CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Subaru just became the latest automaker to raise vehicle prices, and it likely won’t be the last. As new tariffs and 2026 model-year pricing updates collide, car shoppers across the U.S. are noticing a troubling new trend: mid-year price hikes. But there’s still a window of opportunity: Subaru’s latest offers include low-APR financing and compelling lease deals.

If you’re planning to buy a new Subaru this summer, now may be your best chance to lock in a deal before the next round of price hikes hits.

Subaru of America is the latest automaker to hike vehicle prices as the cost of doing business rises. While many suspected tariffs were the cause, Subaru instead cited “current market conditions” and a need to “offset increased costs while maintaining a solid value proposition.”

According to a now-deleted dealer bulletin shared by Car and Driver, price increases range from $750 to $2,055, depending on the model and trim. As best as we can tell, these price hikes apply to all new Subaru models, meaning both 2025 and 2026 models. Here’s a breakdown of the new pricing changes:

These new sticker prices are already beginning to show up on dealer lots, and Subaru has confirmed that MSRP updates are rolling out immediately. However, it remains unclear how quickly they’ll affect prices for older inventory.

Subaru’s 2025 price hikes follow a familiar strategy. The best-selling Subaru models see the greatest price hikes, and those with sluggish sales are barely budging. For fans of the Ascent, Outback, and Forester, nearly $2,000 in price hikes will be an unwelcome sight.

Subaru’s latest price hike is part of a broader trend. Across the industry, automakers are dealing with a one-two punch: steep new tariffs on imported vehicles and parts, and 2026 model-year pricing creeping in. Add slow but steady inflationary pressures to the mix, and what you get is automakers like Subaru announcing mid-year price adjustments.

While Subaru avoided directly blaming tariffs, the timing aligns with similar hikes from other automakers. And with roughly 45% of Subaru’s U.S. sales coming from imported models, the brand is especially vulnerable.

Expect more automakers to quietly follow suit in the coming months. Volkswagen Group, Mazda, and Honda all import a large portion of their U.S. sales volume, and are likely to respond to the challenges. If you’re car shopping this summer, locking in pricing sooner could help you avoid the next wave of increases.

If you’re in the market for a new Subaru, now is the time to act. The brand is raising prices by up to $2,055, and the most popular models are already impacted. While older inventory may still reflect lower pricing, that window is closing fast.

The good news? Subaru is still offering 0% APR on select models, including some of its most in-demand vehicles.

Here’s a rundown of Subaru’s latest offers in late May 2025:

Subaru’s price increases are just the start of what’s shaping up to be a more expensive summer for car shoppers. With tariffs, MSRP hikes, and thinning incentives, it pays to act fast.

Whether you’re considering a Subaru or cross-shopping with competitors, the best deals won’t last long. Before you head to the dealership, make sure you’re prepared:

🔍 Check Dealer Invoice Pricing – Know what others are really paying before you negotiate.

🚗 Search Local Inventory – Compare prices near you and spot pre-hike listings.

Buy with confidence and save more with CarEdge on your side.

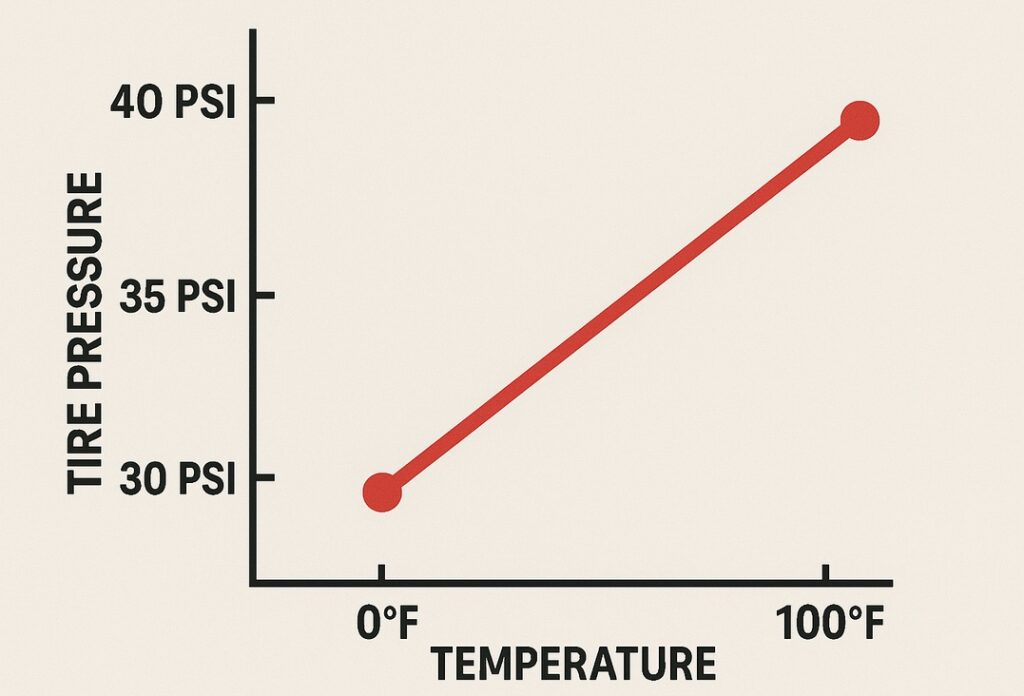

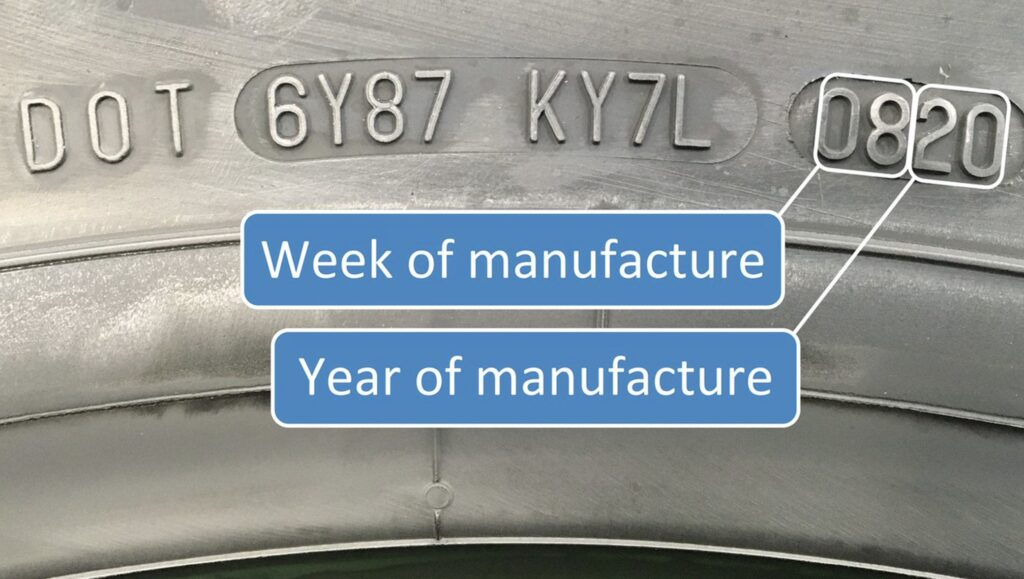

Tires aren’t cheap, but the right care and habits can help you squeeze more miles out of them safely. Whether you’re commuting daily or taking the occasional road trip, your tires are the foundation of your car’s performance and safety. Yet, far too many drivers replace tires sooner than they need to. And if you haven’t noticed, a set of 4 tires can cost well over $1,000 these days.

Here’s the good news: with just a little regular maintenance and a few smart habits, you can extend the life of your tires and your car. Let’s break it down.

Getting more life out of your tires means more money in your pocket, and a safer ride. It’s about consistency, not complexity. A few extra minutes each month checking pressure or rotating tires with your oil change can make a real difference.

Want to go the extra mile? Use the CarEdge Garage to stay on top of tire maintenance, track your car’s value daily, and never miss a service again. It’s free, and it’s the easiest way to make smarter decisions about your car.

In 2025, car buyers are tempted by employee pricing incentives, 0% APR offers, and huge cash discounts. But are you actually getting a good deal? While the ads shout “limited-time savings,” not every offer is as great as it looks. The truth is, some deals are just inflated MSRPs dressed up with a cash rebate.

So how can you tell what’s a smart buy, and what’s just dealership smoke and mirrors?

Start with this: the dealer invoice price. Here’s how to tell if you’re getting a good deal on a car this Memorial Day.

It’s easy to get swept up in the excitement of car sales. Dealerships know this, and that’s exactly why they flood the airwaves with “must-act-now” offers. But behind the scenes, there’s often a big gap between what they’re showing you and what they actually paid for the car.

That’s where many car buyers fall into the trap of overpaying.

It doesn’t help that Ford and Stellantis (Jeep, Ram, Dodge, and Chrysler, among others) are touting employee pricing specials, which are not as good as they seem.

The truth is, knowing what’s a good deal and what’s merely a mirage of a good deal is tougher than it should be in 2025.

The dealer invoice price is the amount a dealership pays the manufacturer for a vehicle. It’s lower than the MSRP (Manufacturer’s Suggested Retail Price) you see on the window sticker. But here’s the key: manufacturers often provide hidden incentives, kickbacks, or volume bonuses that drop the dealer’s real cost even further.

Knowing the invoice price puts you in control:

Even better? With the right leverage, you can often negotiate below the invoice price.

Instead of guessing what’s a good deal, we built a tool that shows you what dealers don’t want you to see. Just select the vehicle you’re considering, and we’ll give you:

✅ Dealer Invoice Price – Know what the dealer paid

✅ Target Discount Guidance – Understand what you should be paying

✅ Cost-to-Own Data – Factor in depreciation, fuel costs, and more

✅ Negotiation Tips – Learn what to say (and when to walk away)

✅ Inventory Pro – See which cars are likely negotiable

And the best part? It’s 100% free. No hidden fees, no catch. See for yourself →

To make the most of your car buying adventure (and your precious time), keep these tips in mind:

With car prices still hovering near record highs and inventory tightening in many areas, you can’t afford to go to the dealership unprepared. But with the right tools, you can make smart decisions, skip the stress, and walk away with a truly great deal. Your car deal starts with the facts, and CarEdge is here to give them to you.

It’s the end of the road for these familiar faces. As automakers shift priorities toward SUVs and electric vehicles, several long-running nameplates are quietly exiting stage left. Some have already ended production. Others are nearly sold out. Whether you’re a nostalgic fan or a bargain hunter, this summer is your last chance to drive home these cars before they’re gone for good.

Remaining inventory nationwide: 54

Production has ended for the Audi A4, as Audi shifts focus toward larger sedans and EVs. The A4 is effectively being replaced by the larger and sportier Audi A5 and S5 models. With Volkswagen Group’s uncertain EV strategy and financial struggles, streamlining the lineup played a role in the decision.

See the last A4 listings before they’re gone.

Remaining inventory nationwide: 3,600

As Cadillac pivots to electric vehicles like the Lyriq, Optiq, and Vistiq, models like the XT4 and XT6 are being discontinued. Production ceased in January 2025, so today’s inventory is all that’s left. At current selling rates (81 days of market supply), the last XT4 will be sold in August or September of this year.

See the last XT4 listings before they’re gone.

Remaining inventory nationwide: 2,061

Following 61 years as a classic American-made car, the last Malibu rolled off the assembly line in November 2024. In May, there were just 2,061 copies of the Malibu left for sale. With just 49 days of market supply, it’s likely that the last brand-new Malibu will find a home sometime in July. Perhaps a lucky museum will see the value and add one to their collection.

See the last Malibu listings before they’re gone.

Remaining inventory nationwide: 17

After 55 years and 1.1 million cars sold, the MINI Clubman ended production back in February 2024. In May 2025, 17 Clubmans remained unsold. Even as a critically endangered species, they’re slow to sell. If you want to claim one of the last Clubmans ever, you could probably get your hands on one over the next few months.

See the last Clubman listings before they’re gone.

Remaining inventory nationwide: 287

You’d be hard pressed to find many truck fans who will miss the Titan, but if you’re among this rare breed of Nissan aficionados, act fast as only 287 Nissan Titans remain unsold. At current selling rates, they’re on track to be extinct sometime in July.

See the last Legacy listings before they’re gone.

Remaining inventory nationwide: 4,615

Subaru has sold 1.3 million copies of the Subaru Legacy since launching the all-wheel drive sedan back in 1989. As the first Subaru model made in America, the Legacy has a special place in the hearts and minds of Subaru fans. Subaru previously announced that production of the Legacy would end sometime this spring. Although over 4,000 remain on dealership lots, it’s a relatively quick seller. At current selling rates, this Subaru sedan will be gone by late summer.

See the last Legacy listings before they’re gone.

Remaining inventory nationwide: 550

Volvo sales have been slowing over the past few years, and the S60 sedan has become a casualty of this trend. The S60 was built in South Carolina, which is now home to the 2025 Volvo EX90 SUV. Volvo will continue to build the S90 in China for other markets, but there are no plans to import them to the U.S. market.

See the last S60 listings before they’re gone.

A handful of other nameplates will also vanish after 2025, but remain widely available for now. The Nissan Versa is one such example. Want to see what else is going away by 2026? Check out our full list of cars being discontinued this year.

As always, be sure to shop smart with CarEdge’s free tools and local market insights. Looking to have an expert negotiate car prices on your behalf? We’ve got the perfect solution.

Happy summer car shopping!

Thinking about holding onto your car for the long haul? You’re not alone. In today’s car market of rising prices and rapid depreciation, many drivers are wondering whether it’s smarter to stick with the car they already own.

At CarEdge, we believe informed decisions save you thousands. Here’s what you need to know before deciding whether to keep your vehicle for longer, or start fresh with something new.

New cars lose 20–30% of their value in the first year alone. By keeping your car longer, you avoid taking that financial hit repeatedly. Plus, you won’t be shelling out for sales tax, registration fees, or dealership add-ons every few years. Insurance costs also tend to drop with older cars. This is especially if you drop comprehensive or collision coverage once the car’s value declines significantly as the miles add up.

Check out our free cost of ownership data

Most auto loans are paid off in 3–6 years. If you hold onto the car after that, you’ll enjoy years of driving without a monthly payment. Having a paid-off car means freeing up cash for other priorities, like savings or paying down debt.

You know your car. Its quirks, service history, how it drives in snow or rain—there’s no learning curve. That trust and comfort can go a long way in peace of mind, especially when you’ve maintained the car well.

Even the greenest EV has a carbon footprint from manufacturing. Holding onto your current car—even if it’s not electric—can be more environmentally friendly than replacing it with a new one every few years.

Buying a car can be a hassle. Keeping your current car means no time spent researching new models, test driving, negotiating prices, or dealing with trade-ins. It’s one less thing to worry about.

Even well-built cars eventually wear down. Between years 8 and 12, expect bigger-ticket repairs like suspension work, HVAC issues, or transmission problems. Costs can vary dramatically depending on the make and model, but reliability becomes less predictable.

See maintenance rankings by make and model

Newer vehicles often come with advanced safety features like automatic emergency braking, adaptive cruise control, blind spot monitoring, and more. Your old ride might not have these, which can make a big difference in both safety and comfort.

Seats wear out. Touchscreens lag. The cabin might feel outdated or less comfortable over time. Even if the engine runs strong, the driving experience may start to feel more like a chore.

After 10 years, most vehicles have very little resale value. This is especially true for cars with well over 100,000 miles on the odometer. In contrast, if you sell after 5 years, you might still recover 40–60% of the original price. If you plan to trade in later, timing matters.

We’ve got plenty of free depreciation tools to keep you informed.

If you own an EV, charger standards and technology may evolve. For instance, early Nissan LEAF owners are encountering challenges finding compatible charging these days. Even gasoline vehicles might also face limitations as fuel blends change or emissions standards tighten. An older car could eventually feel outdated or even unsupported.

Let’s say you buy a $35,000 car.

Over 10 years, buying two newer vehicles could cost $8,000 to $15,000 more than keeping one car the whole time, depending on the model, insurance, taxes, and maintenance needs.

If your car is still safe, reliable, and not draining your wallet in repairs, holding onto it a few more years is often the smartest financial choice. On the other hand, if maintenance costs or safety concerns are piling up, it may be time to move on.

Need help figuring out whether your current car is worth keeping?

👉 Check out the CarEdge Value Tracker, and know when it makes sense to sell.

Or, explore how long-term ownership compares to financing something newer with our full Cost to Own Rankings.