CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Buying a car is tricky in today’s market, and even leasing can feel like three-dimensional chess these days. Although 2022 isn’t the best time in history to buy or lease a car, some shoppers don’t have a choice. It doesn’t help that the average new car payment is a bank-draining $650 a month in 2022. Fortunately, leasing provides a window of opportunity for those who don’t mind what is essentially a long-term rental. These are the best car lease deals in 2022. All examples assume a 5% down payment at signing.

Not sure where to start? Head over to our CarEdge complete guide to leasing to find out what leasing a car is, and when it’s a good idea.

The plug-in hybrid (PHEV) version of the Mitsubishi Outlander sells for an average MSRP of $40,356 depending on the trim. If leasing is an option, you can get into this versatile SUV for $412 per month with an allowance of 12,000 miles a year. How does a plug-in hybrid work? The Outlander can drive 24 miles on pure electricity (which is much cheaper than gas), and then can drive another 300 miles as a regular hybrid system with the help of a combustion engine. It’s kind of the best of both worlds, especially for a lease.

The Kona EV made our CarEdge list of the five best electric cars you can get for under $50,000. The Hyundai Kona EV has an average MSRP of about $40,000, and you can lease one for just $401 a month. The Kona is a great alternative for those considering the Chevy Bolt. Plus, it comes with Hyundai’s unbeatable 10 year, 100,000 mile battery and electric powertrain warranty. This front-wheel drive subcompact crossover gets 258 miles on the charge, exceptional range for a budget EV. Some owners get over 275 miles on a single charge.

If you can find one that’s not marked up, the 2022 Toyota Tundra 4WD is $51,400 at MSRP. If you’re open to leasing, you can sign up for $525 a month for 36 months and 36,000 miles. That’s $125 less per month than today’s average monthly finance payment. The downside? The Tacoma gets 14 miles per gallon when gas prices are well over $4 per gallon.

Last year, the Toyota Tacoma won Best Buy of the Year award from Kelly Blue Book in the mid-size truck category, and now you can lease a 2022 model for under $400 a month. If you buy, the 2022 Tacoma has an average MSRP of $36,300. If you lease, monthly payments are as low as $361.

With an MSRP of $41,900, it’s a pleasant surprise that you can get into a Civic Type R lease for just $410 a month. Over 300 horsepower propels this budget racer to 60 mph in just 5.3 seconds. The challenge is finding one on a dealer lot.

Pre-facelift, the 2021 Chevy Bolt was the least ‘sexy’ electric vehicle on the market. It may look bland, have slow charging, and be subject to one of the most scrutinized recalls in recent memory, but you can lease one for cheap. The 2021 Chevrolet Bolt sells for $38,567 (average MSRP across trim levels), but you can lease one for $367.63 a month. Just make sure that you have proof from the dealer that your Bolt has already had the recall fix. Learn more about the Chevy Bolt recall and vehicle specs here.

The 2022 model year gets a refreshed, modernized front fascia and improved interior. Sadly, driving range figures for the 2022 year remain the same. At least it doesn’t look like a cheap appliance anymore. Here’s the great news: the 2022 Chevrolet Bolt has a lower MSRP than the 2021 model. GM electric vehicles no longer qualify for the federal EV tax credit, so GM must have felt compelled to keep pricing competitive. Whether you go for a 2021 or 2022 Bolt, ensure that the car has had all of the mandatory fire-related recall fixes completed.

You can lease a 2022 Chevy Bolt for $312 a month for 36 months. If you’re considering buying, remember that the $33,595 price tag will not get any help from the federal tax credit. State and local incentives may apply, depending on where you live. Here’s everything you need to know about the 2022 Chevrolet Bolt.

The Bolt EUV is the slightly larger new sibling to the regular Chevy Bolt EV. The EUV sells for $36,245, but you can lease one for just $341 per month. Range is 247 miles, but charging isn’t that great. Learn more about the Bolt here.

The 2022 Kia Niro EV has an average MSRP of $43,500, but it can be all yours (for 36 months) for just $395 with a lease. There’s generous lease support for the Niro for a few reasons. The Kia Niro is about to receive a major upgrade in 2022, and it’s being overshadowed by the new Kia EV6 electric crossover. The Niro can make it 239 miles on a charge, and charging from 0-80% takes about one hour at a DC fast charger. However, if you plug it in at home, it should work just fine for those who drive less than 50 miles a day.

Why is the 2021 BMW i3 such a phenomenal deal in 2022? It was recently discontinued, but it’s still a great option if you’re looking for an affordable, low-emissions way to get around town. Keep in mind that it’s no Tesla. The i3 gets 200 miles of range, 153 of which are on pure electricity. Not to be confused with the new BMW iX3, the 2021 i3 has an optional range extender (on the BMW i3 REX version). All trims considered, the 2021 BMW i3 has an average MSRP of $48,970 while supplies last.

If you’re looking for an all or mostly-electric bargain lease, you can lease the 2021 BMW i3 for $425/month. That’s well under the budget-friendly 10% threshold for a smart lease.

Have questions or comments about the best car lease deals in 2022? Or maybe you’d simply love to connect with fellow car buyers and auto enthusiasts? Check out the CarEdge Community at caredge.kinsta.cloud!

Buying a new car is rarely a wise financial decision. Truthfully, cars are depreciating assets (unless there’s a chip shortage and car prices appreciate). That means from the moment you drive off the lot with your shiny new wheels, you’re actually losing money.

For some car buyers, leasing is a great way around depreciation. However, leasing isn’t for everyone. For many consumers, it’s worth asking the question “what does it mean to lease a car?”. In this guide to leasing a car, we’ll explain all there is to know about leasing, and how to shop smart in 2025.

The last time a car commercial grabbed your attention with an attractive lease deal, it probably included a whirlwind of rates, payments and terms crammed into thirty seconds. What exactly is a car lease? An auto lease is a long term rental agreement for a vehicle that is subject to specific terms and conditions. The lease terms are agreed upon by the customer and dealership (or automaker in the case of Tesla, Rivian and Lucid), and a third-party leasing company who actually takes ownership of the vehicle (and then leases it to you).

There are four parts to a lease:

1) The capitalized cost (which is the out-the-door price on a lease)

2) The residual value of the vehicle

3) The money factor

4) The state sales tax

These four factors determine the total cost of the lease, and in turn the monthly payment. Let’s talk about the details.

Instead of negotiating an out-the-door price (which is the price of the vehicle plus all taxes and fees), you negotiate the capitalized cost (also referred to as the “cap cost”) of the lease. The cap cost is the amount that the leasing company is paying for the vehicle. This will include:

Some of these charges are negotiable. For example, you don’t need nitrogen-inflated tires or security etching that you didn’t ask for billed on your lease agreement. For every $1,000 in additional cap cost, that will roughly translate to $27 a month in payment on a 36 month lease. Take a long, hard look at the itemized invoice before signing anything!

👉 Here’s a guide to which dealer fees are legit, and which you can negotiate.

Residuals are a percentage of the MSRP as set by the leasing company, and they are not negotiable. The residual value is the vehicle’s projected value at the end of the lease term. When you lease, you pay for the amount of depreciation that will occur over the course of the lease term.

For example, if the residual on a 36 month lease is .75 (or 75%), your lease will include payment that covers the 25% expected loss in value over the course of 36 months.

Residual values are not negotiable and they are set by the leasing company based on allotted annual miles to be driven. Specifically, 7,500, 10,000, 12,000 or 15,000 are the standard mileage amounts that are normally offered.

Dealers cannot modify or adjust the residual percentages other than for additional annual miles allowed to be driven. Check out an example of how residual values fit into leasing here. The residual value is disclosed on the lease as the amount that you can purchase the vehicle for at lease end.

The money factor is set by the lender and can be marked up to the consumer, much like on a car loan. When a buyer finances a car, the dealer works with a number of lenders behind the scenes to get an attractive rate. However, that’s not the rate that the salesperson closing the deal will quote. Dealers markup loans, and pocket the difference. Fascinating and distressing, right? Here are all the ways that dealers make money when selling you a car.

With a car lease, dealers make money by marking up the money factor on a lease. The lender charges the dealer a money factor of say, .00125, and the dealer marks it up 50, 75 or even 100 basis points. The difference between the buy rate (what the lender charges the dealer) and the marked up rate (what you’re quoted) is additional backend profit on the lease for the dealer.

You should always try to negotiate the money factor to the buy rate or as close to the buy rate as you can get!

Taxes in most states are added to the total price of the lease. NY, NJ, MN, OH, and GA charge sales tax upfront on the total amount of the lease payments. VA, MD, and TX charge sales tax on the total selling price of the vehicle (the cap cost). In all other states, sales tax is simply factored into your monthly payment.

Sales tax is not negotiable, but it does vary from state to state.

Simply put, the leasing company owns the vehicle that you are leasing from them. In most cases that will either be that brand’s captive lender or an outside bank. The vehicle will be registered in both the leasing company’s name and your name as the lessee. You will be responsible for registration renewals, maintenance and all insurance.

It’s also possible that the leasing company financed the vehicle that they bought from the dealer. In that case, the financial institution would possess the title until the leasing company pays it off.

At CarEdge, we’re always working on something new to help demystify car buying, car selling, and ownership. If you’re considering a new car lease, estimate your monthly payment in seconds with our latest free tool: our car lease calculator.

No, but If you want to lower your monthly payment, consider making a down payment on your lease. In a car lease, the down payment is called a capitalized cost reduction, or cap cost reduction. These up front payments are optional, but they can help make leasing more affordable by lowering the monthly payments. The payment is lower because the cap cost reduction has lowered the cost of the vehicle to the lender.

Any advertised lease payment typically requires a specified amount of cash down. For example, an advertised lease monthly payment may include $3000 cash down plus the first payment, acquisition fee, tax, title, registration and dealer fees.

Remember as a rule of thumb, for every $1000 in cap cost reduction on a 36 month lease your monthly payment will be reduced about $27.

Shoppers with bad credit may be required to make a security deposit, which is returned once the car is returned at the end of the lease.

I put zero down on my leases and when I say zero, I mean not even a penny. Cash down on a lease just reduces the cost of the vehicle to the lease company and if the vehicle were ever declared a total loss, that money that you had put down is lost forever. A lease down payment is not covered by your auto insurance. They only cover the value of the vehicle, not the value of the cash that you put down.

Whatever money you are thinking about putting down, deposit it into a separate investment account and draw from it monthly when you are making your lease payments. This way your money is still making money each month until you need to draw from it.

Yes, your lease’s monthly payment includes interest, this is the money factor.

You can’t shop around for a better interest rate when it comes to a lease without shopping for a different car altogether. You won’t see an interest rate on your contract when leasing a car, but you can request this information from the dealer or leasing company. The total amount of interest paid on a car lease depends on the length of the lease term and even the type of vehicle. If you lease a model that is likely to depreciate faster, the leasing company is more likely to charge higher interest to ensure that loss in value (the residual) is accounted for.

One way to lower your interest rate (Money Factor) on a lease is by placing Multiple Security Deposits if the lender provides the option. Each MSDS equals one monthly payment and will reduce your MF by a percentage point determined by the lender. There is a limit on how many MSDS you can apply, but the savings can be significant in some cases.

Yes, in most cases customers can pay for a lease up front. Paying for an entire lease at the time of signing is called a one-pay, or single-pay lease. Some lenders will discount interest costs if you pay for the whole lease up front. Make sure to find out if there is any benefit to you before you commit to paying for a car lease up front.

Risk Mitigation

Convenience:

Flexibility:

Financial:

The car isn’t yours.

Few vehicles will lease well.

Fees and costs.

Still debating whether to lease or buy? We’ve got you covered. Check out our CarEdge guide to leasing versus buying in 2022.

Yes, an EV lease is a great way to give electric vehicles a try. Some lease companies pass along the EV tax credit to the consumer by lowering the capitalized cost by the EV credit amount.

Leasing an electric car may be a great option to consider since battery technology improves every year. When your lease is up, you’ll be stepping into a whole new world of next-generation EVs.

See the best EV deals right now in your area

Negotiate what you can

The cap cost and money factor are negotiable. You should always try to negotiate the money factor as close to the buy rate as you can get!

Shop around for deals, be flexible

Deciding what to do at the end of a car lease depends mostly on how you feel about the car. Of course, your financial situation and inclinations also come into play.

These are your options at the end of a car lease:

Which option is a good fit for you? If you love the vehicle and can afford to finance or buy it outright, you can keep a vehicle with a good service history at a set price (from the residual on your lease contract).

If you no longer need a vehicle, leasing allows you to simply return the car and keys at the end of the lease term. Remember, leasing is just like a long-term rental.

Stuck on what to do when your lease ends? Check out our guide, “What to Do At the End of a Car Lease.”

Join the CarEdge Community for expert advice and a place to connect

Join the CarEdge Community to connect with auto industry experts and fellow consumers and car enthusiasts. See the best deals, latest news, and car buying shenanigans to steer clear of. Best of all, a sense of community awaits. We’d love to connect with you!

On March 10, 2022, the United States National Highway Traffic Safety Administration (NHTSA) announced safety standards for vehicles without human controls. The historic announcement effectively eliminates the requirement for human controls in future vehicles designed to be fully autonomous. In a few year’s time, cars without steering wheels may enter production.

“As the driver changes from a person to a machine in vehicles equipped with automated driving systems, the need to keep the humans safe remains the same and must be integrated from the beginning,” said Dr. Steven Cliff, NHTSA’s Deputy Administrator. “With this rule, we ensure that manufacturers put safety first.”

Before the NHTSA rule update, occupant protection standards were written for common, traditional vehicles. You know, the ones with steering wheels. The rule updates the standards to clarify what is required of manufacturers when applying the standards to vehicles without traditional manual controls.

In essence, the rule change permits vehicles to operate without driver controls, as long as automakers continue to provide the same high levels of occupant protection as current passenger vehicles.

The NHTSA’s rule change comes in response to a petition from General Motors’ Cruise division to update the requirements for future self-driving vehicles. The new regulations eliminate the need for manual driving controls (a steering wheel and pedals) in fully-autonomous vehicles. This particular rule pertains to crash safety standards. No steering wheel, no problem.

In February, GM’s petition sought to make the case for NHTSA action.

“This petition both demonstrates how the Origin achieves safety objectives of existing standards, and helps enable future AV regulations. NHTSA has made clear in public testimony and regulatory actions, that in order to consider the development of AV standards, they first need more information from real world AV operations. We believe this petition can help enable that outcome: learnings from the Origin, which is designed to improve overall road safety, can help inform the creation of new, updated regulations and standards.”

GM’s Cruise recently unveiled the Cruise Origin, a purpose-built autonomous pod designed for urban mobility. The Cruise Origin and other autonomous vehicles in development needed the NHTSA to update the rules before embarking on the final stages of development. In fact, most automakers are working on autonomous driving technologies.

At least one automaker has refrained from bringing its level 3 autonomy to the United States because of outdated regulations. In 2021, Mercedes-Benz became the first automaker to get regulatory approval for level 3 autonomous driving on European public roads. For now, Mercedes Drive Pilot is available on 8,197 miles of German highways at speeds up to 37 miles per hour. What makes Mercedes Drive Pilot so special is that it is the first approved consumer-ready system to permit the driver to take their attention away from the road while the vehicle is in motion.

Mercedes-Benz cited the murky regulatory environment in America as reason for the delayed rollout of Mercedes Drive Pilot in the US. Now, Mercedes says it intends to bring level 3 Drive Pilot to American roads later in 2022. The S-Class and all-electric Mercedes EQS are the first models to gain Mercedes Drive Pilot in the US.

BMW also hopes to launch Level 3 features on the 7 Series sedan this year.

See every automaker’s plan for autonomous driving here.

Elon Musk was an early proponent of building cars without driver controls. The updated US regulations will open the pathway for Tesla’s without steering wheels. However engineering autonomy has proven to be a greater challenge than anticipated.

Tesla CEO Elon Musk reflected on the complexity of autonomous driving in a recent interview. “I thought the self-driving problem would be hard, but it’s harder than I thought. I thought it would be very hard, but it was even harder than that.”

That isn’t to say that Tesla is giving up. Tesla remains a leader in automation. The controversially-named ‘Full Self-Driving’ feature is currently available to beta testers with high safety scores. However, criticism abounds from customers who are upset over years of delays for a feature they paid $6,000 to $12,000 for.

Tesla’s vertical integration is one of its greatest strengths. Tesla controls the hardware and software in its cars that will one day support autonomous driving. Little by little, they are making steps in that direction. In 2021, Tesla even eliminated the gear selector in the refreshed Tesla Model S. Apparently, the car should ‘know’ which direction it needs to go. Tesla’s engineers think that today’s Teslas are capable of figuring that out. There are gear selector controls on the touch screen in case the car guesses wrong.

Still, the 2022 update to NHTSA regulations paves the way for Tesla, GM, Mercedes and other automakers to make their autonomous dreams a reality. If only they can figure out how to get it to work. I don’t expect to see a single production car without a steering wheel until closer to 2030. Commercial ride-sharing ventures like GM’s Cruise could, however, bring vehicles without driver controls to American roads within a few years.

Here Is Every Automaker’s Plan for Autonomous Vehicles

What would it take for you to feel safe buying a vehicle without a steering wheel? Wouldn’t that take the fun out of driving? Perhaps folks like me will be in search of aftermarket steering wheel mods in a decade’s time.

Imagine using your vehicle as a backup generator for your home, or even to help a stranded motorist reach their destination. Electric vehicles claim just 5% of new vehicle market share in America, however record gas prices are spurring renewed interest in the EV lifestyle. One of the most sought-after features of electric vehicles is bidirectional charging. Also known as vehicle-to-load, or V2L, tomorrow’s cars literally have the power to do so much more than drive us around. Here’s everything you need to know about bidirectional charging in electric vehicles.

During typical use, electric cars draw electricity from the grid, and then consume that energy to power their electric motors. What if you could reverse the flow of electricity back into the grid? Better yet, imagine making money doing it. The future of mobility is about to get weird. Cars are already becoming rolling computers, so it only makes sense that they are capable of revolutionizing the world beyond the driver’s seat.

Simply put, bidirectional charging is the ability for electrical current to flow in both directions: from the grid to the vehicle (to charge the battery pack), and also from the car to the grid, another car, or household appliances.

When an electric vehicle is charged, alternating current (AC) from the grid is converted to direct current (DC) using the car’s built-in converter. To send electricity out of the battery pack and back into the grid or into another electronic device, electricity must first convert back to AC. This is done using an inverter. Vehicles that are manufactured with an inverter are already equipped with the hardware needed for bidirectional charging.

The numbers are in: see average EV prices and the latest EV market share update.

Vehicle to grid (V2G) capability enables an electric car to return electricity to the grid. V2G can help supply energy at times of peak grid demand. In most of the world, electricity demand peaks during the afternoon and early evening. Peak demand causes demand charges, which are higher rates for usage.

Vehicle to grid capability offers a way around demand charges, to the benefit of consumers and grid operators alike. The vehicle’s owner avoids demand charges or even sells electricity to the grid, and the grid gains a new source of electricity when it’s needed the most.

Although V2G is still in its infancy, the technology opens up the possibility of future revenue streams for everyday EV drivers and even automakers. Imagine if your car could make you money while it’s parked in the garage. Rental and ride-hailing fleets could double the revenue from their autonomous vehicles by serving as power suppliers to the grid. It’s a game changing option that is coming to cars in the near future.

V2L allows an electric vehicle’s battery pack to power appliances such as power tools, a coffee machine, cooking equipment, laptops, or even a party. More importantly, vehicle-to-load capability serves as the ideal emergency power source during times of need, such as following a natural disaster or power outage. Some cars, such as the 2022 Hyundai IONIQ 5, can output 3.6 kilowatts via V2L functionality. That is a LOT of power, surely enough to power an entire campsite or family-sized outdoor event.

Naturally, one of the first uses of bidirectional charging that comes to mind is powering one’s home during a power outage. Indeed, vehicle-to-home (V2H) power supply is under development, and it’s even featured in a few of today’s production EVs. It’s important to note that accessories and professional installation of associated hardware are required before any EV can power an entire home. Still, it looks like V2H capability is a real option for EV shoppers to consider in 2022. More on today’s V2H EVs below.

The short answer is that it depends on the battery chemistry. One of the latest battery chemistry types to be employed in EVs is lithium-iron-phosphate batteries, or LFP. LFP batteries quickly rose to prominence due to their remarkable ability to withstand the stresses of repeated charging cycles without severe battery degradation.

Other battery chemistries lose range over time as the battery is charged and discharged (referred to as a charging cycle). Even charging to 100% too often can reduce the life of some battery types. LFP batteries are the perfect companion for bidirectional charging, especially vehicle-to-grid. They handle frequent charging and discharging like a champ.

Other battery types in development are engineered with bidirectional charging capability in mind. Ford’s partnership with SK Innovation resulted in a more environmentally-friendly battery chemistry suitable for the frequent charge cycles of bidirectional charging.

Our EV extended warranty provides peace of mind. Batteries and other electrical components are covered! Get a quote for your EV today.

| Max Power Output | Date Available | V2L Capable? | V2H Capable? | V2G Capable in 2022? | |

| Chevrolet Silverado EV | 10.2 kW | 2023 | Yes | Yes | No |

| Ford F-150 Lightning | 9.6 kW | Mid 2022 | Yes | Yes | No |

| Hyundai IONIQ 5 | 3.6 kW | Now | Yes | No | No |

| Genesis GV60 | 3.6 kW | Spring 2022 | Yes | No | No |

| Genesis G80 | 3.6 kW | 2022 | Yes | No | No |

| Kia EV6 | 1.9 kW | Now | Yes | No | No |

| Toyota bZ4X | TBD | Mid 2022 | Yes | No | No |

For the time being, no Tesla models are capable of bidirectional charging. It’s possible (even likely) that all 2022 Tesla models have the necessary hardware for V2G or V2L, or V2H. However, Tesla has alternative motives for delaying bidirectional charging rollout for as long as possible. If Tesla vehicles became V2H-capable, they would render the $10,500 Tesla Powerwall home battery obsolete!

A few curious Tesla owners have inquired about modifying their cars to become capable of bidirectional charging. The response from Tesla was a warning that doing so would void the vehicle’s battery warranty. So for now, don’t expect Tesla EVs to power your home or appliances.

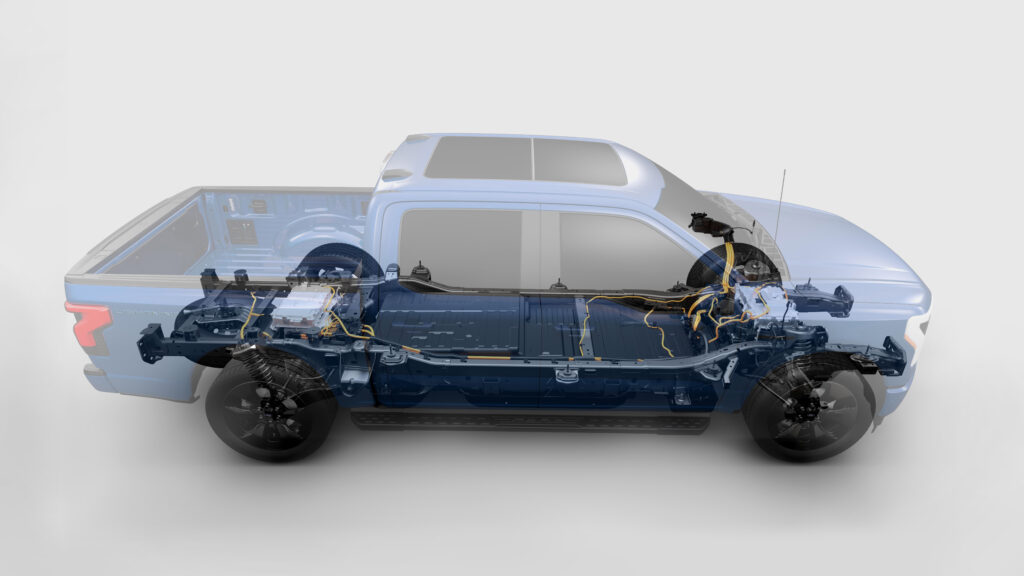

Ford’s F-150 Lightning is widely marketed as the answer to power grid anxieties. Ford Intelligent Backup Power is an available accessory to the popular F-150 Lightning electric truck. With 200,000 reservations in the books, the Lightning is already sold out through 2023.

The F-150 Lightning contains unique battery chemistry that strengthens charging cycle durability while also requiring fewer rare earth metals. Ford’s partner, SK Innovation, has developed a new battery cathode that uses 90% nickel, and 5% each of manganese and cobalt. The new battery chemistry also reduces the harmful environmental and ethical impacts of cobalt mining.

Ford’s engineers designed the new electric F-150 with V2H in mind. In the electric truck segment that’s rapidly gaining steam, automakers are looking for bold ways to make their truck a compelling buy.

“F-150 Lightning with available Ford Intelligent Backup Power can provide power and security during an electrical outage – the first electric truck in the U.S. to offer this capability; in the future, new features will offer additional ways to manage energy use and potentially save on energy costs.”

“The F-150 Lightning extended-range battery system can store 131 kilowatt-hours of energy and deliver up to 9.6 kilowatts of power in a cleaner, quieter, more efficient way versus gasoline-powered generators, and with greater capacity than many wall battery units. F-150 Lightning can also offer lower-cost energy storage in a product customers already own – their truck.”

How long should an electric truck be able to power an entire home? 12 hours? Three days? Ford says that depending on power demand, some homes could be powered for seven days with the F-150 Lightning’s extended range battery.

“With Ford Intelligent Backup Power and the Home Integration System, F-150 Lightning automatically kicks in to power your home if the grid goes down. Once power is restored, the system automatically reverts back to utility power. Based on an average U.S. home at 30 kilowatt-hours of use per day, F-150 Lightning with extended-range battery provides full home power for up to three days, or as long as 10 days when used in conjunction with solar power or rationing.”

Learn more about Ford Intelligent Backup Power in Ford’s official announcement.

The average

Bidirectional charging is yet another way that the electrification of the auto industry is transforming vehicle ownership. In five years (or less), trucks will be judged for how many days they can power your home, and crossovers will be expected to power household appliances with ease.

The fact that vehicle-to-home capability relies on the professional installation of accessories sold separately seems to fly under the radar for many. While vehicle-to-load may become a standard feature that we all take for granted in a decade’s time, retrofitting a home for V2H power will remain a lofty expense for the foreseeable future.

What do you think about bidirectional charging? Do you plan to power your home with your car in the future? Let us know what you think about automaker’s bold plans for EVs in the comments below, or share your thoughts with the CarEdge Community at caredge.kinsta.cloud.

After surpassing 2008’s record on Monday, gas prices will continue to rise for the foreseeable future. On June 14, the national average reached $5.02 per gallon. The record prices hit some drivers harder than others. With energy experts predicting instability for months to come, what’s on the horizon for auto sales in the United States?

| $4.17/gallon | $4.50/gallon | $5.00/gallon | |

| Ford F-150 (20 mpg) | $108 | $117 | $130 |

| Ram 1500 (22 mpg) | $108 | $117 | $130 |

| Chevrolet Silverado (20 mpg) | $100 | $108 | $120 |

| Toyota RAV4 (30 mpg) | $60 | $65 | $73 |

| Honda CR-V (30 mpg) | $58 | $63 | $70 |

| Toyota Camry (32 mpg) | $67 | $72 | $80 |

| Nissan Rogue (30 mpg) | $60 | $65 | $73 |

| Jeep Grand Cherokee (21 mpg) | $104 | $113 | $125 |

| Toyota Highlander (23 mpg) | $75 | $81 | $90 |

| Honda Civic (34 mpg) | $52 | $56 | $62 |

At over $5.00/gallon, a larger portion of consumers are likely to turn to electric vehicles to solve their fuel cost woes. Last time gas prices were at record highs, there were no mainstream EVs for sale. In fact, Tesla’s original Roadster (which sold only 2,450 cars) made its debut in 2008. Although charging infrastructure lags behind sales growth, more and more drivers are making the switch.

In 2021, fully-electric and plug-in hybrid models reached 4.8% market share in the United States. It’s fascinating to imagine what would be possible in 2022 if new vehicle inventory was at historically normal levels.

Here’s how much an EV owner driving 1,200 miles a month and charging at home would spend on fuel (electricity). Miles driven and residential electricity rates reflect the US averages.

| Battery (kWh) | Range (miles) | Cost per charge ($) | |

| Tesla Model 3 LR | 82 | 358 | $11.48 |

| Tesla Model Y Dual Motor | 75 | 330 | $10.50 |

| Volkswagen ID.4 | 82 | 260 | $11.48 |

| Hyundai IONIQ 5 | 77 | 303 | $10.78 |

| Ford Mustang Mach-E | 91 | 305 | $12.74 |

| Rivian R1T | 135 | 314 | $18.90 |

Breaking down the fuel cost per mile highlights potential savings even further:

| Range | Fuel Cost ($) | Cost Per Mile ($) | |

| Tesla Model 3 LR | 358 | 11.48 | 0.03 |

| Tesla Model Y Dual Motor | 330 | 10.50 | 0.03 |

| Volkswagen ID.4 | 260 | 11.48 | 0.04 |

| Hyundai IONIQ 5 | 303 | 10.78 | 0.04 |

| Ford Mustang Mach-E | 305 | 12.74 | 0.04 |

| Rivian R1T | 314 | 18.90 | 0.06 |

| Honda CR-V | 420 | 63.00 | 0.15 |

| Toyota RAV4 | 435 | 65.25 | 0.15 |

| Chevrolet Silverado | 480 | 108.00 | 0.23 |

| Ram 1500 | 572 | 117.00 | 0.20 |

| Ford F-150 | 520 | 117.00 | 0.23 |

This comparison includes gas at $4.50/gal and electricity at the average of $0.14/kWh.

Some headlines don’t age well. In 2008, Wired made a bold statement that is laughable in hindsight. “Rising Gas Prices Finally Kill The Once-Mighty SUV,” the title declared. 2008 saw gas prices climb to $4.10 a gallon, a record that stood until yesterday.

In 2008, sales of the Toyota Yaris increased 46%, and the Ford Focus model jumped 32% year-over-year. “It’s easily the most dramatic segment shift I have witnessed in the market in my 31 years here,” George Pipas, chief sales analyst for the Ford Motor Company told the New York Times that year.

Sales of SUVs were down more than 25% in 2008. Sales of the Chevrolet Tahoe fell 35%. Even the industry-leading Ford F-Series saw sales drop 27% month-to-month in mid-2008.

“The era of large SUVs is over,” said Michael Jackson, chief executive of AutoNation, the nation’s largest auto retailer.

As history would have it, gas prices declined back to $2.79/gallon in 2010. Truck and SUV sales climbed back to record levels by 2015. What could be different this time around? There were no attractive alternatives to combustion vehicles a decade ago. Hybrid cars remained compact, weird-looking appliances. Now, plenty of electric vehicles are hitting the market with good looks, and even better fuel savings.

The ongoing chip crisis and looming materials crisis due to the Ukraine conflict continues to bottleneck EV production, but dealers (and Tesla, Lucid and Rivian) are selling their EVs as fast as they can make them. Electric vehicle market share is likely to surpass the 5% mark in the first half of 2022. Will higher gas prices accelerate the adoption of EVs? The answer largely depends on supply. Dozens of EVs are technically available in 2022, but are they really if you have to wait months to take delivery? One-third of American drivers say they are seriously considering one for their next vehicle. The question is, will there be any to buy?