CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

In an unprecedented move, 13,000 workers from Detroit’s “Big Three” – Ford, General Motors, and Chrysler (now part of Stellantis) – have initiated a coordinated strike, the likes of which haven’t been seen in UAW’s 88-year legacy. Led by UAW President Shawn Fain, this strategic “stand-up strike” not only challenges automakers but also poses a pressing question: How might this impact car prices in the coming weeks? Let’s talk about how the UAW union strike could impact car buying, and what the range of possibilities are.

Is it a car buying apocalypse? You’d think so from some of the headlines this week. However, not everyone sees this as quite such a big deal. Sam Fiorani of Auto Forecast Solutions comments, “This is more of a symbolic strike than an actual damaging one.” But he also warns, if the negotiations fail to progress, a more extensive, damaging strike might just be around the corner.

Yet, the union’s strategy here is clear: by opting for targeted walkouts, the UAW hopes to keep their strike pay costs down, leveraging their $825 million strike fund against the automakers’ multi-billion profit reserves. And while Stellantis might be sitting on a comfortable 90-day Jeep stockpile, they stand to lose more than $380 million in just a week, should the Toledo Jeep plant face shutdowns.

What’s more, new car inventory in the U.S. is already swelling. GM, Ford and Stellantis dealer lots are chock-full, and this trend is expected to continue into October. So, where does that leave car prices? They’re still high, but are trending downward. The real deals are for those who negotiate with data-backed leverage.

Our team of Car Coaches are finding more and more negotiability in today’s car market. However, most of these car price soft spots are NOT advertised online. Sure, manufacturers are advertising a few great APR and lease deals, but most of the savings are coming from negotiation know-how.

Check out these negotiation success stories to see what we mean.

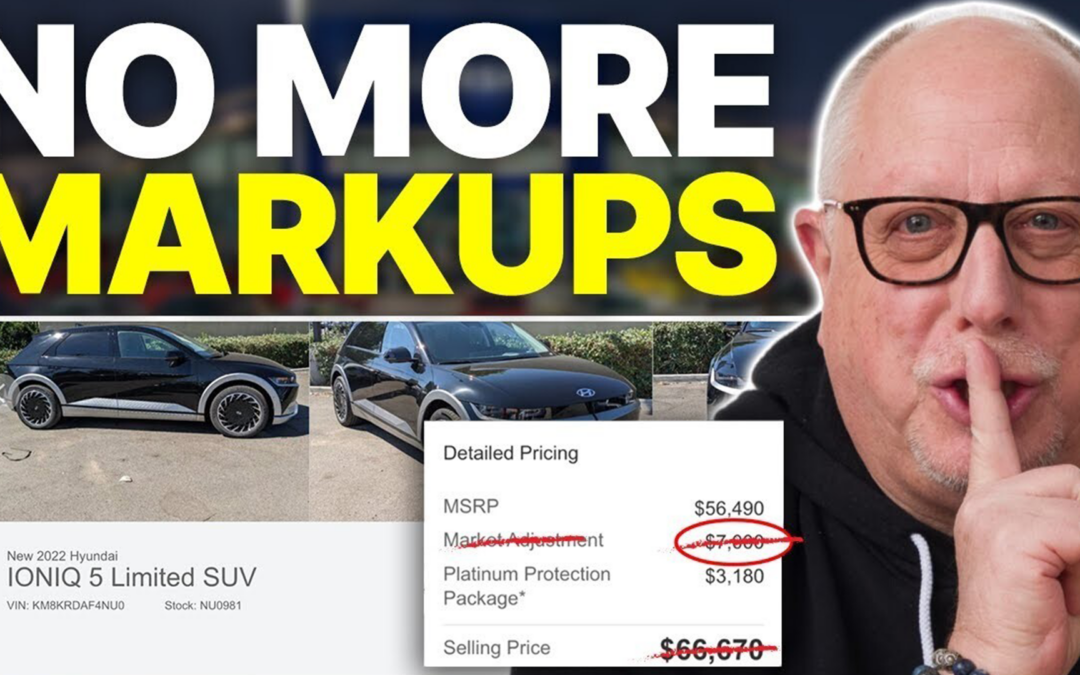

From a car dealership’s perspective, the strike might be a disguised blessing. Memories of the semiconductor chip shortages of 2021-22 still linger. That period saw many dealerships thriving on the opportunity to invoke ‘market adjustments’, leading to lucrative ‘dealer markups’. Simply put, less supply often equals more demand, enabling dealers to push prices up.

Remember, dealer markups, also known as ‘market adjustments’, are nothing but added profits for the car dealership.

Here’s the billion-dollar question: Will this strike inflate car prices?

A lot hinges on the strike’s duration. If the UAW strike stretches beyond 14 days, there’s a good chance we’ll see prices start to nudge upwards. However, considering the leverage UAW holds and the possible intervention from the U.S. government, a prolonged strike seems unlikely.

For those marking their calendars for a late 2023 car purchase, our advice is simple: Stay calm and carry on with your car buying preparations. Even with the specter of a UAW strike looming large, our expert Car Coaches are optimistic about end-of-the-year deals.

Car Market Update for Fall 2023: New and Used Car Forecast

Feeling uneasy about the car market, or simply want some help from a car buying pro? From free car buying resources to 1:1 expert help with your deal, the CarEdge team is here to help! Prefer a simple consultation with an expert? We’ve got that too. Whether you’re looking for car market price tools, or your own personal car coach, we’ve got you covered.

New this week: Car Buyer’s Deal School is now 100% FREE! Start learning today!

We’ll leave you with these reader favorites:

The Best Auto Loan Rates This Month

Connect with thousands of empowered consumers at our fast-growing online forum, the CarEdge Community (100% free)!

As the seasons transition, so does the car market! September has welcomed surprisingly great new car incentives from some brands, and pathetic offers from others. Auto manufacturers are eager to push 2023 models into the limelight before the new year arrives. If you’re in the market for a new car, now’s your golden opportunity. Here’s a roundup of the most enticing offers for buying and leasing.

The highest interest rates in 20 years are not stopping OEMs from launching great financing deals in September. In fact, we were shocked at the abundance of 0.0%-0.9% APR offers. Automakers likely see this month as the last chance to sell 2023 models before they take on a dated feel. Some of your favorite brands are offering jaw-droppingly low interest rates.

Let’s take a look at the best of the best. For a complete list of new car financing offers, head to this resource.

Hyundai: As low as 0.9% APR for all 2023 models, including the popular Palisade, Santa Fe, Sonata and more. The IONIQ 5 EV also qualifies for up to $7,500 in cash incentives. See details at HyundaiUSA.com.

Kia is also offering 0.9% APR financing for all 2023 models for well-qualified buyers. See details at kia.com.

Honda: 0.9% APR for the Honda Accord (including Hybrid), Civic Hatchback, Civic Sedan, CR-V, HR-V, Odyssey, Passport, Pilot, Ridgeline. See details at Honda.com.

Toyota: 1.9% APR financing. See details at Toyota.com.

Chevrolet: 0% financing for the Silverado 1500, and no payments for 90 days (Truck Season Sale). Trailblazer, Equinox, Blazer, Traverse all qualify for 2.1% APR. For all other models, including the Tahoe, Suburban, Colorado and Bolt, Chevy says to contact a dealer for the latest offers.

Ram, Ford, Nissan: Can you believe it? A straight 0.0% APR for many 2023 models. Unfortunately, the automakers say you must contact a dealer for specific offers.

Mazda: As low as 0.9% APR for all 2023 models, including the CX-30, CX-9, and other models.

GMC: APR as low as 0.9% for most models, including the Sierra 1500, Terrain, Yukon, and more.

When it comes to cash incentives, electric vehicles are stealing the show. Especially those not falling under the revised federal EV tax credit. Here’s where you can save the most:

Hyundai IONIQ 5: A huge $7,500 off for some trim options. Caution: some dealerships continue to mark up their Hyundai EVs. The deals ARE out there! See details at HyundaiUSA.com.

Kia EV6, Niro EV, Chevrolet Bolt: Up to $5,000 off. Learn more about Kia deals at kia.com and see Chevrolet offers at chevrolet.com.

Toyota bZ4X: Another whopping $7,500 off. Caution: Toyota’s first EV charges slowly. Think about your charging needs and preferences before buying any EV. Learn more about this offer at Toyota.com.

Nissan Ariya (all-new) and LEAF: $3,750 cash incentive. See details at NissanUSA.com.

Ford: An enticing $3,000 off for both the Mustang Mach-E and F-150 Lightning. See details at Ford.com.

Toyota Prius Prime PHEV: Up to $4,500 off. Learn more at Toyota.com.

Stellantis is bringing stellar new car incentives this month, but their bloated inventory numbers show that they may have no choice. They are offering almost 15% off MSRP for some models, including the Jeep Cherokee, Gladiator, and others. This translates to up to $7,000 for higher trims. And for the Ram 1500? Up to $4,000 off the MSRP!

Ready to drive the latest models without the long-term commitment? Here are the most attractive lease offers.

We detail ALL of the best lease deals from every major brand here.

Hyundai Venue: $151 per month with $3,281 due (Details)

Hyundai Kona: $202 per month with $4,212 due (Details)

Hyundai Elantra: $219 per month with $3,499 due (Details)

Kia Forte: $229/month for 36 months with $2,799 due (Details)

Subaru Legacy: $269 per month for 36 months with $3,255 due (Details)

Honda Civic Sedan: $259 per month for 36 months with $3,399 due (Details)

Toyota Corolla: $321 per month for 36 months with $3,031 due (Details)

Chevrolet Equinox: $299 per month for 24 months with $2,339 due (Details)

GMC Acadia: $289 per month for 24 months with $2,999 due

Mazda CX-30: $301 per month for 36 months with $2,999 due at signing. (Details)

Hyundai Santa Fe: $269 per month for 36 months with $3,999 due (Details)

Honda CR-V: $309 per month for 36 months with $3,399 due (Details)

These are the best truck lease deals right now:

Ram 1500: $359/month for 42 months, $5,599 due at signing (Details)

Silverado 1500 4WD LT: $399 for 24 months with $5,124 due (Details)

Toyota Tacoma: $364 per month for 36 months with $3,064 due (Details)

There are reasons to consider leasing an EV these days. There are fuel savings, the novelty of transportation reimagined, exhilarating performance, and lower emissions. Plus, EV leases are becoming more affordable! The most compelling reason to lease an EV is the protection from ending up with an outdated car. With a lease, you’ll be able to upgrade to a faster charging, longer range model when your lease term is complete. That’s a lot better than being stuck with a slow charging, less-than-capable electric vehicle in a few years!

Here’s a look at the best EV lease deals this month:

| Make | Model | Trim | Months | Monthly Payment (Pre-Tax) | Due at Signing |

|---|---|---|---|---|---|

| Kia | Niro EV | Wind | 24 | $189 | $3,999 |

| Kia | EV6 | Light Long Range | 24 | $219 | $3,999 |

| Toyota | bZ4X | XLE | 36 | $359 | $0 |

| Ford | F-150 Lightning | XLT Standard Range | 36 | $550 | $7,059 |

| Ford | Mustang Mach-E | Premium AWD | 36 | $366 | $5,575 |

| Chevrolet | Equinox EV | 2LT | 24 | $299 | $3,169 |

| Hyundai | Ioniq 5 | SE Long Range | 24 | $189 | $3,999 |

| Hyundai | Kona EV | SE | 24 | $189 | $3,999 |

| Tesla | Model 3 | RWD | 36 | $309 | $2,999 |

| Tesla | Model Y | Long Range AWD | 36 | $339 | $2,999 |

The automotive landscape is in flux, and upcoming weeks may bring even more enticing new car incentives. With rising interest rates surpassing 7%, coupled with MSRP escalations and a cooling used car market, the scales tilt towards reduced demand for brand-new vehicles. Reduced demand almost always results in stronger manufacturer incentives to lure in buyers. This is particularly evident for the high-ticket trucks and SUVs.

Keep track of new cars with the most and least inventory for the latest negotiability updates.

As you head out to shop the dealer lots, remember this: if it’s taxable, it’s negotiable. Even the models with the tightest supply are negotiable with the help of a CarEdge Coach. Check out these car buying success stories!

Take this FREE resource with you: The Ultimate Car Buying Cheat Sheet (Downloadable)

Ready to work 1:1 with a car buying pro? Learn more about CarEdge Coach, your path to the most savings and the least stress. Prefer a DIY path to car buying? With CarEdge Data, you have the tools at your disposal to find the best deals and identify opportunities for negotiation.

And of course, we have hundreds of 100% free car buying guides just a click away. Don’t forget to connect with the CarEdge family over on our Community Forum.

Honda inventory is rising, and is now the highest it’s been since before the pandemic. As a result, Honda models are more negotiable today than at any point in recent years. Across the brand, there’s a 47-day supply of new Honda cars and SUVs.

The current state of Honda’s inventory offers insights into which models provide more wiggle room for negotiation and which ones are a tighter squeeze. Plus, we’ll take a look at the best Honda offers this month. Let’s delve into the numbers and see where you might find the best deals.

Savvy car buyers have a little-known trick up their sleeve: market day supply. Previously, market day supply (MDS) was only used by auto industry insiders. We’re out to change that.

Market Day Supply takes into account the existing inventory of a new or used vehicle, and the selling rate over the last 45 days. What you get is the number of days it would take to sell ALL vehicles in stock at current selling rates, assuming no new inventory was added. In simple terms, MDS reflects the level of demand for a car. High MDS almost always means high negotiability. Low MDS suggests that deals will be harder to come by.

For starters, a ‘healthy’ MDS in the car market is somewhere between 45 and 60 days of supply. Anything below 20 days is a real shortage, and anything above 80 is a serious oversupply. Today, Honda averages a healthy 47 days of supply. For Honda, this is quite high.

When assessing the most negotiable new Honda models based on present market supply, three models stand out: the HR-V, Odyssey and surprisingly, the remaining 2023 CR-Vs. These vehicles offer buyers a good chance to get a sweet deal.

Here’s the latest Honda inventory nationwide. We’ve included used Honda inventory numbers to highlight possible opportunities for better deals, depending on the model.

For local market numbers, check out CarEdge Data.

Honda Sedans:

| Model | New/Used | Market Day Supply (October '23) | Market Day Supply (December '23) | Total For Sale |

|---|---|---|---|---|

| Accord | New 2024 | N/A | 56 | 23,548 |

| Accord | New 2023 | 30 | 58 | 2,662 |

| Accord | Used 2022 | 49 | 60 | 2,204 |

| Accord | Used 2021 | 49 | 54 | 3,285 |

| Accord | Used 2020 | 43 | 48 | 3,384 |

| Civic | New 2024 | N/A | 50 | 17,167 |

| Civic | New 2023 | 34 | 62 | 360 |

| Civic | Used 2022 | 50 | 60 | 2,038 |

| Civic | Used 2021 | 53 | 58 | 2,196 |

| Civic | Used 2020 | 40 | 46 | 4,245 |

Honda SUVs and Trucks:

| Model | New/Used | Market Day Supply (October '23) | Market Day Supply (December '23) | Total For Sale |

|---|---|---|---|---|

| CR-V | New 2024 | 24 | 34 | 33,171 |

| CR-V | New 2023 | 12 | 99 | 1,106 |

| CR-V | Used 2022 | 45 | 60 | 2,383 |

| CR-V | Used 2021 | 47 | 62 | 4,186 |

| CR-V | Used 2020 | 41 | 51 | 5,743 |

| HR-V | New 2024 | 47 | 58 | 21,075 |

| HR-V | New 2023 | 151 | 891 | 691 |

| HR-V | Used 2022 | 59 | 48 | 1,957 |

| HR-V | Used 2021 | 52 | 54 | 2,331 |

| HR-V | Used 2020 | 39 | 50 | 1,427 |

| Odyssey | New 2024 | N/A | 45 | 8,089 |

| Odyssey | New 2023 | 31 | 120 | 512 |

| Odyssey | Used 2022 | 74 | 79 | 833 |

| Odyssey | Used 2021 | 61 | 62 | 1,116 |

| Odyssey | Used 2020 | 51 | 61 | 1,098 |

| Passport | New 2024 | N/A | 55 | 2,720 |

| Passport | New 2023 | 45 | 30 | 3,003 |

| Passport | Used 2022 | 56 | 76 | 604 |

| Passport | Used 2021 | 60 | 71 | 1,379 |

| Passport | Used 2020 | 53 | 61 | 664 |

| Pilot | New 2024 | N/A | 45 | 12,496 |

| Pilot | New 2023 | 26 | 45 | 522 |

| Pilot | Used 2022 | 52 | 71 | 1,760 |

| Pilot | Used 2021 | 48 | 59 | 3,032 |

| Pilot | Used 2020 | 47 | 62 | 1,560 |

| Ridgeline | New 2024 | N/A | N/A | N/A |

| Ridgeline | New 2023 | 39 | 53 | 6,904 |

| Ridgeline | Used 2022 | 57 | 63 | 424 |

| Ridgeline | Used 2021 | 61 | 64 | 370 |

| Ridgeline | Used 2020 | 47 | 57 | 576 |

On the other hand, the least negotiable models in the Honda lineup, perhaps unsurprisingly, are the popular CR-V and the spacious Passport. But don’t lose hope; while new models might be challenging to haggle over, there’s a silver lining.

A closer look at Honda’s inventory reveals that the used car market offers a more balanced playing field. For those eyeing a Honda, it seems that the gently used 2021-2022 models are where the action is. Cars from this year appear to be in ample supply, making them a prime target for savvy buyers aiming for a reasonable deal.

Remember: in general, 2021-2022 used Honda models are in high supply. However, there are nuances from one model to the next. For specific data points for particular models in certain markets, we recommend CarEdge Data.

We track the used car market weekly here, and it’s clear that wholesale prices are in freefall. Slowly but surely, these price declines are translating to retail markets. It seems that used car dealers are fighting the overall market’s downward trend as long as they can.

Even with low inventory for its most popular models, Honda is offering great financing and lease deals this month. Caution: dealers are known to add ‘market adjustments’ onto the price tag of the popular, low inventory models. We do NOT think any Honda buyers should agree to pay any dealer markups in today’s market. Need assistance negotiating markups and fees? Speak to a CarEdge Car Coach today.

The average APR for a new car loan is 9.95%, so these deals are worth considering.

Ridgeline: Enjoy a 0.9% APR for 24 to 36 months (or 2.9% APR for up to 60 months).

Accord and Passport: 2.9% APR for up to 40 months.

Other Models: 3.9% APR for up to 48 months (or 4.9% APR for up to 60 months).

See offer details at Honda.com

Accord: Drive away with a lease at $299/month for 36 months, with an initial payment of $3,299.

Civic Sedan: Get behind the wheel for $259/month, with $3,299 down.

CR-V: Lease deals start as low as $309/month for 36 months with a down payment of $3,399.

Passport: If size matters, this larger vehicle is available starting at $369/month for 36 months, with $4,899 down.

See offer details at Honda.com

The key to negotiation lies in understanding the dynamics and positioning oneself strategically. So gear up, arm yourself with this intel, and drive into your Honda negotiation with confidence. Remember, even in a market pinch, there’s NO justification for overpriced add-ons or inflated warranties.

Ready to negotiate like a pro? Try CarEdge Coach and CarEdge Data today! With these tools at your disposal, you can take control of your car buying experience, understand market dynamics, strategize effectively, and secure the best deal possible. We’re simply here to help!

More drivers are warming up to the idea of electric vehicles, yet, for many, the high purchase price of EVs is too much. On top of that, EVs depreciate faster than other types of cars, leaving many buyers without equity for years to come. The best electric vehicle leases provide a great way to avoid these two obstacles. By leasing, you experience the cutting-edge technology of EVs without the long-term financial commitment. By the time your lease ends, electric mobility will be miles ahead of today’s car models.

These aren’t just the cheapest EV leases available right now. Instead, we’ve curated this list of the BEST EV lease deals in April 2025. What’s the difference? All of these electric cars and SUVs offer fast charging, plenty of range, and high driver satisfaction. Note that these manufacturer lease offers exclude tax, title, and fees. The dealer sets the final price.

👉 Not sure if leasing is for you? Be sure to check out The Consumer’s Guide to Leasing.

Best Lease Deal: $179/month for 24 months with $3,999 due at signing.

The Kia EV6 is one of the fastest-charging EVs available today, period. In face, it’s the fastest-charging EV on sale in 2024 for under $50,000, on pace with the Hyundai IONIQ 5 and Tesla’s most affordable models. For those interested in buying, the EV6 is available with zero percent financing for 72 months right now.

This offer ends on 4/30/2025. See offer details.

Browse Kia EV6 listings with the power of local market data

Best Deal: $299/month for 36 months with $1,000 due at signing.

The Tesla Model 3 is still the king of EVs. Even as sales growth stalls, it’s still Tesla’s market. Legacy automakers can only hope for second place. The main Tesla advantages in 2025 are the vast Supercharger network, and the ease of over-the-air software updates for feature upgrades and recall fixes. The newly-refreshed Model Y is also available with great lease terms.

See offer details at Tesla.com.

Browse used Tesla listings before buying new

Best Lease Deal: $299/month for 24 months with $4,169 due at signing.

The Chevy Equinox EV is one of the best cheap EVs on sale in April 2025. InsideEVs recently awarded the Equinox EV with their ‘Breakthrough EV of the Year‘ award. Despite more recently arriving, the Equinox EV is outselling the Chevrolet Blazer EV by a wide margin. The Equinox EV also has 0.9% APR for 60 months for those wanting to buy.

This offer ends on 4/30/2025. See offer details.

Browse Equinox EV listings with the power of local market data

Best Lease Deal: Lease the Honda Prologue front-wheel drive Touring from $239/month for 24-36 months with just $3,199 due at signing.

Honda went from zero EV sales to having one of the top-selling models in America. This is a stark contrast with Toyota, who has struggled to sell the less impressive bZ4X electric crossover.

This offer ends on April 30, 2025. See offer details.

Browse Honda Prologue listings with the power of local market data

Leasing an EV is the best way to try out the electric vehicle lifestyle without the hefty price tag and long-term commitment. Our rundown of the top electric vehicle leases offers insights into deals that provide both value and quality.

👉 Tired of car buying hassles? Let a professional do it for you! Learn more about CarEdge Concierge, the most-trusted car buying service out there!

Stepping into a car dealership can feel like entering a high-stakes poker game, but with the right guidance, you can confidently call their bluff. CarEdge’s Ray Shefska lifts the veil on dealership tactics with secrets from his impressive 40+ year tenure in the industry. While maximizing profits is part of their playbook, you don’t have to be an unwitting participant. With CarEdge by your side, here are the pivotal questions and strategies to empower your negotiations.

Correct answer: I have a total out-the-door price in mind. I’d like to stay focused on that.

Wrong answer: Yes, I don’t want my monthly payment to be more than $700 per month.

Why: Once the dealer knows what your monthly payment goal is, they immediately start thinking about how much wiggle room they have for add-on products, incentives and other odds and ends of the deal. Once you share your desired monthly payment, you’ll be negotiating that number for the rest of the deal. This makes it alarmingly easy to lose sight of how much you’re actually paying for the car.

Correct answer: I just want to know what the out-the-door number is, can we stay focused on that for now?

Wrong answer: I think I could put between $5,000 and $10,000 down. It depends on what the price of the car is, and how much you give me for the trade-in.

Why: This question is another tactic the salesperson uses to turn you into a ‘payment buyer’. Yes, you’ll eventually have to tell them what your down payment is, but do NOT volunteer that information too early in the negotiation! Car dealership salespeople are going to.

Note: Often, the salesperson will phrase this question as if it’s coming from the bank. For example, “The bank typically wants you to put 20% cash down or more. Were you planning on doing that?” You can still refuse to answer this question early on in the conversation. Remember, you’re still trying to get the out-the-door price from them. That’s the number that matters.

Correct answer: I haven’t decided yet. Once we’ve established an out-the-door number, we can discuss things like that.

Wrong answer: Yes of course, how much can you give me for it?

Why: You should always treat buying a car and trading in as TWO separate transactions, because they truly are. See what your car is worth with offers from multiple online buyers here.

These are the questions you’re most likely to encounter at the finance office. For even more tips, examples and advice, see our Finance Office Cheat Sheet. It’s one of our many free resources!

Correct answer: I have thought about this and I’ve even been pre-approved with competitive credit unions, so I do understand what my loan terms should be in order to keep my payment affordable.

Wrong answer: No, I haven’t thought about it yet. Can you help me lower my payment even further?

Why: When you express uncertainty about your desired loan term, finance managers spot an opportunity to manipulate the loan term to make a deal appear more attractive. By extending the loan term, they can “lower” your monthly payments, even if it ends up costing you more in the long run due to interest.

Correct answer: Yes, if you can beat the rate I have on my pre-approval from the credit union, I’d consider it. The rate and the payment would need to come down enough to justify it.

Wrong answer: Sure! That sounds easier.

Why: Be sure to mention that your payment would need to come down in addition to getting a lower interest rate. Why? All too often, the finance manager can offer you a slightly lower interest rate, only to trick you into add-on products later, meaning that your monthly payment ends up the same or even higher than it was originally.

Are you interested in our tire care package for just $6 per month? Or theft protection for just $10 per month?

Correct answer: Thanks, but for each of these products, I need to see the total cost of the product, not just the monthly payment.

Wrong answer: Awesome, wow I see that this theft protection only adds $10 per month!

Why: Expect them to show you the monthly payment, not the total price of the products on their menu. You’ll have to ask for them to point out the total price. Remember this: A product that adds ‘just’ $10 to your monthly car payment over a 60-month loan term will actually cost you $600.

Would you pay $600 for something like tire protection or theft protection? Or, could you buy these products elsewhere for half the price? This is how you should think about the menu products.

The finance office is not the time to lose sight of the number that matters: the out-the-door price!

Familiarize yourself with car dealer fees and products with our complete introduction.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

Remember that when buying or leasing a car, knowledge is power!