CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

December 2022 Update: To the dismay of many on social media (particularly Reddit), VinFast made an unwelcome announcement recently. The good news: The first VinFast EVs will arrive in California by January 2023. In fact, there are 999 VF8 electric SUVs on the way to America. The bad news: VinFast says that these will be “City variants” with just 180 miles of estimated range, according to the company.

Previously, VinFast had advertised to everyone, including reservation holders, that the VF8 had either 249 miles of range for the Eco variant, or 261 miles of range for the Plus variant.

Okay, say you’re fine with 180 miles on a charge, as long as it comes with a significant price discount. You’d be disappointed. VinFast is offering these City variants of the VinFast VF8 at a $3,000 discount. That means that this 2023 electric SUV will still cost either $55,500 or $62,500, with 180 miles of range. Note, that’s the same range as the Nissan LEAF, and is much less than the Chevy Bolt. With this range and at this price point, we can’t recommend the VinFast VF8 City version. Competitors offer more range for the same (or less) money.

Now, on to the original first-look of VinFast EVs:

Just as legacy OEMs are jumping into the EV race, newcomers and startups are set to enter the North American market within the next year or so. Today, a glance at electric vehicle sales numbers finds Tesla dominating with 67% market share, but that figure is slowly falling as the competition heats up. Volkswagen Group, Ford and Korean automakers trail behind, eager to bite into Tesla’s success. Here to spice things up are newcomers like Rivian, Fisker, Lucid and a half-dozen other boutique automakers.

Overseas, two established EV players are poised to join the fun as well. While Chinese EV success story NIO hasn’t made any commitments, aspiring Vietnamese automaker VinFast is ready to break ground in America. How will this emerging vehicle segment evolve over the next 2-3 years? Whatever happens, it’s looking increasingly likely that VinFast will be a part of the story.

The 2021 LA Auto Show was all about EVs. No one lingered around the occasional displays of cross-cut engines or propped-open hoods. Yet every electric vehicle booth was packed. One of the many oddities and spectacles at the auto show was VinFast, who (almost) nobody had heard of. It almost sounds like the name of a rebranding online car seller who gets your title to you in less than a month. Founded in 2017, VinFast is the automotive wing of Vingroup, a private Vietnamese conglomerate active in tech, retail, industrial development and service industries. Now worth over $35 billion, Vingroup had humble beginnings as a food processing company working out of Ukraine in the early 1990s.

VinFast first set foot in America in the summer of 2020. That was a pretty horrible time to be launching any kind of business venture, but VinFast stuck with it. With an extensive history and enough capital to get the ball rolling, automotive industry analysts are marveling at the pace of VinFast. At the LA Auto Show, VinFast US CEO Van Anh Nguyen told TechCrunch about their expansion plans. Here’s what the ambitious automaker has in store in just the first half of this decade:

With this roadmap in mind, it’s no surprise that VinFast is eyeing an IPO into the US stock market. Rumor has it that they’re shooting for a $60 billion valuation.

When VinFast announced their new 15,000 square-foot headquarters, they also shared some details about future product launches. VinFast followed through on their pledge to officially debut two of its first electric SUVs, the VF 8 and VF 9, at the 2021 LA Auto Show. There’s one aspect in particular that lends so much confidence to VinFast’s growth strategy. Much of their research and development has been focused on streamlining and automating vehicle manufacturing processes. Sound familiar? That’s how a certain American company (starts with a T, ends with an A) overcame the many burdens of production ramp-up. In fact, Tesla was the first American car manufacturer to successfully ramp up automotive production in nearly 100 years. If VinFast has scalable growth in mind, their likelihood of success is far greater than the average EV startup.

VinFast’s approach to EV production isn’t all good news for the consumer. Automotive News recently reported on VinFast’s plan to NOT include a battery pack as part of the standard equipment when the vehicle is purchased. Instead, car buyers will lease a battery pack from VinFast. I guess that’s one way to guarantee a revenue stream!

Renting a battery pack from VinFast won’t be cheap. Unless, of course, you intend to purchase an EV that comes without the usual fuel savings associated with going electric. VinFast Global CEO Le Thi Thu Thuy said the two battery pack options will cost between $100 and $150 PER MONTH. They say the battery leasing model would buffer EV buyers from the risk of degraded battery performance over time. They’ll replace the battery if it falls below 70 percent of its initial charging capacity. The thing is, today’s EVs still retain over 80% of their initial charging capacity with well over 100,000 miles on the odometer. This would have been a reasonable strategy a decade ago, when early battery tech was on shaky, experimental ground. Now, it’s a solution in search of a problem.

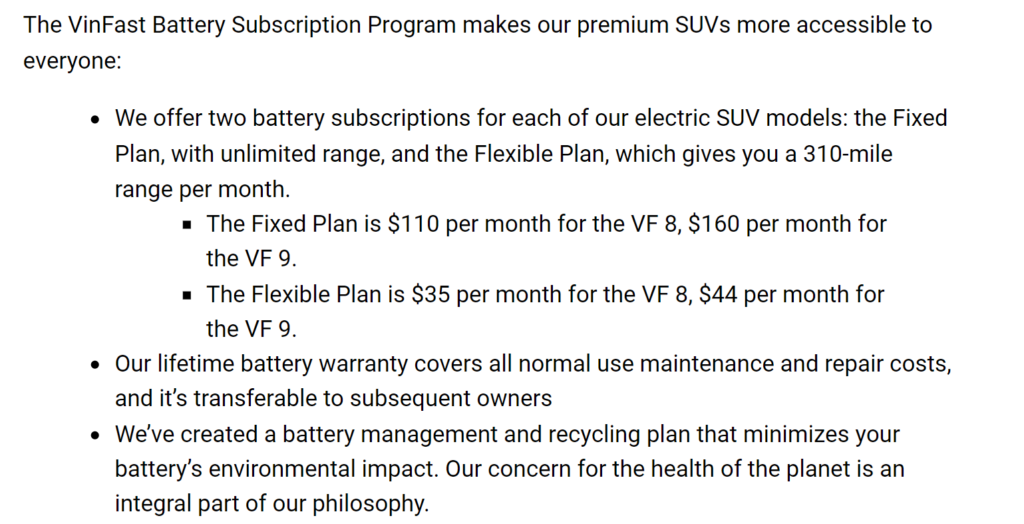

Below is the official announcement from VinFast, showing the pricing tiers for the VinFast VF 8 and VF 9. VinFast battery subscription plans range from $110 to $160 per month on the VinFast Fixed Plan, and $35 to $44 per month on the VinFast Flexible plan, which includes just 310 miles of driving per month.

Why would anyone buy a new car knowing they will have to pay an extra $150 every month for the required battery? That would only work if the car itself sells for ridiculously cheap. We’ll see, but I’m skeptical.

Imagine if Apple required you to purchase a battery for the IPhone separately. The behemoth wouldn’t be where they are today with such a critical product miscalculation. Will VinFast SUVs overcome this looming and unnecessary product feature? Or will they reverse course before launching US sales?

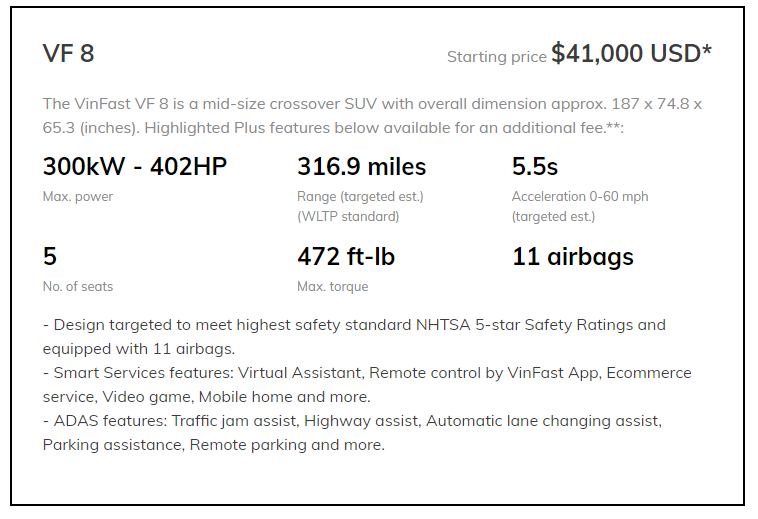

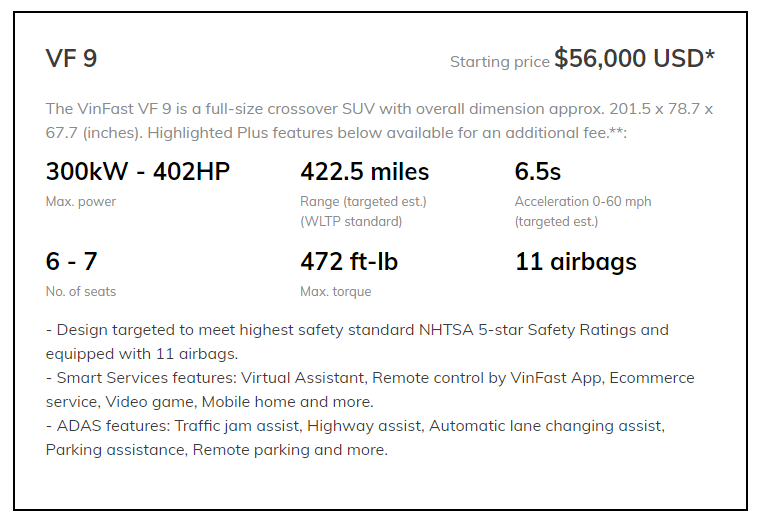

Enough with the negativity. At the 2021 LA Auto Show, VinFast shared two impressive electric concepts. They intend to bring both to production very soon, and both will be sold in the US market. The VF 8 (formerly dubbed the e35) and VF 9 (formerly e36) are two fully-electric SUVs that feature advanced driver-assistance systems and a suite of smart features. Both VinFast SUVs are designed by Italian design firm Pininfarina, and the result is pleasant to look at.

The smaller VF 8 is advertised for up to 310 miles of range on a charge. Stepping up to the larger VF 9 will get you 301 miles of range with the (rented) standard battery, or buyers can opt for the bigger battery that’s good for 422 miles.

Aside from the range figures and pretty images, not a whole lot is known about these two SUVs. The VinFast website shows an interior with a 15” Tesla-style touchscreen front and center. What they do make clear on the website is that interested buyers are welcome to place a reservation for $200. Reservations placed before April qualify for a $3,000 to $5,000 voucher for their VinFast SUV of choice.

VinFast pricing starts at $41,000 for the crossover-styled VF 8, and $56,000 for the larger VF 9 SUV. Power is impressive, yet nothing to write home about. Check out the full VinFast pricing and spec details below. The automaker does make it abundantly clear that this information is subject to change.

I want VinFast to succeed in their North American expansion. Greater competition among automakers almost always results in savings for the consumer. But batteries not included? $150 every month for something that literally comes with every single other electric vehicle in the world? Come on. I hope VinFast sees the reality of the situation and the expectations of the American buyer.

What do you think? Are you willing to give VinFast a chance, or are they wasting their time with this battery nonsense? How affordable would the car have to be for this sales model to work? Let us know what you think. I’d love to hear your thoughts, especially if you might be willing to give the VinFast ownership experience a try.

CarEdge Just Launched a New Search Engine to Make Buying Your Next Car Easier!

We have thousands of EVs (and other vehicles) listed today. Each listing includes industry insights and empowering data. The true TotalPrice that will make buying a car the transparent process it should’ve always been. Check it out!

A U.S. lawmaker introduced a new ‘right to repair’ bill on Thursday. The legislation proposed by Illinois Representative Bobby Rush (D) takes aim at the auto industry eight years after Massachusetts enacted its own legislation that sent shockwaves through the industry. Rep. Rush announced the bill with comments highlighting the struggle over who has access to data as autos inch closer to becoming driving computers.

“Americans should not be forced to bring their cars to more costly and inconvenient dealerships for repairs when independent auto repair shops are often cheaper and far more accessible. As cars become more advanced, manufacturers are getting sole access to important vehicle data while independent repair shops are increasingly locked out.”

The new administration has already brought this issue back into the spotlight. In 2021, President Biden issued an executive order directing the Federal Trade Commission to take action on right to repair. The current administration is looking for ways to reach across the aisle. Representative Rush’s new bill might become a rare glimpse of bipartisanship. A spokeswoman for Rep. Rush told Automotive News that Republican support for the bill is expected soon.

It’s important to remember that this proposed legislation is just now entering the revolving circus that is government in 2022. It remains to be seen if the 2022 ‘right to repair’ bill will ever end up on President Biden’s desk. If it does get enacted into federal law, how does the consumer stand to benefit?

In the vast majority of markets and scenarios, dealer service centers will charge more than independent repair shops for automotive maintenance. Often, dealership service managers make money off of the services they recommend to you. That’s simply the work-for-commission model.

While dealership service centers have their benefits, the savings of going elsewhere are hard to overlook. If cars become so complex that repair shops can’t keep up with the tech, consumers will have no choice but to go to the dealership. That’s probably what most dealers want to happen, and it could become reality sooner than later. That’s the motivation behind the perennial ‘right to repair’ movement. Ultimately, consumers will save on repairs if pricing competition continues to exist between dealers and small repair shops, as it has for decades.

Automaker and dealership alliances thought they were done with the ‘right to repair’ stuff. Back in 2014, associations representing both automakers and independent repair shops agreed to a ‘memorandum of understanding’. This MOU that was seen as a compromise that could settle their differences. The MOU was inspired by a 2013 Massachusetts ‘right to repair’ law. No other state has passed its own ‘right to repair’ bill since then, which was seen as a success of this landmark agreement. The 2014 MOU gave shops in all states the same access to diagnostic and repair information.

Still, the automaker lobby group Alliance for Automotive Innovation touted the success of the 2014 agreement following the announcement of the new legislation. Robert O’Koniewski, Executive Vice President of the Massachusetts State Automobile Dealers Association, didn’t mince words with the perspectives he shared with Automotive News.

“If this has been such a problem nationwide under the 2014 MOU between the vehicle manufacturers and the independent repair community, why has not one other state passed a RTR law to protect repairers and car owners in their own states?”

Representative Rush’s new legislation and Biden’s executive order would give independent repair shops the upper hand. At a time when cars are getting more loaded with tech every model year, repair shops are struggling to adapt. It costs money to acquire the necessary equipment to run high-level diagnostics and make repairs to electronics in newer models.

Associations representing key players in the automotive aftermarket and repair industries have come out in support of the latest legislation. Both the Auto Care Association and the Automotive Aftermarket Suppliers Association have publicly shared their support.

Does your local repair shop service electric vehicles? As of 2022, chances are they don’t. Opinions vary, but the general consensus is that 40% of American auto sales will be fully electric in 2030. Will consumers be cornered into returning to the dealer service center for EV maintenance and repairs? Or will the latest push for ‘right to repair’ laws extend to the coming onslaught of electric vehicles? Behind the scenes, repair shops and dealers are in a tug of war over the future of maintenance.

Current data shows that electric vehicle maintenance costs are less than their gas equivalents. Still, millions of EVs will eventually need some work done. At CarEdge, we hope that lawmakers and industry leaders prioritize the consumer as the pace of change accelerates through this decade. We’ll update this page as the new ‘right to repair’ legislation crawls through congress.

As you meander through the empty lot at the dealership, don’t you dare feel sorry for them. Vehicle inventory is still at all-time lows, and we all know why (it’s the chip shortage!). But dealerships are in the business of making money, and the pandemic and associated bottlenecks have forced dealers to get creative with how they generate revenue. New data from J.D. Power shows that dealers have gotten TOO GOOD at making money at the expense of the consumer.

In January 2022, total profit per vehicle is up to $5,138. That’s five grand in pure profits for every customer that signs on the dotted line. In January of 2021, dealer profit per vehicle sold (PVR) was more reasonable at $2,169 per sale. That’s an unprecedented 137% jump year-over-year.

This is the fourth straight month with average PVR over $5,000. J.D. Power estimates the increase in profits per vehicle sold was enough to offset losses from reduced inventory. The analysts also predict that dealerships’ aggregated new-vehicle sales profit will rise to $4.3 billion, up 117% from 2021.

Where do we start? Dealer markups masked as ‘market adjustments’ are at record-highs, and will continue to be as long as consumers are willing to pay the prices. Incentives are on the way out. Gone are the days of big incentives slashing thousands of dollars off the MSRP.

Unfortunately, consumers carry some of the blame. Data shows that car buyers are financing vehicles for longer and longer terms. The average car loan is now for a whopping 67 months. That’s over five dozen months of paying interest. With the average monthly payment for a new car now at $636 (!!!!!) per month, this isn’t looking good for consumer finances.

If you finance your purchase through a dealership, they will make money on the loan. Car dealerships offer something to lending institutions that you and I can’t: volume. Generally speaking, car dealerships get access to loans at rates that individual consumers can’t. Dealers then mark up these loans and resell them to customers. In the end, the consumer pays more interest and the dealer smiles all the way to the bank.

Keep in mind that you don’t have to get your car financed through a dealership. The next time you buy a car, you should consider getting a pre-approval on a loan from another lender, in addition to seeing what the dealer is able to quote you.

Next time you meander through a sparse dealer lot or step into the F&I office at the dealership, don’t feel obligated to shell out extra cash to line their pockets. Their bank accounts are doing just fine.

That’s why we’re here. CarEdge is your team of consumer advocates. Our goal is to provide the consumer with the negotiating know-how to take control of the car buying process. We have experienced auto sales experts on the team, and a welcoming community of thousands of members. Check out caredge.kinsta.cloud to learn more. Now is not the time to go it alone at the dealership!

As the South Korea Automobile and Research Testing Institute was running new Tesla models through routine tests, engineers noticed a problem. Under certain conditions, the chime for not wearing a seatbelt would not activate. Specifically, if the chime was interrupted during the previous driving cycle, the chime would not sound if the seatbelt was not buckled during the next vehicle start. Tesla says the seatbelt chime still functions properly over 14 mph. In typical Tesla fashion, this Tesla recall has an easy fix for drivers.

Automotive News reports that the recall affects 817,000 Teslas, including some 2021-2022 Model S and Model X, 2017-2022 Model 3, and 2020-2022 Model Y vehicles. Considering that only 24,964 of the 936,172 vehicles Tesla sold in 2021 were Models S or X, the vast majority of the recalled vehicles are Model 3 and Model Y.

A recall affecting nearly one million vehicles would cripple most automakers. Tesla is shrugging it off with an over-the-air software fix. With the launch of the Model S back in 2012, Tesla was the first automaker to design and produce vehicles with full OTA update capabilities. Tesla doesn’t just update infotainment remotely like the competitors are just now getting around to. They regularly update powertrain dynamics, battery performance and just about everything except the rubber on the wheels.

For this ‘massive’ recall, there will likely not be a single trip to a Tesla service center. Tesla owners will receive a notification about a needed software update, and with Wi-Fi connectivity, the car will fix itself. These really are driving computers that can go 0-60 in two seconds.

GM, Ford, Volkswagen and just about everyone else in the industry are now equipping new models with over-the-air update capabilities. However, it will be a few years before these automakers are able to send OTA updates to customers that go beyond infotainment and navigation. For years, legacy talking heads like Bob Lutz dismissed Tesla’s staying power. Now, it seems they’re frantically racing to catch up.

Is Tesla too far ahead of the rest? Will other automakers succeed at bringing OTA capabilities to their lineup? How does the consumer factor into all of this? Let us know in the comments below, and see what others have to say at caredge.kinsta.cloud/community.

GM continues to sink under the weight of the chip shortage. It’s hitting all automakers, however the latest numbers from GM reveal the extent of the impacts. Automotive News reported that General Motors’ net income is down 39% in the fourth quarter to $1.7 billion. On the bright side, GM achieved a record full-year operating profit. That’s no surprise if you’ve been on the market for a GM vehicle.

In 2021, GM’s annual net income surged 56% to $10 billion. GM’s income is up despite the fact that total vehicle sales were DOWN by 13% over 2020 to 2.2 million. The automaker met previous projections with adjusted earnings of $14.3 billion. Total revenue increased 3.7% to $127 billion.

Although total sales and quarterly profits were down, vehicles sold for much higher prices. In the fourth quarter, GM’s average transaction price was $50,149. That’s up 15% year-over-year. At CarEdge, we’ve been pointing out the disappearance of incentives as dealers and automakers look to squeeze every dollar out of every sale. In Q4, incentives fell 65 percent to $1,813 per vehicle, according to TrueCar.

GM cited lower-margin cars as a contributing factor to profit declines. Could this be a side effect of the massive capital investments in electric vehicles? probably. All those batteries and rolling computers can’t build themselves…yet. GM plans to spend $35 billion in just four years on electrification.

As 2021 came to a close, GM had just 199,662 vehicles in stock or in transit to dealers. That’s less than half of what GM had this time last year, and one-third of inventory at the end of 2019.

The automaker said it expects its 2022 adjusted earnings “to remain at or near record levels,” between $13 billion and $15 billion.

General Motors CEO Mary Barra sees electric vehicles as essential to GM’s growth strategy. Automotive News reported that GM aims to deliver 400,000 EVs in North America through 2023. During the recent quarterly shareholder meeting, Barra reiterated the automaker’s commitment to spending $35 billion on electric vehicle development by 2025. She said that this will culminate in the launch of 30 EV models globally by the end of the same year.

General Motors finds itself in a bit of an odd situation. profits are down by 39%, yet they’re selling vehicles for a lot more money. If the chip shortage fades away quickly (as unlikely as that may be), would GM shoot to the top of the pack? We’ll learn a lot about GM’s path forward as Q1 progresses.