CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Updated 9/29/21

Knowing how to sell your car for the most money possible has never been more important. In 2021 we’ve seen used car prices appreciate nearly 30%, which means the car (or truck, or SUV) in your driveway is worth way more than when you originally bought it. What a time to be alive!

If you decide that it’s time to sell your car, there are a few things we recommend you do to make the most money possible. Right now, with new car inventory at all-time lows, car dealers, consumers, and everyone in between will be interested in your used car for sale. To maximize your profits we have a few suggestions.

Let’s explore how you can sell your car and address some common questions, like “Should I get my car detailed before I sell it?” “Should I sell private party or to a dealer?” And, “How much is my car really worth?” Let’s dive in.

National online used car dealers like Carvana, Vroom, CarMax, and Shift have been growing in recent years. These companies are publicly traded and focused heavily on growth. Because of this, digital retailers are always purchasing more vehicles in order to continuously expand their inventory.

To sell your car for the highest price possible we recommend you start by getting free online quotes from these four major players. Their business models rely on them having vehicles to sell, and because of that they have made it very simple to sell them your car online. Getting a quote from Carvana takes less than five minutes and only requires your VIN and the current odometer reading.

Carvana, Vroom, CarMax, and Shift vary their prices by geographic region. We recommend you get quotes from each company to see who is offering the highest price right now. Each company wants a different “mix” of inventory and one of them will want your car the most.

Click here to get a Carvana quote: https://www.carvana.com/sell-my-car

Click here to get a Vroom quote: https://www.vroom.com/sell

Click here to get a CarMax quote: https://www.carmax.com/sell-my-car

Click here to get a Shift quote: https://shift.com/sell-my-car

From our experience, we’ve seen that Carvana and Vroom will typically pay the highest price for newer used vehicles. CarMax typically pays the most for older used vehicles. Shift occasionally tops them all.

Bear in mind that Vroom has recently been admonished by the Better Business Bureau, so if the quote you get from Carvana is within a few hundred dollars of your price from Vroom, you may simply want to go to Carvana.

Car dealers are notoroius for “lowballing” your trade-in. Well, in today’s market you are the one in control, and we recommend you give your local dealers a chance to buy your car from you.

Car dealerships are rapidly running out of inventory, and with Carvana, Vroom, Shift, and CarMax spending a lot of money to buy cars directly from consumers, local car dealers know they need to pony up some serious cash to do the same.

We recommend that you contact all of your local dealerships and share with them the quotes you received from the online digital used car dealers. To sell your car for the most money possible, you need leverage, and with online cash quotes, you have that.

If a dealership is willing to beat the price quote you have, that’s great! Your next concern is likely “will they change the price when I come in and they inspect the vehicle?” To mitigate issues there, watch this video on how car dealers appraise cars, and make them aware of any issues in advance.

We have heard a few horror stories from the online used car dealers that they revise their prices lower once they have inspected a vehicle, so the best thing you can do with them, or with your local dealer is to pre-empt that by telling them about any damage or issues.

After going through the prior two steps, if you are willing to invest more time in the process you’ll likely be able to sell your car for the most money possible to a private buyer. Unlike selling to a dealership, selling to a private party takes a bit more work, however an interested private buyer will likely pay even more than the dealership, because they know that if they don’t buy it from you, they’ll have to buy it at a marked up price from the dealership.

Thankfully, the work you did in the steps before (getting quotes from dealerships) will inform your asking price. We recommend you take the highest offer you received from one of the car dealers and add 10% on top of it. That is a fair listing price for a private party sale.

Why 10%? It’s simple:

Advertising a vehicle for sale right now has never been easier. There is A LOT of fraud on peer to peer websites, however. We recommend listing your vehicle on the classic websites: Facebook Marketplace and Craigslist.

In this market you will likely be receiving many inquires immediately.

If you’re selling your car to a private buyer we recommend you clean and detail it. If you are selling to a dealership there is no need to get the vehicle detailed, however it is a good idea to get the vehicle looking clean and like it has been well maintained.

If you’re selling a vehicle to a private buyer do not be surprised if they ask to see a CarFax report and to get a pre-purchase inspection.

When considering how to sell your car, be prepared to accommodate a PPI and have a vehicle history ready for potential purchasers to review.

Great, so you know how much your car is worth and you’re ready to sell it. You likely now wondering, “So what exactly do I need to sell my car?”

The following items will be useful in making your sales experience as smooth as possible:

If you’re selling to a dealership your experience will be pretty simple … Arrive, sign off on a variety of paperwork that allows the dealership to handle motor vehicle paperwork on your behalf, get your check, and leave.

If you’re selling to a private party it will look a little different.

Here are a few pointers:

Are there really “Black Friday car deals?” Each year it seems the Black Friday tradition has started earlier and earlier, with retailers having Black Friday promotions a week before Thanksgiving even happens. What happens this year amidst the global pandemic is anyone’s best guess.

That being said, automakers have tried for years to drum up sales during any holiday, and Black Friday is no exception. You don’t have to look too far to find automaker’s promoting their incentives and offers this holiday season.

This begs the question though, should you take one of these Black Friday car deals, or are you better off waiting until the end of the year to make your car purchase? 2020 is an atypical year for many reasons, and with new and used car prices swinging dramatically over the past few months, it is hard to say when prices will be best for car buyers.

When it comes to negotiating the best car deal possible, there are two major factors to consider; what manufacturer incentives are, and how likely the dealer is to negotiate on their inventory. If you’re thinking about getting a Black Friday car deal, then you need to understand how both are influenced at this time of year.

Within the automotive industry it is well known that end of year sales promotions are typically the strongest of the year. Why? Because most manufacturers are publicly traded companies, and they have to report their earnings quarterly to their shareholders. Even though a lot of manufacturers run on a “fiscal calendar” instead of the traditional calendar year, there is still a lot of weight put into “end of year” numbers, and inevitably thousands upon thousands of corporate employee bonuses are dependent on hitting certain targets.

As we’ve talked about in other guides here on the CarEdge website, automotive manufacturers are not afraid of a little fraud to hit their annual goals.

*cough cough* BMW *cough cough*

That being said, this isn’t the preferred path to hit sales figures, and believe it or not, automakers prefer to steeply discount their vehicles to sell them to consumers before they fake the fact that they were sold! Novel concept, eh?

Foureyes, a dealership sales enablement software company, has great insight into manufacturer specific discounting. If you visit this page (https://lps.foureyes.io/auto-pricing-trends) you’ll see original equipment manufacturer (OEM) specific discount percentages broken down by model year.

Our recommendation is that you look at this data daily as you’re actively navigating the car buying process. You may not qualify for all of the manufacturer’s incentives, however you can at least time your purchase to align with when they are most aggressive. For most OEMs that will be the end of the year, not Black Friday. The notion that there are Black Friday car deals is really more of a marketing gimmick than actuality.

When are car dealers most likely to negotiate a fair car deal? Black friday, or at the end of the year? The answer to this question is highly variable, and every dealership will be different, but as a rule of thumb, most car dealers will be more likely to negotiate with you on price at the end of the calendar year.

Read our complete guide on how to buy a car: How to Buy a Car: A Case Study

As we’ve talked about in other full-length guides, car dealerships don’t make the bulk of their money from selling cars; they make it from factory incentives when they hit volume goals. There is no time where manufacturer incentives mean more than at the end of the year. Dealership’s can have hundreds of thousands of dollars on the line come December 31st, and a few more car deals could push them over the edge to secure those bonuses.

That being said, dealerships have monthly incentives from their manufacturers as well, and those incentives certainly are in place during the month of November. That’s why it’s impossible to say for certain that every dealer will be more likely to negotiate on price in December vs. November—it depends on where they are in each month relative to their volume based incentives.

Want to make car buying easy? Let us do the hard stuff! It’s like Honey, but for buying cars, trucks, and SUVs. Sign Up For Free

With all that in mind, it is important to remember that the basics of negotiating a car deal do not change. If you’re looking to get the best price possible, you’ll want to focus your efforts on vehicles that have been sitting on dealer’s lots for a long time. Just remember that you can always use our Negotiability Score as a guide for which vehicles dealers are more and less likely to negotiate on.

The Market Price Report is 100% free, so please use that as you begin to navigate the car buying process.

This section of our Black Friday car deals guide is solely focused on manufacturer incentives. Like we discussed above, dealer discounts are going to be dependent on each individual dealership’s interest in negotiating with you. Again, that is primarily driven by how close they are to their monthly volume sales goal, and how long a specific vehicle has been on their lot.

When it comes to consumer incentives being offered by manufacturers, our friends at Find The Best Car Price have done a great job aggregating all of the different incentives in one place.

Many manufacturers, such as Kia, Mazda, Toyota, and more are still offering zero percent financing options. We strongly recommend that you consider these manufacturer financing incentives (if you qualify).

Aside from finance incentives, the manufacturer cash incentives are steep for some vehicles, but nothing too spectacular. If you’re in the market for a Nissan Leaf there are cash incentives up to $6,000. 2020 GMC Sierra 1500 has a $6,000 cash incentive as well, and if you’re in the market for a 2020 Chevy Bolt EV, there are $8,500 in cash incentives on the table.

We recently wrote about a CarEdge community member named Clark, who purchased his Jeep Wrangler a few weeks ago. Clark’s story is a great example of navigating the car buying process in 2020, and especially amidst the ongoing Coronavirus pandemic.

Yes, your focus may be on getting the best Black Friday car deals, however it’s important to be like Clark, and understand big-picture trends in the automotive industry before you step foot in a dealership (or more likely email them).

Because of the Coronavirus pandemic, used car inventory has been in short supply. If you tune in to our weekly show on YouTube, you know that used car prices have been sky high (but are finally coming back down), and that new car manufacturing was nearly eliminated earlier this year, leading to supply constraints at dealerships right now.

All that being said, know that “knowledge is power,” and that being knowledgeable about the market conditions (especially in 2020 when things are as crazy as they have been), can save you thousands of dollars when you eventually do go to buy your car.

Trust me, I know buying a car isn’t easy. Believe it or not, neither is selling a car. After doing it for 43 years, I can assure you that being on either side of a car deal isn’t the most pleasant experience either. This is in large part because of information asymmetry, meaning that the dealer has more information than the car buyer, and the car buyer has most likely been taken advantage of in the past by one dealer or another.

By now you know what our objective here at CarEdge is: we exist to support car buyers as they navigate the process. Today I wanted to share with you my best guess as to how much dealers make on new cars broken down by brand. These are estimates, and not facts. During my 43 year career I worked for a lot of OEMs (original equipment manufacturers, or brands), but not all of them. I don’t know every brands profit margins, but I do have a good sense of what they are for most.

Want to make car buying easy? Let us do the hard stuff! It’s like Honey, but for buying cars, trucks, and SUVs. Sign Up For Free

Keep in mind that profit margins are different by model and not just make. What do I mean? I mean that a Mercedes-Benz C300 is going to have less profit built into it’s MSRP than a G550. That being said, on average, my best guess is that Mercedes-Benz’ have eight percent profit built into the MSRP price. I hope that makes sense.

If you work for one of these manufacturer’s, or at a dealership and you have insight into how much profit is built into the MSRP price for each brand, please leave a comment below and we will update the table to reflect that. This is a “living” document, and should be used as a guide for your car buying process, not as fact. The only way to truly know how much a dealer is making when they sell a new car is to ask them. More on that can be found here.

If you haven’t already, be sure to use our FREE Market Price Report which contains a suggested offer price to help you begin negotiations with any dealer on any car.

Without further ado, let’s dive in!

Here’s about how much profit dealers make on new car sales:

| OEM | profit built into MSRP |

|---|---|

| Acura | 8.00% |

| Alfa Romeo | 8.00% |

| Audi | 8.00% |

| BMW | 8.00% |

| Bentley | 12.00% |

| Buick | 8.00% |

| Cadillac | 8.00% |

| Chevrolet | 8.00% |

| Chrysler | 7.00% |

| Dodge | 7.00% |

| Fiat | 5.00% |

| Ford | 8.00% |

| GMC | 8.00% |

| Genesis | 8.00% |

| Honda | 6.00% |

| Hyundai | 5.00% |

| Infiniti | 8.00% |

| Jaguar | 8.00% |

| Jeep | 6.00% |

| Kia | 5.00% |

| Land Rover | 8.00% |

| Lexus | 8.00% |

| Lincoln | 8.00% |

| Lotus | 7.00% |

| Maserati | 10.00% |

| Mazda | 6.00% |

| Mercedes-Benz | 8.00% |

| Mini | 6.00% |

| Mitsubishi | 5.00% |

| Nissan | 6.00% |

| Porsche | 8.00% |

| Ram | 8.00% |

| Subaru | 6.00% |

| Toyota | 6.00% |

| Volkswagen | 6.00% |

| Volvo | 8.00% |

“How to buy a car 101” should be a mandatory course taught in high schools throughout the United States. It’s incredible that modern day car buying is as aggravating, infuriating, and convoluted as it is, but that doesn’t mean every car shopper shouldn’t know the basics of how to buy a car.

Everyday we receive hundreds of emails from CarEdge members. Many of the emails are success stories about how we’ve helped with our Market Price Report, Deal School e-course, and guides. It puts a huge smile on our face to know that we are helping thousands of people navigate the car buying process more effectively and efficiently.

Just the other day we received an email from a gentleman named Clark. Clark bought a used 2017 Jeep Wrangler with 17,635 miles, and he shared his entire purchase process with us (step-by-step) from start to finish. Clark knows how to buy a car, and we thought we’d take his experience, which he documented and shared with us, as a case study that you can follow when you go to buy your next car.

To protect Clark’s privacy we’ve removed his personally identifiable information from any screenshots. Keep in mind that every resource or tool we recommend in this case study is 100% free.

Without further ado, let’s dive in.

One of the things Clark did that we highly recommend all car buyers do, is he researched trends in the automotive industry before contacting any dealers. Of course you want to get a great deal when you buy your next car, but what if the supply of vehicles is incredibly short right now, and no matter how impressive your negotiating skills are, car dealers simply won’t budge? What if the inverse is true, what if you know that the industry currently has a surplus of inventory, and that dealers are desperate for you to come in and buy a car.

In which scenario do you think you’ll get a better car deal?

Don’t be intimidated by the idea that you’ll need to scour the web looking for industry insights into inventory levels … We have you covered.

Want to make car buying easy? Let us do the hard stuff! It’s like Honey, but for buying cars, trucks, and SUVs. Sign Up For Free

Many research organizations exist that provide weekly and monthly updates on auto industry trends. Unfortunately these resources are only marketed towards industry professionals (which makes sense). That doesn’t mean you can’t access the same information.

Each week we publish a “Market Update” on the CarEdge YouTube channel. These 10-15 minute videos walk you through the high-level trends occurring in the auto industry this week. We pull our data from a few sources:

Our recommendation would be you either watch our weekly Market Update, or you refer to the three resources linked above. Either way, you’ll have a great sense for where the retail automotive market stands week in and week out.

Clark did this, and it was the perfect first step in his car buying process.

Once you have an understanding of the current market conditions, we recommend you zero in on market conditions for the specific vehicle (year, make, model, and trim) that you’re considering buying in your geographic area.

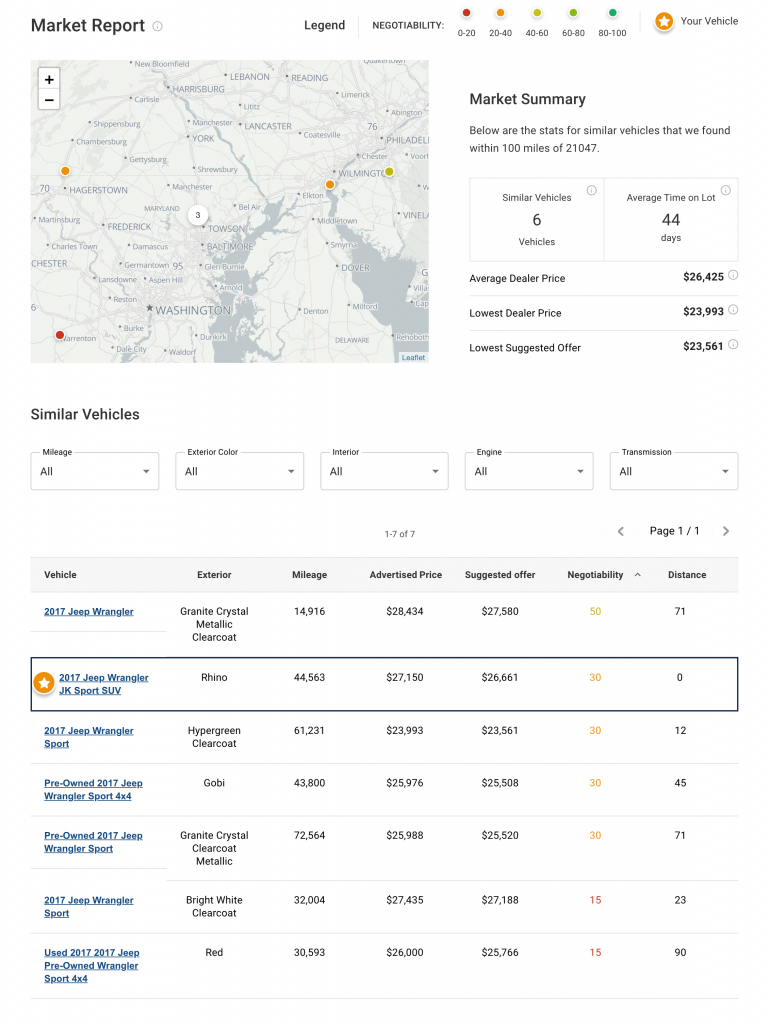

Our free Market Price Report is a great resource to do this, and that’s what Clark used.

You will use the Market Price Report in a two-pronged approach. First, to help you understand market conditions for the specific vehicle you’re interested in, and second to help you negotiate the best out-the-door price possible.

When we analyzed the overall market conditions (in the step above), we learned about inventory levels for the automotive industry as a whole. Now, with the Market Price Report, we’ll look at inventory levels for the specific vehicle we’re interested in for our geographic region.

Let’s break down this screenshot. And again, for clarity’s sake, you can generate up to 100 of these reports for FREE here.

You can see there are 6 similar Jeep Wranglers in my area. The average amount of time they have been on dealer’s lots is 44 days. Either using the map, or the table, I can see there is another Wrangler within 100 miles of my location that has a higher Negotiability Score. The Negotiability Score is a calculation that takes into account days on lot and market conditions.

As a car buyer, I can now see that there aren’t that many Jeep Wranglers in my area, so negotiating a once in a lifetime car deal may not be realistic. That’s okay, this is why we analyze the Market Price Report, to set realistic expectations.

This is exactly what Clark did. From his email to me, Clark said, “I ran 24 different Jeeps through your tool. I narrowed it down to 7 that I liked. I chose to start with the one I bought because I felt like I had the most negotiating power.”

And that is exactly what the Market Price Report is intended for; to help you focus your attention on the best option in your area!

I told you, “How to buy a car 101” really should be a course they teach in all high schools across America!!

After reviewing local market conditions with the Market Price Report, you’ll want to turn your attention towards focusing in on a vehicle or two to negotiate with the car dealer. How do you choose which one to focus on? We recommend you use our Negotiability Score as an indicator for which you should focus on (the higher the score, the better). That’s what Clark did.

Clark knew the days on lot for the specific vehicle, the market conditions in his geographic area, and was ready to contact the dealer to negotiate the out-the-door price. He did something that we highly recommend as well, which is to get a copy of the CarFax before going too deep into the sales process.

We also recommend (although Clark did not do this) getting a pre-purchase inspection on any used vehicle you purchase. It’s a relatively small investment that gives you the peace of mind to know that the car you’re buying isn’t a clunker.

Once those two steps are complete you can then contact the dealer to negotiate the out-the-door price of the vehicle. From Clark, “Long story short After talking about the black book numbers and COVID situation I made an offer of $28,000 + TTL. They came back with an offer of $28,164 + $300 dollar fee for a total of $28,464. Just at what your Dad suggested. (see offer sheet attached)”

Most car salespeople are trained to ask you how you plan to pay for your purchase, cash, finance, or lease. Our advice is to say you’re open to financing through the dealership if their rates are competitive (unless of course you don’t plan to do that).

That being said, you should absolutely secure pre-approved financing from your local bank or credit union before going to the car dealership. That’s exactly what Clark did, “I was pre-approved through my credit union at 3.19% (60Mo) …”

Then Clark did what we recommend all car buyers do; he gave the dealer a chance to beat his pre-approved rate:

“I gave them (the dealer) a chance to beat that which they did at 3.05% (60Mo).”

That is a textbook example of how to negotiate with a car dealership. That is how to buy a car 101!

The car buying checklists we’ve created below are meant to help guide you during your car buying journey. If only buying a car was a simple and easy task … We all know it isn’t. Use the car buying checklist below to make sure you do your due diligence before spending tens of thousands of dollars.

We plan to add more checklists to this page over time. If you have a suggestion for a checklist, please let us know in the comments below. Since you are here, we think you may also be interested in these other free car buying resources:

Without further ado, let’s get into the car buying checklists.

Want to make car buying easy? Let us do the hard stuff! It’s like Honey, but for buying cars, trucks, and SUVs. Sign Up For Free

Please let us know what other car buying checklists you would like to see in the comments below. We’ll frequently update this page. Thank you!