CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Car buyers, take note: Year-end sales are still months away, but that doesn’t mean you can’t score a good deal right now. We found 10 of the best cash discounts that expire at the end of the month. Some deals slash more than a quarter off MSRP.

Below, we’ve rounded up the 10 biggest cash discounts right now. All MSRPs include destination fees, and incentives may vary slightly by region. Every one of these deals expires on September 30, 2025, so act fast.

The Hornet hasn’t been the sales hit Dodge expected, but that’s translating into one of the deepest discounts in recent memory for a compact SUV. You can drive home the plug-in hybrid version of the Hornet with 27% off MSRP right now.

See offer details, or view Hornet listings near you.

Hyundai is sweetening the deal on the redesigned Kona Electric. Importantly, this $7,500 incentive is a manufacturer cash offer, not the federal EV tax credit. The Kona Electric doesn’t qualify for federal incentives, which expire at the end of this month.

See offer details, or view Kona Electric listings near you.

Genesis is cutting prices on its GV60 luxury EV as sales remain slow. Buyers can also choose an alternative 0% financing option. The GV60 is not eligible for federal EV incentives, but state incentives may apply.

See offer details, or view GV60 listings near you.

Luxury three-row SUVs rarely see this kind of discount, but considering parent company Nissan’s slowing sales and vanishing market share, perhaps it’s not such a surprise. September brings a hefty $8,000 off the Infiniti QX60.

See offer details, or view QX60 listings near you.

Ram’s pricing pressure continues. With 15% off MSRP, Big Horn models are suddenly priced far more competitively in the full-size truck segment. Don’t expect deals like this on the F-150 or Silverado.

See offer details, or view Ram truck listings near you.

The Sierra 1500 Elevation trim is carrying big incentives this September. Zero-percent financing aside, this is about as good as it gets for Sierra 1500 deals.

See offer details, or view GMC Sierra listings near you.

Plug-in hybrids like the Jeep Grand Cherokee 4xe are heavily incentivized right now, with nearly $8,000 in cash savings. Why is Jeep’s 4xe series the subject of clearance pricing? Reliability concerns give shoppers pause. See Grand Cherokee total cost of ownership data here.

See offer details, or view Jeep listings near you.

The Encore GX is Buick’s affordable small crossover, and $3,000 off makes this entry-level SUV a great deal. These days, it’s easy to forget that Buick was once known as a luxury brand.

See offer details, or view Buick listings near you.

Nissan is offering a $3,500 cash discount on the Frontier as the automaker struggles to improve U.S. sales numbers. As Toyota, Honda, Hyundai, and Kia have gained fans, Nissan has lost a lot of ground. Car buyers can use that to your advantage.

See offer details, or view Nissan listings near you.

2025 Jeep Gladiator Rubicon 4×4 – 10% Off MSRP

Grab your rubber ducks! Jeep is out to conquer the off-road world with $5,500 off MSRP for the 2025 Gladiator Rubicon. With competition from the Ford Bronco and Toyota Land Cruiser, Jeep is fighting for market share like never before.

See offer details, or view Jeep listings near you.

September’s cash deals won’t last forever, but luckily year-end sales are just around the corner. If you’re not a fan for any of these offers, chances are you won’t have to wait long to find something you like.

As CarEdge’s Ray Shefska puts it:

“If you don’t see the deal you’re looking for this month, don’t worry — chances are you’ll find it during December’s year-end sales push. Automakers and dealers always get aggressive to clear out inventory before the calendar flips. But if you’re shopping for an EV, now is the time to buy. Federal tax credits expire at the end of September, and waiting could mean leaving thousands on the table.”

Want to know where the real car deals are? Use CarEdge Pro to see behind the scenes of your local market and CarEdge Concierge if you’d like a professional to negotiate your deal for you.

Whether you’re considering a lease for your next car or currently have a car on lease, you’re probably aware that a lease gives you no ownership. However, many dealerships processing end-of-lease returns neglect to mention an important detail. In some cases, when a lease is returned, the car has equity on it worth hundreds or even thousands. It’s called auto lease equity, and it’s money that should go in your pocket.

When you lease a car, you don’t get to drive it as much as you want. Rather, the lease is made out for a specific mileage level. Depending on the model and contract, you could be allowed anything from 30,000 miles to 60,000 miles in the three years that you keep the car. If you go over your mileage limit, you will be charged for overages when it’s time to return the car at the end of the 36-month lease period. This can be an expensive miscalculation on your part, so be careful to not exceed your mileage limit, unless you’re prepared to pay up at the end.

Should the opposite happen – if you manage to drive less than you’re allowed – you’ll have ended up paying more for the car than you’ve actually used. It’s this difference that makes up the equity that you have in your car. When the dealership sells the car on the used market, they are likely to get more than they originally hoped for, as they expected the car to have more mileage. They should give you a share of this windfall. Depending on the model and how many miles you’ve managed to save, you could have equity worth a substantial sum of money in the car.

If you’re wondering whether you have auto lease equity, the process is simple.

See, we told you it would be simple. It’s worth checking if you have lease equity, especially if you’re not too happy with your current ride.

Most dealerships don’t pay cash for the lease equity that your car brings them. Rather, they offer to give you credit that you can put towards your next lease, buying a new car, or even if you decide to buy the leased car outright. That’s always an option. Unfortunately, dealerships are often less than upfront about lease equity, and often fail to bring up the subject in the hope that their customers won’t know enough to ask.

See all of your lease-end options

Before you hand in the key at the end of your lease, it’s important that you look at the odometer and determine how many miles you’ve saved. If you’re under your lease mileage allowance, you should bring it up when it comes time to give back the car. Doing so could save you a lot of money in the form of a hefty discount on your next car.

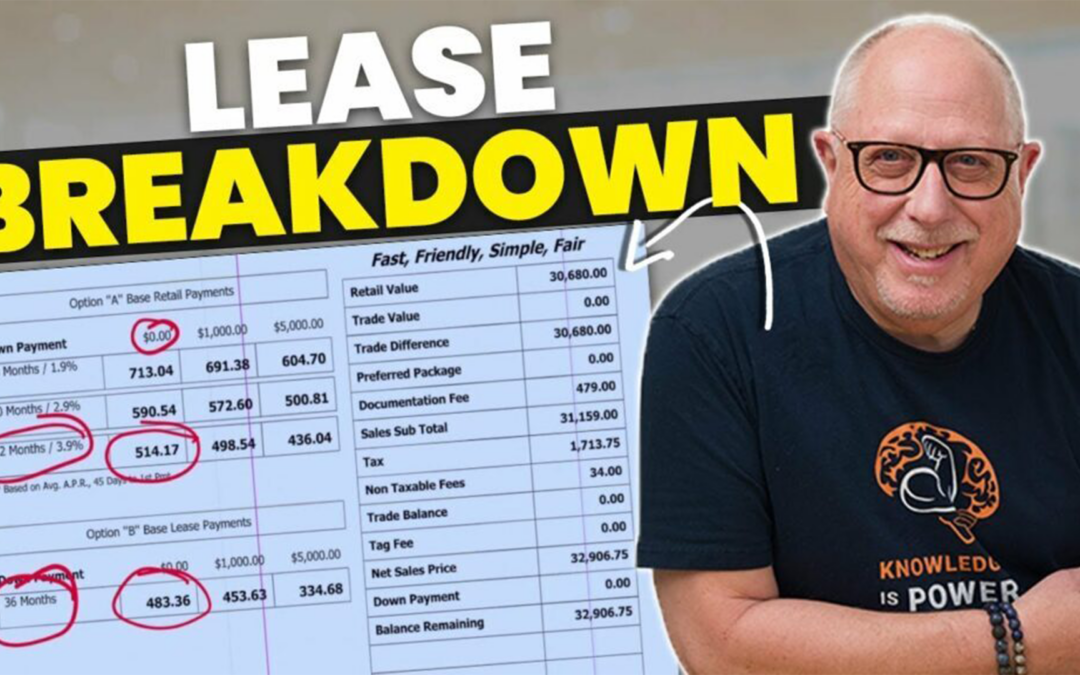

Now for some free car leasing advice from CarEdge co-founder Ray Shefska! Subscribe to our YouTube channel for more tips and tricks for buyers and sellers.

If you’re shopping for a car in 2025, timing matters more than ever. Interest rates, expiring EV incentives, and dealership lots overflowing with new models have created a rare window for buyers to save big. But here’s the catch: not everyone should buy now.

For most car shoppers, the smartest move is to wait for year-end car sales in November and December. EV buyers are the exception, and we’ll explain why.

Mark your calendar. The first big wave of year-end deals will show up around Black Friday in late November. But the real flood of discounts lands in December, when automakers and dealers face the end-of-year crunch.

This is when manufacturers pile on cash rebates, 0% APR financing, and lease specials to hit sales targets and clear out inventory. Dealers are under pressure too, eager to move 2025 models off the lot before they officially become “last year’s cars.”

Now that we’ve covered when showtime will arrive, let’s get into who should wait for year-end specials, and who should just go ahead and buy now.

If you’re considering an electric vehicle, the clock is ticking. The federal EV tax credit expires on September 30, 2025. New IRS guidance confirms that buyers can still claim the credit as long as they have a binding written order with a deposit in place by that date—even if delivery happens later.

For the first time ever, electric vehicle inventory is lower than the overall new car market, at least by the Market Day Supply measure of demand. As buyers rush to snag their $7,500 point-of-sale discount or tax credit, several top electric models have fallen below 30 days of market supply. This makes EVs less negotiable for the time being, at least until inventory builds back up.

Ray Shefska, CarEdge co-founder, puts it plainly:

“EV shoppers should take advantage of the federal tax credits before they expire. Do it now, not later. It will be a while before EVs pile up on dealership lots again, so now is your best chance at savings.”

If you’re buying an EV, September is your deadline. After that, the credit vanishes, and you’ll be left paying more until inventory builds back up in 2026. Check out local EV listings with insider market data.

If you’re shopping for a gas-powered or hybrid vehicle, patience will pay off. Unlike EV buyers who need to act fast, the best move for everyone else is to wait until year-end sales in November and December.

That’s when automakers roll out their biggest discounts of the year to clear 2025 models off lots and make room for 2026 arrivals. Expect 0% APR financing, thousands in cash rebates, and aggressive lease specials once Black Friday kicks off the season.

Ray Shefska puts it this way:

“Manufacturers and dealers get more aggressive in December than at any other time of the year. That’s when you’ll see the deals worth waiting for.”

If you’re buying an ICE or hybrid model, hold off until year-end. You’ll likely save more by waiting just a few months than by rushing into a deal today.

If you’re hunting for the deepest discounts this November and December, look at leftover 2025 models. With 2026 vehicles already arriving, automakers don’t want unsold inventory sitting around. That’s where the best year-end car sales will be found.

As of September 2025, two-thirds of all new car inventory is from the 2025 model year. Open to something older for a greater discount? There are 90,000 2024 models that are still looking for buyers. Buyers should confidently negotiate at least 15% off MSRP for these cars and trucks that will soon reach their second birthday without a buyer.

Expect to see aggressive year-end car deals on:

Put simply: year-end sales are the last chance to score thousands off a 2025 model before automakers reset the board with higher 2026 prices.

If you’re thinking about waiting until next year, think twice. Automakers are already rolling out price hikes for 2026 models, and they’re not small. Subaru has announced increases across much of its lineup, Chevrolet is sneaking in higher MSRPs and padded destination fees, and other brands are following suit.

The truth is, MSRPs rarely fall, and 2026 will be no exception. Even if incentives improve later, higher sticker prices and fees mean many buyers will end up paying more. That’s why year-end 2025 car sales are your best shot at grabbing a 2025 model before the price resets upward.

Here’s another reason to wait: the Federal Reserve is expected to cut interest rates in late 2025, with meetings in September, October, and December. By November and December, auto financing could finally become more affordable.

Lower rates mean two things:

That’s why it pays to be prepared. Shoppers who know what fair pricing and rates look like will be better positioned when demand picks up.

Dealers love to talk about monthly payments, but don’t let that distract you from the total out-the-door cost. Always shop around before accepting a higher APR from the dealership, especially if you’re buying in-demand models like Toyota, Lexus, or Honda. Competitors like Mazda, Hyundai, and Kia commonly offer greater discounts and APR incentives.

CarEdge can help you compare financing offers, negotiate discounts, and avoid dealer tricks. Whether you’re looking at year-end clearance sales or considering one of the last EV credits, the right strategy can save you thousands.

See how we can help make car buying easy and pain-free, no matter your budget.

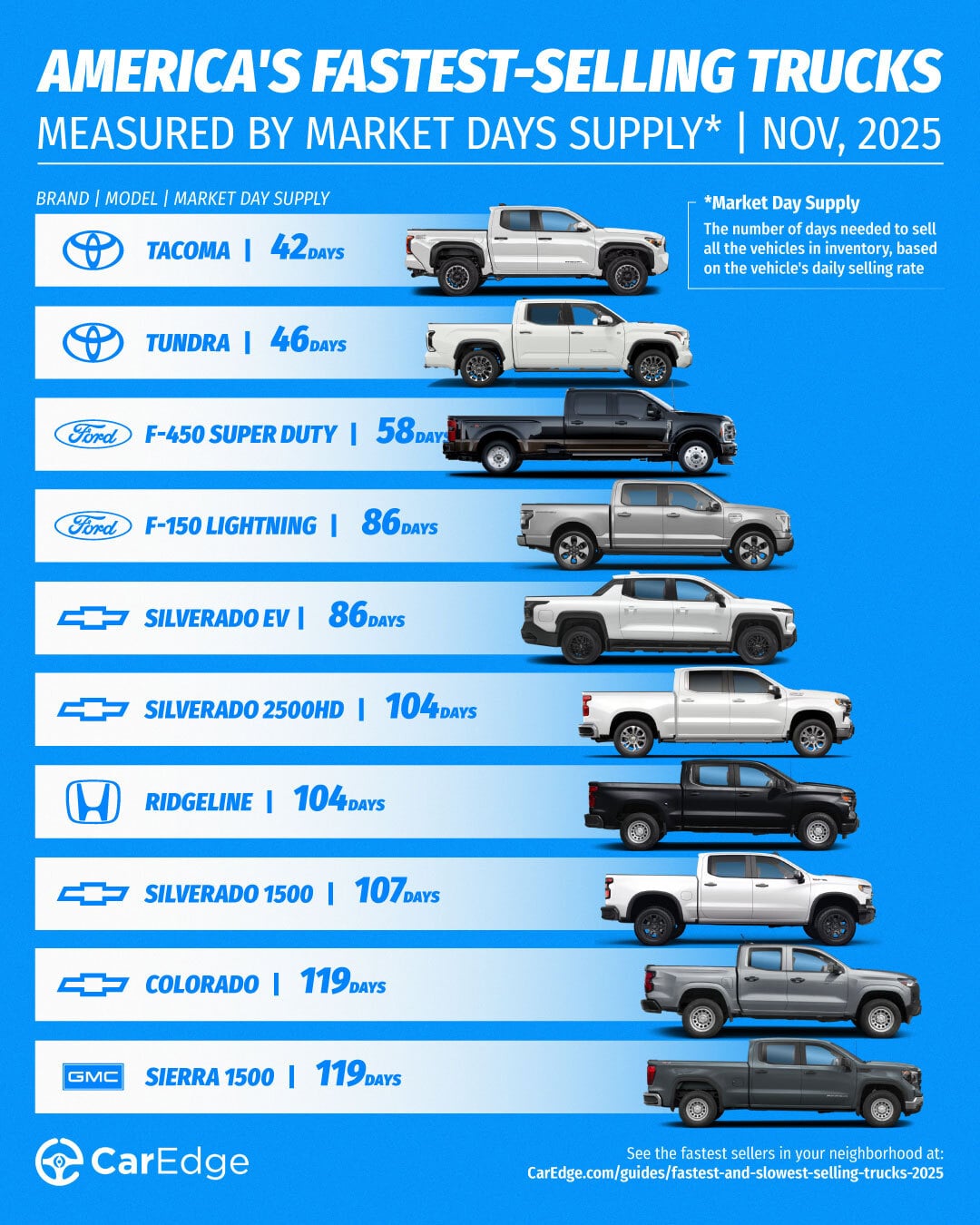

The gap between the fastest and slowest-selling pickups is wider than ever in 2025. With some trucks selling in just over a month, and others sitting unsold for over six months, knowing what’s hot (and what’s not) can make or break your next deal.

That’s why understanding Market Day Supply (MDS) is more important than ever for anyone buying or selling a truck in 2025. At CarEdge, we used real-time inventory and sales data to identify the fastest- and slowest-selling trucks in November.

MDS tells us how long it would take to sell all the current inventory of a particular model at the current sales pace, assuming no new units are added. A low MDS means a truck is selling quickly. A high MDS, on the other hand, signals oversupply, and that can mean buyers have more leverage at the dealership.

Whether you’re buying new or considering a trade-in, here’s what the latest market data from CarEdge Pro reveals about the best-selling and worst-selling trucks in America.

These trucks are in high demand and selling quickly. But if you’re hoping to negotiate a deal on one of these, don’t count on much wiggle room unless you work with a pro.

| Make | Model | Market Day Supply | Total For Sale | 45-Day Sales | Average Selling Price |

|---|---|---|---|---|---|

| Toyota | Tacoma | 42 | 51,245 | 54,331 | $45,723 |

| Toyota | Tundra | 46 | 30,621 | 30,099 | $63,206 |

| Ford | F-450 Super Duty | 58 | 1,578 | 1,233 | $96,354 |

| Ford | F-150 Lightning | 86 | 6,843 | 3,563 | $69,161 |

| Chevrolet | Silverado EV | 86 | 2,946 | 1,541 | $60,307 |

| Chevrolet | Silverado 2500HD | 104 | 30,611 | 13,288 | $40,224 |

| Honda | Ridgeline | 104 | 11,913 | 5,167 | $26,414 |

| Chevrolet | Silverado 1500 | 107 | 77,799 | 32,621 | $29,978 |

| Chevrolet | Colorado | 119 | 27,949 | 10,527 | $25,301 |

| GMC | Sierra 1500 | 119 | 56,676 | 21,350 | $35,094 |

Source: CarEdge Pro

The Toyota Tacoma is the fastest-selling pickup truck in November 2025. On average, this heavy duty pickup truck sits on the lot for a little under two months before finding a buyer. Toyota’s Tundra is in second place at 46 days of supply, with trucks from GM far behind.

We didn’t expect to see two electric trucks on the list of fastest-selling pickups this month. Now that federal EV incentives have expired, the F-150 Lightning and Silverado EV are not likely to return to this list anytime soon.

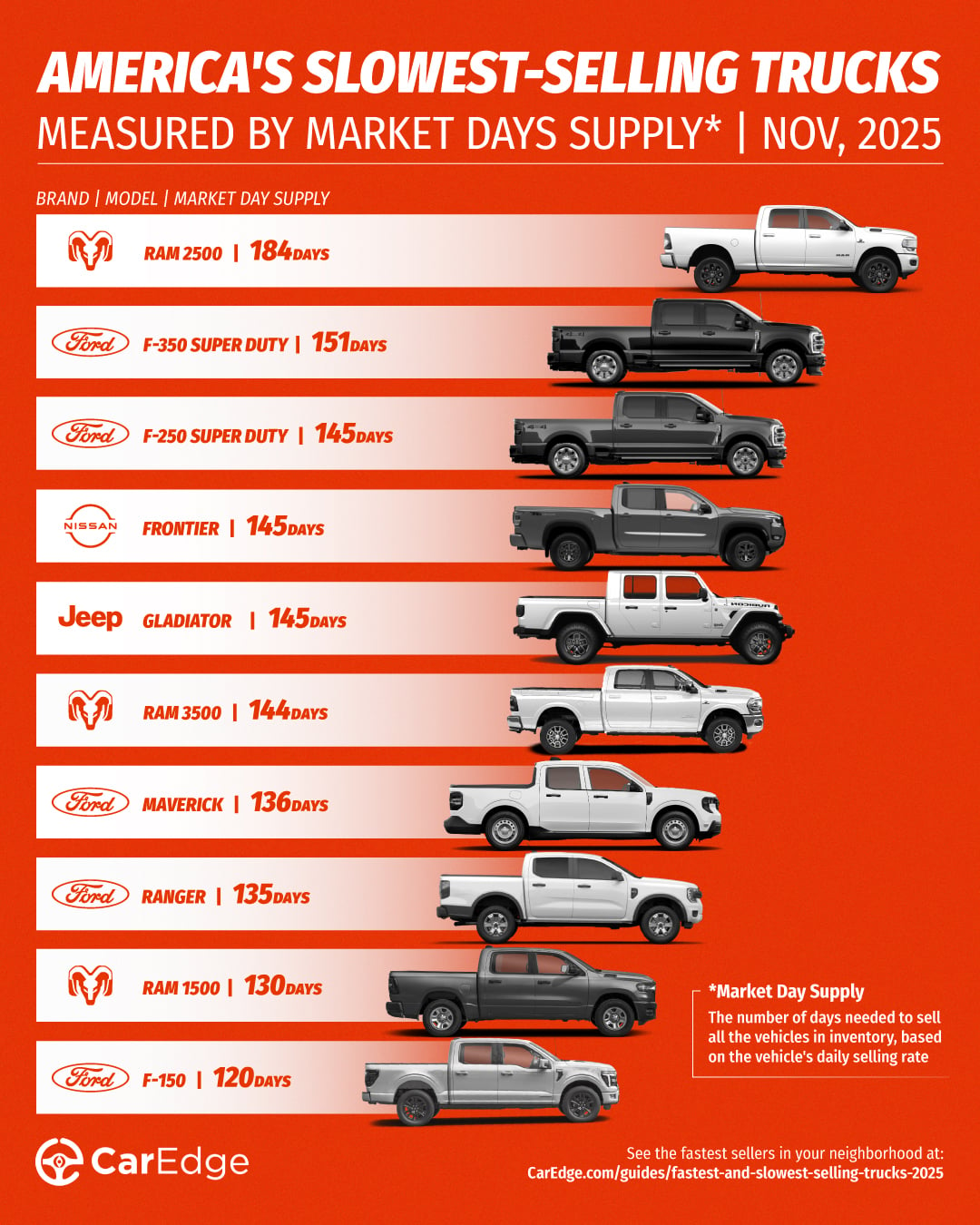

On the flip side, these trucks are struggling to move. Some of these trucks are taking more than six months to sell on average. If you’re in the market, these pickup trucks offer room for negotiation, especially with DIY market insights.

| Make | Model | Market Day Supply | Total For Sale | 45-Day Sales | Average Selling Price |

|---|---|---|---|---|---|

| Ram | Ram 2500 | 184 | 39,136 | 9,577 | $67,626 |

| Ford | F-350 Super Duty | 151 | 31,071 | 9,252 | $76,907 |

| Ford | F-250 Super Duty | 145 | 46,275 | 14,321 | $71,249 |

| Nissan | Frontier | 145 | 21,605 | 6,687 | $22,513 |

| Jeep | Gladiator | 145 | 19,516 | 6,039 | $34,416 |

| Ram | Ram 3500 | 144 | 11,652 | 3,636 | $48,755 |

| Ford | Maverick | 136 | 37,269 | 12,313 | $33,733 |

| Ford | Ranger | 135 | 22,105 | 7,358 | $43,481 |

| Ram | Ram 1500 | 130 | 52,201 | 18,037 | $30,467 |

| Ford | F-150 | 120 | 114,338 | 42,806 | $59,535 |

Source: CarEdge Pro

The Ram 2500 is the slowest-selling truck in America right now. Trucks from Stellantis brands (Ram and Jeep) take up four of the bottom 10 spots in November. Sellers can expect these slow-selling trucks to sit on the lot for at least four months, but this creates great chances to negotiate savings for buyers.

As the truck market ebbs and flows, it’s easy to become overwhelmed. Luckily, there are new tools and services available that take the hassle out of buying a truck entirely. Here’s how CarEdge can help.

👉 Negotiate anonymously with CarEdge AI (NEW!)

👉 Have a pro negotiate your deal with CarEdge’s Car Buying Service

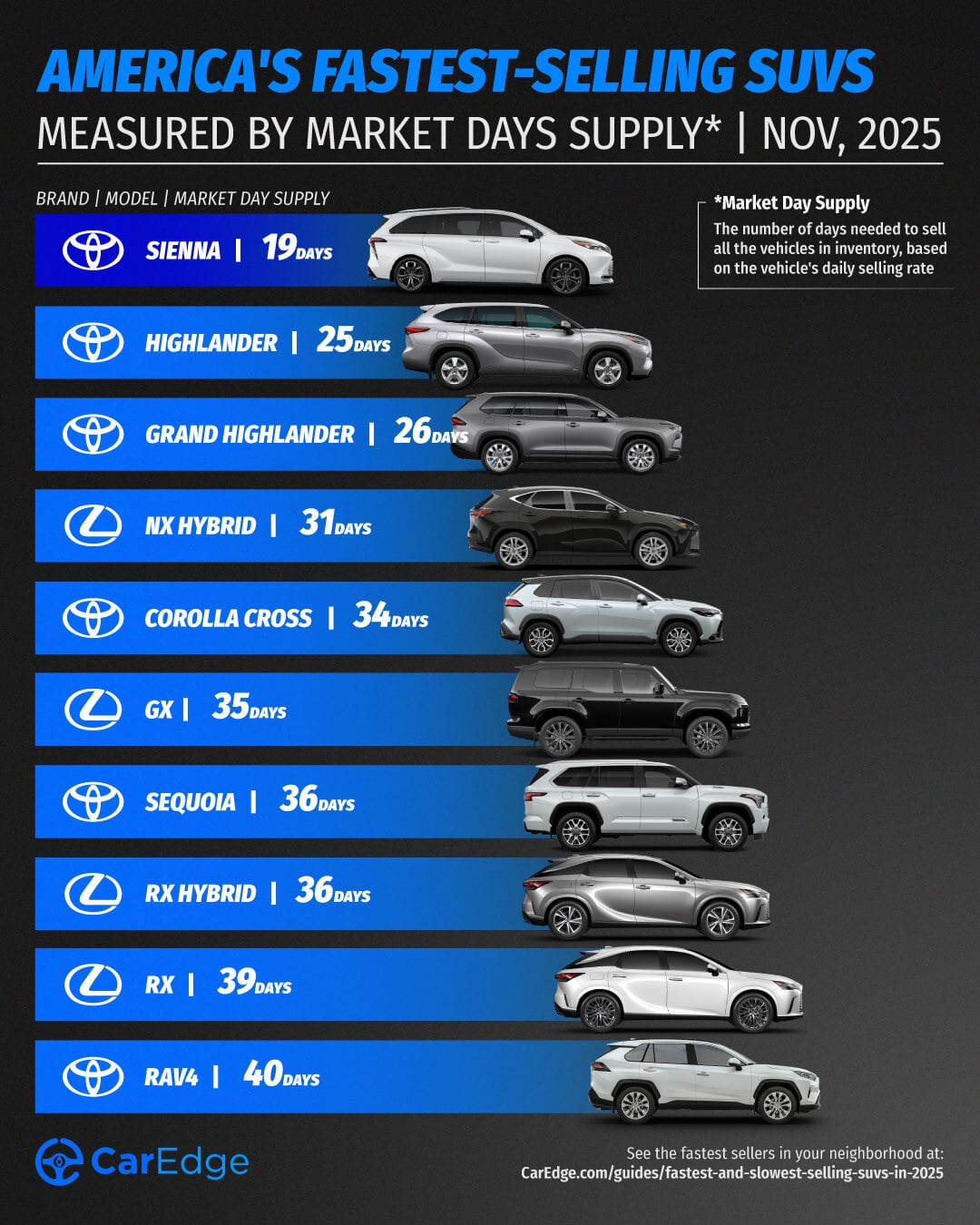

It’s true that SUVs have taken over the car market in recent years, but not all are hot sellers. In fact, the gap between the fastest and slowest-selling models is growing. In 2025, some SUVs and crossovers are being scooped up as soon as they hit the lot, while others are sitting unsold for more than six months. Whether you’re a buyer looking for a great deal or a seller trying to time the market, understanding which SUVs are moving (or not) is essential.

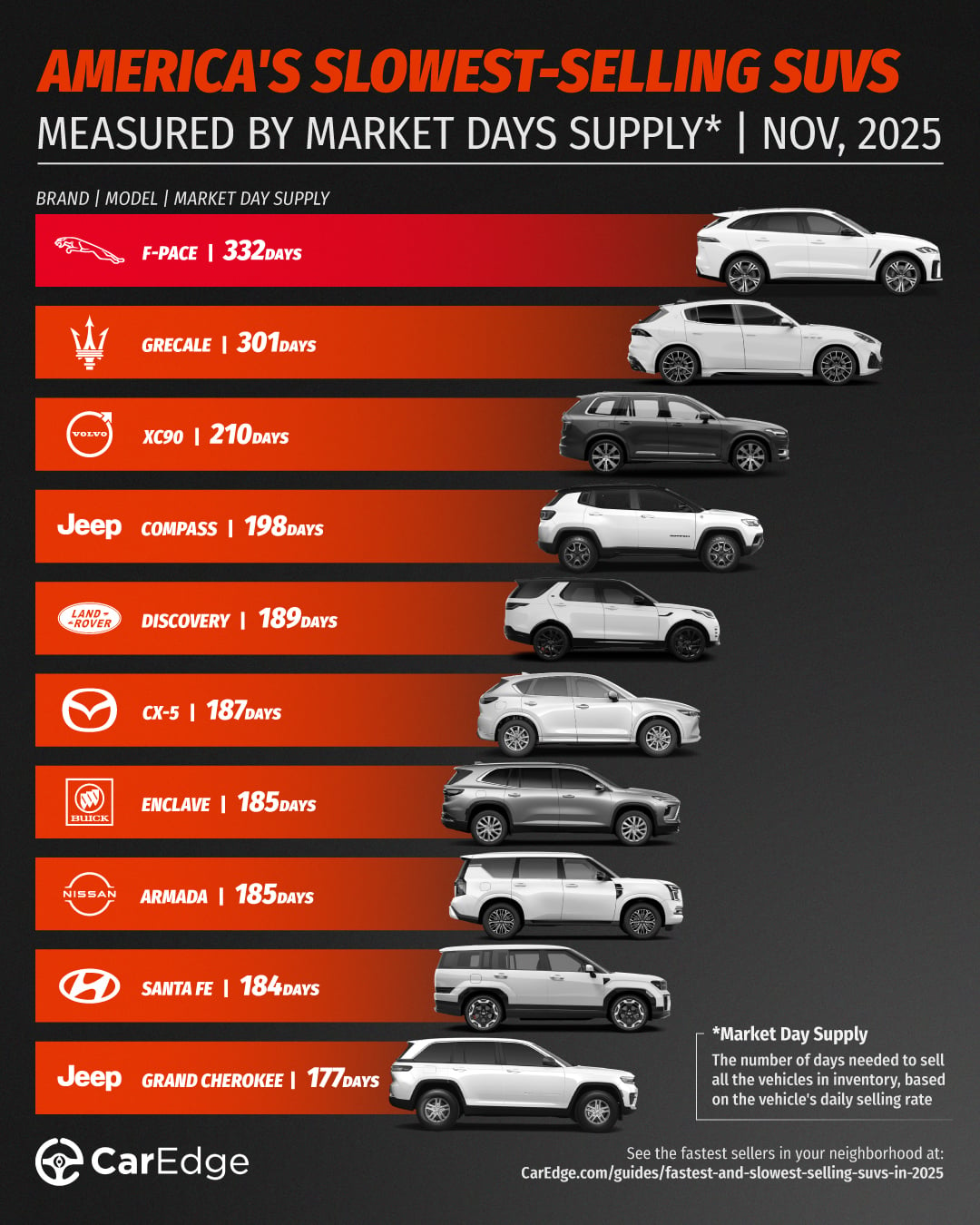

We analyzed November car market data to find the SUVs with the lowest and highest market day supply (MDS). MDS is a measure of how many days it would take to sell through current inventory at the current sales pace. Here are the winners and losers in 2025’s SUV market.

These are the SUVs and crossovers with the lowest market day supply as of November 2025. That means they’re in high demand right now, and are likely harder to negotiate on due to limited availability.

| Make | Model | Market Day Supply | Total For Sale | 45-Day Sales | Average Selling Price |

|---|---|---|---|---|---|

| Toyota | Sienna | 19 | 7,704 | 18,358 | $51,910 |

| Toyota | Highlander | 25 | 5,928 | 10,765 | $52,072 |

| Toyota | Grand Highlander | 26 | 13,733 | 27,573 | $55,573 |

| Lexus | NX Hybrid | 31 | 2,182 | 3,189 | $54,595 |

| Toyota | Corolla Cross | 34 | 14,739 | 19,477 | $31,303 |

| Lexus | GX | 35 | 2,858 | 3,659 | $80,224 |

| Toyota | Sequoia | 36 | 4,408 | 5,483 | $83,585 |

| Lexus | RX Hybrid | 36 | 4,465 | 5,526 | $63,418 |

| Lexus | RX | 39 | 8,315 | 9,702 | $59,010 |

| Toyota | RAV4 | 40 | 70,764 | 80,355 | $37,313 |

Source: CarEdge Pro

All of the top 10 fastest-selling SUVs in 2025 are Toyota or Lexus models. Car buyers are valuing reliability and affordability above all else right now, and the latest data reflects that.

These SUVs have the highest market day supply, which means they’re sitting unsold for longer. Buyers may be able to score better deals on these slowest-selling SUVs in October, especially with this new AI negotiator doing the work for you.

| Make | Model | Market Day Supply | Total For Sale | 45-Day Sales | Average Selling Price |

|---|---|---|---|---|---|

| Jaguar | F-PACE | 332 | 2,299 | 312 | $70,966 |

| Maserati | Grecale | 301 | 675 | 101 | $82,255 |

| Volvo | XC90 | 210 | 15,642 | 3,349 | $71,761 |

| Jeep | Compass | 198 | 21,358 | 4,843 | $31,924 |

| Land Rover | Discovery | 189 | 1,145 | 272 | $73,959 |

| Mazda | CX-5 | 187 | 43,567 | 10,487 | $34,343 |

| Buick | Enclave | 185 | 13,912 | 3,377 | $52,747 |

| Nissan | Armada | 185 | 6,756 | 1,641 | $71,331 |

| Hyundai | Santa Fe | 184 | 42,768 | 10,438 | $42,928 |

| Jeep | Grand Cherokee | 177 | 47,730 | 12,137 | $46,865 |

Source: CarEdge Pro

Many of these models fall into the luxury segment. With recent inflation and persistently high interest rates, buyers are thinking twice about buying luxury vehicles in 2025. Jaguar’s F-PACE is the slowest-selling SUV today. Surprisingly, just one Stellantis model is in the bottom 10. Land Rover has quickly filled the list, with three slow-selling models this month. Many luxury buyers are waiting for interest rates to fall further as year-end sales approach.

For any of these slow-selling SUVs, prices will be more flexible if you come equipped with negotiation know-how.

If you’re looking for a deal, start with the slowest sellers this month. High inventory levels mean dealers are likely motivated to talk pricing if you negotiate with confidence. It’s always best to take a look at the best incentives of the month, too.

“If you’re shopping for a slow-selling SUV, the ball is in your court,” says auto industry veteran Ray Shefska. “Dealers know those vehicles aren’t moving, and that gives you the upper hand in price negotiations.”

Shopping Toyota, Honda, or Lexus? Expect tighter inventory and less room for negotiation. You may need to move quickly if you find the right trim. However, this is no reason to pay for unwanted add-ons or dealer markups!

Thinking about EVs? If it qualifies for the $7,500 federal tax credit, you’ve only got until the end of this month to make a purchase (or get a binding order in writing with a down payment). Although incentives abound, be wary of steep depreciation if you buy any EV. Unless you’ll be keeping your EV for several years, leasing is the smarter choice for your wallet.

With CarEdge Concierge, our experts do the legwork for you, from researching inventory to negotiating with dealers. Already know what you want? Use our AI Negotiation Expert service and have CarEdge AI negotiate with car dealers anonymously!

Explore more free tools and resources with car buying guides, cost of ownership comparisons, and downloadable cheat sheets. There’s no reason to shop unprepared in 2025!

CarEdge is a trusted resource for car buyers, offering data-backed insights, negotiation tools, and expert guidance to help consumers save time and money. Since 2019, CarEdge has helped hundreds of thousands of drivers navigate the car-buying process with confidence. Learn how to buy a car the easy way at CarEdge.com.