CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

If you’ve bought a car before, you’ve experienced the “F&I office.” Shrouded in secrecy, the F&I office, which stands for Finance and Insurance, is one of the greatest profit making centers within a car dealership. F&I Managers can be some of the highest paid employees at a car dealership because they generate so much profit for the business.

That being said, many car buyers are confused when they enter the F&I office. The paperwork, the many products, a good F&I Manager’s sales tactics … They all make it challenging to get in and out of the dealership without having purchased something while in the F&I office.

We also wrote a guide for general car buying jargon that you might also enjoy: The Car Buyer’s Glossary of Terms, Lingo, and Jargon

One way you can feel more confident and comfortable in the F&I office is by understanding the jargon, slang, and lingo used by F&I Managers. That’s why we prepared this guide, our Dealership F&I Office Glossary of Terms.

Please bookmark this page to reference when you are at the dealership in the F&I office. Please also consider sharing this page on social media so that your friends and peers can be more knowledgeable about the car buying process as well.

Without further ado, let’s dive in!

Finance your car purchase with CarEdge. We work with trusted credit unions nationwide. Get pre-approved in minutes!

The buy rate is the interest rate that a financial institution quotes to a dealer when you apply for financing through the dealership. Your dealer may offer you an interest rate that is higher than the buy rate, which is referred to as the sell rate. Ask the F&I Manager, “Are you quoting me the buy rate?” When negotiating your financing options through a dealership.

The sell rate is the interest rate that the dealership quotes you for your dealer-arranged financing. When you submit a credit application through a car dealership, the dealer has the discretion to charge you more than the buy rate. Always ask the F&I Manager if your interest rate is the “buy rate” or the “sell rate”.

The approval is a document from a financial institution that shows you have been approved for a loan with specified terms and conditions. When you submit a credit application through a dealer, they are not required to show you your approvals from the various financial institutions they contacted on your behalf. You should feel comfortable to ask to see your “approval” so that you can confirm they are not marking up your loan.

Equifax, Experian and TransUnion are the 3 credit reporting bureaus. Each company gathers data about your credit use to determine your creditworthiness and credit score.

A prepayment penalty is a fee charged on an auto loan for paying off the entire balance of the loan before the loan term is complete. Most auto loans do not include prepayment penalties, however some can. Prepayment penalty protections vary from state to state, so be sure to understand if your financing option has a prepayment penalty or not before signing the dotted line.

VSI stands for Vendor’s Single Interest, and this fee may show up on your final bank contract when purchasing a vehicle. Typically no more than $100, the VSI fee is a cost passed on to you by the lender that protects the bank in the event that the vehicle they are providing financing for is damaged or destroyed.

The base payment is the monthly payment you will be making on your vehicle without any additional add-ons or ancillary products. Ask your F&I Manager what your base payment is when finalizing your car deal.

The credit application is a form that is typically completed online that car dealerships use to secure loan options on your behalf.

A subvented rate is an interest rate that is lower than you could receive elsewhere because it is subsidized by the manufacturer in an effort to sell more cars. Zero percent financing offers are an example of subvented rate programs from auto manufacturers.

When you are negotiating a deal with a dealer, the salesperson may quote you monthly payments. You may see the salesperson or sales manager write “on approved credit” next to it. It simply means that this payment is only applicable subject to credit approval.

The money factor is the basis for the interest portion of your lease. Money factors can be converted to interest rates by multiplying the money factor decimal by 2400.

The amount you will have to pay out of pocket upon initiating a lease. Many car buyers look for “zero down” leases, however a typical lease will include the first lease payment due at signing.

The residual value is the percentage of the vehicle’s original MSRP that the leasing company expects the vehicle to be worth at the end of the lease term. The residual value is not negotiable and is set for each vehicle at each term (i.e. 36,000 miles and 36 months will have different residual value than 24,000 miles and 24 months). Many leasing companies rely on Black Book and ALG to determine their residual values.

The disposition fee is a fee charged by the lease company to offset expenses associated with the lease return process. The lease disposition fee is typically waived if you lease another vehicle from the same leasing company.

The acquisition fee is a fee charged by the leasing company at the inception of the lease. This fee is not negotiable and it is set by the leasing company. The acquisition fee typically covers the leasing company’s expense to purchase GAP Insurance on the vehicle.

Extended warranties are sold by manufacturers or car dealers, and they provide elongated warranty coverage on a vehicle. Extended warranties can only be sold by the manufacturer or the dealership selling a vehicle. Most extended warranties last for a short period of time, while longer coverages come in the form of vehicle service contracts. Read the full extended warranty guide here.

Vehicle service contracts are commonly referred to as extended warranties, however they are different. Vehicle service contracts are a contractual agreement between two parties (the contract provider and the customer), where the contract provider agrees to pay for any future repairs as stipulated in the contract. Many consumers purchase vehicle service contracts when thinking they are purchasing an extended warranty. Read the complete vehicle service contract guide here.

GAP insurance is a policy that protects car buyers in the event their vehicle is totaled and they owe more money on the loan than the vehicle is worth. For example, let’s say you bought a brand-new Honda Civic for $20,000. You financed it and bought GAP insurance. The second you drive off the lot, you’re in a major accident that totals your car. Your insurance company pays you $15,000 for the totaled vehicle, but what about the remaining $5,000 that you owe? That’s where GAP insurance comes in. GAP insurance will cover the $5,000, plus it should (depending on your policy) cover any deductibles involved. It is advisable to purchase GAP insurance from your auto insurer or bank, but typically not from a dealership since they mark it up significantly. Read the complete GAP Insurance guide here.

Dent and ding coverage is a common insurance product sold to car buyers that provides protection from dents and dings. If you live in a city and you are afraid your vehicle may get a few small dents, dent and ding coverage would cover the cost of repairs instead of you paying out of pocket.

Tire and wheel coverage is another common insurance product that pays for repairs and replacements to your tires and wheels. Be sure to ask if the coverage also covers cosmetic issues with the rims.

Exterior and interior protection products are add-ons that car dealers apply to their inventory without you asking. These protection products are already installed, but that doesn’t mean you can’t negotiate them.

If you pass away while you have your loan, this insurance will pay off the loan so that your estate does not have to. Although infrequently sold nowadays, you may come across this in an F&I office.

Accident and health insurance provides coverage if you become disabled and cannot make your car payment. This is another product that is infrequently sold but you may come across it at a car dealership.

Excess wear and tear coverage is only applicable for a lease and covers cosmetic issues at the time of lease return.

Lojack, and other anti-theft devices are frequently added to vehicles sold at a car dealership. Remember that these anti-theft products are taxable, which means they are negotiable!

The period of time from the date of purchase of an insurance product where you will receive a full refund. After the flat cancel date you will receive a prorated refund. You can ask your F&I Manager, “What is the flat cancel on the tire and wheel protection?”

Menu-selling is a sales methodology used by F&I Managers to present different products that can be sold in conjunction with the purchase of your vehicle. Menu-selling is prolific in the F&I office.

A two term menu is a menu that shows you how ancillary products would impact your payments for two different loan terms.

Nearly every product sold in the F&I office is cancelable. What does this mean? It means that if you feel you made a mistake by purchasing a vehicle service contract, you can cancel it and receive a refund. Read your contracts carefully, but don’t let a F&I Manager tell you otherwise … Insurance products are nearly all cancelable.

The motor vehicle power of attorney form allows the dealership to transfer ownership of the vehicle from the seller (dealer) to the buyer (you).

This is paperwork from the state that has all of your vehicle and owner information so that the state can provide you with your title, registration, and license plates

This is a form that lists the vehicle by VIN and the exact miles that are on the vehicle when it is either traded-in or purchased.

A form that dealership staff will complete and associate with your deal for anything the dealership owes the customer. For example, floor mats that the dealership owes you as part of the car deal.

A similar form to the “we-owe” that lists anything the customer owes to the dealership. For example, the second key for a trade-in.

A form the customer signs stating that they agree to come back and redo paperwork if there are any errors or omissions at the time of completion.

A form you will sign in the F&I office stating that you were made aware of all the products for sale in the F&I office.

How many days the bank gives you from the due date where they won’t charge you a late fee.

When you are trading in a vehicle and you have an existing loan, you will need to request a payoff amount from the financial institution. The payoff amount has a “good until” date, this date represents the date by which the payoff must be made.

When you originate a new loan you can choose to have your first payment made anywhere from 30 to 45 days from the date of origination.

The signer is the main obligor on a loan. The co-signer is the secondary obligor. If the signer does not make their payments the co-signer is on the hook for the loan.

A personal guarantor is the person who guarantees a loan, oftentimes this is required for a business purchase.

Soft credit inquiries do not affect your credit score and are typically used to prequalify for an auto loan.

Hard credit inquiries typically require your authorization and do impact your credit score. Financial institutions run a “hard pull” to make a final decision on your loan application.

What did we miss? Please comment down below and let us know. We’ll update this page as requests are made. Thank you for being a part of the CarEdge community!

We love to hear success stories from our members! Recently, we got an email from a subscriber who leveraged the CarEdge platform to expertly navigate the car buying process to secure a fair price to expertly navigate the sales process and secure a fair price for their brand-new 2021 Mustang GT.

We’re going to take you through Misti’s sales experience and examine the ways that she managed to deal with what seems like an unpleasant dealership.

We’re happy to share the buying experience of Misti Hardy with you today.

Misti visited the dealership in early November with a printout of the exact car that she wanted. She was in and out within 45 minutes, since the dealership had to order the car. She wanted a 2021 Mustang Convertible GT Premium with other specific features.

While she was waiting for the vehicle to arrive, Misti dove into our YouTube channel and learned everything she could about negotiating with car dealerships. During this time, there were several emails and calls with the dealership to check on the status of the car.

In January, she received a call from the dealership that her new Mustang had been delivered. It was time to enact everything that she had learned from CarEdge.

During the test drive, it was clear that the salesperson thought that the sale was in the bag. Misti had other plans.

Once they were inside, Misti told the salesperson about her pre-approved loan offers and asked if the dealership could beat them. At the same time, she asked about any incentives.

The salesperson went to the sales manager to retrieve the information that she asked for. Upon their return, the salesperson said that they could offer a loan and started talking about the monthly payments, which is a common closing tactic. Misti saw this coming and brought up incentives again. The salesperson said that there weren’t any available.

Misti pushed back on the price that she was being offered, which was strictly based on the MSRP. She told us, “I then went on to remind him that I had plenty of time to do research and said, ‘I know that included in the MSRP, there is a floor plan fee and a holdback that goes to the dealer.’ I then pointed out that when we ordered our car, I came to the dealership knowing exactly what I wanted and even had it printed up, which made his job even easier.”

Being a savvy shopper, Misti asked to see the vehicle invoice (an invoice sent by the manufacturer to the dealership). The salesperson acted as if he had no idea what she was talking about. Then, the salesperson said that there was no way the sales manager would let Misti see the invoice.

At this point, she had enough. She said she didn’t feel like she was getting a fair deal, and she would come back next month, when there might be more incentives to give her a fair price. This was a great strategy. After all, you should never make a purchase if you don’t feel you’re getting treated fairly!

Once she threatened to leave, the “nice guy” act disappeared and the salesperson said, “What is it going to take to make this happen today?” Misti said she just wanted a fair deal. She pointed out that when she initially ordered the car, she came in with a printout of the exact car she wanted and all they had to do was order it.

The salesperson responded by offering a price that was $500 over invoice. Misti replied that this sounded fair, as long as she could see the invoice to verify. After talking to the sales manager, the salesperson came back with the invoice and an offer. They ended up giving her a 3.29% discount off of the MSRP, which was a savings of $1,907. It’s great to see someone negotiate their way into some serious savings!

Now that the sales price was agreed upon, it was time for the final step: Heading to the F&I office. Immediately, Misti could tell that the person she was dealing with might have been having a bad day. He was rude throughout the negotiation.

Misti had already secured a quote for a vehicle service contract from CarEdge and she used it to negotiate with the F&I manager. The manager said that since she had ordered her car, she could get a special discount on an extended warranty. Misti replied that she had a quote for a warranty that was $800 less than what the dealership was offering. “It’s from Ford,” was all the F&I manager had to say about the warranty that was offered by the dealership.

The F&I manager was clearly trying to get out of there because he didn’t offer any other kind of warranty or extended protection. In fact, Misti and her husband had to press him to add GAP insurance coverage.

Throughout the negotiations, the manager also made mildly demeaning comments about Misti’s name and other insults that came together to make the whole process a bad experience. However, once Misti was out of the office, the thrill of driving home in her new car overcame the unpleasant experience.

Misti showed up prepared with a vehicle service contract quote from us in hand. With another manager, she might have gone with the dealership warranty, but she was able to definitely save money on her purchase through us. She knew that she could refuse the dealership’s offer and still be covered through another company’s warranty.

On top of that, Misti really took advantage of things she learned from CarEdge. She didn’t fall for the monthly payment closing strategy and kept pushing back until she received a fair price for her vehicle. We’re glad that Misti was able to enact the things that we teach on our YouTube channel and secure a great deal on her vehicle!

We love to hear about the great deals our members secure using the things they’ve learned from CarEdge. One of our regular viewers recently reached out to us to share that they got a great deal on a Toyota Venza. They were able to buy the car with a great interest rate and knock several thousand dollars off the asking price using some of the things they learned from us.

Today’s buying experience comes to us from CarEdge member, John Stubbe. If you have a success story you’d like to share, please share it with us here.

John tells us that he first found our YouTube channel in November 2020. From then on, he was hooked. This year, it came time to buy a new car. He started by checking his credit scores to see what kind of financing he would be working with.

Before he went to the dealership, he visited his credit union and got preapproved for a $36,000 loan at 3.49% APR. Not long after, he found the car that he wanted, a 2021 Toyota Venza XLE. He used our member tools to determine that the car had been sitting on the lot for 54 days, well above the 23-day average. He knew from our videos that it was likely that since it had been sitting on the lot for so long, he could use that knowledge to secure a lower rate.

Our tool also gave the vehicle a negotiation rating of 39 out of 100, showing that there wasn’t going to be much room for negotiation. John likes a challenge, so he proceeded.

With his homework done, he made plans to visit the dealership the next day.

John arrived at the dealership in the afternoon and spoke to the sales director, who then handed him off to an assistant. They went to look at the vehicle and did a test drive. Everything seemed to be in good working order with the Venza.

The car was picked out, so John moved on to the next step: Negotiating the price. He used one of our tried-and-true techniques to ask for the out-the-door (OTD) price and negotiate based on that. While the price on the website was $37,623, the OTD price that they came back with was an alarming $42,562.

It turns out that the car had several add-ons, such as clear coat protection, a clear bra on the front bumper, and other add-ons that John didn’t ask for. John blatantly said, “We’re not paying that price” and kept negotiating.

A half-hour passed before they reached an agreement on the price. The sales manager agreed to drop $2,600 in fees to help make the price more agreeable. With the initial negotiations done, it was time to head back to the F&I office for the final step.

We were extremely interested in what happened at the F&I office, but John didn’t tell us too much. He did tell us that he managed to finance the Venza at a better rate than the one offered by his credit union – 2.94%.

When everything was said and done, John purchased the Venza for $35,354. That’s approximately $2,000 lower than the price advertised on the dealership’s website. We love to see success stories like these!

We love that John was able to use the knowledge that he gained through our website to buy his new car for a great price. It’s stories like these that keep our team motivated to provide amazing tools to customers just like John.

We’ll end this case study with a short story that John shared at the end of his email:

“I had to go back the next day because they didn’t fill the gas tank up. The salesman filled the tank up, and as he handed my keys back, he looked me in the eye and asked, ‘You ever sold cars?’ I said, ‘Nope,’ and he then said, ‘Well, you should. You sure know your stuff, buddy,’ We laughed and laughed. I turned and I just grinned from ear to ear and walked away.”

If you’ve had a great experience buying a car because of our tools, let us know! We’d love to hear from you!

We love to hear stories from our community members when they’ve used CarEdge to score a great deal on their dream car. We recently received an email from one of our members who shared the recent experience she had when using our strategies to buy a new Toyota RAV4.

Today’s buying story comes to us courtesy of Rebecca Silva.

Rebecca started off her email to us with a bit of background information about herself. She openly admits that she is oftentimes too trusting, had never bought a car before, and was terrified of going to the dealership alone. At the same time, she had been following the content provided by CarEdge and felt empowered by what she had learned.

With a specific car in mind — a 2019 Toyota RAV4 with a weather package — she carefully followed the price of the vehicle. Using the Suggested Offer in the Market Price Report, she was able to determine that any price below $30,000 would be a fair price to pay for the car she had picked out.

One day, she received an email about a car that fit all of her specifications. Armed with information, she headed to the dealership. Rebecca even brought her laptop, snacks, and a drink so that she would be well-prepared for the long car buying process.

Before she left for the dealership, Rebecca had two things in mind:

Rebecca made up her mind that if the first condition wasn’t met, she wasn’t going to stick around to find out about the second one. This is one of the tips that we share often, and it’s great to see that she had the right mindset going in for her time at the dealership.

We’ll let Rebecca tell you the next part:

“After the test drive, I was asked the requisite question, ‘Did you love it? Could you see yourself in it? Wouldn’t you like to drive it home?’ I shrugged it off and said that the car was decent. The sales rep didn’t try to use any other emotional manipulation tactics on me after that. Thank you, Ray! I was well trained for that one!”

Not only did she nail that part of the sales process, but as financing was brought up, Rebecca expertly redirected the conversation to the topic that she wanted to focus on first.

Once she was ready, she asked for the service records and reconditioning report, based on another tip she had learned from CarEdge. Fortunately, the sales rep that she was working with was happy to provide this information, satisfying her first criteria for making a purchase.

At one point during the early negotiations, Rebecca noticed that she had been taken in by the “I’m your friend” routine. Thanks to her self-awareness, she was able to keep her head in the game and focus on getting the best deal possible.

Once she was ready to talk pricing, Rebecca asked for the out-the-door (OTD) price breakdown with an itemized list. She quickly noticed that there were several fees lumped together, so she sat down with the sales rep to break down exactly how they had reached the target number.

As a prepared shopper, Rebecca opened her laptop and compared the DMV title and registration fees with what she was being charged. She even took it a step further and showed the sales rep the Black Book breakdown and the CarEdge Market Analysis tool. They looked up the Kelly Blue Book price together.

Rebecca was told by the sales rep that they’ve never come across a shopper like her before…she told us that they said that three times during the course of their three-and-a-half hours together. We love to see our readers make a strong impression!

Once it was time to move to the F&I office, Rebecca had a thoroughly broken down OTD price in hand and was ready for the final step of the car buying process.

Rebecca was in a position to buy the entire car outright with cash. However, she learned from CarEdge that it’s better to finance the car and pay the loan off a few weeks or months later. This is due to the fact that many dealerships have different prices for cash purchases and financed purchases, since they also make money from financing.

She proceeded to go through the financing process. Instead of negotiating over every item on the breakdown, she asked for a lump sum discount that would encompass some of the fees she didn’t agree with.

Thanks to all of her preparation and her use of tools to determine the right price, Rebecca knew to ask for $500 off of the final price. The doc fee of $115 and the VIN etching fee of $50.45 were both encapsulated in this discount request.

The dealership agreed to her $500 discount. Then, it was time for the F&I manager to make his pitches. Rebecca said “no” to every offer. It’s great to hear that she was confident and calm enough to reject every sales tactic. It took about 45 minutes for the F&I manager to realize he wasn’t making any further sales.

We’ve often said that the best indicator of a good deal is how you feel about your purchase after you drive off of the lot. Rebecca felt like she got a great deal, which means that she did.

Rebecca used all of the tools available to her to research the car she had in mind. She kept an eye on market fluctuations and was prepared to pounce when a good deal appeared, which she did. Much of the knowledge that we’ve imparted through our videos and blog posts were able to be put into action, and Rebecca walked away with a great deal on a car she loved and none of the extras that she didn’t care about.

Overall, we’d say Rebecca got an excellent deal on her 2019 Toyota RAV4! If you’ve had a great car buying experience using the resources at CarEdge, let us know. We’d love to hear from you!

👇 Click on a date to jump to information from that time period:

More than 100,000 vehicles were cut from North American production schedules last week, the biggest weekly cuts in months.

North America’s latest chip shortage numbers reflect the impacts of semiconductor plants going offline for summer holiday breaks at plants, according to estimates from AutoForecast Solutions. The only other part of the globe that lost production was Japan — where 7,300 more vehicles were removed from automaker production schedules.

Sam Fiorani, AFS vice president of global vehicle forecasting, pointed to issues being faced at two of the world’s largest automakers.

“Along with much of the industry … Toyota and Stellantis are still looking for ways to handle this crisis,” AutoForecast Solutions executive Sam Fiorani told Automotive News. “Stellantis continues to show its losses in the past and has not properly anticipated how it will be affected going forward; but more losses will be reported in the second half of 2022. Toyota has acknowledged its issues and removed a considerable portion of its production volume in July, with more expected to follow.”

Relief on the way?

Last week, Bosch announced it will invest more than $3 billion in semiconductor production as it looks to develop a lasting solution to the chip shortage.

The forecast worsens as the chip shortage is expected to drag into 2023.

Auto plants in Europe and North America auto plants canceled another 104,000 vehicles from their production schedules because of chip shortages. North American production plants removed 36,000 vehicles from schedules this week. European plants removed 68,000 vehicles from production.

Industry analysts at AutoForecast Solutions now forecast a total of 167,000 vehicles will be permanently lost from production in 2022.

Automotive News reports that the chip shortage numbers can be misleading.

“Trimmed factory plans do not tell the whole story of the chip shortage at the moment. Last week, General Motors said in a regulatory filing that it had built 95,000 vehicles in the second quarter that were incomplete because of missing components. Most of the incomplete GM vehicles were produced in June.”

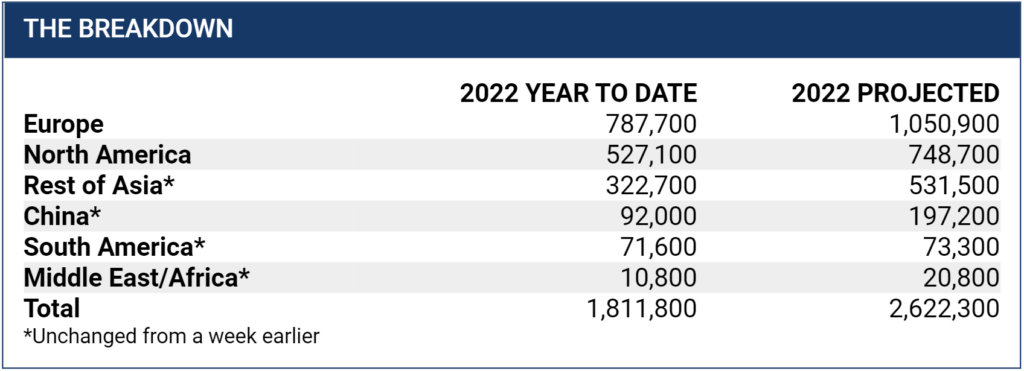

North American factories hit hard again; Expectations for 2022 worsening

An additional 87,500 vehicles were canceled from North American automaker’s production schedules last week. European factories lost another 4,200 units. This is a major loss for factories in North America, and the impacts will be felt in new car inventories in the months to come.

The year started out with forecasters holding on to a glimmer of hope, but that optimism is slipping away. It does not look like the semiconductor chip shortage will end in 2022, and it may extend deeper into 2023 than was previously expected.

Sam Fiorani, AutoForecast Solutions vice president of global vehicle forecasting, told Automotive News that the chip shortage is far from over. “Tackling the semiconductor shortage is a long-term problem because there is no expectation of fewer chips being used in vehicles as they become more complex. In the short term, however, the automotive industry continues to compete for limited fab space with other fields where more profitable chips are the norm. Expectations for a solution this year have faded and 2023 may not see a full recovery either.”

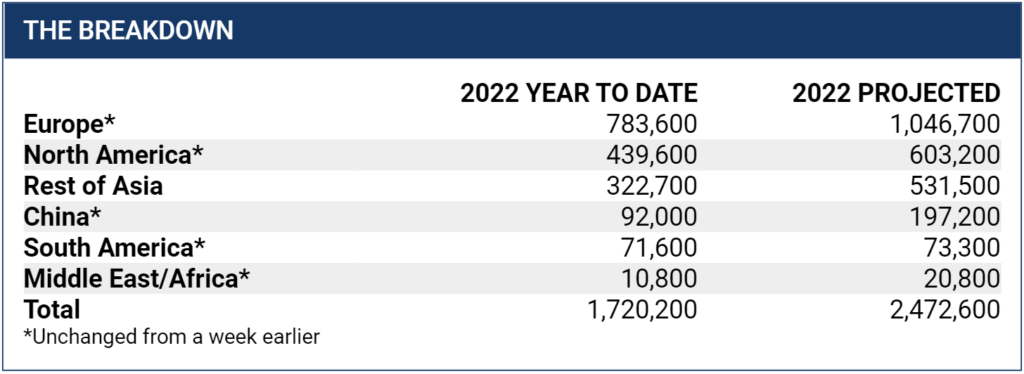

26,400 more vehicles lost; Asian automakers hit hardest

The chip shortage drags on, but there’s a glimmer of hope in the latest numbers from AutoForecast Solutions. For the first time in months, North American assembly plants did not add vehicles to their long list of production schedule cuts. Factories in Europe, China, South America, the Middle East and Africa also avoided making further cuts.

The newly announced 26,400 vehicle production cuts are from Asian factories (outside of China) that have been impacted by the latest COVID lockdowns that have affected supply chains in the region.

AutoForecast Solutions executive Sam Fiorani told Automotive News that the chip shortage is far from over. “The supply of automotive-grade semiconductors continues to hamper global output of trucks and passenger cars, even if the short-term losses do not seem to reflect this slowdown.”

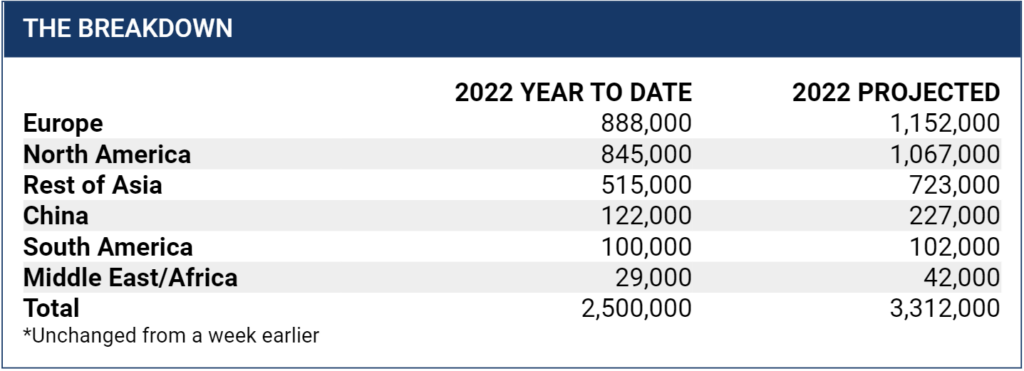

Another 87,500 vehicles removed from production schedules

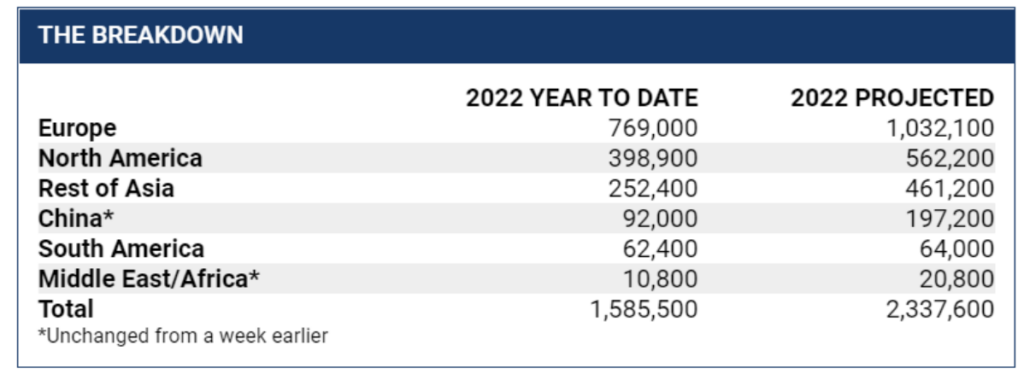

The latest data from AutoForecast Solutions puts 2022’s total production cuts at 1.59 million vehicles, an increase of 259,000 since late March. In 2021, automakers were forced to cut 10.5 million vehicles from production as the semiconductor chip shortage worsened. With the latest 2022 figures, the total impact of the chip shortage has climbed to 12 million vehicles lost from production.

Of the 87,500 vehicles removed from production over the last week, North American factories were the hardest hit, with about 35,600 vehicles lost. Assembly plants in Asia (outside of China) lost 32,800 scheduled vehicles last week. European plants removed about 16,500 vehicles from their schedules, but the ongoing Ukraine crisis continues to loom over the market there.

Shanghai shutdown impacts chip production… again

The Washington Post reports that China’s output of semiconductor chips fell 4.2 percent in the first quarter in China compared to Q1 of 2021. Shanghai remains in lockdown over China’s zero-COVID policy. Shanghai and the surrounding area is a major hub of semiconductor production.

Both Ford and General Motors stop production in Michigan

The chip shortage has forced at least one of America’s two largest automakers to take factories offline next week. Ford is shuttering the Flat Rock Assembly Plant next week, and GM is shutting down production at the Lansing Grand River Plant. Ford makes the Mustang at Flat Rock, and GM’s Lansing Grand River facility makes the Cadillac CT4, Cadillac CT5 and Chevrolet Camaro.

Ford admits that the semiconductor chip shortage is to blame, but GM has not given any reasons for the shutdown. In 2021, Ford sold just 52,414 Mustangs in 2021, making it the worst sales year in decades for the Mustang. General Motors sold even fewer Camaro sports cars in 2021, with sales totaling just 21,893.

It looks like both automakers are rationing what few semiconductors they can get for their higher volume, higher margin models. If that’s their game plan, next week’s targeted cuts make sense. For perspective, Ford sold 726,000 F-Series trucks in 2021, and GM sold 530,000 Chevrolet Silverado trucks.

Automakers are expected to release Q1 sales numbers today. We’ll share the latest impacts of the chip shortage on auto sales once we have the data.

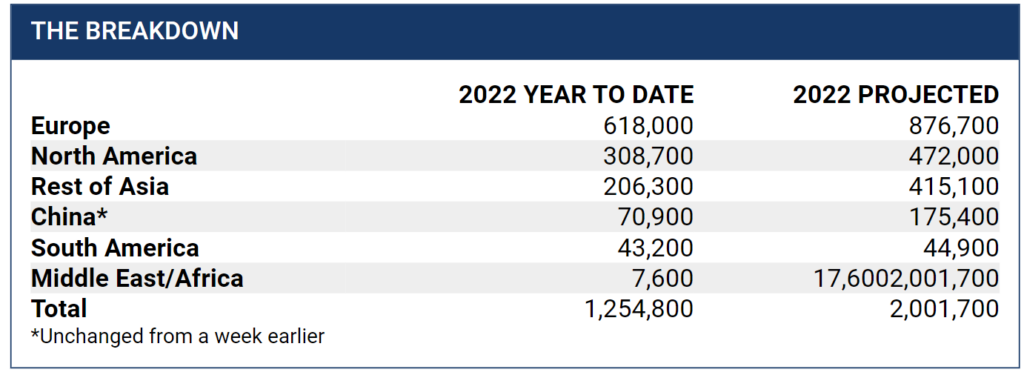

96,300 more vehicles were removed from production schedules

The chip shortage and worsening supply shortages resulted in nearly 100,000 more vehicles being eliminated from auto manufacturer’s production schedules. According to industry analysts at AutoForecast Solutions, about 1.25 million vehicles have been removed from factory schedules worldwide so far in 2022. Ongoing semiconductor chip shortages and supply constraints have raised 2022’s projected production losses to 2,001,700 vehicles worldwide.

European automakers have been hit the hardest in this latest round of cuts. In Europe, 79,100 cars and trucks were removed from factory schedules. Volkswagen Group has been hit particularly hard. VW just announced a delayed launch for the latest ID. model, the ID.5 electric crossover. In North America, 14,200 vehicles were cut.

In 2021, about 11 million vehicles were lost from production. Could this year’s losses approach what we saw last year? The next few months will be critical.

General Motors halts pickup truck production

The semiconductor chip shortage has forced GM to halt production of the Chevrolet Silverado and GMC Sierra during the weeks of April 4 and April 11. GM President Mark Reuss told CNBC that chip supplies were “getting a little better” but the crisis was not over. “We’re not through this, we’re doing the best we can.”

GM’s announcement of a production stop is particularly notable considering that the Sierra and Silverado are higher margin vehicles for the automaker. If these two money-making models are temporarily removed from production, the chip shortage may be worse than company executives make it seem.

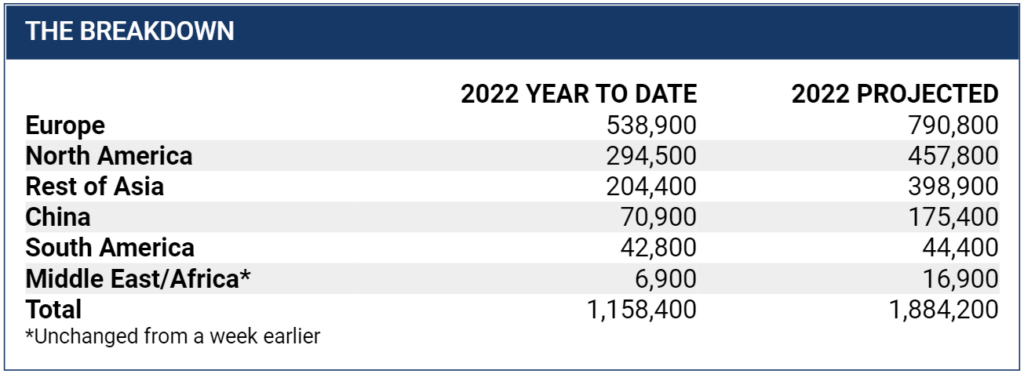

The total vehicles removed from production in 2022 exceeds 1 million

Last week’s earthquake in Japan continues to send shockwaves through automotive supply chains. The quake, which struck along the Pacific Coast northeast of Tokyo, damaged infrastructure and forced several chip makers to suspend operations during clean up and repairs.

Now, AutoForecast Solutions upped their estimate to 1.2 million vehicles have been cut from global production this year because of the chip shortage. Just last week, the analysts estimated 929,500 vehicles removed from production. Newly announced production cuts from European and Asian automakers pushed the figure higher in the last few days.

Chip maker Renesas resumes full production this week

The earthquake on March 16 forced major chip maker Renesas to suspend production at three plants in Japan. Clean up is nearly complete, and Renesas intends to resume production as normal on Wednesday, March 23. Renesas supplies semiconductor chips to General Motors, Ford and Volkswagen, among others.

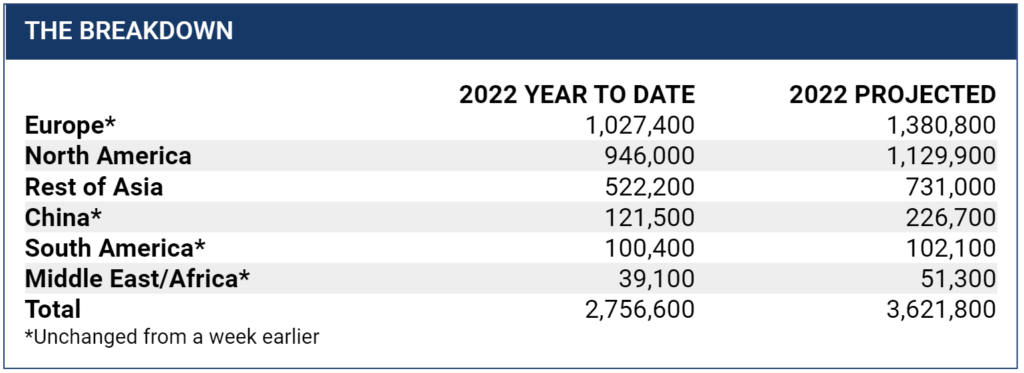

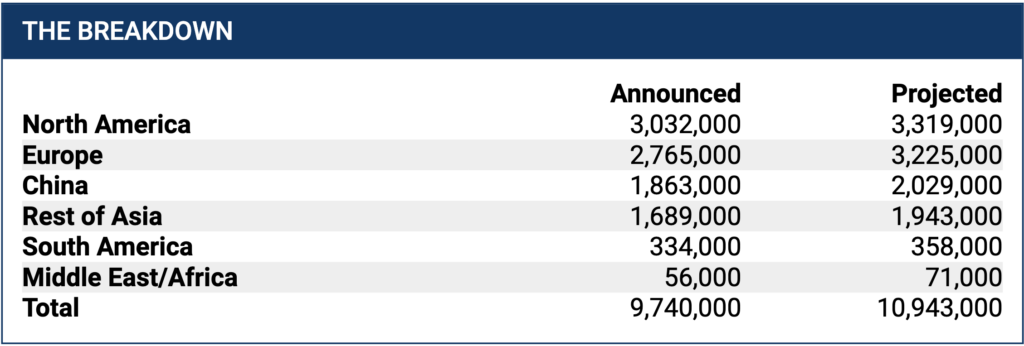

Total and projected vehicles removed from production in 2022

Auto industry analysts at S&P Global Mobility significantly lowered their light vehicle production outlook, citing the “fragility of the world’s economy” and the automotive supply chains. The auto forecasters downgraded their 2022 and 2023 global light vehicle production forecast by 2.6 million units for both years, to 81.6 million for 2022 and 88.5 million units for 2023.

Their worst case scenario forecast shows possible reductions of up to 4 million units for 2022.

Europe is hit especially hard due to the supply chain reliance on both Russia and Ukraine. North American production was reduced by 480,000 units in 2022, and by 549,000 units for 2023.

In total, nearly 25 million units were removed from the S&P Global Mobility light vehicle production forecast between now and 2030.

The takeaway? As long as there’s war in Ukraine (and COVID shutdowns anywhere), there’s no end in sight to the car chip shortage.

After struggling to reach its goals of getting production back to near normal, the ongoing semiconductor chip shortage has forced Toyota to be more realistic. Toyota announced it has slashed April production targets by 150,000 vehicles to a total of 750,000.

In the fiscal first quarter of 2022, Toyota estimates that production will average about 800,000 vehicles a month. That figure is revised down from the previous forecast of 900,000 vehicles or more.

“Up until now, we have conducted recovery production with tremendous efforts from the various relevant parties,” Toyota said. “However, due to the parts shortage, we have had to make repeated last-minute adjustments to production plans, and this has imposed considerable burdens on production sites including those of suppliers.”

Seeing (finally) that unusual times call for more flexibility, Toyota will review production plans on a monthly and three-month basis. Toyota also cautioned that future production numbers may need to be lowered further.

Japanese manufacturer Renesas has suspended chip production at three plants in Japan after a 7.4-magnitude quake rattled the Pacific Ocean floor just off the coast.

Renesas does not know when production might resume at two of the factories. Production has resumed at the third. The plants make chips for automotive, industrial and electrical use. This includes the production of chips for AC-DC electrical power conversion, which is essential for electric vehicle charging.

Where do we start? It’s not looking good. A COVID spike in Shenzhen, China has shuttered Foxconn’s facilities, including those that produce semiconductor chips for the global automotive industry. Shenzhen is home to hundreds of major tech manufacturers, so the COVID lockdown is sure to impact everything from heated seats in cars to cell phone makers.

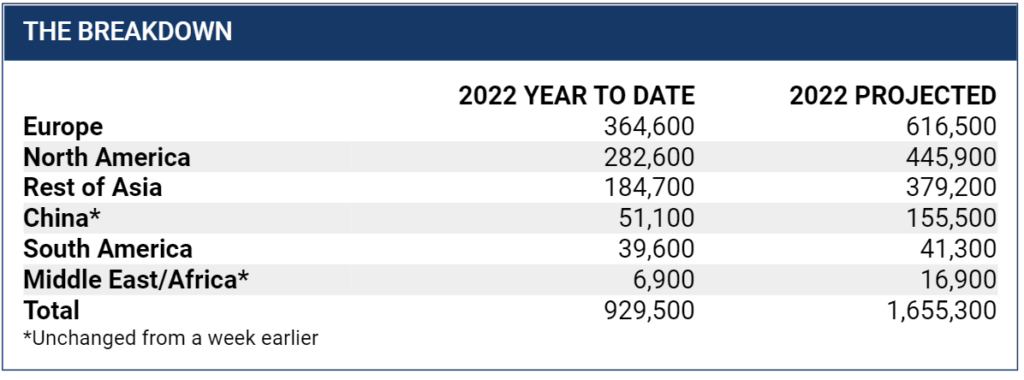

The chip shortage is getting worse in 2022. Just a week after new car inventory officially hit a new record low, AutoForecast Solutions announced that automakers’ chip-related production cuts surged 42 percent from a previous estimate.

Automotive News reports that 929,500 vehicles have been canceled from global production so far this year. That’s up 42% from the prior estimate of 656,200. In 2022, 1,655,300 vehicles are expected to be removed from global production schedules. About 11,000,000 vehicles were lost in 2021 because of the chip shortage. Is that where we’re headed, again?

Toyota will reduce output by 20 percent at its Japanese plan in April, May and June due to the parts shortages hitting Japanese automakers particularly hard.

Tesla’s tight control over its supply chain has cushioned the all-electric automaker from the worst of the chip shortage’s impacts. Many of Tesla’s vehicle components are designed and made in-house. Still, Tesla has been impacted by the 2022 chip shortage.

CEO Elon Musk has noted that Tesla has substituted their typical semiconductors with other types of compatible chips. The Tesla Cybertruck was delayed yet again, and the Roadster remains elusive. Some Tesla components have gone missing as a result of supply chain woes, and some cars have even reached customers without USB ports. However, the automaker continues to make record deliveries, even as competitors struggle severely.

Tesla’s chip shortage strengths recently propelled its sales to surpass BMW in North America. It’s possible that the longer the chip shortage drags on, the stronger Tesla’s grip on the luxury segment will become.

“North America chip cuts more than double” — that’s the headline from Automotive News today. So far in 2022, AutoForecast Solutions has increased their projection of vehicles lost in production due to the chip shortage by 63%, from 767,700 to 1,253,100. At the beginning of this year we were cautiously optimistic that the chip shortage was behind us. Data from industry leaders like AutoForecast Solutions suggested that the worst was behind us.

Sadly, that’s not the case. In just the first six weeks of 2022 over 500,000 vehicles have been taken out of production because of the semiconductor shortage. North America has been hit the hardest, with 221,000 vehicles already having been taken out of production.

| Region | February 2022 | Total 2022 projected |

| Europe | 143,000 | 394,900 |

| South America | 37,500 | 39,100 |

| North America | 221,500 | 384,700 |

| China* | 51,100 | 155,500 |

| Rest of Asia* | 69,200 | 263,700 |

| Middle East/ Africa* | 5,000 | 15,100 |

| Total | 527,400 | 1,253,100 |

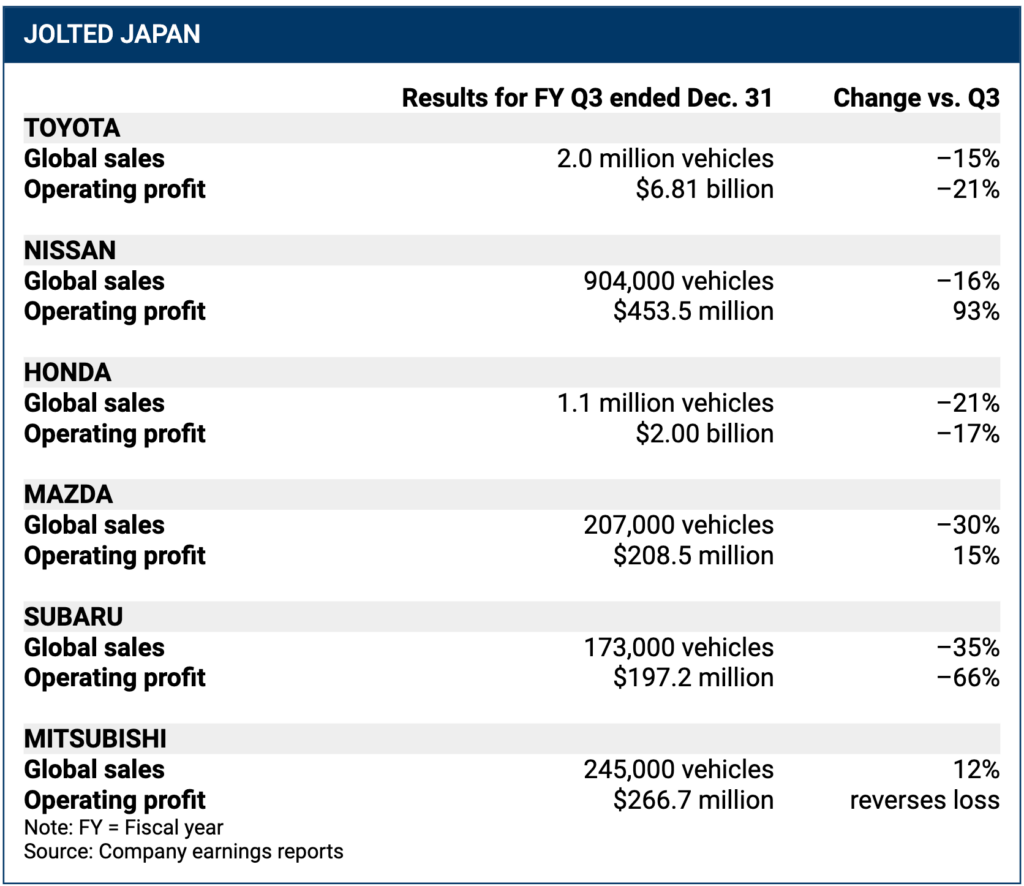

Ford and Toyota are struggling mightily. Ford announced they will cut vehicle output from their plants in Ohio and Missouri this week, as well as reducing shifts at a number of others because of the lack of microchips. Toyota recently revised their annual operating profit projections after profits tumbled 21% in the previous quarter. Subaru and Mazda are also struggling to produce vehicles. All Japanese automakers have found themselves in a tough position.

We’ve seen this before, yet many thought we’d have moved past it by now. The semiconductor chip shortage has impacted sales yet again. Here’s the latest from CarEdge:

In 2021, more than 10 million vehicles were cancelled from production schedules due to supply constraints. New data from AutoForecast Solutions reveals the prolonged impact of the chip shortage in 2022. Globally, the number of vehicles cancelled from production schedules increased 61% from a week earlier. With the revamped estimates creeping ever higher, AFS now projects that more than 1 million vehicles will be cut from factory production schedules in 2022.

What’s the basis of these dismal forecasts? Already in 2022, 370,500 have been officially axed from production. Analysts still think the chip shortage will improve as the year progresses, but the surprisingly higher impacts thus far have lowered optimism across the board.

Silver Lining?

When seasonally adjusted, Thomas King from J.D. Power noted that January sales were actually the healthiest they’ve been since June of 2021. If anything, this highlights just how bad the chip shortage has gotten, and how low our expectations have fallen. Automotive News reports that the seasonally adjusted annualized rate (SAAR) of sales in January was actually on the high-end of forecasts from industry analysts like J.D. Power, Cox, TrueCar and LMC Automotive.

“Another big jump in 2022 estimated production cuts” — that’s the headline from Automotive News. It’s as if we’re watching a re-run of the same movie. Initial estimates for 2022 were that the chip shortage would abate, and that near-normal production would occur. Instead, we are witnessing what we saw last year; automakers are cutting vehicle production drastically week-over-week as a result of insufficient parts.

Let’s look at the latest data from AutoForecast Solutions for vehicle taken out of production in January, and projected for the entirety of 2022.

| Region | January 2022 | Total 2022 projected |

| Europe | 33,000 | 271,500 |

| South America | 17,900 | 19,600 |

| North America | 71,700 | 239,200 |

| China* | 51,100 | 155,500 |

| Rest of Asia* | 55,800 | 250,300 |

| Middle East/ Africa* | 1,300 | 11,300 |

| Total | 230,800 | 947,400 |

Nearly a quarter of a million vehicles were lost in January. At this rate we would expect to see ~3m vehicles lost to the chip shortage in 2022. Last year we lost nearly 11m.

The first projection for 2022 estimated that globally the chip shortage would take 767,700 vehicles out of production. That number has increased 23% in January.

The headline on Automotive News this morning reads, “The chip shortage is back for Year 2” … Sadly, we have bad news to deliver this week. So far this year 187,200 vehicles have been taken out of production. An increase of 38,000 vehicles week-over-week. That number is significantly down from the prior week.

| Region | 2022 YEAR TO DATE | LAST WEEK | CHANGE |

| Europe | 59,600 | 70,800 | -11,200 |

| South America | 48,300 | 41,500 | 6,800 |

| North America | 36,000 | 36,900 | -900 |

| China* | 26,900 | 0 | 26,900 |

| Rest of Asia* | 16,400 | 0 | 16,400 |

| Middle East/ Africa* | 0 | 0 | 0 |

| Total | 187,200 | 149,200 | 38,000 |

Where we saw a more meaningful increase was in the annual projection. That increased to over 900,000 vehicles that are expected to be lost this year due to the chip shortage. Frustratingly, AutoForecast solutions increased the North America projection by over 100,000 vehicles, while reducing Europe and Asia signifigantly.

| Region | 2022 PROJECTED | LAST WEEK | CHANGE |

| Europe | 220,400 | 331,000 | -110,600 |

| South America | 210,300 | 43,200 | 167,100 |

| North America | 291,700 | 186,000 | 105,700 |

| China* | 138,300 | 108,100 | 30,200 |

| Rest of Asia* | 34,000 | 156,600 | -122,600 |

| Middle East/ Africa* | 10,000 | 8,000 | 2,000 |

| Total | 904,700 | 832,800 | 71,900 |

Another week, another chip shortage update. Unfortunately, the projections we received from AutoForecast Solutions paint a more realistic, albeit worse chip shortage scenario than just seven days prior.

This past week 101,900 vehicles were taken out of production, up from 47,300 the prior week.

| Region | 2022 YEAR TO DATE | LAST WEEK | CHANGE |

| Europe | 70,800 | 23,600 | 47,200 |

| South America | 41,500 | 13,800 | 27,700 |

| North America | 36,900 | 9,800 | 27,100 |

| China* | 0 | 0 | 0 |

| Rest of Asia* | 0 | 0 | 0 |

| Middle East/ Africa* | 0 | 0 | 0 |

| Total | 149,200 | 47,300 | 101,900 |

AutoForecast Solutions not only tracks the actual number of vehicles lost to production each week from the chip shortage, they also update a projection for the total number of vehicles they anticipate being lost from production for the entire year. Interestingly, even thought 101,900 vehicles were lost to production this past week, AutoForecast Solutions only increased their projection for the entire year by 65,100 units.

| Region | 2022 PROJECTED | LAST WEEK | CHANGE |

| Europe | 331,000 | 280,800 | 50,200 |

| South America | 43,200 | 31,400 | 11,800 |

| North America | 186,000 | 174,300 | 11,700 |

| China* | 108,100 | 108,200 | -100 |

| Rest of Asia* | 156,600 | 163,000 | -6,400 |

| Middle East/ Africa* | 8,000 | 10,000 | -2,000 |

| Total | 832,800 | 767,700 | 65,100 |

The only justification for this would be that they think the actual losses each week will decline from here on out, or more likely, they’ll simply continue to increase their total projected losses. We saw this last year when their projections went from 500,000 to more than 11 million over the course of the year.

We did get bad news this week from Volkswagen and Toyota. Both companies announced that their plants in Tianjin, China were closed due to pandemic reasons. Toyota annually produces 620,000 vehicles at this production facility, so this will certainly be a story worth keeping our eyes on.

The chip shortage that has plagued automakers for well over a year now appears to be abating. In December of 2021 we measured the slowest increases in expected losses of production as a result of the chip shortage we had all year (around 20,000 vehicles). For the entire year automakers globally lost 10.2 million vehicles from production because of the chip shortage.

Asian auto plants were the hardest hit, with more than 3.6 million vehicles taken out of production. North America was second with nearly 3.1 million vehicles lost, and Europe was third, with approximately 3 million vehicles lost.

What have we seen so far in 2022? Data from AutoForecast Solutions (which is the most consistently updated and reported on data source) shows us that production cuts so far have been relatively small.

| Region | 2022 YEAR TO DATE | 2022 PROJECTED |

| North America | 9,800 | 174,300 |

| Europe | 23,600 | 280,800 |

| China | 0 | 108,200 |

| Rest of Asia | 0 | 163,000 |

| South America | 13,800 | 31,400 |

| Middle East/Africa | 0 | 10,000 |

| Total | 47,300 | 767,700 |

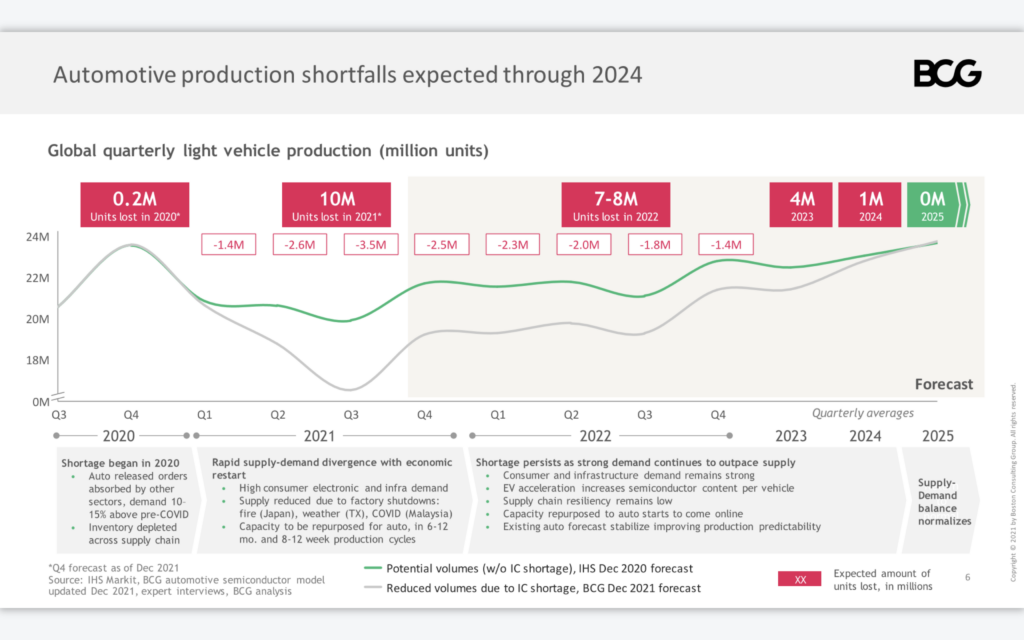

After the industry cut 10.2 million vehicles in 2021, AutoForecast Solutions only projects 767,700 vehicles lost this year. That’s fascinating, because another well respected firm, Boston Consulting Group published a report on the semiconductor shortage and its impacts on the auto industry just three weeks ago.

As you can see, BCG expects automakers to lose 7-8 million units of production this year, as compared to the 10 million lost last year. However the more recent data from AutoForecast Solutions tells a completely different story (less than 1 million vehicles lost).

Who’s right? It’s impossible to know. That being said, the headlines from Toyota and other automakers does make it seem like production is ramping back up. We’ll continue to update this page weekly as we get more data on the ongoing chip and car shortage. Be sure to subscribe to our newsletter to get updates.

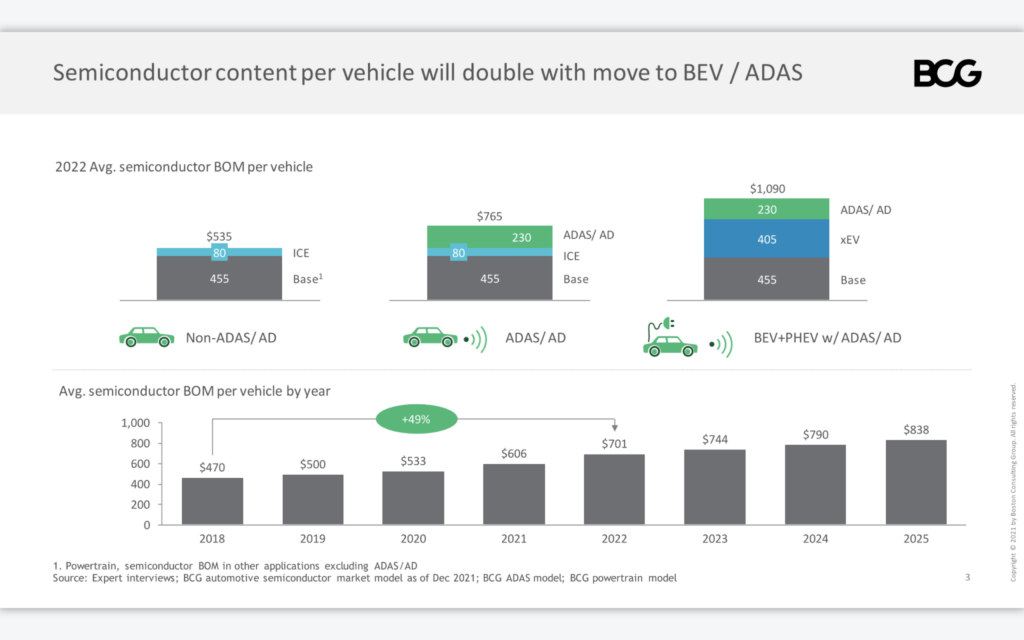

Within the report BCG published there is fascinating data on the cost of semiconductors per vehicle manufactured. BOM stands for “bill of materials”. ADAS is advanced driver assistance systems, and EV stands for electric vehicle.

As you can, a “basic” vehicle with a combustion engine and no ADAS has a total cost of $535 for semiconductors. A combustion engine vehicle with ADAS costs $765, and an EV with ADAS costs nearly $1,100.

The cost of semiconductors, and the number of semiconductors within a vehicle continues to increase as more functionality and features make their way into our cars.

It appears that the worst of the 2021 chip shortage is behind us (at least for the automotive industry that is). Data provided by AutoForecast Solutions tracks the weekly ebbs and flows of chip related production cuts, and for the first time since starting their weekly projections, the worst case scenario for vehicles that will be cut from manufacturer’s production schedules this year because of the microchip crisis declined by 20,000 units.

Two weeks ago, for the first time in over a year, the weekly projection for vehicles lost in production due to the chip shortage did not increase at all. This week it declined. This is great news!

This week, for the third week in a row, the projection for vehicles lost due to the chip shortage for North American factories, actually decreased week-over-week!

This page will be updated as new information becomes available regarding the semiconductor chip shortage of 2021.

Automakers have taken a major hit as a result of the chip shortage. profits at Subaru, GM, Ford, and nearly every other major OEM have been down significantly in 2021. That being said, starting in the November, each company began signaling that they were through the worst of the chip shortage and that things would slowly start to get better.

Each week we track data provided by AutoForecast Solutions on the chip shortage. Their data shows a plateau happening.

| Date | projected # of vehicles lost | Change from prior week |

| 9/13 | 9,436,000 | – |

| 9/20 | 9,574,000 | 138,000 |

| 9/27 | 10,150,000 | 576,000 |

| 10/4 | 10,305,000 | 155,000 |

| 10/11 | 10,561,000 | 256,000 |

| 10/18 | 10,842,000 | 281,000 |

| 10/25 | 10,943,000 | 101,000 |

| 11/1 | 10,983,035 | 40,035 |

| 11/8 | 11,002,000 | 18,965 |

| 11/15 | 11,263,000 | 261,000 |

| 11/22 | 11,285,000 | 22,000 |

| 11/29 | 11,285,000 | 0 |

| 12/6 | 11,323,980 | 38,980 |

| 12/13 | 11,325,198 | 1,218 |

| 12/20 | 11,309,400 | -15,798 |

The table above shows the projected number of vehicles lost because of the chip shortage. Each week AutoForecast Solutions updates this number to reflect the current state of the industry. As you can see the rate at which they have been increasing the total number of lost vehicles is slowing down. This week the projections even decreased.

It was a little over a month ago that the projection increased by 261,000 vehicles globally. Since then, we’ve seen a plateau. It appears that the worst-case scenario for the chip shortage is behind us.

Every automaker has drastically cut back production of their new vehicles as a result of the chip shortage. “Days supply” is an industry metric that is used to measure how much inventory a dealership has in stock relative to demand. Each manufacturer is experiencing a dwindling days supply of inventory. This means dealerships are less likely to discount or negotiate.

| Manufacturer | Days Supply (April) | Days Supply (May) | Days Supply (Oct) | Days Supply (Nov) |

|---|---|---|---|---|

| Ford | 45 | 34 | 38 | 37 |

| Lincoln | 56 | 36 | 30 | 29 |

| Acura | 53 | 50 | 19 | 19 |

| Honda | 56 | 43 | 19 | 17 |

| Genesis | 74 | 57 | 40 | 33 |

| Hyundai | 49 | 41 | 12 | 11 |

| Kia | 34 | 30 | 15 | 12 |

| Mazda | 44 | 38 | 13 | 10 |

| Subaru | 24 | 16 | 5 | 4 |

| Toyota | 26 | 23 | 17 | 21 |

| Volvo | 55 | 45 | 30 | 27 |

With a shortage of new vehicles, we have seen skyrocketing used car prices. Wholesale used car vehicle prices have increased nearly 40% so far in 2021. As of October, retail used car prices are up nearly 30%

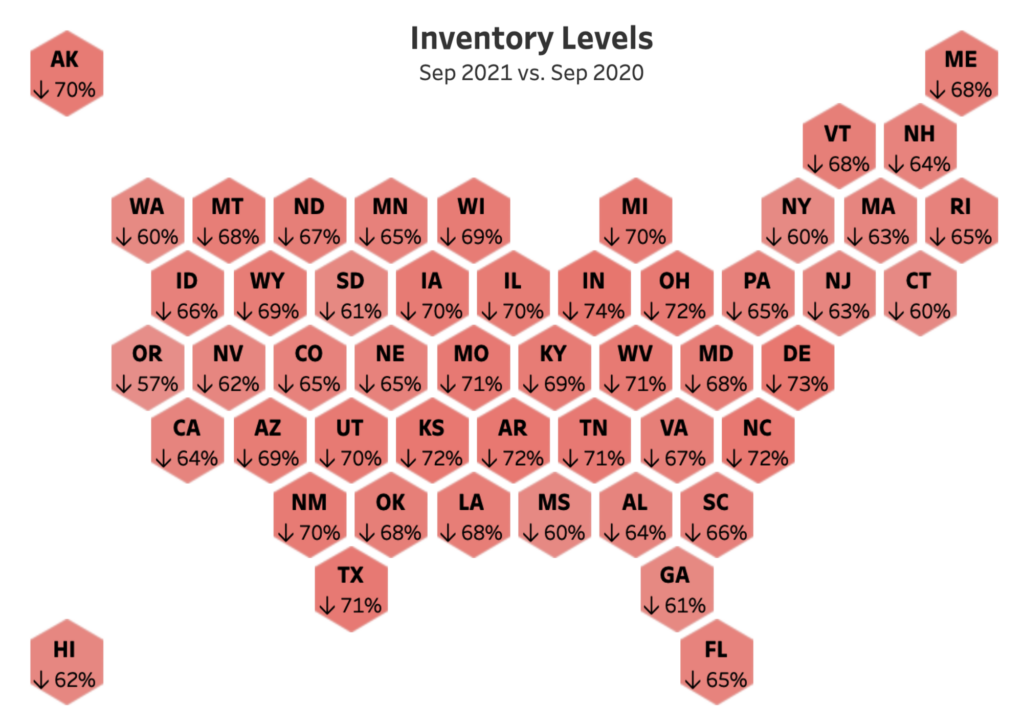

Inventory levels are down across all 50 states. There are some regions of the country that have more inventory than others, and some brands have weathered the storm better than their peers. We created a complete guide on how inventory levels have changed state-by-state to help you navigate finding inventory near you. If you do buy a car out of state, be sure to reference this guide for buying a car from a different state.

Buying a car in this market? Let us help you get a fair deal!

So far automakers have lost nearly 10 million vehicles as a result of the chip shortage. The expectation is that the total loss from the chip shortage will reach 11 million by the end of 2021.

It is estimated that up to 5 million new vehicles will not be produced in 2021 as a result of the chip shortage. Current lost production by manufacturer is below.

| Manufacturer | Lost production |

|---|---|

| Ford | 324,616 |

| General Motors | 277,966 |

| Stellantis | 252,193 |

| Subaru | 45,272 |

| Volkswagen | 45,215 |

| Honda | 42,951 |

| Nissan | 41,928 |

| Toyota | 23,670 |

| Tesla | 6,418 |

| Mazda | 6,133 |

| COMPAS | 4,200 |

| Hyundai | 2,548 |

| Volvo | 1,287 |

Brands impacted so far:

Kia announced at NADA that they will not be limiting production as a result of the chip shortage.

From Black Book, “We are hearing more each week in the market about reduced inventory in the pipeline for Q1.With new car manufacturing facing supply chain struggles due to the microchip shortage, as well as a possible additional round of stimulus, the expectation is that pricing will remain strong throughout Q1 and into Q2.”

Other data from Black Book shows a recent increase in wholesale used car prices. As a result of limited new car supply we are seeing used car prices increase as well.

In a recent interview with Jean-Marc Chery, the CEO of STMicroelectronics for Automotive News, the executive was asked this very question. His response, “Our forecast is that we should start seeing an improvement to the overall situation in the first quarter of 2022.”

No one knows for certain, but many representatives from the largest semiconductor companies have provided guidance that production increases will not meet demand until Q3 of 2021 at the earliest.

From Reuters, “TSMC, the world’s top contract chipmaker, said it was “expediting” auto-related products through its wafer fabs and reallocating wafer capacity. It now expects to lift capital spending on the production and development of advanced chips to between $25-28 billion this year, as much as 60% higher than the amount it spent in 2020.”

Yes. The tactics used before the global chip shortage to negotiate a good car deal still apply today. Will you be able to purchase a vehicle at a similar discount compared to a month ago? No. Will you be able to negotiate a fair deal based on the current market conditions? Yes.

Yes. Used car wholesale prices are just beginning to climb after 20 weeks of declines. If you have a vehicle that you are looking to sell we strongly recommend you get a quote from Carvana, Vroom, and CarMax. Take the highest quote you receive to your local dealership and ask them to beat it. If they don’t, sell it to the highest bidder.

We anticipate that wholesale used car prices will continue to rise for the coming weeks and months. With that in mind, you may want to get a quote today for your vehicle and then wait ~4 weeks to see if it has appreciated more.

Most likely yes. If your lease is coming due over the following 2-4 months it is likely that you will be in the rare position of having “positive equity” in your vehicle. Because used car prices are increasing, it may make sense to purchase your vehicle at the residual value set 3 years ago.

One month after we first reported on AutoForecast Solutions projected decrease in new vehicle supply, not much has changed. Many auto manufacturers are still continuing to face supply shortfalls (not enough semiconductors) to produce all of their inventory. Ford recently increased their production cuts, directly impacting the Ford Edge and Lincoln Nautilus. The total expected shortfall in new vehicles for 2021 for all automakers is projected at 1.6 million units.

General Motors announced on 3/3/21 that “it was further extending production cuts at three North American plants and adding a fourth to the list of factories hit by the global semiconductor chip shortage.”

“The extended cuts do not change GM’s forecast last month that the shortage could shave up to $2 billion from this year’s earnings. GM CFO Paul Jacobson subsequently said chip supplies should return to normal rates by the second half of the year and he was confident the profit hit would not worsen.”

Update 2/15/21: Lost production as a result of the ongoing chip shortage has totaled 680,350 vehicles. AutoForecast Solutions has increased their forecast from 1 million to 1.3 million vehicles that will not be produced in 2021 as a result of semiconductor shortage.

So far lost production is approximately 564,000 units with the prospect of almost 1 million total vehicles not being produced this year because of the existing and ongoing semiconductor chip shortage. AutoForecast Solutions