CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

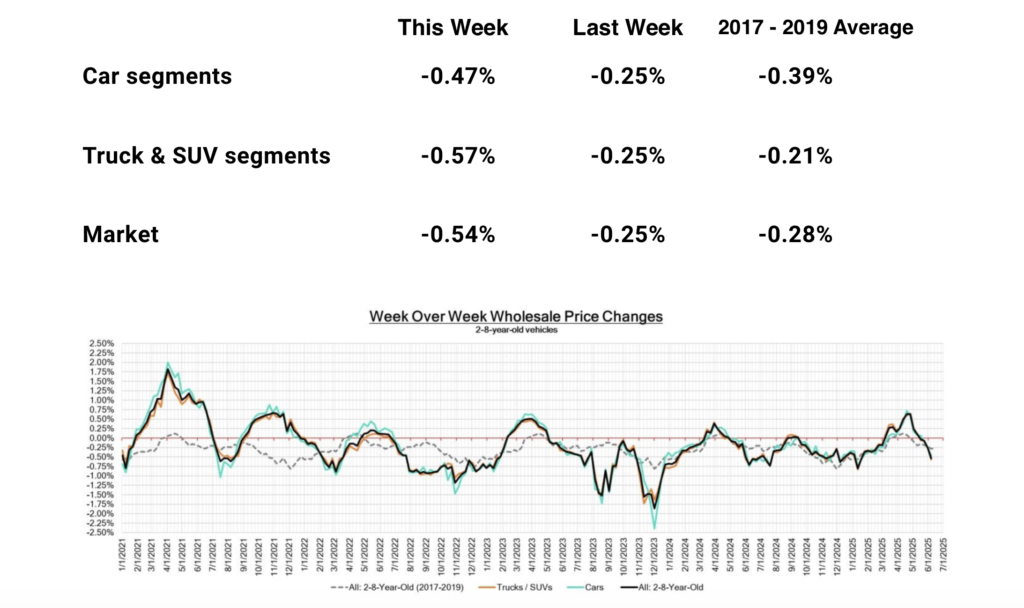

Summer is here, and for used car shoppers, we’re finally seeing a shift. According to the latest data from Black Book, wholesale used car prices have now dropped for three consecutive weeks. And last week, the rate of decline was double the seasonal average. That’s a strong indicator that retail prices could start falling by July or August.

But what comes next depends largely on the new car market. Let’s take a closer look at what buyers and sellers should expect from the used car market this summer.

Used car values typically trail wholesale trends by a few weeks. When auction prices fall, retail prices tend to follow 6–8 weeks later. That puts us on track for softer pricing in the second half of summer 2025. Here’s a look at wholesale used car price trends in 2025, showing that prices are dropping more quickly in June:

What’s behind the shift?

According to CarEdge co-founder Ray Shefska, there’s still a wildcard in play: what happens with new car pricing.

“The only caveat,” Ray explains, “is what happens with new car prices. Do new car prices continue to go up, which would pull used car prices up as well, or does the new car market grow cold, which should lower used car prices?”

Right now, all signs point toward a cooling new car market. If that continues, used car shoppers could soon have more negotiating power. But is the possibility of slightly lower prices worth delaying your purchase? Let’s get into what Ray has to say about that.

If you’re shopping this summer, here’s advice from CarEdge’s Ray Shefska:

“When you find a car that checks your boxes at a fair price, this summer is a good time to go ahead and buy. The key is to do your homework and ensure you’re getting a fair deal. Don’t rush into a purchase, especially as prices are on the downtrend.”

Trying to time every market shift is tough. What’s more important is that you do your research and use car buying tools to ensure you’re getting a fair price. Shop around for financing rates, and never agree to pay for forced add-ons.

🔍 Don’t skip the inspection. The average used car in America now has over 70,000 miles on the odometer. A Pre-Purchase Inspection (PPI) is essential to avoid buying a problem car.

Grab Your FREE Used Car Buying Toolkit – Window Sticker, Target Price, and More

For private sellers and those trading in a vehicle, this summer may be your last chance to get a top-dollar offer before prices slide further.

If you’re on the fence about selling, now’s the time to make your decision.

If you’re buying, it’s a good time to monitor used car market trends. Used car prices could continue trending downward as summer progresses. For sellers, acting sooner rather than later can help lock in the best value before the market softens further. It’s due time to see how much your car is worth. And if you’re just keeping an eye on the market, pay close attention to both new and used car pricing, as the direction of the new car market will heavily influence what happens next.

It’s not your imagination — some automakers really are raising prices more than others. A new market analysis shows that while average new car prices are inching higher in 2025, the real story is more nuanced. While some automakers are piling on the incentives, others are moving in the opposite direction.

At first glance, car prices appear relatively stable. According to the latest data from Kelley Blue Book, the average transaction price for a new vehicle held steady at $48,799 in May. Compared to May 2024, that’s a 1.0% increase. Meanwhile, the average MSRP ticked up to $50,968, a 2.1% increase year over year.

But a closer look at individual automakers reveals some surprising trends. Here’s a look at which brands are raising prices the most, and which are doing the opposite.

While prices rose across the board, five automakers posted the highest year-over-year increases in transaction prices. The numbers are eye-opening:

| Automaker | May 2025 | May 2024 | Price Increase |

| Volkswagen Group | $60,696 | $53,686 | 13.1% |

| Jaguar Land Rover | $107,766 | $98,036 | 9.9% |

| General Motors | $54,060 | $51,243 | 5.5% |

| Nissan-Mitsubishi Alliance | $36,576 | $34,691 | 5.4% |

| Mazda | $36,429 | $34,644 | 5.2% |

One important factor driving price inflation is the introduction of all-new, higher-priced models. Some automakers are leaning into premium segments, especially in electric vehicles. General Motors, for instance, has been ramping up production of high-dollar electric trucks in 2025, like the GMC Hummer EV and Silverado EV. These pricey additions skew the average transaction price upward, even if legacy model pricing remains more stable.

At the same time, incentive spending is being reined in. Volkswagen, Mazda, Land Rover, Volvo, and BMW all reduced incentive spending by more than 10% in May. Chrysler, Jeep, and Ram also offered fewer discounts.

On the other end of the market, Tesla, Toyota, and Nissan boosted incentive spending. Toyota increased incentives by over 20% month-over-month. Still, Toyota’s incentive spending remains modest at just 4.1% of the average transaction price. If you’re looking for a great deal, it might be worth an electric test drive. EV incentives average 14% of the average transaction price in 2025.

While some automakers are raising prices, others are lowering them. The truth of the matter is, most of these falling prices are not due to lower MSRPs, but instead result from higher incentives.

Five automakers saw year-over-year price decreases in May 2025:

| Automaker | May 2025 | May 2024 | Price Decrease |

| Stellantis | $53,623 | $56,193 | – 4.6% |

| Tesla | $55,277 | $56,860 | – 2.8% |

| Ford Motor Company | $55,159 | $56,115 | – 1.9% |

| Hyundai Motor Group | $37,210 | $37,612 | – 1.1% |

| BMW | $70,255 | $70,811 | – 0.8% |

As you can see, car price trends are far from uniform in 2025. While some brands push further into premium territory, others are using huge incentives to stay competitive, or simply to finally move 2024s off the lot. Stellantis, in particular, has aggressively discounted models like the Jeep Grand Cherokee and Ram 1500 amid growing inventory. Nissan is doing much of the same.

Interestingly, Stellantis shares something in common with one of the automakers raising prices the most: Volkswagen. Despite taking opposite approaches to pricing, both of these global giants consistently appear on the list of slowest-selling vehicles each month. Here’s a look at the models struggling the most on dealer lots today:

| Make | Model | Market Day Supply | Total For Sale | Total Sold (45 days) | Average Selling Price |

|---|---|---|---|---|---|

| Ram | Ram 2500 | 392 | 8,133 | 934 | $69,711 |

| Audi | Q4 e-tron | 388 | 2,559 | 297 | $58,598 |

| Audi | A6 | 368 | 2,854 | 349 | $67,586 |

| Volkswagen | ID.4 | 262 | 4,621 | 795 | $43,845 |

| Jaguar | F-PACE | 243 | 2,943 | 544 | $71,349 |

| Land Rover | Range Rover Velar | 241 | 3,379 | 630 | $72,453 |

| Porsche | Taycan | 241 | 2,098 | 391 | $143,756 |

| Alfa Romeo | Stelvio | 218 | 875 | 181 | $55,472 |

| Audi | A8 | 217 | 546 | 113 | $96,267 |

| Land Rover | Discovery | 209 | 1,668 | 360 | $75,392 |

See the complete list: The Fastest and Slowest-Selling Cars Right Now

In short, these trends reflects a broader shift in strategy across the auto industry: sell fewer vehicles, but make more profit on each one. That’s exactly why automaker profits have soared in the post-pandemic era. For many OEMs, the 2020–2022 supply chain bottlenecks turned into a “when life gives you lemons, make lemonade” moment. Instead of chasing volume, automakers leaned into higher-margin models.

With prices continuing to climb for some brands and segments, buyers need to be more strategic than ever. Here’s how to navigate this market:

1. Shop the deals. Low APR financing and attractive lease offers are out there, but you have to know where to look.

➡️ Compare deals now

2. Stay flexible. Don’t fall in love with one specific make or model. Today’s “dream car” might cost you hundreds more each month compared to a more affordable alternative.

➡️ Find fair prices with CarEdge Pro

3. Look beyond the sticker price. Total cost of ownership matters more than ever. A car with great fuel economy, low depreciation, and strong reliability will save you thousands down the road.

➡️ Use CarEdge Research to find the best value… It’s FREE data!

4. Get expert help. Don’t go it alone. A CarEdge Concierge can help you compare options, negotiate on your behalf, and ultimately save big — all while reducing stress.

➡️ Learn how a personal Concierge can help you today.

If you’ve been thinking about leasing a new car, this Fourth of July is your best chance for a deal between now and Labor Day sales. Automakers are rolling out some of the best lease offers we’ve seen all year, with monthly payments as low as $129/month.

Below, we’ve rounded up the best Fourth of July lease deals. Just a handful of brands have announced July incentives, so we’ll keep updating this page as more deals arrive. Note: Manufacturer lease offers don’t include taxes and fees, which must be paid upfront or rolled into your monthly lease payments.

💡 Did you know? CarEdge Concierge doesn’t just help car buyers. We negotiate lease deals too, saving our clients thousands. Let us do the legwork so you can focus on enjoying your new ride. Learn more about our car deal negotiation service.

Zero-down lease specials are increasingly rare in 2025, but sluggish sales make the Model 3 cheaper than ever before. Even if you’re an EV-skeptic, this deal is worth a test drive.

This is one of the cheapest lease offers this month, period. The IONIQ 5 is known for ultra-fast charging and quirky design.

👉 Need help negotiating this lease? Let CarEdge Concierge handle it.

This is a value-packed lease on a subcompact SUV that’s great for city driving and everyday use. It’s not the roomiest crossover out there, but it’s better-equipped than most models at this price point.

See Kona listings with local price insights.

The Tucson PHEV gives you the flexibility of gas and electric in one of Hyundai’s most popular models.

Compare local lease inventory: Search Hyundai listings near you.

With the Bronco Big Bend, rugged style meets everyday practicality. This isn’t the best deal out there this July 4th, but it’s a solid lease on a capable SUV.

See Ford listings with local price insights.

Ford’s EV lease offer includes employee pricing incentives and potential bonus perks like a home charger. In 2025, the Mustang Mach-E is one of the top-selling electric vehicles on the market.

⚡ Want to save more? Let CarEdge Concierge negotiate the lease for you.

The Maverick remains one of the most affordable and fuel-efficient pickups in America. It’s not as capable as a full-size truck, but you won’t find truck leases this cheap with the F-150.

See Maverick listings with local price insights.

It’s hard to beat a full-size truck lease under $550/month, especially with the F-150’s reputation as a workhorse. Before you lease, be sure to check out our CarEdge value ratings.

🚗 Browse local Ford inventory: Search Ford lease deals near you

This is the cheapest lease in America right now. The Niro EV isn’t the fastest-charging, but for a commuter vehicle, it’s just about perfect if you have a place to plug in overnight.

See Kia Niro listings with local price insights.

With all-wheel drive, modern looks, and a lease deal under $300 a month, the Seltos is a top pick for budget-conscious lease shoppers. Kia isn’t advertising offers for the front-wheel drive Seltos, but you may be able to find an even cheaper deal.

See Kia Seltos listings with local price insights.

The Carnival Hybrid is a fan-favorite hybrid minivan with loads of tech and passenger space. It’s rare to see a cheap lease deal for family haulers like this.

See Kia Carnival listings with local price insights.

Only six car brands have announced July 4th specials as of mid-June. Most of the rest are likely to arrive on July 1, 2025. Need help deciding between lease options? Or want to make sure you’re getting the best monthly payment possible?

CarEdge Concierge can negotiate your lease for you. From trucks to EVs and everything in between, we help you avoid paying too much, all while ensuring you’re stressing A LOT less. It’s the easiest way to lease a car!

In a move that has stunned consumer advocates, the California Senate just passed a bill that would dramatically increase the fees car dealers can charge buyers. This comes even as lawmakers publicly pledge to address affordability in the state. Senate Bill 791 shows that many California lawmakers have other intentions.

On June 3, 2025, Senate Bill 791 passed with overwhelming bipartisan support. This bill would allow California car dealers to charge up to $500 in documentation fees, up from the current cap of $85. That’s a 500% to 600% increase in car buying fees, depending on the vehicle’s price. The bill still must pass the Assembly before heading to Governor Newsom’s desk.

“This is the opposite of saving money for people,” Rosemary Shahan, president of Consumers for Auto Reliability and Safety, told CalMatters. “It’s just benefiting car dealers at the expense of car buyers.”

Supporters of the bill, including the California New Car Dealers Association, argue that inflation and new state regulations have made it more expensive to process transactions, including loan paperwork and DMV registration. They say the $85 cap hasn’t kept up with reality.

But opponents are calling it a “junk fee”, one that will quietly increase the cost of buying a car without improving the vehicle or experience for the customer.

“It’s amazing how lobbyist’s dollars can influence politicians to vote against their constituents’ best interests, ” said Ray Shefska, CarEdge Co-Founder and 43-year auto industry veteran. “This bill reinforces that in America, whether it be national, state or local, we have the best politicians money can buy. When things are already barely affordable, let’s by all means make it even more difficult for people buying cars in California.”

See which car buying fees are legit, and which should be negotiated.

Despite growing political attention on “junk fees” in everything from travel to event tickets, only one state senator voted against the bill: Sen. Henry Stern (D-Calabasas). He called out what he sees as a pattern of bad behavior from auto dealers, and said they “haven’t earned the trust to justify this major increase.”

Other lawmakers who voted in favor of the bill include:

According to Digital Democracy, the California New Car Dealers Association has donated nearly $3 million to lawmakers since 2015, including $28,700 to Senator Jones, and $13,000 to Senator McGuire.

One Republican senator, Roger Niello, recused himself from voting altogether due to his family’s involvement in car dealerships.

Notably, the bill exempts state government vehicle purchases from paying the fee, even as everyday Californians would be required to pay it in full.

The bill now moves to the California Assembly, where lawmakers are expected to negotiate its final terms. Cortese has hinted that the $500 cap may be reduced to win Governor Newsom’s support.

Still, with the average new car now costing $48,699, a 1% documentation fee could mean hundreds in extra charges for buyers already navigating record-high prices, interest rates, and tariffs.

At CarEdge, we believe buyers should know exactly what they’re paying for — and why. Hidden fees like this make it harder for consumers to make informed decisions and harder still to afford the car they need.

If you believe car buyers deserve transparency — not hidden fees — contact your California Assembly representative today and urge them to vote NO on Senate Bill 791. Tell lawmakers that affordability means protecting consumers, not padding dealership profits.

Find Your Representative and Take Action Now

Your voice matters. Let Sacramento know: No more junk fees.

Don’t go it alone in today’s murky car market. Learn how you can save more and buy confidently with CarEdge’s free tools.

![These Fourth of July Car Deals Are Already Live [2025]](https://caredge.com/wp-content/uploads/2025/06/2025-Ford-F-150-Tremor-1080x675.jpg)

Time sure flies, doesn’t it? The Fourth of July is just around the corner, and several automakers aren’t wasting any time rolling out their big summer sales. All of the deals below are officially available through July 7, 2025, but keep in mind: the rest of the industry is likely to wait until July 1 to drop their July 4th incentives. Check back each week as more sales roll in!

Honda is coming out strong this summer with low APR and competitive lease offers across its most popular models — including the all-new Prologue EV.

Compare Honda deals with local market insights, or see offer details.

Ford is continuing its Employee Pricing for All promotion through July 7, 2025. While it sounds appealing, the reality is more nuanced, as we explored in our guide to employee pricing. That said, one deal is worth noting, mostly since the F-150 is so popular:

Truck fans, be sure to check out the best truck deals from competitors this month. More deals could drop closer to the holiday weekend, so stay tuned.

Compare Ford deals with local market insights, or see offer details.

Hyundai is offering well-rounded incentives across its gas, hybrid, and electric lineup — including the first-ever 2026 IONIQ 9, a 3-row EV SUV.

Compare Hyundai deals with local market insights, or see offer details.

Nissan just announced 0% financing offers for two popular SUVs: the Rogue and Pathfinder. The 2025 Pathfinder is an especially great deal for families in search of three rows.

Compare Nissan deals with local market insights, or see offer details.

Kia is leaning into low-APR financing and EV incentives for the summer season.

Compare Kia deals with local market insights, or see offer details.

Genesis has some of the best luxury car incentives in June, and these offers last through Fourth of July weekend.

Compare Genesis deals with local market insights, or see offer details.

These are just the early birds. Most automakers are likely to unveil their Fourth of July incentives closer to the start of the new month. With auto loan rates remaining around 10% APR for new cars (and even higher for used cars), you can’t argue with the financing deals were already seeing. Leasing is looking like an increasingly great option, too.

Keep this page bookmarked — we’ll update it regularly as new Fourth of July car deals roll out.

Need help negotiating? CarEdge Concierge can help you get the best price — without the hassle.

Head over to our Best Deals Hub for the rest of this month’s standout offers.