CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Most car buyers don’t typically think of autumn as a great time to buy a car, but it’s the perfect time if you know where to look. Whether you’re planning to buy, hoping to sell, or are just curious about where the industry is headed, you’ve come to the right place. Buckle up as we steer you through the latest trends, from brand inventories and market conditions to financial forecasts. Let’s roll!

The new car market still hasn’t reached so-called ‘normal’. Will it ever? Only a fool would make bold predictions after what we’ve all witnessed this decade. However, let’s talk about what we do know.

This autumn, we’re seeing an increase in cars on the lot, yet a significant disparity persists between automakers in terms of inventory levels. The current industry average hovers just under 60 days in terms of Market Day Supply. Why should you care about Market Day Supply (MDS)? This metric is crucial when understanding how much bargaining power you might have at the dealership. Brands with a high MDS are more eager to shift their inventory, and therefore, more likely to negotiate on price.

In the present market, Infiniti, Chrysler, Lincoln, Ford, Dodge, Buick, and Jeep have high inventory levels. This makes them prime targets for savvy buyers looking to negotiate a better deal. Here’s a look at nationwide inventory for the most negotiable new car brands:

| Make | Market Day Supply (Nationwide 9/1/23) |

|---|---|

| Infiniti | 119 |

| Chrysler | 179 |

| Lincoln | 128 |

| Ford | 99 |

| Dodge | 190 |

| Buick | 113 |

| Jeep | 179 |

| Market Average | 72 |

As you can see, all of these brands are dealing with a surplus of new car inventory right now. The longer that a new car sits on a dealer’s lot, the more negotiable it becomes for the knowledgeable car buyer. Dealers pay ‘floorplanning costs’ to keep inventory, so every day cuts into their profit margins. Learn how to use this information to your advantage with this 100% free Car Buying Cheat Sheet.

On the flip side, if you’re looking at Kia, Honda, Subaru, Lexus, BMW, and Toyota, be prepared for a bit of a struggle. These brands are facing low inventory levels. In some instances, new arrivals are pre-sold before they even hit the lot!

Here’s nationwide inventory for these new cars:

| Make | Market Day Supply (Nationwide 9/1/23) |

|---|---|

| Kia | 35 |

| Honda | 33 |

| Subaru | 48 |

| Lexus | 50 |

| BMW | 49 |

| Toyota | 40 |

| Market Average | 72 |

See local car market data for every make and model with CarEdge Data.

Surprisingly, Subaru remains a brand that’s willing to negotiate even when their inventory is low. Let’s take a look at some examples of today’s Subaru inventory:

| Make | Model | Market Day Supply | Total For Sale |

|---|---|---|---|

| Subaru | Ascent | 66 | 6,992 |

| Subaru | Solterra | 82 | 2,092 |

| Subaru | Crosstrek | 61 | 18,096 |

| Subaru | Forester | 74 | 26,782 |

| Subaru | Outback | 80 | 24,836 |

| Subaru | Impreza | 63 | 4,031 |

| Subaru | Legacy | 58 | 3,498 |

| Subaru | WRX | 83 | 3,339 |

| Subaru | Brand Average | 71 | 89,879 |

Our Coaches frequently empower Subaru lovers with the skills to negotiate even low-inventory new and used Subaru models. Check out these success stories of what is possible!

These are the top trends that our team of Car Coaches are watching this fall season. Each of these variables has the potential to disrupt the new car market in significant ways.

Inventory Surge: The buildup of new car inventory has already begun, but the question remains, will it last into fall? With sky-high interest rates continuing to dominate buyer’s mindsets, we think it will. We predict a buildup of new vehicle inventory as we near the end of 2023, slowly but surely.

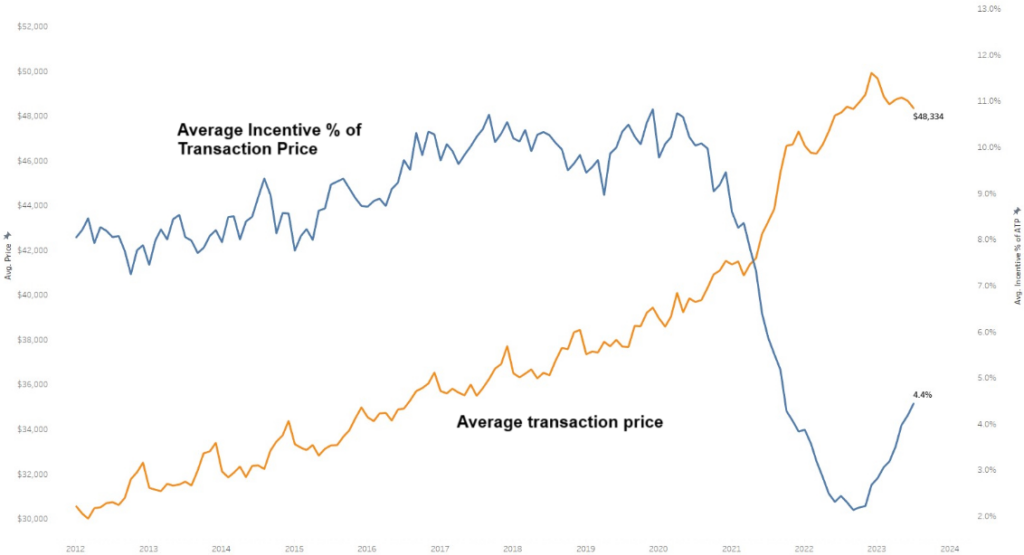

Manufacturer Incentives: Manufacturer incentive spending is at a two-year high, accounting for 4% of the transaction price on average. Brands like Ram and Jeep have recently advertised new models at 10-15% below MSRP. If manufacturers increased their incentives to pre-pandemic historical norms around 7-9%, that would entice more buyers to take action. We don’t expect automakers to raise incentives at such a rapid pace by winter, however.

The UAW Wildcard: There’s speculation of a 10-20 day UAW strike that could cause short-term hiccups. While we don’t expect this to be a game-changer, it’s something to keep an eye on. It would, however, be a bigger deal for automakers like Stellantis and General Motors. Analysts estimate that a 10-day strike would cost them about $5 billion.

CarEdge New Car Market Seasonal Rating: It’s a ‘fine’ time to buy a new car.

Better deals are anticipated this winter, but depending on what vehicle you’re in the market for, this autumn just might be the perfect time to negotiate a great deal.

While used car prices have slightly decreased, they are still far above historical averages. This means you’re unlikely to snag a bargain, especially if you’re gunning for a reliable vehicle with a clean history for under $20,000.

Pro Tip: Never enter the used car market blind. Always get a pre-purchase inspection (PPI) to understand the future maintenance needs and overall condition of the car.

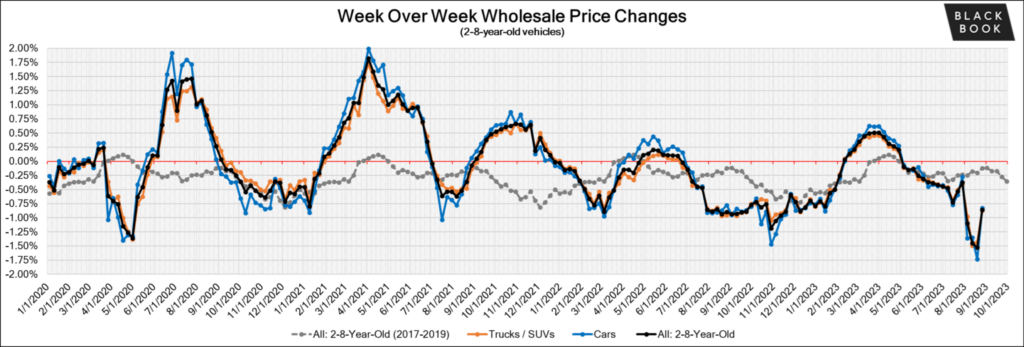

Trade-in values will continue to slowly decline as wholesale auction values are expected to keep falling. Following historically steep declines in wholesale used car prices in July and early August, we expect a more gradual decline in the fall.

Whereas used cars, trucks and SUV values were falling at a rate of -1.00% to -1.5% weekly as of last month, we expect weekly used car values to decline by around -0.5% to -0.3% for most of this season. Why? There’s no indication that a glut of used car inventory will arrive on the market any time soon to drive down values quickly.

The best used car sellers (especially those looking to trade-in) should hope for is slow but steady drops in value in September through November. You’re likely to get more for your trade-in or used car sale today than you will in a few months.

CarEdge Used Car Market Seasonal Rating: very difficult for buyers on a budget.

This is especially true if you’re looking for a vehicle of decent, reliable quality for under $20,000. Interest rates incentivize large down payments and cash buyers, but most of us don’t have the means to put $10,000 or $20,000 down.

No matter what, don’t give up. From free car buying resources to 1:1 expert help with your deal, the CarEdge team is here to help!

If you’re in the market for a new or used car, here’s our most important advice for you: Generally, say NO to market adjustments. A lot has changed since the madness and mayhem of late 2021 and early 2022. The exceptions are true specialty vehicles like Ford Bronco Raptor or Toyota RAV4 Prime, which are so in-demand that markups are almost a given.

For most new and used car models, there’s no way car dealers could justify additional markups in 2023. Staring down a tough deal? Work with a Car Coach to negotiate the BEST deal possible.

We’ll leave you with these reader favorites (100% free). Happy car shopping!

In this market analysis driven by CarEdge Data, we’ll take you on a tour through the market day supply of new cars across all 50 states and break down the inventory for the five major automakers. Armed with data, you’ll be in the best position to negotiate a great deal on your next vehicle.

Looking for the best and worst states to buy a car? We’ll answer these questions and more with the latest data. You’ll also want to check out the states with the highest fees and taxes.

At CarEdge, we leverage cutting-edge tools to dig deep into the auto industry. One crucial metric we focus on is ‘market day supply, also known as ‘MDS’. Essentially, it provides an estimate of how many days it would take to sell off the current inventory of vehicles at the present rate of sales, assuming that no new vehicles are added to the inventory.

In a balanced market, a 60-day supply of new cars is considered the standard, providing a decent equilibrium between supply and demand.

Anything substantially above this indicates an oversupply, while anything below 40 days suggests a shortage. This information serves as a starting point to identify potential negotiation leverage for smart car buyers like you.

Let’s dive in and take a look at automotive trends across the United States. We’re looking at overall new car supply in all 50 states, and supply numbers for the top-selling brands in the U.S.: Ford, Toyota, Chevrolet, Honda, and Hyundai.

Use the sort feature by clicking on the arrows at the top of each column.

| State | New Car Inventory (Day Supply - All Makes) | Ford Days Supply | Toyota Days Supply | Chevrolet Days Supply | Honda Days Supply | Hyundai Days Supply |

|---|---|---|---|---|---|---|

| Alabama | 68 | 130 | 40 | 53 | 34 | 58 |

| Alaska | 92 | 106 | 13 | 97 | 40 | 120 |

| Arizona | 74 | 104 | 44 | 58 | 35 | 81 |

| Arkansas | 69 | 109 | 13 | 59 | 18 | 78 |

| California | 73 | 95 | 41 | 65 | 43 | 71 |

| Colorado | 69 | 95 | 42 | 49 | 28 | 89 |

| Connecticut | 75 | 118 | 47 | 54 | 32 | 55 |

| Delaware | 78 | 116 | 48 | 61 | 31 | 68 |

| Florida | 72 | 97 | 46 | 71 | 33 | 51 |

| Georgia | 67 | 86 | 36 | 64 | 33 | 61 |

| Hawaii | 83 | 105 | 23 | 152 | 69 | 86 |

| Idaho | 76 | 90 | 36 | 61 | 20 | 79 |

| Illinois | 70 | 126 | 42 | 54 | 25 | 59 |

| Indiana | 69 | 92 | 40 | 60 | 22 | 65 |

| Iowa | 80 | 112 | 45 | 60 | 32 | 60 |

| Kansas | 70 | 87 | 47 | 61 | 39 | 35 |

| Kentucky | 67 | 84 | 37 | 54 | 28 | 52 |

| Louisiana | 74 | 124 | 38 | 66 | 28 | 56 |

| Maine | 69 | 100 | 42 | 53 | 31 | 58 |

| Maryland | 72 | 107 | 51 | 68 | 27 | 68 |

| Massachusetts | 70 | 103 | 49 | 57 | 31 | 67 |

| Michigan | 69 | 106 | 40 | 52 | 26 | 60 |

| Minnesota | 75 | 89 | 42 | 63 | 37 | 67 |

| Mississippi | 69 | 106 | 31 | 61 | 26 | 58 |

| Missouri | 75 | 98 | 51 | 49 | 28 | 68 |

| Montana | 77 | 84 | 42 | 74 | 35 | 75 |

| Nebraska | 80 | 114 | 59 | 60 | 24 | 84 |

| Nevada | 75 | 87 | 35 | 70 | 28 | 87 |

| New Hampshire | 69 | 104 | 40 | 82 | 33 | 52 |

| New Jersey | 67 | 108 | 51 | 62 | 35 | 52 |

| New Mexico | 71 | 86 | 33 | 69 | 22 | 76 |

| New York | 68 | 93 | 46 | 61 | 30 | 52 |

| North Carolina | 66 | 100 | 37 | 53 | 23 | 60 |

| North Dakota | 82 | 104 | 49 | 85 | 23 | 70 |

| Ohio | 71 | 103 | 41 | 64 | 23 | 72 |

| Oklahoma | 72 | 90 | 29 | 59 | 23 | 62 |

| Oregon | 85 | 88 | 52 | 86 | 46 | 188 |

| Pennsylvania | 73 | 103 | 43 | 68 | 31 | 53 |

| Rhode Island | 82 | 93 | 43 | 65 | 41 | 57 |

| South Carolina | 63 | 116 | 36 | 66 | 25 | 46 |

| South Dakota | 94 | 92 | 52 | 89 | 26 | 123 |

| Tennessee | 69 | 91 | 49 | 66 | 29 | 69 |

| Texas | 69 | 92 | 34 | 58 | 32 | 58 |

| Utah | 72 | 99 | 27 | 41 | 26 | 91 |

| Vermont | 116 | 127 | 73 | 71 | 190 | 132 |

| Virginia | 68 | 92 | 47 | 63 | 27 | 63 |

| Washington | 76 | 94 | 50 | 82 | 38 | 87 |

| West Virginia | 74 | 97 | 45 | 66 | 29 | 57 |

| Wisconsin | 74 | 111 | 44 | 59 | 24 | 75 |

| Wyoming | 95 | 65 | 61 | 106 | 49 | 143 |

There’s a lot to digest in the above table, so we’re going to focus in on the states with the highest and lowest new car inventory overall, and for each of the five best-selling car brands in America.

If you’re looking for more room to negotiate, consider buying a car in states with high inventory levels. Not sure where to start? Here’s our guide to buying a car in another state.

Vermont leads with an impressive 116-day supply, followed by Wyoming at 95 days, South Dakota at 94 days, and Alaska at 92 days. Other states rounding off the top ten in this category include Oregon, Hawaii, North Dakota, Rhode Island, Iowa, and Nebraska—all well above the 60-day norm.

On the flip side, states like South Carolina, North Carolina, Georgia, Kentucky, New Jersey, Alabama, New York, Virginia, Arkansas, and Colorado have the lowest new car inventories, all hovering around the 60-70 day supply mark.

Negotiating a new car is certainly not impossible in these states, as our team of Coaches has helped hundreds of buyers in these states this year alone. But with the tightest inventory, it’s simply smart buying to be aware of the overall market from day one.

You might be asking, if a balanced market hovers at a 60-day supply, why are the states with the lowest inventory still above this mark? Well, these numbers are an average across all brands—from the glut of Ram trucks to the scarcity of Hondas and Subarus. For specifics on make and model for any zip code or region, CarEdge Data has you covered.

Next, we’ll dive deeper and take a closer look at the five best-selling automotive brands in America. There are some BIG differences between the top players when it comes to inventory on dealer lots.

Ford inventory is among the highest in the auto market right now, with the brand having a 97-day supply of new cars nationwide. In some states, Ford’s inventory exceeds 120-day supply.

If you’re eyeing a Ford, states like Alabama, Vermont, Illinois, Louisiana, and Connecticut offer the most room for negotiation due to 100+ day supplies of new cars.

Conversely, Wyoming, Montana, Kentucky, New Mexico, and Georgia are your least favorable states in terms of Ford inventory.

Notably, Ford’s electric Mustang Mach-E, traditional Mustang, and Explorer have the most supply, while the Maverick and Ranger are relatively sparse and tougher (but not impossible) to negotiate.

Browse local Ford listings with the power of data.

Toyota’s nationwide average stands at a tight 42-day supply. Vermont, Wyoming, Nebraska, Oregon, and South Dakota have the highest inventory for Toyota. In contrast, states like Arkansas, Alaska, Hawaii, Utah, and Oklahoma have the least Toyota inventory.

The Sequoia, Corolla, and Sienna are currently in high demand, all with less than 40-day supplies. The electric bZ4X, 4Runner, and Crown have the highest inventory numbers, and as a result, the highest negotiability from the get-go.

See localized inventory, price and negotiability with CarEdge Data.

Chevrolet averages a balanced 61-day inventory nationwide. For Chevy, Hawaii, Wyoming, Alaska, South Dakota, and Oregon are your go-to states for choice and negotiability, while Utah, Missouri, Colorado, Michigan, and North Carolina are less ideal with tighter supply.

The Silverado and Equinox are most abundant on dealer lots. The Corvette, Trax, and Colorado have the least inventory.

Honda’s supply averages a mere 32 days nationally, owing to lingering effects of the supply chain shortages that every automaker previously dealt with. States like Vermont, Hawaii, Wyoming, Oregon, and California have the highest Honda inventory, but nowhere even comes close to Vermont.

There are just five Honda dealerships in Vermont, but between them there are 1,014 new Hondas for sale. Day’s supply sits around 180 days, which is highly unusual for Honda. Perhaps Honda buyers in New England should consider heading to The Green Mountain State for the greatest negotiability.

Arkansas, Idaho, New Mexico, Indiana, and Oklahoma offer the least room for negotiation with the lowest Honda inventory. When it comes to model inventory, the HR-V and Passport have the greatest supply nationwide, while the CR-V and Pilot are much harder to come by.

Hyundai has been steadily climbing the ranks in the battle for automotive market share. As Summer 2023 winds down, Hyundai’s inventory numbers are looking healthy, and notably better than competitors Honda and Toyota. There’s currently a 62-day supply of new Hyundai’s nationwide, with quite a bit of variability from one state to the next.

Hyundai inventory is most abundant in Oregon, Wyoming, Vermont, South Dakota, and Alaska. In contrast, Kansas, South Carolina, Florida, New York, and New Jersey have less stock.

The IONIQ 6 and IONIQ 5 are abundant, while the Venue and Elantra are in short supply. Hyundai and sibling Kia have really struggled to sell EVs ever since the revamped federal tax credit removed eligibility due to the ‘Made in America’ requirement.

See Hyundai inventory and price data near you.

Ready to utilize data for unparalleled negotiating leverage? We’ve got tools to suit your needs and budget. From free resources to expert car buying help, we’ve got it all. Enjoy these reader-favorite free car buying tools:

Ready to negotiate a sweet deal? Collaborate with a Car Buying Coach for insider-only insights or opt for a one-time consultation through CarEdge Consult. For the DIY aficionados out there, CarEdge Data provides the robust market intelligence you need to navigate your car buying journey.

Regardless of your budget, we have a plan to help you save thousands. Embark on your informed car buying adventure today with peace of mind! With CarEdge, you’ll know you got the BEST deal.

Ford’s inventory is overflowing in 2023. Indeed, the brand known for its robust line-up seems to be outpacing the current car market’s appetite. Paradoxically, price tags on these vehicles have climbed a staggering 27% since 2019. It appears Ford is navigating uncharted waters with an abundance of cars at their dealerships, waiting for buyers.

For those considering adding a new Ford to their garage, this might just be your golden opportunity. Let’s explore further.

In the automotive world, a balanced market dances around the 60-day inventory supply benchmark. This means, without the influx of any new stock, dealerships should ideally exhaust their current inventory in a two-month span at the prevailing sales rate. In 2023, Ford’s numbers have dramatically eclipsed this industry norm.

Currently, Ford boasts a 96-day supply, translating to a whopping 318,339 cars available across American Ford dealerships. Some models like the all-electric Mustang Mach-E and Ford’s van lineup, including the Transit and E-Series, have even higher inventory supplies, with the former leading at an impressive 214 days.

Even the iconic Mustang isn’t zipping away as speedily as one might expect, with a 168-day inventory. F-150 inventory is climbing as ‘trimflation’ pushes truck prices ever higher. As we approach Labor Day 2023, F-Series inventory sits at 117 days nationwide. For the best-selling electric truck on the market, the F-150 Lightning, there’s currently a 97-day supply nationwide with 3,632 for sale.

As Labor Day 2023 approaches, let’s delve deeper into the inventory landscape of every Ford model.

For comparison’s sake, here are the ten new car models with the highest inventory right now.

| Make | Model | Market Day Supply | Total For Sale | Total Sold (45 Days) |

|---|---|---|---|---|

| Lincoln | Aviator | 403 | 4,771 | 533 |

| Jeep | Renegade | 393 | 11,550 | 1,322 |

| Jeep | Cherokee | 364 | 4,606 | 570 |

| Ram | Ram 2500 | 354 | 23,910 | 3,042 |

| Chrysler | Pacifica Hybrid | 344 | 7,235 | 947 |

| Jeep | Grand Wagoneer | 331 | 3,771 | 513 |

| Jeep | Gladiator | 291 | 21,743 | 3,360 |

| Ram | Ram 1500 Classic | 247 | 5,051 | 920 |

| Mitsubishi | Outlander PHEV | 241 | 1,679 | 313 |

| Maserati | Grecale | 234 | 2,171 | 417 |

This is serious stuff, folks. When an automaker inches north of 80 days’ supply of new cars, it’s noteworthy. When best-selling models are all over 100 days’ supply, that’s big news. Ford’s luxury nameplate is also flooded with unsold new cars.

Ford Motor Company’s premium brand has an unprecedented inventory problem right now. Just how much unsold Lincoln inventory is sitting on lots right now? Lincoln overall has a 125-day supply. Here’s the breakdown by model:

If you’re looking for a more premium SUV, Lincoln dealerships should be willing to negotiate on pricing with inventory numbers like these. See localized inventory and pricing insights with CarEdge Data.

Why on Earth would we be sharing inventory numbers with the masses? Does anyone care? In fact, you should care if you’re in the market for a new Ford. Real-time inventory data is just one of the many data points that our CarEdge Coaches use to help our members. When inventory is high, dealers are more likely to budge on every aspect of the deal, from trade-in valuation to out-the-door pricing.

In simple terms, here’s how these numbers can be used as leverage. Looking for an affordable electric vehicle with great range, fast charging and the federal tax credit? Show your local Ford dealer that you’re familiar with the Mustang Mach-E’s inventory surplus. Ready to negotiate a sweet deal on a new F-150, Explorer or Mustang? You now have data on your side.

Access ALL of the latest car market data with CarEdge Data, your one-stop resource for auto insights. Ready for a pro to assist? Work with a CarEdge Coach for live support from start to finish, or schedule a Consult for a quick chat. We’re on your side! Let us know how we can help you save the most with your new or used car deal.

Labor Day is not just about barbecues and the beach; it’s also one of the best times to get a great deal on a new car. If you’re considering buying a car, these Labor Day deals are the ones worth your time. Our team of Car Coaches pored over every offer and selected the real deals among the crowd. Here’s a breakdown of the best Labor Day car sales to look out for from major car brands.

For those eyeing an Acura, there’s a 3.9% APR offer for 24-36 months or 4.9% for 37-60 months on models including the Acura MDX, RDX, TLX, and Integra. Offers are valid until 9/5/23. Learn more about current Acura offers.

Cadillac is offering a 1.9% APR for 36 months for the CT4 and CT5. Also, the XT5 and XT6 come with a 1.9% APR for 36 months plus a $1,500 purchase allowance when you finance with Cadillac. Deals last until 9/5/23. See the details at cadillac.com and browse listings here.

Chevrolet’s Summer Drive Event is on, and deals are valid through 9/5/23. Qualified buyers can score 1.9% APR for 36 months when financing with GM. Chevrolet is also offering cash incentives for the Equinox ($1,250), Blazer ($1,250), Traverse ($1,000), Silverado ($2,500), Malibu ($750), and Camaro ($750). For the Silverado, a total of $6,500 is available for buyers with a trade-in. Notably, these offers won’t apply to factory-ordered vehicles. Learn more about Chevrolet deals and browse local inventory.

Depending on region, get up to $2,500 cash incentives for the Chrysler Pacifica Plug-In Hybrid. States that participate in the CARB emissions program qualify for the full incentive. Others qualify for $750 cash incentives. For the Chrysler 300, buyers get a $2,000 cash incentive. Learn more at chrysler.com and browse local listings.

There are some decent Dodge lease offers this month. These are the best offers:

Learn more about Dodge deals at Dodge.com and browse local listings.

Ford EV inventory is climbing, and the automaker is offering incentives to move vehicles off the lot. Lease a Mustang Mach-E for just $409 per month for 36 months with $5,188 due at signing. Lease a F-150 Lightning for $633 per month for 36 months with $6,332 due at signing.

Ford also has some good financing deals right now. The Mustang qualifies for 1.9% APR for 72 months with a $1,000 cash offer. The Bronco Sport, Escape, Edge and Explorer all qualify for 2.9% APR for 60 months and between $1,000 – $2,000 in cash bonuses. The F-150 and F-150 Lightning both qualify for 3.9% APR for 60 months and $500 customer cash, which is a good deal in today’s high-interest market. See Ford’s current offers in your area.

Browse Ford listings near you with local market data.

The following Genesis models qualify for 3.49% APR for 60 months and between $1,500 and $2,000 in cash incentives: GV70, GV80, G70, G80, G90.

Learn more at Genesis.com or browse local listings.

The Sierra 1500 qualifies for 0.9% APR, $3,250 bonus cash, and no payments for 90 days. The Acadia and Terrain are both eligible for 1.9% APR financing. Learn more about GMC Labor Day sales and see listings near you.

Honda has a few great financing offers this month. Finance the Ridgeline for 0.9% APR for 24 to 36 months, and 2.9% APR for 37 to 60 months. The Accord, Accord Hybrid and Passport qualify for 2.9% APR for 24 to 48 months, and 3.9% APR for 49 to 60 months. Other Honda models qualify for 3.9% APR or higher.

Honda’s brand loyalty program offers as much as $1,250 in cash incentives right now. The cash offer ranges from the Ridgeline ($1,250), Passport ($1,000) and all other models ($500). Honda also has a number of great lease deals this month, which you can learn more about here. See the details at Honda.com.

Browse Honda listings near you, all with the power of local market data.

Hyundai offers some of the best Labor Day car sales in 2023. Ever since the IONIQ 5 lost the federal tax credit, Hyundai has been upping incentives for the EV. Today, IONIQ 5 and IONIQ 6 leases include a $7,500 discount. IONIQ 5 and IONIQ 6 financing offers start as low as 0.99% APR financing for up to 48 months. Current Hyundai owners and lessees can save an additional $2,500.

The Kona features a cash offer of $1,500, the Tucson offers $2,000 off, and the popular Santa Fe has a $2,500 cash offer. All Hyundai Labor Day sales are valid through September 5, 2023.

Learn more about Hyundai’s Labor Day sales and browse local listings with market data.

Make no payments for 90 days with the 2023 Jeep Grand Cherokee. The 2023 Jeep Cherokee Altitude Lux is advertised for 15% below MSRP for an average savings of $6,300. The 2023 Jeep Compass and Renegade are 10% off MSRP, but be wary of unexpected dealer fees that seem to plague Jeep dealerships. The Gladiator features employee pricing currently.

See Jeep Labor Day sales near you.

Browse local listings with market insights.

The Kia EV6 features $5,000 cash back and 0.9% APR through 9/5/23, although Kia electric models lost eligibility for the federal EV tax credit. The Kia Niro EV qualifies for $3,750 cash back and 0.9% financing. State and local incentives may apply. The Kia Soul, Forte, and Stinger qualify for 2.9% APR financing. See details for Kia’s Labor Day sales.

Browse Kia listings with local market data.

This Labor Day, Lexus is offering $2,000 lease cash for the ES and ES Hybrid. The new electric Lexus RZ and NX plug-in hybrid qualify for $7,500 in lease cash. Learn more about Lexus deals near you at Lexus.com.

View local Lexus listings with market data.

Lincoln has a few good deals for Labor Day 2023. Finance the Lincoln Corsair and Nautilus for 3.9% APR for 60 months with $2,000 cash when you have a trade-in. See details from Lincoln.

Browse local Lincoln listings with powerful market insights.

Several Mazda models qualify for 2.9% APR for 36 months: CX-90, CX-30, CX-5, CX-50, and the Mazda3 Hatchback. The MX-5 Miata RF is available for 0.9% APR. Learn more about Mazda’s Labor Day deals, and browse local listings.

Nissan’s Thrill of the Drive sales event lasts through September 5, and features deals on financing and leases.

These are the best Nissan deals this Labor Day: Lease an Altima SV for $329/month for 36 months with $3,099 due. Lease a Nissan Rogue for $409/month for 36 months with just $2,009 due.

Ready to go electric? Lease the new Ariya starting at $369/month with $4,129 due. Nissan is offering 0% financing for the Rogue, Murano, and Titan. Explore more Nissan Labor Day sales at NissanUSA.com.

Browse Nissan listings with the power of local market insights.

Ram is advertising 10% off MSRP for the Ram 1500 Classic as inventory rises on dealer lots. Despite slow truck sales, Ram and parent company Stellantis aren’t doing much in the way of financing offers. As Labor Day approaches, 2.9% APR is the best they can do for the Ram 1500. Learn more about Ram deals near you.

Browse local Ram listings with negotiability factors.

The Toyota National Sales Event lasts through 9/5/2023, and offers decent (but not stellar) financing and lease deals.

These are the standouts among the deals: The following models qualify for 2.99% APR: 2023 Tacoma 4×2 is the featured financing deal at 2.99% APR for 60 months. Front-wheel drive Highlanders are offered at 3.49% APR. All of the following models qualify for 3.99% APR: bZ4X EV, Camry (excluding hybrids), Corolla (excluding hybrids), Corolla Hatchback, Highlander AWD (excluding hybrids), RAV4 (excluding hybrids).

Among the best Toyota lease deals are the Corolla Cross for $359/month for 36 months with $3,009 due, and the Prius for $475/month for 36 months with $3,185 due. See the latest Toyota deals near you.

Browse Toyota listings with local market insights that save you money.

Currently, the Taos and Tiguan both qualify for 1.9% APR for 36 months, which is a great financing offer. If a six year loan is in your future, the Atlas and all-electric ID.4 are offering 3.9% APR for 72 months.

Lease the highly-acclaimed ID.4 for just $349/month for 36 months with $4,999 due. Check out all of Volkswagen’s Labor Day sales here, and browse local listings.

Volvo’s Summer Safely Sales Event ends on August 31, and it’s not yet clear what deals and offers will replace it come Labor Day weekend. Check volvocars.com as the holiday approaches for the latest sales.

In the realm of car sales, mastering negotiation can pivot a purchase from a financial burden to a steal of a deal. Given the present Labor Day car sales, fine-tuning your negotiation prowess could equate to hefty savings. Remember, substantial Manufacturer’s Discounts are a sign that there’s room to haggle.

Prepared to harness the power of negotiation for your upcoming car investment, potentially saving thousands? You’re in the right place. Team up with a Car Buying Coach to negotiate using auto industry insights typically unavailable to the public.

If a one-time consultation is more your style, CarEdge Consult offers expert advice tailored for your needs. For those looking to embark on a DIY car buying journey powered by rich auto market data, CarEdge Data is the perfect fit.

Subaru inventory is flourishing more than most would anticipate. While variability exists from one dealership to another and from one market to the next, armed with the latest car market data, you’re well-positioned to negotiate favorable deals on Subarus today. Currently, Subaru has a 67-day supply of new cars and SUVs across its range. Interestingly, some models are quite negotiable. Let’s delve deeper into the best Subaru deals available this month, followed by insights on how you can harness market data to negotiate Subaru prices.

Here’s a summary of the big picture today. Interest rates have risen 300% since 2021, and gone are the days of zero percent financing. In 2023’s auto market, any APR below 4% is considered a great deal. These are Subaru’s best financing offers today:

These are Subaru’s best leases this month.

Equipped with the latest inventory data, it’s clear which Subaru models and trims are up for negotiation. High inventory indicates a higher likelihood of dealerships being willing to adjust prices, especially considering the escalating interest rates they grapple with for unsold cars. Although Subaru has historically maintained low inventories, the current scenario offers some pockets of opportunity.

| Make | Model | Market Day Supply | Total For Sale |

|---|---|---|---|

| Subaru | Ascent | 66 | 6,992 |

| Subaru | Solterra | 82 | 2,092 |

| Subaru | Crosstrek | 61 | 18,096 |

| Subaru | Forester | 74 | 26,782 |

| Subaru | Outback | 80 | 24,836 |

| Subaru | Impreza | 63 | 4,031 |

| Subaru | Legacy | 58 | 3,498 |

| Subaru | WRX | 83 | 3,339 |

| Subaru | Brand Average | 71 | 89,879 |

The most negotiable new Subaru models include:

The Solterra EV, in particular, is trailing behind its competitors like the Hyundai IONIQ 5, Kia EV6, and even the Volkswagen ID.4. And it’s nowhere near the Tesla Model Y, which has become much more affordable in 2023. This slow sales momentum, combined with its not-so-impressive charging speeds, makes it a prime candidate for negotiation. However, it does NOT qualify for the federal EV tax credit! See which EV models do here.

As for the other models, Subaru sedans have always been the slower sellers, but it’s the first time that the popular Forester and Outback have been this negotiable in years.

Considering the flood of 2024 Subaru inventory arriving on dealer lots this month, all Subaru models are negotiable right now.

Let’s took a closer look at the inventory and negotiability for Subaru’s top selling models. Using this information, we’ve seen which trims are in highest supply, and which are surprisingly negotiable today. Note that Subaru has some 2023 inventory to clear out, and these are selling slowly compared to 2024 models.

Here’s a look at the best-selling Subaru model, the Subaru Crosstrek. Last year, Subaru sold 155,000 of these, which was slightly more than the Outback.

| Year | Model | Trim | Market Day Supply (2023) | Total For Sale |

|---|---|---|---|---|

| 2023 | Crosstrek | Base | 68 | 6 |

| 2023 | Crosstrek | Premium | 750 | 50 |

| 2023 | Crosstrek | Sport | 205 | 41 |

| 2023 | Crosstrek | Limited | 293 | 91 |

| 2024 | Crosstrek | Base | 24 | 504 |

| 2024 | Crosstrek | Premium | 37 | 5,679 |

| 2024 | Crosstrek | Sport | 44 | 1,472 |

| 2024 | Crosstrek | Limited | 47 | 2,963 |

Looking at the market day supply for each Crosstrek trim level and model year, we can see that these are the most negotiable today:

Subaru’s second-best seller, the Subaru Outback, has significantly higher inventory than the Crosstrek. In 2022, Subaru sold 147,000 Outbacks in the United States. Here’s a complete look at Subaru Outback inventory today.

| Year | Model | Trim | Market Day Supply (2023) | Total For Sale |

|---|---|---|---|---|

| 2023 | Outback | Base | 77 | 12 |

| 2023 | Outback | Premium | 34 | 91 |

| 2023 | Outback | Onyx Edition | 23 | 121 |

| 2023 | Outback | Limited | 18 | 305 |

| 2023 | Outback | Touring | 24 | 177 |

| 2023 | Outback | Wilderness | 19 | 106 |

| 2024 | Outback | Base | 66 | 198 |

| 2024 | Outback | Premium | 56 | 3,789 |

| 2024 | Outback | Onyx Edition | 82 | 2,683 |

| 2024 | Outback | Limited | 64 | 5,913 |

| 2024 | Outback | Touring | 59 | 2,636 |

| 2024 | Outback | Wilderness | 66 | 2,904 |

As we can see, these are the Outback trim options with the highest inventory in terms of market day supply, and as a result are the most negotiable:

Next up, the Subaru Forester. Subaru’s #3 model had 114,000 sales last year in America. Subaru hasn’t delivered any 2024 model years just yet. Here’s the complete breakdown of Forester inventory today:

| Year | Model | Trim | Market Day Supply (2023) | Total For Sale |

|---|---|---|---|---|

| 2023 | Forester | Base | 27 | 553 |

| 2023 | Forester | Premium | 32 | 3,080 |

| 2023 | Forester | Sport | 43 | 2,230 |

| 2023 | Forester | Limited | 51 | 3,854 |

| 2023 | Forester | Wilderness | 66 | 3,986 |

| 2023 | Forester | Touring | 75 | 3,662 |

| 2024 | Forester | Base | 0 | 0 |

| 2024 | Forester | Premium | 0 | 0 |

| 2024 | Forester | Sport | 0 | 0 |

| 2024 | Forester | Limited | 0 | 0 |

| 2024 | Forester | Wilderness | 0 | 0 |

| 2024 | Forester | Touring | 0 | 0 |

These are the most negotiable new Foresters today:

Soon, 2024 Forester inventory will arrive on dealer lots. Once that happens, 2023 models will become much more negotiable. If you’re in the market for a new Forester, we recommend waiting until the 2024 models arrive so you can score a sweet deal.

We analyzed thousands of data points to find the most negotiable used Subaru models today. It quickly became clear that there’s a lot of variability in used Subaru inventory. For some models, there’s A LOT of inventory and high negotiability. For others, not so much.

| Model | New/Used | Market Day Supply | Total For Sale |

|---|---|---|---|

| Ascent | used | 59 | 3920 |

| BRZ | used | 71 | 607 |

| Crosstrek | used | 51 | 7,353 |

| Forester | used | 56 | 14,413 |

| Impreza | used | 59 | 7,176 |

| Legacy | used | 66 | 5,528 |

| Outback | used | 56 | 16,591 |

| Solterra | used | 183 | 179 |

| WRX | used | 76 | 3,283 |

We found that in general, 2018-2019 model year Subarus have the highest inventory today.

Among models, Subaru sedans like the Legacy, Impreza and WRX definitely have the most inventory. Let’s take a look at the details.

These are the best model years in terms of inventory and negotiability for every Subaru model:

| Model | Year | Market Day Supply | Total For Sale |

|---|---|---|---|

| Ascent | 2021 | 67 | 953 |

| BRZ | 2018 | 110 | 71 |

| Crosstrek | 2019 | 64 | 1,421 |

| Forester | 2018 | 72 | 1,367 |

| Impreza | 2014 | 65 | 556 |

| Legacy | 2019 | 95 | 646 |

| Outback | 2018 | 62 | 1,660 |

| Solterra | 2023 | 178 | 182 |

| WRX | 2022 | 91 | 621 |

When it comes to overall highest inventory (and highest negotiability), the winners are [almost] all sedans. The Solterra EV snuck into the top spot as EV competitors simply offer faster charging and more range. Subaru’s cars aren’t as popular as they were a decade ago, but that can be to your advantage at the negotiating table.

| Model | Year | Market Day Supply | Total For Sale |

|---|---|---|---|

| Solterra | 2023 (used) | 178 | 182 |

| Legacy | 2019 | 95 | 646 |

| WRX | 2022 | 91 | 621 |

| WRX | 2015 | 87 | 348 |

| Legacy | 2022 | 86 | 364 |

| Legacy | 2021 | 77 | 416 |

| Legacy | 2018 | 75 | 467 |

| Legacy | 2020 | 73 | 718 |

| Forester | 2018 | 72 | 1,367 |

| Ascent | 2021 | 67 | 953 |

Want to elevate your savings even further? Ready for even more insider data? Collaborate with a Car Buying Coach to negotiate using insights only industry insiders are privy to. If a one-time consultation is more your style, CarEdge Consult offers expert advice tailored for your needs. For those looking to embark on a DIY car buying journey powered by rich auto market data, CarEdge Data is your go-to resource. Embark on your Subaru buying journey today, fortified with market intelligence!

Compare premium plans to see how we can help you save thousands. We’ve got options for every budget.