CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

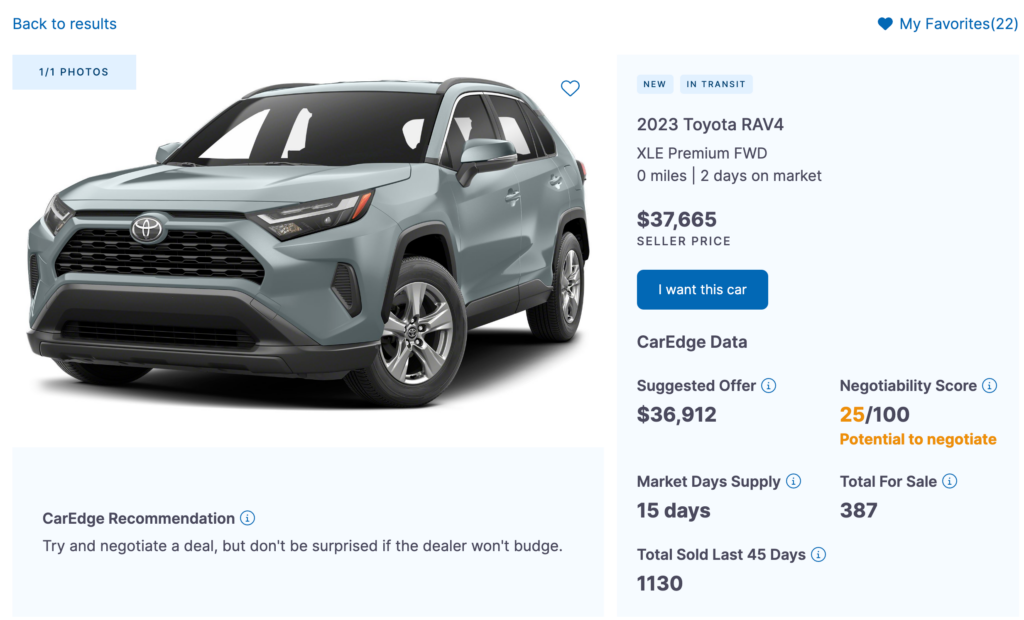

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Navigating the world of car loans can be daunting, but understanding how interest rates work is key to making a wise investment in your new or used vehicle. By learning how to save on car loan interest, you can potentially save thousands of dollars over the life of your loan. In this guide, we’ll explore expert tips for securing the best interest rates when buying both new and used cars. Already bought your car? We’ll dive into refinancing options too.

Your credit score plays a major role in determining the interest rate you’ll receive on a car loan. Lenders use credit scores to assess the risk associated with lending money, and a higher score often results in lower interest rates. Before shopping for a new car, check your credit score and work on improving it. Paying off outstanding debts, making timely payments, and keeping your credit utilization low can all help boost your score.

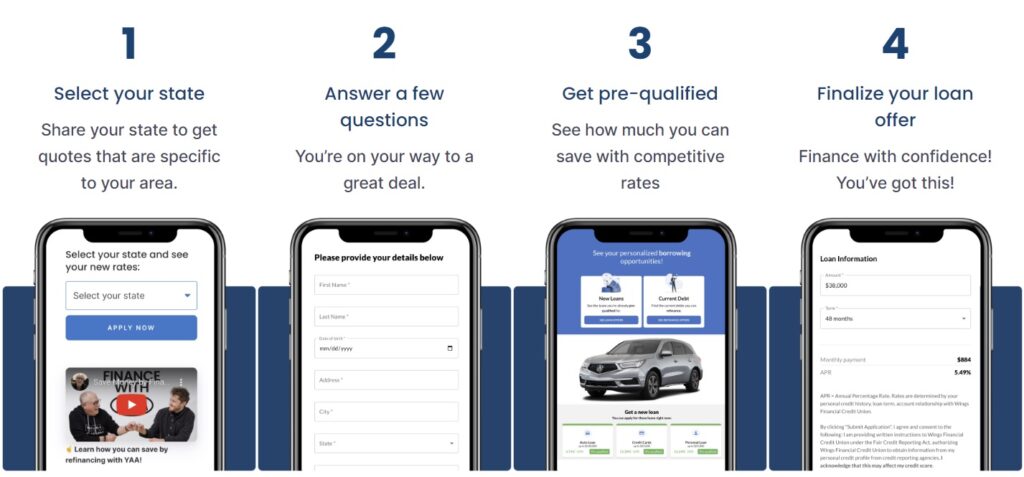

Don’t limit yourself to the dealership’s financing options. Shop around for car loans from banks, credit unions, and online lenders to find the best interest rates. Get pre-approved for loans from multiple lenders and compare the terms, fees, and interest rates to secure the best deal. Don’t forget to get a free quote with CarEdge-approved credit unions. Even if you decide to finance elsewhere, you can use our low rates as leverage when negotiating.

While a longer loan term may result in lower monthly payments, it also means you’ll pay more interest over the life of the loan. Opting for a shorter loan term can save you money in the long run by reducing the total interest paid. Keep in mind that this will result in higher monthly payments, so ensure it fits within your budget.

| Loan Amount | Interest Rate | Loan Term | Monthly Payment | Total Interest Paid |

| $25,000 | 4% | 36 mo | $738.01 | $2,568.36 |

| $25,000 | 4% | 60 mo | $460.59 | $4,635.40 |

A larger down payment can help you save on interest by reducing the loan amount and demonstrating to lenders that you’re financially responsible. Aim for a down payment of at least 20% of the car’s purchase price to minimize the interest costs and potentially qualify for a lower rate.

A large loan discount in the auto financing world refers to a reduction in interest rates or fees offered by a lender when a borrower takes out a car loan that exceeds a certain threshold. This practice is based on the principle that larger loans usually involve more significant risks for the lender, and the reduced interest rate or fees help to incentivize borrowers to choose that particular lender for their car financing needs.

Tier bumps in auto loans are a practice employed by some lenders to offer a more favorable interest rate to borrowers who may be on the cusp of qualifying for a better tier or category. Essentially, the lender “bumps” the borrower up to a higher tier, which comes with a lower interest rate, despite their credit score or financial profile not quite meeting the standard criteria for that tier. This practice can be particularly beneficial for car buyers who have borderline credit scores or are working on improving their financial situation.

Loan-to-value (LTV) ratio is an essential factor that lenders consider when determining interest rates for auto loans. The LTV ratio is the amount of the loan compared to the market value of the vehicle being financed. A higher LTV ratio typically indicates a higher risk for the lender, as it means they are financing a larger percentage of the vehicle’s value. In such cases, lenders may charge a higher interest rate to compensate for the increased risk. To secure a lower interest rate on an auto loan, aim for a lower LTV ratio by making a larger down payment or opting for a vehicle with a lower price tag.

Automakers often offer special financing deals or cash rebates to encourage new car sales. Keep an eye out for manufacturer incentives, such as low or 0% APR financing, which can significantly reduce your overall interest costs. Be sure to read the fine print and weigh the pros and cons of these offers before deciding. To make the most of your car loan interest savings, check out our guide on the best auto loan rates and learn how to secure the most favorable financing deals.

Certified Pre-Owned (CPO) vehicles are a great option for used car buyers seeking lower interest rates. These vehicles undergo rigorous inspections and often come with extended warranties, making them a lower-risk option for lenders. As a result, CPO vehicles typically qualify for lower interest rates compared to non-certified used cars.

Browse certified pre-owned (CPO) car listings at CarEdge Car Search

If you already have a car loan with a high interest rate, consider refinancing to save on interest costs. Refinancing involves taking out a new loan to pay off your existing loan, ideally with a lower interest rate. This can be a smart move if your credit score has improved since you initially took out the loan or if interest rates have dropped.

When buying a used car, use your trade-in as leverage to negotiate a better interest rate. Dealerships often make more profit from used car sales, so they may be more willing to offer lower interest rates to secure the deal. Research the value of your trade-in before negotiating to maximize its impact on your loan terms. Be sure to check the Black Book valuation of your trade-in with CarEdge Pro. Finally, you have access to the same car value data that dealers use!

Check out our guide to getting more for your trade-in

Dealerships may add a markup to the interest rate they offer on car loans, pocketing the difference as profit. Be aware of this practice and ask for a direct quote from the lender to ensure you’re getting the most competitive rate possible. If you have multiple loan pre-approvals, you can use them as leverage to negotiate the best rate with the dealer.

It’s smart to understand how dealers make money before negotiating.

If your car loan allows for early repayment without penalties, consider making extra payments or paying off the loan ahead of schedule. This can save you a significant amount of money on interest charges over the life of the loan. Just be sure to double-check your loan agreement for any prepayment penalties before proceeding.

By taking the time to research your options, improve your credit, and negotiate favorable loan terms, you can save thousands of dollars over the life of your loan. Remember, every bit of effort you put into securing a lower interest rate will pay off in the long run.

At CarEdge, we’re dedicated to helping you make the most informed decisions when purchasing a vehicle. Whether you’re looking for expert advice, comprehensive data, or personalized coaching, we’re here to help you save money and drive away with confidence. Check out our free resources, or explore our premium car buying help today and start your journey toward the best car loan interest rates available.

Buying a car can be an exciting yet daunting experience, especially with so many factors to consider and decisions to make. But fear not, as we’ve gathered top car buying tips from industry experts to help guide you through the process with confidence. By leveraging these expert insights, you’ll not only save money but also secure the best possible deal on your new car. So buckle up and let’s dive into these expert car buying tips for a smoother, smarter, and more successful car purchasing experience!

Determine a realistic budget for your car purchase based on your financial situation and needs. For example, if you earn $50,000 annually and can comfortably allocate 15% of your income for transportation, your budget would be $7,500, which comes out to $625 every month. Don’t forget about fuel and auto insurance!

Remember to factor in additional costs such as taxes, fees, and add-ons, which could increase the total cost of ownership. For instance, if you’ve set a budget of $20,000 and live in a state with an 8% sales tax, you should account for an additional $1,600 in taxes.

It’s also essential to be aware of optional add-ons offered by dealers, such as extended warranties, paint protection, or gap insurance, which could increase the overall cost. More on that below. Stick to your budget during negotiations to avoid overspending and ensure you get the best value for your money.

Understand how car dealerships make money so you can better negotiate on various aspects of the car deal. It’s crucial to research different elements of a car purchase, including dealer holdback, manufacturer incentives, and profit margins, to gain an advantage in negotiations.

Begin by researching the invoice price and the fair market value of the car you’re interested in. This information will give you a solid starting point for negotiations.

Investigate any available manufacturer incentives, such as cash rebates or low-interest financing offers, that can help you save money on your purchase. Be sure to factor these incentives into your negotiation strategy, as dealers might be more inclined to offer a better deal when incentives are available.

CarEdge can be an invaluable resource in your research process. Our comprehensive vehicle listings, depreciation data, and expert advice can help you make informed decisions and better understand the intricacies of car buying.

Utilize the car price negotiation cheat sheet to learn about strategies for effective negotiation. Be prepared to walk away, know when to negotiate on price, and don’t be afraid to play hardball to secure a better deal.

Know EXACTLY what to say with this cheat sheet

Be aware of unnecessary dealer add-ons that can inflate the price of a vehicle. Review the list of common add-ons, and challenge or refuse those that don’t provide value to you as a buyer.

Examples of unnecessary dealer add-ons include:

Check out our complete guide to challenging dealer add-ons

Explore various financing options available to you, such as bank loans, credit unions, or dealer financing. Compare interest rates and terms to secure the best financing deal that suits your needs.

In many cases, you’ll be able to find lower interest rates elsewhere. Dealers mark up their rates nine times out of ten. Get pre-approved with a trusted credit union for better financing rates that will save you thousands of dollars over your loan term.

Even if you choose not to finance with a credit union, you can use their lower rates as leverage when negotiating at the dealership.

Following these expert car buying tips can significantly enhance your car purchasing experience and save you money. By setting a budget, doing thorough research, employing effective negotiation techniques, challenging dealer add-ons, and shopping around for financing options, you’ll be well-equipped to secure the best possible deal on your new car. Remember, patience and persistence can make a significant difference in the outcome.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

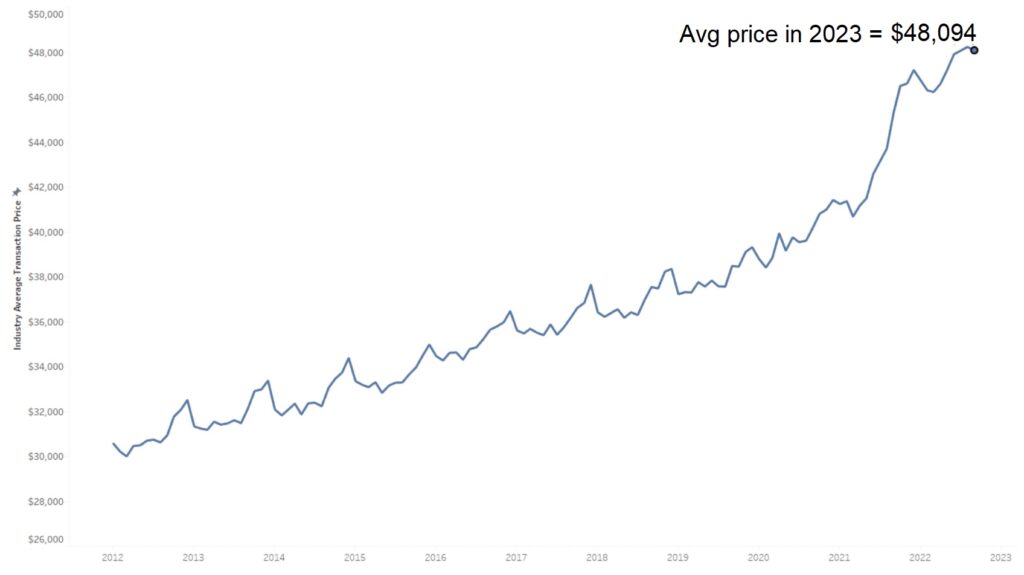

As we navigate the new year, the automotive industry is showing signs of recovery, with new car sales expected to lift slightly in Q1 2023. In a recent press release, automotive research firm Edmunds shared its predictions for the industry, highlighting the potential for growth in sales volume. We’ll dive into the key findings from the press release, and summarize the standout data to provide a clear outlook on what’s in store for the car market.

According to Edmunds, new vehicle sales in the first quarter of 2023 are expected to reach approximately 3.9 million units, a 0.6% increase compared to Q1 2022. This growth is an encouraging sign for the automotive industry, which has faced numerous challenges over the past couple of years, including supply chain disruptions, inventory shortages, and fluctuating consumer demand.

Edmunds’ predictions also shed light on the performance of various vehicle segments in Q1 2023. SUVs and trucks continue to dominate the market, with the SUV segment expected to account for 54.5% of new vehicle sales. Trucks follow closely, comprising 21.7% of the market share, while passenger cars trail behind at 23.8%. This trend highlights the ongoing consumer preference for SUVs and trucks, which offer more space, versatility, and capabilities compared to traditional passenger cars.

Back in 2021, SUVs held 52.5% of U.S. market share, trucks were 23.4%, and sedans were 24.1% of total light-duty sales. As we can see, vehicle sales by segment are holding relatively steady following the rapid rise of crossover SUVs in the past decade.

Edmunds also provides a breakdown of market share by manufacturer, with the top three spots held by General Motors (16.6%), Toyota (14.3%), and Ford (13.5%). These industry giants continue to lead the pack, benefiting from strong brand recognition, diverse vehicle lineups, and loyal customer bases. It’s important to note that these figures could still fluctuate, depending on factors such as production capabilities, consumer demand, and inventory availability.

In Summary: Q1 2023 New Vehicle Sales Predictions

Total Q1 2023 Sales: 3.9 million units (0.6% increase from Q1 2022)

SUVs: 54.5% market share

Trucks: 21.7% market share

Passenger Cars: 23.8% market share

General Motors: 16.6% market share

Toyota: 14.3% market share

Ford: 13.5% market share

The Q1 2023 new vehicle sales predictions from Edmunds paint an optimistic picture for the automotive industry, as sales are expected to lift slightly compared to the previous year. The data also highlights the ongoing dominance of SUVs and trucks in the market, as well as the strong positions held by major manufacturers like General Motors, Toyota, and Ford. As we move further into 2023, it will be interesting to see how these predictions pan out and whether the industry continues on its road to recovery.

As always, CarEdge will keep you updated on the latest trends and insights in the automotive world, helping you make informed decisions on your car-buying journey. Check out the different ways we can help you buy your next car for less. We’re real people helping drivers save real money! The proof is in the pudding: these success stories show how much the CarEdge Community saves every day.

Purchasing a vehicle is a significant investment, and understanding your potential monthly car payments is crucial to ensure it fits within your budget. One of the best ways to estimate your payments is by using a car payment calculator. With a plethora of options available, CarEdge’s tool stands out as an ultimate car payment calculator that is both user-friendly and reliable, and never sells your data to third parties. This article will guide you on using this top-ranking calculator, discuss the importance of understanding your monthly payments, and explain the factors that influence your car loan payments.

Just here for the calculator? No problem. Calculate your monthly car payment here.

A reliable car payment calculator is an indispensable tool for potential car buyers. It helps you gauge whether a specific vehicle is affordable and prevents you from overextending your finances. While dealer salespeople may encourage you to focus solely on monthly payments, it’s essential to consider the overall price of the vehicle, interest rate, and loan term as well. This comprehensive approach ensures you make well-rounded decisions and avoid deceptive sales tactics that could cost you more in the long run.

Your monthly car loan payments depend on three primary factors:

The loan amount is the cost of the vehicle minus any down payment or trade-in value. The interest rate, determined by your credit score and market rates, represents the percentage charged by the lender for borrowing money. Lastly, the loan term refers to the duration of the loan, typically expressed in months or years. Balancing these factors helps you find the right car loan for your financial situation.

Car loan amortization is the process of breaking down the loan repayment into equal monthly installments over the loan term. It allows borrowers to understand how each payment contributes to the principal and interest components of the loan. In the initial phase of the loan term, a larger portion of the monthly payment goes towards interest, while a smaller portion is allocated to the principal. As the loan progresses, the interest component decreases, and the principal component increases, eventually leading to the loan’s full repayment. The CarEdge Car Payment Calculator shows your full amortization schedule, so you know exactly where your money is going.

Simplify your financing with one calculator that takes into account the loan amount, interest rate, and loan term to provide you with an accurate estimate. Plus, see resale value projections too!

Here’s how it works:

By following these simple steps, you can quickly and accurately estimate your monthly car payments and make informed decisions when purchasing a vehicle.

Visit caredge.com/financing to access the ultimate car payment calculator

Keep in mind that while monthly payments are an essential factor, they should not be the sole consideration when purchasing a vehicle. It’s crucial to account for the overall price, interest rate, and loan term to make the best decision possible.

CarEdge’s top-ranking car payment calculator simplifies the process of estimating your monthly payments, providing an accurate and user-friendly interface. By using this powerful tool, you can confidently navigate the car-buying process and find a vehicle that meets both your needs and financial requirements.

When you’re buying a car, one of the biggest decisions you need to make is how much money to put down. The down payment you make can have a significant impact on your monthly car payment, interest rate, and the overall cost of your loan. In this article, we’ll provide expert advice from CarEdge’s Ray Shefska and break down everything you need to know about choosing the right down payment for your budget.

The down payment is the initial payment you make on a car, and it has a significant impact on the overall cost of your car. In this section, we’ll discuss the reasons why the down payment matters, including how it affects your monthly payments, interest rates, and loan terms.

CarEdge’s Ray Shefska shared this wisdom and advice: “I think that in today’s market the minimum down payment should be 20% of the total out-the-door price and if possible, upwards of 30%. That way, you have at least covered your taxes, tags, and doc fees, with some applied to the principal. Even with 20% down, I think that it still makes sense to look at GAP insurance, especially on a used car or a new car with a market adjustment.”

The credit bureau Experian says a 20% down payment might help shield you from depreciation. Depreciation refers to the ever-shrinking value of your car. The value of a new car declines about 20% in just the first year. Try out our depreciation calculator for the make and model you’re in the market for.

What does that look like in a real world example? It depends on the price of the car you’re thinking about buying. A 20% down payment for a $20,000 car is $4,000, but a 20% payment for a $60,000 car is $12,000. The monthly payments for each of these scenarios would be vastly different, despite having the same down payment percentage. More on that later.

The average down payment on a car varies depending on whether it’s a new or used car. We’ll look at the latest data to see what the average down payment is today. We’ll also discuss why putting down a larger down payment can help protect you from depreciation.

In 2022, the average down payment on a new vehicle was just over $6,000, according to Edmunds. This is an increase of 27 percent from 2021, and is the highest it has ever been. The average down payment on used vehicles was $3,574 in 2022. For both new and used cars, the average down payment in 2022 was far below the recommended 20%. This partly explains why the average monthly payment for a new car is above $700/month in 2023. Over 15% of new car buyers pay over $1,000 a month, not including insurance or fuel.

The down payment amount can have a significant impact on financing. A larger down payment lowers the amount financed, which means a lower monthly payment and less interest paid over the life of the loan. It can also reduce the risk of being upside down on the loan. You don’t want to be end up owing more than the car is worth. On the other hand, a smaller down payment may lead to higher monthly payments and more interest paid over the life of the loan. It’s important to find the right balance between a down payment that fits your budget and financing that makes sense for you.

Auto loan rates are at a 14-year high. When your loan has a higher interest rate, you will avoid hundreds or even thousands of dollars in interest payments by making a larger down payment. Another option is to refinance to a lower rate as soon as possible. In many cases, by putting a few hundred more dollars down today, you’re saving much more in interest over the loan term.

According to the latest data from NerdWallet, the average auto loan rate in March 2023 is 6.07% for new cars and 10.26% for used cars. Borrowers with low credit scores qualify for even higher auto loan rates.

To better understand how your down payment affects your monthly car payments, we’ve created a table based on a used SUV priced at $35,000. Use this table as a guide to help you make an informed decision when buying a car and choosing a down payment amount.

You can see that with a higher down payment, your loan amount decreases, and your monthly payment drops substantially.

What about interest? If you finance the FULL $35,000 in this example, you’d pay $6,088 in total interest over 60 months. However, if you put $10,000 down, you’re paying $4,300 in interest. The numbers don’t lie: a higher down payment will save you in the long run.

Why should you finance with a credit union? Credit unions offer the best rates, helping you save money for years to come. They offer lower rates than banks, have no hidden fees, and are known for their personal approach to customer service. Work with a CarEdge-approved credit union for the best rates. Drive your dream car at a rate you can afford.

We’ve got tools that empower you to make smarter car buying decisions. From the industry’s best car buying data package to CarEdge Concierge, we’ve got options to suit every driver and budget. CarEdge Coaches are here to help guide you through the car buying process. Our team of expert coaches is dedicated to providing personalized advice and support to help you save money and avoid costly mistakes. With CarEdge Coach, you’ll have access to one-on-one guidance from experienced professionals who understand the car buying process inside and out. Prefer a DIY experience? CarEdge Data is the perfect toolkit for you. Whether you have questions about financing options, down payment amounts, or negotiating with a dealership, we’re here to help you make informed decisions and achieve your car buying goals.