CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Google search “car research websites” and you’ll be greeted with about a half dozen advertisements and nearly 1 trillion search results. If you thought it would be easy to find a website to help you research your next ride, you’re in store for some analysis paralysis!

Today our team at CarEdge decided to list out our top five car research websites that we recommend. Please keep in mind that none of these websites sponsor us or have paid us for placement on this list. Each of the websites listed below has a specific niche that they cater to, and we think it’s worth highlighting them here.

Without further ado, let’s jump right into it.

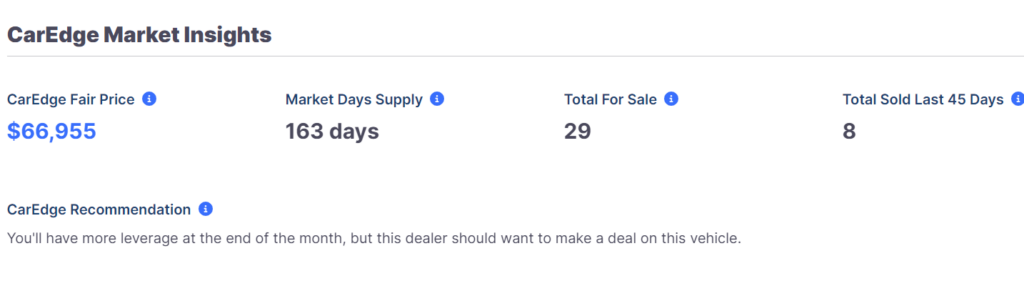

If there is one question we get asked most frequently at CarEdge, it’s some variant of “Well, how much should I offer for this vehicle?” Answering that question is now much easier with the CarEdge Fair Price. Your Fair Price is calculated with local market data and price trends taken into consideration.

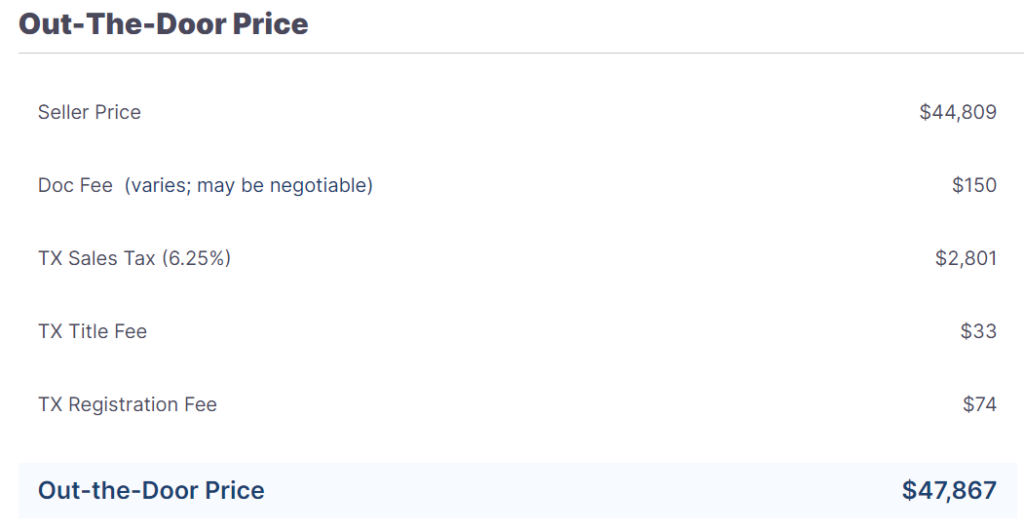

Many car shoppers out there are getting lured into dealership showrooms with unattainably low advertised prices. What did we do about that? We built CarEdge Car Search, a car search engine that shows you the Out-the-Door Price, not just the advertised price!

By simply taking into account your tax rate and the typical fees in your area, CarEdge gives you a clear view into how much it will really cost to purchase a vehicle.

Having the confidence to offer a fair value for a vehicle is not easy, and as we all know, if we lowball the salesperson, there’s a good chance we won’t hear back from them anytime soon.

That’s why we like that CarEdge added market insights to their vehicle results. You can see how many days a car has been on the dealer’s lot, what the local supply of that vehicle is, and how many similar cars have sold in the past 45 days.

Plus, there are no ads or lead generation form for dealers. Instead, CarEdge has a 4 step buying guide that you can download (which includes handy email templates) to contact the dealer and get a fair price. Even better, CarEdge offers the option of working with a Car Coach who will help you negotiate your deal from start to finish.

Check out the unique market insights included with CarEdge Car Search.

Finding the right vehicle can be tough. If you’re buying new it can be a bit easier (you can always customer order one directly from the factory), but when you try and find the exact right used car, it can take days, weeks, and sometimes even months, before you’re able to stumble across the car, truck, or SUV you’ve been searching for.

AutoTempest is one of the most helpful and useful car research websites available, especially if you’re looking for a hard to find used car. Their search functionality aggregates used car listings from across a variety of sources, and their standardization of data allows you to filter search results for highly specific criteria, such as fuel type, drive type, and more.

Rather than spend an hour on eBay, an hour on Craigslist, and an hour on Cars.com, one search on AutoTempest will pull in results from all of those websites (and more) at once. Save time, reduce the number of browser tabs you have open at once, and rejoice when you find your new to you used car quicker than before!

If you’re trying to stay organized, having all of your information in one place can be very helpful. Rather than trying to remember a bunch of logins and passwords, using one tool can help you keep things organized. CapitalOne’s Auto Navigator is attempting to provide you with exactly that experience.

After ending their mortgage business, Capital One has invested heavily into being a dominant auto lender. To that end, they built a very robust online car research website that anyone (not just Capital One clients) can use.

Auto Navigator offers the same type of search functionality as other traditional car research websites, but what makes them special is that they offer a simple and seamless pre-qualification to their process. If you go ahead and pre-qualify on their website you’ll be able to see potential offers for monthly payments on the vehicle listings. This can be helpful to reference during the vehicle research process.

Although it isn’t our recommendation to negotiate your car deal based off of the monthly payment, it is entirely advisable to research which vehicles may meet your monthly payment goal. CarsDirect offers one of the best user experiences for doing this.

We hope to see it improve in the future, but for now, your best bet is to “shop by payment” on the CarsDirect “find deals by payment” page.

CarDirect lists out dozens of options at a variety of price points, and even has a separate page for lease deals by payment as well. Unfortunately this is only for new cars, trucks, and SUVs, and not used, but maybe someday in the not too distant future we’ll have a similar breakdown for used vehicles. In the meantime, if you’re looking for a car research website that helps you identify options within your monthly payment goal, this is your best bet.

Bear with me for a moment here, but CarGurus is like the Zillow of the automotive industry. They seemingly have ALL the data. And with all the data, they have an opportunity to create a lot of really interesting and compelling insights.

CarGurus has a simple and intuitive search engine, but candidly it feels exactly the same as all the other “brand name” car research websites out there. Where CarGurus stands out, is with its lesser known Price Trends feature.

The Price Trends feature allows you to view price trends over a set period of time for any particular make, model, and year of vehicle. You can also view trends based on body style. This is super helpful during the research process, as you may be able to identify a specific vehicle, or type of vehicle that has decreased in price in the past few weeks and is now in your budget. Identifying trends across a vehicle, or vehicle type, can be incredibly helpful at the beginning of the car research process.

For example, you can see that minivan prices have been increasing at a much slower rate than convertible prices.

With this information you may be more interested in researching minivans instead of convertibles — yes, I am aware this is a poor comparison, who cross shops a Honda Odyssey with a Mazda Miata — but the thought is still true! In terms of research, CarGurus has you covered in ways that other websites don’t.

So there you have it, those are the top five car research websites we recommend. If you’d prefer to search through the 1 trillion search results to find a different website, more power to you. Our recommendation is that you focus on one of these five websites, and you’ll have a better car buying experience.

America runs on credit. Odds are, when you step foot in a car dealership you’ll need to be prepared to fill out a form or two that let the dealer check your credit score. However, many people don’t know what credit score car dealers actually use.

Unlike your traditional FICO score, car dealers — more accurately lending institutions that sell auto loans to dealerships — refer to another, less known score, called The FICO® 8 Auto Score, or its competitor CreditVision. To answer the question “What credit score do car dealers use?” We need to learn more about both of these products.

Fair Isaac Corporation (FICO) is a publicly traded data analytics company. You’re most likely familiar with their FICO score.

FICO offers specific products and solutions for car dealers and auto loans. Their product is called Auto Score 8. As you can see here from FICO’s promotional materials, Auto Score 8 is meant to help dealers assess credit risk and make approval decisions for auto loans. To answer the question ‘What credit score do car dealers use?” We need to dig into Auto Score 8, as it is in the industry standard credit score for auto loans.

Similar to your normal FICO score, you can request a copy of your current Auto Score from FICO for a fee.

What you really need to understand is that your Auto Score is calculated similarly, but differently than your traditional FICO score. The score range for the Auto Score is 250-900 (instead of the traditional 300-850). FICO promotes that Auto Score will help dealerships and lending institutions in five distinct ways:

FICO does not have a monopoly on the credit score market. There are other data analytics companies out there that want a slice of the pie.

TransUnion offers a product called CreditVision, which competes directly with FICO. Although CreditVision is not specific to car dealers or auto loans, it is important to mention here. When it comes to understanding what credit score car dealers use, CreditVision is important to be aware of.

TransUnion does offer dealer specific solutions that you should be aware of. This 2018 marketing video helps you get an understanding of what they provide dealerships with.

The main draw of CreditVision is the products ability to look at alternative credit data when calculating your score. Alternative credit data can include:

Regardless of if a dealership is using FICO® 8 Auto Score or CreditVision, my experience has taught me that there are three things that the banks and credit unions look at to determine your creditworthiness. They are, ability, stability and willingness.

Ability is defined by how much you earn and how much you payout on a monthly basis. In other words, do you have the ability based on your income to direct a certain percentage of that towards things like housing costs (mortgage or rent payments), car loans, and credit card payments?

Banks usually don’t want your debt payments to exceed more than 35 to 40% of your gross income. Say you earn $5,000 gross a month before taxes and deductions. The maximum amount of money banks would want to see you spending on debt is $2,000 per month.

This includes housing, cars and credit cards.

When you go to the dealer, ask yourself, “Do I have the ability, based off of what I earn and my current obligations, to take on additional debt?” That’s the question the dealer is asking themselves!

Stability is how long you have lived where you live, how long you have worked where you work, how long you’ve been employed in your line of work, and many other things of that nature.

Have you had three different addresses and four different jobs in the last three years? If you have, that would not show a bank stability. If you’re constantly moving and you’re having difficulty keeping a job for an extended period of time that could be a “red flag.”

Stability for the bank is someone who has resided at the same address for three years or longer, has been employed by the same employer for three years or longer, or has been employed in the same field for an even longer period of time.

Perhaps you’re a real estate agent and you’ve been in that line of work for 10 years. You’ve been with your present employer for three years, and you’ve lived at your current address for five years. That to a tee is stability.

You don’t move a lot, and you’ve been working in your industry for 10 years. To a car dealer or a bank, you don’t represent a big risk. If you have stability, you’re potentially the type of customer they are looking for, but that all depends on the last factor; willingness.

Willingness, is how you have handled your past debt obligations; mortgages, car loans, credit cards, phone bills and the like.

Have you paid them on time all the time or just some of the time? Have you paid them off ahead of schedule or did you fall behind schedule? If you fell behind schedule, how often did that happen? Did it happen once in three years or did it happen a dozen times in those three years?

Willingness signals to the bank exactly what kind of risk your loan poses to them.

If all of your accounts have always been paid on time or early, you are more than likely to get a loan quickly and easily because you pose little risk to the bank. If however you have a track record of paying your obligations off late, you immediately become riskier for the bank.

This generally translates into paying a higher interest rate. If the dealer or the bank is going to take the risk, they want to make money off of it. The greater the risk (less willing you’ve been in the past) the higher your rate of interest.

Now that we’ve answered the question “What credit score do car dealers use?” And we’ve addressed the three factors that influence your credit score, let’s discuss what credit score you actually need to buy or lease a new car.

In order to lease a car, you need to convince the leasing company that you’ll be able to make your monthly payments for the full time period of the lease. Unlike when you buy a car, leasing entails no ownership responsibility. In that regard, leasing is similar to renting an apartment. Each month the landlord expects payment. The same goes for your car lease.

620 is a minimum score you need to secure a lease. Below that, when you reach subprime credit, your chances of convincing a leasing company to “rent” you a vehicle become very challenging. This isn’t to say it’s impossible, however it certainly won’t be at an attractive price point.

A credit score in the Prime range will yield more favorable terms.

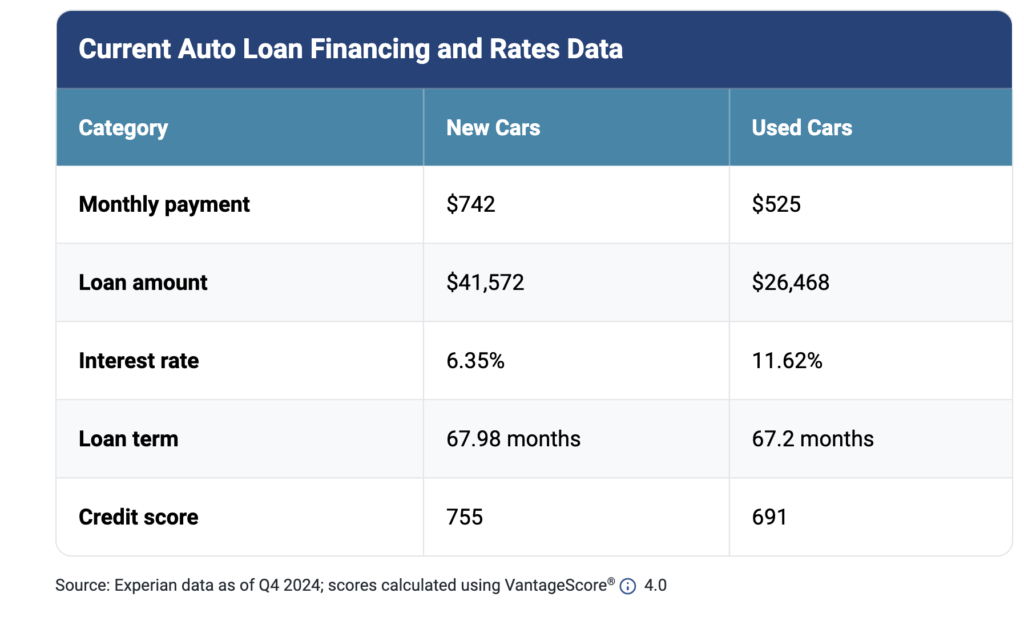

Unlike leasing, when you buy a car you become the individual holding the title. It’s relatively rare that someone comes into a dealership with cash and pays for a car upfront. With interest rates as low as they are, it really makes no sense why anyone would do that.

That means you’ll be financing your car. Nearly anyone can receive a loan on a car. The challenge will be getting the best rate possible. As your credit score decreases, the loan interest rate increases. In 2024, it’s common for borrows with ‘sub-prime’ or ‘deep-subprime’ credit to only qualify for rates over 15% APR. The worst auto loan rates are over 20% APR. How do you avoid these VERY costly interest rates? Work on raising your credit score, and having a sufficient income-to-debt ratio.

What is the moral of the story? If you want to get a car loan with little to no hassle, you need to always pay your loans, utility bills and credit cards on time. By doing this you will assure yourself the continued availability of credit at the best and least expensive rates and terms.

So always remember that banks are looking for your ability to repay your loan, the stability you have shown in your career and how often you have moved and how willingly you have paid back your past credit obligations. Ability, stability and willingness. These are the keys to good credit.