CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

For the fifth-month in a row, new car prices climbed to a new record in August. Car buyers continue to pay more, even as signs point towards the bubble bursting. The latest industry insights from Kelly Blue Book and TrueCar make it clear that new car prices have yet to peak.

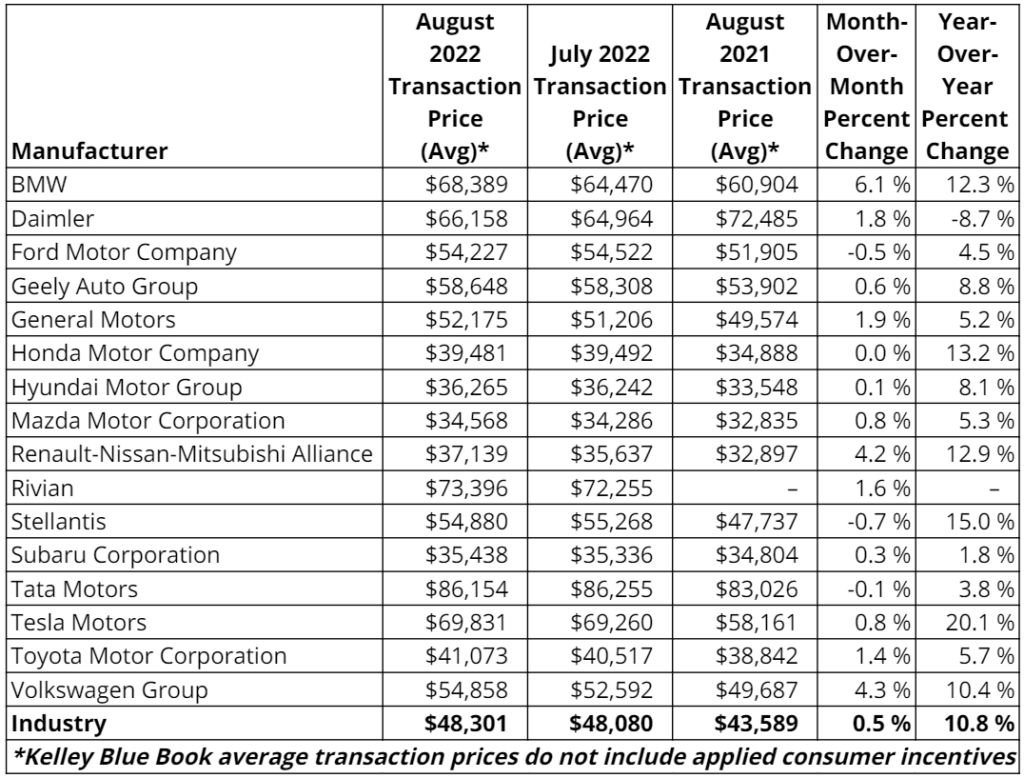

According to new data released this week by Kelley Blue Book, the new vehicle average transaction price (ATP) increased to $48,301 in August 2022, climbing 0.5% since July. August’s new car prices were 10.8% higher ($4,712) year-over-year from August of 2021. Luxury sales remain very strong, now making up 17.5% of overall market share.

There were 1.2 million units in inventory in August. At 43 days’ supply, that’s an improvement year-over-year. Still, new car inventory remains well below historical norms. See the latest new car inventory for each manufacturer here.

Ram, Volvo, Lincoln, Buick, Alfa Romeo and Fiat have the most competitive prices right now, selling 1% or more below MSRP in August. Hyundai, Land Rover, Honda and Kia continue transacted between 5-and-9% over sticker last month. Non-luxury vehicle buyers paid on average $1,102 above sticker price, an increase from July.

The average price paid for a new non-luxury vehicle last month was $44,559. Luxury buyers paid $65,935 on average, but KBB points out that luxury prices are averaging closer to MSRP than they had in months past. Non-luxury buyers paid $1,102 over MSRP in August, an increase since July.

What price parity? It might be time to give up on that dream, at least for the short-term. The average price paid for a new electric vehicle rose by 1.7% in August. EV prices are now 15.6% higher than they were one year ago. The average price for a new electric vehicle is now $66,524, according to Kelley Blue Book.

Here’s how each market segment fared in August:

Manufacturer incentives slowed to a trickle in the second half of 2021, and they’ve yet to return in any meaningful way. KBB found that incentives decreased slightly in August, averaging only 2.3% of the average transaction price. Incentive spending remains at 20-year lows.

Some OEMs are more generous than others right now. Data from TrueCar shows that Stellantis (Jeep, Dodge, Ram, Chrysler) incentives are highest right now, but only at 4.6% of ATP on average. Volkswagen, Nissan and General Motors were all between 3.3% and 3.6% of ATP in August. For perspective, most automakers were offering incentives totaling between 6% and 8% of transaction prices one year ago.

August’s average ATP of $48,301 is more than 80% of the median household income in 15 states. How much worse can it get before new car prices come back to reality? Sadly, even automaker executives note that they’re still selling every car they can manage to make right now. Demand remains strong, so there’s no incentive to lower prices right now.

In fact, automakers are being forthright about their realization that keeping dealer lot inventory slim is best for them and the dealers. This summer, Nissan executive Ashwani Gupta shared the brand’s intention to keep inventory low, and his acknowledgement of who this strategy benefits.

“We have learned that this is more efficient,” Gupta said. “And this is good for dealers. The dealer is ordering a car that is already requested by a customer.”

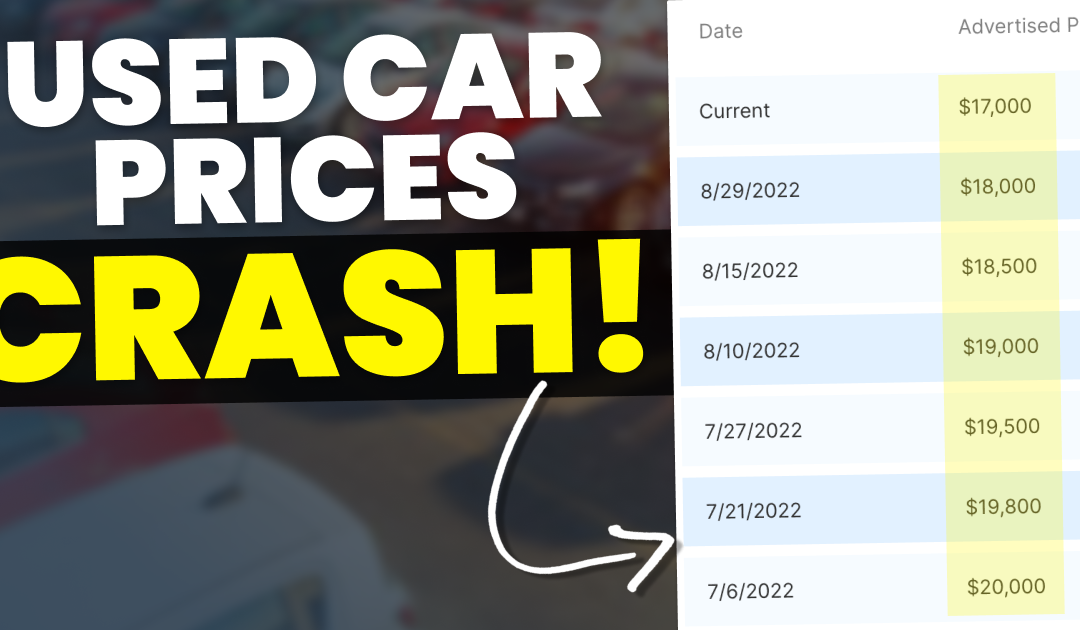

Today’s car buyers have more leverage than at any time in the past year, if only they would negotiate a deal on a used car insteadWe’ve heard it all before, but what makes August’s data significant is the contrast with now 12 weeks in a row of major weekly price declines at wholesale auctions.

As the average price of a new car continues to inch towards $50,000, we must take a step back to understand how we got here, and where we’re headed. On the new vehicle front, the new record was driven by the continued popularity of luxury models, tight but improving inventory, and historically low manufacturer incentives.

Kelley Blue Book notes that luxury share remains near an all-time high at 17.5% of auto sales. This inevitably pushes market averages higher, but it points to a larger underlying problem – new cars are becoming a luxury item out of reach for many. Automakers continue to announce cancellations of their more affordable offerings. The Chevy Sonic, Hyundai Veloster, Mazda CX-3 and Volkswagen Passat to name a few. It’s clear that they’re laser-focused on higher-margin models, no matter how much it further damages vehicle affordability.

We’ve pointed out for weeks that your best shot at a deal is in the used car market right now. You don’t have to spend over $50,000 on a new car with a $1,000/month payment. The used car market is certainly softening at wholesale auctions. Wholesale prices are down roughly 7.5% in three months, with luxury segments seeing sharper declines.

Dealers are becoming anxious about the real possibility of losing money on used inventory they paid too much for just weeks ago. It costs them money to hold inventory, and they’re eager to sell right now. Everyone should be able to negotiate 5% to 10% off of the sticker price right when shopping used vehicles right now. Not sure how to go about doing that? Our very own auto experts are ready to empower you with the skills at the CarEdge Community.

General Motors finally released details about what could turn out to be the most important electric vehicle of the decade. Yes, Tesla pioneered the mass production of EVs in the 2010s, but GM intends to bring them to the masses with affordable pricing. Now that we know almost everything about the 2024 Equinox EV, how does it compare to the Chevy Bolt EV and EUV, and the many higher-priced electric crossovers on the road? Plus, we’ll also go over why I don’t think the Equinox EV will cost $30,000, despite GM’s comments.

Only two big questions remain after GM released details and new images of the Equinox EV in September. Although we don’t yet know exact pricing or battery capacity, the latest press releases have revealed a future-ready EV with great range, decent charging, and GM’s reiterated $30,000 price tag. Let’s dig into the details, and why I sincerely think this model alone will be a make-or-break moment for the electrification of America’s legacy automakers.

The Equinox EV will be available in standard and extended range battery options. Front-wheel drive will offer either battery capacity, and all-wheel drive will only be offered with the long-range pack. GM has not divulged the battery capacity figures, but we do know that the Equinox EV will be powered by the Ultium electric platform that GM engineered in partnership with LG Energy Solutions. That’s great news, as the Ultium battery has proven to be a game changer in the GMC Hummer EV and Cadillac Lyriq.

These are the unofficial range figures that GM shared with us:

On the performance side, the Equinox won’t compete with the more powerful Blazer EV, or many of the other segment competitors for that matter. It’s becoming clear the GM wants the Equinox to stand out for every day functionality and eye-catching affordability.

GM has not released official passenger and cargo volume numbers, but they did release some key numbers. The Equinox EV is larger than the gas-powered Equinox. It’s 7.4 inches longer overall with a wheelbase that is 9 inches wider. The much wider wheelbase creates more interior space, similar to how other automakers have make crossovers feel a lot more like larger SUVs. In terms of overall width, the EV is 3 inches wider than the gas version.

The Equinox EV is one inch shorter than the gas version, and that’s definitely for aerodynamic reasons.

We’ll update this page as more info becomes available.

This was the only letdown in my book, but it’s not a deal breaker. General Motors has often touted the next-generation capabilities of its Ultium batteries. More range, faster charging, better efficiency. The Ultium-powered Cadillac Lyriq charges at 190 kilowatts and the GMC Hummer EV peaks at 180 kW, so I was a bit confused to see that the Equinox EV is limited to 150 kilowatt charging speeds at a DC fast charger. It’s totally possible that CEO Mary Barra and the crew are taking a page out of Porsche’s EV gameplan: underpromise and overdeliver.

Even with 150 kw charging speeds, what matters more is the charging curve. Early testing with the Hummer EV shows that at 65% state of charge, the Hummer was still pulling 170 kilowatts. That’s a great sign. Combined with GM’s claimed ability for the Equinox EV to add 70 miles of range in 10 minutes, and it starts to sound like a pretty sweet deal for those who travel at a leisurely pace.

To summarize:

When charging any electric car at home, you have two options. No additional installation is required to simply ‘trickle-charge’, which means plugging in to a standard three-prong wall outlet. Commonly known as level one charging, this would add just 3-5 miles of range per hour, but drivers like myself find it to be plenty enough since I leave my car plugged in all night, and I don’t drive more than 30 miles on most days.

If you drive over 40 miles per day at least a few times each week, you’ll either want to install a level 2 home charger, or plan to spend time at public charging stations. A trained electrician will be needed to install a level 2 charger, and equipment plus labor can add up to a few thousand dollars. If you do go the level 2 route, you’ll be rewarded with MUCH faster home charging.

The Equinox EV will have some of the fastest home charging available from any EV, including luxury options. The Equinox’s standard level 2 charging is rated at 11.5 kilowatts, which is noticeably higher power than most EVs today (limited to 6 to 9 kilowatts at level 2). The higher trims of the Equinox EV will go even further to 19.2 kW home charging. With that, the Equinox RT and RS could add 51 miles of range per hour.

Don’t forget that EVs typically charge overnight while you sleep. It can be tempting to compare home charging times to a quick gas station fill-up, but life with an EV is altogether a different automotive lifestyle.

What comes standard: if you’re a fan of massive horizontal touchscreens, we have good news. The Equinox comes standard with an 11 inch infotainment touchscreen, a separate 11 inch digital gauge cluster, manual cloth seats, and 250 miles of estimated range from Chevrolet’s standard battery.

Standard safety features are generous. Standard Chevy Safety Assist includes:

Additional safety and assist features are available in higher trims, as detailed below.

Starting price: GM says “around $30,000 before incentives”; CarEdge expected price: $32,000

The 1LT includes all of the standard features mentioned above, including:

Starting price: TBD; CarEdge expected price: $37,000

The Equinox 2LT is likely to be the option for the budget-conscious EV buyer who wants more range, improved looks, and niceties like heated seats. The 2LT adds:

Starting price: TBD; CarEdge expected price: $48,000 – $55,000

The 3LT has most of the bells and whistles, but pricing will likely undercut its nearest competitors like the Ford Mustang Mach-E and Kia EV6. Available options like all-wheel drive, heads-up display and SuperCruise are expected to drive a fully-loaded Equinox 3LT to a substantially higher price.

In addition to the features included in lower trims, the 3LT includes:

Starting price: TBD; CarEdge expected price: $52,000

GM has decided to launch the electric Equinox in the fall of 2023 with the 2RS trim. This is the entry-level sporty trim option. It’s all about looks.

Starting price: TBD; CarEdge expected price: $60,000

Available 19.2 kilowatt home charging is the real standout option with the 3RS. Aesthetically, this is as close as the Equinox EV gets to its sportier sibling, the 2022 Chevy Blazer SS EV.

The 3RS also includes:

Why do I think the higher trims will costs over $20,000 more than GM’s “aroud $30,000” starting price? It’s VERY difficult to make money selling EVs at $40,000 right now, not to mention ten grand cheaper. Ford recently admitted they aren’t turning a profit on the Equinox’s rival the Mustang Mach-E. Raw material prices have shot up by over 100% since 2020, and inflation is real.

In August of 2022, President Biden signed the Inflation Reduction Act of 2022 into law. With the new law arrived a completely revamped EV tax credit and future rebate. We’ve already covered the details of the new EV tax credit and which models will qualify, but here’s a summary of the biggest changes:

The Equinox EV will qualify for at least half ($3,750) of the new EV tax credit. GM plans to build it in Mexico with Ultium batteries made in America. Whether or not the Equinox qualifies for the full $7,500 will depend on where GM sources the lithium and other minerals in their batteries.

Yes, it’s true: With incentives, the 2024 Equinox EV may cost as little as $23,000. That would be a true turning point in EV adoption.

The 2024 Chevrolet Equinox EV will be up against stiff competition in this burgeoning electric crossover segment. These are some of the most popular competitors:

Stay tuned to the latest EV coverage by subscribing to our CarEdge Electric YouTube channel. Join the thousands of EV buyers, owners and enthusiasts in the Electric Vehicle forum at caredge.kinsta.cloud. Bring your questions, the community has answers!

Car sales increased for the first time in more than a year in August. While overall market conditions seem to be improving, many automakers are still in a tough spot (we’re looking at you Toyota, Honda, and Subaru). Will increasing new car inventory and sales lead to more manufacturer incentives and lower prices? Here’s what the August data reveals, and what new trends suggest for car buyers in September 2022.

Industry analysts at LMC Automotive and TrueCar are reporting that for the first time since last summer, new car sales increased last month. Excluding fleet sales, TrueCar expects U.S. retail deliveries of new vehicles to be 1,015,575 units, up 6 percent from a year ago and up about 3% from July 2022.

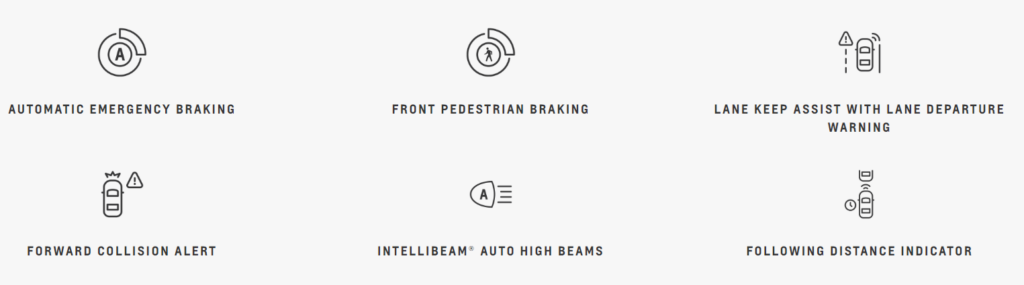

As CarEdge’s Ray Shefska points out, an extra day in August really helped pump up sales numbers for some automakers. August’s seasonally adjusted annualized rate (SAAR) for new vehicle sales (light duty models) is approximately 13 million, which is down 14 percent from August 2021. U.S. new car sales are still in a slump, but August sales numbers are showing some signs of improvement.

LMC Automotive reported total light-vehicle sales rose 4 percent to 1.13 million (including fleet sales). Taken together, August would mark the first monthly year-over-year gain since summer 2021. Does that mean the auto industry has come out of rock bottom?

Is the American auto industry climbing back to normal? The best answer we have with August sales data is … maybe? Only seven automakers report monthly U.S. sales figures, and that leaves a massive data gap that severely limits the interpretation of monthly sales. Ford, Honda, Hyundai, Kia, Subaru, Toyota and Volvo release sales data monthly, but big names like General Motors, Stellantis and Tesla don’t. The seven who do tallied 617,363 sales in August, down 1.8 percent year-over-year, according to the Automotive News Research & Data Center.

From the automaker perspective, just how you feel about last month’s data depends on who you work for. Experts at Cox Automotive take the latest numbers with a grain of salt. Cox Automotive Senior Economist Charlie Chesbrough shared his cautious optimism. “There are small signs that new-vehicle inventory levels are stabilizing, but they are also not getting significantly better. Some automakers have far more inventory than others, and some are managing their operations more efficiently.”

Meanwhile, TrueCar’s analysts see the data as validation for what they’ve predicted for months. “August is shaping up to confirm our early predictions that the industry may be turning the corner,” said Zack Krelle, Industry Analyst at TrueCar. “We’re seeing consecutive month over month increases for incentives, while average transaction prices are softening. Inventory is also slowly growing, and sales are improving slightly.”

When it comes to winners, Ford Motor Company was the shining example of what many see as better times ahead. In August, total Ford Motor Company sales increased 27.3 percent to 158,088 units. Plus, there’s even better news if you’re in the market to buy. Ford ended August with 254,400 vehicles in dealer stock or in transit (although one has to wonder how many are actually on dealer’s lots right now), up from 250,200 at the end of July and 210,800 a year earlier.

The F-150 added a new accolade last month: best-selling electric truck. Ford says that electric vehicle sales were up 307 percent year-over-year. The automaker cited the Ram pickup, Tesla Model 3 and Model X as the Lightning’s top three conquests.

Demand remained strong, with more than 76,000 retail orders placed for 2023 model vehicles last month, a 41 percent increase compared with 2022 model orders in August last year.

Hyundai and Kia snapped a five-months of sales declines in August. Hyundai’s U.S. sales were up 14 percent, and Kia sales increased 22 percent. Inventory is also looking marginally better for the two brands. Hyundai Motor America said it ended August with 19,209 vehicles trucks in U.S. inventory, up from 14,784 at the end of July but still only about half of the 39,357 it had a year earlier.

“This month we’re seeing Hyundai and Kia doing well, which I believe is in part due to the freshness of their lineups, with greater design changes than other OEMs,” said Justin Colon, Vice President of OEM Solutions at TrueCar.

New car sales slipped at Toyota and Honda in August as Japanese automakers were continuing to feel the direct impacts of Asian supply chain disruptions. Toyota’s sales fell 9.8 percent, and Honda was down 38 percent. Honda’s Acura brand was even worse, with sales down 47 percent. Honda’s U.S. monthly sales have dropped for 13 months straight.

Check here for the latest new car inventory numbers (updated as they become available)

Other bits of good news were to be found in August sales reports. Still, it’s important to zoom out and remind ourselves that small monthly gains are dwarfed by over a year of sinking inventory, higher prices, and fewer manufacturer incentives. For example, incentive spending was down 52% from last year but up 9% from July 2022. TrueCar estimates that the average transaction price in August was down slightly from July, but is still up 10% from a year ago. Buying a car remains very expensive, however rising interest rates, slightly better inventory and a softening used car market are all giving car buyers more to think about as we head into autumn.

Our very own Ray Shefska had this to say about August sales numbers. “The Seasonally-Adjusted Annualized Rate (SAAR) is still significantly below where they thought it would be earlier this year. That doesn’t leave me feeling optimistic. I think we all need to wait until early October before drawing conclusions. By that time, we’ll have every automaker’s Q3 2022 sales numbers to pore over. It’s hard to draw any conclusions when only a few automakers report monthly sales numbers. After a year of bad news on the inventory front, automakers and car buyers alike are ready for optimism. Patience is key to informed car buying in a time like this.”

If you’re thinking about hauling the kids off to school with zero emissions, today’s EVs offer more range, faster charging and greater fuel savings. The best electric cars and SUVs for families are available in a wide range of options to meet your needs, and an even wider range of price points. These are the best electric crossovers and SUVs on sale in 2024.

If you need space for four, five, or maybe six people (plus those furry friends), these 3-row electric SUVs are built for you.

Reviewers absolutely LOVE the new Kia EV9. As the first mainstream 3-row electric SUV to hit the American market, the EV9 was highly anticipated. We can confirm that it has been worth the wait. Step inside this full-size SUV, and you’ll immediately note the spaciousness and luxurious feel of this premium-feeling Kia. This one is worth a test drive.

Price: $56,395 – $75,395

Range: 230 – 304 miles

Charging (public fast charger): can add 200 miles in 18 minutes

Passenger volume: 159 cubic feet (three rows, seats 6)

Cargo volume behind second row: 44 cubic feet

Total cargo volume: 82 cubic feet

NHTSA safety rating: Not Rated (5-Star Euro Rating)

See Kia EV9 new and used listings with local market data.

Rivian is just beginning to ramp up production and sales of the Rivian R1S, the full-size electric SUV companion to the R1T electric truck. The 2024 Rivian R1S is a blend of luxury and off-road capability. This 3-row EV is made in America, at a converted manufacturing facility in Normal, Illinois. We can only recommend this great vehicle if you live within a reasonable distance of one of Rivian’s service centers. If you end up needing service, you don’t want to pay for a long-distance tow truck!

Price: Starting at $74,900

Range: 316 miles

Charging (Public fast charger): can add 140 miles in 20 minutes

Passenger volume: (three-row SUV)

Cargo volume behind second row: 46.7 cubic feet

Total cargo volume: 104.7 cubic feet

Safety rating: Top Safety Pick+ by IIHS

Learn more about the Rivian R1S.

With gull-wing doors and a massive glass roof, there’s no hiding the fact that the Tesla Model X is a luxury SUV. In 2024, the Model X has seen multiple price cuts, and now starts around $80,000.

Price: $79,990 to $120,000+

Range: 351 miles

Charging (Public fast charger): can add 200 miles in 15 minutes

Passenger volume: N/A (three rows)

Cargo volume behind second row: 42.5 cubic feet

Total cargo volume: 92.3 cubic feet

Safety rating: 5 stars from Euro NCAP

See Tesla Model X new and used listings.

These electric crossover SUVs are the highest-rated, most-loved EVs for families today. Although they lack a third row, they’re plenty big enough for most families of four. Spaciousness, pricing, range and charging speeds vary from one electric model to another. We’ve also included NHTSA safety ratings if they’re available.

The Model Y is the best-selling electric vehicle in America. Model Y prices have fallen 20% from 2022’s highs. It’s now possible to buy a Model Y for well below $50,000 with the point-of-sale EV tax credit. Although it’s known for autonomous driving, the full capability (known as FSD) is a $15,000 package.

Price: $49,990 to $74,990

Range: 279 to 330 miles

Charging (Public fast charger): can add 200 miles in 15 minutes

Passenger volume: 106 cubic feet

Cargo volume behind second row: 26.6 cubic feet

Total cargo volume: 72 cubic feet

NHTSA safety rating: 5 stars

See Model Y new and used listings.

Ford’s first serious EV is very popular among small families and speed freaks alike. If the Mustang brand has a special place in your heart, this just might be the EV for you.

Price: $45,995 to $63,575+

Range: 224 to 312 miles of range

Charging (Public fast charger): can add 120 miles in 20 minutes

Passenger volume: 104.5 cubic feet

Cargo volume behind second row: 29.7 cubic feet

Total cargo volume: 59.7 cubic feet

Safety rating: IIHS Top Safety Pick

See Mustang Mach-E new and used listings.

I can confidently say that the IONIQ 5 is a great family car, and that’s because my wife and I haul our own kiddo around in this segment-bending electric crossover with hot hatch flavors. The IONIQ 5 has won many awards, including Car and Driver’s 2022 EV of the Year. It charges VERY fast, and that’s what I love most about the car.

Price: $40,925 to $57,400+

Range: 220 to 303 miles

Charging (Public fast charger): Adds 200 miles of range in 20 minutes

Passenger volume: 106.5 cubic feet

Cargo volume behind second row: 27.2 cubic feet

Total cargo volume: 59.3 cubic feet

Safety rating: Top Safety Pick Plus from IIHS

See Hyundai IONIQ 5 new and used listings.

The spaceship-styled EV6 is Kia’s version of the Hyundai IONIQ 5, which shares the e-GMP electric powertrain. The Kia EV6 has slightly less passenger and cargo space than the Hyundai, but it’s better range and equally fast charging make it an obvious feature on this list of best electric cars for families.

One thing to bear in mind: most EVs, including the EV6 and IONIQ 5, have a flat floor, meaning that there’s a bit more interior space than it would appear. The best thing you can do is check one out in person!

Price: $43,920 to $61,600+

Range: 274 to 310 miles

Charging (Public fast charger): Adds 200 miles of range in 20 minutes

Passenger volume: 103 cubic feet

Cargo volume behind second row: 24.4 cubic feet

Total cargo volume: 50.2 cubic feet

Safety rating: In Europe, the EV6 earned 5 stars

See Kia EV6 new and used listings.

We have great news for those in search of an affordable and capable EV that qualifies for the federal tax credit. The ID.4 is now made in Tennessee at Volkswagen’s Chattanooga plant! The newest American-made EV is equipped with decent range, okay charging, and a comfortable interior that’s designed for families. However, don’t expect Tesla-level infotainment. The ID.4 is best for those who are content with the simpler things in life.

Charging speeds are merely okay, but the 2024 model year gets a decent improvement.

Price: $38,790 to $55,000

Range: 208 to 275 miles

Charging (Public fast charger): Adds up to 190 miles of range in 30 minutes

Passenger volume: 99.9 cubic feet

Cargo volume behind second row: 30.3 cubic feet

Total cargo volume: 64.2 cubic feet

Safety rating: Top Safety Pick Plus

See Volkswagen ID.4 new and used listings.

The Inflation Reduction Act eliminated the original EV tax credit and replaced it with a completely revised tax credit. For vehicles that qualify, up to $7,500 in tax credits are available. However, the incentive is based on battery sourcing, which will be determined by the automakers. Income limits restrict buyer eligibility, too. See the full details on qualifying models here.

There’s also a used EV tax credit for the first time, but a price cap of $25,000 eliminates every single family EV on this list.

Generous state and local incentives may make the switch to an EV much more affordable, depending on where you live. See the most generous state-level EV incentives, and check with the DSIRE clean energy incentive database to find more incentives for your specific location.

Which family-size electric car are you considering? Let us know in the comments, or better yet join the conversation at our CarEdge Community forum.

At CarEdge, empowering you is what drives us. Car buying, selling and ownership are too often accompanied by hassles and headaches. We do our best to save time & money with real advice from auto experts. Right now, the used car market is going through some big changes. In 2023, buyers have more leverage. For four months in a row, used car prices have declined at the wholesale level. Retail prices are softening, and we’re seeing more CarEdge members negotiate better and better deals.

If you’re in the market to buy a used car your goal should be to get 5-10% off of the dealer’s advertised price. Still, some brands are more negotiable than others. In this guide we’ll walk you through what has changed in the market, why you have leverage, and how you can get that 10% off.

Let’s dive in!

Data from Black Book reveals that days to turn, a metric used to measure how long cars sit on the lot before selling, is increasing. At the same time, there are more used cars for sale right now than at any other point of 2022. Supply is up.

Increasing dealer inventories, paired with higher interest rates, means that car dealers are paying more “floorplanning” cost than they have in years. Floorplanning is the interest payments car dealers make on their inventory. Just like you and me, car dealers typically finance the purchase of their inventory, which means that as inventory sits and interest rates rise, dealers have a financial incentive to negotiate and lower their prices to sell vehicles.

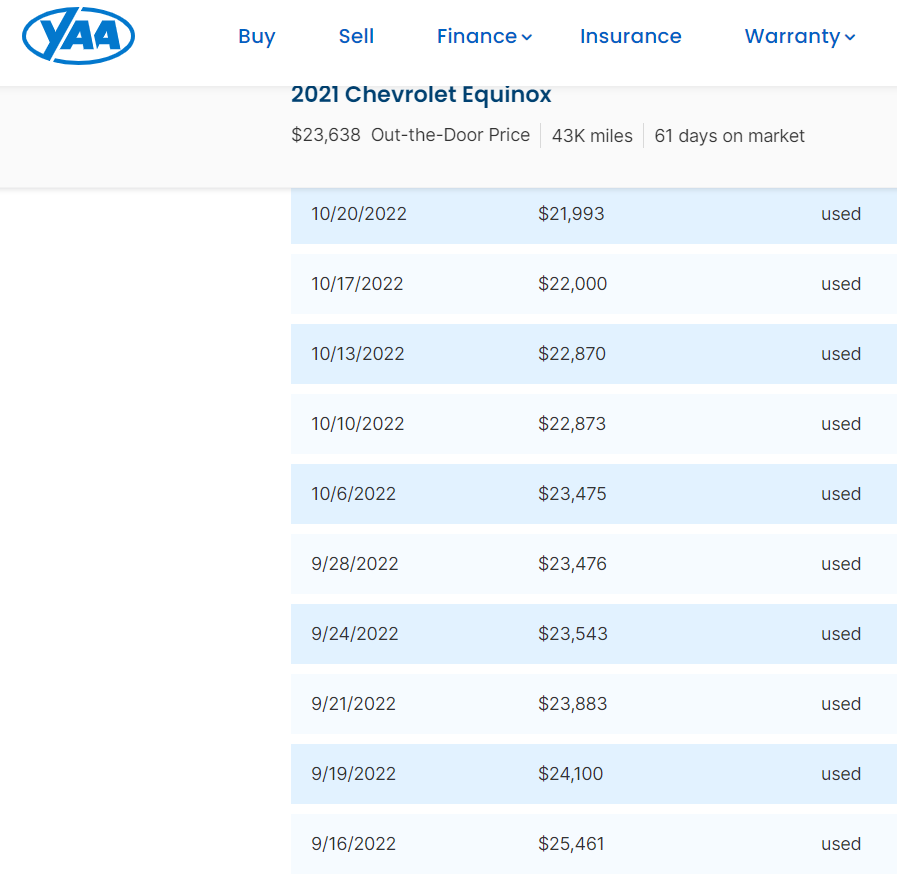

Dealers are once again working hard to sell cars. How do they do that? They lower their prices. Suddenly, with the softening of the market, more dealers are negotiating again, and many are starting to drop their used car prices rapidly. A quick look at CarEdge Car Search shows that more vehicles are seeing price drops. Take a look at this 2021 Chevrolet Equinox, for example. This dealer has discounted the price by 14% in ONE MONTH.

Over the past 35 days this dealer has dropped the advertised price by $3,500! That’s a 14% decrease in price in one month. Wow! As you can see, the most recent price declines are more significant. This is because the dealer is feeling the pressure of increased carrying costs, and a softening wholesale market (they can’t simply go to the auction and sell this car to make money like they could earlier in the year).

Use this information to your advantage! If you went to this dealership and requested an out the door price, be prepared to negotiate an additional 10% off of that amount. Why not? You already know the dealer is desperate to sell this car. Even if you end up with just 5% off, that’s still a win!

When you go to negotiate a used car, know that these are the five reasons why they’ll be willing to negotiate with you. Feel free to even print this out and show them if they give you a hard time!

In fact, you can now finance with CarEdge to secure a low rate through our credit union partners. Not interested? You can still use your pre-approval as leverage to negotiate a lower APR at the dealership. Learn more about financing your car purchase with CarEdge!

Some dealers just don’t look at the big picture and are oblivious to the car price trends we’re seeing right now. Not every car dealer understands that right now is the time to give up some of the profit they had planned to make on a vehicle in order to make a sale today before prices drop further in weeks to come. CarEdge Car Dealer Reviews and Markups.org are great places to learn what others have experienced at dealerships near you. Crowdsourcing car buying experiences is changing the game for the better!

With both new and used car prices still greatly inflated, it’s important to think about how today’s buying decisions could affect your future finances. New car prices are up 6% year-over-year, and 24% since July 2020. There’s no sign of new car prices coming down, and automakers seem to be announcing MSRP hikes weekly.

Deal School is 100% FREE! Learn how to negotiate!

If you’re determined to buy a new car, don’t expect MSRPs to go down at all. However, more buyers who work with CarEdge are able to buy at MSRP, with some even securing a deal under MSRP. Check out our latest success stories!

Work with dealers selling cars without markups. They’re not common, but they’re certainly out there. With MSRPs likely to increase in 2023, consider yourself a winner if you buy the new car you want with zero markups or dealer add-ons. Don’t forget, you can challenge dealer add-ons!

On the other hand, used cars are more negotiable than at any point in time this year. If you’re looking for a better deal, here’s what you need to know: used car prices are declining at the retail level, but we expect price drops to continue for many weeks to come. There will be better deals in the weeks ahead.

While making long-term predictions is difficult right now, we’re confident that used car prices will be even more negotiable (with lower sticker prices) at the end of November than they are today.

If you are in the market for a used car right now, your goal should be to negotiate 5-10% off of the sticker price, or consider waiting a few more weeks (or longer) for the market to soften further.

Yes. As a buyer you have more leverage than at any point in the past 18 months. Does this mean used car prices are “good” or “fair”? No way. Used car prices rose 45% in 2021, so finding a true bargain is next to impossible. Used car prices remain inflated, but for those who need a vehicle, market conditions have improved, and are likely to continue to improve. Here’s what’s clear: you have more leverage today than at any other time in 2022.