CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

It’s true that SUVs have taken over the car market in recent years, but not all are hot sellers. In fact, the gap between the fastest and slowest-selling models is growing. In 2025, some SUVs and crossovers are being scooped up as soon as they hit the lot, while others are sitting unsold for more than six months. Whether you’re a buyer looking for a great deal or a seller trying to time the market, understanding which SUVs are moving (or not) is essential.

We analyzed August car market data to find the SUVs with the lowest and highest market day supply (MDS). MDS is a measure of how many days it would take to sell through current inventory at the current sales pace. Here are the winners and losers in 2025’s SUV market.

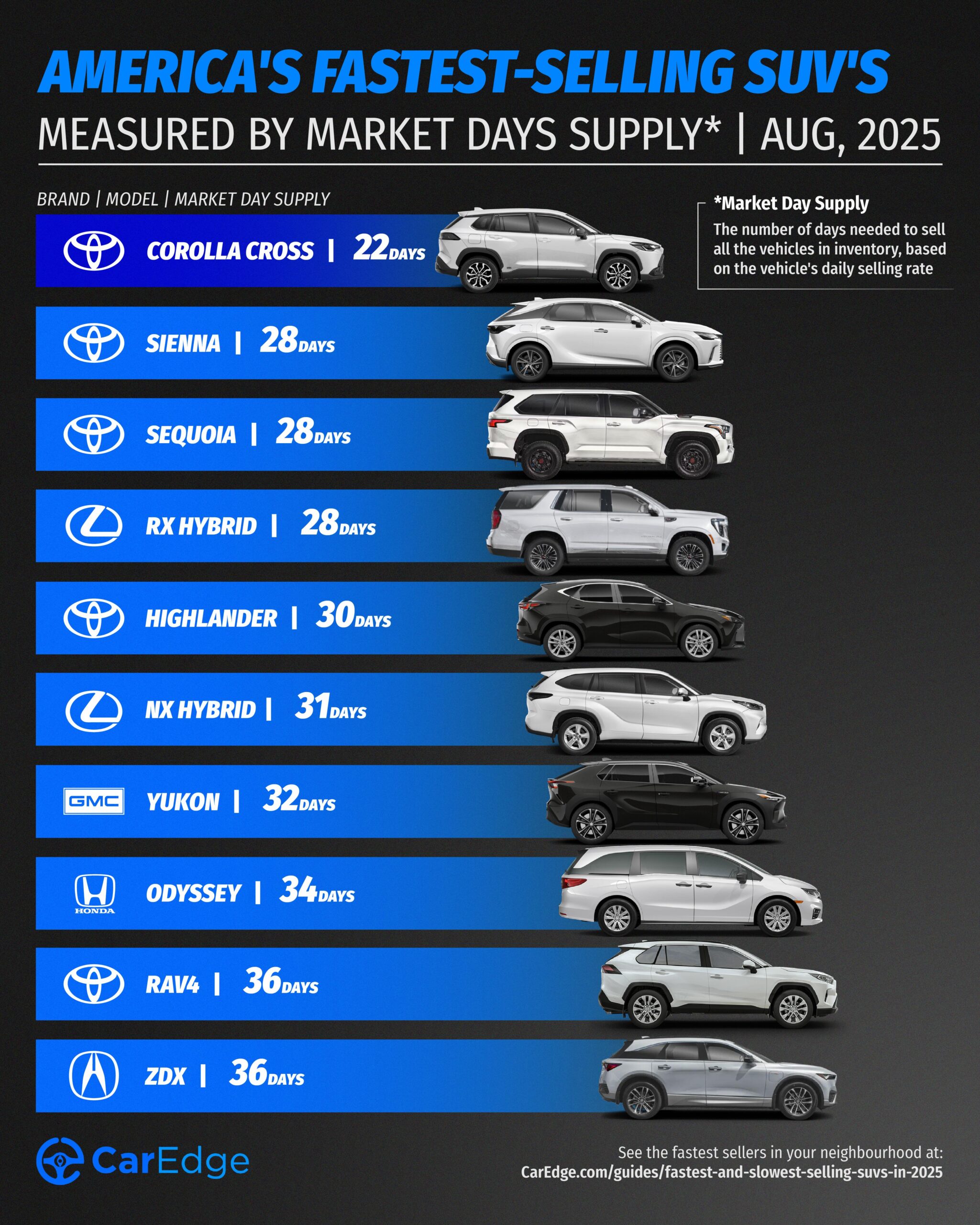

These are the SUVs and crossovers with the lowest market day supply as of August 2025. That means they’re in high demand right now, and are likely harder to negotiate on due to limited availability.

| Make | Model | Market Day Supply | Total For Sale | Total Sold (45 days) | Average Selling Price |

|---|---|---|---|---|---|

| Toyota | Corolla Cross | 22 | 9,443 | 18,965 | $31,181 |

| Toyota | Sienna | 28 | 9,572 | 15,344 | $51,591 |

| Toyota | Sequoia | 28 | 3,348 | 5,325 | $83,490 |

| Lexus | RX Hybrid | 28 | 2,511 | 4,085 | $63,083 |

| Toyota | Highlander | 30 | 5,470 | 8,172 | $52,052 |

| Lexus | NX Hybrid | 31 | 2,750 | 3,962 | $54,654 |

| GMC | Yukon | 32 | 4,373 | 6,126 | $87,674 |

| Honda | Odyssey | 34 | 5,654 | 7,574 | $46,334 |

| Toyota | RAV4 | 36 | 56,325 | 69,950 | $37,540 |

| Acura | ZDX | 36 | 1,217 | 1,501 | $68,906 |

Source: CarEdge Pro

Toyota’s reputation for reliability, fuel efficiency, and value continues to drive strong demand for Toyota SUVs like the Corolla Cross, Sienna, and Sequoia. Seven of the 10 fastest-selling SUVs in 2025 are Toyota or Lexus models. Lexus joins the mix with the RX and NX Hybrids, two compact options that luxury buyers love. GMC’s Yukon is the only ‘Detroit Big Three’ SUV on the list this month.

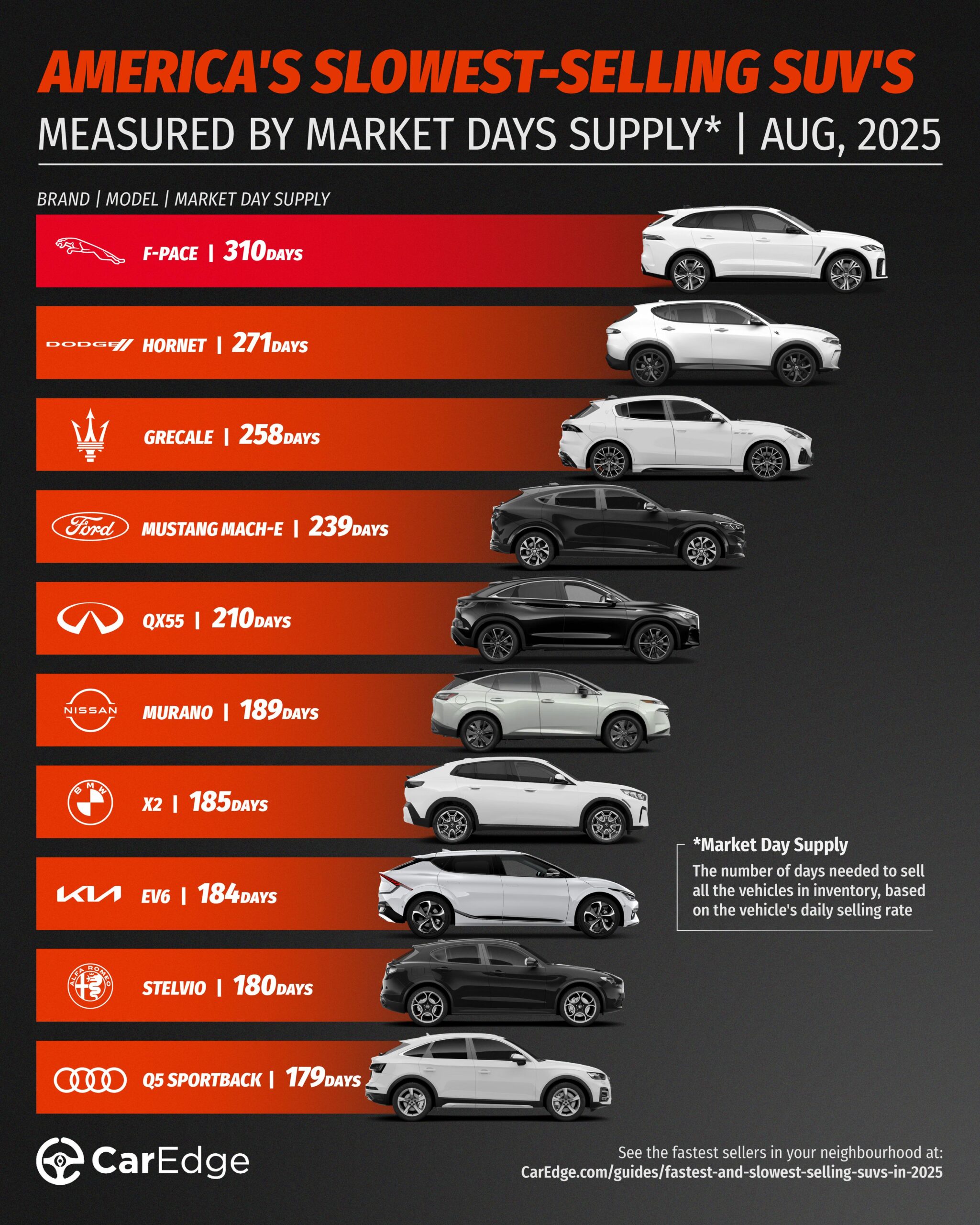

These SUVs have the highest market day supply, which means they’re sitting unsold for longer. Buyers may be able to score better deals on these slowest-selling SUVs in August, especially with this new AI negotiator doing the work for you.

| Make | Model | Market Day Supply | Total For Sale | Total Sold (45 days) | Average Selling Price |

|---|---|---|---|---|---|

| Jaguar | F-PACE | 310 | 2,751 | 399 | $69,742 |

| Dodge | Hornet | 271 | 2,911 | 484 | $36,536 |

| Maserati | Grecale | 258 | 631 | 110 | $79,872 |

| Ford | Mustang Mach-E | 239 | 22,597 | 4,247 | $48,656 |

| Infiniti | QX55 | 210 | 936 | 201 | $53,990 |

| Nissan | Murano | 189 | 20,164 | 4,797 | $47,020 |

| BMW | X2 | 185 | 1,238 | 301 | $52,596 |

| Kia | EV6 | 184 | 4,613 | 1,128 | $50,536 |

| Alfa Romeo | Stelvio | 180 | 842 | 210 | $56,239 |

| Audi | Q5 | 179 | 7,566 | 1,898 | $56,305 |

Source: CarEdge Pro

Many of these models fall into EV or luxury segments where buyer demand is softer in 2025. Jaguar’s F-PACE is the slowest-selling SUV today. Surprisingly, just three Stellantis models are in the bottom 10. The Ford Mustang Mach-E stands out as an electric SUV with sluggish sales despite aggressive incentives. There’s a lot more competition in the electric crossover segment, and Ford is struggling to keep up with hot sellers from GM, Hyundai, and Tesla.

For any of these slow-selling SUVs, prices will be more flexible if you come equipped with negotiation know-how.

If you’re looking for a deal, start with the slowest sellers this month. High inventory levels mean dealers are likely motivated to talk pricing if you negotiate with confidence. It’s always best to take a look at the best incentives of the month, too.

“If you’re shopping for a slow-selling SUV, the ball is in your court,” says auto industry veteran Ray Shefska. “Dealers know those vehicles aren’t moving, and that gives you the upper hand in price negotiations.”

Shopping Toyota, Honda, or Lexus? Expect tighter inventory and less room for negotiation. You may need to move quickly if you find the right trim. However, this is no reason to pay for unwanted add-ons or dealer markups!

Thinking about EVs? There are some good deals out there, but know what you’re getting into. EVs like the Mustang Mach-E might feature great incentives, but they also depreciate quickly. Unless you know you’ll be keeping your EV for several years, leasing is the smarter choice.

With CarEdge Concierge, our experts do the legwork for you, from researching inventory to negotiating with dealers. Already know what you want? Use our AI Negotiation Expert service and have CarEdge AI negotiate with car dealers anonymously!

Explore more free tools and resources with car buying guides, cost of ownership comparisons, and downloadable cheat sheets. There’s no reason to shop unprepared in 2025!

CarEdge is a trusted resource for car buyers, offering data-backed insights, negotiation tools, and expert guidance to help consumers save time and money. Since 2019, CarEdge has helped hundreds of thousands of drivers navigate the car-buying process with confidence. Learn how to buy a car the easy way at CarEdge.com.

Not all trucks fly off the lot. In fact, the gap between the fastest and slowest-selling pickups is wider than ever in 2025. With some trucks selling in just over a month, and others sitting unsold for over six months, knowing what’s hot (and what’s not) can make or break your next deal.

That’s why understanding Market Day Supply (MDS) is more important than ever for anyone buying or selling a truck in 2025. At CarEdge, we used real-time inventory and sales data to identify the fastest- and slowest-selling trucks in August 2025.

MDS tells us how long it would take to sell all the current inventory of a particular model at the current sales pace, assuming no new units are added. A low MDS means a truck is selling quickly. A high MDS, on the other hand, signals oversupply, and that can mean buyers have more leverage at the dealership.

Whether you’re buying new or considering a trade-in, here’s what the latest market data from CarEdge Pro reveals about the best-selling and worst-selling trucks in America.

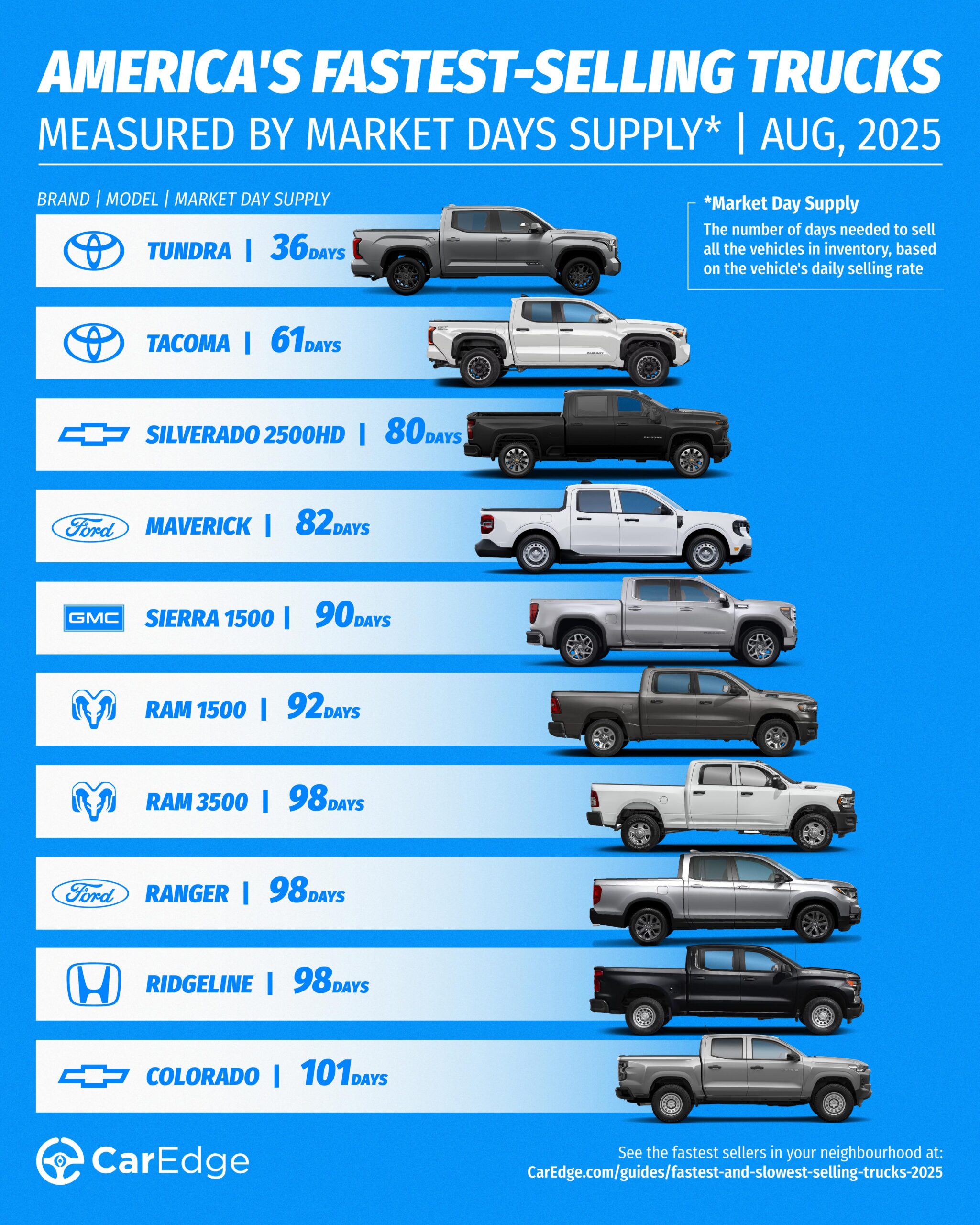

These trucks are in high demand and selling quickly. But if you’re hoping to negotiate a deal on one of these, don’t count on much wiggle room unless you work with a pro.

| Make | Model | Market Day Supply | Total For Sale | Total Sold (45-days) | Average Selling Price |

|---|---|---|---|---|---|

| Toyota | Tundra | 36 | 22,749 | 28,471 | $62,618 |

| Toyota | Tacoma | 61 | 65,840 | 48,478 | $46,065 |

| Chevrolet | Silverado 2500HD | 80 | 25,290 | 14,257 | $65,316 |

| Ford | Maverick | 82 | 26,332 | 14,392 | $32,780 |

| GMC | Sierra 1500 | 90 | 46,018 | 23,053 | $61,040 |

| Ram | Ram 1500 | 92 | 37,951 | 18,505 | $58,746 |

| Ram | Ram 3500 | 98 | 9,059 | 4,170 | $53,961 |

| Ford | Ranger | 98 | 14,265 | 6,543 | $43,902 |

| Honda | Ridgeline | 98 | 10,542 | 4,830 | $44,941 |

| Chevrolet | Colorado | 101 | 24,931 | 11,062 | $42,768 |

Source: CarEdge Pro

The Toyota Tundra is the fastest-selling pickup truck in August 2025. On average, the Tundra sits on the lot for just one month before finding a buyer. Toyota’s Tacoma is in second place, with trucks from GM, Ford, and Ram far behind.

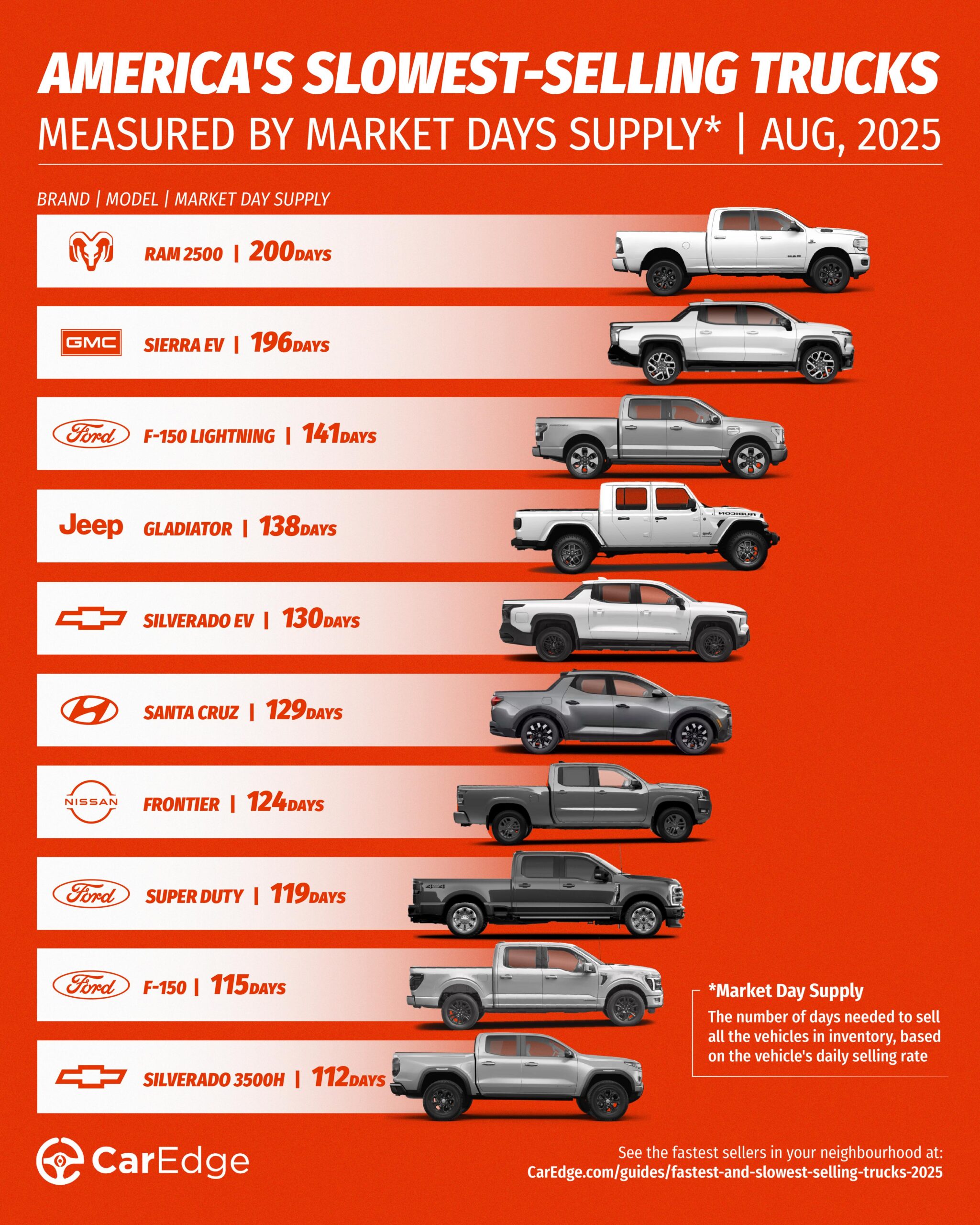

On the flip side, these trucks are struggling to move. Some of these trucks are taking more than six months to sell on average. If you’re in the market, these pickup trucks offer room for negotiation, especially with DIY market insights.

| Make | Model | Market Day Supply | Total For Sale | Total Sold (45 days) | Average Selling Price |

|---|---|---|---|---|---|

| Ram | Ram 2500 | 200 | 31,729 | 7,149 | $63,370 |

| GMC | Sierra EV | 196 | 3,707 | 853 | $92,215 |

| Ford | F-150 Lightning | 141 | 9,096 | 2,900 | $68,721 |

| Jeep | Gladiator | 138 | 17,419 | 5,672 | $47,500 |

| Chevrolet | Silverado EV | 130 | 3,661 | 1,263 | $92,215 |

| Hyundai | Santa Cruz | 129 | 9,279 | 3,231 | $35,724 |

| Nissan | Frontier | 124 | 18,228 | 6,629 | $39,132 |

| Ford | SuperDuty | 119 | 39,493 | 14,944 | $71,782 |

| Ford | F-150 | 115 | 116,720 | 45,571 | $59,354 |

| Chevrolet | Silverado 3500HD | 112 | 9,917 | 3,990 | $69,644 |

Source: CarEdge Pro

The Ram 2500 is the slowest-selling truck in America right now. However, electric pickup trucks are in second and third place as buyers struggle to make the switch to EVs. Sellers can expect these slow-selling trucks to sit on the lot for at least four months, but this creates great chances to negotiate savings for buyers.

As the truck market ebbs and flows, it’s easy to become overwhelmed. Luckily, there are new tools and services available that take the hassle out of buying a truck entirely. Here’s how CarEdge can help.

👉 Negotiate anonymously with CarEdge AI (NEW!)

👉 Have a pro negotiate your deal with CarEdge’s Car Buying Service

Buying a used car can be a smart financial decision — if you ask the right questions. Pre-owned vehicles come with unique risks, from hidden damage to unclear pricing. That’s why it’s crucial to go into the process prepared and confident.

Use this guide to make sure the dealership (or private seller) is giving you the full picture. If they dodge any of these questions, consider it a red flag.

Used car prices often vary by dealership, but the OTD price reveals the real cost, including taxes, fees, and dealer-installed accessories.

👉 Use our free Out-the-Door Price Calculator to compare offers.

The longer a used car sits, the more room there is to negotiate. A vehicle that’s been on the lot for 45–60+ days may come with bigger discounts.

📊 Use CarEdge Pro to check days on lot, supply, and local market pricing.

A Carfax or AutoCheck report should be free and readily available. It reveals accidents, maintenance, and ownership history.

🚨 No history report = red flag. Walk away if they won’t provide one.

It’s important to note that if you’re buying a used car from a private seller, you may need to purchase your own vehicle history report. All you’ll need is the car’s VIN.

A Pre-Purchase Inspection (PPI) can uncover hidden mechanical issues that a dealer won’t mention. This step alone can save you thousands.

Pro tip: Always choose an independent mechanic who’s not affiliated with the seller.

Used cars can vary greatly, even within the same make, model, and year. A test drive helps you catch mechanical concerns and ensure comfort. Drive on a variety of road surfaces at low and high speeds.

Take note: A test drive doesn’t replace the need for a pre-purchase inspection by an independent mechanic.

Used cars may still have factory warranty remaining or include a dealer-backed warranty. Ask for details, and if they’re selling you an extended warranty:

Compare to CarEdge Extended Warranty plans for full transparency. No markups, just clear coverage.

Buying from a private seller can sometimes get you a better deal. However, it comes with more risk and fewer protections than buying from a dealership. That’s why it’s critical to ask the right questions up front.

Here are some additional questions you should ask a private party seller before agreeing to buy a car:

💡 Pro Tip: Bring a printed bill of sale template and ensure both parties sign it. Also, double-check your local DMV requirements for title transfers and taxes before finalizing anything. See some examples here, but always ensure that all required fields are on your form.

Buying used doesn’t mean buying blind. Let CarEdge’s car buying service do the legwork:

✅ We find the best pre-owned vehicles

✅ We negotiate pricing and review contracts

✅ We coordinate inspections, delivery, and paperwork

Learn more about how CarEdge can help.

CarEdge is your trusted partner for smarter used car shopping. We provide expert tools, unbiased insights, and negotiation support — so you never overpay. Start your car search at CarEdge.com and take control of your next purchase.

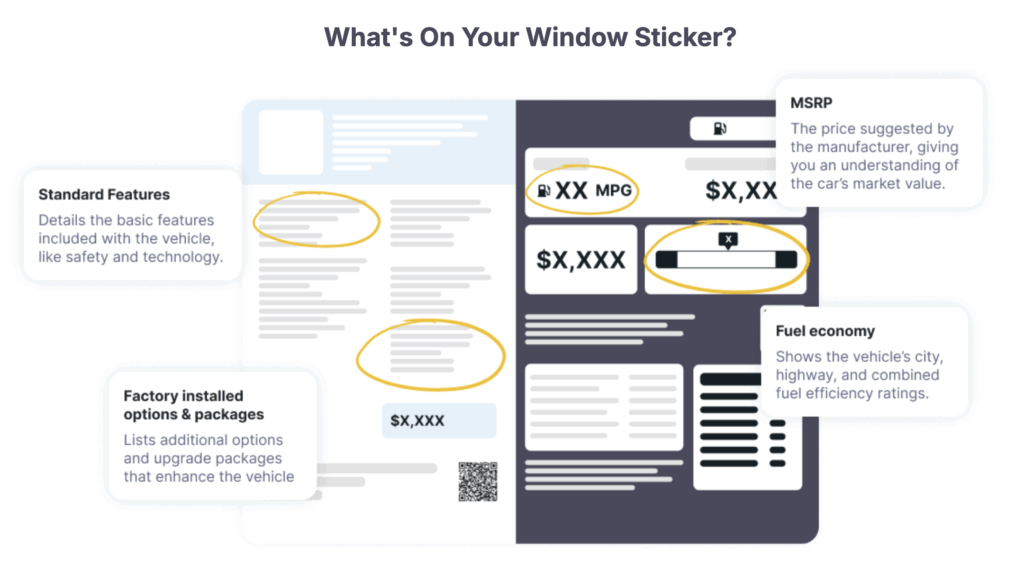

Understanding what’s on a new car’s window can save you from overpaying or falling for dealer tricks. If you’ve ever heard the terms Monroney sticker or window sticker and felt confused — you’re not alone. These labels are crucial for transparency when buying a car, and every buyer should know what to look for.

In this guide, we’ll break down what a Monroney sticker is, why it exists, and how to read it. You’ll leave feeling more confident and equipped to understand what a car really includes — no matter what a salesperson might tell you.

Before car buyers had access to standardized pricing, buying a car was like walking into the Wild West. Salespeople could pick and choose what to tell you — and what to charge.

That all changed with the creation of the Monroney sticker, a federally mandated label that must be displayed on every new car for sale in the U.S. You’ll also hear it referred to as the window sticker — they’re the same thing.

This label lists everything a shopper needs to know about the car’s equipment, price, and origin. It was designed to protect buyers and level the playing field.

Only 9% of Americans say car salespeople have high ethical standards — the lowest of any profession according to Gallup. That’s why federal law stepped in.

Here’s what’s included on every Monroney sticker:

Check out an example of where you’ll find this important information:

📌 Important: Dealer-installed accessories (like pinstripes, floor mats, or nitrogen tires) are not listed on the Monroney sticker. They appear on a separate dealer addendum sticker, which is not federally regulated.

The name comes from Senator Almer “Mike” Monroney, who sponsored the Automobile Information Disclosure Act of 1958. Signed into law by President Dwight Eisenhower, the act required automakers to include standardized labels on all new cars.

Before this law, car buyers had no way to verify what was included in a vehicle or whether the price was fair.

Monroney was a leader in consumer protection and also played a role in creating the Federal Aviation Administration (FAA). His legacy lives on every time you look at a new car’s window sticker.

Want to learn more about the law? Visit the Consumer protection Branch at the U.S. Department of Justice.

Let’s recap what you’ll find on a new car’s Monroney (window) sticker. This information is required by law and cannot be altered or removed by dealers:

💡 Tip: If you don’t see this sticker on a new car, ask why — and consider walking away.

So you’re standing on a dealership lot — where should your eyes go first?

The Edmunds guide to reading a window sticker is an excellent visual breakdown. You can view it here, but here’s a quick summary:

In today’s car market, dealer markups and confusing add-ons are everywhere. But the Monroney sticker keeps it real — it’s the one label they can’t legally change.

When you’re comparing similar vehicles across different dealerships, the window sticker helps you:

Whether you’re shopping used or just want to do your research from home, you no longer have to visit the lot to see the original window sticker. CarEdge now offers access to digital Monroney stickers on most vehicles — giving you instant insight into the car’s features, options, and MSRP breakdown.

✅ Great for used cars that originally included premium options

✅ Helps compare trim levels and original pricing

✅ Saves time and reveals red flags before you visit the dealership

View the original window sticker — and shop smarter from the start.

Q: Is a Monroney sticker required by law?

A: Yes. Every new car for sale in the U.S. must display a Monroney sticker — it’s federal law.

Q: Are Monroney and window stickers the same thing?

A: Yes. These two terms refer to the same federally required label.

Q: Can dealers alter or remove the Monroney sticker?

A: No. It’s illegal for dealers to modify or remove the sticker prior to sale.

Q: Does the window sticker include dealer add-ons?

A: No. Only manufacturer-installed options are listed. Dealer-installed accessories appear on a separate sticker.

Q: Do used cars have a Monroney sticker?

A: No. The law only applies to brand-new vehicles. However, used vehicles may have copies of the original sticker or digital replicas provided by the dealer.

Founded by industry veterans, CarEdge is your trusted resource for transparent car buying. From understanding pricing to negotiating deals and avoiding scams, we provide data-backed insights, expert tools, and concierge services to help you buy with confidence.Want help with your next car purchase? Let us find and negotiate the best deal for you! Explore CarEdge’s car buying help today.

Buying a car doesn’t have to mean spending weekends at dealerships or stressing over sales tactics. If you’re looking for a hassle-free, professional way to purchase your next vehicle, car buying services, also known as car concierges, might be exactly what you need.

These services take care of the entire car buying process for you, from sourcing vehicles to negotiating prices and coordinating delivery. In this guide, we’ll explain exactly how car buying services work, what they offer, and why so many drivers choose to use one.

A car buying service, also known as a car concierge, is a professional service that simplifies the car buying process by doing the work for you. Whether you’re buying new or used, a concierge can help you find your ideal vehicle, negotiate the best price, and manage the paperwork and delivery.

Think of it as a personal assistant for buying a car — one that knows the auto industry inside and out and advocates for your best deal.

“If your car buying service seems too complicated, they’re doing something wrong. The best in the business are easy to understand and navigate.”

— CarEdge Team

Car buying services provide an all-in-one solution for shoppers who want to save time, money, and stress. Here’s what a top-tier car buying concierge will offer:

A concierge begins by learning your exact preferences — make, model, trim, color, features, budget, and timeline.

This is where the concierge adds serious value.

Already own a vehicle? No problem.

Once the deal is done, the concierge arranges delivery and ensures everything’s finalized.

Curious how it all comes together? Here’s what the car concierge process typically looks like:

Your journey begins with a quick consultation — by phone, email, or chat. You’ll share your goals, budget, preferences, and trade-in situation. Most services charge a flat fee between $1,000 and $3,000, sometimes with additional delivery charges.

The concierge searches the market and presents you with a handpicked list of vehicles that match your criteria.

Once you pick your top choice, the concierge gets to work negotiating.

With the deal locked in, your concierge arranges delivery or pickup, manages the paperwork, and ensures a smooth, painless handoff.

Wondering if a car buying service is worth it? Here are some of the top reasons drivers turn to a concierge:

Skip the dealership entirely. You don’t have to browse endless listings, haggle with salespeople, or worry about paperwork. Your concierge handles everything.

Concierges negotiate every day and know what’s fair — and what’s not. Many customers end up saving more than the cost of the service.

Buying a car can be overwhelming. A concierge makes it easy, clear, and confidence-inspiring. No pressure, no games.

Car concierges are perfect for:

When it comes to car buying services, not all concierges are created equal. CarEdge Concierge stands out with industry expertise, real-time market tools, and a track record of saving customers thousands.

With CarEdge, you’re not just hiring a service — you’re gaining a trusted advocate in your corner. Try CarEdge Concierge and make your next car purchase the easiest one yet.

Q: What is a car buying concierge?

A: A car buying concierge is a professional who helps you purchase a vehicle by handling the search, negotiation, trade-in, paperwork, and delivery — all on your behalf.

Q: How much does a car buying service cost?

A: Most services range from $1,000 to $3,000, plus delivery fees if the vehicle is shipped.

Q: Can a concierge help with used cars too?

A: Absolutely. Many customers use car buying services to find and negotiate for high-quality used vehicles.

Q: Do I still get to choose the car?

A: Yes! The concierge provides a shortlist of options, and you approve every step of the process.

Q: Is using a car buying service worth it?

A: If you value convenience, transparency, and expert-level negotiation, the answer is yes — especially when you consider the time and money you could save.

CarEdge is a trusted resource for car buyers, offering data-backed insights, negotiation tools, and expert guidance to help consumers save time and money. Since 2019, CarEdge has helped hundreds of thousands of drivers navigate the car-buying process with confidence. Learn more at CarEdge.com.