CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

“I got a great deal.”

“How do you know?” I asked?

“Well, I negotiated over $2,000 off the original price, so I’m pretty sure I made out well. Didn’t I?”

After doing this for as long as I have, it doesn’t take long to burst someone’s bubble.

“Maybe you did… I know when I was managing dealerships I told my salespeople that they needed to be ready to lower the price three time during a negotiation — the customer always likes to win three times, then they’ll buy the car.”

I don’t take pride in bursting their bubble, it just comes with the territory at times.

“So, in your case, that $2,000 you shaved off the price is certainly some hefty savings, but I’d venture it was baked into the price they initially quoted you.”

The look on my son’s friend’s face was starting to sour.

“Don’t fret though, I’m sure they only made a couple hundred or maybe a thousand dollars off your deal, it’s just there may have been more room to negotiate.”

In today’s internet era, you may feel like you know how much wiggle room there is to negotiate on a new car, but at the end of the day, as a consumer, it’s hard to really know. Sure, tools like Kelly Blue Book can help you understand what a car is worth, but KBB and others miss out on vital pieces of information (such as manufacturer incentives, how long a car has been on the lot, and more).

When it comes to knowing how much you can negotiate on a car purchase there are 3 vital pieces of information that I always look for, and if I were you, I’d do the same.

Let’s explore each one of these.

You might also enjoy this article if you haven’t read it already: How Much Do Dealers Markup Used Cars?

The window sticker is the Manufacturers Suggested Retail Price, hence MSRP. What you need to find out is the percent of margin built into that MSRP. For example, for many less expensive cars (Toyota, Hyundai, etc.) the percent of margin (markup) might be very little, as little as only 2 or 3% of the MSRP.

It’s important to understand that the dealer buys the car from the manufacturer at the invoice price, and then lists the car for sale at or near the MSRP price. This is the retail price.

That means a car with an MSRP of $18,000 might only have $360 of profit built into it.

👉 Get the window sticker for free (don’t let others charge you for this!)

Generally speaking, and as a rule of thumb, the more expensive and luxurious the car, the more margin is built into the retail price. Where an $18,000 car may only have $360 of profit built into it, a $100,000 car may have as much as $10,000 in margin.

How can you determine what the dealers mark up on a car is? Unfortunately, it isn’t an exact science because it changes from car to car and dealer to dealer. However, you can use the guideline of 2 or 3% on less expensive brands, and 5 to 10% on luxury brands as a rule of thumb.

Regardless of if you’re buying a Kia or a Mercedes, the reality is there isn’t too much room to work with when just looking at the mark up. This is where factory incentives come into play.

Dealer incentives (also commonly referred to as factory incentives) are put in place by the manufacturer and allow for greater price flexibility because they artificially inflate the margin on any given car. The percent of margin in new cars can range from a low of 2% to as high as 15%, including all incentives.

The internet is a wonderful tool for finding information on incentives for particular cars. Bear in mind that there can be two types of incentives; customer incentives and dealer incentives.

Customer incentives range from rebates to special loan interest rates. Rebates can be as little as $500, or as much as $10,000 depending on the brand and the model. Other customer incentives can take the form of recent college graduate programs or active military or retired military and first responder programs.

There can also be hidden incentives based on who you work for or where you graduated college. Always ask the dealer about these types of programs and incentives, because it doesn’t cost them a dime! These programs and offers are usually through the manufacturer, so the dealer has no reason not to assist you here.

Customer incentives are relatively easy to learn about. Manufacturers actively market their recent college graduate programs, and websites like Edmunds.com keep track of constantly changing rebates and incentives.

Dealer incentives on the other hand are much harder to know about, and they can greatly affect how much you can negotiate on a new car. Manufacturers have monthly, quarterly, and even annual sales incentives for their dealers.

You need to understand that manufacturers have one objective, and that is to sell as many cars as possible. Many manufacturers are public companies. That means that each quarter they need to share their finance metrics with shareholders. Shareholders want to see that manufacturers are growing and selling more cars.

With that understanding, it’s easy to see why manufacturers put sales incentives in place for their dealers. Manufacturers need dealers to move as many cars as possible so that the manufacturer’s shareholders are excited about the brand’s growth.

Dealer incentives are quite significant. For example, a BMW dealership that hits their monthly sales incentive could receive $50,000 to $200,000 from the factory depending on their sales volume.

Obviously this means the dealer will be happy to lower the price on a car so that they get the kickback from the manufacturer. Use this to your advantage! Always ask the dealer how close they are to hitting their goal, if they need one or two more sales to get there, guess who just picked up some leverage? Yep, you!

The third criteria to know how much you can negotiate on a new car is how long the vehicle has been sitting on the dealers lot. The age of a car, and specifically how long it has been at a dealership can drastically affect a dealers willingness to discount a car.

If you’re looking for the car with the most “wiggle room,” then ask the dealer for the oldest inventory.

You might also enjoy this article if you haven’t read it already: What Happens to Unsold New Cars?

The reason for this is quite simple, the longer a car sits on a dealer’s lot the more it costs them (we talk about carrying costs in this post). This increases the dealers incentive to sell the car, and ultimately to save you more money.

By showing your interest in their oldest car, you’ll immediately get their attention. Make it clear you’re willing to entertain the “old” car if they make the price less than a younger (a similar car that has spent very little time in inventory). I can assure you from my 42 years of experience, they’ll be happy to do this for you.

Cars, unlike fine wines, don’t necessarily get better with age. Dealers want “old” cars gone! That gives you leverage, and getting a good deal is all about leverage.

So, now that you have some inside information you should feel more comfortable negotiating your next car deal. However, if you are like the majority of people that just hate to have to deal with this type of negotiation, there is help for you. Learn more about buying with CarEdge. We do the negotiating for you, and have your car delivered to your door.

👉 Check out this month’s best new car incentives (0% APRs, lease deals, and more!)

It’s always upsetting to learn that someone’s overcharged you for something. When I was asked “What can you do if you’re scammed by a car dealership?”, I knew I had to answer it.

Legitimately, if you’ve signed all the documents, completed your purchase, and driven your new car home, legally, in most jurisdictions, there isn’t much of anything you can do. In the eyes of the law, you’re the owner of that car. That doesn’t mean there aren’t practical steps you can take to try and resolve the issue, however.

If you feel that may have been taken advantage of, overcharged, or outright scammed, here’s the steps I would recommend you take.

Once you’ve realized something fishy happened, you may want to immediately call your salesperson. I wouldn’t recommend doing that. The salesperson isn’t going to be able to do anything to help resolve this issue, and they probably won’t want to if they did something nefarious.

You’ll want to talk to the sales manager, or better yet, the general manager (GM). When you do get through to a manager, the first thing you should try and do is appeal to them to “do the right thing.”

Don’t threaten or yell at the GM. In my 42 years in the car business, rarely did I see this tactic pay off. Car people are real people, just like you and me. They have families, and friends, and they can be swayed to help people in need.

Start out by approaching them as a human being and appeal to them on a human level. Ask them to do what is morally right. You might frame it exactly like that by saying something along the lines of, “Rarely in life can we make a wrong right, but now is one of those opportunities.” If you were legitimately scammed by a dealer, this tactic should work.

Be prepared to explain what the issue is and provide what you think would be a fair solution. The last part is critical. Come prepared with what you think would be a fair resolution to the problem.

By providing a solution, you are showing the GM good faith. This will encourage the necessary conversation that will ultimately lead to an acceptable resolution for everyone involved.

My experience has shown that this type of approach usually leads to a reasonable resolution. Personally, and during my 42+ year career in the car business, I am (and always was) more inclined to help a friendly person solve a problem than a screaming, threatening person.

Do you ever wonder how much car dealers mark up used cars? You might enjoy this article if you haven’t read it already: How Much Do Dealers Markup Used Cars?

If presenting your issue to the general manager doesn’t resolve the problem, your next best bet would be to contact the managing partner, dealer principal, area vice president or the owner of the dealership.

I can tell you from experience that if I couldn’t resolve a customer issue at my level, and it made it up the ladder to someone of greater authority, they were going to do whatever they had to do to make the problem go away. The dealer principal, vice president, or owner is too busy with other things to really want to deal with you. Use that to your advantage!

When I worked for the Penske organization, we had a regional VP that always reminded us that if a customer issue ever reached him, he would do whatever he had to do to make the customer happy. His advice to us (his managers) was to simply handle the issue at our level so he wouldn’t have to.

With that being said, if you weren’t able to resolve the issue with the general manager, do your best to talk to the next level of authority. They’re likely to do whatever it takes to “make the problem go away,” and considering you want a fair resolution, this is one way to get it. At most dealerships you can identify this person on their website. If you can’t, call the receptionist and ask.

What if “talking it out” doesn’t work? Do you still have options if you were scammed, overcharged, or taken-advantage of by a car dealership? The answer is yes.

You can contact the Better Business Bureau, your state’s Consumer protection Office, or even the Attorney General’s office. These three options could be time consuming. However, the Better Business Bureau would try to broker a resolution in a more timely manner than the other two would.

The Office of Consumer protection and the Attorney General’s office generally want to see a pattern of abuse by a dealership before taking action. You may need to wait years for enough complaints to be filed before they will do anything. This is frustrating, but it’s the reality of the situation.

The court of last resort, so to speak, is social media. There are any number of sites where you can post a review of the dealership and share your experience. Once again, do it in a respectful manner, no name calling, no shouting, no threats, as Sergeant Joe Friday from the old TV show Dragnet would say, “just the facts ma’am, just the facts.”

Although it may feel “good” to write out a diatribe, do your best to be succinct and factual in your online review. This will more than likely elicit a positive response from the dealer management. Dealers want to protect their online reputation. This means they’ll usually want to make amends for their wrongdoing to encourage a more positive review from you.

So what should you do if you’re scammed by a car dealership? Whether be an overcharge, a bait and switch, or something in between, realize that you might not have legal standing for your issue, but you do have options as to how to address it. From my experience, these are the avenues I suggest you travel if you ever find yourself feeling taken advantage of at a car dealership.

Ready to achieve more than simply avoiding scams, and outsmart the dealerships altogether? Enroll in Deal School now—CarEdge’s online, completely free car-buying course. Gain the insider knowledge to take charge of your purchase. Start mastering your deal today! It’s FREE HELP!

America runs on credit. Odds are, when you step foot in a car dealership you’ll need to be prepared to fill out a form or two that let the dealer check your credit score. However, many people don’t know what credit score car dealers actually use.

Unlike your traditional FICO score, car dealers — more accurately lending institutions that sell auto loans to dealerships — refer to another, less known score, called The FICO® 8 Auto Score, or its competitor CreditVision. To answer the question “What credit score do car dealers use?” We need to learn more about both of these products.

Fair Isaac Corporation (FICO) is a publicly traded data analytics company. You’re most likely familiar with their FICO score.

FICO offers specific products and solutions for car dealers and auto loans. Their product is called Auto Score 8. As you can see here from FICO’s promotional materials, Auto Score 8 is meant to help dealers assess credit risk and make approval decisions for auto loans. To answer the question ‘What credit score do car dealers use?” We need to dig into Auto Score 8, as it is in the industry standard credit score for auto loans.

Similar to your normal FICO score, you can request a copy of your current Auto Score from FICO for a fee.

What you really need to understand is that your Auto Score is calculated similarly, but differently than your traditional FICO score. The score range for the Auto Score is 250-900 (instead of the traditional 300-850). FICO promotes that Auto Score will help dealerships and lending institutions in five distinct ways:

FICO does not have a monopoly on the credit score market. There are other data analytics companies out there that want a slice of the pie.

TransUnion offers a product called CreditVision, which competes directly with FICO. Although CreditVision is not specific to car dealers or auto loans, it is important to mention here. When it comes to understanding what credit score car dealers use, CreditVision is important to be aware of.

TransUnion does offer dealer specific solutions that you should be aware of. This 2018 marketing video helps you get an understanding of what they provide dealerships with.

The main draw of CreditVision is the products ability to look at alternative credit data when calculating your score. Alternative credit data can include:

Regardless of if a dealership is using FICO® 8 Auto Score or CreditVision, my experience has taught me that there are three things that the banks and credit unions look at to determine your creditworthiness. They are, ability, stability and willingness.

Ability is defined by how much you earn and how much you payout on a monthly basis. In other words, do you have the ability based on your income to direct a certain percentage of that towards things like housing costs (mortgage or rent payments), car loans, and credit card payments?

Banks usually don’t want your debt payments to exceed more than 35 to 40% of your gross income. Say you earn $5,000 gross a month before taxes and deductions. The maximum amount of money banks would want to see you spending on debt is $2,000 per month.

This includes housing, cars and credit cards.

When you go to the dealer, ask yourself, “Do I have the ability, based off of what I earn and my current obligations, to take on additional debt?” That’s the question the dealer is asking themselves!

Stability is how long you have lived where you live, how long you have worked where you work, how long you’ve been employed in your line of work, and many other things of that nature.

Have you had three different addresses and four different jobs in the last three years? If you have, that would not show a bank stability. If you’re constantly moving and you’re having difficulty keeping a job for an extended period of time that could be a “red flag.”

Stability for the bank is someone who has resided at the same address for three years or longer, has been employed by the same employer for three years or longer, or has been employed in the same field for an even longer period of time.

Perhaps you’re a real estate agent and you’ve been in that line of work for 10 years. You’ve been with your present employer for three years, and you’ve lived at your current address for five years. That to a tee is stability.

You don’t move a lot, and you’ve been working in your industry for 10 years. To a car dealer or a bank, you don’t represent a big risk. If you have stability, you’re potentially the type of customer they are looking for, but that all depends on the last factor; willingness.

Willingness, is how you have handled your past debt obligations; mortgages, car loans, credit cards, phone bills and the like.

Have you paid them on time all the time or just some of the time? Have you paid them off ahead of schedule or did you fall behind schedule? If you fell behind schedule, how often did that happen? Did it happen once in three years or did it happen a dozen times in those three years?

Willingness signals to the bank exactly what kind of risk your loan poses to them.

If all of your accounts have always been paid on time or early, you are more than likely to get a loan quickly and easily because you pose little risk to the bank. If however you have a track record of paying your obligations off late, you immediately become riskier for the bank.

This generally translates into paying a higher interest rate. If the dealer or the bank is going to take the risk, they want to make money off of it. The greater the risk (less willing you’ve been in the past) the higher your rate of interest.

Now that we’ve answered the question “What credit score do car dealers use?” And we’ve addressed the three factors that influence your credit score, let’s discuss what credit score you actually need to buy or lease a new car.

In order to lease a car, you need to convince the leasing company that you’ll be able to make your monthly payments for the full time period of the lease. Unlike when you buy a car, leasing entails no ownership responsibility. In that regard, leasing is similar to renting an apartment. Each month the landlord expects payment. The same goes for your car lease.

620 is a minimum score you need to secure a lease. Below that, when you reach subprime credit, your chances of convincing a leasing company to “rent” you a vehicle become very challenging. This isn’t to say it’s impossible, however it certainly won’t be at an attractive price point.

A credit score in the Prime range will yield more favorable terms.

Unlike leasing, when you buy a car you become the individual holding the title. It’s relatively rare that someone comes into a dealership with cash and pays for a car upfront. With interest rates as low as they are, it really makes no sense why anyone would do that.

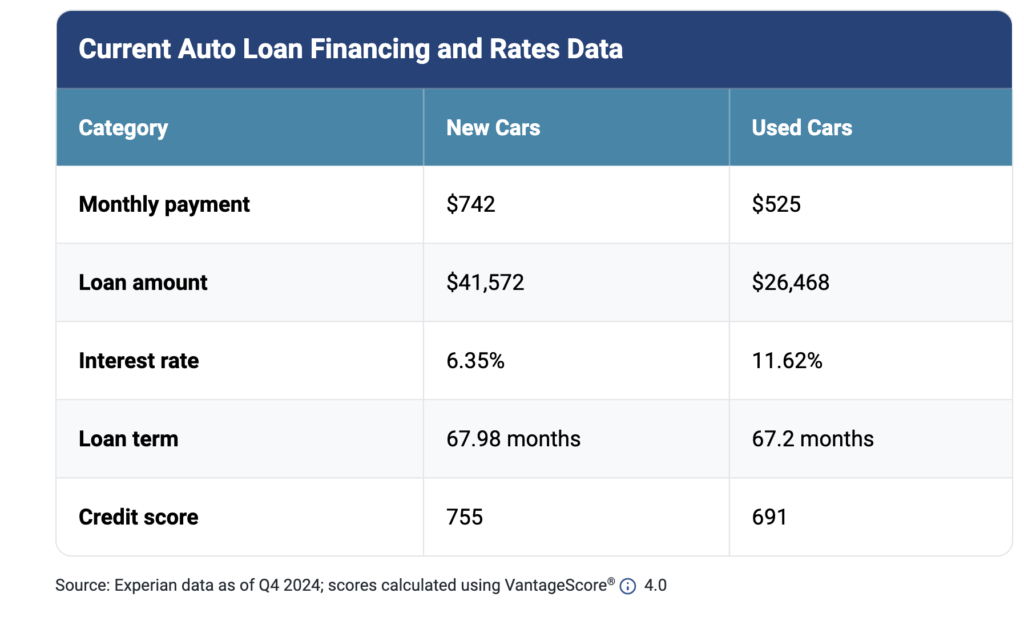

That means you’ll be financing your car. Nearly anyone can receive a loan on a car. The challenge will be getting the best rate possible. As your credit score decreases, the loan interest rate increases. In 2024, it’s common for borrows with ‘sub-prime’ or ‘deep-subprime’ credit to only qualify for rates over 15% APR. The worst auto loan rates are over 20% APR. How do you avoid these VERY costly interest rates? Work on raising your credit score, and having a sufficient income-to-debt ratio.

What is the moral of the story? If you want to get a car loan with little to no hassle, you need to always pay your loans, utility bills and credit cards on time. By doing this you will assure yourself the continued availability of credit at the best and least expensive rates and terms.

So always remember that banks are looking for your ability to repay your loan, the stability you have shown in your career and how often you have moved and how willingly you have paid back your past credit obligations. Ability, stability and willingness. These are the keys to good credit.

Do you ever wonder why car dealers are always trying to buy your car? It has something to do with how much dealers markup used cars. There is a lot of money to be made in used cars.

In my career, I’ve seen many different ideas about what the markup should be for a used car. There are many factors to consider. Let’s breakdown how dealers determine their price for used cars, and how much markup they apply to come up with the selling price.

Where to start? With a quick history lesson.

In the old days (you have to remember, I spent 42 years in the car business),pricing in the good old days was simple, easy, and best of all, it worked.

When a customer would walk in we knew how much profit was in the list price. We’d negotiate, and end up selling the customer their used car with a profit of $1,000 or $2,000. The best part was, the customer felt like a winner because they negotiated us off of our original price, and we made money.

Today it’s completely different. Today’s car buyers have access to more information before they walk in.

On the other side of the deal, car dealers today have software that helps them determine how much a car is worth. These software programs are complex. They tell dealers what they should price each used car at in relation to similar cars in the market so that they’ll sell. They can even take into account geographic and seasonal differences between dealerships.

Pricing for profit isn’t the primary concern for most car dealers. Even more important than profit nowadays is how quickly a dealership can turn its inventory. Turn is the term used to describe the amount of time a car sits on a dealers lot before it’s purchased by someone.

For many dealers (especially the big ones), the idea is to sell or turn your inventory within 60 days of acquiring it.

Many stores have strict aging policies for their used cars. If a used car doesn’t sell within 60 days (or at the max 90), off to the auction it goes. The dealer will sell a used car at auction and replace it with a different car that they think will sell within the 60 to 90 day timeframe. For most dealers, it’s important to turn your inventory as fast as possible. As a car sits on the lot, its actual value is declining. From the dealer perspective, what was worth $10,000 when you traded it is now worth $9,000 90 days later.

The longer a car sits on the lot, the lower the selling price becomes.

Most dealerships work on a strict 60 to 90 day policy for their used cars. This means they’re adjusting a used cars price downward every 10 days to try and sell the car.

There is even software that tracks how much interest a used car gets and changes the list price in realtime. Dynamic pricing decisions occur on an almost daily basis.

As much as the market will bear for that model. With that advent of sophisticated software platforms and “big data,” we’re seeing more and more dealers allowing algorithms to set prices, rather than human beings.

Last year, one iSeeCars survey showed that 31% of car buyers are paying over MSRP for new cars. At the used car level, it’s harder to collect similar data, but just imagine the markups running rampant.

That being said, the average used car markup today is probably about $2,500. Hard to find specialty cars (Ferrari, Lamborghini, McClaren and others), or models in short supply could (and should) be much higher. But, for your run of the mill used car, expect the dealer to have a $2,500 markup in the price. Remember, to get the best deal, you’ll want to find one of the older cars on the lot!

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

At the end of the day, what’s most important to nearly everyone on this planet (after health, family, etc.), is money. Maslow’s hierarchy of needs tells use that after our psychological needs are met (food, water, shelter, etc.) we move on to our safety needs (personal security, employment, resources). Without a doubt, that means earning an income is a top priority. That begs the question, how much can a car salesman make?

In any given year, I managed salespeople that have well out-earned me (earning multiple hundreds of thousands of dollars). I’ve also managed salespeople that barely made a living at all.

In sales, it’s pay for performance, and for the car salesman, it’s no different.

Here’s how much a car salesman can make.

A car salesman’s income is tied directly to their effort and their skill level. For example, someone new to the business who is just starting to learn their craft might find themselves on a salary based pay plan for the first 90 days. This fixed pay plans would guarantee monthly earnings of $3,000 or so for the first three months on the job. After 90 days, pay plans for car salespeople generally go to commission only, although more and more dealerships today are developing hybrid compensation plans that include a salary plus commission, with the hope of encouraging more college educated people to consider a career in the retail automobile business.

How hard the salesperson works on developing their skills (either through available training or through practice talking with customers) will directly correlate to how much they make. Sales professionals are like athletes (bear with me here), in that they have to practice to continually improve. There’s a saying that amateurs practice to get it right, while professionals practice so that they’ll never get it wrong. Top car sales professionals always practice and rehearse so that they can make sure they “never get it wrong.”

You might enjoy this article if you haven’t read it already: What to Do If You’re Scammed by Car Dealership

Those who don’t practice or work on their skills (or those who sit aimlessly at their desk waiting for a customer to come in — the sad reality is that this represents the work ethic of a lot of car salespeople nowadays) as opposed to proactively seeking out customers, will usually find themselves at the very low end of the pay scale. This means they could be earning between $2,000 to $3,000 a month. I hate to categorize them as “bad” salespeople, rather they’re unmotivated salespeople, but the fact still remains, they’ll only be earning a few thousand dollars each month. Any aspiration of earning six figures or more each year is hard to come by for this group of salespeople, they’re lucky to make more than $40,000 annually.

An average salesperson, and by average I mean someone who sells around 8 cars a month, will make between $3,000 to $4,000 a month. Above average sales people, those selling between 10 to 12 cars a month, will earn somewhere between $4,000 to $6,000 a month. Selling 8 to 12 cars a month certainly isn’t going to make you rich, but it can provide a steady income stream. Plus, the jump from “above average” salesperson to “superstar” can represent a huge increase in earnings, one that almost certainly will cross the six figure threshold.

Top producers (of which there are very few), who are capable of selling between 25 to 50 cars a month will generally find themselves earning $150,000 to upwards of $500,000 or more annually. As someone once said, “that’s not chicken feed, that is some heavy duty money.”

Oh, and you don’t need a college degree in order to earn it, you just need to work on your craft (take advantage of training, never believe that there is nothing left to learn, utilize social media to create your own brand, and always practice and rehearse your sales techniques), and put forth the correct effort. The “correct” effort is staying in contact with your existing customer base and always remembering that all of your contacts with them are about them and not about you.

The most successful automobile sales people I know understand that nothing happens without first connecting on a human level with your customer and always maintaining that type of connection into the future. Building relationships (ie trust) takes time, and in sales it’s easy to lose sight of this. A lot of new salespeople like to focus their energy on the next sale. The salespeople I worked with that earned over $500,000 per year liked to focus on building lasting relationships (and getting referrals from) their existing customers. If you want to make more than six figures as a car salesman, this is one path to do it.

So there you have it, car salespeople’s earnings can range from not much, all the way to “you’ve got to shitting me, I didn’t know that you could make that type of money.” That is what makes the car business so great!

Over my 42+ years in the retail car business, I’ve seen too many different types of salesperson compensation plans. At each stop in my career, each pay plan had one thing in common — they were structured to keep the total salesperson’s compensation within the industry benchmark of 18 to 22% of expenses (more on that here).

Most comp plans (98%) fall within those industry benchmarks. So whether a salesman earned 35% of gross profit or 15% of gross profit on a deal, because of other factors involved, the compensation never really exceeded the 18 to 22% benchmark.

How could that be? Easy, every comp plan has things baked into it that lower what part of a sale’s gross profit is commissionable. For instance, most pay plans have a thing called “pack.”

Pack is a predetermined dollar amount that will be subtracted from the deal’s gross profit before the commission is calculated. Pack is utilized to cover such dealership expenses as advertising, inventory management software, utilities and non-revenue producing employees, such as administrative and accounting staff.

The greater the stores expenses are, the larger the pack will be.

As an example, in a store where the salesperson’s commission is set at 35%, the pack might be $1,500. That means that $1,500 is subtracted from the gross profit every time the salesperson closes a deal before the commission is calculated.

In a store where the commission is set at 20%, the pack might only be $500, but when everything is all said and done, each of those store’s sales comp would end up falling within the industry benchmarks of 18 to 22%.

What is truly interesting is that when everything is calculated into a salesperson’s commission (percentage of gross profit, unit bonuses, bonuses from the manufacturer for selling certain models, or hitting individual goals), the average commission for selling a car usually ends up being between $400 to $500. I don’t know why that is, I just know that over 42 years that’s what it would end up being for most of my salespeople.

The other interesting kicker is that most luxury brands tend to produce slightly higher commissions. This is simply because the gross profits tend to be higher as compared to volume brands like, Chevy or Toyota and say, Honda.

I remember working in a Pontiac store (yes, Pontiac was a brand) in the mid 1990’s, where I had two salesmen who each earned in excess of $150,000 a year (selling Pontiacs), while I, as their Sales Manager, was earning considerably less! I have also worked with sales people who represented high end luxury brands like BMW and Porsche who consistently were earning $400,000 to $500,000 annually. Those salespeople would even hire their own 1099 “staff” to help them with all the customer follow up, and relationship building.

If your goal is to make more than six figures selling cars, then getting into a luxury store may be beneficial for you. However, the barrier to entry at a luxury store may also be higher (ie they won’t hire just anybody).

Regardless, as you can see, there is a lot of money to be made in the retail automobile industry.