CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

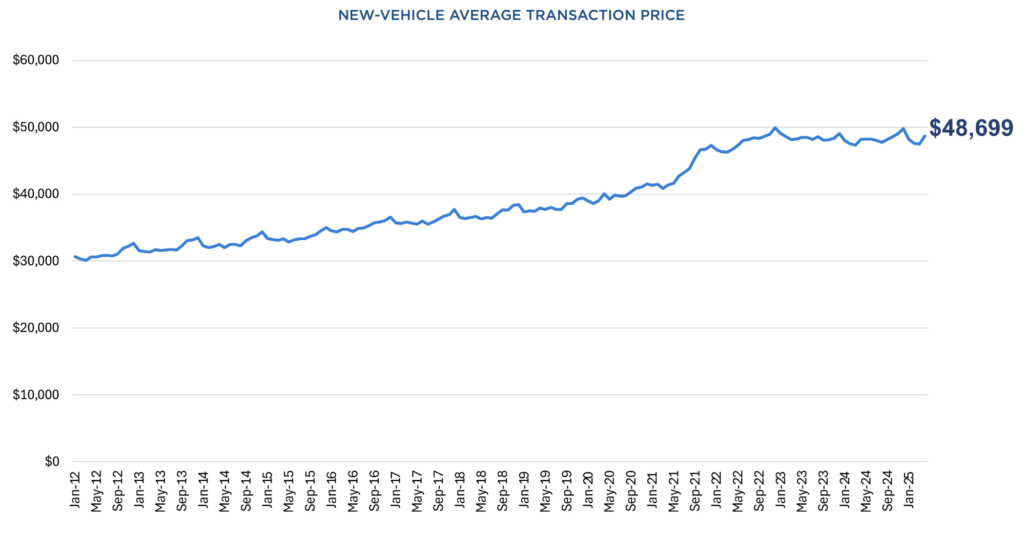

A major milestone is fast approaching in the auto market: the average new car selling price is about to surpass $50,000 for the first time. After years of rising MSRPs, stubbornly high interest rates, and climbing insurance costs, drivers are feeling the pressure from every angle. However, there are still ways to find value if you know where to look. Here’s why industry experts are confident that new car prices will reach this unfortunate milestone in 2025, and what car buyers can do to still come out on top.

According to the latest data from Cox Automotive, the average new car transaction price currently sits at $48,699, just shy of the December 2022 peak of $49,929. Car price inflation has been unstoppable since the COVID-19 pandemic. While prices cooled slightly at times in 2023 and 2024, two key developments are pushing them back up again:

1. 2026 model year pricing is arriving, and most prices are marching higher.

2. Tariffs on imported vehicles are beginning to trickle into pricing. Even American-made cars are being hit as global supply chains prove tough to adapt to the new trade landscape. In response, automakers like Subaru and Ford have already announced mid-year price hikes. We could see more sneaky price increases from other brands this summer.

It’s important to remember: the $50,000 figure is just an average. There are still dozens of new cars for sale under $30,000 in 2025, though the number is shrinking. The last new car under $20,000, the Nissan Versa, is being discontinued after this year. If you’re shopping with a tighter budget, check out our list of new cars under $25,000 in 2025.

Not all cars are getting more expensive in 2025. In fact, a few are seeing price cuts. Let’s take a look at where there’s wiggle room, and where prices continue to rise.

Prices aren’t rising evenly across the market. In fact, some of the biggest increases are hitting the most budget-conscious buyers.

Prices are rising fastest for these cars:

These cars are holding steady (for now):

If you’re buying a car this summer, all hope is not lost. With inventory rising for certain brands and models, some cars and trucks are more negotiable than others. Our data tools make it easy to spot where the deals are. Check out CarEdge Pro to see how you can find the most negotiable new and used cars in your area. Ready for pros to take the wheel? Let us negotiate on your behalf to help you save thousands.

“This isn’t the time to walk into a dealership unprepared,” says Ray Shefska, Co-Founder of CarEdge. “Car prices are high, interest rates are brutal, and insurance isn’t letting up. But there are deals to be had if you know where to look — and how to negotiate. That’s what we help people do every day.”

It’s also important to remember that price is just one part of the equation. New car loan rates remain near 30-year highs, averaging around 9% APR, while used car loans hover around 14% APR. On top of that, auto insurance rates jumped 15% in 2024 and are still climbing. That’s why it’s essential to factor in the total cost of ownership, not just the sticker price. Use our free CarEdge cost of ownership tools to get the full picture before you buy.

We’ll be watching the market closely this summer and will keep you posted as prices continue to evolve. Hopefully we’re wrong, but all signs point to the $50,000 average becoming the new normal sometime in 2025.

From 0% financing to zero-down leases, June 2025 is shaping up to be a surprisingly strong month for new car deals. Despite pressure from tariffs and the arrival of fresh 2026 models, these automakers are stepping up to lure in buyers. In fact, a few early Fourth of July promotions are already live.

Let’s dive into this month’s top offers.

0% APR for 60 months plus $1,750 bonus cash

Nissan’s Summer Sales Event is finally delivering the goods. In addition to 0% APR, buyers can opt for 1.9% APR for 72 months — still a fantastic offer.

Looking to lease? Nissan is advertising $299/month for 39 months with $4,329 due for the Rogue Platinum AWD.

👉 See local Nissan Rogue listings with pricing insights

0% APR for 60 months plus $1,000 bonus cash

This is one of the best deals available on a three-row SUV this month. Like the Rogue, Nissan’s 1.9% APR for 72 months is also available if you need a longer term.

👉 See local Nissan Pathfinder listings with pricing insights

0% APR for 72 months

With seating for up to eight and the efficiency of a plug-in hybrid, this is a family-focused minivan deal. Chrysler is also offering a lease at $499/month for 36 months with $4,449 due at signing. Don’t expect incentives like this on a minivan from Toyota or Honda!

👉 See local Chrysler Pacifica listings with pricing insights

0% APR for 60 months

Chevy still has around 200 of the outgoing 2024 Tahoes to move. With 0% APR financing, this is a rare opportunity to score a deal on one of America’s most popular full-size SUVs.

👉 See local Chevrolet Tahoe listings with pricing insights

Zero-down lease deal

GM is offering current lessees of 2020+ models a $297/month lease with $0 down, $0 first month, and $0 security deposit. Others can still get in with $2,250 due at signing. This is one of just two true zero-down lease deals this month.

👉 See local Buick Encore GX listings with pricing insights

0% APR financing for 60 months, or lease the Model 3 for 24 months with $0-down and $349/month.

Just a few years ago, we’d never expect to see a Tesla with 0% financing or zero-down leases. But in June 2025, this Model 3 deal is one of the best in the EV segment, especially considering Tesla’s low maintenance costs and premium tech.

👉 Configure your Tesla Model 3, or see used Model 3 listings near you

1.9% APR for 72 months

No tricks here! Stellantis is offering 1.9% APR regardless of down payment, so buyers with solid credit can finance this full-size truck for less. Truck deals like this are usually only for last year’s model, but not this time.

👉 See local Ram 1500 listings with pricing insights

1.9% APR for 72 months

While Jeep is pushing employee pricing, the 1.9% APR financing will save more for most buyers. This hybrid SUV has plenty of inventory, so deals should be negotiable.

👉 See local Jeep Grand Cherokee 4xe listings with pricing insights

2.99% APR for 60 months, or lease from $249/month for 36 months with $3,699 due.

A sub-3% interest rate is rare for Honda, especially on the Accord. This midsize sedan offers exceptional value, reliability, and low total cost of ownership.

👉 See local Honda Accord listings with pricing insights

$6,500 cash back with trade-in or lease from $429/month with $3,369 due

Truck shoppers take note: Chevy’s cash back offer equals nearly 10% off MSRP, and the lease is highly competitive. Compared to Ford’s employee pricing deals, the Silverado is clearly the better value in June.

👉 See local Chevrolet Silverado 1500 listings with pricing insights

From 0% APR on SUVs to rare zero-down lease offers, June 2025 presents a golden opportunity for summer buyers and lessees prepared to act quickly. With fresh 2026 pricing arriving and tariffs adding uncertainty, we don’t expect these deals to last beyond the Fourth of July.

Want expert help navigating these deals?

Get the insider pricing, expert negotiation, and peace of mind you deserve.

👉 Have experts negotiate your car deal

👉 Prefer DIY negotiation? Use CarEdge Pro to know what to pay

Each week, CarEdge rounds up the latest mainstream vehicle recalls so you don’t have to dig through the fine print. All recall data is sourced directly from the National Highway Traffic Safety Administration (NHTSA).

If you’re not sure whether your car has an open recall, check right now using the NHTSA recall lookup tool — all you need is your VIN.

Issue: The center information display may go blank when shifting into reverse, violating FMVSS 111 on rear visibility.

Remedy: Nissan dealers will update the display software free of charge. Owner notification letters are expected to be mailed by July 1, 2025.

See if your Nissan is included in this recall.

Issue: A software issue may impact the dashboard infotainment system and rear camera function.

Remedy: Dealers will push out an over-the-air software update. Ford will begin mailing safety notifications by June 16, 2025, with a second letter to follow when the fix is ready.

See if your Ford or Lincoln vehicle is included in this recall.

Issue: Moisture can enter the reverse light assembly and cause light failure.

Remedy: Dealers will replace both reverse light assemblies and repair wiring as needed, free of charge. Notification letters will be mailed starting June 30, 2025. For more help, contact Toyota at 1-800-331-4331.

See if your Toyota Tundra is included in this recall.

Issue: A software bug may distort the rearview camera image when reversing, failing FMVSS 111 standards.

Remedy: Dealers will update the camera software at no cost. Letters to owners will begin mailing July 18, 2025. VW customer service can be reached at 1-800-893-5298.

Check if your Atlas or Atlas Cross Sport is impacted by this recall.

Even a minor recall can impact your safety. Always check your vehicle’s recall status by entering your VIN at the NHTSA Recall Lookup. If you’re car shopping, don’t forget that CarEdge Car Search shows you open recalls before you buy, so you can make an informed decision.

Check out car listings with recall information, local market insights, and more →

The summer car buying season is here, but June 2025 brings new challenges that could trip up even seasoned shoppers. Between the expiration of Memorial Day deals, tariff-induced price hikes, and the arrival of 2026 models, buyers need to play it smart this month.

If you’re shopping for a new or used car in June, here’s how to stay in control of your deal, and ultimately save more while stressing less.

Most Memorial Day offers, including 0% APR financing and cash incentives, officially end on June 2. If you’re hoping to lock in a deal you saw in May, don’t wait.

After that, expect automakers to scale back incentives. With tariffs pressuring profit margins and interest rates creeping up again, many brands are already pulling back on generous financing and lease offers.

Pricing strategies are all over the map right now, and it’s creating confusion for buyers. Recent pricing announcements show that automakers are still figuring out how to navigate ongoing 25% tariffs on auto imports:

While some automakers are trying to keep buyers engaged, others are already adjusting prices in anticipation of tighter margins.

On May 28, a federal court put the Trump administration’s proposed reciprocal tariffs on hold, offering a brief reprieve in the broader trade fight. However, it’s important to note that this ruling does not affect the ongoing 25% tariffs on imported vehicles and parts, which remain in full effect.

These tariffs continue to put pressure on automakers that rely heavily on imports. Brands most affected include:

Meanwhile, automakers with large U.S. production footprints (such as Toyota, Honda, Ford, and General Motors) are somewhat more insulated, although they still face higher costs for imported components.

👉 New: The Best (and Worst) American-Made Cars and Trucks

The takeaway? Tariff-driven cost increases are still rippling through the market, especially for brands with global supply chains. Price hikes may continue as automakers adjust to these lasting headwinds.

Use our free Tariff Checker to see which cars are directly impacted

Cheap lease deals and 0% financing are fading. Interest rates remain near 30-year highs, and with bond market volatility, we’re seeing rates drift even higher.

That said, not all segments are affected equally. Automakers are more likely to incentivize vehicles they need to move, including:

Use tools like CarEdge Pro to zero in on the most negotiable cars near you.

After a frenzy of spring buying, new car inventory is finally creeping up. According to CarEdge Pro, market day supply jumped 15% from early April to late May, going from 72 to 83 days.

But it’s not an even playing field:

Here’s a look at new car inventory for the top 20 car and truck brands in America. Brands with a higher inventory (as measured by market days of supply) are more likely to offer the best deals in June, along with having the most negotiable prices:

| Brand | Days of Market Supply | Cars For Sale | Negotiability Score | Average Selling Price |

|---|---|---|---|---|

| Toyota | 37 | 289,117 | Low | $43,366 |

| Ford | 109 | 492,443 | High | $53,551 |

| Chevrolet | 75 | 308,835 | Average | $48,101 |

| Honda | 61 | 194,477 | Below Average | $37,898 |

| Nissan | 111 | 177,222 | High | $33,488 |

| Hyundai | 122 | 229,928 | High | $36,768 |

| Kia | 80 | 156,788 | Average | $36,401 |

| Subaru | 86 | 113,548 | Average | $36,192 |

| GMC | 93 | 138,937 | Above Average | $65,559 |

| Jeep | 119 | 139,449 | High | $48,439 |

| Ram | 139 | 115,170 | High | $60,992 |

| Mazda | 127 | 109,159 | High | $37,019 |

| Volkswagen | 113 | 66,458 | High | $37,045 |

| BMW | 83 | 58,463 | Average | $76,057 |

| Lexus | 38 | 40,210 | Low | $61,475 |

| Mercedes-Benz | 109 | 82,593 | High | $79,714 |

| Audi | 143 | 49,687 | High | $66,087 |

| Buick | 82 | 38,474 | Average | $35,629 |

| Cadillac | 101 | 45,727 | High | $77,527 |

| Dodge | 97 | 17,746 | Above Average | $50,100 |

We’re approaching a symbolic milestone: the average transaction price is nearing $50,000, according to Cox Automotive. It’s hovered just below that figure multiple times in the past three years. June or July are likely to be the month we finally cross that line.

Why? 2026 models are arriving, and with them come modest price increases. Our recent analysis of 2026 pricing shows that MSRP hikes remain the norm, not the exception.

With prices rising, incentives drying up, and market conditions shifting fast, having a solid strategy is more important than ever. Here’s how to shop confidently and get the best possible value in today’s market.

CarEdge, the best place to buy, sell, and own a car with confidence, recently surveyed 408 U.S. drivers to better understand how consumers are navigating the car market in 2025. The survey, conducted from May 16 to May 19, comes at a pivotal time. Following the implementation of U.S. auto tariffs on April 3, car prices, interest rates, and inventory levels have all been in flux. With uncertainty growing, CarEdge sought to answer a critical question: how are real drivers adapting their car buying behavior?

Survey participants represent a broad cross-section of car shoppers and owners, from those who’ve recently purchased to those holding off for the foreseeable future. The full survey is available at CarEdge.com. Below, we break down the most important findings from this May 2025 snapshot.

The survey responses paint a picture of a divided car market, shaped by mixed economic signals and widespread caution. Among all respondents, 16% reported purchasing a car after the April 3 tariff announcement, while another 12% said they had bought a vehicle shortly before the tariffs went into effect. A much larger share (52%) said they are still actively shopping for a car, while 20% said they have not purchased a vehicle in the past six months and do not plan to buy one in 2025.

Tariffs have clearly impacted perceptions. Interestingly, among those who bought their car before April 3, 38% acknowledged they made the purchase early specifically to avoid the risk of higher prices. Among those who purchased after April 3, 16% said they believe they paid more due to the tariffs, with the vast majority of post-tariff buyers (84%) saying they believe they did not pay more.

Looking ahead, half of respondents are still planning to buy a car before the end of 2025. Of those future buyers, about a third plan to purchase new, another third are shopping used, and the remaining 30% are still undecided.

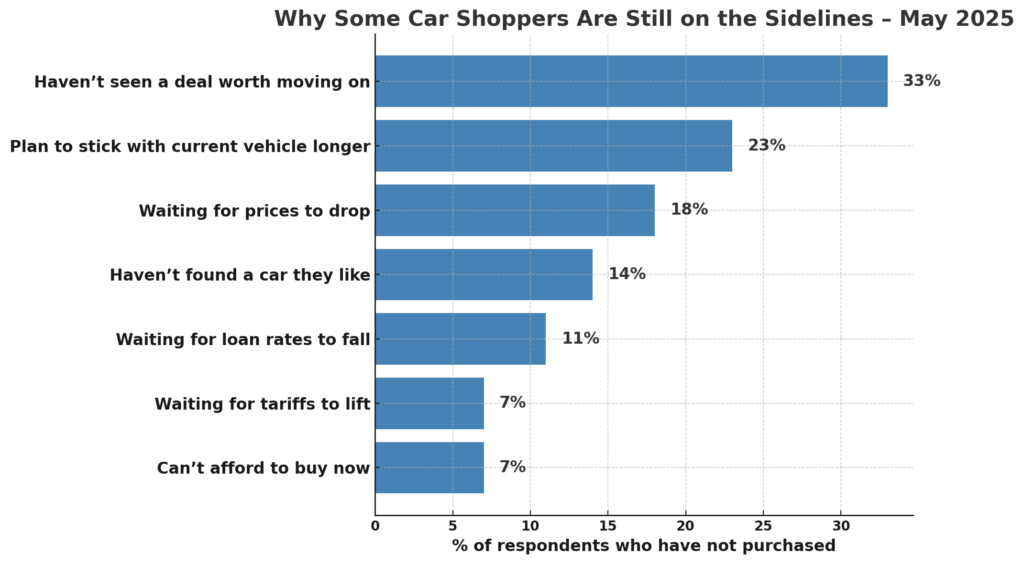

When it comes to what’s keeping people on the sidelines, affordability challenges and a lack of compelling deals top the list.

These are the barriers to buying (as a percent of all respondents who have not purchased):

With these top-line insights in mind, we next explore specific groups within the survey to uncover how recent and future car buyers are thinking about today’s market.

Survey respondents who purchased a car in the six months leading up to April 3 offer another layer of insight. Among these buyers, 61% purchased new and 39% purchased used.

What stands out most in this group is that more than a third (38%) said they intentionally bought their car early to avoid potential price hikes from tariffs. For the remaining 62%, tariffs didn’t factor into the timing of their purchase.

Income again played a role in how buyers approached the market. Among households earning $200K or more, just 22% said they made their purchase early in response to the looming tariffs. Nearly half (48%) of buyers earning between $100K and $199K did the same. In contrast, 39% of buyers earning under $100K said they bought early to avoid tariff-related price hikes.

This suggests that low- to middle-income consumers were more likely to act on policy changes and proactively adjust their buying timeline. Higher-income households, on the other hand, may not have been as concerned about the possible impact of tariffs on car prices this spring.

For respondents who bought a car after the April 3 tariff rollout, the data reveals a blend of resilience and skepticism. Among this group, 81% purchased a new vehicle, while 19% opted for a used one.

Despite the added costs associated with the new tariffs on imported vehicles, most post-April 3 buyers didn’t feel the sting. A strong majority—84%—said they don’t believe they paid more as a result of the tariffs. Still, 16% acknowledged they believe they did.

Among buyers who purchased after the April 3 tariff implementation, a different pattern emerged. Higher-income households were more likely to believe tariffs increased the price they paid. Specifically, 27% of households earning over $200,000 said they believed they paid more because of tariffs. In contrast, only 11% of households earning between $100,000 and $199,999 felt the same. Meanwhile, 17% of buyers with incomes under $100,000 said they believed tariffs had raised their purchase price.

These results suggest that while tariffs haven’t universally discouraged buyers, those with tighter budgets and those with a keen eye on policy changes are the most attuned to their potential impact.

Among those still planning to buy a car in 2025, the data reveals a thoughtful and strategic group of shoppers. Less than half (44%) of active shoppers expect to make their purchase within the next three months, while a majority (56%) plan to buy later this year.

When it comes to what they’re looking for, 54% say they’re in the market for a new car. About 19% are shopping for used vehicles, while just over a quarter are still unsure.

As for why these shoppers haven’t yet moved forward, deal quality remains the leading barrier. Respondents were asked to select all reasons why they have yet to purchase in 2025. 50% say they haven’t seen an offer worth acting on, while 30% are waiting for prices to come down. Another 21% say they haven’t found a car or truck they like. A smaller group is holding out for lower loan rates (18%), while tariffs were cited by just 11% of active shoppers.

One-fifth of active shoppers said that their decision to keep their current vehicle for longer was a factor in delaying their purchase.

Looking at the income distribution of active shoppers, the data continues to reflect a largely middle-income profile. The majority fall between $50K and $149K in household income, suggesting that many of these buyers are financially capable, but remain cautious in an uncertain economy.

Among drivers who have neither purchased a car in the past six months nor plan to buy one in 2025, a few clear themes emerge. This group is not driven by fear of rising costs or policy uncertainty, but rather by satisfaction with their current vehicle, and a lack of appealing options in today’s market.

The majority of these respondents (71%) say they’re sticking with their current vehicle longer, a sign that many Americans are adopting a “wait and see” approach to the market. Beyond that, 23% haven’t seen a deal worth moving on, while 9% say they haven’t found a car or truck they like. Price sensitivity remains a factor, with 20% waiting for prices to drop and 14% holding out for lower loan rates.

Concerns about tariffs are present, but not widespread. Among those on the sidelines right now, the reasons cited are roughly the same for all income segments. About one quarter say that they’re keeping their current vehicle for longer, while roughly 20% say they haven’t seen any deals worth acting on yet. The third most common reason for sitting out today’s car market is waiting for prices to come down. Only 7% cited tariffs as one of their reasons for not planning to buy a car in 2025.

The 2025 CarEdge Consumer Survey shows that the American car market remains fractured and cautious in the wake of economic headwinds and new policy shifts like auto tariffs. While some shoppers are moving forward with confidence, many are hesitant, skeptical, or simply waiting for conditions to improve.

The overarching takeaway? The car market in 2025 is no longer defined by pent-up pandemic demand or rapid inflation. Instead, it is being shaped by deal quality, interest rates, and policy awareness. For automakers, dealers, and car buyers alike, understanding these shifting motivations is key to navigating what’s shaping up to be one of the most complex car buying environments in recent history.

Founded in 2019 by father-and-son team Ray and Zach Shefska, CarEdge is a leading platform dedicated to empowering car shoppers with free expert advice, in-depth market insights, and tools to navigate every step of the car-buying journey. From researching vehicles to negotiating deals, CarEdge helps consumers save money, time, and hassle. Join the hundreds of thousands of happy consumers who have used CarEdge to buy their car with confidence. With trusted resources like the CarEdge Research Center, Vehicle Rankings and Reviews, and hundreds of guides on YouTube, CarEdge is redefining transparency and fairness in the automotive industry. Follow us on YouTube, TikTok, X, Facebook, and Instagram for actionable car-buying tips and market insights.