CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

These are the final days of January’s car deals. On Tuesday February 3, Presidents Day incentives will arrive from all major brands. Be sure to check back for the new deals this week. With inventory levels trending higher and 800,000 leftover 2025 models sitting on dealership lots, Presidents Day car deals are forecast to be big, especially for aging inventory. While we await the February deals, check out the best offers expiring this week.

Best Deal in February: 0% APR for 72 months for the Model Y Standard Rear-Wheel Drive

The Model Y is still the best-selling EV in America, but as incentives wane and sales slow, Tesla is bringing out their best financing incentives ever. Just beware of steep depreciation when buying new. In fact, it’s smart to check used Tesla listings before committing to a new purchase.

Best Truck Deal in February: 0% APR for 72 months on 2025 models, or 0% APR for 60 months on 2026 models

Ram is offering interest-free financing on both 2025s and brand-new 2026 Ram 1500 models. This is the best full-size truck deal on the market in February.

This offer expires on February 2, 2026. See offer details.

Browse Ram 1500 listings with the power of local market data

Best Deal in February: 0% APR for 60 months for the Rogue, as well as the 2025 Pathfinder and 2026 Murano

Nissan continues to fight hard to win back market share previously lost to Toyota, Honda, Kia, and Hyundai. In February, Nissan is offering zero-percent financing for three popular SUV models.

This offer expires on February 2, 2026. See offer details.

Browse Nissan Rogue listings with the power of local market data

Best Deal in February: $0-down lease, $479/month for 36 months

The best-selling vehicle in America is now available with no money down. Ford’s zero-down lease on the F-150 STX is the best pickup truck lease in February. We’ll have to see if Ford continues this lease deal for Presidents Day. The STX comes well-equipped with features like the 2.7-liter turbocharged V6 engine.

This offer expires on February 2, 2026. See offer details.

Browse Ford F-150 listings with the power of local market data

Best Deal in February: 0.9% APR for 72 months

Low-APR financing for six years on one of the most well-rounded crossovers in its class is something to move on if you’re in the market. Mazda regularly offers low-APR offers for 60 months, but this sweetens the pot.

This offer expires on February 2, 2026. See offer details.

Browse Mazda listings with the power of local market data

Best Deal in February: Lease the 2026 Corolla SE frim $209/month for 36 months with $3,999 due

Urban commuters, take note. This is a steal considering the legendary reliability and overall value of the Toyota Corolla. If you’re not ready to go electric for your work or school commute, this is a great, affordable alternative.

This offer expires on February 2, 2026. See offer details.

Browse Toyota listings with the power of local market data

Best Deal in February: Lease the 2026 Silverado 1500 LT 4WD from just $379/month for 36 months with only $1,379 due

Although Ford’s F-150 lease deal is even better, Chevy loyalists will have a hard time beating this Silverado lease deal with little money due at signing. It’s a great offer for those who want a full-size pickup without owning it long term. Hopefully this truck deal sticks around for Presidents Day.

This offer expires on February 2, 2026. See offer details.

Browse Silverado listings with the power of local market data

Best Deal in February: This zero-down lease for the 2025 Bronco Sport Big Bend 4×4 starts at $399/month for 36 months with just the first month due at signing.

The off-road capable crossover segment has gotten crowded in recent years. Now, Ford is fighting to reclaim market share with a zero-down lease deal for the Bronco Sport Big Bend.

This offer expires on February 2, 2026. See offer details.

See Bronco Sport listings with the power of local market data

Best Deal in February: Lease the Explorer Active 4WD from $499/month for 36 months with $499 due at signing

Ford’s best-selling family SUV is available for a dirt-cheap lease in early February, but it’s unclear if it will stick around beyond the second of the month.

This offer expires on February 2, 2026. See offer details.

Browse Explorer listings with the power of local market data

Best Deal in February: 1.9% APR for 60 months

In early 2026, BMW has more inventory than they’re used to. In order to move the metal, they’re offering a rare low-APR offer on a top-selling model in the entry-level luxury market, the 2026 BMW X3 xDrive.

This offer expires on February 2, 2026. See offer details.

Browse BMW X3 listings with the power of local market data

Last month’s huge sales showed that automakers are desperate to sell remaining 2025 models. If you don’t mind a car that has already seen many moons on the dealership lot, these older models will certainly present the biggest chances for negotiating a deal. Without a doubt, it’s still a buyer’s market in February 2026.

Tired of the car buying hassle? CarEdge Concierge handles the entire process for you, from finding the right vehicle to negotiating the best price. Or, if you prefer a DIY approach with professional tools,CarEdge Pro gives you insider data and an AI agent to negotiate on your behalf.

We’re here to help!

After debuting way back in the 1984 model year, minivans have seen their share of ups and downs. But in 2026, the minivan is enjoying a North American renaissance, finding new uses and attracting different types of buyers.

In the United States, 2025 sales were up 20% to 395,352, more than a quarter of which (110,006) were Chrysler Pacificas. In Canada, the growth was even more impressive. Automakers sold 42,377 minivans in Canada in 2025, up 34% over the previous year, according to Automotive News.

A dominant family vehicle in the 1980s and ’90s, minivans became a niche segment, representing less than two percent of the new-vehicle market in recent years.

Chrysler CEO Chris Feuell told Automotive News that after double-digit surges in the first six months of 2025, minivan sales “settled into a more normal pace in the second half of the year.”

Feuell said Stellantis provided additional marketing and sales support in an effort to boost North American sales. Throughout much of 2025, CarEdge Best Deals featured low-APR financing offers for the Pacifica and recently resurrected Voyager.

Feuell said Stellantis slowed the pace of the assembly line in Windsor for about six weeks “until we got a better understanding of how the tariffs were going to be impacting the business.”

“It allowed us to restore the inventory levels to healthier levels and improve our mix and thus improve our turn rates,” she said.

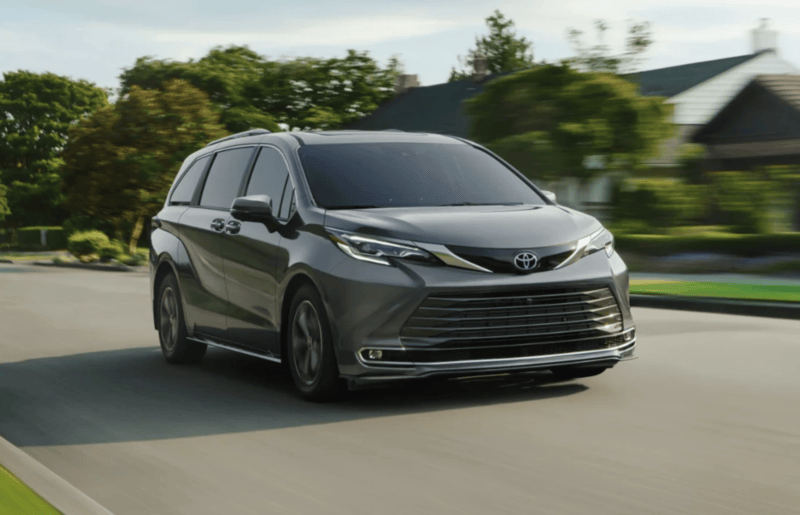

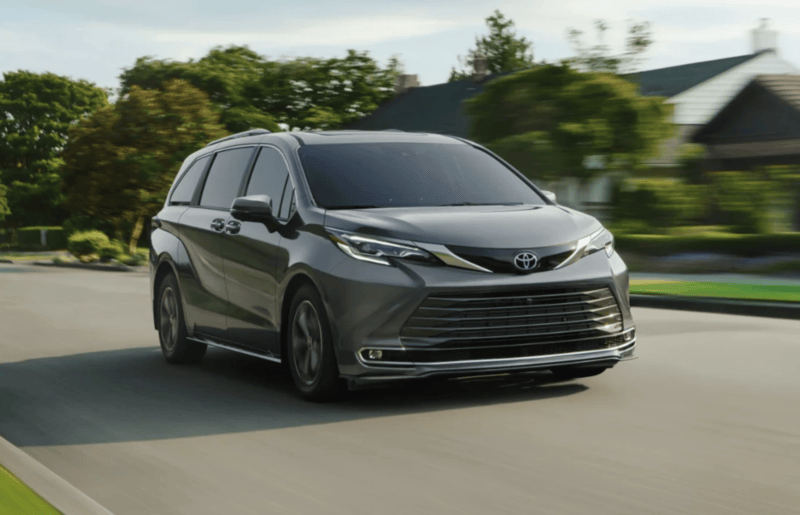

Automotive News reports that Toyota Sienna sales rose 35% to 101,486 in the U.S. last year, where the Sienna trailed only the Pacifica. The Honda Odyssey finished third in the U.S., up 10% to 88,462 sales.

Toyota Canada Director of Product Planning, Sales and Inventory Planning and Marketing Rebecca Wu said a minivan’s versatility makes it a popular choice among consumers.

“Think about the benefits of a van,” she said. “A lot of our customers are using it for outdoor activities and sometimes it might even be for their families. But sometimes it’s even for home improvement projects.”

SUV prices have steadily climbed since 2021, with three-row options outpacing overall car price inflation. As once-mainstream options like the Suburban and Expedition become more associated with luxury pricing, families looking to pack into a single vehicle have turned to minivans like the Chrysler Pacifica, Toyota Sienna, and Kia Carnival.

The rise of hybrid minivans has also changed the minivan’s reputation from gas guzzler to economical, Earth-friendly choice. Toyota’s hybrid Sienna is also available with all-wheel drive, a combination northern families would have once only dreamed of. For 2026, the hybrid Toyota Sienna gets up to 36 miles per gallon. Ten years ago, the Sienna was good for just 21 miles per gallon. Times are changing!

From the spaceship vibes of the Kia Carnival to the heavily modified minivans of YouTube, it’s clear that three rows are no longer just for huge, budget-minded families. Recent industry announcements show there’s more to come.

In August, Stellantis unveiled the Chrysler Pacifica Grizzly Peak Concept, which it called “the Ultimate Adventure Minivan.” Think AWD, a lifted suspension, and off-road tires.

Even luxury brand Genesis is playing with the idea of getting into the minivan game. They recently shared their Jet On Wheels minivan concept, which would be as shocking as the Cybertruck if it ever made it to production. Don’t count on it, though—it’s considered a design experiment. Still, the fact that Genesis is thinking about minivans shows how far we’ve come from the Chryslers of the ’90s.

👉 Stay on top of the best minivan and three-row SUV deals at our Monthly Deal Hub. New offers are announced during the first week of each month!

Just two automakers have announced plans for Super Bowl LX commercials that will air during the game on February 8, 2026. According to NBCUniversal, 30-second spots for the 2026 game are priced between $8 – $10 million. As of now, only Toyota and Cadillac have decided to write the big checks for primetime advertising. Fewer automakers than usual will be featured in the Super Bowl commercial breaks, with some big names already announcing they won’t participate.

Here’s a look at every automaker with Super Bowl commercials in 2026.

As the only true consumer-focused Super Bowl car commercial announced so far, Toyota is front and center for the big game. Toyota has revealed its commercial for Super Bowl LX, and it tells the story of a family and 30 years of RAV4. The RAV4 is completely redesigned for 2026 and now features a hybrid powertrain across the lineup.

The 2026 Toyota RAV4 starts at $33,350 for the base LE trim and is expected to cost over $50,000 for the sport-tuned GR Sport.

GM’s luxury brand is looking to transform its reputation from one that caters to older drivers to the backbone of a brand-new racing team. Rather than featuring the 2026 Cadillac lineup, the Super Bowl LX commercial will feature the Cadillac F1 team.

“The Super Bowl spot will take the team into millions of homes, while the Cadillac Countdown will give a front-row view in one of the busiest areas in the US,” said Dan Towriss, CEO of Cadillac Formula 1 Team Holdings.

Cadillac will become F1’s 11th team. Sergio Pérez and Valtteri Bottas will drive the Ferrari-powered Cadillac car in its debut season.

According to industry experts at AdAge, for most automakers, Super Bowl marketing is in the rearview mirror. The category, once a Big Game stalwart, is poised for another down year with only two brands—Toyota and Cadillac—confirming ad buys as of today. Instead of shelling out as much as $10 million for 30 seconds of airtime in the game, plus millions more for production costs, many automakers are seeking more value with their media buys.

Automakers are turning to more cost-effective options like streaming platforms, YouTube, and social media for their advertising budgets.

It would likely help if ad placement costs didn’t continually increase. Mike Marshall, head of global advertising for NBCUniversal, told Bloomberg that some ad slots for the Feb. 8 game on NBC have sold for $10 million. That’s a new record by a large margin.

The $10 million price tag is a 43% increase from 2022, when $7 million bought you 30 seconds of exposure. This year’s game is expected to attract an audience of up to 130 million viewers.

The typical cost for a 30-second commercial in the Super Bowl has risen 122% over the last decade. According to USA Today’s Ad Meter, here’s how much a Super Bowl commercial cost has risen over the last 25 years:

The car graveyard is growing faster than ever in 2026.

Every week, automakers announce another model getting the axe. In January alone, four models were dropped from the likes of Tesla, Dodge, Hyundai, and others. Some are old favorites that just couldn’t keep up. Others are failed experiments that never found a buyer. Either way, they’re all headed to the same place: automotive history.

The drumbeat of auto cancellations has grown so frequent that we decided to keep track of it all with a new resource: grimly named the Auto Obituaries. On this guide, we’ll be tracking every single cancellation as it happens in 2026. Check back often, because in today’s market, your favorite car could be next.

Hyundai is pulling the plug on the Santa Cruz compact pickup after just one generation, according to sources who spoke with Automotive News. Poor sales and bloated inventory are believed to be driving the decision. Ford’s Maverick outsold the Santa Cruz by a 6-to-1 margin in 2025, leaving Hyundai dealers sitting on nearly five months of unsold inventory by year’s end. Since their shared 2021 debut, the Maverick has racked up over 467,000 U.S. sales compared to just 140,000 for the Santa Cruz. The Maverick’s sub-$20,000 starting price significantly undercut the Santa Cruz’s $25,000 base MSRP. The Santa Cruz’s higher price, lack of a hybrid option, and polarizing design never caught on with buyers.

Hyundai isn’t abandoning trucks entirely. Hyundai plans to start building a midsize pickup in summer 2029, switching to traditional body-on-frame construction to compete with the Toyota Tacoma, Ford Ranger, and Chevrolet Colorado.

According to CarEdge, there were 226 days of supply for the Santa Cruz in late January, nearly triple the industry average.

Tesla will end production of the Model S sedan and Model X crossover next quarter to make room for an Optimus robot assembly line at its California factory, CEO Elon Musk announced on January 28. Musk said discontinuing the models is part of Tesla’s shift from an automotive company to a “physical-AI provider” focused on autonomous vehicles, robotaxis, and humanoid robots.

Combined sales of the Model S, Model X, and Cybertruck plunged 40 percent in 2025 to just 50,850 units X, according to Automotive News.

The Model S launched in 2012 as Tesla’s first mass-market vehicle. Starting at $96,630 in 2026, the Model S has seen its fair share of price changes in recent years as demand peaked and then steadily fell.

The Model X followed in 2015 with signature falcon-wing doors and now starts at $101,630. Both models are being axed as Tesla doubles down on its higher-volume Model 3 and Model Y, which sold nearly 1.6 million units globally last year despite a 7 percent decline.

The Dodge Hornet has been discontinued after just a few years on the market, with Stellantis pointing to “shifts in the policy environment” as the reason for axing the Italy-built crossover. In reality, the Hornet has just always been a very poor seller.

Stellantis initially announced in July that the Hornet would be postponed for the 2026 model year while the company evaluated U.S. tariff impacts, but production has now officially ended.

Built alongside the Alfa Romeo Tonale, the Hornet launched in 2023 with both conventional gasoline and plug-in hybrid options, starting at $31,990 for the base GT model X. It joins a long list of short-lived Dodge small crossovers, including the Caliber, Nitro, and Journey.

These cars are sticking around for now, but were recently making headlines for similar reasons. Stay tuned, as this may be a sign of things to come.

In January, Volkswagen announced that the Tennessee-built ID.4 will soon be renamed the ID.Tiguan. Following the end of U.S. federal EV incentives, ID.4 sales fell off a cliff. With policy changes being cited by nearly every OEM in recent lineup announcements, we wouldn’t be surprised if we soon learn that the ID.4 is canceled. It’s a great EV if you can find one at the right price, so we hope a name change will brighten its future.

General Motors has indicated that the recently resurrected Chevrolet Bolt will only live to see 18 months of production before it is canceled yet again. The Bolt was always a popular EV, largely due to the attainable price point around $30,000. However, policy changes seem to have gotten the best of GM’s much-hyped affordable EV strategy. At least the Bolt will stick around for much of 2027.

Wondering which cars will be axed next? Check out the slowest-selling cars in America.

While everyone’s lining up for the same RAV4s, CR-Vs, and F-150s, there are plenty of excellent vehicles that offer similar value, without the markups or slim inventory. These 10 cars fly under the radar, and that’s actually good news for you. Less demand means better negotiating power, bigger discounts, and often, better manufacturer incentives.

We’ve focused this list on two things that matter most when playing it smart: reliability and affordability.

All vehicles start under $40,000. All offer legitimate value. If you disagree with any cars you see here, drop us a note on the CarEdge Community Forum. Maybe you’ll even change our minds!

Without further ado, these are the cars that we think are worth the test drive before you settle for the best-seller in your neighbor’s driveway.

Starting Price: $30,745 MSRP with destination fees

Why It’s Underrated: Everyone wants the RAV4 Hybrid, so they overlook its smaller, cheaper sibling. Before you get in line for a 2026 RAV4, we think the less popular Corolla Cross Hybrid is worth a look.

The Corolla Cross Hybrid sits on Toyota’s proven platform, gets 42 mpg combined, and costs thousands less than a comparable RAV4 Hybrid. Consider this: the Corolla Cross XSE costs $8,000 less than the 2026 RAV4 XSE. It has nearly identical reliability credentials—because both models share Toyota’s 5th generation hybrid powertrain.

The interior is nicer than you’d expect at this price point, but it’s still a budget model. Plus, you can actually find these on dealer lots without a markup, unlike their RAV4 cousins.

Toyota sold just 100,000 copies of the Corolla Cross in 2025, despite tallying 478,000 sales for the very similar RAV4.

Starting Price: $28,445 MSRP with destination fees

Why It’s Underrated: People think it’s too small and too slow. They’re missing the point.

The Crosstrek is consistently in the top tier of Consumer Reports’ reliability rankings. It comes standard with all-wheel drive (most competitors charge $1,500-2,000 for that), gets excellent safety scores, and has one of the lowest cost-of-ownership figures in its class.

Yes, the base engine is underwhelming. But if you’re buying a Crosstrek for drag racing, you’ve already made a mistake. This is a get-to-work-in-a-snowstorm, haul-camping-gear type of compact crossover.

Subaru often brings low-APR incentives to the Crosstrek.

Starting Price: $31,485 MSRP with destination fees

Why It’s Underrated: The CX-5 has been around for over a decade with minimal issues. It has a borderline premium interior that rivals luxury brands, handles better than anything in its class, and has a low overall cost of ownership.

Better yet, Mazda routinely offers better manufacturer incentives than you’ll find for the RAV4 or CR-V. See the best offers of the month.

Starting Price: $31,985 MSRP with destination fees

Why It’s Underrated: To many, Kia’s reputation is stuck in 2005. That’s unfortunate, because their vehicles aren’t.

The Sportage Hybrid won U.S. News’ “Best Cars for the Money” award. It comes loaded with features that cost extra on Toyota and Honda. Worried about reliability? Kia is winning over skeptics with a 10-year/100,000-mile powertrain warranty.

Kia’s reliability has genuinely improved. They’re not Toyota-level yet, but they’re solid mid-tier, and that warranty gives you coverage longer than most people keep their vehicles anyway. The hybrid system delivers excellent fuel economy without the Toyota markup.

According to EPA testing, the 2026 Sportage Hybrid is good for 43 miles per gallon in combined city/highway driving. That’s a few MPGs better than most RAV4 trim options!

Starting Price: $25,890 MSRP with destination fees

Why It’s Underrated: Are you sure you want to join the compact crossover club? The Civic is a legendary car full of value and character. In fact, along with the Toyota Camry, it’s one of the only sedans that still ranks in the top 10 sellers by volume. Looking to keep your car budget in check? That’s another reason to love the Civic: it starts at $25,890.

Unless you regularly haul a big family or go off-road, SUV drivers are paying extra for ride height you don’t need. The Civic gets better gas mileage, costs less to insure, is easier to park, and will last just as long as any crossover.

After peaking at 377,000 sales back in 2017, Honda sold just 238,000 Civics in 2025.

Starting Price: $38,250 MSRP with destination fees

Why It’s Underrated: People assume luxury means expensive repairs. With Lexus, that assumption is wrong.

The UX is the most reliable luxury subcompact SUV according to Consumer Reports. Lexus has topped J.D. Power’s dependability rankings three years running. What’s behind their success? To be frank, a Lexus is Toyota engineering with a nicer interior.

In 2026, the UX comes standard with a hybrid powertrain good for over 40 miles per gallon. This means hundreds of dollars in annual fuel savings for the average driver.

Yes, it’s smaller than German competitors. But it’s also more reliable than German competitors, cheaper to maintain, and will probably still feel premium in 10 years when others are nickel-and-diming you for sensors and software updates.

Browse Lexus UX listings near you

Starting Price: $27,950 MSRP with destination fees

Why It’s Underrated: People think bigger is always better. In urban environments, a large SUV can be a headache.

The HR-V brings Honda’s legendary reliability to the subcompact crossover segment. Consumer Reports gives it above-average reliability ratings, and Honda’s track record for affordable maintenance speaks for itself.

The real magic is the interior space. Honda’s engineers are wizards at maximizing every inch. The cargo area is impressive for a vehicle of this size, and the rear seat is more spacious than many midsize SUVs. Pair that with decent fuel economy (28 mpg combined) and Honda’s reputation for going 200,000+ miles on an engine, and you have a smart choice for anyone who doesn’t need to tow a boat.

Last year, Honda sold 148,000 copies of the HR-V. That’s one-third of the sales that the CR-V achieved.

Buying a car doesn’t have to be miserable. Here’s a wild thought: what if you could just have an expert handle it all for you, from finding the right fit to negotiating every aspect of your deal?

That’s exactly what we do at CarEdge.

Since launching our car buying service a few years back, we’ve negotiated over 3,000 deals for drivers around the nation. On average, CarEdge clients save $2,200 by letting us negotiate on their behalf. Say goodbye to the ‘traditional’ way to buy a car, and let’s get you the price, and experience, you deserve!