CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Auto insurance rates are climbing once again in 2025, and the latest data suggests that relief is nowhere in sight. According to the February 2025 Consumer Price Index, the motor vehicle insurance index rose 2.0% in January, pushing the 12-month increase to nearly 12%. Car insurance costs have been rising steadily for the past three years, and new factors – including tariff’s impacts on car prices and auto parts – threaten to send rates even higher. Here’s what’s driving up auto insurance costs in 2025, and what it means for drivers.

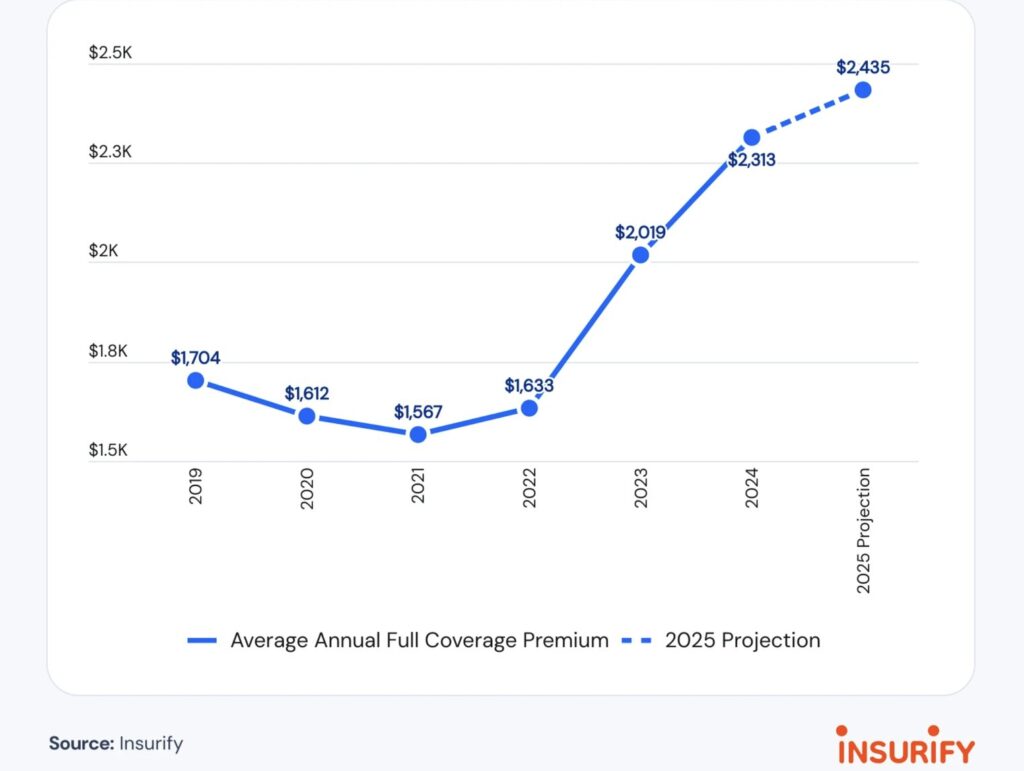

Auto insurance rates have been on a steady upward trajectory since 2022, and new projections suggest that costs will increase another 5% in 2025. According to Insurify, auto insurance rates soared 15% in 2024, while EV insurance costs for nine popular models jumped 28% over the same period.

Today, the average cost of full-coverage auto insurance is $2,313 per year, but for many drivers, it’s far worse. In six states, annual premiums exceed $3,000, making car ownership even more expensive. Many drivers fail to plan for insurance costs prior to purchasing a vehicle, making insurance expenses one of the hidden costs of vehicle ownership, alongside depreciation.

Several factors are driving the increase in car insurance costs, including:

Some states are seeing a bit of relief. In the second half of 2024, average premiums decreased in 21 states. However, Insurify projects that drivers in Florida, New York, Georgia, Nevada, and Delaware will see the biggest rate hikes in 2025, with full-coverage rates expected to rise another 10% in these high-cost states. Nationwide, the average auto insurance premium is forecast to reach $2,435 in 2025.

New tariffs on cars, auto parts, and manufacturing materials are poised to make vehicle ownership even more expensive in 2025.

According to a Wall Street Journal report, auto insurance rates are particularly sensitive to tariff’s impacts because higher car prices lead to higher repair costs – which in turn drives up insurance premiums.

While tariffs on Canadian and Mexican imports have been delayed, the Trump administration has announced new tariffs on steel, aluminum, and imported semiconductors – all of which will increase manufacturing costs for automakers. Additionally, auto repair costs will rise as imported components become more expensive. As both car prices and repair costs rise, auto insurance rates will follow suit.

Even before these tariffs take effect, vehicle repair costs are already rising. The February 2025 CPI report showed that vehicle repair costs increased by 7.4% year-over-year, reflecting higher parts costs and labor shortages. With 40% of imported car parts coming from Mexico and Canada, many automotive repairs will become more expensive in 2025.

Tariffs are also expected to drive new car prices to record highs in 2025. As of February, the average new car sells for $49,740, or just a hair below 2022’s record high. Later this year, average new car prices are likely to surpass $50,000 for the first time.

One prominent industry analyst predicts that if the Trump administration’s proposed 25% tariffs on Mexico and Canada go into effect, the cost of a new car could rise by nearly $6,000. A Benchmark analysis estimates that these tariffs would push the average new car price above $54,500, a 12% increase compared to 2024.

The auto industry is among the most vulnerable to these tariff increases due to its heavy reliance on global supply chains. Benchmark found that:

Between rising repair costs, climbing insurance rates, and looming auto tariffs, the cost of car ownership is headed even higher in 2025. Auto insurance rates are up 12% over the past year, and experts predict another 5% increase this year, with drivers in high-cost states facing the biggest hikes.

At the same time, tariffs on vehicles and auto parts could add thousands of dollars to the cost of new cars, leading to even steeper increases in insurance premiums. The combined impact of these factors means that car buyers and owners need to be more strategic than ever when shopping for a new vehicle or renewing their insurance policy.

💡 How can you save?

At CarEdge, we provide free tools and expert insights to help you navigate rising car costs in 2025. From comparing insurance rates to finding the best car deals, we’re here to help you make smarter car-buying decisions.

👉 Lock in a Low Rate BEFORE Insurance Premiums Rise – Compare Offers in Minutes

Presidents’ Day weekend is shaping up to be a great time to buy a truck in 2025. With an oversupply of 2024 models lingering on dealer lots and automakers pushing aggressive financing incentives, truck buyers can take advantage of some of the biggest discounts we’ve seen in months. It’s almost like December’s clearance sales never ended. Whether you’re looking for a workhorse or a luxury-packed pickup, here are the best Presidents’ Day truck deals to take advantage of in February 2025.

Best Offer: Lease from $399/month for 36 months with $0 due at signing (select markets only, check Toyota.com for availability). This offer expires on March 3, 2025.

The 2025 Toyota Tacoma is a popular midsize truck with legendary reliability. In fact, the Tacoma earned the #3 spot in our car reliability rankings. Although this zero-down truck deal is available in select markets, similarly compelling deals are available in other regions.

👉 Check out the best Toyota deals near you

Offer: Lease from $389/month for 24 months with $3,609 due at signing (for returning GM lessees). See offer details. This offer expires on March 3, 2025.

GMC’s full-size Sierra 1500 continues to be a top contender in the pickup segment. If you’re a current GM lessee, you can take advantage of one of the lowest monthly payments on a full-size truck this February.

👉 Check out the best GMC deals near you

Offer: 4.9% APR for 72 months + up to $12,500 cash allowance for current FCA lessees on select V6 2025 Ram trucks. See offer details. This offer expires on March 3, 2025.

For truck buyers looking for big savings, Ram’s cash allowance is one of the best incentives available this Presidents’ Day. Current lessees of FCA vehicles can get up to $12,500 in savings, making it one of the strongest deals on a 2025 model.

👉 Check out the best Ram deals near you

Offer: 0% APR financing for 60 months on the 2024 Chevy Silverado EV. See offer details. This offer expires on March 3, 2025.

With up to 440 miles of all-electric range, the 2024 Chevrolet Silverado EV is one of the longest-range electric trucks on the market. Chevy is offering zero-percent financing for 60 months, making this one of the best deals available for anyone looking to make the switch to an EV pickup. If you can charge at home overnight, this is a fantastic deal.

👉 Check out the best Chevrolet deals near you

Offer: 3.9% APR for 60 months + $3,350 bonus cash. The F-150 Lightning is available with 0% APR for 72 months and includes a free home charger with installation. See offer details. This offer expires on March 3, 2025.

Ford has 73,000 2024 F-150s left to sell, so it’s no wonder that they’re offering serious incentives in February. Buyers can get low financing rates on the gas-powered F-150, while those going electric can take advantage of zero-percent financing and a free home charger with installation for the F-150 Lightning.

👉 Check out the best Ford deals near you

February 2025 is a great time to buy a truck, with manufacturers offering deep discounts on pickups. Whether you’re interested in a low-payment lease, zero-percent financing, or massive cash discounts, these Presidents’ Day truck deals are worth considering before they expire in early March.

The key to maximizing your savings is shopping smart and negotiating with confidence. At CarEdge, we offer free and premium tools to help you get the best possible deal on your next truck purchase:

✅ CarEdge Car Buying Guide – Check local inventory levels, see dealer invoice pricing, and find the most negotiable trucks in your area.

✅ CarEdge Car Buying Service – Have an expert negotiate the deal for you, securing the lowest price and best financing terms. Home delivery is available.

Buying a car in 2026? Your location can have a big impact on how much you’ll pay. From state sales taxes to registration fees, the cost of a new or used car can vary by thousands of dollars depending on where you buy. So, where can you find the best deals this year? We’ve analyzed nationwide data to identify the cheapest states to buy a car in 2026. Whether you’re looking for a brand-new ride or a used car, knowing where to shop can help you save big on your next vehicle. Here’s where in America you’re most likely to drive home a great deal.

Nationwide, the average new car transaction price in 2026 is $50,000. However, that number only tells part of the story. The actual cost of a new car varies widely from one state to the next due to differences in sales tax, registration fees, and dealer charges.

By calculating the total out-the-door price for the average new car across all 50 states, we’ve pinpointed where car buyers will save the most – and where they’ll pay the highest prices. But first, an important note: When buying a car out of state, the sales tax you owe is based on where you register the vehicle, not where you buy it. Always check with your local DMV to confirm the exact process and avoid unexpected costs.

If you’re looking to save thousands of dollars on your next vehicle, your best bet is to shop in one of these five states.

Why It’s the Cheapest: No state sales tax, low registration fees

Total Additional Costs: $500–$700

🚗 Average Savings vs. Most Expensive States: $3,500+

Oregon is the absolute cheapest state to buy a car in 2026, thanks to its lack of a statewide sales tax and low registration fees. On top of that, dealership documentation fees (Doc Fees) are lower than the national average.

Why It’s Affordable: No state sales tax

Total Additional Costs: $650–$850

🚗 Average Savings vs. Most Expensive States: $3,000–$3,500

New Hampshire also has no state sales tax, keeping vehicle prices lower than in most other states. While registration fees in New Hampshire are slightly higher than in Oregon, the savings on sales tax still make it one of the most affordable places to buy a car.

Why It’s Affordable: No state sales tax, low registration costs

Total Additional Costs: $500–$750

🚗 Average Savings vs. Most Expensive States: $3,000+

Montana has long been a go-to state for those looking to buy a car while avoiding extra fees. With no state sales tax and relatively low registration fees, Montana remains one of the cheapest states to purchase a vehicle in 2026.

Why It’s a Great Deal: No state sales tax, reasonable fees

Total Additional Costs: $650–$900

🚗 Average Savings vs. Most Expensive States: $2,000+

Alaska rounds out the top five with zero state sales tax and lower-than-average Doc Fees, making it one of the best states for keeping out-the-door costs low.

Why It’s a Great Deal: No state sales tax, low fees

Total Additional Costs: $700–$2,200*

🚗 Average Savings vs. Most Expensive States: $2,000+

Delaware is another no-sales-tax state, meaning buyers can avoid a hefty extra charge when purchasing a new or used vehicle. However, Delaware charges a Doc Fee that is 4.25% of the vehicle’s value, which in practice in similar to a sales tax. Still, Delaware is one of the cheapest states to purchase a car in 2026.

Looking for your state? We’ve crunched the numbers for all 50 states, using the state sales tax rates, vehicle registration fees, and average Doc Fees to calculate the out-the-door price in each U.S. state. Feel free to sort the data by any of the variables to see how your state stacks up.

| State | Cheapest States to Buy a Car | State Sales Tax | Average Doc Fee | Registration Fees | Average New Car Price (w/ tax and fees) |

|---|---|---|---|---|---|

| Oregon | 1 | 0.00% | $250 | $169 | $50,159 |

| New Hampshire | 2 | 0.00% | $375 | $51 | $50,166 |

| Delaware | 5 | 0.00% | $2,114* | $45 | $51,910 |

| Montana | 3 | 0.00% | $299 | $237 | $50,276 |

| Alaska | 4 | 0.00% | $299 | $245 | $50,284 |

| New York | 6 | 4.00% | $175 | $146 | $52,040 |

| South Dakota | 7 | 4.20% | $200 | $122 | $52,140 |

| Hawaii | 8 | 4.00% | $395 | $78 | $52,192 |

| Georgia | 9 | 4.00% | $599 | $20 | $52,338 |

| Missouri | 10 | 4.23% | $565 | $57 | $52,455 |

| Colorado | 11 | 2.90% | $699 | $595 | $52,469 |

| New Mexico | 12 | 4.88% | $339 | $60 | $52,553 |

| Wisconsin | 13 | 5.00% | $299 | $85 | $52,598 |

| Alabama | 14 | 4.00% | $489 | $393 | $52,601 |

| North Dakota | 15 | 5.00% | $299 | $123 | $52,636 |

| Oklahoma | 16 | 4.50% | $599 | $100 | $52,665 |

| Louisiana | 17 | 5.00% | $425 | $64 | $52,703 |

| Wyoming | 18 | 4.00% | $500 | $616 | $52,835 |

| Nebraska | 19 | 5.50% | $299 | $83 | $52,843 |

| Ohio | 20 | 5.75% | $250 | $31 | $52,866 |

| Vermont | 21 | 6.00% | $200 | $78 | $52,986 |

| Maine | 22 | 5.50% | $499 | $40 | $53,000 |

| West Virginia | 23 | 6.00% | $250 | $52 | $53,010 |

| Texas | 24 | 6.25% | $150 | $74 | $53,056 |

| Michigan | 25 | 6.00% | $260 | $128 | $53,096 |

| Arkansas | 26 | 6.50% | $129 | $28 | $53,113 |

| Utah | 27 | 6.10% | $299 | $57 | $53,114 |

| South Carolina | 28 | 6.00% | $400 | $40 | $53,148 |

| North Carolina | 29 | 4.75% | $699 | $370 | $53,159 |

| Kentucky | 30 | 6.00% | $450 | $26 | $53,184 |

| Pennsylvania | 31 | 6.00% | $449 | $39 | $53,196 |

| Virginia | 32 | 5.30% | $799 | $36 | $53,197 |

| Iowa | 33 | 6.00% | $180 | $333 | $53,221 |

| Washington | 34 | 6.50% | $199 | $73 | $53,228 |

| Idaho | 35 | 6.00% | $399 | $126 | $53,233 |

| Illinois | 36 | 6.25% | $347 | $151 | $53,330 |

| Minnesota | 37 | 6.88% | $125 | $69 | $53,338 |

| Massachusetts | 38 | 6.25% | $459 | $60 | $53,351 |

| Maryland | 39 | 6.00% | $499 | $187 | $53,394 |

| Indiana | 40 | 7.00% | $199 | $38 | $53,440 |

| Kansas | 41 | 6.50% | $499 | $80 | $53,535 |

| Arizona | 42 | 5.60% | $499 | $564 | $53,573 |

| Rhode Island | 43 | 7.00% | $399 | $58 | $53,660 |

| Connecticut | 44 | 6.35% | $599 | $180 | $53,660 |

| Nevada | 45 | 6.85% | $499 | $49 | $53,677 |

| Tennessee | 46 | 7.00% | $499 | $29 | $53,731 |

| California | 47 | 7.25% | $85 | $524 | $53,936 |

| New Jersey | 48 | 6.63% | $695 | $271 | $53,986 |

| Florida | 49 | 6.00% | $999 | $297 | $54,004 |

| Mississippi | 50 | 7.00% | $425 | $719 | $54,347 |

Whether you’re shopping for a new or used car in 2026, here are some smart ways to save:

Buying a car this year? Knowing where to shop could save you thousands. Before heading to the dealership, make sure you’ve done your research and know what to expect. Stay on top of the latest car market trends, incentives, and deals with the free CarEdge Research Hub. Compare total cost of ownership, explore today’s best offers, and make the smartest car-buying decisions.

Looking for the best lease deals this February? You’re in luck. Presidents’ Day 2025 is shaping up to be one of the best times to lease a new car, with low monthly payments, zero-down offers, and attractive incentives from top automakers.

With new car prices still near record highs, leasing is a great way to avoid the hidden costs of depreciation while keeping your monthly costs lower. In February, automakers are rolling out limited-time lease specials on some of the most popular SUVs, trucks, and sedans. Whether you’re interested in zero percent APR leases, cash discounts, or low down payment options, here are the best Presidents’ Day lease deals in 2025.

Note that manufacturer lease incentives exclude taxes and fees. Not all dealers participate.

General Motors is rolling out its best Presidents’ Day lease deals for the Buick brand. Here’s a look at the best offers in February. Note that to qualify for the best terms, most of these incentives require that you’re a current lessee of a GM vehicle.

2025 Buick Encore GX AWD Preferred – Lease from $343/month for 36 months with $0 due at signing (This zero-down lease deal is available to current lessees of 2020 or newer select GM models. See details at Buick.com.)

2025 Buick Envista AWD Preferred – Lease from $199/month for 24 months with $4,040 due at signing for eligible current lessees. See details at Buick.com.

2024 Buick Envision AWD Sport Touring – Lease from $319/month for 24 months with $4,019 due at signing for eligible current lessees. This lease deal is available to current lessees of 2020 or newer select GM models. See details at Buick.com.

Ford is rolling out some of the best lease deals this Presidents’ Day, with attractive offers across its lineup of trucks and SUVs. Whether you’re eyeing an EV, SUV, or a durable work truck, Ford’s February incentives offer serious savings. Here are the best Ford lease deals right now:

2024 Ford Bronco 4×4 Big Bend 4×4 – Lease from $499/month for 36 months with just $999 due at signing. See details at Ford.com.

2024 F-150 Lightning – Lease from $566/month for 36 months with just $566 due at signing. See details at Ford.com.

2025 Ford Mustang Mach-E Select – Lease from $336/month for 39 months with $4,185 due at signing. See details at Ford.com.

2024 Ford F-150 STX 4×4 – Lease from $389/month for 36 months with $5,547 due at signing. See details at Ford.com.

GMC is offering some of the best lease deals this Presidents’ Day, particularly for returning GM lessees. If you currently lease a GM model, you’ll find low-payment options on popular GMC trucks and SUVs.

2024 GMC Sierra 1500 – Lease from $389/month for 24 months with $3,609 due at signing (for returning GM lessees). See details at GMC.com.

2024 GMC Terrain – Lease from $370/month for 39 months with $0 due at signing (for returning GM lessees). See details at GMC.com.

Mazda’s stylish SUVs are available with affordable lease deals this February. While some offers require more cash upfront, these lease terms are among the lowest-priced options available this Presidents’ Day.

2025 Mazda CX-30 – Lease from $199/month for 33 months with $4,449 due at signing. See details at MazdaUSA.com.

2025 Mazda CX-5 – Lease from $229/month for 36 months with $5,099 due at signing. See details at MazdaUSA.com.

2025 Mazda CX-90 – Lease from $349/month for 36 months with $4,889 due at signing. See details at MazdaUSA.com.

Toyota’s best-selling SUVs, trucks, and hybrids are available with low monthly lease payments, including some rare zero-down lease offers in select markets.

2025 Toyota Tacoma – Lease from $399/month for 36 months with $0 due at signing (select markets only, check Toyota.com for availability).

2025 Toyota Prius – Lease from $389/month for 36 months with $0 due at signing. See details at Toyota.com.

2025 Toyota RAV4 – Lease from $349/month for 36 months with $3,999 due at signing. See details at Toyota.com.

2025 Toyota Camry – Lease from $269/month for 36 months with $3,999 due at signing. See details at Toyota.com.

With huge lease incentives from Buick, Ford, GMC, Mazda, and Toyota, Presidents’ Day 2025 is one of the best times to lock in a low monthly payment on a new car, truck, or SUV. Be sure to compare offers in your area, as some of the best Presidents’ Day lease deals are available in select markets!

As Presidents’ Day 2025 approaches, you may be wondering if now is the right time to purchase a new vehicle. While year-end sales typically offer the biggest discounts, this year is shaping up differently. A lingering oversupply of 2024 models has pushed automakers to extend aggressive financing offers into February 2025. This means that Presidents’ Day car deals are some of the best we’ve seen in months – but only if you know where to look.

If you’re considering buying a new car in 2025, these top Presidents’ Day offers could help you score a great deal. Let’s dive in!

Seemingly out of nowhere, Honda and Acura have burst into the EV market with great success. Honda’s Prologue is one of the best-selling electric vehicles in America right now, and Acura’s ZDX is just as great, only a lot more luxurious. Right now, finance the 2024 Acura ZDX with 0% APR financing for 72 months.

🚗 Check out the best Acura deals in your area

Noticing a trend? Another top deal this Presidents’ Day is the Ford Mustang Mach-E. Also a top-seller, Ford’s sporty electric SUV is good for over 300 miles of range, and up to 480 horsepower. In February, Ford is offering 0% APR financing for 72 months on remaining 2024 Mustang Mach-Es. The 2024 F-150 Lightning also qualifies for this zero percent financing offer.

🚗 Check out the best Ford deals in your area

The best Honda Presidents’ Day sale is without a doubt the Honda Prologue, which features 0% APR financing for 72 months on remaining 2024s. But the deals don’t end there. The Honda Passport offers 1.9% APR for 60 months, and the Honda Accord is available with 2.9% APR financing for 60 months right now.

Considering these are some of the best-selling cars in America, these are excellent opportunities for savings.

🚗 Check out the best Honda deals in your area

In February 2025, Jeep has 47,000 leftover 2024s to sell. That’s a recipe for great deals and high negotiability. The best Presidents’ Day Jeep specials feature zero percent financing and big cash discounts. Right now, both the 2024 Jeep Grand Cherokee 4xe and 2024 Jeep Wrangler 4xe offer 0% APR for 72 months.

Other Jeep models like the non-hybrid Grand Cherokee, Compass, and Gladiator are advertised with 0% APR for 36 months in February.

🚗 Check out the best Jeep deals in your area

Two popular Nissan models are available with 0% APR financing for 60 months in February 2025. Both the Nissan Titan pickup truck and Nissan Rogue qualify for this incentive. If you’re considering going electric, the Nissan Ariya extends the zero percent financing offer out to 72 months.

🚗 Check out the best Nissan deals in your area

Presidents’ Day 2025 is shaping up to be one of the best times to buy a new car, thanks to aggressive 0% APR financing offers on leftover 2024 models. Automakers like Acura, Ford, Honda, Jeep, and Nissan are rolling out deep discounts, making February a prime opportunity to secure a low monthly payment or avoid interest charges altogether.

Whether you’re looking for a fuel-efficient sedan, a capable SUV, or an electric vehicle, the key to maximizing savings is negotiating smart and acting fast. We offer dozens of free resources to help you master the art of car buying with confidence.

💡 Looking for premium car buying tools? Use CarEdge Pro to check local inventory levels, see dealer invoice pricing, and find the most negotiable cars and trucks near you. Ready to have a pro get you the best deal? CarEdge’s Car Buying Service takes care of everything – from negotiating pricing to securing financing – so you can drive away with confidence.