CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

In 2019, market analysis and research firm Deloitte predicted that electric vehicles would reach price parity with combustion-powered counterparts in 2022. One year later, General Motors Chief Technology Officer Matt Tsien shared his optimism about EV prices. Cost parity between EVs and conventionally powered vehicles “will come sooner than many people think,” he said during a keynote speech at a Society of Automotive Analysts event. Skip forward to the second half of 2022, and EV prices are running away from ICE cars. The latest analysis from iSeeCars.com reveals just how much more expensive used EVs are, and recent MSRP hikes are driving new EV prices even higher.

Used car prices are dropping rapidly at the wholesale level, however buyers have yet to see any significant price drops at the retail level. Over the past eight weeks, used car prices have dropped nearly 5 percent at dealer auctions. Could the car price bubble be finally coming to an end? If you’re in the market for an electric vehicle or plug-in hybrid, we’re far from it.

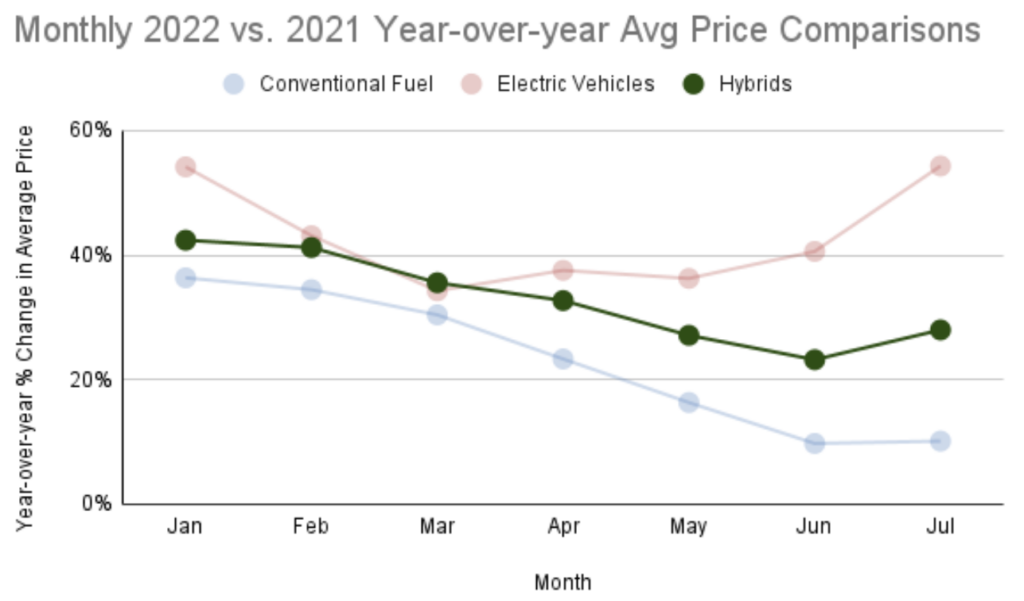

According to data from iSeeCars, used electric car prices saw an increase of 54.3% from July of 2021 to July 2022. Over the same period, gas-powered cars were up just 10.1%. Number crunchers at iSeeCars analyzed the prices of over 13.8 million 1-5 year old used cars sold between January and July of 2021 and 2022 to determine the price growth of electric cars compared to ICE vehicles.

As gas prices reached new records this spring, the demand for EVs rose in parallel. However, a closer look at the data reveals that the few affordable electric cars on the market saw the greatest price increases, and by a long shot.

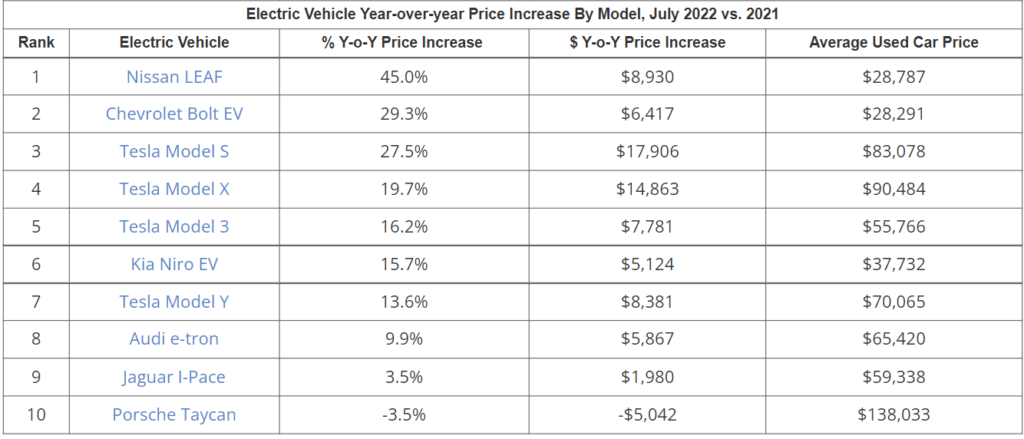

At a time when the average EV transaction price is over $66,000, the future of electric mobility is riding on the success of more affordable options. The number of sub-$40,000 EVs seems to be shrinking by the day.

iSeeCars found that America’s two most affordable electric cars saw prices increase the most. Used Chevrolet Bolt prices were up 29.3% since 2021, and used Nissan Leaf prices were up 45%. For the Leaf (which starts at $27,800 new), this massive price spike translates to an average sale price of $28,787 in July 2022. The average used Chevy Bolt sold for $28,291 last month. Considering the specs of the Bolt (notably charging capabilities), that’s a lot of money for a used EV.

With DC fast charging times typically around 45 minutes to one hour to add 200 miles of range, both of these electric models are likely to see drastic depreciation as much faster charging EVs become more commonplace. This is especially true for the Leaf, which lacks the decent range of the Bolt.

The Kia Niro EV seems to be the outlier here. With 239 miles of EPA-rated range and 77 kilowatt DC fast charging capability, it almost seems like a good deal with used Niro EV prices ‘only’ increasing 15.7% year-over-year. At the time of writing, used Kia Niro EVs are priced between $35,000 and $43,000.

New electric vehicles are seeing price hikes, too. Just last week, Ford announced that the 2023 Mustang Mach-E was getting a massive price increase. The base Select trim now starts at $48,195 (up $3,200). The rear-wheel drive option was eliminated, effectively canceling the most affordable Mustang Mach-E. The most popular trim, the Premium AWD Mustang Mach-E, now starts at $56,175 before the $1,300 destination fee. That’s a $6,075 increase from earlier in 2022.

When Ford reopened F-150 Lightning orders in August, the news was accompanied by a $6,000 to $8,500 price increase. The most affordable F-150 Lightning now starts at $46,974. Most buyers will want the XLT with extended range, and that option now starts at $80,974. Will Ford lower the price by $1,000 to qualify for the new EV tax credit? We’ll find out soon enough.

Tesla prices are up over 20% since early 2021. The Model 3 is now 27% more expensive, and the most popular EV in America, the Model Y, now costs 30% more with a starting price of $65,990. Rivian made headlines when they canceled the most affordable configuration of the Rivian R1T electric truck. Anyone with basic math skills (or a calculator) can see that new and used EVs alike are becoming more expensive.

This right here is the question we’re all doing our best to answer. Still, it’s hard to tell. Here’s what needs to happen before EV prices will go down:

Is there any good news? It depends on which EVs you’re interested in, and your buying timeline. The new EV tax credit is the first to ever offer a used EV tax credit and future rebate, however strict eligibility requirements for both are causing an uproar. For some, buying an EV may soon be thousands of dollars cheaper. For others, federal EV incentives vanished when President Biden signed the Inflation Reduction Act of 2022 into law. See which new EVs and used EVs qualify for the revised incentives.

Want to stay informed about the latest EV pricing, ownership and development news? Join the CarEdge Community for free. Our Electric Vehicle forum is the place to be for EV discussion, advice and expert consultation!

We track new car inventory monthly, and it’s been encouraging to see automakers like Ford and Toyota having more cars shipped to dealers. Still, automakers are selling every car they can make. With that said, more drivers are placing factory orders for vehicle builds that might not arrive until well into next year, or worse. Here’s how long car buyers are waiting for the vehicle they want. We want to send a special thank you to CarEdge Coach Mario for sharing this update with our audience!

Important note: These times are strictly for factory ordered cars. Many of these models are now available on dealer lots.

Hyundai Motors owns 51% of Kia, and the two Korean automakers have grown increasingly close over the past decade. Today, many of their vehicles share components, and therefore have been similarly impacted by supply chain constraints.

These are the factory order wait times our team of Car Coaches is hearing in 2025:

Right now, buyers placing orders for a Subaru are regularly being told that the wait time for delivery will be between one and four months, and in some cases longer. Subaru was hit hard by the chip shortage, and has yet to pull out of the slump.

In general, 2-3 months wait can be expected for any custom-ordered Subaru in 2025. Here are some additional details from what CarEdge Coaches are seeing:

How long you should expect to wait depends on the Toyota model and spec that you want. For Toyota deliveries, you’ll be looking for an available allocation rather than a custom order. For Toyota hybrids and plug-in hybrids, wait times are generally much longer.

In 2025, most Toyota models no longer have long waitlists for an available allocation, with the exceptions being the Prius, GR86, GR Corolla, Grand Highlander Hybrid, Land Cruiser, Sienna, Supra M/T and Spec Edition TRD Pro. For these models, you can expect to wait 3-4 months for an allocation that’s not already spoken for.

It is worth noting that more Toyota hybrid models may start seeing longer wait times as demand increases during summer buying season.

On average, Honda factory orders (or allocations) placed today can expect a short wait before delivery, generally less than two months. The only remaining Honda models with inventory constraints are the Civic Si and Civic Type R.

Otherwise, these are the Honda factory order wait times we’re seeing in 2025:

Accord: Immediate

Civic: 1-2 months

CR-V: 1-2 months

CR-V Hybrid: 2-3 months

Odyssey: 1-2 months

Pilot: 1-2 months

Ridgeline: Immediate

For Jeep and Ram factory orders, wait times depend on what model and trim you want. Don’t forget that these two brands have the highest new car inventory in the industry right now, so lot inventory is especially negotiable. Don’t expect the same negotiability with Ram and Jeep factory orders.

These are the Ram truck factory wait times our team is encountering in 2025:

Ram 1500: 2-3 months

Ram Super Duty: 3-5 months

Jeep factory orders: 8 – 10 weeks

These are the Ford factory order wait times we’re seeing this year:

Bronco: 6-9 months

Ford F-150: 5-6 month wait time for higher trims (King Ranch, Tremor, Platinum), less than 3 months on XL, XLT and Lariat

F-250: 2-3 months

F-350: 2-3 months

Mustang: 3 months

Tesla regularly updates wait times for the Model Y, Model 3, Model S and Model X. As of 2025, here are Tesla wait times as shared on Tesla.com. Note that there are many possible configurations that affect estimated delivery dates, so check Tesla’s configurator for the most accurate estimate.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

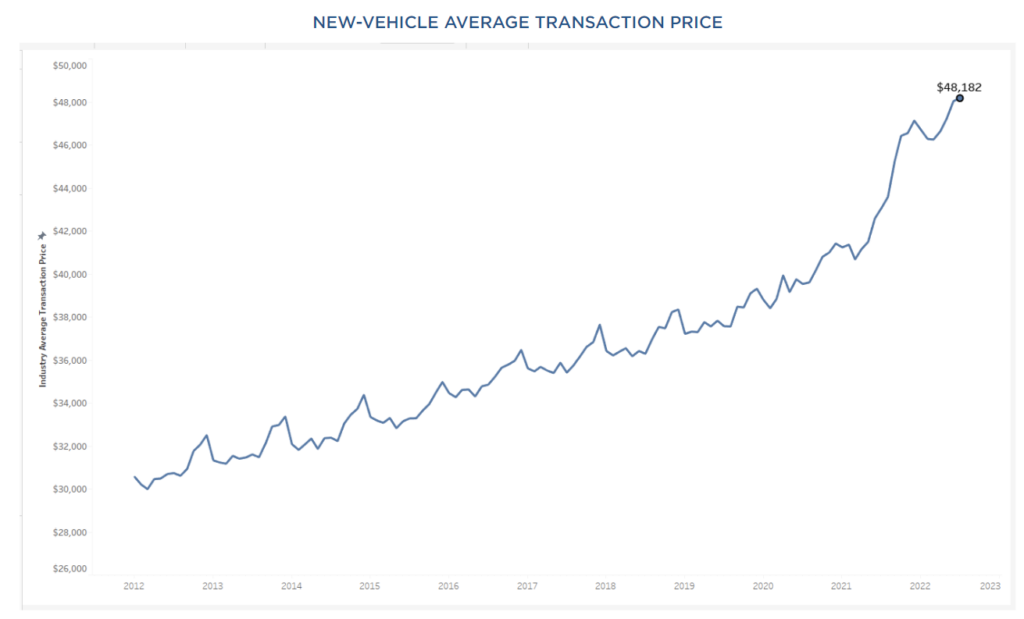

Another month, another new record for car prices. In July, new car prices climbed 0.3% higher, and the average monthly payment increased by 0.9%. Used car prices have decreased at the wholesale level for eight weeks, but new car prices remain at record highs as dealer inventory stays slim. Here’s the latest new car price data from Cox Automotive, what it means for new car prices in August, and our best guess as to when new car prices may finally start to come down.

The average transaction price (ATP) for a new vehicle increased by 0.3% in July to a new record of $48,182, according to the latest Kelley Blue Book transaction price report. Year-over-year vehicle price increases are astounding. Since July 2021, the average new vehicle transaction has increased 11.9%, or $5,126. Looking back two years to the heart of the pandemic slump, the average new car transaction price is up 21.5% since July 2020. Worse yet, the ATP is up 58% over a decade. In 2012, the average transaction price was near $30,000.

Why are new car prices still going up? Rather than the prices themselves increasing substantially in July, other factors are largely responsible for the new record. The average interest rate increased another 19 basis points last month. The average auto loan interest rates across all credit profiles are 3.86% for new cars and 8.21% for used cars, according to data from MarketWatch. Gone are the days of zero percent interest rates, and the Federal Reserve will likely hike rates higher to get a handle on inflation.

Another factor contributing to record high average transaction prices is the popularity of luxury vehicles. Luxury vehicle share remains historically high, pushing the average ATP higher. The post-pandemic ‘K-shaped recovery’ has resulted in divergent economic situations from one household to the next. One family might be struggling to make ends meet, while the other is more well off than ever before. This trend has contributed to a surprisingly healthy luxury vehicle market, and more consumers willing to pay a premium for a new car in 2022.

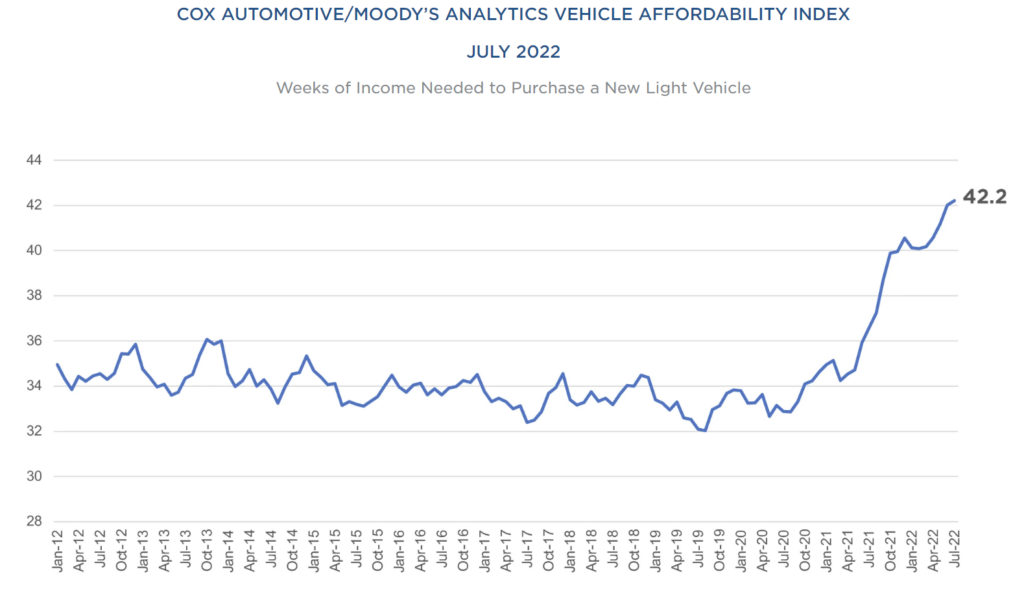

The average monthly payment for a new car is now $733/month. That’s a new record, and it’s just a hair above June’s previous record of $730. Nationally, median one-bedroom rent is now $1,450, which is 11% higher than a year prior. In several Midwestern and Southern states, the average car payment is now on par with rent. We’ve never seen this before.

Cox Automotive’s Vehicle Affordability Index really puts this in perspective. The Vehicle Affordability Index is driven by the consumer’s vehicle transaction prices, the income of the consumer, amount financed by the consumer, and the interest rate provided by the lender. The result is a value that represents the number of weeks of the median household income in America that would be needed to buy the average new vehicle.

The number of median weeks of income needed to purchase the average new vehicle in July increased to 42.2 weeks from a downwardly revised 42.0 weeks in June. In other words, the average new vehicle purchase costs as much as 42 weeks of median income in America. Financial advisors generally recommend keeping total car expenses below 20% of monthly income, but very few Americans are able to do that today. With an average monthly car payment of $733, monthly income would need to be AT LEAST $3,665 to achieve this.

New-vehicle affordability in July was much worse than a year ago when prices were lower, incentives were higher, and rates were much lower. The estimated number of weeks of median income needed to purchase the average new vehicle in July was up 15% from last year. One year ago, auto interest rates were near record lows, incentives still existed, and prices were 11.9% lower.

In July, some automakers had improved inventory. Some, such as Ford and Toyota, had the greatest increases in inventory in several months. Still, with order backlogs and demand far exceeding supply, dealer lots remained nearly empty, and car prices remained high.

See the latest new car inventory numbers here.

New car prices will fall once automakers are able to produce more vehicles. What needs to happen for vehicle production to increase? Supply chain disruptions must come to an end once and for all. We’ve been watching automakers ration their supplies of semiconductor chips, wire harnesses, and even electric vehicle batteries as the pandemic and the war in Ukraine continue to disrupt supply chains.

There is now a question as to whether automakers will ever go back to their old ways of over producing vehicles and discounting them well below MSRP. They now see that consumers are willing to pay higher prices for cars, and that’s good for their bottom lines. As long as people agree to pay marked up prices, there will be no incentive to bring prices back down to historical norms. Many in the industry see this as the only path forward, given today’s market conditions.

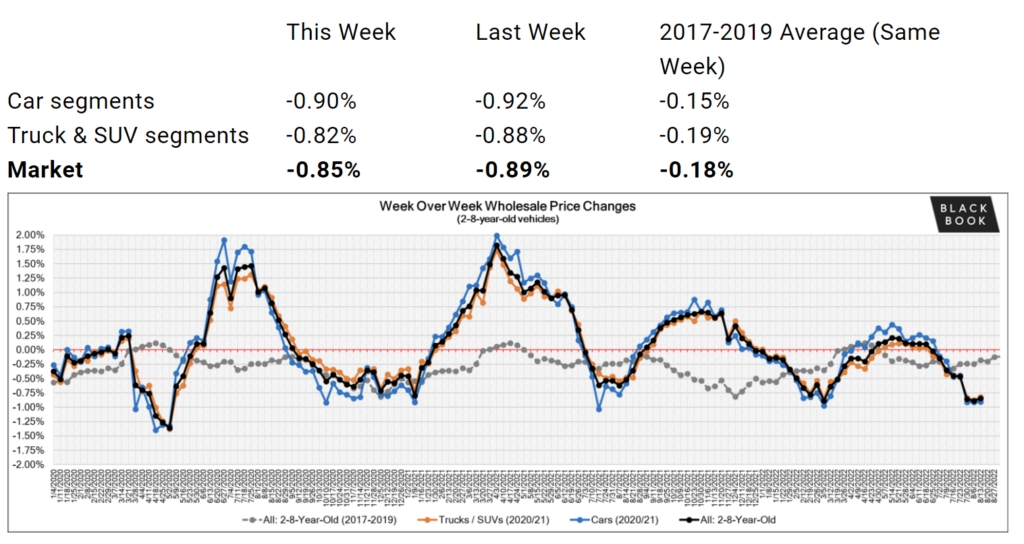

There is a bit of a silver lining. For eight weeks in a row, we’ve been tracking steepening declines in wholesale used car prices. We can confidently say that a trend has emerged. At auction, used car prices have dropped about 4% in two months. We expect these declines to soon translate to retail used car prices, and at the very least, dealers will be willing to negotiate a deal. Based on past trends, we expect retail used car prices to begin to decline in September. Don’t hold your breath, a used car might be the better value in 2022.

After years of asking for a used electric vehicle tax credit, we finally have it. Unfortunately, it’s not all that we had hoped it would be. Income limits are strict, and vehicle price caps are even tighter. We analyzed price data to find every EV and plug-in hybrid that may qualify for the used EV tax credit. One takeaway: It’s hard to find a sub-$25,000 electric vehicle!

As far as we can tell from the language of the Inflation Reduction Act, the strict Made-in-America and battery sourcing requirements that apply to new EVs and PHEVs do not apply to used EVs. However, the bill allows for the Treasury Secretary to finalize rules by the end of 2022, so it’s not set in stone just yet.

Beginning on January 1, 2023, car buyers can claim a $4,000 tax credit when purchasing a used electric vehicle for under $25,000. For buyers purchasing an EV under $13,300, this incentive is capped at 30% of the vehicle’s price. The seller must be a qualified dealer, and the buyer must have an adjusted gross income (AGI) of under $75,000 (individual), $112,500 (head of household) or $150,000 (joint filers).

Just how many used EVs can be easily found for under $25,000? A quick look at used EV prices is a reality check. If you’re open to settling for an electric vehicle model with lower range, slower charging and more miles on the odometer, you might find a deal that qualifies.

Range:

2011-2015 models – 73 to 84 miles

2016-2017 models – 84 to 107 miles

2018-2022 models – 150 to 226 miles

Max charging speed:

50 to 100 kW (charge to 80% in 45 minutes)

See used Nissan Leaf listings.

Range: 238 miles

Max charging speed:

55 kW (charging to 80% in just under an hour)

See used Chevrolet Bolt listings.

Range: 82 miles

Max charging speed:

50 kW

See used Chevrolet Spark EV listings.

Range: 81 miles to 188 miles, depending on model year and trim

Max charging speed: 40 kW (charge to 80% in 20 minutes)

Range: 258 miles

Max charging speed: 75 kW (charge to 80% in 50 minutes)

See used Hyundai Kona EV listings.

Range: 258 miles

Max charging speed: 75 kW (charge to 80% in 50 minutes)

See used Kia Niro EV listings.

Range: 111 miles

Max charging speed: 75 kW (charge to 80% in 50 minutes)

See used Kia Soul EV listings.

Range: 84 miles

Max charging speed: 85 kW

Range: 83 miles

Max charging speed: 7.2 kW

See used Volkswagen e-Golf listings.

The used (and new) EV tax credit does make plug-in hybrids (PHEVs) eligible, as long as they have a battery capacity of at least 7 kilowatt-hours. CarEdge’s auto expert Mario Rodriguez analyzed used PHEV prices, and these are the PHEV models that have a shot at qualifying under the $25,000 price cap.

The latest data shows wholesale used car prices dropping, but that has yet to translate to lower retail prices. Electric vehicles and plug-in hybrids are likely to be the last to see price declines, as they remain in high demand. We’ll keep you updated with the latest info.

Keep track of EV market share as more Americans go electric.

The Inflation Reduction Act of 2022 has thrown a wrench in the EV buying plans of many. Just three weeks after we first heard word of this deal between two Senators, it has been signed into law. Time is of the essence if you’re on the fence about an EV purchase! But don’t run out to buy that shiny new Tesla Model Y just yet. The language of the Inflation Reduction Act’s ‘Clean Vehicle Credit’ details requirements and important dates that you need to know about before signing a contract to purchase.

If buying an EV in America is in your future, here’s what you need to know today.

These are the big changes to the EV tax credit:

These new EV tax credit eligibility requirements eliminate several of the most popular electric vehicles on sale today. Here’s our list of the winners and losers, including those that will qualify for at least half of the new credit.

If you’re considering buying a Tesla Model Y, Cadillac Lyriq or Chevrolet Bolt, wait until January 1, 2023 to make the purchase. The revised EV tax credit removes the 200,000 sale cap for automakers on January 1, 2023. The 200,000 sale cap had previously disqualified Tesla and GM EV models from the original $7,500 EV tax credit.

Why only the Model Y? The Model Y is the only Tesla that will qualify for the new tax credit because of the price caps. The revised EV tax credit caps SUV and truck prices at $80,000, and sedans at $55,000. The only Model 3 under the price cap is the rear-wheel drive Model 3, but it sources batteries from CATL in China, so it is disqualified. The Model S and Model X are far too expensive. The Model Y is the most popular EV in America, so this is still good news for Tesla.

Ford makes the Mustang Mach-E in Mexico, and that’s not an issue as the new bill requires final assembly to be in the U.S., Canada or Mexico. However, Ford has battery sourcing agreements with numerous battery suppliers, and that’s where it gets complicated.

Ford currently makes the Mustang Mach-E in Mexico with batteries from LG Chem (now LG Energy Solutions). LG manufactures these battery cells in Poland, but the battery pack assembly is in North America. It’s unclear if Ford’s battery assembly meets the 40% battery component requirement. Unfortunately, Ford just signed an agreement with Chinese battery manufacturers CATL to supply batteries for upcoming Ford Mustang Mach-E’s. This may disqualify the automaker briefly, but not for the time being. Ford has already announced plans for two battery plants in Kentucky and Tennessee.

Does the F-150 Lightning qualify for the new EV tax credit? Yes, but it depends on where exactly the batteries are sourced from. Ford has said that is sources many F-150 Lightning battery packs from SK Innovation’s factory in Georgia, USA. That’s great for eligibility. However, Ford recently shared that they are sourcing more batteries for the Lightning from Chinese automaker CATL. That could complicate eligibility.

Most F-150 Lightning trim options that include the Extended Range battery (for 320 miles of EPA-rated range) are near or over the $80,000 price cap for trucks. Check your vehicle build specs and pricing to see if your total MSRP is under the $80,000 limit.

If you secured a written binding contract to purchase before the bill was signed, you could claim the original $7,500 tax credit when you file 2022 taxes.

In summary, most Ford electric vehicles will likely qualify for at least half of the new EV tax credit, which would be $3,750. Of course, this depends on battery sourcing. It’s possible that Ford EVs could eventually qualify for the full $7,500 once we know more about where Ford’s battery suppliers source their minerals.

Many of today’s best electric vehicles are made overseas for now. The Kia EV6, Audi etron, Polestar 2, and my own Hyundai IONIQ 5 are all disqualified due to the Made-in-America requirement.

The language of the bill states that as soon as it is signed into law, EVs that do not have final assembly in the United States, Canada or Mexico will lose eligibility. The bill was signed on August 16, 2022.

See our full list of EVs that will lose eligibility, and those that will qualify.

The ‘Transition Rule’ in the new EV tax credit allows buyers to claim the original $7,500 EV tax credit if the buyer has signed a “written binding contract” BEFORE the Inflation Reduction Act of 2022 was signed into law.

Love legalese? Read the Senate’s Inflation Reduction Act’s text here.

The new bill states that the new used EV tax credit will take effect January 1, 2023 as a tax credit, and it will become refundable at the point of sale starting on January 1, 2024. There are STRICT limitations, however.

To qualify for the used EV tax credit, the vehicle must meet the following qualifications: cost less than $25,000; be at least 2 years old; and sold by a qualified dealer. Buyer income limits are an adjusted gross income of $75,000 for individual tax filers, $112,000 for head of household, and $150,000 for joint filers. Taxpayers are allowed one used EV credit every 3 years.

It’s a wild time to be in the market for an EV. Did we miss something? Let us know in the comments, or better yet chat with our EV and general car buying experts at the CarEdge Community Forum. You can also email me at [email protected]. This is an evolving situation!