CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

As spring car buying season approaches, the new and used car markets are ripe for deal seekers. However, knowledge is certainly power in 2024. Attractive low APR offers have continued well beyond year-end sales, making new cars a potentially better deal than used ones. Additionally, the glut in new car inventory has tilted the scales, making new vehicles more negotiable. For those not keen on long-term commitments, leasing emerges as an appealing option, thanks to favorable terms spurred by the oversupply. If you’re wondering if spring 2024 is a good time to buy a car, here are three things you should know before stepping foot on a dealership lot.

If you’re on the fence about whether it makes sense to buy new or used in spring 2024, the tie-breaker may be today’s enticing new car APR offers. 2023’s year-end deals seem to have bled over into the new year, propelled by surging new car inventory, and hundreds of thousands of unsold 2023 models.

As of the latest promos, we counted no fewer than ten 0% financing offers. When you zoom out to include deals below 1.99% APR, that number grows to 21 active offers. But if you’re not paying attention, it’s easy to fall victim to today’s overall high interest rates.

Whether you intend to buy new or used, it’s important to factor in the cost of borrowing money when budgeting for your next vehicle. Despite the great incentives available today, as of the most recent data, the average new car loan rate is 9.95% APR. Used car loan rates are even higher, closing in on 14% APR.

Insurance rates have gone up, too. In 2023, car insurance premiums climbed 24%, the quickest spike in decades. In 2024, Insurify predicts that rates will climb an additional 7%. On the bright side, the US Energy Information Administration forecasts average gas prices to remain lower than in recent years. The EIA expects US gas prices to average $3.40/gallon in 2024.

All in all, it’s smart to prepare for the total cost of owning a vehicle BEFORE you buy. Take advantage of CarEdge’s free data for detailed cost of ownership rankings, with data on maintenance, depreciation, insurance, and more.

Simply put, there’s a worsening oversupply of new cars right now. As we race towards spring car buying season, there’s no sign of the new car glut easing. As of today, there’s an 89-day supply of new cars in America. Typically, that figure is closer to 60 days. Some brands, such as Nissan, Jeep, Ram, and Ford, have nearly twice the average inventory. Nissan can’t seem to sell cars right now. Stellantis has been in the same boat for well over a year.

👉 See the latest new car inventory numbers here.

Why does inventory matter to consumers? We say it all the time: when inventory surges, deals are sure to follow. Some cars, trucks, and SUVs are more negotiable than others. Here at CarEdge, we stay on top of the latest market trends. Why do we do it? To bring you insights on where the best deals are, of course. As of today, the following new and used car segments are most negotiable, considering supply, demand, and inventory data: Electric vehicles, trucks, vans, luxury crossovers and SUVs. This is a generalization based on the model-specific inventory and deal insights available through CarEdge Data.

👉 See the specific new car models with the highest and lowest inventory here.

Used car prices are falling, albeit more so at wholesale auctions than on dealer lots. In 2023, used prices fell 7%, and are now down 21% from all-time highs in December of 2021.

Our team of CarEdge Coaches reports that used car prices are certainly more negotiable today than they were in months past, but car dealers are stubbornly resisting the downward pressure in the market, and are too often leaving price tags as-is. Don’t let that stop you from mastering car buying negotiation skills.

👉 Try Deal School, our 100% FREE car buying course!

If you don’t expect to hold on to your next vehicle for more than five years, consider leasing to avoid the massive depreciation that comes along with buying any new car. Gone are the days of selling any used car for a profit. With the ongoing oversupply of new vehicles, it’s not just APR and cash offers that are abundant right now. Leasing deals are shockingly good this month.

When a dealer leases a car, they’re technically still making a sale. It’s just that the leased car is sold to a third party who then leases it. So in other words, automakers and dealers alike love leasing a car to you, and offer sweet deals in times of high new car supply. Here are a few of the best lease deals this month:

See all of this month’s lease deals

Wondering if leasing makes sense for you? Check out CarEdge Co-Founder Ray Shefska’s guide to leasing versus buying in 2024.

The spring of 2024 offers compelling reasons for consumers to consider new vehicles, thanks to attractive APR offers and an oversupply that enhances negotiation potential. However, buyers should tread carefully, considering high loan rates and insurance premiums. For those looking for flexibility, leasing provides a viable path to bypass the steep depreciation of new car purchases. Remember, you can always see this month’s best APR, cash, and lease deals here. We update our resources as soon as the latest offers are announced.

👉 Looking for help, or simply want to hand over the keys and take the hassle out of car buying completely? Learn more about buying your next vehicle with CarEdge.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

Drivers despise haggling with salespeople. From bait-and-switch pricing to misleading online prices, there’s a lot to dislike about the whole experience. It’s no surprise that just 26% of car buyers think that the car buying process is transparent. In the age of online shopping, wouldn’t it make sense to buy your next car online? Today, there’s a better way to find the perfect vehicle at the right price. Here’s how CarEdge is taking no-haggle car buying to the next level.

Price transparency is a real problem in car buying. We hear horror stories from car shoppers all the time. It’s about time that someone did something about it. Here at CarEdge, our team set out to find a lasting solution to car buying woes. The result was the launch of a new way to buy a car: pre-negotiated, no-haggle car pricing through a network of vetted car dealers.

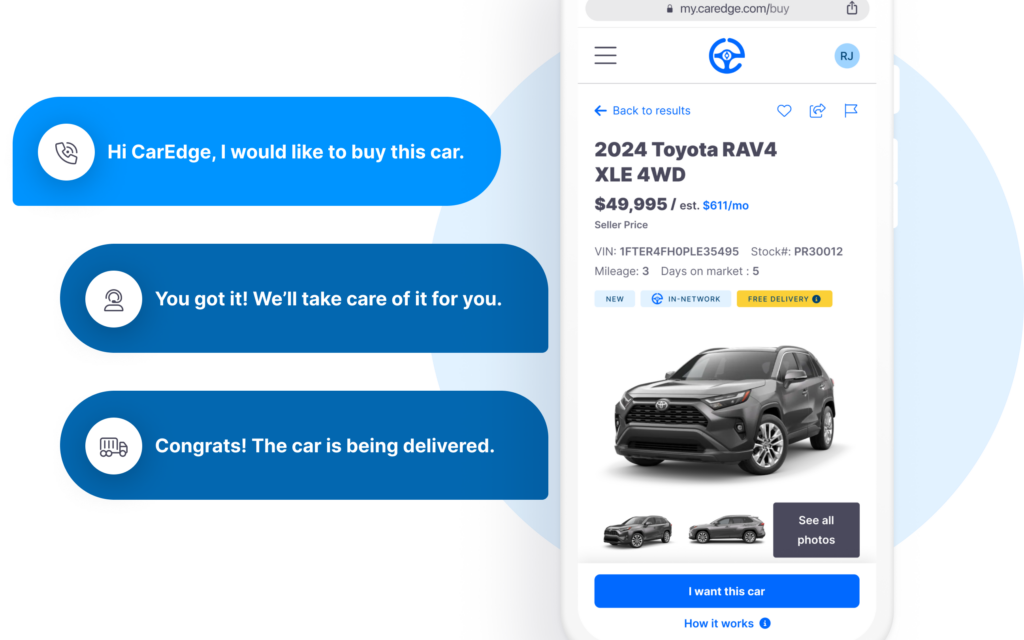

By choosing to only work with honest car dealers with stellar reputations, CarEdge is changing the way Americans buy cars. Imagine this: you browse for cars online, find the vehicle you want at a price you’re happy with, and then connect with your personal Concierge who will take it from there. Days later, your car is delivered to your driveway.

How does CarEdge work? Is there a catch? Next, we’ll lay out the entire process, from start to finish.

Buying a car through CarEdge involves a stress-free process that’s managed entirely from the comfort of your home. Here’s an overview of how it works:

👉 For more information, visit CarEdge’s How It Works page.

On average, drivers who buy with CarEdge save a few thousand dollars on their new car. In many cases, CarEdge is able to source the exact vehicle a customer wants (make, model, year, trim, and even color), for thousands of dollars less than you’ll find elsewhere. CarEdge even has below-invoice deals (that’s far below MSRP!).

We welcome you to browse hundreds of real, unfiltered CarEdge reviews at the CarEdge Community Forum. See how much you could save in time, money, and hassle!

Got questions or want more information about no-haggle car buying with CarEdge? Simply want to talk to our team of experts? We’re here to help! We’re real people here to save you real money. Feel free to reach out to us at [email protected] with any inquiries or for further assistance.

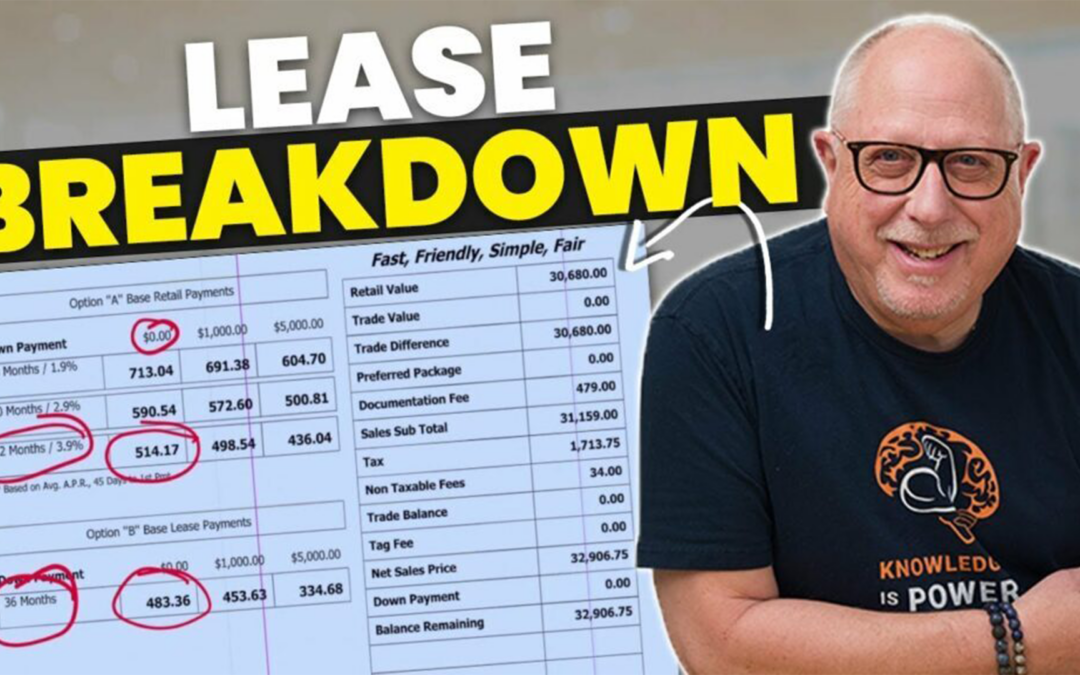

The decision between buying and leasing a car is a tricky one. In 2024, this choice is even more pertinent due to shifting market dynamics and attractive manufacturer incentives. Drawing insights from CarEdge Co-Founder Ray Shefska, we delve into the nuances of buying versus leasing to help you make an informed decision.

Leasing has traditionally been a popular option for drivers seeking lower monthly payments and the flexibility to change cars every few years. However, leasing fell out of favor during the pandemic era. In 2024, leasing is once again growing in popularity as drivers look to avoid the high interest rates that come with buying. There are also reasons why the dealers and car manufacturers themselves are fans of leasing.

Leasing keeps customers coming back to the dealership, more so than selling does. It’s also seen as a proven method of increasing brand loyalty. Ray highlights that many manufacturers are trying to increase the number of vehicles that are being leased due to the benefits it offers both dealerships and customers. Leasing ensures customers return at the end of their term, potentially increasing brand loyalty and dealership traffic.

Historically, leasing deals accounted for about 30% of all new car sales. However, this figure has recently dipped to around 17-18%. In response, manufacturers are rolling out aggressive leasing deals to climb out of the leasing slump. In early 2024, there’s an abundance of attractive lease offers for popular models.

First, let’s talk about whether buying or leasing makes sense for you.

Leasing in 2024 offers several advantages over buying:

👉 See the Best Lease Offers This Month

Purchasing a vehicle outright continues to be a viable option for those looking for long-term value and ownership. These are the main advantages of buying instead of leasing:

👉 If you’re looking for a complete, in-depth breakdown of leasing see the CarEdge Consumer’s Guide to Leasing in 2024.

The decision to buy or lease in 2024 hinges on personal preferences, driving habits, and financial considerations. Ray advises, “Customers should check the manufacturer website and see what kind of sales and lease offers are available in their area before heading to the dealership.” Additionally, it’s crucial to check insurance costs before falling head over heels for any new car.

👉 See this month’s best leasing and financing offers

In 2024, whether to buy or lease a car depends on your individual needs and lifestyle. With manufacturers pushing more attractive lease deals, leasing may become a more appealing option for many. Leasing is a great way to avoid the worst effects of today’s high interest rates.

However, the long-term benefits of ownership and the freedom that comes with buying a car remain compelling factors. By carefully weighing the pros and cons and staying informed about current offers, you can make a decision that best suits your circumstances and ensures your satisfaction in the ever-changing automotive landscape.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

In the realm of car buying, understanding market days supply can be a game-changer for finding great deals. Market days supply refers to the number of days it would take to sell all current inventory at the current sales pace without additional supply. A higher market day’s supply indicates more room for negotiation, often leading to better incentives for buyers. Currently, Nissan stands out with an overall market day supply of 135 days. That’s nearly double the ‘healthy’ inventory standard of between 45 to 80 days of supply on hand. The context of today’s market reveals a concerning trend for the brand, and a potential advantage for deal seekers.

Here’s a look at the latest Nissan inventory, and where you can find the best offers this month.

Nissan’s situation is dire for two reasons: the rapid growth of its inventory, and falling market share in the U.S.

Right now, Nissan’s inventory sits at 135 days of supply, with 185,875 cars unsold. In December 2023, Nissan’s days of supply were at 112, a significant jump from a “healthy” 71 days in September 2023. This near doubling of inventory in just four months raises questions about Nissan’s market position and sales strategy.

The decline in Nissan’s US market share further complicates the picture. From holding 11% of American new car sales in 2018, Nissan’s share plummeted to 6% in 2022. Despite a 23% increase in sales in 2023, with 898,796 vehicles sold, its market share dipped further to 5.8%. Nissan’s EV sales continue to struggle, too. In other words, Nissan is in trouble in the U.S. car market.

Here’s a look at Nissan’s real-time inventory in the U.S. market:

| Make | Model | Market Day Supply | Total For Sale |

|---|---|---|---|

| Nissan | Altima | 160 | 20871 |

| Nissan | Ariya | 166 | 5028 |

| Nissan | Armada | 248 | 5683 |

| Nissan | Frontier | 184 | 19824 |

| Nissan | Kicks | 165 | 18054 |

| Nissan | LEAF | 252 | 2594 |

| Nissan | Maxima | 114 | 842 |

| Nissan | Murano | 164 | 6936 |

| Nissan | Pathfinder | 119 | 16222 |

| Nissan | Rogue | 87 | 44908 |

| Nissan | Sentra | 186 | 30632 |

| Nissan | Titan | 255 | 5781 |

| Nissan | Versa Sedan | 105 | 6318 |

| Nissan | Z | 182 | 904 |

Let that sink in. Nissan only has one model with under 100 days of supply. Remember, a healthy inventory is between 45-80 days, depending on the time of the year. Three models exceed 200 days.

But how does Nissan compare to the competition? Are Honda, Toyota, and Mazda also in the same boat? Let’s take a look.

Nissan’s primary rivals include other Asian automotive giants renowned for blending reliability with affordability. Here’s how Nissan’s inventory levels compare to its key competitors:

Yet, Nissan’s inventory dilemma isn’t isolated within the global market. American brands also show varied levels of supply:

This comparison highlights Nissan’s unique position and suggests that for those looking to purchase a new car, Nissan dealerships might be more inclined to offer attractive deals to reduce their bloated inventories. For deal hunters, Nissan’s current predicament could be a silver lining, offering the chance to negotiate more favorable terms on a new vehicle. See detailed inventory numbers for your area with CarEdge Data.

👉 See the most negotiable new cars, trucks, and SUVs this month

With Nissan’s current oversupply, this month presents prime opportunities for buyers to snag great deals. From 0% APR on select models to substantial cash back offers, there’s a wide array of incentives available. Check out the highlighted deals for models like the 2024 Altima and the 2023 Rogue. For a more detailed look at local market data, utilize CarEdge Data‘s insights.

2024 Nissan Altima: 0% APR for 36 months

2024 Nissan Murano: 0% APR for 36 months

2023 Nissan Titan and Titan XD: 0% APR for 60 months

2023 Nissan Rogue: 1.9% APR for 60 months

Most other models qualify for APR offers under 3.0% APR

2024 and 2023 Nissan Titan: $3,590 total savings + $1,500 cash back

2023 Nissan Murano: $4,500 total savings

2023 Nissan Rogue: $2,000 cash back

2024 and 2023 Nissan Armada: $1,500 cash back

Several Nissan models qualify for $500 – $1,000 cash back. See the details at NissanUSA.com

2024 Nissan Sentra S: $269 for 36 months with $3,059 due

2024 Nissan Altima SV: $289 for 36 months with $3,389 due

2023 Nissan Ariya Engage FWD: $199 for 18 months with $4,399 due

2023 Nissan Rogue S AWD: $339 for 36 months with $3,739 due

2024 Nissan Pathfinder S 4WD: $409 for 36 months with $3,849 due

See all of Nissan’s offers this month at NissanUSA.com. Negotiate with confidence using CarEdge Data’s local market insights.

In conclusion, Nissan’s current oversupply and market position may seem like a challenge for the brand, but it spells good news for smart car buyers. With a high market day supply and a noticeable dip in U.S. market share, Nissan is more likely to offer attractive deals to move inventory.

This unique situation provides a rare opportunity for deal hunters to secure favorable terms on a new Nissan, from leasing to financing. By leveraging the current market dynamics and utilizing resources like CarEdge Data for local market insights, buyers can navigate this buyer-friendly market with confidence.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

When it comes to buying a car in 2024, there are three things to know to spend less, and avoid overpaying. To navigate this evolving market, we sought the expert advice of CarEdge Co-Founder Ray Shefska, who shared his top insights for those looking to purchase a new or used vehicle this year. Here are three crucial points to consider before making your decision.

The first key point is the potential for negotiation due to aging inventory. Remember this: the average new car sells for nearly $50,000 these days, but you DON’T have to spend that much. Lot inventory has risen substantially over recent months, especially with new cars. Use this to your advantage!

Auto industry veteran Ray Shefska emphasizes the importance of doing your research before talking to ANY salesperson. “With the cost of carrying on hand inventory higher than it has been in over a decade, how many days a vehicle has been in the dealer’s inventory is extremely important.” Ray is referring to sky-high floorplanning costs. High interest rates don’t just hit buyers; car dealers are impacted too.

Ray advises asking the salesperson or Sales Manager about the oldest vehicles in terms of inventory days, especially those that match your preferences in trim and color. Better yet, use tools like CarEdge Data to find particularly negotiable new or used car inventory in your area.

👉 See this month’s most and least negotiable new cars

As Shefska points out, aging inventory is perfectly ripe for negotiating a sweet deal. “The longer any vehicle sits, the greater the carrying costs are, and the greater the impact is on the profitability of the vehicle sale.” This situation presents a unique opportunity for buyers to put car buying skills to work, saving thousands of dollars along the way.

👉 Try CarEdge’s Deal School (100% FREE) to master the art of negotiating!

The second critical thing to know before buying any car in 2024 is your credit situation. Knowing your credit score is always a good thing, but with auto loan rates averaging north of 10% APR, it matters now more than ever before.

It’s painful to say, but the average new car APR is now 9.95%. Used car prices may be lower, but be prepared to pay more in loan interest. Today, the average used car rate is almost 14% APR. Ray stresses the importance of getting pre-approved and knowing your budget limits. “If you’re open to APR offers below 5%, the opportunities are nearly endless as automakers increase incentives to sell excess inventory,” he adds, highlighting the importance of shopping around.

Remember, before committing to a car purchase, it’s crucial to know where your credit score stands and what monthly payment you can comfortably afford.

There are plenty of free car payment calculators available online, such as this calculator from NerdWallet. Be sure to enter an APR that you’re likely to qualify for! Not sure? Perhaps a good first step would be to speak with your local credit union.

Wouldn’t it be nice if loan payments were all you had to plan for? Your monthly car bill is just the beginning. There’s also gas money, the possibility of repairs or routine maintenance, and of course car insurance. And that’s aside from worsening depreciation in 2024.

A recent analysis by Insurify shows that auto insurance premiums increased by 24% in 2023 and are likely to climb an additional 7% in 2024. This makes it essential to get an insurance quote before finalizing your vehicle purchase. As Ray warns, “Many people are shocked when they find out how much their insurance premium will increase because of the vehicle that they just purchased.” Understanding this expense is crucial for maintaining a manageable monthly budget. Learn more about auto insurance rates in 2024.

These insights offer a clear roadmap for new and used car buyers in 2024. By focusing on these key areas – negotiating on aging inventory, understanding your financial capacity, and considering rising ownership costs like insurance and maintenance – you can make a well-informed and financially sound decision when purchasing your next vehicle. Remember, preparation and knowledge are your best tools in the current automotive market.

👉 We track the best deals every month. See this month’s best new car deals here.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!