CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Once a brand synonymous with budget-friendly options, Kia has been striving to shed its old image and emerge as a reputable name in the automobile industry. But how do Kia’s latest cars and SUVs fare in terms of dependability? How reliable are Kia cars and SUVs today? If you’re thinking about purchasing a Kia, we’ve got data you’ll want to see.

Kia’s dedication to quality has not gone unnoticed. In 2024, Kia proudly stands within the top 10 of the most reliable car brands, as ranked by Consumer Reports. Let’s see how Kia’s reliability score measures up against its competitors:

Lexus – 79

Toyota – 72

MINI – 71

Acura – 70

Honda – 70

Subaru – 69

Mazda – 67

Porsche – 66

BMW – 64

Kia – 61 (Down one spot from the previous year, but with a higher score)

This list of the top 10 most reliable brands has gone through quite the shuffle in recent years. Brands like BMW and Kia have entered the top 10, while others like Lincoln and Audi were kicked off.

So, is Kia a reliable brand in 2024? Considering the latest rankings and reviews from Consumer Reports, the answer is a resounding yes.

How does Consumer Reports determine their reliability rankings? Here’s how they explain their methodology:

“Every year, CR asks its members about problems they’ve had with their vehicles in the previous 12 months. This year, we gathered data on over 300,000 vehicles, from the 2000 to 2024 model years (with a few early-introduced 2024model years), that address 17 trouble areas, including engine, transmission, in-car electronics, and more. We use that information to give reliability ratings for every major mainstream model.”

There you have it. This robust methodology is why consumers put so much trust in the Consumer Reports rankings and reviews. This makes it even more noteworthy that Kia has joined the top 10 most reliable car brands.

Next, we’ll take a look at the most reliable Kia models.

Consumer Reports tested nine Kia models, and there was a wide range of reliability scores among them. From the terribly rated Sorento to the superb Sportage and Carnival, it’s clear that Kia still has some work to do to bring the entire model lineup into the top rankings.

The most reliable Kia models include the Sportage, Carnival and Forte. The K5 and popular Telluride are not far behind.

Here’s how the nine Kia models CR tested were most recently rated:

The Sportage PHEV, Carnival and Forte may be the most reliable Kia models, but how do the top sellers fare? Here are the reliability rankings of the best-selling models. A few of the most reliable models are also the most popular!

Base Price: $26,290

Top Spec Price: $43,190

MPG: City 17 / Hwy 34 / Combined 25 miles per gallon

Consumer Reports Reliability Score: 60

You’ve probably noticed the redesigned Sportage’s spaceship-like front fascia over the past year. Most drivers would agree that it looks good, and is a pleasure to own. Consumer Reports says that The hybrid Sportage is the one to go for because it is “quicker, quieter, and gets 36 mpg overall.” Sounds like a winner for this price point.

When it comes to reliability, the Sportage ranks slightly above average for the brand with an overall score of 60.

Browse Kia Sportage listings with local market data.

Base Price: $19,690

Top Spec Price: $25,090

MPG: City 31 / Hwy 41 / Combined 35 miles per gallon

Consumer Reports Reliability Score: 44

In 2023, there are just a handful of new cars priced under $20,000. The Kia Forte still makes the list, just barely. This compact car has some redeeming features, such as impressive fuel economy. However, it has a stiff suspension that is noticeable on any road surface, and a loud cabin with lots of road noise. At this price, it’s still not bad for getting around town.

Browse Kia Forte listings with local market data.

Base Price: $35,890

Top Spec Price: $52,985

MPG: City 14 / Hwy 30 / Combined 21 miles per gallon

Consumer Reports Reliability Score: 59

In just a few years, the Kia Telluride has gone from a market newcomer to one of the top selling SUVs out there. There’s no doubt about it: the Telluride offers amazing value for the price. With seating for up to 8 passengers and a well-equipped 291-hp, 3.8-liter V6 engine, there’s a lot to love. Regarding the Kia Telluride’s reliability, it scored just above average in Consumer Report’s testing and member surveys.

Browse Kia Telluride listings with local market data.

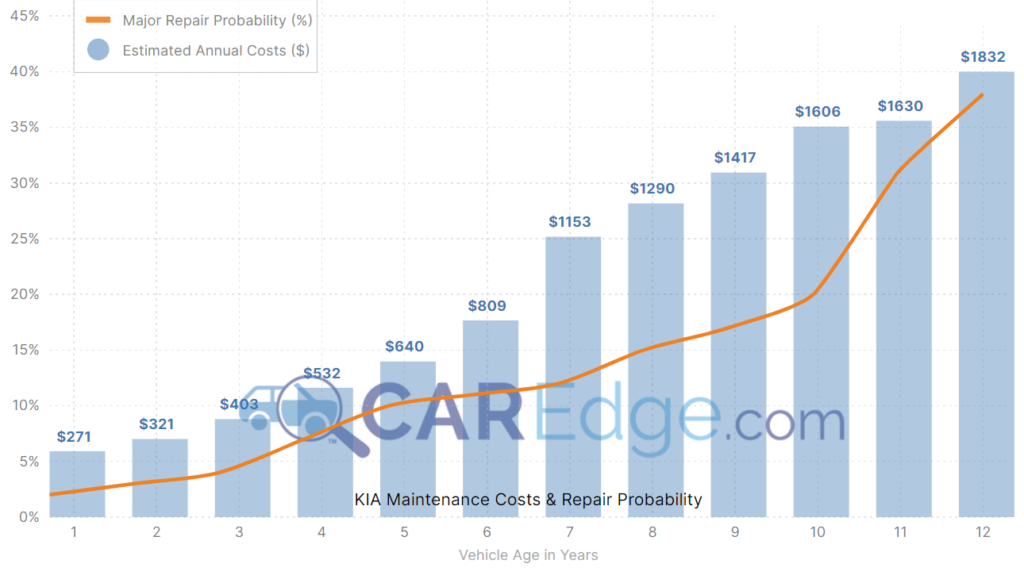

According to our CarEdge Maintenance Cost Rankings, Kia ranks #7 in the least expensive brands to maintain after 5 years. That’s in the top quarter of the 42 car brands sold in the U.S.

On average, the 5-year cost to maintain a Kia is $2,167. That’s $500 more than Toyota, about $100 more than Honda, and nearly $100 less than Kia’s sibling Hyundai.

KIA models average around $8,442 for maintenance and repair costs during their first 10 years of service. That’s because more frequent and costly maintenance is typically required between 5 and 10 years of operation. This is more than the industry average for popular brands by $1,628.

There is also a 19.92% chance that a KIA will require a major repair during that time. This is 0.58% better when compared to the other auto manufacturers in this segment that we have studied.

See the complete breakdown of Kia’s cost of ownership expenses and Kia maintenance costs.

Kia’s transformation from a budget-friendly brand to a name that resonates with reliability is commendable. With continual improvements and a keen eye on quality, Kia is steadily carving a niche for itself in the automobile industry. As you contemplate your next vehicle purchase, Kia certainly deserves consideration.

Nationwide, Toyota has 39 days of inventory. It’s true that Toyota models are some of the fastest selling cars on the market today, but this is actually an improvement. One month ago, Toyota was stuck with just a 30-day supply of new cars. More inventory means more negotiability, and Toyota has introduced some pretty tempting finance and lease deals. Let’s take a look at Toyota’s inventory this month, and the best Toyota special offers right now.

New inventory for 2023 and 2024 Toyota models is increasing after a rough summer for the much-loved automaker. The following Toyota models all have higher inventory levels today than they did one month ago:

Toyota’s rising inventory is good news for car buyers, but the brand continues to have a tighter inventory than most automakers in America. Here are the five OEMs with the lowest new car inventory today. Car market inventory is commonly measured with market day supply. Market Day Supply (MDS) represents the number of days it would take to sell the current inventory at the present sales rate, assuming no new inventory is added.

You guessed it! Toyota is on the list:

| Brand | Inventory Days Supply |

|---|---|

| Honda | 34 |

| Kia | 37 |

| Toyota | 39 |

| Lexus | 56 |

| Subaru | 63 |

| Market Average | 74 |

As we approach the end of the year, Toyota is clearly more eager to sell vehicles as 2024 model year vehicles arrive on dealer lots. Rising inventory only adds to the urgency for Toyota dealers.

Right now, Toyota is offering competitive APRs in this high-interest auto finance market. These are Toyota’s special offers this month.

3.99% APR for 48 months

Offer applies to all trims, but excludes Camry Hybrids. The Camry Hybrid offer is currently 4.99% APR for 48 months. See details and regional offers at Toyota.com.

Browse Camry listings with local market data.

3.99% APR for 48 months

Offer applies to all trims, but excludes RAV4 Hybrids. The RAV4 Hybrid offer is currently 4.99% APR for 48 months. There are no offers advertised for the RAV4 Prime. See details and regional offers at Toyota.com.

Browse RAV4 listings with local market data.

2.99% APR for 60 months

Offer applies only to 4×2 models, and applies to 13 trim options. Be sure to check the details at Toyota.com.

Browse Tacoma listings with local market data.

3.99% APR for 48 months

This offer applies to all trims, but excludes the Corolla Cross and hybrid models. See details at Toyota.com.

Browse Corolla listings with local market data.

Here’s the Toyota finance and lease offer for every new Toyota model today. We’ve also included the latest nationwide inventory numbers.

| Model | Days Supply (September) | Finance Offer | Lease Offer |

|---|---|---|---|

| 4Runner | 60 | No advertised offers | $615 for 36 months with $3,265 due |

| bZ4X | 99 | 1.99% APR for 48 months | No advertised offers |

| Camry | 43 | 3.99% APR for 48 months | $388 for 36 months with $3,028 due |

| Corolla | 21 | 3.99% APR for 48 months | $407 for 36 months with $407 due |

| Corolla Cross | 34 | No advertised offers | $369 for 36 months with $3,019 due |

| Corolla Hatchback | 50 | 3.99% APR for 48 months | No advertised offers |

| Crown | 76 | No advertised offers | $543 for 36 months with $4,053 due |

| GR Supra | 62 | No advertised offers | $803 for 36 months with $803 due |

| GR86 | 40 | No advertised offers | $418 for 36 months with $3,038 due |

| Grand Highlander | 26 | No advertised offers | $631 for 36 months with $3,281 due |

| Highlander | 44 | 3.49% APR for 60 months | No advertised offers |

| Prius | 25 | No advertised offers | $368 for 36 months with $3,038 due |

| RAV4 | 34 | 3.99% APR for 48 months | $413 for 36 months with $3,028 due |

| Sequoia | 33 | No advertised offers | $915 for 36 months with $915 due |

| Sienna | 28 | No advertised offers | No advertised offers |

| Tacoma | 44 | 2.99% APR for 60 months | $433 for 36 months with $3,083 due |

| Tundra | 51 | No advertised offers | $641 for 36 months with $641 due |

| Venza | 56 | No advertised offers | $455 for 36 months with $3,055 due |

| Brand Total | 39 |

For local Toyota inventory data and deals (new or used), learn more about CarEdge Data.

Our Car Coaches have successfully negotiated Toyota prices dozens of times in the past month. Here are a few examples of what’s possible with negotiation prowess.

The CarEdge Team is ready to help you negotiate a great deal on your next Toyota. Connect with a Coach today!

In recent years, automotive recalls have become almost commonplace. Yet, when an automotive giant like Ford faces not one, but two investigations by the National Highway Traffic Safety Administration (NHTSA) into the adequacy of their recall remedies, it warrants concern. Here’s the latest on Ford’s recall investigation, and how you can check if your car is impacted.

Back in October 2018, Ford issued a massive recall for over 1.2 million 2012-18 Ford Focus sedans. The prescribed solution was for dealers to reprogram the powertrain control module and, where necessary, replace the canister purge valve.

However, a second recall was initiated in July 2019. This covered approximately 57,000 2012-14 and 2017 Focus sedans, which, although included in the 2018 recall, did not get the intended powertrain control module update.

Now, the NHTSA is probing whether Ford’s recall solutions effectively addressed the underlying problem. Auto News reports that they’ve received 98 complaints from consumers regarding failure of the canister purge valve in the 2012-18 Focus models. Some of these vehicles had already undergone the recall remedy, whereas others had never been recalled but displayed the same defect. This has raised suspicions that Ford isn’t adequately addressing recalls. Whether this has been due to Ford’s internal policy or mere accident is up for debate.

A separate investigation is now looking into the 2018-21 Ford EcoSport vehicles. This came in the wake of 95 consumer complaints about engine failures due to a sudden loss of oil pressure. In a particularly concerning report, a vehicle owner stated the oil light came on even when the oil was full, leading to engine malfunction. This isn’t a cheap fix, either. The severity of the issue is such that it often requires a complete engine replacement.

In response to the unfolding events, Ford spokesperson Maria Buczkowski assured that Ford is actively cooperating with the NHTSA’s inquiries.

Recalls, although common, are usually decisive and efficient solutions to potential safety risks. What makes this situation exceptional is the frequency of Ford’s recalls. Not only has Ford topped the recall charts for the past three years, but 2023 alone has seen the company issue 44 recalls, affecting a staggering 4.6 million vehicles.

Is Ford’s recall a big deal? This is not the first, but the second time that Ford has faced an official NHTSA recall investigation this year. Automotive News reports that in August, the NHTSA announced that it was looking into Ford’s handling of a recall for 2022 Ford Mustang Mach-E electric SUVs. The 2022 recall was meant to address sudden power loss in 50,000 Mustang Mach E’s.

These five automakers have the most recalls in 2023:

According to new NHTSA stats, Ford issued 67 recalls in 2022. In 2022, Volkswagen had the second highest number of recalls, followed by Daimler Trucks North America and Chrysler.

With recalls being a pressing issue, one has to wonder about the root cause. Ford’s CEO, Jim Farley, has not shied away from acknowledging the elephant in the room. He’s openly admitted to quality control being a significant concern and has promised to prioritize fixing these issues. Farley has been quoted saying, “Fixing quality is my No. 1 priority,” but also cautioned that resolution will be a gradual process, spanning several years.

Perhaps having not one but two open NHTSA investigations will hasten the pace of Ford’s long-term solution for the quality control that plague the company.

The average auto loan rate has reached highs not seen in 40 years. New and used car loans are becoming more expensive, and that’s not likely to change anytime soon. We’ll delve into the latest data from Cox Automotive to better understand the true cost of buying a car today, revealing some notable trends along the way.

Buying soon? Take this auto finance cheat sheet with you.

The latest numbers from Cox Automotive show just how expensive car loans have become. The average new car interest rate is now 9.95%. One year ago, this figure stood at 7%. Step back to 2021, and the average new car loan APR was around 5%.

In early 2024, new car loans with 0% APR constitute a mere 2.4% of the market, a major drop from one year prior. Low APR car loans, those with an APR under 3%, now represent 10.4% of the market. This marks a slight increase as holiday year-end car sales continue. However, low interest rate loans previously accounted for over 35% of new car loans in early 2022.

Knowing that the average transaction price of a new car sold last month was $48,451, we can calculate how much interest car buyers are signing up for when they make a purchase. This is a GREAT way to wrap your head around the TRUE cost of a car loan.

We always recommend putting 20% down when buying a car. This helps you avoid the risk of becoming ‘upside down’ on your loan, and means you’ll pay less in total interest. Let’s say today’s average buyer puts 20% down, and takes out a loan for the remaining balance ($38,761) at today’s average APR of 9.95%.

With a 60-month car loan, the average car buyer would pay a total of $10,595 in interest. In other words, the new car wouldn’t cost $48,451. After five years of payments, the car actually costs $59,046.

Pre-owned vehicles may have lower sticker prices, but the cost of financing one is much higher. In October, the average used car APR was 13.94%. That’s significantly higher than where rates stood a few years ago, when 9% APR was the norm.

Used car prices are still high. Each year, Cox Automotive tracks the annual decline in three-year-old used car values. You’d expect a 2020 model year used car to end 2023 worth a lot less than it began the year, right? Used car values have been declining more slowly than in years past. This is good news for those looking to sell their cars, but bad news for buyers.

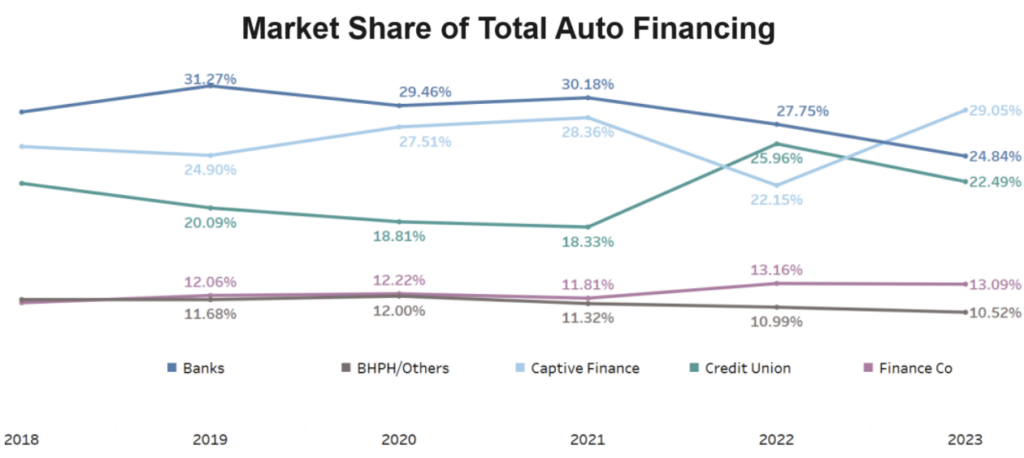

After years of surging popularity, credit unions and banks are losing auto loan market share. Car buyers are increasingly taking advantage of the best manufacturer financing incentives to secure the lowest rate. This sends more business to captive financing.

Here’s a look at how car buyers are financing in 2024, courtesy of Experian:

Captive financing is not inherently undesirable, as long as you get the best rate possible. Captive financing simply refers to loans provided by a subsidiary of the manufacturer, such as Hyundai Motor Finance, or Toyota Financial Services.

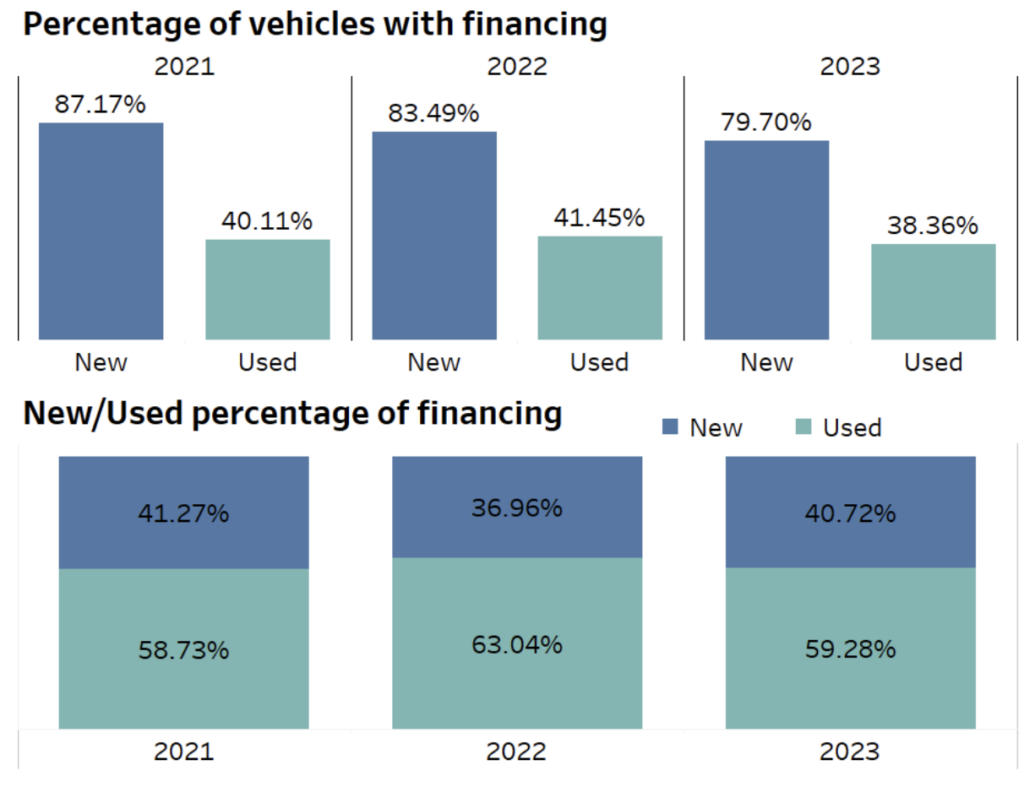

Cash is king in 2024, as it was last year. Fewer buyers are financing their cars as the cost of borrowing soars. Here’s a look at the latest stats, again courtesy of Experian:

In Q2 2023, 79.7% of new cars and 38.4% of used cars were financed. This is in comparison to last year’s figures of 83.5% for new car purchases, and 41.5% for used cars.

A concerning trend is the sidelining of consumers with lower credit scores from the used car market, largely due to persistent high auto finance rates. Subprime and deep subprime used car loans now make up just 22.04% of the market, down from 29.96% in 2020.

It’s crucial for today’s car buyers to know what they’re getting into when signing on the dotted line. Auto finance rates haven’t been this high in two decades. Many drivers are experiencing higher monthly payments driven by soaring interest rates for the first time. Those who are caught off guard are more likely to become delinquent, and may become the target of a vehicle repossession.

Stay informed and secure the best deal when you buy your next car with expert insights. Try CarEdge Data for behind the scenes market analysis. Looking for personalized help? Work 1:1 with a Car Coach to save the most, or have a quick chat when you schedule your first Consult call.

Buying a car doesn’t have to be miserable. Let us know how we can help you score big wins with your next ride!

The last time a car commercial grabbed your attention with an attractive lease deal, you were probably bombarded with a flurry of rates, payments, and terms squeezed into a mere thirty seconds. So, what exactly is a car lease?

An auto lease is a long-term rental agreement for a vehicle, governed by specific terms and conditions. The lease terms are mutually decided by the customer and dealership. Intriguingly, a third-party leasing company takes actual ownership of the vehicle and then leases it to you.

Let’s dissect a vehicle lease agreement into its four primary components:

These core factors dictate the overall cost of the lease, subsequently influencing your monthly payment.

Let’s take a closer look at each of these four parts of an auto lease. Once we’ve covered the basics, we’ll familiarize you with the parts of a lease contract, so you know exactly what you’re getting into. Skip ahead to the example here if you like.

The cap cost diverges from the out-the-door price, which integrates the vehicle price with all taxes and fees. Instead, you negotiate the cap cost during a lease, representing the sum the leasing company pays for the car. This figure typically includes:

It’s important to note that some of these expenses, like security etching or nitrogen-inflated tires, are negotiable. To provide context: a $1,000 increase in cap cost approximates to an additional $27 monthly on a 36-month lease.

Before committing, scrutinize every detail of the buyer’s order, distinguishing legitimate fees from the negotiable ones.

We’ll take a look at the parts of an auto lease contract in a bit, or you can skip ahead to it here.

This value mirrors the car’s projected worth at the end of the lease. Depreciation during the lease term is what you’re paying for. If, for instance, the residual on a 36-month lease stands at .75 (75%), you’re essentially covering the 25% anticipated depreciation over that period.

Residual values, set by the leasing company, vary depending on the yearly mileage you’re permitted (standard figures being 7,500, 10,000, 12,000, or 15,000 miles). Dealerships cannot modify these values, with the sole exception being adjustments for additional allowed mileage. This residual is disclosed, highlighting what you’d need to pay if you wish to purchase the vehicle at the lease’s end.

Similar to an interest rate on a car loan, the money factor can be marked up, benefiting the dealer. Dealers typically receive a money factor (for instance, .00125) from a lender, and might mark it up by 50 to 100 basis points. The disparity between this base rate and the marked-up rate translates into profit for the dealer.

Pro Tip: Always aim to haggle the money factor close to its buy rate.

Sales tax varies state-by-state. See your state’s tax rates here. While most states append the tax to the lease’s total price, others like New York, New Jersey, Minnesota, Ohio, and Georgia impose it upfront on the overall lease payments. Virginia, Maryland, and Texas, on the other hand, tax the total selling price (cap cost). Though non-negotiable, understanding your state’s tax nuances is crucial for understanding what you can afford in any car deal.

At CarEdge, we’re always working on something new to help demystify car buying, car selling, and ownership. If you’re considering a new car lease, estimate your monthly payment in seconds with our latest free tool: our car lease calculator.

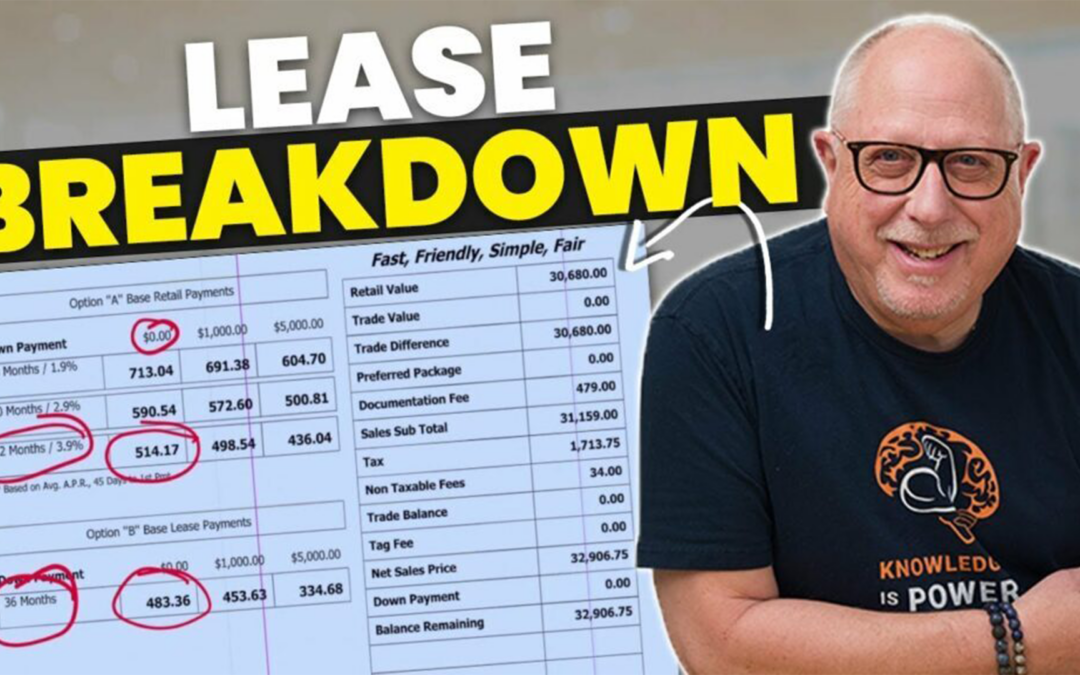

There’s no better way to learn than to work through a real example. That’s exactly what we’re about to do by breaking down the parts of a real auto lease contract.

In this image, we can see the first few lines of a lease contract. Expect this portion to contain the contact information for you and the lessor, who is the dealer. There will also be information about the specific vehicle you are leasing. Make sure the VIN number matches the car you want! If you have a trade-in, that information will be listed here too.

The next part of your vehicle lease agreement includes some very important information. First, check the ‘Amount due at lease signing’, which is box #2 in our example. Does it match the deal you’re expecting?

Now let’s move on to box #3. Check the box for the remaining months of payments after the first payment. This number should say 23 if you’re signing a 24 month lease, 35 if you’re signing a 36 month lease, and so on. This is how you confirm that you’re getting credit for the first month’s payment, which is due at signing in most cases.

Below that, you’ll see an itemized list of what you’re paying at lease signing. Pay attention to the details in section 6.

You should see the license, title, registration and tax fees listed. You’ll also see the Doc Fee, which varies by state.

Pay careful attention to the line items that may be dealer add-ons that you don’t want. In section 6 in our example, lines A.11 through A.13 are where we would see this.

Section 6.B line #2 is where you would see any rebates or incentives you’re expecting. If you’re expecting an electric vehicle tax credit, for example, it should be shown here.

Now, make sure the ‘Total’ number equals what you expect.

The above section explains how your monthly payments are calculated. It can be tough to follow, but we’ll highlight which parts are most important to double-check.

Section 7.A is the total price of the vehicle, which should be MSRP, or ideally discounted from MSRP, plus any additional fees you agree to.

In this example, the total price includes the agreed upon selling price of $57,409 plus the acquisition fee of $650 and the electronic filing fee of $33 for total price of $58,092.

Double check this number. If the gross capitalized cost is higher than you’re expecting, find out why. Is there a dealer markup on the vehicle? You’re paying more than you should if so.

What is a ‘rent charge’, you ask? The rent charge is the total interest that is paid during the term of the lease. The rent charge is based on the agreed upon money factor used in the lease calculation.

Ensure that the allowed mileage matches what you expect. Learn what the excess mileage rate is if you exceed the limit.

Towards the end of this section, you’ll see the ‘total monthly payment’. Is this what you expect? This is how much you’re agreeing to pay every month.

You need to make sure that the discounted selling price that you negotiated matches line A in section 11. Section 11 line B will also list any accessories or options that you have agreed to be added to the selling price, such as excess wear and tear protection, tire and wheel insurance or even a service contract. Please make sure that nothing has been added that you have not agreed to.

Read the first line in bold. You do NOT have to purchase add-ons or protection products to enter into the lease. No matter how hard the salesperson pitches their value, remember that you can say no. If you do agree to any, they should be listed here.

The total taxes to be paid for the lease are included. Make sure this number is what you expect. Taxes and state fees are estimated because if the state increases the sales tax rate or vehicle registration rates during the term of your lease agreement you will have to pay the new rates and fees.

Below these first few pages of the car lease agreement, you’ll have standard disclosures for your auto insurance policy information, vehicle warranties, and additional terms and conditions. Wondering what happens if your leased car gets stolen? You’ll find that information here.

Every week, our team of Car Coaches helps hundreds of drivers negotiate the best lease terms. It’s a commonly held misconception that leases aren’t negotiable, but that’s far from the truth. With basic knowledge of how to navigate an auto lease contract, you can stay in control of your deal.

Ready to work with an auto industry insider for the most savings? Here’s how we can help.

We also have hundreds of free resources, including these reader favorites:

Stop by the CarEdge Community forum! We’d love to see you there.