CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

We receive a lot of questions from CarEdge Members, and this one comes to us nearly everyday; “Is now a good time to buy a car?” While the past year has been anything but normal (used car prices increased more than 35% in 2021), we may actually be coming up on a period of time where buying a car might make sense. I promise we’ll explain below.

Let’s discuss if right now is a good time to buy a car. Whether you should buy new or used, or if you should consider leasing. Let’s also keep in mind that the same rule applies as it did last year: if you don’t need to buy a car right now, please don’t. Prices are inflated, and while we are seeing some renewed deal-making, that doesn’t necessarily reflect a “great” value.

Let’s dive in.

Yes. The short answer is “yes.” How can we possibly say that when used car prices have increased 35%+, and new cars are typically selling for MSRP (or more)? Well, the answer is pretty simple, we’re seeing that dealerships are starting to get nervous about the expensive inventory they’ve purchased, and some are ready to get back to deal-making.

This is true on both used and new vehicles.

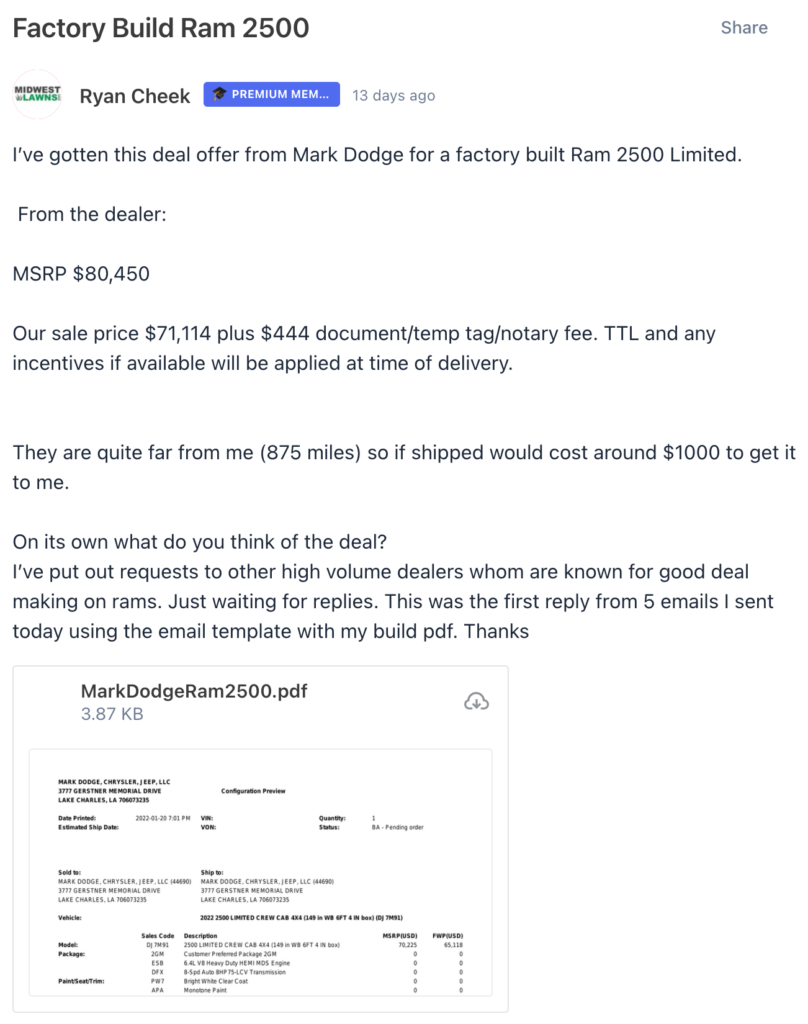

Take this 2022 Ram 2500 factory order deal for example.

Ryan’s deal is a perfect example of what’s possible in the used car market right now. This is nearly 12% under MSRP. For months now we have seen dealerships selling cars, trucks, and SUVs at well over MSRP, and this is proof that not all deals have to be that way.

New car inventory levels are slowly starting to creep back up, and while dealerships do not have as much inventory as they did pre-pandemic, they are slowly but surely beginning to negotiate again. If you are going to factory order a vehicle, be sure to watch this video to get the best price possible.

Okay, so that’s new cars. What about used vehicles. Is now a good time to buy a used car? It pains me to say it, but yes. Right now, after a very slow January (car sales were down nearly 10% in the United States), car dealers are getting cold feet while they floorplan very expensive used car inventory.

Interest rates are increasing, and that means that the cost to hold inventory at a dealership is increasing as well. Each day a vehicle sits on a car dealer’s lot they lose money. A few months ago this wasn’t much of a concern because interest rates were very low, and consumer demand was very high.

Now, interest rates are creeping up, and after a slow start to the year, many dealers are getting nervous that they bought their inventory high, and may end up having to sell it low. In January we saw four consecutive weeks of wholesale used car price declines. A few months ago, if a dealer bought a used car for an inflated price they could simply go back to the auction and sell it for even more (used cars were appreciating). That’s not happening right now, and so dealers are more willing then they have been to negotiate and make a deal with a retail customer.

From our sources, we are hearing that dealers are taking up to $2,000 losses on used cars, simply to sell them and try and make the profit up on the “back end” of the car deal (the finance, extended warranty, etc.)

As a savvy CarEdge Member, we encourage you to go to Deal School, and come in prepared with financing and extended warranty quotes so that you can play offense instead of defense when you do go to the F&I Office.

Is right now the best time to buy a car in 2022? That’s a great question. While we do think right now is a good time to buy, it may not be the best. Traditionally the end of the year is the best time to buy , that’s when dealerships typically have incentives from their manufacturers to hit volume-based sales objectives. As a result of the chip shortage those objectives have vanished.

With that in mind, the end of the year is no longer the absolute best time to buy a car. In 2022 what will dictate the best or worst time to buy a car will be based on how many vehicles automakers need to take out of production. Last year we lost 11 million vehicles globally as a result of the chip shortage. The expectation for this year is that we’ll lose 1 million.

If there are more new cars produced earlier in the year, and less losses than expected, we could be in for end of year car deals. If that doesn’t happen, then we could be looking at continued high prices.

We expect that used car prices will increase again in the spring with tax returns getting into consumers hands. Right now appears to be a very good time to buy a car in 2022 (again, with the caveat being, only if you need to).

CarEdge Members get exclusive access to car buying coaches, negotiations tips and tricks, and the information you need to drive away satisfied every time. We founded CarEdge in 2019 to help level the playing field for consumers. Whether you’re buying a car, getting a repair done, or selling your vehicle, our team of experts is here to help you save money and get rid of the the headache.

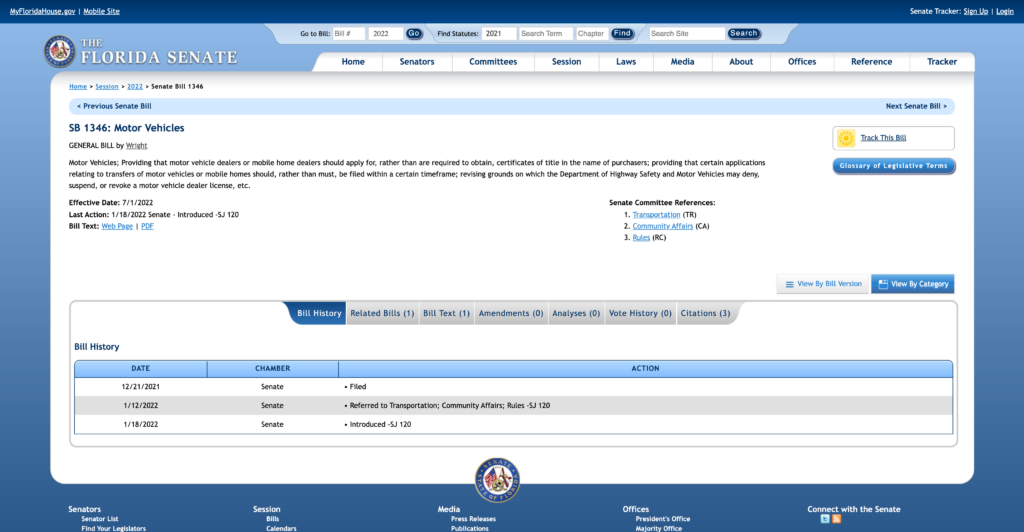

A new bill in the state of Florida is quite possibly the most confusing and concerning piece of legislation we’ve seen in years as it relates to consumers and car buying. SB 1346: Motor Vehicles in the Florida state Senate was proposed by Senator Tom Wright of Florida’s district 14.

We have contacted Mr. Wright’s office and have not heard back from them.

The bill as proposed would remove the legal requirement for a car dealer or motor home dealer to “obtain certificates of title”. The bill would also remove the requirement that a dealer be required to inform the state about transfers of ownership of a vehicle.

This is pure craziness, especially amidst the ongoing lawsuit against Carvana that claims the company has not been able to get customers the permanent title and registration for their vehicles. How convenient would it be if the law changed to no longer make that a requirement? Wow.

Carvana and other startup online car dealers like Vroom and Shift have been plagued with issues. Their Better Business Bureau pages paint a concerning story. Many customers have waited months to get their permanent registration for their vehicle. Without the title and registration you cannot get insurance or legally operate a vehicle. This issue has occurred in many states.

Now, this proposed law in Florida would get rid of that issue by simply removing the law that required Carvana and all dealers to obtain the title of a vehicle. That’s purely insane, as the title is the one document that states who truly owns the property.

Here is the complete language of the bill:

Motor Vehicles; Providing that motor vehicle dealers or mobile home dealers should apply for, rather than are required to obtain, certificates of title in the name of purchasers; providing that certain applications relating to transfers of motor vehicles or mobile homes should, rather than must, be filed within a certain timeframe; revising grounds on which the Department of Highway Safety and Motor Vehicles may deny, suspend, or revoke a motor vehicle dealer license, etc.

We’ll update this page as the bill progresses through the Florida state Senate.

Legal troubles are mounting for Carvana. The second-largest used vehicle dealer in the nation has faced a class action lawsuit in Pennsylvania, regulatory woes in Florida, a suspended license in Illinois, and now criminal charges.

Paul Breaux, Carvana’s lead lawyer, is facing 57 criminal charges in the state of Illinois. It’s been revealed that in May of this year, the Illinois Secretary of State filed 27 counts of failure to transfer vehicle titles by a dealership and 50 counts of improper use of titling and registration.

Carvana is on the defensive. In a statement issued by the company, Breaux said that the charges lack merit. “The State of Illinois has charged me because Carvana delivered a car to a customer’s home. This is surprising and confusing both because it feels extremely anti-consumer and because I proactively met with several Illinois officials in 2017 to describe this exact practice and they did not then nor have they since raised any concerns, during which time we’ve delivered tens of thousands of cars to Illinois homes and provided exceptional customer experiences.”

We can only speculate that if the Secretary of State of Illinois filed 57 charges against Breaux, there’s more to the story than Carvana is ready to admit.

The charges are extensive, but in summary, Carvana is in trouble for continuing to sell and deliver used vehicles in Illinois after the state had suspended their dealers’ license on May 10. Illinois’ Secretary of State Police Director Elmer Garza told Automotive News that as Carvana’s legal representative, Breaux bears responsibility for wrongdoing related to the company’s licensing in the state. In February, Illinois announced that it had begun investigating consumer complaints about the company’s vehicle titling and registration procedures.

Garza told Automotive News that they weren’t just dealing with isolated incidents, but rather extensive complaints. “In this particular case, we had over 100 complaints against [Carvana] for failure to transfer title, which resulted in an inspection, which resulted in the other charges,” Garza said. “Most of that stuff is records violations pertaining to their licensing agreement with the state.” It now looks like their investigation found at least 57 instances of legal wrongdoing.

Illinois charged Breaux with two counts of failure to comply with licensees’ requirement to keep records and make inspections; one count of failure to comply with licensees’ requirement to document evidence of right to possession; one count of failure to comply with licensees’ requirement on records for new and used vehicles; and one count related to maintaining records for special plates.

In a separate filing on May 12, the agency charged Breaux with two counts of Carvana operating as an unlicensed used-vehicle dealer.

In early 2022, the Secretary of State’s office found that Carvana had been regularly abusing the use of the state’s temporary tags and had been failing to properly transfer title of vehicles sold in the state.

Carvana recovered their license to sell in Illinois after a judge blocked state agencies from revoking their dealer license while the investigation continued. It’s unclear how today’s news of dozens of charges filed will impact Carvana’s license to sell in the state.

A class action lawsuit was filed against Carvana in Pennsylvania in late 2021. The lawsuit alleges that Carvana has unlawfully delayed permanently transferring certain car titles, despite having a contractual obligation to do so in a timely manner.

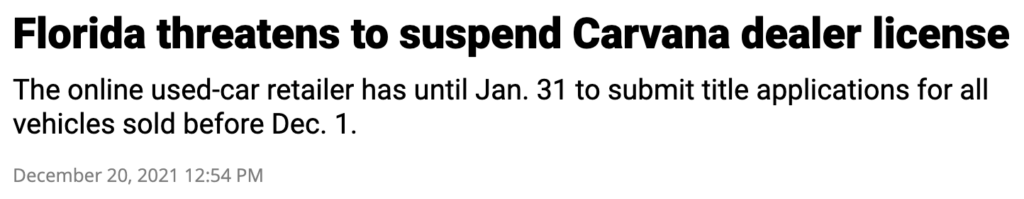

In Florida, Carvana narrowly avoided having their dealer license suspended. Carvana was under fire for breaking Florida law by failing to deliver titles to customers within 30 days of purchase. The Florida Department of Highway Safety and Motor Vehicles decided it would not go after Carvana’s license, citing “significant progress” in how Carvana operates in the state. That includes Carvana’s no-brainer decision to stop selling vehicles until the vehicle’s title is in their possession. Yes, you read that right.

In North Carolina, Carvana has been closely watched by the Attorney General. Wake County, home to Raleigh, suspended Carvana’s license to sell for six months due to a flood of consumer complaints. In Charlotte, Carvana is essentially on probation as the state monitors sales carefully. North Carolina attorney general Josh Stein told WSOC-TV that he’s received more than 60 complaints about Carvana that involve all sorts of issues.

The latest developments in Illinois show that this saga is far from over.

Don’t buy from Carvana unless you have a substantial auto repair fund and a whole lot of patience. Time and time again, Carvana has sold faulty, poorly maintained used vehicles to unsuspecting buyers. Carvana does offer a 7 day return option, but too many Carvana buyers are seeing their vehicles turn into symbols of misery very quickly. In one recent instance, Carvana tried to compensate a buyer with a measly $300 when her Volkswagen Tiguan had a catastrophic failure just days after it was sold. As if that wasn’t enough, Carvana led the consumer down a terrible path of expensive towing fees, poor customer service, and more. You can check out the full story here.

And then there’s the title and registration problem. Carvana has faced lawsuits and investigations in three states for failing to transfer the titles of vehicles they sold to the buyer. In arguably worse cases, Carvana even sold cars when they themselves did NOT even have the title yet. Wow.

As consumer advocates, we wouldn’t wish the Carvana experience on anyone. Sure there are success stories, but it’s just too much of a gamble with your hard-earned money. Selling to Carvana is a different story, we’re about to explain.

What about selling a car to Carvana? When it comes time to say goodbye to your beloved (or hated) current set of wheels, you have more options than ever before. From Vroom to CarMax and even the guy down the block, everyone wants to buy your used car. But when it comes to selling to Carvana, here’s what you need to know.

Carvana pays top dollar for used cars. The only way you’re likely to get a better offer is to sell to a private party. Carvana is in growth mode, meaning that they aim to sell more and more cars to grow their business. As a publicly traded company, they have to please their investors, and that means growth. Therefore, they usually outbid other online car buyers. That means more money for you.

If you’re wondering if selling to Carvana is a good deal, the answer is that it usually is. Still, you’ll want to see what Carvana’s competitors can offer you. That’s why we created a way for you to compare multiple quotes, all in one spot. You’ll only enter your car’s info once! Try it out and let us know what you think!

Our own Zach Shefska sold his own car to Carvana and documented the whole experience. See how it went, and what advice he has to share, in this guide to selling to Carvana.

Buying a car is hard, and it’s becoming even more difficult. Car prices are through the roof, and online car dealers like Carvana and Vroom are struggling to satisfy their customer. These companies stormed onto the scene offering a simple and easy car buying process, however, right now Carvana is facing a class action lawsuit from disgruntled customers, and Vroom isn’t faring much better.

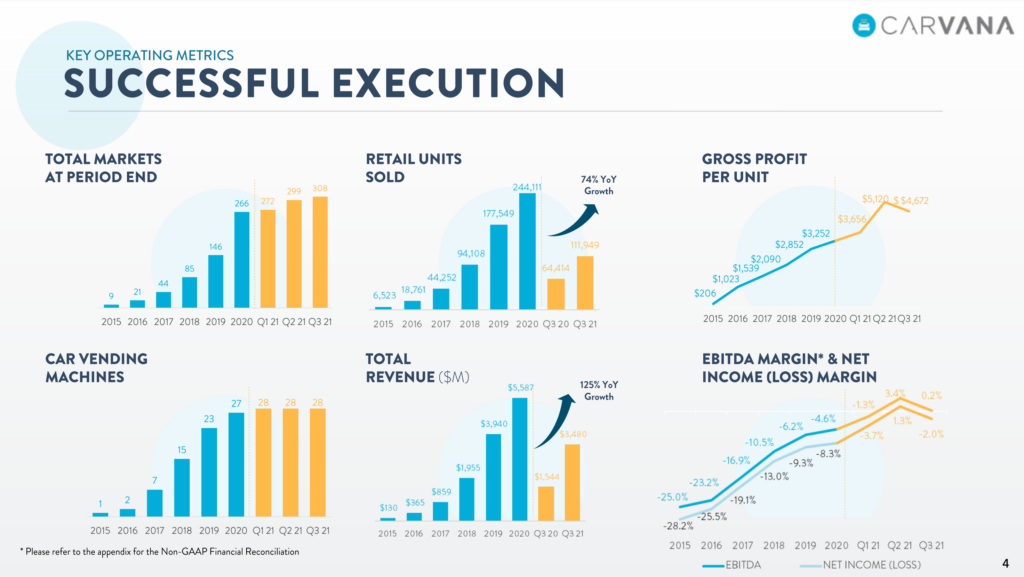

Carvana has grown very fast. In 2015 they sold just 6,500 vehicles nationally. In 2021 that number skyrocketed past 300,000. The company recently celebrated an impressive milestone; one million total vehicles retailed since their founding.

Carvana’s rapid growth has led to investor fanfare and a sky-high stock price. But what’s happening under the hood (pun intended) at Carvana? Things aren’t quite as rosy.

Right now there is an active class action lawsuit against Carvana, and it alleges many missteps the company has taken when interacting with their customers. The most egregious being title and registration issues that do not allow customers to legally drive the vehicles they’ve purchased.

Let’s breakdown the Carvana lawsuit, what is alleged, and what you need to know.

👉 Click here if you’re interested in a full review of selling to Carvana. I sold them my Volvo a little over a year ago and vlogged the experience.

A class action lawsuit has been filed in Pennsylvania court against Carvana. The suit alleges that Carvana has unlawfully delayed transferring cars’ titles for months. Without a title, a consumer cannot lawfully operate a motor vehicle or secure insurance because they cannot lawfully claim ownership of it. That’s obviously a problem when you’ve just spent tens of thousands of dollars to “buy” a car.

The suit, filed in Pennsylvania, breaks consumer protections as outlined in the Pennsylvania Unfair Trade Practices and Consumer protection Law.

Carvana has faced this issue in other states as well. For example multiple news reports from Florida tell the same story. Carvana actually lost their dealers license in North Carolina in 2021 for the same issue as well. At this point it is a well known pattern of behavior that Carvana is not capable or producing the permanent title and registration for all of their vehicles.

According to the lawsuit, one of the plaintiffs purchased a 2017 Kia Sportage from Carvana on December 29, 2020. Carvana then delivered the vehicle to their residence with an Arizona temporary license tag. The customer signed the sales and delivery documents in paper and electronic form.

Over the course of nearly a year, and after countless email exchanges, Carvana never provided the driver with their permanent registration. Instead, they issued six different temporary tags from multiple different states (Arizona, Tennessee, and Pennsylvania).

Without proper registration and a vehicle’s title you cannot legally operate it. You also can’t claim ownership of it. By withholding the permanent title from a customer, Carvana essentially sold someone a car and did not actually transfer ownership. The lawsuit alleges this happened to other customers as well.

You don’t have to look too far to see that getting a vehicle’s title and registration from Carvana are common issues. The Better Business Bureau page for Carvana is concerning. Plus, a quick dive on Reddit, TikTok, and other social media exposes even more common problems faced by Carvana customers.

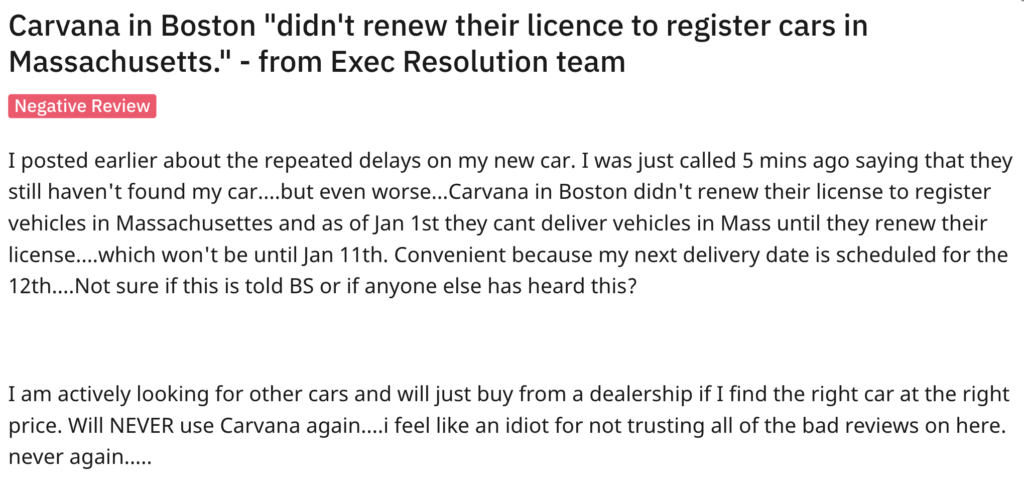

Take for example this experience documented on reddit from car buyer in Massachusetts. Carvana has struggled to maintain their dealer licenses in many states. If your dealer license lapses or is suspended you cannot legally sell vehicles. That’s exactly what happen in Boston, resulting in delays for customers.

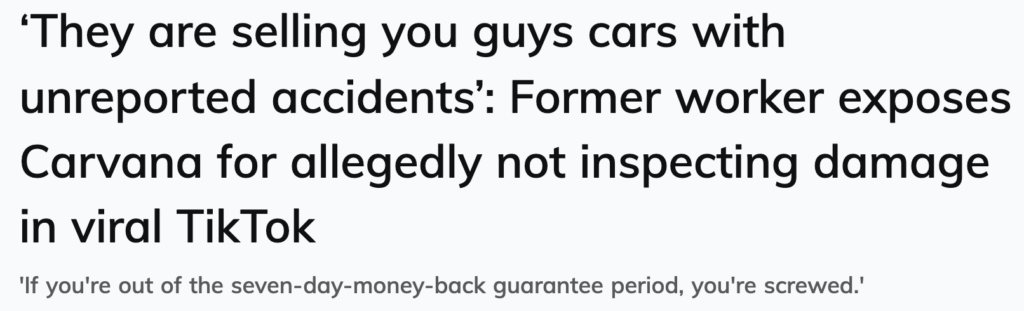

Then there was the viral TikTok of former Carvana employees saying that the company does not disclose accidents or recondition cars effectively. While we cannot comment on the validity of these statements, it is important to understand that Carvana does purchase cars from rental car companies, and rental car companies do not report accidents to insurance companies or services like CarFax. They don’t have to, since they can simply take care of the repairs in-house. This means you may not know you’re buying a vehicle that previously had damage, and this is why we always recommend getting a pre-purchase inspection on a used car.

In addition the title and registration issues that led to the current Carvana lawsuit, these other issues are things you should be aware of before you buy a car from Carvana.

What about selling a car to Carvana? Are there any common issues or challenges you should expect to face then?

No! Generally speaking, selling to Carvana is easy and simple. Honestly, it’s a bit too simple and easy … They barely inspect the vehicle, they come to you with a tow truck, and they give you the money immediately.

👉 Click here if you’re interested in a full review of selling to Carvana. I sold them my Volvo a little over a year ago and vlogged the experience.

Should you do business with Carvana? Is the company “legit”? The owners of Carvana, Ernest Garcia II and his son Ernest Garcia III, have a long history in the automotive industry.

Before Carvana, Ernest Garcia II pleaded guilty to felony bank fraud charges for his role in the collapse of Charles Keating’s Lincoln Savings and Loan Association in the early 1990’s. After that experience, Garcia bought Ugly Duckling, a bankrupt rent-a-car franchise. After many years Garcia renamed the company DriveTime. Nowadays, DriveTime and Carvana do a lot of business together.

While Carvana’s origin story is interesting, it doesn’t inspire much confidence. This is especially true when you realize that Garcia II sold more than $3.6 billion of Carvana stock last year.

Is Carvana legit? Sure, they are a massive business, with billions of dollars in the bank, but do they play by the rules and leave a good taste in your mouth? That’s still to be determined.

When my dad and I founded CarEdge in 2019 we knew that the way people bought cars was inevitably going to change. Our best guess was that the hassle of negotiating a car deal would stick around for another 20, maybe 30 years. We hoped that by then the price of a car would simply be the price of a car, and the “grind it out” nature of trying to buy an auto at a fair price would be long forgotten.

Well, I think we may have been wrong.

Over the past week, two memos have been leaked from major domestic automakers. One from Ford, and another from GM (screenshots below). Both of the letters are directed towards their dealer bodies, and they each make it clear: stop screwing around with customers and tarnishing our brand.

Could the beginning of the end of car dealerships be happening right before our eyes? I think the answer is a resounding “yes”.

Before we unpack the memos from Ford and GM, let’s take a trip down memory lane. Why do car dealerships even exist?

Reports vary, but the first car dealership was opened in either 1897 or 1898. Automakers of this era leveraged a variety of sales channels to sell their initial vehicles, dealer partners being one of them. These partners were exactly that; partners. Dealers were not owned and operated by the automaker, instead they were independent third party businesses that agreed to abide by rules and regulations put in place by the automaker.

Automakers loved this model. It was (and still is) highly profitable for them. They loved it so much that they lobbied state-by-state to pass “franchise dealer” laws that make it illegal for a vehicle manufacturer to sell directly to a consumer, instead they have to sell through a franchised dealer.

Traditional automakers are great at designing, manufacturing, and distributing their product. They are not interested in day-to-day customer engagement, setting up service appointments, or doing anything beyond building and selling cars to their dealers.

Automakers get paid when they wholesale a vehicle to their dealer partner. Then the dealer has to (no pun intended), deal with the end user. In this way, legacy automakers have been able to separate themselves from the expensive practices of customer engagement and instead pass that along to their dealer partners.

Why do car dealerships exist? Because automakers have been able to generate massive profits from this system. However, after 100+ years, it appears another model may potentially be even more valuable for them.

Tesla notoriously refused to sell their cars through dealer partners. Instead, the upstart EV automaker insisted on having their customers purchase directly from them. This is illegal in many states, however after lobbying for many years, most states now have “carve out” laws that allow EV manufacturers to sell directly to consumers.

Here’s example of that “carve out” language in Connecticut:

Would allow a manufacturer to receive a dealer’s license if it does not have a franchise agreement with a new-car dealer in the state, if it builds only electric vehicles and only sells the vehicles it builds, and if it does not have a controlling ownership link to a manufacturer licensed as a dealer in the state.

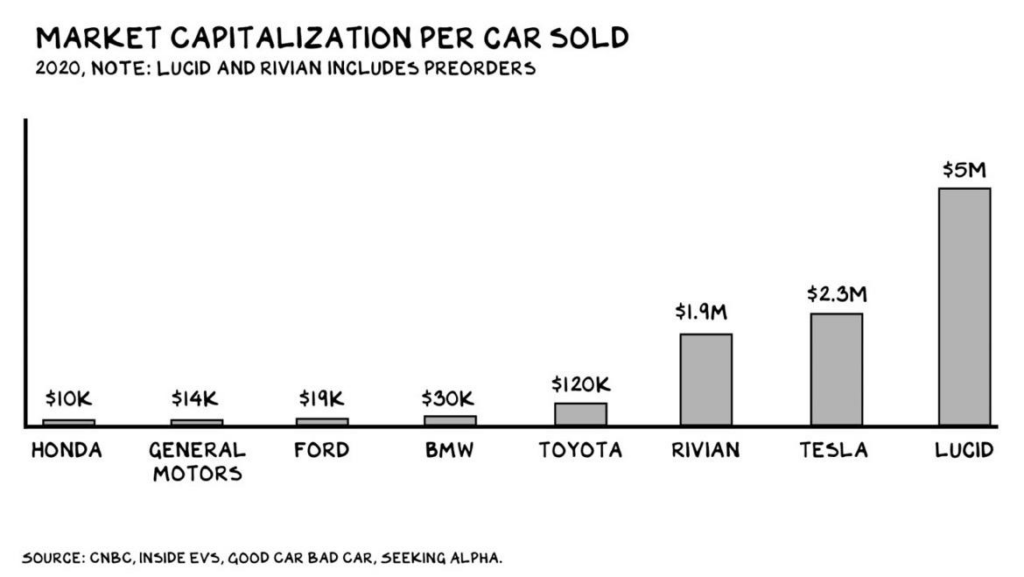

Nowadays EV automakers can sell direct to consumer in many states via the internet, and they are just starting to prove how lucrative this business model can be. Tesla, Rivian, and Lucid are shining examples of how valuable direct to consumer sales models can be. Tesla is a $1T+ company, and Rivian, even though they’ve only sold a few hundred vehicles is valued at north of $100B. Ford, GM, and other legacy automakers want to catch up. For perspective, Toyota, the highest valued traditional automaker, is “only” worth $330B.

Within the past week both Ford and GM have sent memos to their dealers that say the exact same thing: don’t tarnish our brand, treat customers well, or lose allocation of inventory from us. These leaked memos represent the first attempt Ford and GM are taking to “stand up” to their dealers.

Both memos reference the dealership’s franchise agreement, and both make it clear that if the dealership does not treat customers in a way that enhances their brand, they will take away allocation of inventory.

Sure, these memos represent the first time we’ve seen automakers stand up to their dealers, and for that reason, we’re excited to see them, however the issue is, if GM or Ford actually tries to enforce their own rules they’ll certainly get taken to court. Why? Because nearly every Ford and GM dealership in the United States breaks their rules, so if they begin to selectively enforce the rules, you can be certain some dealer groups will fight back.

While the franchise dealership model has served automakers well for 100+ years, it’s clear as day that a transition away from that model is upon us. This transition won’t happen overnight, and we shouldn’t expect dealerships to simply vanish. Dealerships play a vital role in society, especially when it comes to vehicle repairs and maintenance, however it appears clear that Ford, GM, and many other automakers want to catch up to Tesla’s valuation, and one of the ways they’ll do that is by taking more control of the sales process.

Dealerships aren’t going anywhere anytime soon, but the shift away from the dealer model is happening 20 years earlier than we had imagined. It will be interesting to see how this market evolves, especially as Tesla and other EV startups continue to get praise.

It goes without saying that the Ford F-150 Lightning is one of the hottest new electric trucks to hit the market in 2022. With over 200,000 reservations and a groundswell of support to produce more EV trucks, Ford appears to be “all-in” on the F-150 Lightning. So much so that Ford is beginning to play a bit of hardball with their dealers and their customers, unlike anything we’ve ever seen before.

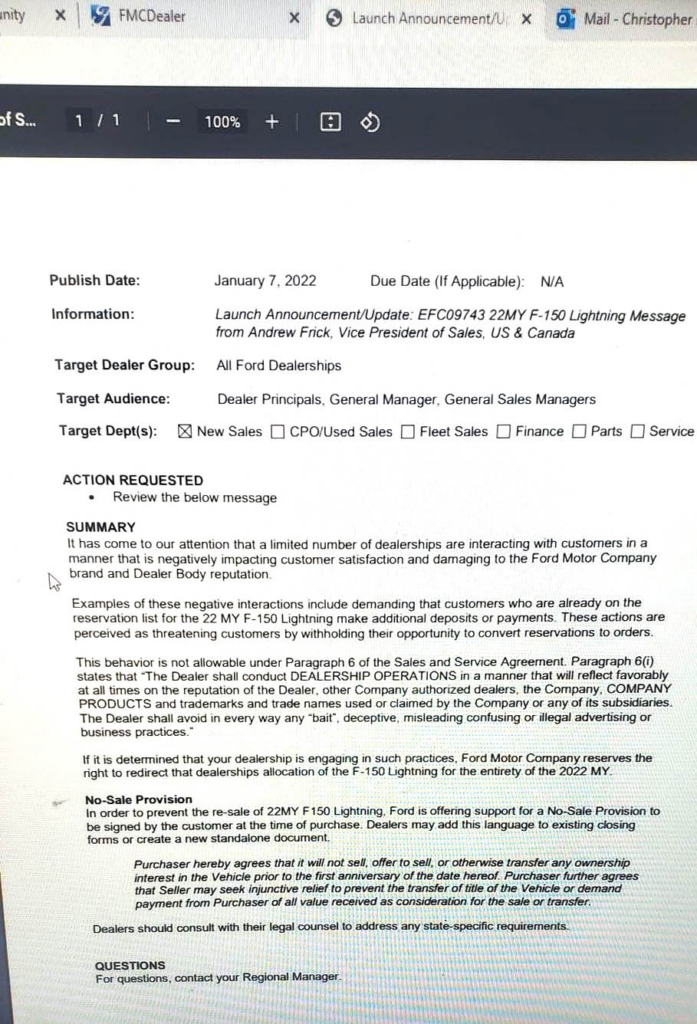

👉 A memo sent from Ford corporate to their dealers was recently leaked online, and from it we learned a lot about how the legacy automaker is thinking about the release of the F-150 Lightning. “It has come to our attention that a limited number of dealerships are interacting with customers in a manner that is negatively impacting customer satisfaction and damaging to the Ford Motor Company brand and Dealer Body reputation.” Huh, a car dealer interacting with customers in a way that is not consumer-centric? We’ve never heard of that!

Here’s what you need to know about the new 2022 Ford F-150 Lightning, it’s pricing, how dealers are (and aren’t) marking it up, the “no sale” clause and more.

Pricing for the 2022 Ford F-150 Lightning was recently announced and confirmed by Ford. The MSRP before options for each trim level are:

An additional $10,000 will get you the Extended Range battery pack, and myriad other options can easily increase the MSRP of a new 2022 F-150 Lightning.

There are no currently no incentives on the Ford Lightning (with the exception of existing military and first responder discounts). Ford continues to offer financing incentives, which may become more attractive as the Federal Reserve contemplates interest rate hikes in 2022.

Pricing for the F-150 Lightning is competitive with the other electric trucks that are on the market and have been announced by major automakers.

In the memo from Ford to their dealers they explicitly stated, “Examples of these negative interactions include demanding that customers who are already on the reservation list for the 22 MY [2022 model year] F-150 Lightning make additional deposits or payments. These actions are perceived as threatening customers by withholding their opportunity to convert reservations to orders.”

If you are on a Lightning reservation list and your dealer is requesting you put down an additional deposit or pay extra to retain your reservation, you DO NOT need to do that. Reference this memo when you reply to the dealer. Ford is adamant about preserving some sort of “positive” customer experience when it comes to purchasing the Lightning.

For the first time in a long time, we have an automaker standing up to their dealer body. Traditionally, automakers let their dealers do whatever they want with customers. At the end of the day MSRP does stand for “Manufacturers Suggested Retail Price”. That being said, Ford recognizes that companies like Tesla (which is currently valued at 10 times the valuation of Ford) have improved the customer experience, and Ford needs to catch up.

The memo goes on to read:

“This behavior is not allowable under Paragraph 6 of the Sales and Service Agreement. Paragraph 6(i) states that ‘The Dealer shall conduct dealership operations in a manner that will reflect favorably at all times on the reputation of the Dealer, other Company authored dealers, the Company, Company products and trademarks and trade names used or claimed by the Company or any of its subsidiaries. The Dealer shall avoid in every way any ‘bait’, deceptive, misleading confusing or illegal advertising or business practices.'”

This part of the memo is a bit humorous since Ford could easily reprimand all of their dealers for false advertising. As we all know bait and switch practices, deceptive pricing, and misleading and confusing tactics are used day in and day out at countless dealerships. That being said, Ford is threatening to not allocate F-150 Lightning inventory to dealers who behave in this way with the Lightning. That’s newsworthy as it’s the first time Ford or any major automaker has stood up to their dealers on a mass-market vehicle, and it could signal the beginning of the end for unilateral dealer control over the customer experience.

Ford is not only exhibiting control over their dealers, they’re also trying to control the re-sale market of the Lightning. From the memo, “In order to prevent the re-sale of 22MY F-150 Lightning, Ford is offering support for a No-Sale provision to be signed by the customer at the time of purchase. Dealers may add this language to existing closing forms or create a new standalone document.”

The language Ford sent to their dealers reads, “Purchaser hereby agrees that it will not sell, offer to sell, or otherwise transfer any ownership interest in the Vehicle prior to the first anniversary of the date herof. Purchaser further agrees that Seller may seek injunctive relief to prevent the transfer of title of the Vehicle or demand payment from Purchaser of all value received as consideration for the sale or transfer.”

The memo goes on to state, “Dealers should consult with their legal counsel to address any state-specific requirements.”

Not only is the legality of this language a question, the ethics of it are questionable too. How can Ford try and control what a consumer can do after allowing their dealers have been adding additional dealer markup to their vehicles for over a year now?

Ford recognizes that their customers could make a profit by buying a new 2022 F-150 Lightning and re-selling it on the used car market. They have added this language to prevent them from doing that, but they haven’t done anything to stop their dealers from adding tens of thousands of markup to their vehicles. This seems like an overstep. Instead of trying to control consumers, Ford should focus on controlling their dealers first.