CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Stepping into a car dealership can feel like entering a high-stakes poker game, but with the right guidance, you can confidently call their bluff. CarEdge’s Ray Shefska lifts the veil on dealership tactics with secrets from his impressive 40+ year tenure in the industry. While maximizing profits is part of their playbook, you don’t have to be an unwitting participant. Here’s how you can outsmart the car dealership sales team

Correct answer: I have a total out-the-door price in mind. I’d like to stay focused on that.

Wrong answer: Yes, I don’t want my monthly payment to be more than $700 per month.

Why: Once the dealer knows what your monthly payment goal is, they immediately start thinking about how much wiggle room they have for add-on products, incentives and other odds and ends of the deal. Once you share your desired monthly payment, you’ll be negotiating that number for the rest of the deal. This makes it alarmingly easy to lose sight of how much you’re actually paying for the car.

Correct answer: I just want to know what the out-the-door number is, can we stay focused on that for now?

Wrong answer: I think I could put between $5,000 and $10,000 down. It depends on what the price of the car is, and how much you give me for the trade-in.

Why: This question is another tactic the salesperson uses to turn you into a ‘payment buyer’. Yes, you’ll eventually have to tell them what your down payment is, but do NOT volunteer that information too early in the negotiation! Car dealership salespeople are going to.

Note: Often, the salesperson will phrase this question as if it’s coming from the bank. For example, “The bank typically wants you to put 20% cash down or more. Were you planning on doing that?” You can still refuse to answer this question early on in the conversation. Remember, you’re still trying to get the out-the-door price from them. That’s the number that matters.

Correct answer: I haven’t decided yet. Once we’ve established an out-the-door number, we can discuss things like that.

Wrong answer: Yes of course, how much can you give me for it?

Why: You should always treat buying a car and trading in as TWO separate transactions, because they truly are. See what your car is worth with offers from multiple online buyers here.

These are the questions you’re most likely to encounter at the finance office. For even more tips, examples and advice, see our Finance Office Cheat Sheet. It’s one of our many free resources!

Correct answer: I have thought about this and I’ve even been pre-approved with competitive credit unions, so I do understand what my loan terms should be in order to keep my payment affordable.

Wrong answer: No, I haven’t thought about it yet. Can you help me lower my payment even further?

Why: When you express uncertainty about your desired loan term, finance managers spot an opportunity to manipulate the loan term to make a deal appear more attractive. By extending the loan term, they can “lower” your monthly payments, even if it ends up costing you more in the long run due to interest.

Correct answer: Yes, if you can beat the rate I have on my pre-approval from the credit union, I’d consider it. The rate and the payment would need to come down enough to justify it.

Wrong answer: Sure! That sounds easier.

Why: Be sure to mention that your payment would need to come down in addition to getting a lower interest rate. Why? All too often, the finance manager can offer you a slightly lower interest rate, only to trick you into add-on products later, meaning that your monthly payment ends up the same or even higher than it was originally.

Are you interested in our tire care package for just $6 per month? Or theft protection for just $10 per month?

Correct answer: Thanks, but for each of these products, I need to see the total cost of the product, not just the monthly payment.

Wrong answer: Awesome, wow I see that this theft protection only adds $10 per month!

Why: Expect them to show you the monthly payment, not the total price of the products on their menu. You’ll have to ask for them to point out the total price. Remember this: A product that adds ‘just’ $10 to your monthly car payment over a 60-month loan term will actually cost you $600.

Would you pay $600 for something like tire protection or theft protection? Or, could you buy these products elsewhere for half the price? This is how you should think about the menu products.

The finance office is not the time to lose sight of the number that matters: the out-the-door price!

Your Guide to Car Dealer Fees: What’s legit, and what’s not?

Ready to outsmart the dealerships? Our seasoned experts will 1) find the car you’re looking for, 2) negotiate your deal, from start to finish, 3) arrange the paperwork so you just sign on the dotted line. Want home delivery? We can do that too!

Here’s how CarEdge Concierge works.

Remember that when buying or leasing a car, knowledge is power!

On January 17, U.S. President Donald Trump announced that a new 10% tariff will be imposed on the U.K., Denmark, Norway, Sweden, France, Germany, the Netherlands, and Finland as retaliation for their opposition to Trump’s initiative to control Greenland. Trump said the tariffs on goods from these countries will rise to 25% from June 1, 2026. Greenland has been a part of Denmark since 1814, and has been an autonomous territory since 1953.

Immediately, shares of Europe’s biggest automakers began to tumble. The renewed fears of a trade-war are seen as a threat to their bottom lines, and to their ability to keep prices competitive in the U.S. market.

As of the most recent data from 2024, roughly 800,000 passenger vehicles were imported into the U.S. from the EU, with German automakers like Mercedes-Benz, Audi, and Porsche making up 73% of that. Other key players in the trans-Atlantic auto trade are Land Rover, MINI, and Jaguar.

Italian brands like Alfa Romeo and Maserati, both under the Stellantis umbrella, are spared from the Greenland tariffs due to the neutral stance taken by Italy’s government. If the European Union forms a more united front against the U.S., more makes and models could be subject to Trump’s Greenland tariffs.

Whether or not Mercedes-Benz, Land Rover, and the Volkswagen Group raise prices in 2026 comes down to one thing: how long the tariffs stick around. If the Trump administration ends up raising the tariffs to 25% as indicated, these luxury OEMs will have a hard time keeping pricing where it sits today.

Here’s a look at where average selling prices sit for these brands as of late January 2026 according to CarEdge data:

If prices begin to creep higher, we could see more luxury buyers pivot to domestic or Japanese brands. In January, new car supply remains healthy for the most-affected European brands. By measure of market-day supply (how long it would take to sell all inventory at current daily sales rates), the four key players are sitting in a good spot.

BMW (82 days of supply), Mercedes-Benz (85 days of supply), Porsche (98 days of supply), and Audi (106 days of supply) are all experiencing relative stability in January, but that could soon change.

Don’t expect price hikes to come quickly. European luxury brands are in a constant fight for market share with the likes of Tesla, Cadillac, and even newcomers like Rivian and Lucid in the U.S. market.

At home in Europe, these same brands are already under pressure with Chinese brands like BYD and Xpeng winning over more buyers. Europe’s legacy automakers will hold off on price hikes for as long as possible to remain competitive.

However, if 25% tariffs do indeed arrive in June 2026, that wil be a hurdle too big to ignore, and price changes are likely to reflect that.

For one German luxury automaker, establishing a heavy presence stateside continues to pay off. The BMW plant in Spartanburg, South Carolina produces models like the X3, X4, X5, X6, X7, and XM. Roughly half of these vehicles are exported worldwide, making the U.S. the largest automotive exporter by value for BMW Group.

BMW’s domestic manufacturing strength in the U.S. is expected to largely shield it from auto tariffs in 2026. Luxury car buyers can expect greater price stability from BMW as a result.

If you’ve ordered anything from Amazon, you’re familiar with boxes of your latest purchases showing up on your doorstep. However, with the introduction of Amazon Autos, you can get more than just your essentials delivered. But is buying a car on Amazon a good idea? Here’s everything you need to know about how this new option compares to buying a car the old-fashioned way.

Dubbed Amazon Autos, the largest online retailer’s new database of online car listings has generated headlines over the past year for a number of reasons. Some even heralded the launch as a true game-changer in the car market. But in reality, buying a car on Amazon isn’t all that different from buying one from your average dealership. That’s both good and bad news for consumers.

Here’s how buying a car on Amazon works:

Make no mistake: you’re still buying from a dealer; Amazon Autos only acts as an online marketplace for cars. The cars listed there are the same ones that dealerships list on their own and third-party websites. Amazon just makes online car shopping feel like the branded experience nearly 200 million Americans know and use frequently.

Amazon doesn’t hold any of the inventory you see online. They’re merely combining the online shopping experience consumers expect from this global ecommerce giant with online car shopping. In most cases, this approach requires trading no-haggle, “competitive” pricing for convenience.

In addition, dealers advertise no-haggle pricing to ensure healthy profit margins on their end while playing on consumers’ dislike of dealing with salespeople and negotiating. Remember, dealers have plenty of profit in the form of holdbacks, manufacturer-to-dealer cash, and even volume bonuses. That’s not to mention the money they make when you finance your purchase, especially if you opt for an extended warranty or similar add-on.

All of this means that you’re much more likely to overpay on the car you choose than if you were to go your own way and negotiate confidently. Admittedly, for some, Amazon Autos might be a compromise worth making to skip the haggling process. Yet, it’s important to recognize that you’re instantly limiting your ability to land a great deal when you forfeit your right to negotiate car pricing.

If there’s anything we’ve learned about the car buying process, it’s that exploring your options only helps you make a better deal and drive away without that sinking weight of buyer’s remorse. Should you choose to browse cars for sale on Amazon Autos, keep the following three tips in mind to make sure you’re not leaving money on the table.

Always research demand factors for the cars you’re interested in. Are you shopping for a car that’s less popular than the hottest sellers on the market? Does it sell slower than the market average in your area?

If so, you’re much more likely to overpay with “no-haggle pricing.” Search for inventory that has been sitting on the dealership lot the longest. Those are the cars that dealers are motivated to sell at a discount, not the ones listed on Amazon.

The out-the-door (OTD) price includes the full picture, from the vehicle’s selling price to local taxes and fees. Before making a purchase on Amazon Autos, or anywhere for that matter, ask for the OTD price before you show you’re serious about any vehicle. Dealers often attempt to sneak in unwanted add-ons or fees into the sale. The OTD price will reflect that.

On a related note, don’t be a monthly payment shopper. When car dealership salespeople see that all you’re focused on is the monthly payment, that’s purely encouragement for them to throw on some extras you don’t need or want ‘for only $5 more each month.’

Remember, this money adds up to a much larger sum over time. Use this free Out-the-Door Price Calculator to get an idea for what to expect.

Always compare the prices you see on Amazon Autos with what’s available elsewhere. Avoid going with the first offer you see. Remember to always compare the OTD price from multiple sellers and use their competing offers to your advantage.

Taking negotiations off the table can remove much of the stress associated with buying a car. But what if AI could negotiate for you? With CarEdge Pro, you get access to fair pricing, insider data, and an AI agent that does all the talking.

In summary, when you buy a new or used car on Amazon, you’re still buying through a traditional dealership. The vehicles listed on Amazon Autos belong to participating dealerships; they’re not even owned by Amazon or stored within their warehouses. And while Amazon Autos may offer no-haggle pricing, there’s something crucial most shoppers overlook: you’re rarely getting the best price possible.

If you want to skip the tense negotiation process but still walk away with a good deal, have an expert handle your deal with CarEdge. Join more than 10,000 happy drivers who’ve used our car buying service to ensure their next big purchase is one they can be proud of.

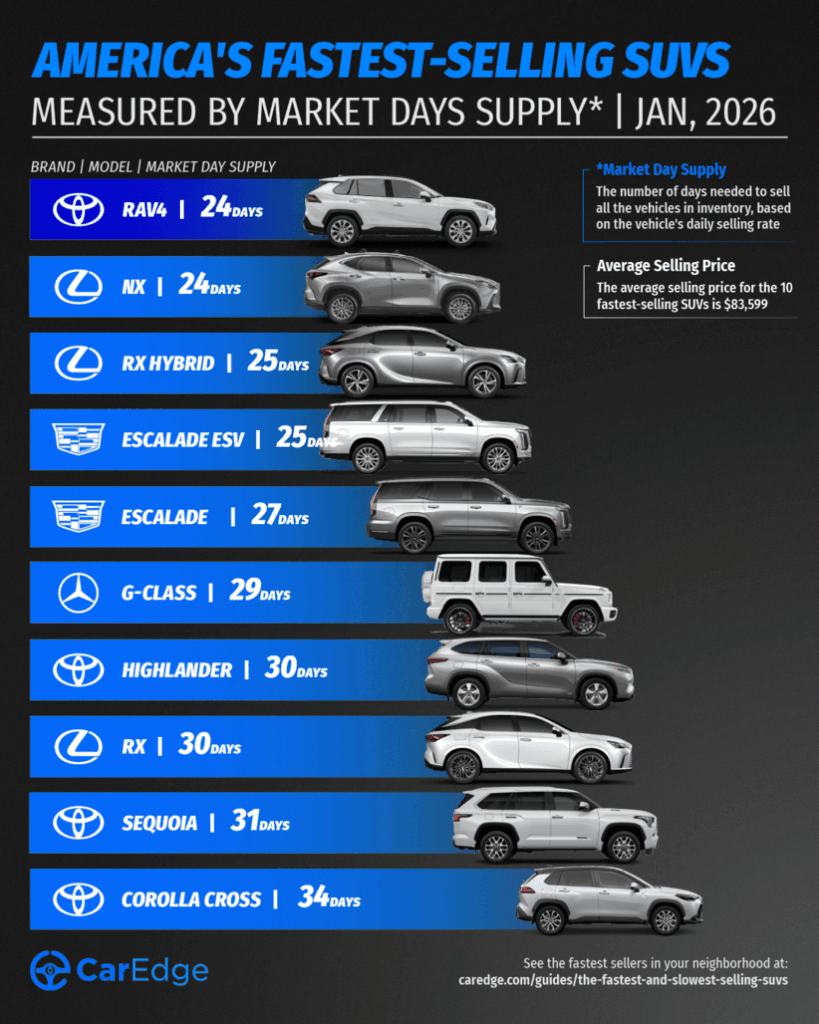

Out with the old, and in with the new seems to be the theme in this month’s rankings of the fastest and slowest-selling SUVs and crossovers. In early 2026, the glory days of EV sales are gone, and reliable namesakes from Toyota are back at the top. Right now, some SUVs are being scooped up as soon as they hit the lot, while others are sitting unsold for nearly a year on average.

We analyzed January 2026 auto market data to find the SUVs with the lowest and highest market day supply (MDS). MDS is a measure of how many days it would take to sell through current inventory at the current sales pace. Here are the winners and losers so far in 2026’s SUV market.

These are the SUVs and crossovers with the lowest market day supply in January 2026. That means they’re in high demand right now, and are likely harder to negotiate on due to limited availability.

| Make | Model | Market Day Supply | Total For Sale | 45-Day Sales | Average Selling Price |

|---|---|---|---|---|---|

| Toyota | RAV4 | 24 | 38,923 | 73,186 | $37,389 |

| Lexus | NX | 24 | 3,008 | 5,713 | $51,475 |

| Lexus | RX Hybrid | 25 | 5,027 | 9,227 | $64,200 |

| Cadillac | Escalade ESV | 25 | 1,149 | 2,057 | $127,519 |

| Cadillac | Escalade | 27 | 2,381 | 3,919 | $125,506 |

| Mercedes-Benz | G-Class | 29 | 1,062 | 1,643 | $201,631 |

| Toyota | Highlander | 30 | 5,480 | 8,100 | $52,703 |

| Lexus | RX | 30 | 5,954 | 8,828 | $59,760 |

| Toyota | Sequoia | 31 | 3,644 | 5,254 | $84,101 |

| Toyota | Corolla Cross | 34 | 15,087 | 20,040 | $31,703 |

Source: CarEdge Pro

Toyota is back on top yet again in January. Seven of the 10 fastest-selling SUVs are Toyota or Lexus models. If you’ve been following along for a while, this isn’t unusual. Toyota’s reputation for reliability, affordability, and overall value continues to be a hit with buyers. Consumer Reports named Toyota as the most-reliable brand yet again last year.

If you haven’t noticed, SUVs are no longer budget-friendly vehicles for the most part. No one wants a $50,000 crossover that lacks in reliability. Buyers are valuing reliability and affordability above all else right now, and the latest data reflects that.

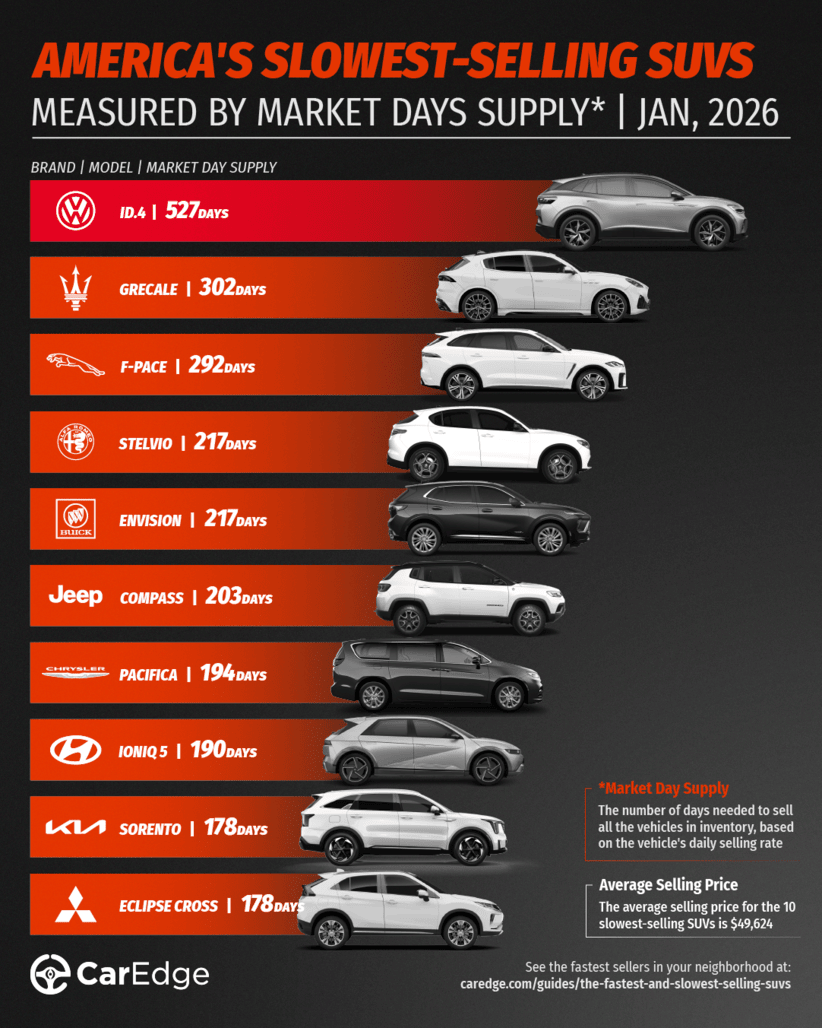

These SUVs have the highest market day supply, which means they’re sitting unsold for longer. Buyers may be able to score better deals on these slowest-selling SUVs in January 2026, especially with this new AI negotiator doing the work for you.

| Make | Model | Market Day Supply | Total For Sale | 45-Day Sales | Average Selling Price |

|---|---|---|---|---|---|

| Volkswagen | ID.4 | 527 | 1,500 | 128 | $49,534 |

| Maserati | Grecale | 302 | 638 | 95 | $84,448 |

| Jaguar | F-PACE | 292 | 2,148 | 331 | $69,503 |

| Alfa Romeo | Stelvio | 217 | 887 | 184 | $55,467 |

| Buick | Envision | 217 | 8,352 | 1,735 | $40,150 |

| Jeep | Compass | 203 | 27,375 | 6,063 | $32,392 |

| Chysler | Pacifica | 194 | 16,442 | 3,815 | $46,694 |

| Hyundai | IONIQ 5 | 190 | 10,693 | 2,536 | $47,865 |

| Kia | Sorento | 178 | 35,349 | 8,955 | $40,126 |

| Mitsubishi | Eclipse Cross | 178 | 2,715 | 685 | $30,058 |

Source: CarEdge Pro

With the federal EV tax credit now over, the Volkswagen ID.4 is the slowest-selling car in America for the second month in a row. There’s a year and a half of market supply right now, meaning that an ID.4 on a dealer’s lot today may see 2027 before finding a buyer.

Several of the others fall into the luxury segment. With recent inflation and persistently high interest rates, buyers are thinking twice about buying luxury vehicles in 2026.

Four Stellantis models are in the bottom 10 this month. Jaguar’s F-PACE has been a slow-selling model for all of the past year, despite being the top model by volume for the British automaker.

For any of these slow-selling SUVs, prices will be more flexible if you come equipped with negotiation know-how.

If you’re looking for a SUV deal in 2026, start with the slowest sellers this month. High inventory levels mean dealers are likely motivated to talk pricing if you negotiate with confidence. It’s always best to take a look at the best incentives of the month, too.

“If you’re shopping for a slow-selling SUV, the ball is in your court,” says auto industry veteran Ray Shefska. “Dealers know those vehicles aren’t moving, and that gives you the upper hand in price negotiations.”

Shopping Toyota, Honda, or Lexus? Expect tighter inventory and less room for negotiation unless market dynamics shift dramatically. You may need to move quickly if you find the right trim. However, this is no reason to pay for unwanted add-ons or dealer markups!

With CarEdge Concierge, our experts do the legwork for you, from researching inventory to negotiating with dealers. Already know what you want? Use our AI Negotiation Expert service and have CarEdge AI negotiate with car dealers anonymously!

Explore more free tools and resources with car buying guides, cost of ownership comparisons, and downloadable cheat sheets. There’s no reason to shop unprepared in 2026.

CarEdge is a trusted resource for car buyers, offering data-backed insights, negotiation tools, and expert guidance to help consumers save time and money. Since 2019, CarEdge has helped hundreds of thousands of drivers navigate the car-buying process with confidence. Learn how to buy a car the easy way at CarEdge.com.

Sure, the year-end sales bonanza is behind us, but January still has plenty of solid deals if you’re willing to dig a little. The catch? Not every offer is worth your time. Some are downright underwhelming once you read the fine print. We went through the latest manufacturer incentives to flag the ones you should probably ignore. Here are the 5 worst manufacturer incentives for new cars this month.

Don’t miss our roundup of the best January deals, featuring the best values in the market.

In January, Jeep is advertising a Grand Wagoneer lease starting at $1,320/month for 39 months with $3999 due at signing. Worse yet, this is for the base model. There are better lease offers to be found with the Chevrolet Tahoe and Ford Expedition. Did we mention that this model is already a year old, too?

See Jeep offer details, or browse local listings like a pro.

Unless there’s zero chance that you’ll EVER be trading in your truck for something newer, the consumer advocates here at CarEdge plead that you stay far away from any seven year auto loans. In January, GMC is advertising 6.9% APR financing for 84 months when you finance a Sierra 1500 Denali. That’s going to put a lot of folks in negative equity, and that’s not something GMC should be proud of.

See GMC offer details, or browse local listings like a pro.

Rarely do you come across a non-luxury lease deal advertising $14,749 due at signing, but that’s exactly how GMC is diving into the new year. And as with any lease advertisement, this is before taxes and fees. In some cases, lessees will be putting about $20,000 down at signing for a vehicle they’ll never loan. Yikes!

See GMC offer details, or browse local listings like a pro.

The F-PACE has been one of the slowest-selling luxury models for months on end. With those market conditions in mind, you’d think there would be bargains. However, the best offer in January is a F-PACE P250 R-Dynamic S AWD lease for $679/month for 36 months with $6995 due at signing. That’s a mouthful. Or, finance with 3.9% APR for 48 months.

That might not seem bad on the surface, but again, this is one of the slowest-selling cars in America right now. Nearly $7,000 due at signing just doesn’t add up.

See Jaguar offer details, or browse local listings like a pro.

For a year-old new car, you’d expect major savings, perhaps 10-15% off MSRP. In January 2026, the best Stellantis can do is just $1,500 in cash savings for the 2025 Dodge Hornet GT and GT Plus. We’d call it shocking, but it’s par for the course from Stellantis. Skip this deal!

See Dodge offer details, or browse local listings like a pro.