CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

We hear it all the time: electric cars save you money. Electricity is cheaper than gas, EVs require less maintenance, and incentives abound. However, there’s no hiding the fact that electric vehicles are expensive, especially the models with the best range, performance and charge rates. To shed light on the reality of electric vehicle savings, we dug deep into the data. How long does it take to break even when buying an EV? We were surprised with what we found.

The X4 is one of the most direct competitors to the 2022 Tesla Model Y, the best selling electric vehicle in America. Although Tesla models no longer qualify for the federal EV tax credit, the cost of the BMW X4 and high fuel consumption make this an interesting comparison.

| Model | MSRP | Price Difference | Incentives | Fuel Economy | Range | Time to Refuel | Cost to Refuel ($5.00/gal or $0.14 per kWh) | Annual Fuel Cost (15,000 miles) | Average Annual Maintenance Cost | Time to Break Even |

|---|---|---|---|---|---|---|---|---|---|---|

| BMW X4 xDrive30i | $51,800 | -- | 24 MPG | 413 miles | 5 min | $86.00 | $3123 | $228 | ||

| Tesla Model Y Long Range | $62,990 | +$11,190 | State and local only | 3.8 mi/kWh (125 MPGe) | 330 miles | 20 to 30 min | $10.50 | $477 | $77 | 4 years |

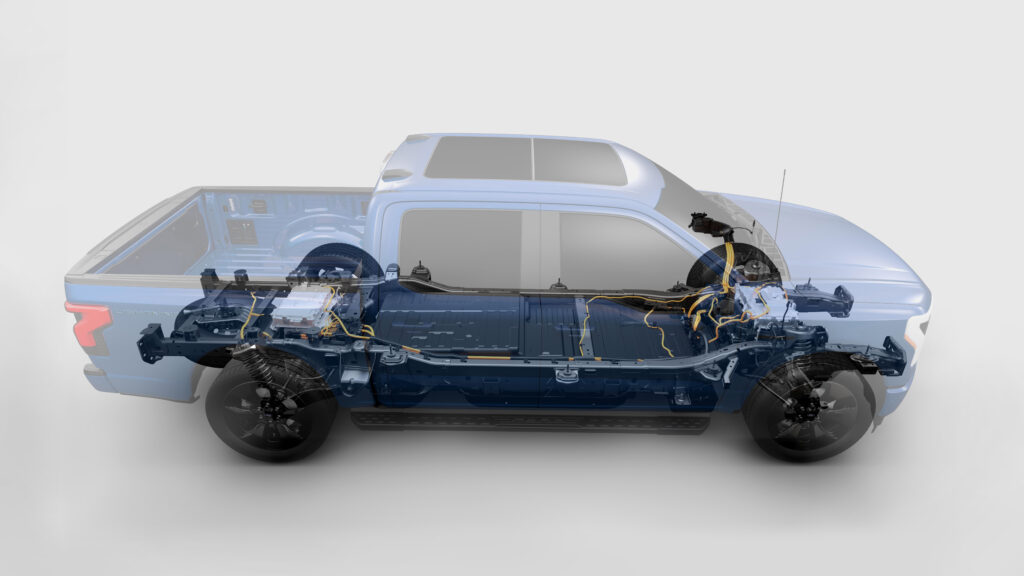

Pickup trucks get the worst fuel economy. It’s just a matter of physics; the shape of a truck is not aerodynamic, and they’re often heavy. The F-150 Lightning weighs 35% more than the gas-powered F-150. So you would think that the time to break even would be shorter when buying an electric truck over the combustion equivalent.

This side-by-side comparison highlights the importance of price parity for EVs. When EVs are similarly priced to ICE vehicles, the cost of ownership savings are crystal clear. But what about when the electric version costs over $25,000 more out the door? Have a look for yourself.

| Model | MSRP | Price Difference | Incentives | Fuel Economy | Range | Time to Refuel | Cost to Refuel ($5.00/gal or $0.14 per kWh) | Annual Fuel Cost (15,000 miles) | Average Annual Maintenance Cost | Time to Break Even |

|---|---|---|---|---|---|---|---|---|---|---|

| Ford F-150 Platinum 4WD 3.5 | $62,070 | -- | 20 MPG | 520 miles | 5 min | $130.00 | $3750 | $228 | ||

| Ford F-150 Lightning Platinum | $90,874 | +$28,804 | Fed, state and local | 2.1 mi/kWh (70 MPGe) | 320 miles | 45 min | $18.34 | $860 | $77 | 9.5 yrs (7 yrs with tax credit) |

Toyota sells nearly half a million RAV4s every year. Will things change now that Toyota has launched its first fully-electric vehicle? The all-new bZ4X lacks the range and charging speed to compete with the best in 2022’s electric segment, but how does it stack up to the popular RAV4 hybrid? How long would it take to break even when paying a premium for the electric bZ4X?

| Model | MSRP | Price Difference | Incentives | Fuel Economy | Range | Time to Refuel | Cost to Refuel ($5.00/gal or $0.14 per kWh) | Annual Fuel Cost (15,000 miles) | Average Annual Maintenance Cost | Time to Break Even |

|---|---|---|---|---|---|---|---|---|---|---|

| Toyota RAV4 XLE Hybrid | $30,545 | -- | 40 MPG | 580 miles | 5 min | $72.50 | $1,875 | $228 | ||

| Toyota bZ4X XLE FWD | $42,000 | +$11,455 | Fed, state and local | 3.5 mi/kWh (119 MPGe) | 252 miles | 1 hour | $10.19 | $606 | $77 | 8 years (2.7 yrs with tax credit) |

Subaru’s first EV is built on the same electric platform as the new Toyota bZ4X. Subaru is known for being Earth-friendly, but is the new Solterra EV friendly to your wallet? With range and charging figures more akin to 2015’s standards than today’s best EVs, the Subaru Solterra is off-road capable, but a tough sell for those who truly venture off the beaten path.

| Model | MSRP | Price Difference | Incentives | Fuel Economy | Range | Time to Refuel | Cost to Refuel ($5.00/gal or $0.14 per kWh) | Annual Fuel Cost (15,000 miles) | Annual Maintenance Cost | Time to Break Even |

|---|---|---|---|---|---|---|---|---|---|---|

| Subaru Forester base | $25,395 | -- | 29 MPG | 481 miles | 5 min | $83.00 | $2,588 | $228 | ||

| Subaru Solterra Premium | $46,220 | +$20,825 | Fed, state and local | 3.1 mi/kWh (104 MPGe) | 228 miles | 1 hour | $9.97 | $677 | $77 | 10 years (6.5 yrs with tax credit) |

The Hyundai IONIQ 5 won big at the 2022 World Car Awards, but is it a winner for your wallet? It all depends on how much you drive, and how long you plan to keep the vehicle. The Hyundai Santa Fe just received a total makeover, and its price remains much lower than the IONIQ 5’s. Still, EVs are super efficient and electricity is cheap. Just how long would it take to break even when buying an IONIQ 5 EV instead of the more affordable Santa Fe crossover?

Disclaimer: I own a Hyundai IONIQ 5 Limited AWD, and it’s awesome.

| Model | MSRP | Price Difference | Incentives | Fuel Economy | Range | Time to Refuel | Cost to Refuel ($5.00/gal or $0.14 per kWh) | Annual Fuel Cost (15,000 miles) | Average Annual Maintenance Cost | Time to Break Even |

|---|---|---|---|---|---|---|---|---|---|---|

| Hyundai Santa Fe SEL | $27,875 | -- | 26 MPG | 489 miles | 5 min | $94.00 | $2,883 | $228 | ||

| Hyundai IONIQ 5 SEL RWD | $45,900 | +$18,005 | Fed, state and local | 3.4 mi/kWh (114 MPGe) | 303 miles | 20 to 30 min | $10.15 | $502 | $77 | 7 years (4.2 yrs with tax credit) |

In many states and localities, thousands of dollars of additional incentives are available. Colorado, Connecticut, Delaware, Maryland and California are just some of the states with very generous EV incentives. State and local incentives can reduce the time to break even considerably. For example, in Delaware, buyers of the Hyundai IONIQ 5 will break even versus the Santa Fe in just 3.5 years with the federal EV tax credit and state rebates factored in.

Conversely, for car buyers who can’t take advantage of the federal EV tax credit or any state incentives, it will take many more years to reap the full savings of switching to an electric vehicle. In the case of the new Ford F-150 Lightning, it could take up to 8 years to break even without any incentives, assuming 15,000 miles per year of driving.

Check this out >>> The North Carolina Clean Energy Technology Center’s DSIRE database is the BEST one-stop resource for all EV incentives. Plus, you’ll see what solar power incentives are available in your area too.

The difference between driving 10,000 miles per year and 20,000 miles per year is massive when it comes to realizing the savings of driving an EV. The average American driver travels about 14,000 miles per year in their vehicle. Simply put, long-distance commuters, frequent travelers and fleet operators will see the greatest cost savings of going electric.

With the 2023 Ford F-150 Lightning, a driver who travels 15,000 miles per year and can take advantage of the full $7,500 federal EV tax credit should expect to break even versus a combustion F-150 in 7 years. However, if they drive 25,000 miles per year, the break even period narrows to just 4 years. After that, they will be saving roughly $4,000 every year in fuel and maintenance costs. Clearly, EVs make more sense as a long-term purchase.

The maintenance figures included in this cost comparison is sourced from We Predict, a Michigan-based data analysis company. They dug deep into automotive maintenance data and found that during the first three years of vehicle ownership, the average annual maintenance for an electric vehicle is just $77. And based on personal experience, that’s likely for new tires (EVs are MUCH heavier).

During the same period, combustion vehicles average $228 in annual maintenance, with most of the costs in the first few years going towards oil changes and the like.

We may be underestimating the maintenance savings associated with going electric when comparing luxury brands. For example, BMW is notorious for costly maintenance. Opting for a Tesla Model Y over a BMW will likely result in even greater maintenance savings, and therefore a reduced break-even period.

As of early June 2022, the average gas price in the United States is $4.87 per gallon. In California, it’s $6.34. Nevada, Hawaii, Washington, Oregon and Illinois all have gas prices much higher than the national average. In these states, EV drivers will see even greater fuel savings.

Let’s take a closer look at an example of someone purchasing a Hyundai IONIQ 5 in California. We’ll assume that the consumer qualifies for the full $7,500 EV tax credit and the $2,500 state rebate for a zero-emissions vehicle. They drive 15,000 miles per year. At gas prices of $6.34 per gallon, the break even point for the IONIQ 5 versus the Hyundai Santa Fe arrives in just 2.5 years, versus 4 years for the rest of the nation. That figure includes the 59% higher residential electricity rates in California.

What can we learn from this EV cost of ownership comparison? The specifics of your situation matter.

These are the most important questions to ask when deciding whether or not it makes sense to buy an EV in 2022. Have questions? Let us know in the comments, or better yet join the CarEdge family at caredge.kinsta.cloud/community. You can also reach me at [email protected]. We’d love to hear from you.

November 2022 Update

Is this the beginning of a Toyota EV scandal?

Norwegian EV testers have found that the Toyota bZ4X does not get anywhere close to achieving the claimed range, efficiency and battery capacity shared by Toyota. The most we’ll known EV testers in Norway, Elbil24, tested the AWD Toyota bZ4x three times in 70-degree weather, and we’re shocked with the data they collected.

Here’s a summary of what they found, but I recommend reading it for yourself at elbil24.no (using a translator). Elbil24 found that the AWD Toyota bz4x has a 62 kilowatt-hour usable battery, much lower than the 71 kWh Toyota claims. In standardized range testing with an outdoor temperature of 70 degrees F and with the climate control set to 73 F, the bZ4X drove just 190 miles on a full charge. Its efficiency is 25% worse than Toyota claims. Merely turning the climate control on dropped the range estimate by nearly 30%.

This isn’t the first poor showing for the model. Toyota bZ4X charging tests are bad to the point that it’s almost scary. InsideEVs previously found that it takes 90 minutes (yes, 1.5 hours) to charge the AWD bZ4X from 0% to 90% (adding 205 miles of range). Trying to get the car to 100% was pointless. It took another few HOURS. Check out their experience here.

Needless to say, we can’t recommend the Toyota bZ4X or its platform sibling the Subaru Solterra with testing showing huge disappointments. We’ll update this page as we learn more.

When Toyota unveiled the Prius hybrid in August of 2000, green tech and sustainability advocates jumped for joy, while the rest of the world pondered the reliability and durability of a hybrid gasoline-electric powertrain. Toyota proved to the world that it was on to something, and has since gone on to sell more than 15 million hybrid vehicles globally. Over 22 years later, Toyota has launched its first-ever fully-electric vehicle, the 2023 Toyota bZ4X. Has the bZ4X electric crossover been worth the wait? Well, it depends on your driving habits and budget. Here’s what we know.

For those who were anticipating an affordable EV from Toyota, I have some bad news. The 2023 bZ4X starts nearly $17,000 above the entry-level RAV4, and $12,000 over the RAV4 XLE Hybrid. The bZ4X is offered in two trims: XLE and Limited. The front-wheel drive XLE starts at $43,215 with destination. Adding dual-motor all-wheel drive to either trim will tack on $2,080. The Toyota bZ4X Limited with all-wheel drive comes out to $49,995. Of course, these MSRPs are before any dealer markups.

Although the bZ4X is Toyota’s first fully-electric mass-market vehicle, America’s best-selling brand sold enough Prius and RAV4 plug-in hybrids (PHEVs) to approach the sales cap enshrined in the existing federal EV tax credit. In 2022, the federal EV tax credit is worth up to $7,500, depending on your tax liability. Tesla and General Motors electric vehicles no longer qualify for this incentive after the two automakers exceeded their 200,000 sale limit, and completed the phase-out period.

Analysts (and even Toyota itself) estimate that the bZ4X will remain eligible for the full $7,500 EV tax credit through 2022. Soon after, they expect to hit the 200,000 sale limit, and the one-year phase out period will ensue until the credit disappears entirely.

State incentives in the form of rebates, tax credits and tax exemptions promote EV adoption in a number of states around the country. Find out if your state offers generous incentives here.

Toyota will offer bZ4X owners and lessees one year of free fast charging at EVgo stations.

EVgo is America’s third-largest public charging network behind Tesla and Electrify America. Over 800 DC fast chargers are located around the U.S., with most located on the coasts, Texas and Great Lakes region.

Before you get too excited about free charging at EVgo, let’s talk charging capabilities. Electric vehicle enthusiasts like myself are puzzled by the outdated charging speeds of the 2023 bZ4X. The front-wheel drive bZ4X is capable of charging at up to 150 kilowatt speeds, which isn’t bad (if the charging curve can sustain that). However, the more powerful and likely more popular all-wheel drive bZ4X is only capable of charging at 100 kilowatts. Why the difference? Battery supply shortages forced Toyota to source the batteries for these two powertrain variants from two different suppliers. And with these charging speeds, it almost seems like Toyota was scraping the bottom of the global battery barrel.

The bZ4X’s charging times are wild, and not in a good way. A recent bZ4X charging test by Kyle Conner of Out of Spec Reviews found that it took 58 minutes (an hour!!!!!) for the AWD bZ4X to charge from 10% to 80%.

Additionally, InsideEVs found that it took 93 minutes to charge from 0% to 90%. That’s NOT normal for an EV in 2022. For comparison, my very own Hyundai IONIQ 5 accomplishes the same feat in 20 minutes, and Tesla’s can do that in 15 minutes. Over 80% of EV charging is done at home overnight, but if you’re a frequent traveler, be very wary of the Toyota bZ4X’s charging speeds.

The 2023 bZ4X’s range is merely okay. It would not be NEARLY as big of an issue if it could charge faster. The front-wheel drive bZ4X is rated for 242 miles with the Limited trim, and 252 miles on the XLE. Upgrade to dual-motor all-wheel drive, and range suffers. The AWD Toyota bZ4X is EPA-rated for 222 miles on the Limited, and 228 miles with lower trims.

Can Performance and Features Redeem Toyota’s First EV?

The bZ4X comes standard with a panoramic glass roof. There’s also adaptive cruise control, lane-departure warning, lane-keeping assist, blind-spot monitoring, rear cross-traffic alert, and Safe Exit Assist. The Limited’s features include a motion-activated power liftgate, a heated steering wheel, heated and ventilated front seats, an upgraded camera, 20-inch rims and faux-leather upholstery. Does that make it worth the hours you’ll spend charging? I’m not so sure.

Toyota’s first EV is loaded with safety features, but bZ4X charging and range capabilities leave a lot to be desired. With the all-wheel drive variant, you’re essentially buying 2016 tech at 2023 prices.

I know more than a few Toyota fans who are disappointed by the bZ4X’s specs. Will this EV turn out to be a winner for Toyota? Time will tell.

Gas prices are up over 50% since last year, and that has more drivers looking to an electric vehicle for their next car purchase. The average EV costs a whopping $19,000 more than internal-combustion engine (ICE) vehicles in 2021, and that figure has surely risen after a dozen price hikes from Tesla and MSRP increases from the rest. So, affordability is hard to come by when shopping for an EV. Fortunately, EV incentives can make a difference, and a big difference depending on where you live.

In the United States, the federal EV tax credit remains in effect for up to $7,500 off of next year’s taxes. Revisions to the electric vehicle tax credit failed passage in 2021, but legislators are looking into other pathways for revisions to the law. (Stay up to date with the latest here.)

The current federal EV tax credit code was written with a 200,000 vehicle cap per automaker. Once an automaker sells 200,000 electric vehicles, a step-down of the credit begins to phase out the incentive before it completely disappears. How does the EV tax credit phase out? The credits continue at full value until the second quarter after the 200,000 sale threshold is reached. For the next six months, the EV tax credit steps down to half of the maximum value ($3,750), followed by one-quarter value for the final six months ($1,875).

These are the automakers no longer eligible for the federal EV tax credit:

Others have been slow to catch up, but the industry is going all-in on EVs.

These are the next automakers expected to reach the 200,000 sale cap for the federal EV tax credit:

Toyota’s place on the list is due in large part because of plug-in hybrid (PHEV) sales contributing to sales totals.

See the latest federal EV tax credit phase out numbers at EVAdoption, an amazing resource full of head-turning data.

EV incentives are subject to frequent change at the whims of legislators and the limits of funding. Stay informed as you consider your EV purchase. Several states around the country have pending legislation that may affect electric vehicle incentives in the year to come.

EV cost of ownership largely depends on availability of incentives, at least until EV prices come down to cost parity with ICE. When will EVs get cheaper? Not in 2022, and it may be a few years before raw material costs and supply shortages settle into a new normal. In fact, that may be just in time for battery shortages if electric vehicles become as popular as many would suspect.

What do you think? Are state and federal incentives keeping the electric dream alive? What would happen to automaker’s half-trillion dollar electrification plans if incentives were to evaporate overnight? It’s a scary thought considering what’s at stake for them.

At a time when the average transaction price for a new vehicle is inching closer to $50,000, getting your money’s worth matters more than ever. Electric vehicles are popular, but they’re expensive. Most importantly, not all EVs are equal in terms of range, charging speed, and overall value for the money. These are the worst deals for a new electric car in 2022, plus some better alternatives on the market today.

Long the authority when it comes to hybrid powertrains, the world waited with great anticipation for the first all-electric Toyota. The automaker that brought us the legendary Prius collaborated with Subaru to engineer the 2023 Toyota bZ4X, and its sibling the Subaru Solterra (more on that below). The result is puzzling. At a time when Hyundai, General Motors and of course Tesla are bringing cars to market with fast-charging times under 30 minutes, Toyota jumps into the game with an electric crossover that takes a whole hour to charge under optimal conditions.

Okay, so it charges slowly. What about the Toyota bZ4X’s range? The front-wheel drive bZ4X is rated for 242 miles with the Limited trim, and 252 miles on the XLE. Upgrade to dual-motor all-wheel drive, and range suffers. The AWD Toyota bZ4X is EPA-rated for 222 miles on the Limited, and 228 miles with lower trims.

Pricing starts at $43,215 before incentives, and tops out at $49,995 for the bZ4X Limited all-wheel drive.

Here’s a summary of what the 2023 Toyota bZ4X offers:

I get why Subaru drivers love their cars. I’m a fan of the outdoorsy, all-terrain capable vehicles at an attainable price. Now that Subaru’s first electric vehicle has arrived, I’m heartbroken. It’s not a compelling EV, especially compared to the competition as a 2023 model.

Toyota’s new electric platform paired with all-wheel drive and the Subaru badge will set you back at least $46,220, and the Solterra Touring’s MSRP is a lofty $53,220. Range isn’t anything to brag about. In fact, it just might cause range anxiety from day one.

2023 Subaru Solterra

Perhaps if you don’t travel too far off the beaten path, the 2023 Subaru Solterra could be right for you. But that defeats the purpose of having a Subaru, doesn’t it?

Here’s our full review of the Subaru Solterra.

When it comes down to the specs, looks and driving experience, the 2022 Volvo XC40 Recharge is not a bad car. Many owners love its zippy performance and Scandinavian looks. What’s not to like? The price paired with the range. The XC40 Recharge is not an affordable EV. With a starting price of $51,700 and most trim options ending up around $60,000, this Volvo’s price approaches that of its competitor: the Tesla Model Y.

Here’s what to expect from the 2022 Volvo XC40 Recharge:

The I-PACE was one of the first electric vehicles to earn mainstream popularity in North America. When it arrived in 2018, range and charging capabilities were on-par with the best. What’s the problem then? Jaguar has not invested in powertrain upgrades for the I-PACE, and it has consequently fallen out of favor among EV buyers.

The 2022 Jaguar I-PACE starts at an MSRP of $71,200, plus destination and fees. What do you get for such a lofty price, other than the Jaguar brand?

Seasoned electric vehicle enthusiasts may be surprised to see the Lucid Air on this list of overpriced EVs, but hear me out. Although the newly-released 2022 Lucid Air starts at $78,900, you’d be hard pressed to find one in 2022 for under $150,000. Lucid’s design is sharp and sleek, and it’s certainly worthy of a luxury price tag. But if you want all the bells and whistles seen in Lucid’s commercials, brace yourself for sticker shock. The fully-loaded Lucid Air Dream Edition costs $169,900.

Within the electric luxury sedan segment, the Lucid Air makes the Tesla Model S look like a bargain. Although the base ‘Air Pure’ starts at $77,400, the Air Pure won’t be available until late 2022 at the earliest. If you’re looking for luxury, a glass roof, and insane performance, the Tesla Model S offers that and more at $99,990. Even with the federal EV tax credit factored in, the Lucid Air Dream Edition costs over $50,000 more, and stepping down to the Lucid Air Grand Touring at $139,900 will still cost 30% more than the Tesla.

At least you get some impressive specs with the Lucid Air, but the competition offers more value and a longer track record of build quality and electric powertrain performance. Still, the Lucid Air is the range king of all electric cars for now.

Here’s our full review of the Lucid Air.

At CarEdge, we’re all about solutions. If you’re on the market for one of these overpriced electric cars, here are some more compelling EVs to take for a test drive.

2022 Hyundai IONIQ 5

Why? For less than $50,000, this retro-styled EV sports a roomy cabin, decent range, and ultra-fast charging powered by the new e-GMP platform’s 800-Volt engineering.

Price: $44,875 – $56,200

Range: 256 to 303 miles

Charge time: Adds 180 – 200 miles of range in 18 minutes (230 kW charge speeds)

Availability: Available now. Check CarEdge Car Dealer Reviews to find the best dealers to work with.

Does it qualify for the federal EV tax credit? Yes!

Learn more with our in-depth review of the IONIQ 5.

2022 Kia EV6

Why? If you love the Hyundai IONIQ 5’s specs and pricing, but aren’t a fan of the looks, chances are the Kia EV6 will be right up your alley. This sporty electric crossover is also powered by the new e-GMP platform’s 800-Volt architecture for the fastest charging available.

Price: $40,900 – $55,900

Range: 274 to 310 miles

Charge time: Adds 190 – 210 miles of range in 18 minutes (230 kW charge speeds)

Availability: Available now. Check CarEdge Car Dealer Reviews to find the best dealers to work with.

Does it qualify for the federal EV tax credit? Yes!

Learn more with our in-depth review of the EV6.

2022 Ford Mustang Mach-E

Why? You’d be hard-pressed to find a dissatisfied Mustang Mach-E owner. This EV is on a much more sport-oriented suspension, with a family-friendly modern interior.

Price: $43,895 – $61,995

Range: 224 to 314 miles

Charge time: Charging improvement incoming via over-the-air update, but for now, the Mustang Mach-E adds 59 miles of range in ten minutes, and charging from 10%-80% takes about 45 minutes.

Availability: Available now. Check CarEdge Car Dealer Reviews to find the best dealers to work with.

Does it qualify for the federal EV tax credit? Yes!

Learn more with our in-depth review of the Mustang Mach-E.

2022 Tesla Model Y

Why? This is still the best electric crossover on the market. Great efficiency, range and charging speeds paired with Tesla’s superior over-the-air update capabilities makes this EV the EV sales leader. If only it still qualified for the federal tax credit!

Price: $62,990 – $82,990

Range: 303 – 330 miles

Charge time: Add 200 miles of range in 15 minutes at over 1,200 Tesla Supercharger locations in North America.

Availability: Available now via Tesla’s direct-to-consumer sales, or pre-owned on CarEdge Car Search.

Does it qualify for the federal EV tax credit? No, not unless the tax credit is revised by congress.

Learn more with our in-depth review of the Model Y.

2022 Volkswagen ID.4

Why? If you can find one at MSRP, the ID.4 is a solid choice for those opting for a more leisurely, less sporty EV. However, it has lost much of its appeal ever since the Hyundai and Kia electric crossovers hit the market with much faster charging.

Price: $41,230 – $52,500

Range: 249 – 260 miles

Charge time: Add up to 190 miles of range in 40 minutes

Availability: Available now. Check CarEdge Car Dealer Reviews to find the best dealers to work with.

Does it qualify for the federal EV tax credit? Yes!

Learn more with our in-depth review of the ID.4.

2022 Tesla Model S

Why? Tesla’s first mass-produced model has matured into the gold standard among luxury EVs. It’s pricey, but sky-high resale value and frequent OTA updates make this Tesla a smart choice for those in the market for something larger than the more popular Model 3.

Price: $99,990 – $156,990

Range: 348 – 405 miles

Charge time: Add up to 200 miles of range in 15 minutes

Availability: Available now via Tesla’s direct-to-consumer sales, or pre-owned on CarEdge Car Search.

Does it qualify for the federal EV tax credit? No, not unless the tax credit is revised by congress.

2022 Mercedes-Benz EQS

Why? The first dedicated electric vehicle from Mercedes to make it to North America is something to behold. It doesn’t have the Tesla Supercharger network, but the interior is luxury on another level.

Price: $102,310 – $108,510

Range: 350 miles

Charge time: Add up to 200 miles of range in 20 minutes

Availability: Available now. Check CarEdge Car Dealer Reviews to find the best dealers to work with.

Does it qualify for the federal EV tax credit? Yes!

Learn more with our in-depth review of the EQS.

Do you agree with this analysis, or did we miss the mark? Please, let us know in the comments below, or join us at the CarEdge Community to talk cars, deals and more. Our CarEdge auto experts are ready to take the headache out of your car buying experience.

Here in the United States, the first quarter of 2023 brought EV market share to 7.2% along with a new EV sales record, despite an overall auto market slump. Electric cars are hot right now, but buying one is easier said than done. Supply shortages, insufficient charging infrastructure and unattainable prices are just some of the reasons why many Americans want an EV, but hesitate to make the switch. Nevertheless, California has announced a ban on new ICE vehicles that starts in 2035. Other states are beginning to follow suit. Which states are banning ICE cars, and which 17 are likely to go that route next? The answers tell us a lot about where the automotive industry is headed, and also the challenges that consumers may face when buying a car in the next decade.

Why don’t states have to follow federal emissions rules? Well they do, but they are allowed to enforce more stringent rules. California was originally granted a waiver from the 1970 Clean Air Act so that it could enforce even stricter emissions standards to combat smog. Since then, other states have followed suit with transportation-related emissions targets.

Today, nearly a quarter of Americans live in a state where sales of internal combustion engine (ICE) vehicles are set to be phased out.

If you’re no stranger to the auto industry, you likely know that California’s strict emissions standards have shaped fuel economy standards and electrification plans for a few decades. In August of 2022, California announced that it will phase out gasoline-powered cars by 2035 to reduce demand for fossil fuels responsible for human health hazards and climate-warming emissions. Governor Gavin Newsom said the transportation sector is “responsible for more than half of all of California’s carbon pollution, 80 percent of smog-forming pollution, and 95 percent of toxic diesel emissions.”

Will California’s ICE ban be moved forward to 2030? It’s possible. While it seemed to be a likely move just one year ago, the limitations that automakers face in making EVs will likely prevent states from moving up timelines to before 2035. Still, some politicians are advocating for a quicker phase out of fossil fuels, and the cities of Oakland, Culver City and Berkeley are already targeting a 2030 deadline.

The California Air Resources Board (CARB) adopted the Advanced Clean Cars II proposal on August 25. In addition to banning light-duty vehicles powered by internal combustion engines in 2035, the new rules set a timeline for a phase-out period.

California’s new CARB policy requires that 35 percent of new passenger vehicle sales in California must consist of zero-emissions vehicles by 2026, with the requirement increasing to 68 percent by 2030, and 100% in 2035.

A new regulation promoted by the California Air Resources Board (CARB) would require that rideshare companies achieve a level of zero greenhouse gas emissions and to ensure 90 percent of their vehicle miles are fully electric by 2030. California, a state that relies on ridesharing more than most other American states, will be putting the pressure on Uber, Lyft and others.

The new EV tax credit impacts everyone. See the models that qualify, and the many that don’t.

Since the 1990s, 17 states have enacted laws requiring state emissions policies to mirror those of California. These are the states that follow CARB emissions standards:

All of these states and the District of Columbia are likely to officially adopt the 2035 ICE ban in the coming days or weeks.

We’re one nation under different sets of rules. Washington and Massachusetts have so-called trigger laws in the books that require them to follow the lead of the California Air Resources Board (CARB). With the latest news from California, Washington and Massachusetts have also announced a 2035 ban on ICE cars.

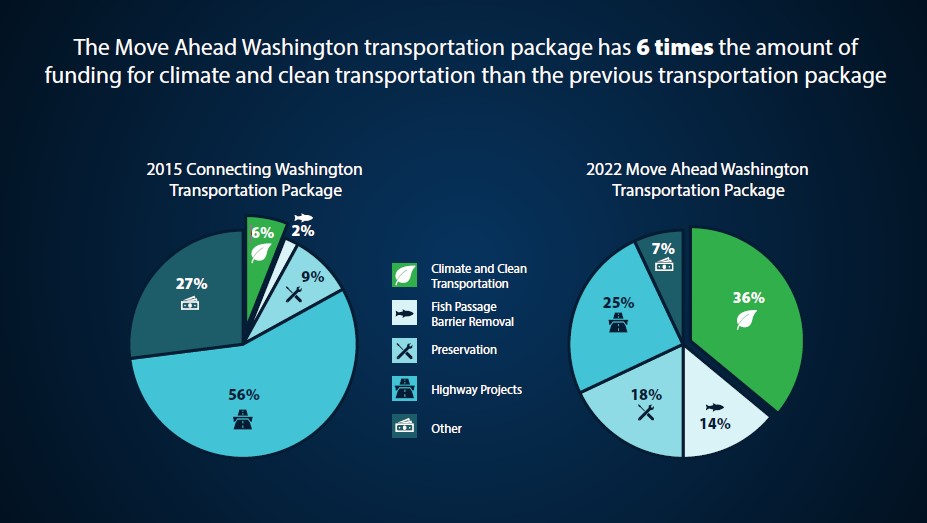

Previously, the 2022 Move Ahead Washington transportation package passed the state’s legislature and made it to Governor Inslee’s desk for a signature. Thirty-six percent of the $16 billion transportation package is dedicated to climate-friendly transportation infrastructure, such as electric vehicle charging, public transit electrification, and even low-emissions ferries.

Within the 2022 Move Ahead Washington package is a bold new policy aimed at ending sales of new internal combustion engine (ICE) vehicles starting in 2030, just 7 years away. For now, Washington has decided to pursue California’s 2035 target. Perhaps politicians in Washington state have been keeping an eye on automakers struggling to ramp up EV production just 7 years from the more ambitious target.

“Transportation is our state’s largest source of greenhouse gas emissions. There is no way to talk about climate change without talking about transportation. This package will move us away from the transportation system our grandparents imagined and towards the transportation system our grandchildren dream of,” Inslee said in a statement.

In 2020, transportation overtook electricity generation as the top source of carbon emissions in the United States.

New York will ban the sale of ICE cars and light-duty trucks starting in 2035. In September 2021, Governor Kathy Hochul signed a bill implementing the future ban. The New York law also seeks to eliminate emissions from medium- and heavy-duty vehicles by 2045. The state government is required to create a detailed plan for zero-emissions vehicle development by the end of 2023.

The New York ICE ban has eyes on the truck sector. Governor Hochul instructed the Department of Environmental Conservation (DEC) to propose new regulations that will accelerate the adoption of electrified trucks in particular.

“When adopted, this new regulation will require an increasing percentage of all new trucks sold in New York to be zero-emissions vehicles beginning with the 2025 model year, cementing our state as a national leader on actions to address climate change while spurring economic opportunities and helping to reduce air pollution,” said DEC Commissioner Basil Seggos.

Massachusetts is another state with a trigger law requiring state emissions policy to mirror that of the California Air Resources Board. The state has now adopted the same 2035 ICE ban that the Golden State has.

Roughly 27 percent of Massachusetts emissions come from passenger vehicles. As the state seeks out strategies to achieve net-zero fossil-fuel emissions by 2050, a ban on the sale of new combustion-powered vehicles has entered the picture.

Massachusetts is one 17 states that adhere to California’s vehicle emission standards, a policy first adopted in 1991 to ensure the state has strict anti-pollution regulations.

In 2021, Virginia became the 17th state to adopt some of California’s tailpipe emission standards that are stricter than federal rules. One year later, elections shifted the balance of power.

“House Republicans will advance legislation in 2023 to put Virginians back in charge of Virginia’s auto emission standards and its vehicle marketplace,” House Speaker Todd Gilbert said in an August 2022 statement, according to the AP. “Virginia is not, and should not be, California.”

For the time being, Virginia is on track to ban light-duty ICE vehicles in 2035 as it follows California’s lead. With a republican governor and House, it is quite possible that this could change.

In 2023, the 17 CARB states are seeking to set a target date for the nationwide phase-out of combustion-fueled light-duty vehicles starting in 2035.

Why stop at heavy duty trucks? The battery and charging technology isn’t quite there yet for big rigs, and supply chain logistics are too fragile to disrupt with talk of bans on combustion engines.

Proponents of a nationwide ban on ICE sales say that it’s the most effective way to combat pollution since emissions spread beyond state borders. A nationwide ban on ICE vehicles does not appear likely for now, but we’ll keep an eye on the latest developments at both the state and federal levels.