CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Average monthly car payments have been increasing ever since the beginning of the chip shortage in 2020. Today, the average monthly car payment for a new car exceeds $700 for the first time ever, while the average monthly car payment for a used vehicle is more than $500.

Over the last 18+ months we’ve covered the tenuis rise of car prices. It’s shocking to think that the average car payment is now closing in on the average mortgage payment in America. Data from Edmunds shows that 12% of new car buyers in June are paying more than $1,000 a month. In 2021 the average home mortgage payment was roughly $1,000 a month. Let that sink in.

Here’s the latest data on new and used car payments, affordability, and which vehicles you should consider if you are looking for a relative “bargain” in today’s market.

Let’s dive in.

Data from J.D. Power/LMC Automotive suggests that the average new car transaction price was $45,844 in June. As compared to data from Cox Automotive, this average transaction price is actually down considerably when compared to prices from the end of 2021 and earlier in 2022.

For example, at the end of 2021 the average transaction for a new vehicle was $47,077 according to Cox Automotive, however the average monthly payment was only $688. This was a function of cheaper interest rates.

Today, the average monthly payment for a new car stands at $712 dollars. That is more than rent for a one bedroom apartment in some cities.

| City | Rent |

|---|---|

| Akron, OH | $640 |

| Wichita, KS | $710 |

| Lubbock, TX | $720 |

| Shreveport, LA | $740 |

| Lexington, KY | $800 |

| El Paso, TX | $860 |

| Baton Rouge, LA | $860 |

| Tallahassee, FL | $860 |

| Oklahoma City, OK | $870 |

| Des Moines, IA | $890 |

Average loan terms for a new car sit at 70 months, with most consumers opting for 6 year financing terms at an average interest rate of just over 5%. Back in December of 2021 the average new car interest rate was under 4%, accounting for the uptick in monthly payment amounts.

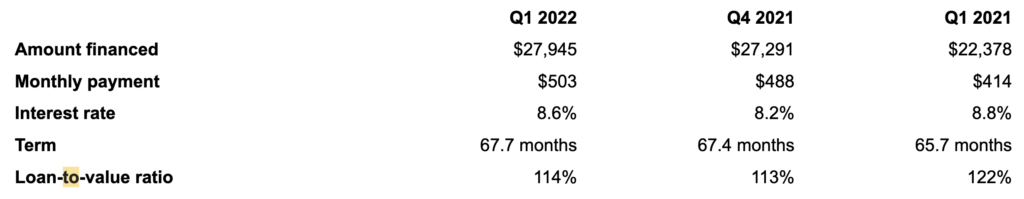

As you very well know, used car prices have skyrocketed ever since the beginning of the chip shortage. For the first time ever, the average used car monthly payment sits above $500. Data for Q1 of 2022 shows an average interest rate of 8.6% and an average loan term of 68 months. We expect data for Q2 to show a significant increase in the interest rate and monthly payment. We would not be surprised to see 9%+ as the average interest rate on a used car loan, and monthly payments in excess of $525 for the first time ever.

Used hybrids and electric vehicles are especially expensive in today’s market, with monthly payments on more fuel efficient vehicles in excess of $700.

Cox Automotive tells us that the average transaction price for a new car was $47,148 in May 2022. Where are the new car values?

Sadly, non luxury vehicles are seeing their prices increase rapidly as more consumers look for “value”. The average price paid for a new non-luxury vehicle in May was $43,338; on average a customer paid $1,000 over MSRP for a new non-luxury vehicle. We are seeing some below MSRP deals on Stellantis brands; Jeep, Ram, Alfa Romeo, Chrysler.

The average luxury car buyer paid $65,379 in May. They also spent about $1,000 over MSRP to get their new car.

The average electric vehicle buyer paid $64,000 in May. The Chevrolet Bolt represents the only real “bargain” in the EV space.

The average truck buyer paid $56,216 in May, while the average van buyer paid $48,671, and the average SUV buyer paid $46,073. The only “value” segment on the list are cars, where the average sedan buyer paid $41,902 in May.

Automakers such as Nissan have average transaction prices of $34,681. Compared to other automakers such as Toyota ($40,036) and Hyundai ($35,988) they represent a relative “steal”.

Ford, Stellantis, and GM have seen their average transaction prices increase significantly. Ford’s average transaction price stands at $49,528. Stellantis is at $53,212, and GM is at $50,854.

Update: The public comment period is NOW OPEN. The deadline is September 12, 2022! Here’s how you can submit a comment. Share with your friends and family!

On June 27th, The Federal Trade Commission proposed a new set of rules that would make many commonplace car dealer sales tactics illegal. Let’s break down the proposal and discuss what tactics dealers use to take advantage of customers.

FTC Bureau of Consumer protection Director Samuel Levine explained the reasoning behind the proposed rules. “As auto prices surge, the commission is taking comprehensive action to prohibit junk fees, bait-and-switch advertising and other practices that hit consumers’ pocketbooks. Our proposed rule would save consumers time and money and help ensure a level playing field for honest dealers.”

From time to time, consumer’s voices are actually heard by those who have the power to make a change. The FTC explained the role of consumer complaints in the drafting of this proposal.

“Consumer complaints suggest that some dealers have added thousands of dollars in unauthorized charges, including for add-ons that consumers had already rejected. These issues are exacerbated when pre-printed consumer contracts automatically include charges for optional add-ons, when consumers are rushed through stacks of paperwork, or when they are asked to sign blank documents.”

Perhaps you’ve experienced this firsthand. We help CarEdge members cancel unwanted products all the time. It’s just another unnecessary obstacle to buying a car in 2022.

Without further ado, these are the four anti-consumer dealer practices targeted by the FTC’s proposed rules.

The new FTC rule would ban all add-ons that do not add any benefit to the product. Examples of included products are nitrogen-filled tires that contain no more nitrogen than is normally found in the air, duplicate warranty coverage and unnecessary GAP insurance, a product that not every car buyer will benefit from.

How many times have you inquired about a specific car that was advertised, only to learn of a ‘market adjustment’ or slew of dealer add-ons? Transparent pricing is a novelty in today’s auto sales, however the FTC’s proposed rule would require that dealers advertise the true price of the car online.

Why should any car buyer be penalized for paying cash? The new FTC rule would require auto dealers to advertise the cash price of the vehicle without add-ons. The customer would have to be told the price of the car, with and without financing. Notably, this mandatory price disclosure would have to be without optional add-ons from the get-go. No more teasing it out of the salesperson.

If the customer agrees to pay something different, both they and a dealership manager must sign a document saying so.

How to Challenge Forced Front-End Add-Ons At a Dealership

“Express, informed consent” would be required for add-ons commonly pushed on buyers in the financing and insurance (F&I) office when buying a car. What would be different? Disclosures and consent options must go beyond “a signed or initialed document, by itself” or “prechecked boxes,” the FTC said. I’m wondering, why wasn’t it always like this?

Here’s 5 things you need to know before stepping into the dealership F&I office.

As this is breaking news, it’s too soon to know what dealership lobbies like the National Automobile Dealers Association think of it. I think we can all assume they won’t be fans of the proposal. The NADA spends $3 million a YEAR on lobbying efforts in Washington, and their influence is strong at the state level, too.

How did car dealerships become so powerful in America? It’s a story of power, money and influence.

Opposition to the new FTC proposal came from one of the panel’s own members. FTC Commissioner Christine Wilson felt “unlawful practices persist” within the auto retail industry, but said the proposal courted “unintended but negative consequences.” Commissioner Wilson cited prior regulations which had hurt competition and proved difficult to keep current. Interestingly, she also cited the rise of direct-to-consumer sales and Carvana’s online sales model as reasons for opposing the rule.

One state where the auto dealer lobby has enormous power is Florida. Over 1,000 car dealers belong to the Florida Automobile Dealers Association. Dissenting FTC Commissioner Wilson happens to be from Florida. Coincidence? Maybe.

Can the dealership model save itself from the rise of direct-to-consumer sales? Transparent pricing would be a step in the right direction. With the dealer markups and bait-and-switch tactics all too common in today’s car buying experience, wouldn’t you opt for honest pricing given the chance?

Leave your comment in support of this proposal! We hope you’ll share this important opportunity with your friends and family.

The new and used car markets have seen it all in the first few years of this decade. 2020 kicked off with a few months of normalcy before the bottom fell out. Car sales plummeted by 15% before pulling the quickest turnaround in automotive history. In 2022, simply finding the car you want can be a tall order, not to mention getting it at MSRP. But the way we buy cars has changed too. A third of car sales are now completed online, and the recent popularity of direct-to-consumer sales is showing that shoppers are tired of the dreaded dealership runaround.

My own recent car buying experience taught me a lot about how in today’s market, knowledge certainly is power. Although it’s still a seller’s market, that doesn’t mean you can’t drive away a winner with your next auto purchase. These are the game-changing solutions that are bringing consumer empowerment to the car buying experience in 2022.

I’ve experienced the annoyance of online dealership pricing firsthand. Earlier this year, I was in the market for a car. After narrowing down my search to a few models, I began the tedious process of contacting dealerships to get the ‘real’ pricing. I was quickly discouraged, but refused to give up. Dealers would advertise a car at MSRP, but upon making contact, the true price became difficult to tease out. Some salespeople would let me know on the phone that there was a $2,000 to $10,000 ‘market adjustment’, which of course wasn’t reflected in the online pricing. Others would only spill the beans once I specifically asked about ‘additional dealer markups’. However, the madness didn’t end there.

Buying a car, whether new or used, too often feels like an obstacle course in this day and age. Asking your salesperson about dealer markups doesn’t cut it nine times out of ten. I quickly learned that it was just as important to inquire about dealer add-ons. Shopping for the all-electric Hyundai IONIQ 5, I found more than a few dealers in my region claiming to sell ‘at MSRP’, but with up to $2,500 in dealer add-ons such as pinstripes, ceramic coating, nitrogen-inflated tires and door guards. After a dozen phone calls ending in disappointment, I was left wondering if I should just go buy a Tesla to avoid the haggling and money games. Or maybe I’d wait it out for Ford’s supposed Model-e no-haggle pricing. Still, I pushed on.

Fortunately, I did end up finding the car I wanted at true MSRP at Hyundai 112 in New York. The power of crowdsourced reviews at CarEdge’s Car Dealer Reviews made it a whole lot easier to sift through thousands of auto dealers to find honest, pro-consumer car dealerships in America. Nearly 2,000 dealerships have been reviewed, with more added every day. So even if the dealership went out of their way to seem honest, I could see what real customers had to say. Why didn’t this exist before?!

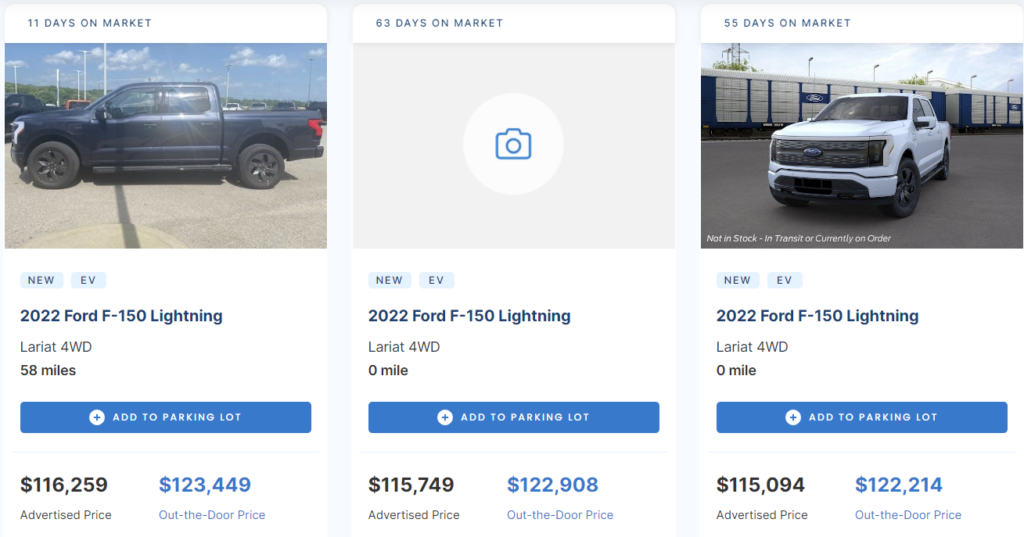

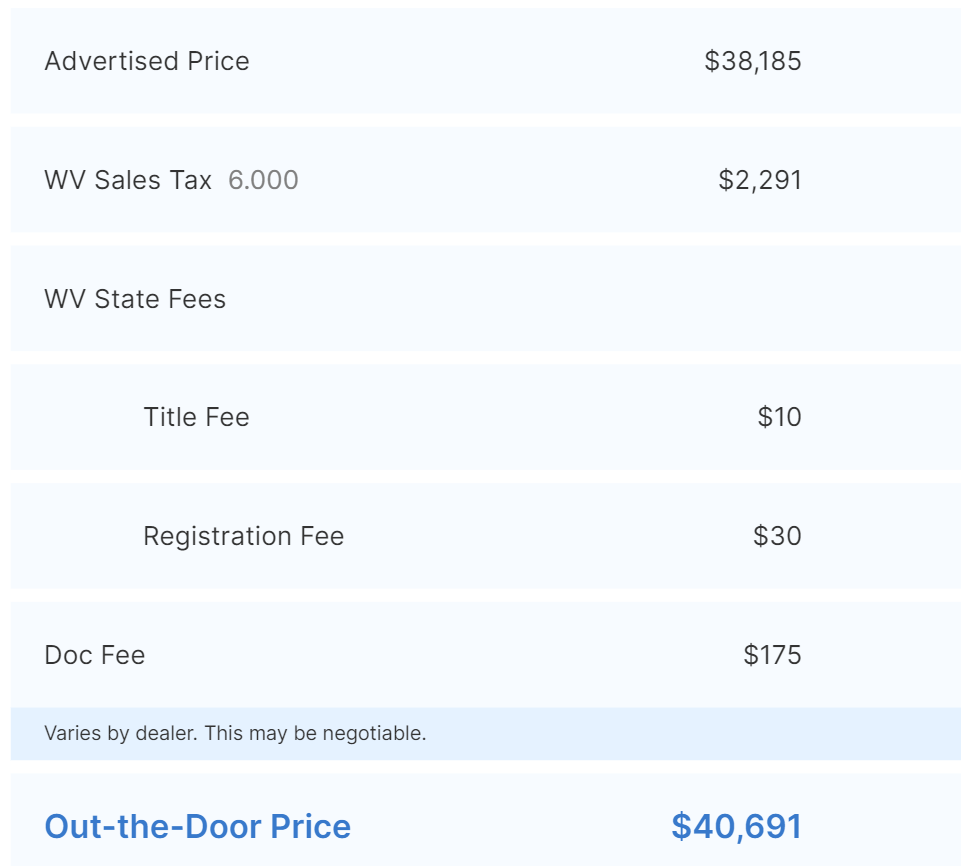

When shopping for a car, the price you see is usually not the price you pay. The number you should really be looking for is the out-the-door price. With this in mind, CarEdge created the perfect car search engine for car shoppers looking for transparent pricing. CarEdge Car Search features the Out-the-Door Price to give you a better idea of how much a car really costs. It takes the dealer’s advertised price and adds in estimated taxes and fees. Finally, consumers get an accurate picture of what to expect in the finance office.

A $2,500 difference between the advertised price and Out-the-Door Price is not uncommon. Taxes, doc fees and registration fees vary widely from state to state. When buying in states with a high sales tax, the difference can be substantial for a car with a big price tag.

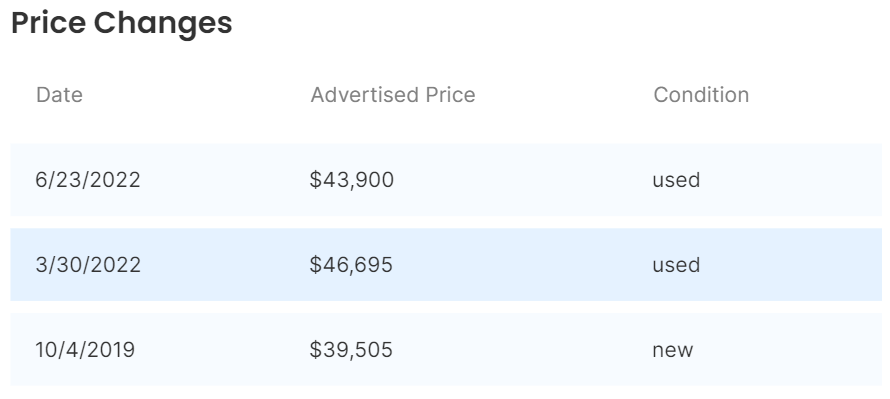

During a vehicle’s lifetime, there can be sharp changes in its market value. Knowing the price history is key to effective negotiating. If a car has seen repeated price drops or has been sitting on the market for a long time, your buying power is much greater than if it was fresh on the lot. CarEdge Car Search includes detailed new and used price history for every vehicle on the market.

This 2019 Honda Ridgeline has been on the market for months, and has seen a significant price drop. Time to negotiate!

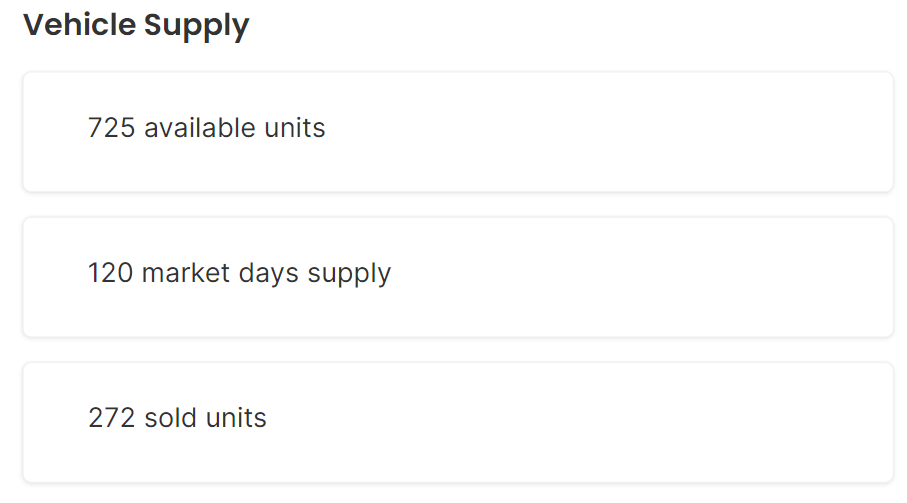

Vehicle supply data is yet another number you can use to your advantage when negotiating on a new or used vehicle. For instance, if there’s an abundance of Nissan Rogue’s in your region, you know the dealer better not be playing ‘limited inventory’ games with you.

On the other hand, if there are only 15 Hyundai IONIQ 5’s around (as was the situation in my case), you know that you’re going to be fighting an uphill battle. All in all, you’re a better informed and more prepared car buyer with the behind-the-scenes research that CarEdge Car Search provides with every auto listing.

Past auto maintenance troubles giving you anxiety? Now you can get a free, no-hassle instant quote for an extended warranty while searching for your next car online. Since the start of the pandemic, Americans have been spending 124% more money on auto repairs. That’s a startling figure that would surely be lower if more drivers opted for an extended warranty with top-tier coverage and transparent pricing.

Get a free quote for CarEdge’s Extended Warranty for ANY vehicle before OR after you buy!

Whether you’re thinking about buying new or used, the latest new car inventory and used car sales statistics point towards a rough second-half of 2022. Fortunately, this new car buying toolkit from CarEdge puts power back in the hands of the people.

What’s the motivating force that keeps you showing up to work day after day, year after year? Is it your desire to own a home, the need to provide for your family, or simply to cover the bills? In 2022, more Americans are seeing their hard-earned money go straight to their monthly car payment. The latest numbers tell a worrisome tale of the economic reality that seems to be worsening.

The average transaction price reached a May record of $45,502, according to number crunchers at J.D. Power. Add in the cost of financing, taxes and fees, and the average TOTAL cost of buying a car is ten grand higher at $55,821, according to Cox Automotive and Moody’s Analytics. Considering that the U.S. median household income is $70,284, inflation is at 40-year highs and gas prices mean $100 fill-ups, how much worse can it get?

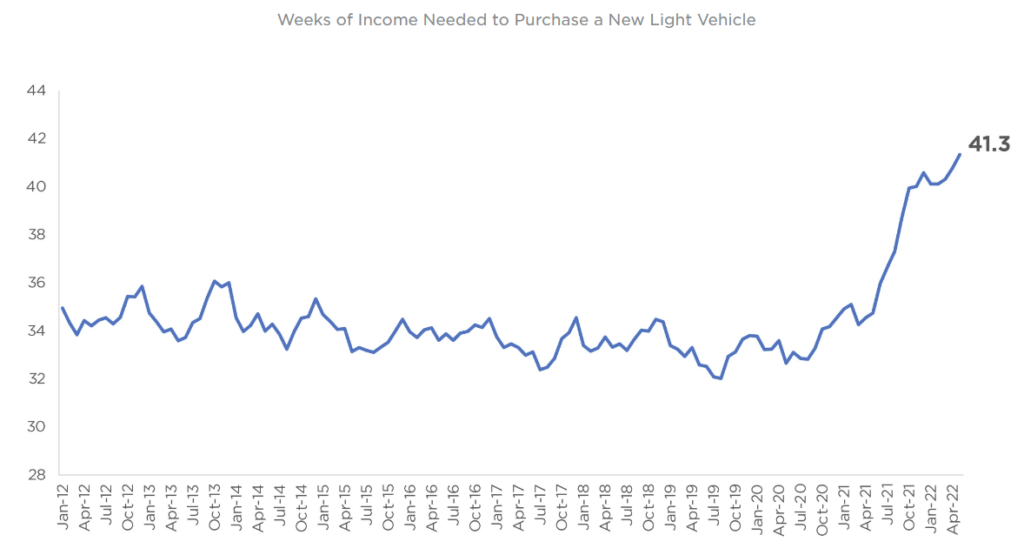

It now takes 41 weeks of the average American’s household income to purchase a new vehicle

It can get worse, but will it? Rising interest rates mean that an auto loan will cost more over time. The average amount financed on a new car purchase is now $39,721. We’re all friends here, so let’s call it $40,000. The data show that most car buyers opt for a 72 month loan (even I did for my recent electric vehicle purchase), so let’s do the math to see how rising interest rates cost buyers.

In May, the average auto loan interest rate reached 4.07%. The Federal Reserve is openly stating that they plan additional interest rate increases as they flex their muscle in last-ditch efforts to put a damper on inflation. In all likelihood, the average auto loan rate will reach 5% at some point in the next year. Over a 72-month loan term for the average $45,502 transaction, the difference between 4% and 5% auto loan rates totals $1,400 more in interest paid over the life of the loan. At a 5% interest rate, today’s average auto loan will cost $6,813 in interest over 72 months.

Why are automakers and car dealers keeping prices inflated despite the economic downturn deepening? Simply put, it’s because consumers continue to pay the higher prices. From the perspective of the American consumer, lack of widespread public transportation and our deeply ingrained ‘car culture’ means that for many, a car is a necessity, not a want. Americans are paying higher prices because in many cases they have to. Cars get us to work, to school and to the grocery store.

AutoNation CEO Mike Manley said in April that the nation’s largest dealer group had “not seen any reduction in the demand for new vehicles or really any perceivable segment-shifting as a result of current economic conditions.”

“We, frankly, have customers for basically everything that’s coming,” Manley told Automotive News.

Evidence for their bold claims? Kelley Blue Book says that the average vehicle sold went for $1,000 over MSRP. That’s not how it used to be.

We’ve been tracking the volatility of the used car market. The pre-pandemic ups and downs gave way to prices in freefall at the height of the pandemic, followed by an unprecedented turnaround that culminated in skyrocketing used car prices as new car inventory was squeezed by the chip shortage.

What a wild ride it’s been. As of June 2022, overall used car prices have increased more than 30% year-over-year. In some vehicle segments, prices are 60% higher than they were in 2021.

See used car price trends here, updated weekly

More often than not, it makes a lot of financial sense to repair an older vehicle than to shell out record amounts of cash (and financing) for a new car. Only those who drive A LOT (over 15,000 miles per year) might see the benefits of buying a newer, more fuel efficient vehicle. We recently did the math, and the break-even point when purchasing an EV over a combustion-powered competitor can take from four years to sometimes nearly a decade, depending on out-the-door cost, incentives and annual miles driven.

Maintenance isn’t cheap, but with the average monthly car payment over $600/month, more drivers are cornered into picking the lesser of two evils.

If you’ve noticed things getting a bit hectic lately, you’re not alone. Two years into the pandemic, 2022 has brought its own set of challenges, setbacks and surprises. Maybe you’ve been impacted by one of these challenges, or perhaps you’re one of the fortunate few who haven’t. Here at CarEdge we’ve been asking ourselves “what happens in 2022 and beyond” to help us plan for our business. Today I thought we would share our thoughts with you.

How will a looming recession affect consumers, automakers and the auto service industry?

Economists are only half-joking when they quip that we could be close to ‘talking ourselves into a recession.’ With an annual inflation rate over 8%, volatile stock markets, record-high gas prices, and rising interest rates, there are many factors that are dampening consumer sentiment in the United States.

An economic slowdown will impact nearly everyone, and each household will feel it differently. Although a recession by definition has not happened yet, there are indications that economic growth is slowing. Economists are taking note, and more than a few are sharing predictions. But when it comes to your money and lived experiences, how much do words matter? It’s a question worth pondering.

Recessions happen every four years on average

Diane Swonk is one of the most respected macroeconomists today, and this is what she had to say in a recent interview with PBS NewsHour. “I think the probability of recession is very high in the second half of the year and as we move into 2023. In fact, we’re forecasting what’s called a growth recession, which is when growth is not enough to hold unemployment down, and it continues to rise in 2023 to derail the inflation we have and get it back to being insignificant to most consumers.”

If a recession is knocking on our door, it’s wise to prepare as best we can. For most consumers, that means saving money and spending less. Discretionary spending, essentially spending by choice rather than by need, always plummets in a recession. For some (but not all) households, discretionary spending includes that shiny new car you’ve had your eye on. In a recession, auto sales decline significantly.

Just how bad could it get? New vehicle sales in the U.S. fell nearly 40 percent during the ‘Great Recession’ of 2008. 2020’s pandemic-driven recession was the shortest in history, lasting just two months. Even then, auto sales were down 15 percent compared to 2019.

Economic slowdowns affect the auto service and repair industry too, but the magnitude of impacts will depend on just how bad it gets. In most scenarios, the demand for auto service will stay fairly steady (as everyone needs occasional car maintenance). When the Great Recession put several million Americans out of work, the impact was significant and long-lasting, and enough to reduce the demand for auto maintenance for a few years.

The truth is, no one knows what the economy has in store over the next few years. Regardless, it would be wise to prepare for the worst while hoping for the best, even if that means putting off the purchase of your next vehicle. Our prediction is that a recession will be with us for 12+ months and that we’re already in the beginning stages of it.

Consumers will continue to drive less as a result of changes in our ways of working post-pandemic. The “new normal” for consumers will be significantly fewer miles per year than in pre-pandemic years. In fact, we’ve already seen this trend showing up in national surveys of driving habits.

In late 2021, a survey from Hankook Tire found that just 36 percent of Americans drive every day. The statistic decreased by 12% over the course of 2021, and if the first five months of 2022 are any indication, a new host of factors (notably record gas prices) are likely to keep drivers off the road.

A recent article in Forbes highlighted the staying power of remote work. A third of workers feel more productive at home, and 36% of remote workers say they’d quit if they were forced back to the office. The nature of work in America has changed forever. Remote work may have a lasting impact on America’s driving habits, but it’s not enough to stop the post-pandemic traffic jam.

According to the U.S. Department of Transportation, travel on U.S. roads rose 11.2% in December 2021 compared with December 2020. The spike has resulted in a nearly full recovery in road traffic compared to 2019, with just 1% fewer miles being driven.

What about gas prices? Clearly, driving costs a lot more than it did last year. The national average is $4.59 per gallon nationwide. That is 50 percent higher than gas was at this time last year, according to AAA. Shockingly, hundreds of dollars in added fuel expenses each month isn’t keeping drivers at home.

Memorial Day weekend is expected to bring 37.9 million Americans to the road, according to Arrivalist. That’s more than the last pre-pandemic Memorial Day weekend. Will Americans continue to disregard the cost of fuel? Time will tell. Our prediction is that Americans will not return to their pre-pandemic driving habits.

Last year, 11 million cars were lost from production due to the worsening semiconductor chip shortage. Unfortunately, it doesn’t look like it’s getting any better. So far in 2022, 1.8 million cars have been removed from automaker production schedules. Over half a million of those cars were scheduled to be built in North America.

Automakers will continue to struggle to produce enough new vehicles to meet consumer demand. The ripple effects from lost production in 2021 and 2022 will permeate throughout 2023, 2024 and 2025. We should expect a shortage of quality used cars and prohibitively high prices for in-market car buyers. Used vehicles will continue to appreciate (or at a minimum not depreciate as they did in pre-pandemic times). We’ve seen used car prices rebounding yet again over the past few weeks (see the latest numbers here).

The average age of a vehicle on the road will continue to increase as consumers hold onto their existing cars longer. The average light-duty vehicle on American roads is now over 12 years old. Twenty years ago, the average auto was 9.6 years old. Drivers are responding to the car shortage by simply holding on to their cars longer. That’s not a bad idea with the way things are going. We expect this trend to continue.

Electric vehicle market share surpassed 5% for the first time in the first three months of 2022. And that was BEFORE gas prices shot up. But it’s not all about EVs, either. Hybrids, plug-in hybrids and full battery electric vehicles (collectively known as electrified vehicles) were up 41% year-over-year in 2021, despite average prices being thousands more than combustion engine counterparts.

Even as consumers drive less, we should expect to see continued and increased demand for EV and hybrid powertrain vehicles. More consumers will become EV and Hybrid “curious” and consider those powertrains for their next vehicle.

See the latest EV market share numbers here

The average transaction price for a fully-electric vehicle is roughly $11,000 more than ICE vehicles. Incentives (such as the federal EV tax credit) help some buyers overcome the cost, but it’s still a luxury that most driver’s can’t afford. Will EVs get any cheaper? Not anytime soon, especially since battery production costs have thrown a wrench into automaker’s plans to lower prices.

In an effort to mitigate inflation, we should expect interest rates to rise further. As the cost to borrow money increases, consumers (and businesses) will be more cash-conscious than before. The Federal Reserve just raised interest rates for the first time in three years, and they said it surely won’t be the last hike.

New car buyers probably won’t see much of a change at first. Captive lending makes it possible to hold off major rate increases for as long as possible to entice buyers into the dealer showrooms. However if the mortgage industry is any foreshadow of what’s to come, car buyers should expect auto interest rates to increase expeditiously over the coming months.

It’s important to remember that a higher interest rate will cost buyers of expensive vehicles most (on a dollar-for-dollar basis). A 6% interest rate will result in about $6,000 in total interest paid for a $40,000 loan over 60 months, but just $2,400 for a $15,000 loan over the same term.

How much do rising interest rates increase car payments? Let’s consider this example. Right now, the average amount borrowed with an auto loan is roughly $40,000 (wow!). With a 72-month loan, a 3.5% interest rate would result in $4,400 in interest paid over the life of the loan. With a 6% interest rate, that same loan would cost $7,700 in interest. It’s not pocket change.

Of our 5 predictions for 2022 and beyond we are most concerned about the impacts of a global recession and the continued car shortage. It’s impossibly difficult to predict all of the effects we’ll see from these phenomena, however we’re cautiously optimistic that we’ll be able to “weather the storm” and be on firmer footing because of it. By 2025 we think we are on the other side of “this”.

What can you do about these 5 known factors in the remainder of 2022? Stay alert, informed and prepared. Whether that means saving a few extra dollars or making that older vehicle last a little longer, every little bit will help ease the anxiety brought on by the uncertain times we live in.