CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Sadly, these days it’s not possible to leisurely head to a dealership and pick out the perfect vehicle. Inventory remains at record lows, and supply chain shortages are going to get worse before they get better. The electric lifestyle is an adjustment for most first-time EV buyers, and preparation eases the transition considerably. You don’t want your new car honeymoon to be ruined by missed opportunities or misconceptions. Here are five reasons why you should plan ahead before making your first electric car purchase.

Inventory is slim to none for all new autos, and electric vehicles have been hit especially hard by the supply shortages of 2021 and 2022. EVs are the product of truly global supply chains, and that makes them particularly vulnerable to disruptions. EV leader Tesla has so far avoided the worst of the supply shortages, however high demand has new orders seeing delivery dates over 8 months away.

Tesla isn’t the only automaker seeing serious delays. The popular Volkswagen ID.4, Ford Mustang Mach-E and Hyundai IONIQ 5 are all hard to find on a dealer lot nationwide. Data from Cox Automotive shows that day’s supply, the preferred industry metric for new car availability, is dismal for several electric vehicle makers.

Here’s the day’s supply for popular brands that sell electric cars in America. Tesla, Rivian and Lucid sell directly to consumers, so there is no available data for their models.

As bad as these supply estimates are, many shoppers note that many dealers have just a few cars on the lot. Don’t expect to find exactly what you want at your local dealership.

If you’re eager to get yourself into a new car as soon as possible, check out CarEdge Car Search to locate electric cars around the country. Beware misleading postings from dealerships. I’ve found that about half of dealer postings are actually misrepresenting cars that are already spoken for.

It’s not fun, but it’s worth it to call around. Soon, you may find yourself forgetting which dealers you’ve contacted, so it’s wise to keep a spreadsheet of who you’ve reached out to, and their inventory situation. While you’re at it, keep track of what their dealer markups are for EVs. Some dealers are taking advantage of the situation and charging $5,000, $10,000 or even $20,000 over MSRP.

If you don’t find what you’re looking for at a competitive price point, most automakers let you place an order for their popular EVs. Sometimes, you’ll have to order through a dealership, so keep that in mind if you don’t see a way to place an order on the automaker’s website. For example, the Hyundai IONIQ 5 and Cadillac Lyriq can only be ordered through a participating dealer.

If you have your eyes set on a Tesla, placing an order is simple. In fact, it takes just a few minutes (but requires a non-refundable deposit). However, demand far exceeds supply for Tesla models. Expect to wait 6-10 months for a Model Y.

If you drive less than 30 miles a day and live near public fast chargers, don’t sweat it. However, long distance commuters and rural EV owners will be glad they thought about how to meet their charging needs.

Over 80% of electric car charging is done at home at affordable residential electricity rates, costing less than $15 for a full charge. If you skip any special home charger installation, plugging in to a typical wall socket will add two to four miles of range per hour. Over 12 hours (at night, for example), a standard wall outlet will add about 25 to 50 miles of range. However, frequent travelers will get tired of the slow charging speeds possible with basic 110-volt wall outlets.

For those who regularly drive more than 50 miles each day, it will likely be worth the investment to get a level 2 home charger installed. A level 2 charger increases power supply to 240 volts, and adds about 20 to 40 miles of range per hour. Unless you’re lucky enough to already have a 240-volt dryer outlet in your garage, installing a level 2 charger at home can cost between $700 and $1500, depending on labor costs and the condition of existing electrical infrastructure in the home.

We’ve covered all you need to know about how much it costs to charge an electric car in our CarEdge guide to charging.

At some point, a public DC fast charger will be essential for travels. If you purchase an electric vehicle with over 200 miles of range, getting to one shouldn’t be a problem. However, there continues to be wide variation in charge times, and that will make or break the EV ownership experience for frequent travelers.

The Hyundai IONIQ 5, Kia EV6 and Tesla models can all add about 200 miles of driving range in about 20 minutes. However, the 2023 Subaru Solterra EV takes 56 minutes to add the same range. Pay attention to the details, and consider how each electric model would fit into your lifestyle and needs.

For many households, tax liability fluctuates from year to year. If you know when a particularly large tax bill will be due, it might be a great time to buy an electric vehicle. The current federal electric vehicle tax credit is worth up to $7,500, however tax filers who owe at least as much in annual tax liability will get the full benefit from the credit. For example, a family who has a federal tax liability of $5,500 will only be able to claim $5,500 of the EV tax credit. That’s why it makes sense to purchase an EV when tax liability is expected to be at least $7,500.

Plug-in hybrids qualify for between $2,500 and $7,500, depending on battery size.

The credit (non-refundable) remains in effect for all automakers who have yet to reach the law’s 200,000-vehicle limit. Tesla and General Motors have surpassed the limit, so buyers of the Bolt, Silverado EV, and Tesla models won’t benefit from this generous incentive unless Congress overhauls the law. Revisions to the EV tax credit are possible in 2022. Stay up to date with the latest EV tax credit developments here.

If you live anywhere near a major metropolitan area, especially along the coasts, you’ve got nothing to worry about. The rest of us need to bear in mind the limits of EV newcomers like Rivian, Lucid and Fisker when it comes to serviceability. Tesla now has 150 service centers across the country, but a few states remain without a Tesla service center. Fisker’s affordable Ocean electric SUV is loaded with impressive specs, however service centers will be few and far between for years to come.

This is where the strength of legacy automakers really stands out. A Tesla or Rivian service center will be hard to find in rural America, however legacy automakers have established dealer networks in every corner of the country.

Before you go out and buy an EV, have a plan for how and where you’ll get it serviced. Electric vehicles come with a great warranty, so you’ll definitely want a way to take advantage of it.

There’s always something bigger and better in the development pipeline. Newer models tout more range, faster charging and improved performance. On the other hand, prices tick upward with every added feature.

When does it make sense to hold out for the latest and greatest? It depends on what you value most, and which electric vehicle features you desire most. Looking to get more range out of a Volkswagen or Hyundai EV? 2023 models get a slight bump. Craving faster charging? Waiting a year might save you five minutes per charge. Don’t expect huge changes from one year to the next. Automakers have set the expectation for incremental improvements.

Ultimately, it will be up to you to decide what’s worth the wait, and when it makes sense to buy (or lease) an electric car.

Planning ahead for your electric car purchase not only has the potential to save you money, it also makes the transition to the electric lifestyle a lot easier. It’s important to consider your household’s unique needs and wants as you shop around. In 2022, EVs represent past, present and leading-edge technologies at a wide range of price points. Here at CarEdge, we’re keeping track of EV availability in 2022.

As always, CarEdge Electric is here to empower you with the knowledge to approach car ownership with confidence. Our weekly EV newsletter is full of helpful tips, the latest EV news, and new car reviews. Consider becoming a member for expert insights and one-on-one guidance throughout the car buying process.

The manufacturing of electric vehicles is a global process, with raw materials from every corner of the globe playing a vital role in battery chemistry. New forecasts from automotive energy analysts predict massive increases in electric vehicle production costs due to the entanglement of EV supply chains in the ongoing Russian invasion of Ukraine. The latest supply chain worries are on top of the ongoing chip shortage that threatens to stretch through 2022.

In 2021, fully-electric and plug-in hybrid passenger vehicles soared to 9% of global new vehicle market share. In Europe, EVs now make up 19% of all passenger vehicle sales. Even in the United States, electric car market share is approaching 5%. Although EV sales continue to be subdued by supply shortages and lack of inventory, most automakers remain on a path towards 100% electrified sales. However, getting there is easier said than done without the raw materials needed to make gigawatt-hours of batteries. There are dozens of EVs on sale in 2022, but finding one on a dealer lot is no easy task.

A new report by S&P Global Mobility highlights the unforeseen costs piling onto EV battery production because of the Russian invasion of Ukraine, and the resulting international sanctions. Building an electric car is about to get costlier, and buying one will get more expensive.

The analysts at S&P Global Mobility estimate that the best-selling Tesla Model Y could see input costs for battery raw materials surge by $8,000 per vehicle this year. Tesla recently increased Model Y prices for the tenth time in as many months to a base price of $62,990. Just a year ago, the same model listed for $49,990.

The same report forecasts that production costs for the popular Mercedes-Benz EQS could skyrocket by $11,000 year-over-year. The EQS luxury sedan already starts at an MSRP of $103,360, and climbs to $126,360 for the highest trim. With production costs eating into Mercedes’ margins, MSRPs are likely to climb higher any day now.

For years, EV advocates (and Elon Musk) have touted the importance of electric cars reaching cost parity with combustion-powered vehicles. It’s widely believed that when electric cars cost the same as an equivalent ICE car, the masses will rapidly transition to electric mobility.

The latest supply chain disruptions have analysts delaying the arrival of EV cost parity. In the months leading up to the war in Ukraine, raw materials needed for battery production were already becoming more costly. Cleantechnica reported back in November that lithium carbonate prices surged by 313%, cobalt hydroxide was up nearly 82%, and nickel sulfate rose by 34% over the course of 2021.

S&P Global Mobility said that Russia’s invasion of Ukraine is inflating raw material prices even further. Russia is the world’s third-largest supplier of nickel. German supplier BASF said it will not sign new agreements with Russian nickel suppliers because of the invasion. The analysts suspect that other manufacturers will take similar actions.

The latest data and expert analyses point towards a 5-10% increase in prices for most EV models in 2022. Tesla has already seen a 26% increase in prices since 2022, including steep price hikes in early 2022.

There are rumors that Hyundai may soon be raising MSRPs for the popular IONIQ 5, and Ford increased prices for the Mustang Mach-E by $1,000-$3,000 in February. When is the most affordable time to buy an electric car? If you’re set on buying an EV in 2022, make a purchase as soon as possible. Unfortunately, it looks like inventory and pricing are only going to get worse for the foreseeable future.

Following the ups and downs of the past two years, automakers, dealers and buyers have seen it all. Low demand in 2020, not enough cars to sell in 2022, and wild swings in pricing. What about the consumer perspective? Things are changing quickly, and it can be hard to keep track. What do interest rate hikes mean for car buyers in 2023? We spoke with CarEdge car buying expert Mario Rodriguez to find out.

There are very few automaker or dealer incentives right now. The sellers have the upper hand in today’s market. They’ve raised MSRPs, and additional dealer markups have piled on. Selling new cars, dealers can toy with the profit equation. Both front-end and back-end profit scenarios are on the table for a dealer.

Either they could increase the car’s price and drop interest rates via captive lending, or take the opposite approach and keep car prices the same but raise interest rates for buyers. When it comes to interest rates, however, NEW car buyers probably won’t see much of a change, at least after this first Fed rate hike.

Automakers can afford to subsidize the small rate increases because of captive lenders, not to mention the record profits they make per vehicle sold right now. There’s been a lot of inflation, but not to the magnitude of the MSRP hikes we’ve seen.

As of November 2023, attractive financing rates for new cars range from 0.0% to 2.9% APR. Black Friday deals feature several low APR offers.

Drivers with great credit scores should keep an eye out for anything below 3% APR for new car buyers.

This is where buyers will feel the pinch. Used cars sell for less (on average), and a lot more math is involved with profit margins for dealers. Private party lenders are quicker to reflect baseline rate hikes. It might take a few months for new car loan rates to rise noticeably, however used car loan rates will rise immediately.

Through a credit union, used car buyers with great credit scores can secure a used car loan for under 7% APR. As of November 2023, the average used car loan rate is 14% APR.

It’s important to bear in mind that a higher interest rate will cost buyers who demand an expensive vehicle more than if a cheaper vehicle was to be purchased. A 6% interest rate will result in about $6,000 in total interest paid for a $40,000 loan over 60 months, but just $2,400 for a $15,000 loan over the same term.

More interest rate hikes are likely in early 2024. The latest consumer sentiment and spending data shows that Americans are increasingly getting used to a high rate of inflation. That’s not a good sign, and leads many experts to think that the US Federal Reserve will issue at least a few more rate hikes to combat inflation.

A magnitude 7.4 earthquake struck off the coast of Japan on Wednesday, bringing painful memories of the 2011 earthquake back for many. Four people died in the tremor and its aftermath, and Japanese infrastructure took a severe hit. Areas north of Tokyo have experienced power outages affecting 2 million people and thousands of factories.

Railways across much of central and northern Japan are offline after the earthquake destabilized bridges across the region. Some roads were damaged as well. Without transportation corridors, Japanese automaker’s domestic supply chains can’t function.

Automotive News reports that Toyota will suspend operations on 18 production lines at 11 factories. In total, Toyota operates 28 production lines at 14 factories in Japan. Toyota said they will lose about 20,000 vehicles scheduled for production because of the earthquake. The earthquake shutdown will directly affect production of the Toyota RAV4, Land Cruiser, Yaris, and other models sold abroad.

Multiple Lexus models are also impacted. The Lexus LS and IC sedans, RC and LC coupes and NX crossover will all see production cuts because of Wednesday’s earthquake.

The latest supply chain and production woes come just days after Toyota announced scaled-back production targets for 2022. Toyota’s production cuts were made public BEFORE the latest earthquake. The automaker already cautioned that production targets may need to be downgraded further, and that’s looking more likely after the latest natural disaster.

Before the earthquake, Toyota slashed April production targets by 150,000 vehicles to a total of 750,000. Looking ahead, Toyota expects production to be 10 percent lower in May and 5 percent lower in June than previously estimated. Citing the instability of supply chains, Toyota will review production plans on a monthly and three-month basis.

Here’s everything you need to know about the latest chip shortage updates.

Murata, the top global supplier of ceramic capacitors used in cars, said it had suspended operations at four factories in Japan following the quake. The impacts of Murata’s production shutdown will be felt for months to come, and not just among Japanese automakers.

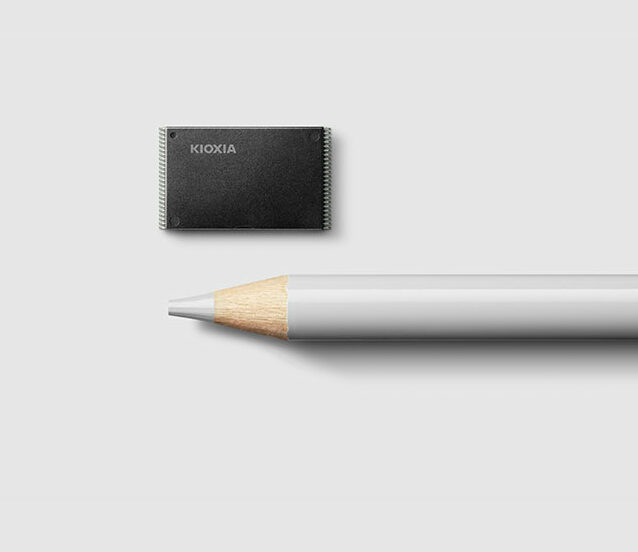

The quake disrupted production at Kioxia’s plant in Japan, according to TrendForce. The affected factory is responsible for about 8% of Kioxia’s production. The company provides chips to a variety of industries, including auto manufacturing.

The industry analysts at TrendForce say that damage to semiconductor chip production is inevitable following the earthquake.

“Due to the extremely high stability required in the crystal growth process, the industry has not yet announced the impact of the quake. TrendForce specifies, in addition to shutdown inspections, damage to machines and silicon wafer input is inevitable.”

The chip shortage and new car inventory shortage are not getting any better. In fact, it’s getting worse. It seems like the situation changes daily, with geopolitics and mother nature taking a stab at disrupting the automotive industry just as it tries to get back on its feet.

Check back soon for the latest CarEdge updates. Bookmark our chip shortage update page for the latest weekly updates on the supply chain disruptions in 2022.

Honda is late to the electric vehicle party. Now, Honda is depending on General Motors to get their EV plans off of the drawing board and onto the ground. Will their much-anticipated Prologue electric SUV be worth the wait? The automaker’s first North American EV will undoubtedly be compared to their decades-long reputation for great hybrid powertrains. As the 2024 Honda Prologue nears production, here’s what you need to know about Honda’s plans for EVs.

This was the pre-production concept….

This is the production-ready Prologue EV…

Honda’s electric SUV will be Honda on the outside, and GM on the inside. The automaker didn’t quite play their cards right when it comes to electrification. After stubbornly sticking to internal combustion and hybrid vehicles for the past several development cycles, Honda is now scrambling to make one heck of a U-turn. Why? As a global automaker, Honda pays close attention to the regulatory environment in Europe, Asia, America and beyond. Most of Honda’s major markets have announced timelines for the elimination of new combustion vehicle sales as part of efforts to combat climate change and poor air quality.

The European Union will ban sales of new gas and diesel cars, including hybrid vehicles, starting in 2035. Japan and the United States have also announced a series of policies aimed at encouraging the adoption of EVs. Several European countries are even establishing EV-only zones in densely populated urban centers in an effort to slash emissions for public health. If Honda wants to have a future, they have to go electric.

In 2020, Honda and General Motors announced a partnership that will bring Honda’s first North American electric vehicle to market mid-decade. Why the collab? GM has invested BILLIONS in its new Ultium battery technology and electric motors, and they’re eager to increase their returns by sharing with a competitor in dire need of an electrification jump-start. Honda is far behind the others, even behind other former EV skeptics like Toyota.

General Motors will do everything except design in the exterior and interior of the 2024 Honda Prologue. GM will even build the Prologue in its North American factories. By mid-2023, Honda-branded EVs will be leaving GM plants in Michigan.

All that we can infer about Honda Prologue specs comes from what’s been announced about the 2023 Cadillac Lyriq, which shares GM’s Ultium platform with the Prologue. The Prologue is likely to be about the size and weight as the Lyriq, since they will share the same drivetrain and battery. Honda is keeping their cards close, so it’s the best we have for now.

Arriving in mid-2022, the Cadillac Lyriq will have a large 100 kilowatt-hour battery and a single rear-mounted permanent magnet electric motor delivering 340 horsepower and 325 lb-ft of torque. An all-wheel drive version will arrive later.

The Lyriq can receive 190 kW charging at a DC fast charger, which is enough to add 200 miles of range in a half-hour. The Lyriq will have a top-end range of about 300 miles, and we expect the Prologue to have similar figures. We recently featured the Cadillac Lyriq with a full CarEdge preview if you’d like to know more about the electric crossover entering production in 2022.

Also, we have everything you need to know about GM’s new Ultium electric platform here. It’s fascinating stuff!

Considering how other Ultium-powered EVs are priced for the 2023 model year and where Honda is positioned in the overall market, we estimate that the 2024 Honda Prologue pricing will start around $45,000. Fully-optioned trims with all-wheel drive are likely to cost between $50,000-$55,000. Lithium prices are largely to blame for the worsening inaffordability of EVs.

Honda does already have a full BEV for sale, but it’s not coming to North America. The pocket-sized Honda ‘e’ is a much-loved city car in Europe. It seems to appeal to the same folks who love their Mini Coopers. The Honda e wouldn’t do well on the sparse interstates of America. It only has 137 miles of range.

General Motors is providing the Ultium platform for an Acura EV that will arrive shortly after the Prologue. Nothing else is known about the Acura EV, but it will likely share all of the same underpinnings as the Honda Prologue SUV.

Still, Honda has jumped on the all-EV bandwagon. Or rather, they were left with few options considering the global regulatory environment. Honda’s target for the electrification of its full lineup is planned for 2040. That’s 5 to 10 years behind many competitors, including their partner GM.

Honda updated their Prologue configurator in October to 2024 availability. If that’s too long of a wait, dozens of other EVs will be on sale by mid-2022. In 2022, the Honda Prologue’s direct competitors in the crossover SUV segment are already battling it out for market share. These are the top picks for car buyers eager to get into an electric crossover sooner:

Need an EV in 2022? Here’s the pricing and availability of every electric vehicle on the market in 2022.

We’ll be sure to update this page as more information becomes available. Add it to your bookmarks if you’re excited about the first Honda EV in America!