CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

As Hurricane Milton barrels toward Florida’s Gulf Coast, the automotive industry is bracing for significant losses. Over 122,000 new cars are parked in the storm’s projected path across Central Florida, with landfall expected on October 9th. While residents focus on evacuating, thousands of cars will be left behind to face damaging winds and floodwaters. Here’s a closer look at which automakers and regions will be most affected by Milton, from Tampa Bay to the Space Coast.

In the greater Tampa metro area alone, over 35,000 new cars are for sale, many of which are at serious risk of damage from storm surges predicted to reach up to 12 feet. Considering that about half of Tampa sits lower than 20 feet above sea level, storm surge will pose a major risk to all, not just cars. Local economies will feel the impacts for months to come. When it comes to the car market, Hurricane Milton could throw a wrench in year-end car sales that normally ramp up come November and December.

These are the major car brands with the largest new car inventory in the Tampa area:

These numbers reflect the total new car inventory for a 30-mile radius extending out from St. Petersburg, Florida as of October 7, 2024. Given these numbers, the Tampa area is facing potential losses that could impact local dealerships for months to come. In fact, Florida inventories and sales are so significant that Hurricane Milton could impact some automaker’s bottom lines.

See local car market data with CarEdge Pro

While the overall number of luxury cars in Milton’s path is lower, the percentage of their total U.S. inventory at risk is staggering. Brands like McLaren, Alfa Romeo, and Aston Martin have some of the highest proportions of their national inventory in Florida, making them particularly vulnerable:

With luxury vehicles making up a smaller market share, the impact of losing even a few hundred cars could cause significant disruptions for these high-end brands.

With a one-two punch from hurricanes Helene and Milton, the Southeastern US will be recovering for months to come. With the possibility of thousands of cars totaled from flood damage, the car market in Florida will be most impacted. In the short term, new and used car prices could jump as available inventory shrinks and car dealers look to make up lost profits.

As Florida car shoppers move north in search of undamaged inventory, the demand for new cars in the neighboring states of Georgia, South Carolina, and Alabaman may push prices higher. Unfortunately, recent events have taught us that car dealerships don’t hesitate to add ‘market adjustments’ to MSRPs when demand exceeds supply.

For those outside of the Southeast, it’s unlikely that car prices will be impacted by Milton. However for Floridians, a tough car market is about to get even more challenging.

Florida has long been known as one of the toughest states for car buyers. Uncapped documentation fees that average around $995—three times the national average—already make buying a car in the Sunshine State a costly affair. Florida also tends to have tighter inventory than other states. With the added destruction from Hurricane Milton, car buying could become even more difficult and expensive.

Post-hurricane recovery efforts could see dealerships facing inventory shortages, leading to inflated prices and markups above MSRP. With demand likely to outstrip supply, shoppers may also encounter more aggressive dealer fees in the months ahead. It’s times like these when a cap on dealer fees sure makes sense. Unfortunately, Florida is one of the only states without one.

Hurricane Milton is shaping up to be one of the most devastating storms for Florida’s automotive market. With thousands of new cars in the storm’s path, dealerships and automakers are likely to experience financial strain. If history is any lesson, this will inevitably trickle down to consumers. If you’re considering buying a car in Florida in the near future, prepare for higher prices and limited options as the state recovers from the storm.

For those in immediate need of a vehicle, buying a car out of state may be a better option as local inventory shrinks. As multiple storms hit the Gulf Coast, car buyers will need to cast a wider net to find deals and avoid potential markups.

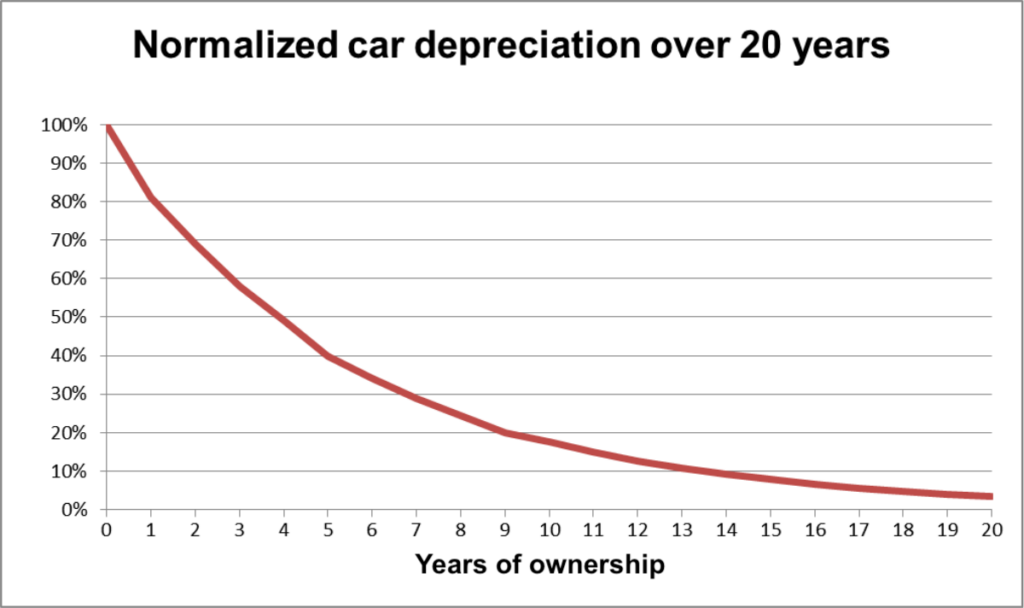

Car depreciation is what makes cars a bad investment—they always lose value over time. If we could sell our cars for what we paid, we’d be collecting them like baseball cards. But the reality is, 99.9% of vehicles lose value, just like rust on an old car.

Cars aren’t investments—they’re tools for transportation. On average, a new car loses 20% of its value in the first year and 40% by year three. Imagine buying a house for $500,000, only for it to drop to $300,000 in value three years later—that’s the same financial hit you take with many new cars. Here’s a closer look at what car buyers should expect with depreciation, and how to avoid the worst of it.

When you buy any new car, depreciation can’t be avoided. On average, new cars will lose around 20% of their value after one year of ownership. After that, they may lose about 15% more per year until the four-year mark.

However, not all cars depreciate equally. As an extreme example, we’ve seen low-mileage luxury cars and EVs lose over 50% of their value over just three years. The good news is that it doesn’t have to be this bad.

The worst depreciation happens in the first few years for a new car. By avoiding a brand-new vehicle and buying one that’s 2-5 years old, you can dodge the steepest drop in value. Let someone else take the loss! When you buy a gently used car, you will lose far less money to depreciation if you decide to sell your car in the future.

When it comes to new car depreciation, the numbers don’t lie. New car depreciation is unavoidable. A new car costing $40,000 can easily lose $16,000 in value over three years, costing the owner over $400 per month in depreciation. But if you buy that same car at three years old for $24,000, you’ll only lose $7,500 in value over the next three years—less than half the depreciation cost.

New 100% FREE car research tools mean that you have more ways than ever to see which cars depreciate the fastest. Check out the free CarEdge Research Hub for up-to-date car depreciation data.

Yes, there’s something special about driving a brand-new car. But unless you really love that new-car smell and pulling off those safety stickers, a slightly used vehicle offers the best bang for your buck. Be smart, shop wisely, and use our tools to find the best value on the market. Use the tools available today with CarEdge’s Research Hub – it’s 100% free data!

One of the most common questions we are often asked is, “When is the best time to buy a car in order to get the best price?” The answer is simple: year-end sales are your best bet. Let’s break down why the end of the year is ideal for negotiating a great car deal.

Dealerships are highly motivated to sell at the end of the month and year. Every day, sales managers review their inventory to identify which cars need to sell quickly. The longer a vehicle sits on the lot, the more it costs the dealer, which increases the likelihood of a discount.

Using CarEdge Pro, you can see how long cars have been sitting on dealer lots, giving you an edge in negotiations. Plus, dealerships push hardest at the end of the month to hit sales goals, offering the best deals during this period.

December 31st is the absolute best day to buy a car. Not only are year-end incentives in full swing, but dealerships are closing their financial books, and some may face inventory taxes on unsold cars. This creates even more pressure to clear inventory and offer deeper discounts.

Can’t wait for December? The last day of each month is also a great time to buy. Sales targets drive dealerships to offer better deals as they aim to hit their numbers. You can still find solid discounts, even if it’s not year-end.

Plan your car purchase for the end of the month for the best deal. To really maximize savings, head to the dealership on New Year’s Eve and be prepared to negotiate. Using CarEdge Pro, you’ll have the information you need to get a great deal before the clock strikes midnight. Rather have a pro negotiate for you? Learn more about CarEdge Concierge.

![Every Zero-Down Lease Deal This Month [October 2024]](https://caredge.com/wp-content/uploads/2024/03/2024-09-16_Cheapest-Leases-This-Month_Blog-Header-Image_1920x1080_v1-1080x675.jpg)

Finally, some good news for car shoppers: October 2024 is packed with zero-down lease deals. As year-end deals approach, manufacturers are rolling out some serious lease incentives to sell remaining inventory before the new year. Right now, it’s totally possible to get into a new car with no money down. Be sure to check back regularly, as automakers update these offers during the first week of each month!

The Best Lease Deal: Lease the 2024 Tacoma SR5 for $449/month with $0 due at signing. It’s very rare to see a best-selling truck lease special with no money down!

See Tacoma lease options, and browse listings near you.

The Best Lease Deal: Lease Toyota’s first EV, the bZ4X crossover, for just $359/month with zero due at lease signing.

See bZ4X lease options, and browse listings near you.

The Best Lease Deal: Returning lessees of any GM vehicle can lease the Encore GX for $333/month for 36 months with $0 due at signing.

See Encore GX lease options, and browse listings near you.

The Best Lease Deal: Returning lessees of any GM vehicle can lease the GMC Terrain for $370/month for 39 months with $0 due at signing.

See Terrain lease options, and browse listings near you.

🚗 See ALL of the best lease offers available this month

These October 2024 lease deals offer an excellent chance to drive away with a new vehicle with zero money down. Whether you’re looking for a truck, an electric SUV, or a traditional crossover, these zero-down leases are hard to beat. And now for even better news: We expect the number of zero-down leases to grow in the months ahead. With 2025 models arriving on dealer lots, year-end sales are set to be huge.

Keep checking back for updates, as more deals are on the horizon.

Buying a rental car can be an affordable way to get a newer vehicle, but it’s important to weigh the pros and cons. Rental cars are often priced lower than those privately owned, making them appealing to budget-conscious buyers. But are the risks worth it? Let’s weigh the pros and cons to find out.

Rental car companies like Hertz offer no-haggle prices on one to three-year old used cars, which can be significantly lower than the true market value. For example, a 2023 Tesla Model 3 could be thousands of dollars cheaper than its resale value. Additionally, rentals are well-maintained, with strict maintenance schedules and frequent cleanings. At least, that’s what’s supposed to happen. As many who have rented a car know, the experience can bring surprises, most notably unpleasant odors. With that said, let’s move on to the reasons why buying a rental car can be a bad idea.

While buying a rental car can save you money, it comes with some downsides. The most significant concern is high mileage. Rental cars often accumulate mileage faster than privately owned vehicles, leading to more wear on components. This is a big part of why rental cars are so affordable.

Additionally, while rental agencies maintain their fleets, cosmetic wear and tear from frequent use are not always addressed. Common signs of wear, like minor scratches or worn interiors, may still be present. Your rental car company should permit you to take the car to an independent mechanic for a pre-purchase inspection. These PPIs typically cost $100-$300, but it could easily identify problems that would cost you thousands of dollars.

Perhaps the most common complaint from those who rent cars is the smell. First, there are the lingering smells of previous drivers. Second, there are the odors that vehicle cleaning leaves behind. It’s not unusual to rent a car that somehow smells of cigarette smoke, even if smoking was never permitted in the vehicle. These odors can be very tough to eliminate.

Rental cars also tend to have limited features and are typically basic models without the higher-end trims or optional upgrades you might find in privately owned vehicles. Lastly, used car resale values may be lower than average, as many buyers shy away from purchasing former rental cars.

With the rise of electric vehicles in rental fleets, buying an electric rental car can be a cost-effective option for those looking to make the switch on a budget. Hertz is selling thousands of EVs after learning that renters are hesitant to give EVs a try on a time-constrained business trip or vacation. After all, charging is time-consuming. However, there are some precautions that every used EV shopper should take, whether buying from a rental car company or elsewhere.

Buying a rental car can be a cost-effective way to get a reliable vehicle, but it’s essential to weigh the pros and cons. High mileage, potential cosmetic wear, and limited features may not matter if your primary goal is affordability and ease of purchase. However, you should always get a vehicle history report and inspect the car carefully. If you’re looking for an affordable car without the frills, a rental car could be a smart choice. For EV shoppers, pay extra attention to battery health and charging history to ensure you’re getting a well-maintained vehicle.

See depreciation data, total cost of ownership, maintenance costs, and so much more at the 100% FREE CarEdge Research Hub.