CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

The average price paid for a new car has jumped by 30% in just five years, but that doesn’t mean you can’t get a great deal on an affordable new ride. In early 2024, the average selling price of a new car remains near all-time highs at $48,759. Believe it or not, today there are still several new cars on sale for under $25,000. These are the Consumer Reports reliability ratings for the five cheapest new cars on sale in 2024.

Starting Price: $20,400

Fully-Loaded Price: $25,000+

Special Offer: Buy or lease for just $399/month. Learn more

Consumer Reports Reliability Rating: 43/100

The 2024 Chevrolet Trax stands out for its sleek and modern design, which is paired with a shockingly affordable price for an SUV. It offers impressive fuel efficiency, making it an economical choice for both city driving and longer journeys. Additionally, the Trax is equipped with the latest technology and safety features, ensuring a comfortable and secure driving experience.

Browse Chevrolet Trax listings with the power of local market data.

Starting Price: $16,290 (manual), $17,960 (automatic)

Fully-Loaded Price: $29,995

Consumer Reports Reliability Rating: 45/100

The 2024 Nissan Versa Sedan offers exceptional value as one of the only new cars available for under $20,000 today. The Versa offers a surprising range of features and solid quality. It boasts a comfortable and spacious interior considering its sub-compact size. Additionally, the Versa Sedan delivers good fuel economy, averaging 32 miles per gallon in the city and 40 MPG on the highway.

Browse Nissan Versa listings with the power of local market data.

Starting Price: $16,695

Fully-Loaded Price: $26,130

Consumer Reports Reliability Rating: 50/100

The 2024 Mitsubishi Mirage is a cost-effective, affordable new car. Considering it’s not a hybrid, the Mirage is very fuel efficient, boasting 36 MPG in the city and 43 MPG on the highway. It features a range of trims and modern technology, along with notable safety, including 7 airbags. That’s a lot for such a small car. This makes it a practical choice for those prioritizing economy and safety in a small vehicle.

Browse Mitsubishi Mirage listings with the power of local market data.

Starting Price: $19,990

Fully-Loaded Price: $32,985+

Consumer Reports Reliability Rating: 67/100

The 2024 Kia Forte is now Kia’s most affordable offering after the discontinuation of the Kia Rio last year. The Forte is a compact sedan that combines practicality with the best reliability ratings for under $20,000. It features a spacious interior for the price, with a total interior volume of 96.0 cubic feet. This spaciousness is complemented by a range of options and trims, catering to various preferences and needs. The Forte is a great choice for those who desire more than the cheaper Mitsubishi and Nissan can offer.

Browse Kia Forte listings with the power of local market data.

Starting Price: $19,800

Fully Loaded Price: $31,995+

Consumer Reports Reliability Rating: 60/100

The 2024 Hyundai Venue stands out as the only other SUV on this list, albeit a subcompact one. It offers a decent cargo volume of 18.7 cubic feet with the rear seats up, which expands to 31.9 cubic feet when the rear seats are folded down. This makes it a versatile choice for both daily commutes and more demanding cargo needs. The 2024 Hyundai Venue is the only SUV priced below $20,000, but even with destination fees applied, it’s going to surpass that figure. Its compact size, affordability, and versatile nature make the Venue a unique offering for those seeking a budget-friendly SUV.

Browse Hyundai Venue listings with the power of local market data.

In conclusion, the search for affordable and reliable new cars in 2024 reveals a diverse range of options under $25,000. Models like the Chevrolet Trax, Nissan Versa, Mitsubishi Mirage, Kia Forte, and Hyundai Venue stand out for their balance of price, reliability, and modern features. Each offers unique advantages, from the Trax’s incredible value to the Venue’s versatility as a subcompact SUV. These models demonstrate that affordability doesn’t necessarily come at the expense of quality and reliability. See the latest deals on the Chevy Trax and more here.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

If you’re thinking about buying or selling a vehicle in 2024, you’ve most likely encountered an unfortunate truth in today’s market: trade-in values have taken a dive. But what’s driving this decline, and how does it affect your next vehicle purchase? Will trade-in values fall further in 2024? Let’s delve into the dynamics of trade-in values in 2024, exploring the causes behind this trend and what you can expect when you decide to trade in your vehicle.

In 2024, trade-in values are trending downward, primarily due to a steady decline in used car values at wholesale auctions. Last year’s volatility in the wholesale used car market has led to an 11% drop in values within just two months towards the end of 2023. We’re seeing that trend carry over into 2024. Despite this decrease at the wholesale level, retail prices have remained stubbornly high, resisting substantial drops as dealers maintain higher price points.

The used car dealers who make offers for trade-ins are nervous about two things: the slowing used car market, and high interest rates. Many dealers suffered huge losses on electric vehicle trade-ins in 2023 as values went into freefall. The same could be said about other vehicle segments, from vans to luxury SUVs.

The used car market turmoil has resulted in trade-in values falling more dramatically compared to retail prices.

👉 See this week’s used car market update

CarEdge Co-founder Ray Shefska has some thoughts to share about trade-in values in 2024. Ray highlights that, despite the drops, trade-in values in 2024 are still far from what they used to be pre-pandemic. The automotive market is slowly inching towards a balance, but it’s a gradual process. “The car market remains out of balance due to the 16 million vehicles that were never built during the pandemic shortages. This shortfall will continue to impact the market throughout the decade, but we’re starting to see signs of improvement,” he noted.

What can you do to stay on top of the latest trends in trade-in values for your car? Get offers from online buyers with no strings attached! See real-time offers from online buyers with CarEdge.

According to Ray, 2024 is expected to bring back some normalcy in terms of market seasonality, which has been absent for a while. The early part of 2024 has already seen a dip in trade-in values, attributed to the post-December buying slump.

However, this trend is likely to reverse during the tax refund season in spring, which typically sees an uptick in used car purchases. This increase in demand often leads to a temporary boost in trade-in values.

“Post-tax season, I expect a slight decline in trade-in values in early summer, followed by a steady market until the year-end car buying season. Remember, depreciation is normal for every vehicle. What we’ve seen over the past few years was abnormal to say the least.”

Ray’s pulse on the market is rooted in over 40 years in the automotive industry. If anyone knows a thing or two about trade-in values, it’s Ray.

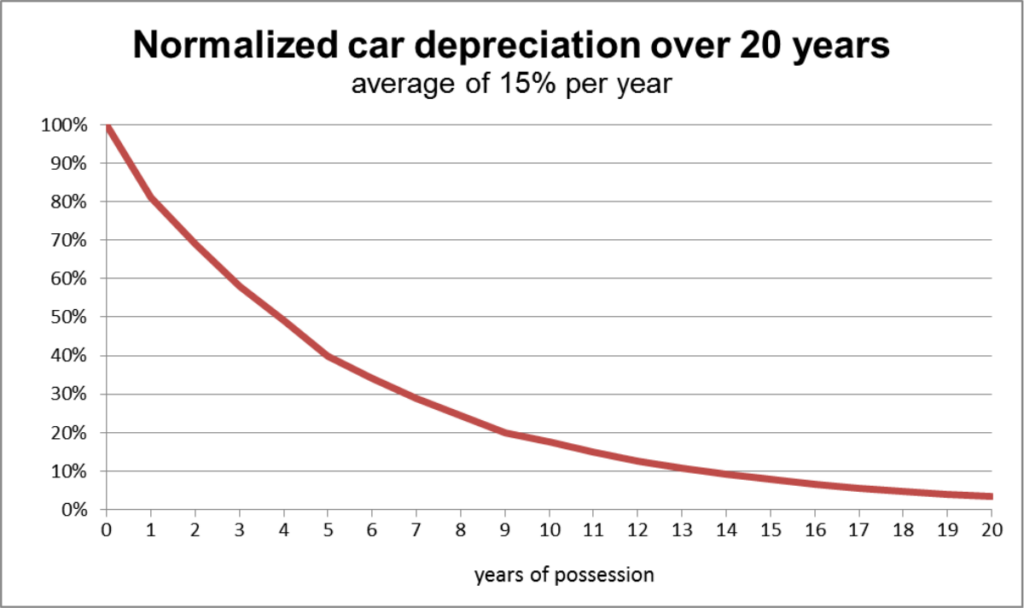

Historically, vehicle values take a 20% hit in the first year of ownership. It’s normal to lose around 40% of a car’s original value in the first five years.

Navigating the auto trade-in market in 2024 requires an understanding of these new trends and their underlying causes. From the pandemic’s lasting impact to the return of market seasonality, various factors are shaping trade-in values this year. Whether you’re planning to trade in your vehicle soon or later in the year, staying informed about these trends can help you make a more strategic decision, ensuring you get the best value for your car in a shifting market.

👉 Don’t forget to check your car’s trade-in values from online buyers (no spam, guaranteed!). Get your no-hassle offers here.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

When searching for the best new car deals, a powerful tool is the latest local inventory data. Equipped with behind-the-scenes market insights, you’re setting out with negotiation leverage on your side. The best way to compare apples to apples in new car inventory is with a little-known metric: market day supply. Market Day Supply (MDS) refers to the number of days it would take to sell all current inventory at the current rate of sales, without any new supply being added. MDS isn’t perfect, but it’s one of the best tools we have for gauging supply and demand in the new car market.

With a mix of leftover 2023 models and newly arrived 2024s piling up on dealer lots, now is the perfect time to put your car buying toolkit to work to hunt down some deals.

We’ve used CarEdge Data to identify the new car brands with the most and least inventory in every region in America. Skip ahead to your region using the table of contents below.

These are the most and least negotiable new cars in Maine, Massachusetts, Connecticut, Rhode Island, New Hampshire, and Vermont in early 2024.

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| Dodge | 314 | 1754 |

| Chrysler | 260 | 838 |

| Ram | 258 | 4448 |

| Jeep | 249 | 12836 |

| Buick | 131 | 1036 |

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| Toyota | 48 | 13930 |

| Lexus | 48 | 1956 |

| BMW | 49 | 3000 |

| Honda | 57 | 8134 |

| Cadillac | 64 | 636 |

As is the trend in recent times, Stellantis brands dominate the list of most negotiable new cars in New England. Asian automakers like Toyota, Lexus, and Honda have the least inventory.

See local market inventory for specific models with CarEdge Data.

This region includes the states of New York, New Jersey, Pennsylvania, Delaware, Maryland, and Washington DC this month.

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| Dodge | 311 | 9182 |

| Chrysler | 218 | 3028 |

| Jeep | 198 | 35721 |

| Ram | 192 | 12880 |

| Mazda | 120 | 24950 |

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| BMW | 46 | 9378 |

| Honda | 48 | 24661 |

| Lexus | 49 | 8008 |

| Toyota | 50 | 36908 |

| Cadillac | 55 | 3254 |

Stellantis brands take the top spot yet again. These are the same brands we saw on this list over most of the past year. However, it is interesting to see Mazda inventory so high on the East Coast.

See local market inventory for specific models with CarEdge Data.

This region includes Virginia, North Carolina, South Carolina, Florida, Georgia, Tennessee, West Virginia, Kentucky, Alabama, Mississippi, Louisiana, and Arkansas in early 2024.

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| Dodge | 365 | 29398 |

| Ram | 211 | 33461 |

| Jeep | 184 | 37196 |

| Chrysler | 166 | 3694 |

| Buick | 125 | 11446 |

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| Toyota | 38 | 75528 |

| Honda | 43 | 33148 |

| Kia | 46 | 21222 |

| Lexus | 46 | 14694 |

| BMW | 53 | 13157 |

There’s a whole year of inventory for new Ram trucks in the Southeast right now. Toyota, Kia, Honda, and BMW are far less negotiable with slim supply.

See local market inventory for specific models with CarEdge Data.

This region includes Ohio, Indiana, Michigan, Illinois, Wisconsin, Iowa, Missouri, Minnesota, Kansas, Nebraska, South Dakota, and North Dakota right now.

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| Dodge | 354 | 13671 |

| Ram | 178 | 28066 |

| Jeep | 164 | 35543 |

| Chrysler | 142 | 4302 |

| Buick | 129 | 18753 |

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| Lexus | 38 | 4786 |

| Toyota | 41 | 30521 |

| Honda | 43 | 23579 |

| Cadillac | 53 | 4754 |

| BMW | 62 | 7074 |

As expected, Stellantis brands like Dodge, Ram, and Jeep have the highest inventory and therefore the most negotiability in the Midwest.

See local market inventory for specific models with CarEdge Data.

In the Southwest region, we’ve included the states of Texas, Oklahoma, New Mexico, Arizona, and Nevada in early 2024.

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| Dodge | 361 | 16824 |

| Chrysler | 229 | 2190 |

| Ram | 188 | 21176 |

| Jeep | 178 | 20976 |

| Nissan | 123 | 30298 |

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| Toyota | 39 | 28338 |

| Lexus | 47 | 7636 |

| Kia | 50 | 10604 |

| Cadillac | 50 | 4032 |

| Honda | 51 | 17611 |

This month, Nissan joins Stellantis brands in the ranks of most negotiable new cars based on inventory.

See local market inventory for specific models with CarEdge Data.

In this region, we have California, Oregon, Washington, Alaska, and Hawaii this month.

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| Dodge | 396 | 10698 |

| Ram | 265 | 13031 |

| Jeep | 220 | 17964 |

| Chrysler | 212 | 2496 |

| Nissan | 134 | 19606 |

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| Toyota | 39 | 41813 |

| Honda | 49 | 26063 |

| BMW | 50 | 11087 |

| Kia | 56 | 11823 |

| Cadillac | 58 | 2190 |

Looking for car deals on the west coast? Follow the inventory! Stellantis brands like Dodge, Ram, Jeep, and Chrysler are the most negotiable car brands in states like California and Oregon.

See local market inventory for specific models with CarEdge Data.

In the Mountain West region, we have Colorado, Utah, Wyoming, Montana, and Idaho in early 2024.

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| Dodge | 352 | 1682 |

| Chrysler | 210 | 369 |

| Jeep | 199 | 6543 |

| Ram | 180 | 6723 |

| Nissan | 151 | 4845 |

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| BMW | 40 | 987 |

| Toyota | 47 | 9400 |

| Honda | 57 | 3283 |

| Lexus | 57 | 1125 |

| GMC | 65 | 3221 |

Nissan joins Dodge, Ram, Jeep, and Chrysler on the list of most negotiable car brands in 2024. BMW, Toyota, Honda, and GMC have the least inventory in the Mountain West.

See local market inventory for specific models with CarEdge Data.

Did you notice a trend in the data? It’s abundantly clear that Stellantis brands (Chrysler, Dodge, Jeep, and Ram), are having a VERY tough time selling cars in 2024. Everywhere you look, Stellantis’ vehicles are sitting on the dealership lots for longer than any other cars today. Does that make them more negotiable? Yes, but not always. The dealer has to be reasonable and motivated to sell. By you arriving with this powerful market data in hand, you’re setting off on the right foot. Negotiation know-how is worth a lot in today’s car market!

👉 Try our 100% FREE car buying course: Deal School from CarEdge

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

It’s a new year, but car buyers are still facing some of the same challenges. In 2024, the dilemma of choosing between a new or used car is influenced by several factors, including depreciation rates, interest rates, price trends, and the lingering effects of the pandemic. Let’s break down what you need to know to make the best decision in 2024.

Key Takeaways:

The automotive landscape has seen dramatic shifts in trade-in and resale values over the past few years. In 2024, a trend that began last year is continuing: used car prices are declining in wholesale markets, impacting trade-in values significantly. The era of purchasing a new car and flipping it for profit is over. Instead, we’re returning to the traditional pattern where new cars lose a substantial portion of their value as soon as they leave the dealership.

This year, expect to see an uptick in subvented rates from captive lenders, as new car sales decelerate. Low APR offers are here to stay in 2024. Manufacturers are increasingly offering incentives to clear inventory, including surprising zero percent financing deals available in January. Despite stable interest rates, the high cost of loans remains a critical factor in the car market. Consequently, we anticipate a larger share of new car loans will be sourced through captive lenders like Hyundai Motor Finance, Ford Credit, and Toyota Financial Services.

Towards the end of 2023, data from Cox Automotive showed an uptick in 0% APR offers. We expect this trend to continue into 2024.

With the average used car loan rate now north of 13% APR, plenty of used car shoppers are checking out new car offerings to simply pay less interest.

Check out the best APR offers this month

Don’t pay dealer markups for any vehicle in 2024. No matter what the salesperson might tell you, we’re firmly in a buyer’s market. This isn’t 2022’s car market anymore.

After consecutive years of rising MSRPs, the tide is turning in 2024. Although prices for the latest models have increased for the 2024 model year, we don’t foresee this trend continuing once 2025 model pricing is announced.

Resistance to high prices is growing among consumers, evident in slowing sales and increasing inventory, particularly for expensive cars, SUVs, and trucks. This resistance is gradually influencing the used car market as well.

These 2023 models have the most remaining inventory, and high negotiability

Used-car wholesale prices have given up 53% of their pandemic gains. However, wholesale markets are largely off limits to the average car buyer. Unfortunately, this drop is less pronounced in retail prices. According to the Consumer Price Index, retail used car prices have given up just 36% of the pandemic price spike two years later. Retail used car prices are down 12.6% from the July 2022 highs.

Why are used car prices still high in 2024?

The auto market is still feeling the lasting effects of the pandemic-induced semiconductor chip shortage. Pandemic-related factory shutdowns resulted in 16 million vehicles never being produced. These missing vehicles contribute to a global shortage of used cars, expected to last until at least the late 2020s. Ray Shefska of CarEdge predicts a return to normalcy in the used car market might not occur until 2030.

In 2024, used car prices will continue their gradual decline, influenced by high interest rates deterring potential buyers. With new car loan rates exceeding 13% APR, a 20-year high, many buyers are turning away from used cars in favor of new vehicles with more attractive financing options. Indeed, new car deals make more sense for many buyers in 2024.

2024 presents a nuanced picture for car buyers. While new cars offer more favorable financing options and the appeal of owning a brand-new vehicle, they also come with the risk of rapid depreciation and of course, higher prices.

On the other hand, used cars, although more affordable, are still priced relatively high due to market shortages years ago. Ultimately, the decision depends on individual priorities, financial situations, and long-term plans for vehicle ownership.

Free Car Buying Help Is Here

Ready to outsmart the dealerships? We have FREE resources for new and used car buyers alike. Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

As we step into 2024, American drivers are noticing a larger auto insurance bill with their policy renewals. Based on an analysis of 97 million auto insurance quotes from Insurify, a clear picture emerges of the key trends in car insurance prices for this year. We’ll examine the factors driving up costs, and take a look at how consumers and the industry are adapting.

In 2023, auto insurance rates in the U.S. climbed 24% to an all-time record high. The spike in rates was driven by rising repair costs, natural disasters, and more frequent car accidents. This uptick in insurance costs led to record losses for insurers. The latest data suggests that car insurance premiums aren’t done climbing. Insurify projects that car insurance rates will increase by 7% in 2024. That’s almost double the typical annual rise.

The national average cost of a full-coverage policy now stands at $2,019 per year, amounting to 2.6% of the median household income. In comparison, state-minimum liability insurance averages at $1,154 annually.

In 2023, car insurance rates increased by 638% more than the average wage growth. Nearly 62% of Americans reported a rise in their car insurance rates, and about 22% experienced more than one increase in the same year.

To combat these hikes, many drivers opted to lower their coverage limits or increase their deductibles. Insurify’s data shows that most drivers took action to reduce their premiums, often accepting more risk in exchange for lower monthly premiums.

New York stands out with the highest car insurance costs in the country, averaging $3,374 annually for a full-coverage policy.

States with lower incomes are feeling the brunt of these insurance cost increases. Drivers in these states spend a larger portion of their earnings on car insurance, exacerbating the financial strain on households already facing economic challenges.

The past few years have been tough for the insurance industry. After suffering a $3.8 billion net underwriting loss in 2021, losses deepened to $26.9 billion in 2022. 2023’s numbers are still pending, but there were some signs of a recovery late in the year.

The rising costs of maintenance and repairs, increased severity of accidents, and pandemic-induced market fluctuations have all contributed to these losses. The Bureau of Labor Statistics reported an 8.46% increase year-over-year in auto repair costs as of November 2023.

Advanced vehicle technologies and electric vehicles bring new challenges, with repair costs for high-tech cars and EVs like Tesla being substantially higher. Insurance companies are increasingly forced to choose between writing a check for a $20,000 repair bill after a seemingly minor accident, or writing the car off altogether.

In light of the rising car insurance rates, here are some practical recommendations for car buyers looking to save money on their auto insurance in 2024:

By following these recommendations, car buyers can make more informed decisions and potentially save money on their auto insurance in 2024, despite the overall trend of rising rates.For more information on the latest auto insurance trends, check out Insurify’s latest update.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!