may seem on the surface. This is due to closely intertwined automotive supply chains spanning the three North American manufacturing hubs.

A new report from S&P Global Mobility forecasts that lost production due to tariffs could reach 20,000 units per day that are not built. This would equate to one third of North American vehicle production being lost due to tariffs.

It remains unclear how quickly consumers will begin to see higher sticker prices and lower incentives. What we do know is which new cars and trucks are most severely impacted. Here’s a look at some of the models now facing higher costs due to the tariffs, including average selling prices and market supply data as of spring 2025.

The following new cars, SUVs, and trucks are manufactured in Mexico, and sold in the United States. Note that many other models contain parts that are manufactured in Mexico and imported into the U.S. for final assembly.

| Make | Model | Country of Origin | Average Selling Price | Days of Supply | Total For Sale | 45-Day Sales Total |

|---|---|---|---|---|---|---|

| Audi | Q5 | Mexico | $58,462 | 74 | 7,765 | 4,697 |

| BMW | 3 Series | Mexico | $55,598 | 121 | 5,067 | 1,890 |

| BMW | 2 Series Coupe | Mexico | $49,663 | 186 | 4,106 | 996 |

| Chevrolet | Silverado 1500 | U.S. and Mexico | $54,508 | 129 | 84,463 | 29,359 |

| Chevrolet | Equinox EV | Mexico | $42,944 | 101 | 8,327 | 3,699 |

| Chevrolet | Blazer EV | Mexico | $49,635 | 195 | 11,215 | 2,584 |

| Ford | Bronco Sport | Mexico | $33,689 | 175 | 43,625 | 11,198 |

| Ford | Maverick | Mexico | $34,541 | 142 | 34,977 | 11,097 |

| Ford | Mustang Mach-E | Mexico | $48,137 | 89 | 10,161 | 5,109 |

| GMC | Sierra 1500 | U.S. and Mexico | $62,381 | 108 | 48,095 | 20,013 |

| Honda | Prologue | Mexico | $54,310 | 179 | 11,775 | 2,953 |

| Kia | K4 | U.S. and Mexico | $25,267 | 75 | 19,274 | 11,507 |

| Nissan | Sentra | Mexico | $23,813 | 155 | 31,396 | 9,099 |

| Nissan | Kicks | Mexico | $25,756 | 120 | 25,519 | 9,535 |

| Ram | Ram 1500 | U.S. and Mexico | $58,431 | 133 | 51,508 | 17,400 |

| Ram | Ram 2500 | Mexico | $65,058 | 106 | 20,085 | 8,526 |

| Ram | Ram 3500 | Mexico | $71,664 | 124 | 11,388 | 4,145 |

| Toyota | Tacoma | Mexico | $46,796 | 54 | 55,021 | 45,724 |

| Volkswagen | Jetta | Mexico | $26,157 | 90 | 9,216 | 4,616 |

| Volkswagen | Tiguan | Mexico | $32,995 | 68 | 11,491 | 7,615 |

| Volkswagen | Taos | Mexico | $29,145 | 152 | 14,497 | 4,305 |

All prices and market data are as of March 3, 2025, reflecting the state of the car market before tariffs officially began.

In 2025, 20 models of new cars, SUVs and trucks are manufactured in Mexico for export to the United States. The automakers likely to be hardest hit by President Trump’s tariffs are Nissan, Volkswagen, Ford, and General Motors. Due to Volkswagen’s smaller model lineup, the German automaker will feel an outsized impact with three popular models being produced in Mexico.

Buyer’s looking for one of the more affordable new cars on sale today will be impacted by tariffs. Three popular models among budget buyers are all produced in Mexico: the Nissan Kicks, Nissan Sentra, and the new Kia K4. Finding a new car under $25,000 will become even more difficult in 2025 due to tariffs.

In 2023, the United States imported 141,847 motor vehicles and parts from Canada, a record high. These new cars are manufactured at facilities located in Ontario, with a large portion exported to the United States. As of the most recent data, the U.S. was the largest market for Canadian automotive exports, making up 62% of total auto exports. Here are all of the cars and trucks manufactured in Canada for export to the U.S. in 2025:

| Make | Model | Country of Origin | Average Selling Price | Days of Supply | Total For Sale | 45-Day Sales Total |

|---|---|---|---|---|---|---|

| Chrysler | Pacifica | Canada | $47,483 | 125 | 7,717 | 2,783 |

| Chrysler | Voyager | Canada | $41,815 | 178 | 1,218 | 308 |

| Dodge | Charger | Canada | $54,189 | 239 | 7,298 | 1,372 |

| Honda | CR-V | U.S. and Canada | $37,967 | 66 | 56,300 | 38,135 |

| Honda | Civic | U.S. and Canada | $28,783 | 59 | 21,550 | 16,553 |

| Lincoln | Nautilus | China and Canada | $61,047 | 219 | 16,457 | 3,375 |

Stellantis and Honda will be hardest hit by tariffs on Canada in 2025. The Civic and CR-V are top-sellers for Honda. As models known for their affordability and overall value, it will be interesting to see if Honda Motor American Honda Motor, the North American branch of Honda Motor Company, decides to pass import tariffs on to car buyers in the form of MSRP hikes or severe reductions in incentives.

Continue to check back each week as we monitor the real-time impact of tariffs on car prices for these affected models.

Just a handful of new cars are produced in China for export to the United States. The following models will be subject to the 10% tariff on imports from China:

Polestar, no longer under Volvo’s umbrella, is going to be hit the hardest from the tariffs on Chinese imports. Sales of Polestar’s electric vehicles have already been falling in North America due to competitors with faster charging, more driving range, and lower price tags. If tariffs continue for months on end, it’s not clear if Polestar will see 2025’s challenges as reason enough to exist the North American market entirely to focus on more favorable tides in Europe and Asia.

If you’re shopping for a new car, here’s what you need to know:

These tariffs are already reshaping the auto market, and will cost both consumers and automakers money. Whether automakers shift production to the U.S. in response remains to be seen, but for now, buyers should be prepared for rising costs in the form of rising MSRPs and a reduction in incentives, like zero percent financing.

If you have been considering shopping around for a better insurance rate, now is the time. Tariffs are likely to drive premiums even higher in 2025 as car parts are subjected to the levy. Compare quotes today to lock in your rate before the coming hikes.

CarEdge will continue tracking these developments and providing insights on how they affect car prices, financing, and buying strategies. Stay informed, and check out our free car buying tools to help you navigate the challenges ahead for car buyers in 2025.

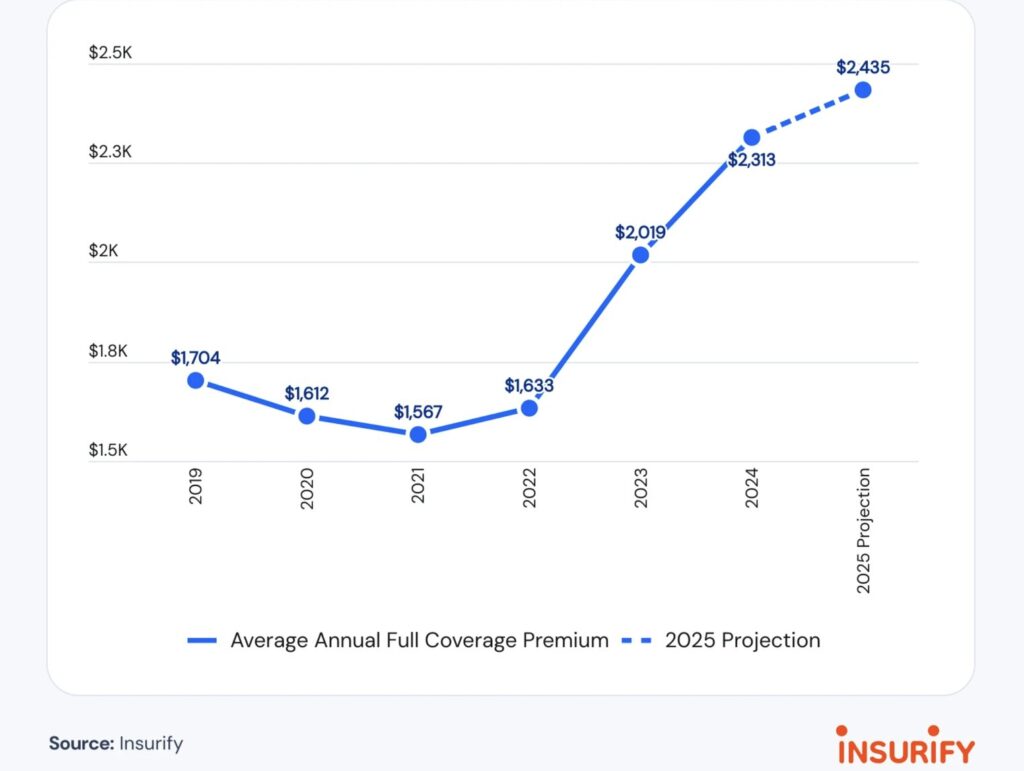

Auto insurance rates are climbing in 2025, and while that’s no surprise to most drivers, what might shock some is which states have the highest accident rates. Car accidents are a major factor driving insurance premiums higher, but they aren’t the only culprit. Rising car prices, increased repair costs, and even tariffs map push rates higher this year.

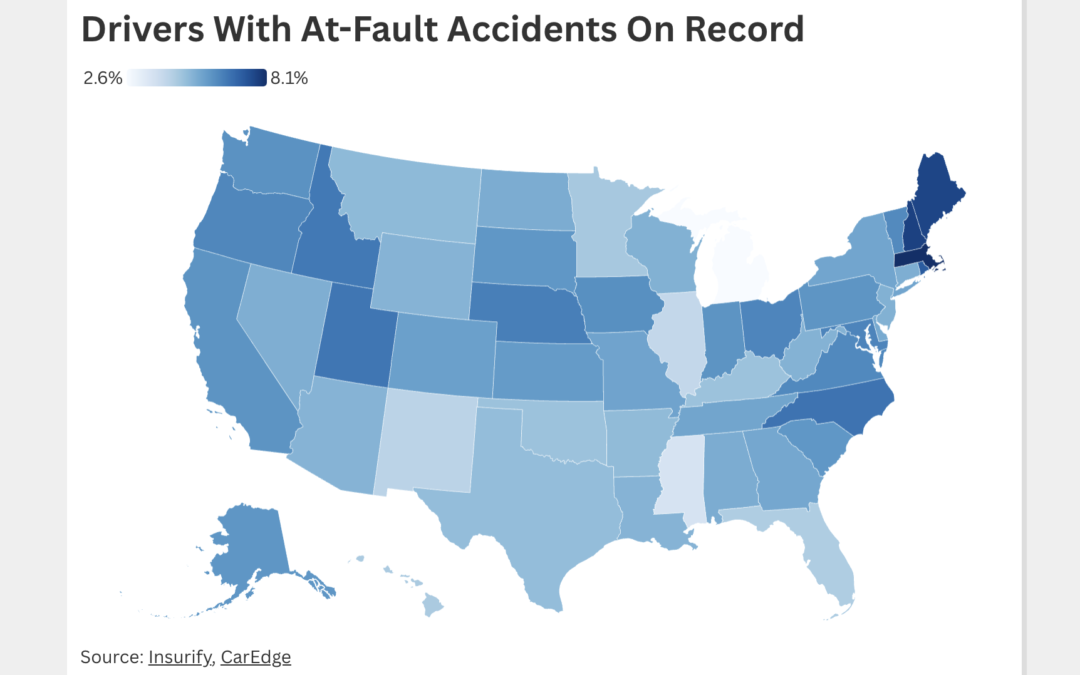

Using Insurify’s latest insurance data, we’ve identified the states with the most at-fault accidents in 2025 — and the states where drivers are least likely to be involved in a crash.

Insurify, a digital insurance marketplace licensed in all 50 states, connects drivers with quotes from over 100 providers. Thanks to this expansive data set, Insurify is able to track national trends, offering a unique look at which states have the highest accident rates.

Nationally, 5.3% of drivers have an at-fault accident on their record. But in some states, that number is significantly higher.

New England stands out as the region with the most accident-prone drivers. Massachusetts takes the top spot, with 8.1% of drivers having an at-fault accident on their record. New Hampshire follows closely behind at 7.7%, while Maine rounds out the top three at 7.6%. Rhode Island also ranks in the top five, with 7.1% of drivers reporting accidents.

North Carolina is the only non-New England state in the top five, with 6.6% of drivers having an at-fault accident on record.

Here’s a look at the 10 states with the highest accident rates in 2025:

| State | Drivers with At-Fault Accidents |

|---|---|

| Massachusetts | 8.05% |

| New Hampshire | 7.67% |

| Maine | 7.59% |

| Rhode Island | 7.12% |

| North Carolina | 6.61% |

| Utah | 6.56% |

| Idaho | 6.49% |

| Nebraska | 6.36% |

| Maryland | 6.26% |

| Ohio | 6.23% |

Source: Insurify data

On the other end of the spectrum, some states report far fewer accidents. Whether due to lower population density, better infrastructure, or safer driving habits, these states see fewer crashes than the national average.

Michigan has the lowest rate of at-fault accidents in the country, with just 2.6% of drivers having one on their record. Mississippi follows at 3.6%, while Illinois and New Mexico also rank among the least accident-prone states.

Interestingly, Florida, often criticized for aggressive driving, high insurance costs, and outrageous dealership fees, is also among the states with lower accident rates, at just 4.5%. This suggests that while Florida has unique insurance challenges, at-fault accidents aren’t the primary issue.

Here’s how all 50 states and the District of Columbia rank in terms of drivers with at-fault accidents on their record, as of 2025:

The visualization above was produced by CarEdge using Insurify data.

Having an at-fault accident on your record can significantly increase your car insurance premiums. On average, drivers who cause an accident see their rates rise by $800 or more per year, depending on the severity of the crash and their insurance provider. These rate hikes typically last three to five years before gradually returning to normal—assuming no additional accidents occur.

But even drivers with clean records aren’t immune to rising premiums. Insurance companies set rates based on the overall risk in a given area. If a state or city experiences high accident rates, insurers adjust their pricing accordingly to offset increased claim payouts. That means even if you’ve never been in an accident, living in a high-risk state could mean paying more for coverage.

If your rates have gone up, it may be time to compare insurance quotes and explore ways to lower your premium. Shopping around, maintaining a clean driving record, and improving your credit score can all help keep costs down in 2025. Stay safe out there!

![Reviewed: 5 Best Instant Cash Offer Sites to Sell Your Car [2025]](https://caredge.com/wp-content/uploads/2023/11/Image-1080x675.png)

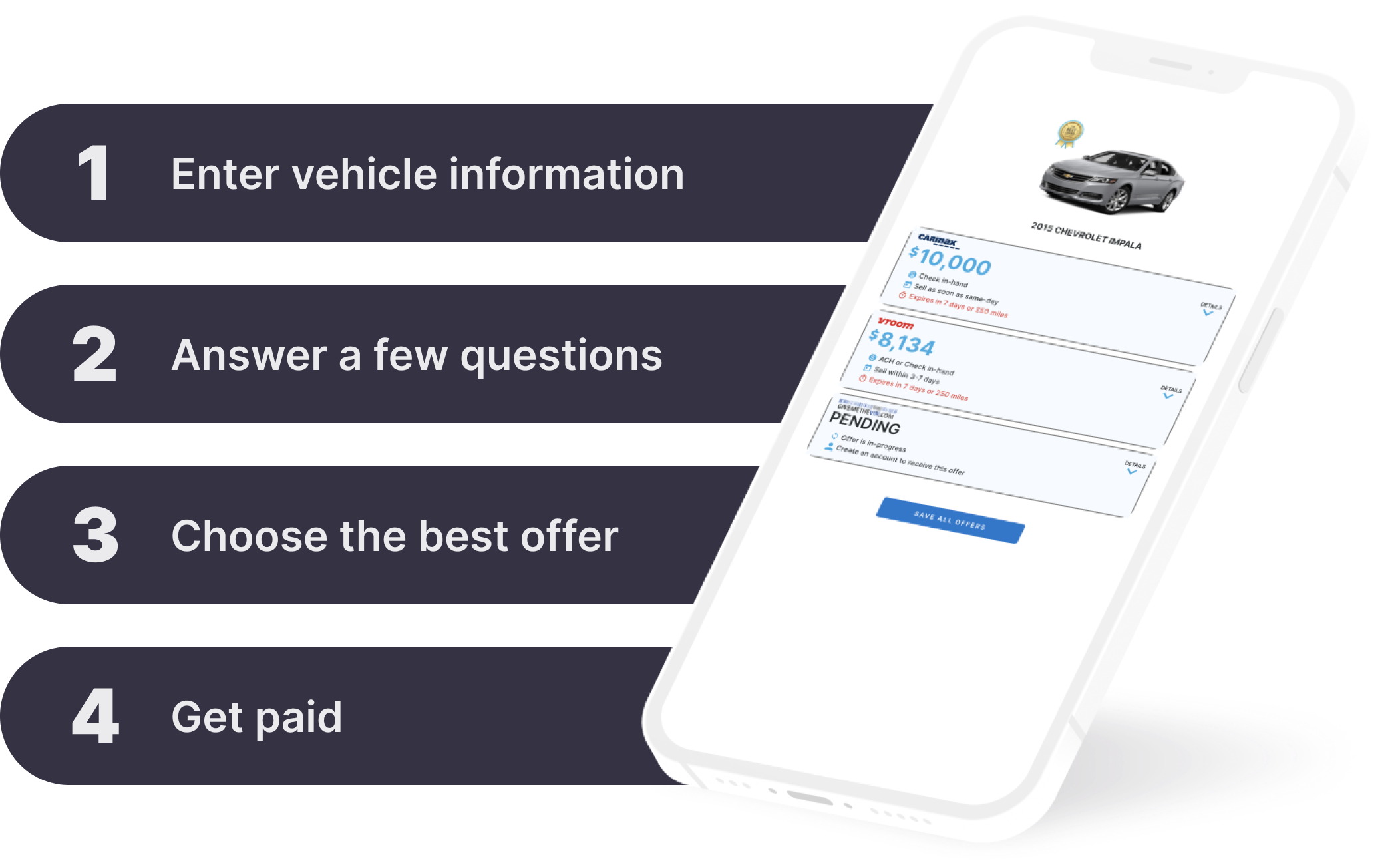

If you’re looking to sell your car quickly and hassle-free, getting an instant cash offer for a car can be one of the easiest ways to do it. Instead of haggling with private buyers or trading in for a low-ball offer, these online platforms provide an upfront price based on your vehicle’s details. But which services are worth considering? We’ve reviewed five of the best options to help you get the most for your car in 2025.

Summary: CarEdge provides a transparent process for selling your car by offering market-based pricing insights and connecting you with vetted buyers. With a data-driven approach, CarEdge ensures you get a competitive instant cash offer while giving you the tools to make an informed decision.

CarEdge’s instant cash offer is sourced from three trusted partners: Peddle, givemethevin.com, and webuyanycar.com.

Pro:

Cons:

The Verdict: CarEdge is a great choice for sellers who want a transparent, data-driven approach to getting the best instant cash offer for their car.

Summary: CarMax is a well-known brand that offers a straightforward process for selling your vehicle. By entering your car’s details online, you’ll receive an instant cash offer that you can redeem at any of the 253 CarMax locations nationwide. The offer is valid for seven days, giving you time to compare deals.

Pro:

Cons:

The Verdict: CarMax is a great option for those who prefer an established company and don’t mind visiting a physical location to complete the sale. However, it can come with the unpleasant dealership experience that most drivers prefer to avoid.

Summary: Carvana provides a completely online selling experience. You enter your car’s details, receive an offer, and if you accept, Carvana will pick up your vehicle and issue payment, with no need to visit a dealership. Note that Carvana’s instant cash offers are known to fluctuate from day to day.

Pro:

Cons:

The Verdict: Carvana is a good option for sellers who want a fully digital, contact-free process. However, sellers should be aware that offers can fluctuate wildly day to day, depending on market conditions. Compare quotes from other instant cash buyers before you commit.

Summary: Kelley Blue Book (KBB) provides a tool that generates an instant cash offer based on your car’s details and market value. This offer can be redeemed at participating dealerships after an inspection.

Pro:

Cons:

The Verdict: KBB Instant Cash Offer is a great option for those who prefer to sell their car through a well-known website with multiple dealership options. It’s not recommended for sellers who prefer to stay away from the dealership experience.

Summary: EchoPark provides an instant cash offer online, valid for seven days or 500 miles. If you sell your car to EchoPark within 48 hours of receiving the offer, they’ll add an extra $250 to your payment. However, you must bring your car to an EchoPark location to finalize the deal.

Pro:

Cons:

The Verdict: EchoPark is a strong option for sellers who live near one of its locations and want to maximize their offer with the $250 bonus incentive.

The best option depends on your priorities. If you want the best offer without dealership hassles, CarEdge is a great option. With CarEdge’s car value tracking tool, you can see your car’s value change in real time. This makes it easier to decide when to sell. If you prefer a traditional dealership experience, CarMax or KBB Instant Cash Offer could work better. For those near an EchoPark location, the extra $250 incentive makes it a great pick.

Ultimately, all sellers should compare offers from each of these online car buyers to see where the best deal is. Instant cash offers for cars can vary widely from one buyer to the next.

Walking into a dealership can feel like stepping onto a high-pressure battlefield of negotiations. Salespeople are trained to close the deal quickly, and some will say almost anything to get you to sign on the dotted line. While many sales professionals are honest, there are common tactics designed to rush your decision or make a deal seem better than it really is.

If you’re buying a car in 2025, knowing these five common car salesperson lies can help you negotiate smarter and avoid getting taken for a ride. Don’t forget your custom Car Buying Guide to get the best deal, no matter what you’re in the market for!

This classic tactic creates a false sense of urgency, making you feel like you’ll lose out on a great deal if you don’t act fast. It’s meant to pressure you into making an impulsive decision before you have time to shop around or think things through.

Reality Check: While manufacturer promotions and incentives do expire, dealerships set their own pricing. If a dealer is truly motivated to sell, they’ll likely offer the same deal—or something very close to it—tomorrow, next week, or even next month. If you feel rushed, walk away and take your time.

Salespeople use this line to make you feel like you’re getting an unbelievable bargain. The idea is to make you hesitate to negotiate further, thinking that they’ve already cut the price as low as possible.

Reality Check: Dealerships rarely lose money on a car sale. Between manufacturer rebates, holdbacks, incentives, and extended warranties, dealers have plenty of ways to make up for any so-called ‘loss.’ They wouldn’t stay in business if they were truly selling at a loss, so don’t let this claim stop you from pushing for a better deal.

👉 Use these Car Buying Cheat Sheets to beat the dealer, EVERY time

This tactic plays on ‘fear of missing out’ and is meant to make you feel pressured to buy before someone else does.

Reality Check: Sure, popular models do sell quickly, but unless you’re after an extremely limited or in-demand car, there’s usually another one available. A salesperson may or may not have other interested buyers, but it’s almost always an attempt to rush your decision. If you’re unsure, leave the lot and check the dealership’s online inventory later—chances are, the car will still be there.

This is a classic numbers game. By making you believe you’re getting an above-market offer on your trade-in, the dealer can justify charging more for the new car—or distract you from negotiating on financing terms.

Reality Check: Trade-in values are based on wholesale market prices, not what the dealer “paid.” Often, if a dealer offers a high trade-in value, they make up for it by adding hidden fees, increasing the price of the new car, or adjusting loan terms. Before heading to the dealership, research your trade-in’s true market value using tools like CarEdge Pro so you know what your car is really worth.

👉 Trade-In Tactics For Success (Free Guide)

Salespeople want to minimize concerns about a used car’s reliability. Saying a vehicle has no issues or a clean history can ease doubts and make you more likely to buy without further investigation.

Reality Check: Even if a car has no reported accidents on a Carfax or AutoCheck report, that doesn’t mean it’s problem-free. Hidden damage, flood history, or undisclosed mechanical issues could still exist.

Always get a third-party mechanical inspection (also known as a Pre-Purchase Inspection) before purchasing any used car. It’s a small price to pay to avoid thousands of dollars in unexpected repairs down the road.

👉 Stay on top of your car buying to-do list with this complete checklist!

Car dealerships use pressure tactics to speed up the sale, but with the right preparation, you stay in control. Here’s how to safeguard your purchase and maximize your savings:

Do Your Research – Know the fair market price of the car you’re considering. Use tools like CarEdge behind-the-scenes Pro to check real-time pricing and historical trends.

Take Your Time – If it’s meant to be, it’ll still be there tomorrow. Never feel pressured to buy on the spot. This is especially true of used car purchases.

Negotiate Based on the “Out-the-Door” Price – Dealers add fees, taxes, and extra costs. Always ask for a detailed breakdown of all charges. Use this free Out-the-Door Price Calculator to know what to expect.

Verify Everything – Don’t take a salesperson’s word for it. Get a vehicle history report, read the fine print, and get a pre-purchase inspection for any used car.

Be Ready to Walk Away – The best negotiating tool? Your willingness to leave. If a deal doesn’t feel right, walk away and find a dealership that respects your time and budget.

CarEdge car buying experts are ready to help you save time, a LOT of stress, AND money. Get started today with your FREE Car Buyer’s Guide!