CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Having bad credit doesn’t mean you can’t buy a car—it just means you need to be smart about it. In 2025, car prices remain high, and auto loan interest rates are even higher for buyers with low credit scores. But don’t worry—there are ways to navigate the car-buying process and secure financing, even with bad credit.

Whether you’re rebuilding your credit or buying a car with no credit history at all, this guide covers everything you need to know. From down payment requirements to the best lenders for bad credit, we’ll walk you through the steps to buy a car in 2025 without getting ripped off.

In the world of auto financing, lenders classify borrowers into different credit tiers. Here’s a breakdown:

| Credit Tier | Credit Score Range | Financing Impact |

|---|---|---|

| Prime | 660+ | Low interest rates (as low as 4-6%) |

| Near Prime | 620-659 | Moderate interest rates (8-12%) |

| Subprime | 580-619 | High interest rates (12-18%) |

| Deep Subprime | Below 580 | Very high interest rates (18-25% or more) |

If your credit score falls in the subprime or deep subprime category, you will likely face higher loan rates, larger down payment requirements, and stricter lender requirements.

The national average used car loan rate for subprime borrowers is 16.78%, while deep subprime borrowers see rates above 20%. On a $20,000 car loan, that could mean paying thousands more in interest over time.

Why it matters: A larger down payment lowers your monthly payments, improves your loan approval chances, and reduces how much you pay in interest over time.

Here’s why a down payment is essential when buying with bad credit:

How much should you put down?

👉 Example: If you’re looking at a $15,000 car, here’s how different down payments impact your financing:

| Down Payment | Loan Amount | Example Monthly Payment (16.5% APR, 60 months) |

|---|---|---|

| $0 | $15,000 | $370/month |

| $1,500 (10%) | $13,500 | $333/month |

| $3,000 (20%) | $12,000 | $296/month |

Pro Tip: Trade in your current vehicle to boost your down payment! Even a low-value trade-in can help.

In 2025, the average used car loan rate is hovering around 14% APR. However, this includes car buyers across all credit scores. Drivers with bad credit are qualifying for loans with APRs between 15% and 20% in 2025. However, those who play it smart and shop around are guaranteed to save serious money. Here’s what you need to know.

Why it matters: Getting pre-approved for a car loan puts you in control. It allows you to:

✔️ Know your real budget before walking into a dealership

✔️ Avoid getting ripped off by dealer financing

✔️ Compare multiple lenders for the best rates

Where to get pre-approved:

🚨 What to avoid:

Check your credit report before applying. You can get a free credit report at AnnualCreditReport.com to see if there are any errors dragging your score down.

Why it matters: Lenders won’t approve just any car for buyers with bad credit. They prefer reliable, affordable vehicles that hold their value well.

Avoid luxury cars, sports cars, and high-mileage vehicles. These are harder to finance and come with higher insurance costs.

Best cars to finance with bad credit:

📌 Target vehicles priced under $20,000. Cars under this price point sell quickly, so act fast when you find a good deal. However, keep in mind that securing a loan for under $10,000 is possible but can be challenging. Loans under $5,000 are next to impossible. Keep these realities in mind before you buy.

Talk to a local bank or credit union about their lending policies before heading out to buy a car.

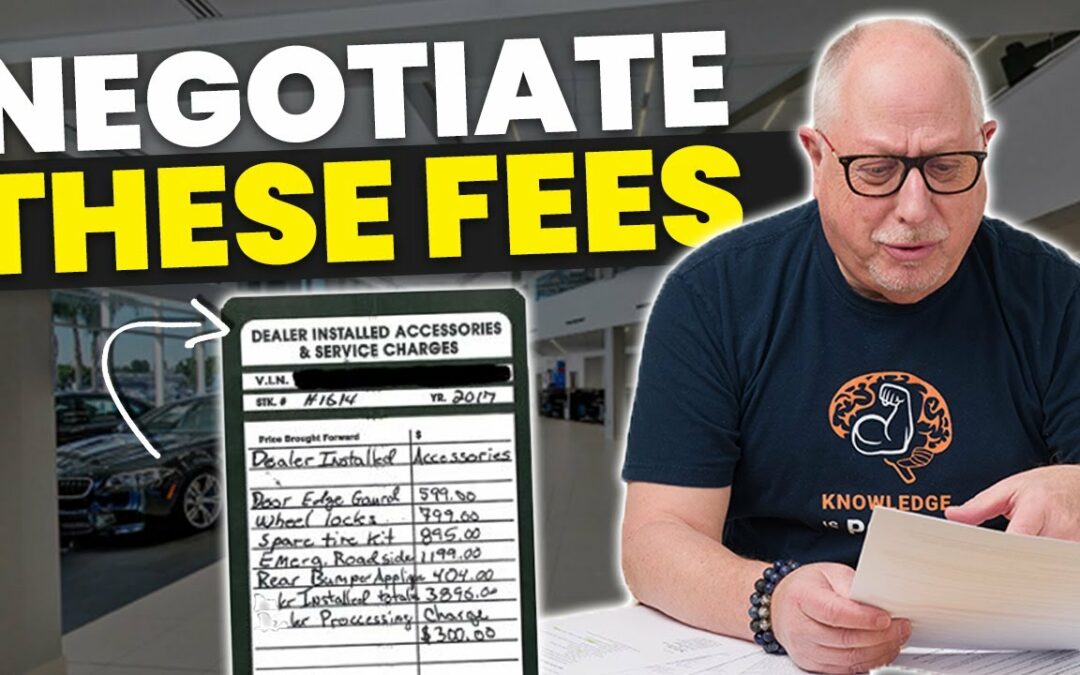

Why it matters: Dealerships make a fortune off bad credit buyers with overpriced loans, sneaky fees, and unnecessary add-ons.

What to watch out for:

🚩 “Yo-Yo Financing” scams – A dealer lets you take the car home before financing is finalized, then calls back saying you need a higher interest loan. Make sure financing is finalized before you drive home in your new car.

🚩 “Packing the Payment” tricks – They sneak in warranties and add-ons without telling you. Despite what the salesperson or finance manager may say, none of these products are required. Read the product contract before agreeing to anything.

🚩 “Spot Delivery” fraud – You sign a contract, but later they claim financing fell through and demand a higher interest rate.

Before signing anything, ask:

❓ What’s my APR? (Aim for as low as possible)

❓ What’s the Out-the-Door Price of the car? (Don’t just focus on the monthly payment!)

❓ Check the loan terms: Can I pay extra or refinance later without penalties?

Why it matters: Even a small credit score boost can save you thousands on your car loan. Even if your credit score is deep in the subprime category, a slight improvement could save you hundreds of dollars in interest.

How to improve your score in 30-90 days:

✔️ Lower your credit card balances (improves credit utilization)

✔️ Look for errors on your credit report (resolving them could boost your score fast!)

✔️ Make all payments on time (even utilities and rent matter!)

What’s the impact of a higher credit score? Take a look at the following real-world examples. Pay close attention to how much interest is paid at each of the different loan rates.

| Credit Score | Example APR (60 months) | Interest Paid on $15,000 Loan |

|---|---|---|

| 720+ | 6.5% APR | $2,610 |

| 660-719 | 10.5% APR | $4,450 |

| 600-659 | 14.9% APR | $6,240 |

| 500-599 | 20.0%+ APR | $9,190+ |

Even raising your score from 580 to 620 could cut your APR by half! That would keep hundreds of dollars in your wallet over the life of your loan.

For those considering buying a new car with bad credit, be extra cautious. New car prices are still near record highs, and financing costs are extremely expensive—even for buyers with good credit. With average used car loan rates at 14% and new car loan rates often exceeding 10% for subprime borrowers, it’s easy to end up in a negative equity situation, where you owe more than the car is worth.

That’s why buyers with bad credit should avoid financing expensive new cars and instead look for reliable used cars under $20,000. This strategy will help you avoid excessive interest costs and reduce the risk of negative equity down the road.

Learn more about how to protect your finances and avoid negative equity.

As spring car buying season approaches, used car prices are already starting to rise. Historically, March, April, and May are some of the most expensive months for used cars due to higher demand from tax refund buyers.

If you’re looking for the best deal on a used car, waiting 90 days could save you hundreds—or even thousands—of dollars. By late spring and early summer, inventory levels will improve, and demand will start to cool off, making it the ideal time to buy.

However, if you must buy now:

✔️ Stick to used cars under $20,000 to avoid overpaying

✔️ Save 10-25% for a down payment to reduce interest costs

✔️ Get pre-approved BEFORE going to a dealership to secure a better loan

✔️ Avoid dealer scams by knowing which fees are legit

✔️ Use these Free Car Buying Calculators to know what to expect

🚗 Ready to find the best car deals? Get your FREE Car Buyer’s GuideWant a pro to negotiate for you? Let CarEdge handle everything!

Spring is just around the corner, and if you’re in the market for a used car, you might want to think strategically about when to buy. The worst time to purchase a used car is fast approaching, as prices historically rise in April and early May when demand surges. On the flip side, if you’re thinking about selling, spring is the perfect time to get the most for your car.

Here’s everything you need to know about where the used car market stands heading into spring 2025.

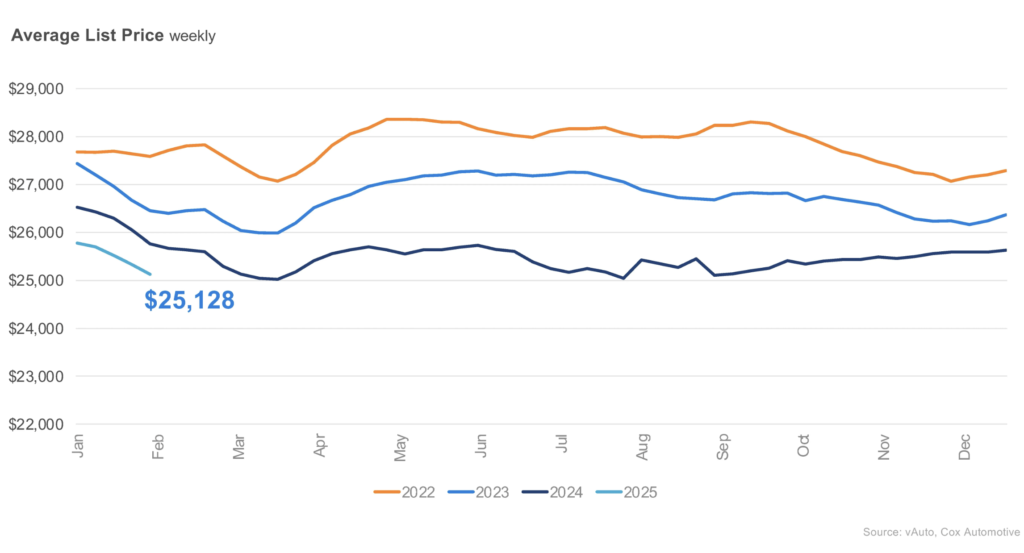

While used car prices have come down from their record highs in 2022, they’re still well above historical norms. As of March 2025, the average used car selling price is $25,128. That’s $5,000 higher than just five years ago. However, our weekly used car price updates show that selling prices have been slowly falling in early 2025. As we head into spring, seasonal trends are on track to send prices the other direction. With spring car-buying season ahead, prices are about to climb higher,

Several factors are expected to drive used car prices higher for spring 2025:

Tax Refund Season Fuels Demand – Many buyers use tax refunds for down payments, creating a rush of demand in April and May.

Lower Inventory at Affordable Price Points – Used cars under $15,000 are in short supply, with only a 35-day supply on the market. That’s nine days lower than last year, according to Cox Automotive.

New Car Prices Keep Climbing – As automakers continue to push new car prices higher, more drivers are shopping used car lots in search of affordability. As preowned lots get crowded with shoppers, negotiations become more challenging.

Top Brands Are the Most Competitive – Used Ford, Chevrolet, Toyota, Honda, and Nissan models made up 51% of all used cars sold last month. Because these brands are in high demand, prices are expected to rise the most in the spring.

Here’s a look at the average selling prices of the top 10 used cars in America in 2025, courtesy of CarEdge Pro:

| Make | Model | Average Selling Price (Used) | Days of Supply (Used) |

|---|---|---|---|

| Ford | F-150 | $29,591 | 61 |

| Chevrolet | Silverado 1500 | $29,212 | 60 |

| Toyota | RAV4 | $23,794 | 52 |

| Tesla | Model Y | $30,999 | 37 |

| Honda | CR-V | $20,010 | 50 |

| Ram | 1500 | $29,500 | 64 |

| GMC | Sierra 1500 | $33,500 | 60 |

| Toyota | Camry | $20,589 | 58 |

| Nissan | Rogue | $19,498 | 59 |

| Honda | Civic | $16,495 | 55 |

Although used car and truck prices have fallen from recent highs, they still remain far above historical norms. Car prices have exceeded the rate of inflation over the past 5 years, adding insult to injury for household finances.

Today’s used car buyers are unsurprisingly finding the best deals on higher mileage vehicles. As drivers hold on to vehicles longer, the odometer readings continue to creep higher. The average used car on sale in the U.S. has 70,000 miles on the odometer, a new all-time high. It’s more important than ever to get an independent Pre-Purchase Inspection on ANY used car before buying.

👉 Get Your FREE Used Car Buying Toolkit – Window Sticker and All!

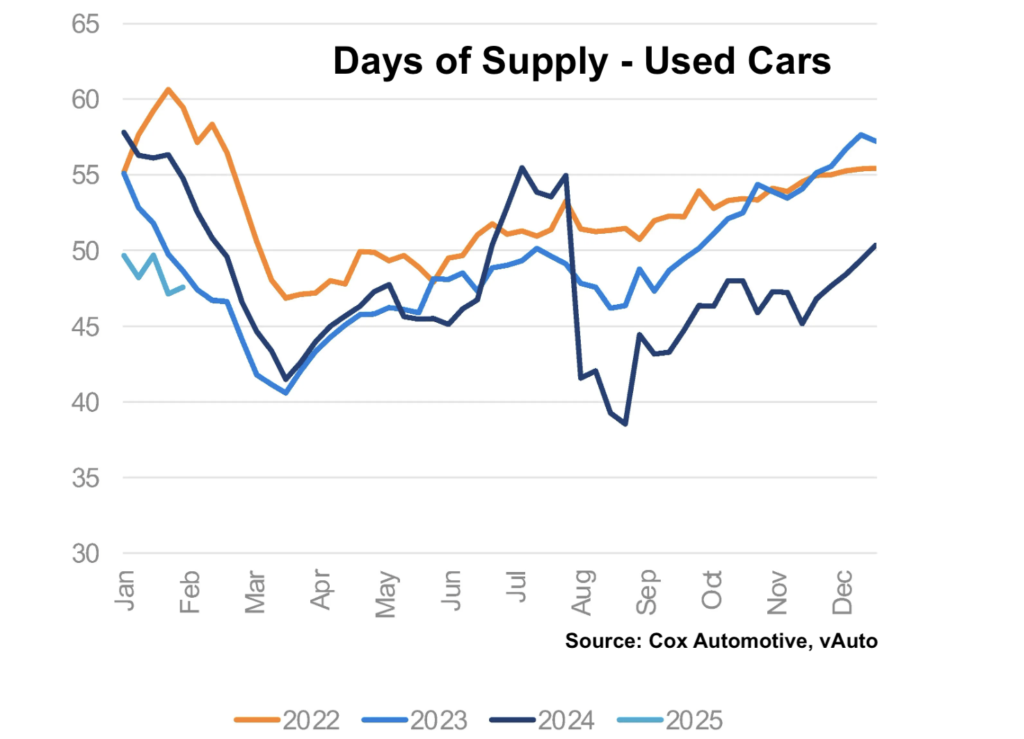

Another reason prices will keep rising? There simply aren’t enough used cars on the market.

Total used car inventory is down 3% year-over-year. There are currently 2.23 million used cars for sale in the U.S., compared to 2.5 million three years ago. The lingering effects of pandemic-era production shutdowns continue to impact supply, with fewer used cars available today.

Days of supply shows a tightening market. Right now, the market has a 48-day supply of used cars, down from 56 days at this time last year. With demand about to spike, this will shrink further, making it harder to find the right car at a great price.

If you’re shopping for a used car, expect inventory to tighten and prices to rise as we enter spring. Basic supply and demand principles lend themselves to higher used car prices in April through early May.

Financing a used car in 2025 comes with a major challenge: high interest rates. The average used car loan rate is still hovering around 14% APR, making it tougher for buyers to afford monthly payments. Even those with excellent credit are struggling to find rates below 7% APR, even when financing through credit unions and local banks.

Unfortunately, relief isn’t on the horizon. The Federal Reserve has signaled that future interest rate cuts are on hold due to persistent inflation. That means used car loan rates are likely to remain elevated for the next several months.

💡 CarEdge Tip: If you need to finance a used car, shop around for the best rates before stepping foot in a dealership. Comparing offers from multiple lenders—especially local credit unions—can help you secure the lowest possible rate.

While buyers face a more competitive market, April 2025 is an excellent time to sell a used car or trade one in.

More buyers = better offers – With demand increasing, used car sellers will have more negotiating power, whether selling to a private buyer or trading in at a dealership. Sellers who are familiar with seasonal trends in used car prices are more likely to get a fair offer.

Higher trade-in values – As dealers have a harder time sourcing inventory, trade-in offers will be more competitive, especially for popular brands like Toyota, Honda, Subaru, and Ford.

If you need a car soon – Act fast before prices climb higher. If you’re set on buying this spring, compare listings now and lock in a deal before demand spikes.

⏳ If you can wait 90 days – Consider holding off until late May or early summer, when the spring surge settles and inventory stabilizes.

🚗 If you’re selling – Spring is the time! Take advantage of high demand and strong trade-in values before the market shifts come summer.

👉 Get Your FREE Used Car Buying Toolkit – Featuring Target Price, Window Sticker and More!

Looking for a reliable, affordable used car in 2025? You’re not alone. With new car prices still near record highs, the used car market remains the best place to find a budget-friendly vehicle. The challenge? Finding a reliable used car that won’t break the bank on repairs.

That’s why we’ve put together this list of the best used cars under $10,000, featuring vehicles with strong reliability ratings, reasonable maintenance costs, and great overall value. While the national average selling price for these cars is often higher than $10,000, we’ve included realistic target prices based on the latest market trends—meaning with some patience and negotiation, you can land one of these for under $10,000 in 2025.

Consumer Reports Reliability Score: 78/100

Average Selling Price: $11,978

Target Price: $9,500 for a 2016 Mazda 3 with 100,000 – 130,000 miles and a clean history.

Why It’s Great:

The 2016 Mazda 3 is an all-around winner, offering a fun driving experience, excellent fuel economy, and strong reliability ratings. With 33 miles per gallon in mixed driving, it’s an ideal choice for commuters who need something cheap and efficient. The Mazda 3 also earns an A+ CarEdge Value Rating, making it one of the best used cars under $10,000.

🔍 Browse Mazda 3 listings near you

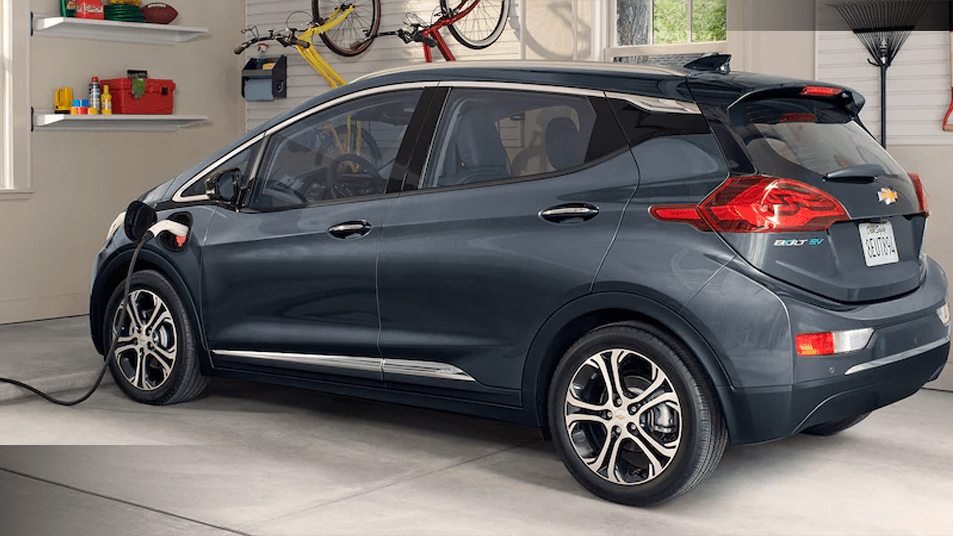

Consumer Reports Reliability Score: 88/100

Average Selling Price: $12,793

Target Price: $9,800 for a 2017 Chevrolet Bolt EV with under 120,000 miles and a clean history.

Why It’s Great:

The Chevy Bolt is best used EV under $10,000—but with a few caveats. If you can confirm that the Bolt has received its battery replacement under the 2021 recall, it’s a fantastic value. With over 200 miles of range, the Bolt is great for commuting and around-town driving. However, it’s not ideal for road trips due to slow charging speeds.

🔍 Browse Chevrolet Bolt EV listings near you

Consumer Reports Reliability Score: 74/100

Average Selling Price: $10,153

Target Price: $7,500 for a 2018 Chevrolet Cruze with 100,000 – 120,000 miles and a clean history.

Why It’s Great:

The Chevy Cruze is fuel-efficient, affordable, and packed with value. With newer styling, a smooth ride, and good reliability ratings, it’s a great alternative to pricier compact sedans like the Honda Civic and Toyota Corolla.

🔍 Browse Chevrolet Cruze listings near you

Consumer Reports Reliability Score: 62/100

Average Selling Price: $13,177

Target Price: $9,800 for a 2016 Buick LaCrosse with 100,000 – 130,000 miles and a clean history.

Why It’s Great:

The Buick LaCrosse is an underrated luxury sedan, offering a smooth ride, spacious interior, and solid reliability. While new models were expensive, depreciation has made it one of the most affordable used sedans on the market. If you negotiate well, you can land a clean LaCrosse for under $10,000.

🔍 Browse Buick LaCrosse listings near you

Consumer Reports Reliability Score: 61/100

Average Selling Price: $11,985

Target Price: $9,500 for a 2016 Chevrolet Malibu with 100,000 – 120,000 miles and a clean history.

Why It’s Great:

The Chevy Malibu is a sleeper pick for one of the best budget-friendly sedans. It’s comfortable, spacious, and relatively inexpensive to maintain. Now that Chevrolet has discontinued the Malibu, used prices have softened, making it an even better value in 2025.

🔍 Browse Chevrolet Malibu listings near you

Consumer Reports Reliability Score: 56/100

Average Selling Price: $11,999

Target Price: $9,800 for a 2016 Subaru Legacy with 120,000 – 140,000 miles and a clean history.

Why It’s Great:

If you’re looking for an affordable all-wheel-drive sedan, the Subaru Legacy is your best bet. Subaru’s AWD system makes this an excellent choice for drivers in snowy or rainy climates. While the reliability score isn’t the highest on this list, Subarus are known for their longevity—as long as the previous owner kept up with regular maintenance.

🔍 Browse Subaru Legacy listings near you

Consumer Reports Reliability Score: 53/100

Average Selling Price: $13,408

Target Price: $9,800 for a 2015 Subaru Outback with 110,000 – 150,000 miles and a clean history.

Why It’s Great:

With all-wheel drive, high ground clearance, and a spacious interior, the Subaru Outback is a fantastic option for outdoor enthusiasts or families who need versatility. It’s one of the most capable vehicles under $10,000, especially in winter climates.

🔍 Browse Subaru Outback listings near you

Finding a reliable, budget-friendly used car is tough in today’s market, but these ten models offer the best value under $10,000 in 2025. Whether you need a fuel-efficient commuter, all-wheel-drive sedan, or affordable EV, these options check all the right boxes. However, with plenty of miles on the odometer, it would be smart to protect your wallet with an affordable Vehicle Service Contract to avoid unexpected repair costs.

💡 Want to make sure you’re getting the best deal? Use CarEdge’s free tools to check fair market value and negotiate the best price on a used car.

Car insurance costs continue to rise in 2025, with the national average annual premium now reaching $2,895. However, not all vehicles are equally expensive to insure. Some models stand out for their lower insurance rates, making them excellent choices for drivers looking to save on total cost of ownership.

We’ve analyzed CarEdge insurance data to find the cheapest cars to insure in 2025. These models not only offer affordable coverage but also have solid reliability, reasonable maintenance costs, and strong safety ratings—all factors that contribute to lower insurance premiums.

Let’s dive into the cars with the cheapest insurance in 2025 and why they are such great choices.

The Mazda CX-5 takes the top spot as the cheapest car to insure in 2025. This popular compact SUV combines strong safety ratings, a smooth ride, and a cabin with a premium feel. Its affordability extends beyond insurance, with affordable total ownership costs and a starting price around $30,000.

See Mazda CX-5 Deals and Value Ratings

In 2024, Honda sold 402,000 copies of the CR-V in America, earning fifth place in the sales charts. One reason for the CR-V’s loyal following is affordable insurance. Its advanced safety features and low theft rates contribute to its low insurance costs. With a reputation for durability, this SUV is a smart pick for long-term ownership.

See Honda CR-V Deals and Value Ratings

The Hyundai Kona is a fun-to-drive subcompact SUV that boasts a modern design, impressive fuel efficiency, and strong safety ratings. Kona drivers save about $1,000 per year on insurance compared to the national average.

See Hyundai Kona Deals and Value Ratings

After 30 years on the market, the Subaru Outback remains a top-selling model for Subaru. The combination of all-wheel drive and top-tier safety ratings makes the Outback one of the cheapest cars to insure in 2025..

See Subaru Outback Deals and Value Ratings

Minivans tend to have lower insurance premiums due to their family-friendly nature and strong safety features. The Chrysler Voyager is a budget-friendly alternative to the Pacifica, offering a practical and spacious cabin without breaking the bank on insurance.

See Chrysler Voyager Deals and Value Ratings

The Subaru Crosstrek is another insurance-friendly option, thanks to its all-wheel drive and standard safety features. The Crosstrek is a great choice for those who need a versatile compact SUV with low long-term costs.

See Subaru Crosstrek Deals and Value Ratings

The Hyundai Tucson is a popular compact SUV that offers a balance of affordability, technology, and fuel efficiency. With Hyundai’s excellent manufacturer warranty and top safety scores, it’s no surprise that insurance costs remain low.

See Hyundai Tucson Deals and Value Ratings

Sporty, stylish, and packed with value, the Mazda CX-30 is one of the best small SUVs for budget-conscious drivers. Its strong crash test performance and reasonable repair costs keep insurance rates below the national average.

See Mazda CX-30 Deals and Value Ratings

Despite its rugged off-road reputation, the Jeep Wrangler is among the cheapest SUVs to insure. Its long-term durability, high resale value, and simple design contribute to reasonable insurance costs.

See Jeep Wrangler Deals and Value Ratings

For eco-conscious buyers, the Kia Niro offers hybrid and fully-electric options with low insurance rates. Its affordable maintenance costs and solid safety scores make it one of the cheapest cars to insure in 2025.

See Kia Niro Deals and Value Ratings

Our car insurance comparison study assumes a 40 year old good driver with full coverage and good credit that drives around 13,000 miles per year. They also assume a single-car policy on a brand-new vehicle, and won’t reflect any multi-car discounts.

Several factors influence how much you’ll pay for auto insurance, including:

If you’re looking to save money on insurance in 2025, compact SUVs and hybrid models tend to be the best bets. The Mazda CX-5, Honda CR-V, and Hyundai Kona lead the pack, offering insurance rates more than $1,000 below the national average.

Before buying a car, it’s always smart to compare insurance quotes to ensure you’re getting the best deal. CarEdge offers free tools to help you calculate the total cost of ownership, including insurance, depreciation, and maintenance costs.

Following a strong December fueled by luxury sales and holiday promotions, the new year kicked off with a sharp decline in vehicle transactions. According to new data from Cox Automotive, new car sales dropped 25% month-over-month in January, leading to a notable increase in inventory levels. With year-end buying season over and interest rates still high, new car inventory is up 26% since the start of January.

For car buyers, this means increasing negotiability for February’s Presidents’ Day deals. Let’s take a closer look at how new car inventory, pricing, and incentives are shaping up for 2025.

As sales cooled off in January, total new vehicle inventory rose to 2.92 million units at the start of February, marking a 14.2% increase year-over-year. However, the biggest change is the sharp rise in days’ supply, which surged to 96 days, far above the industry norm.

Ford and Chevrolet have the largest share of new car inventory, accounting for 17% and 11% of available stock, respectively. Meanwhile, Toyota, Honda, Kia, and Hyundai continue to dominate overall sales, with strong retail demand keeping their days’ supply lower than competitors.

Some brands are carrying particularly high levels of unsold inventory, creating opportunities for buyers to negotiate better deals. Stellantis—home to Jeep, Dodge, Ram, and Chrysler—has seen a dramatic shift in its supply situation. After struggling with excessive inventory last year, aggressive discounting has helped normalize Stellantis’ stock levels, though some models still linger well above industry averages:

However, Ford and Lincoln now top the charts for the highest inventory buildup, with many 2024 models still sitting unsold. Ford’s lineup is particularly weighted down by last year’s models, with 63% of their inventory still 2024 models.

Despite the slowdown in overall sales, compact SUVs and full-size pickup trucks continue to be America’s best-selling vehicles.

The Toyota RAV4 remains the best-selling SUV, making it one of the least negotiable vehicles on the market. With an average listing price of $38,403, buyers can expect strong demand and limited discounts on this popular model.

On the other hand, full-size trucks have significantly more inventory, leading to higher negotiability. The Ford F-150, America’s best-selling truck, has a staggering 141 days’ supply—far above the industry average. Buyers looking for a full-size truck may find bigger discounts and more dealer incentives as brands work to move inventory.

With demand cooling off, new car prices took a step back in January.

The average listing price for a new vehicle dropped to $48,637, a 2.5% decrease from December. While this still represents a 2.5% increase year-over-year, the decline is a welcome relief for shoppers who faced record-high prices in 2023 and 2024.

For budget-conscious buyers, more affordable new cars are still available:

One of the biggest drivers of December’s strong sales was higher manufacturer incentives, but those deals dropped in January. In January 2025, new car incentives fell to 7.2% of the average transaction price, or approximately $3,486 per vehicle.

February’s rising inventory has automakers bringing back BIG incentives for Presidents’ Day, especially on leftover 2024 models.

See the best deals in your ZIP code (free tool)

January’s slowdown has set the stage for some of the best Presidents’ Day car deals in years. With inventory climbing, buyers shopping for EVs, full-size trucks and slower-selling SUVs will have more leverage to negotiate. While incentives dipped slightly in January, they remain well above 2024 levels, and Presidents’ Day sales events are expected to bring even deeper discounts as dealers work through excess inventory.

For the best deals, focus on models with high days’ supply, especially these slowest-selling cars and trucks.

Shop smart in 2025! Use CarEdge’s free tools to compare local inventory levels, dealer pricing, and market trends before heading to the dealership.