CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

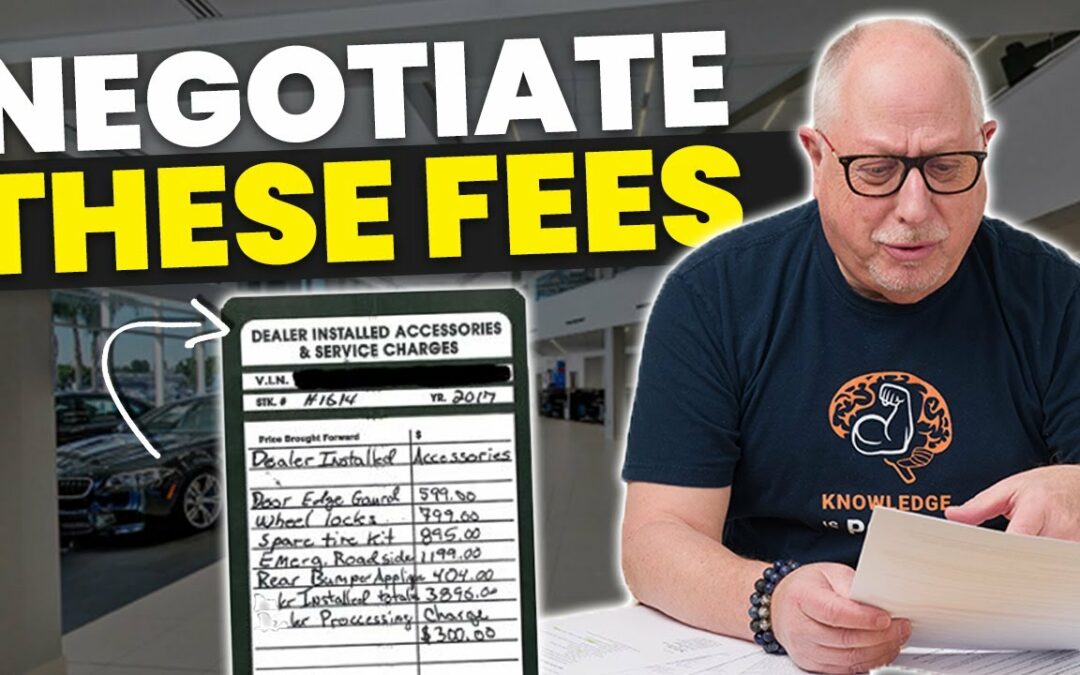

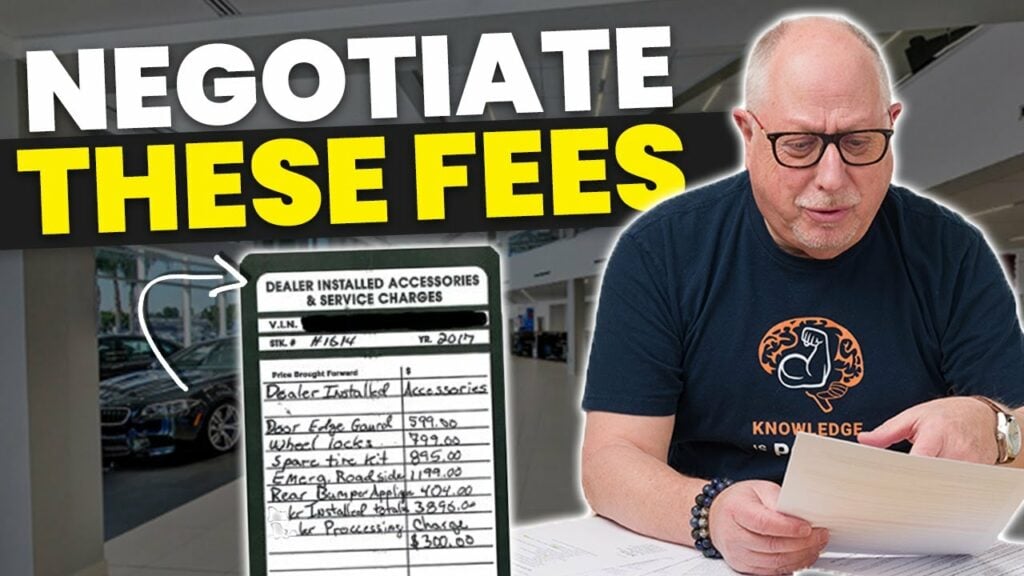

Some car dealers do everything they can to be honest and showcase their integrity. Others do whatever they can to make an extra buck. While we’d love to tell you about all the great car dealers out there, we’re here to be your advocate in the car buying process. A big part of advocating for you is arming you with information.

Today, we’re going to take a look at unethical car dealer practices that you absolutely should be made aware of before you buy a new car. Even if a friend recommends your car dealer, even if you have a friend who works there, you should know about these practices.

We’re about to cover unethical car dealer practices that occur at every stage in the car buying process, from advertising a price you’ll never get, to packing your loan payments, to getting kickbacks from lenders.

We recently received an email from a reader in which they linked us to a dealership that was advertising two different prices: one if you financed with them and one of you didn’t. Guess which price was higher?

If you decided to finance with them, they gave you the price advertised in big, bold letters. Otherwise, you paid $1,000 more to use your financing option. Essentially, you must finance at the dealership and agree to whatever rates and terms they set up for you, or you’ll pay more.

This practice is not exactly common, but it does tie into more common practices. Car dealers often advertise prices that aren’t even available to most customers. The advertised price includes every available rebate, such as a first responder or recent graduate rebate. Then, when you show up to buy the car, they tell you that you don’t qualify.

Another prevalent practice is not including the price of tags, title fees, and other related expenses that they could easily add to the advertised price.

Essentially, one of the primary unethical car dealer practices that you absolutely must know is that the advertised price is not always what you’ll end up getting. You should research the market price of any potential car before you even visit the dealership so that you know what you should be paying. In other words, do your homework.

Let’s play out a scenario: you walk into a shady car dealership, and a salesperson starts asking you questions. One of the earliest questions they’ll ask is, “how much can you pay per month?”

If you say $350, you can be confident they’ll do mathematical gymnastics to make sure that you pay $350. The financing managers do this by tweaking the loan amount and the APR until it works out that you’re paying either the exact amount, or more, than what you said you could afford.

So, if the loan should’ve been $300 but they inch it up to $350, then you’ll end up paying an extra $2,400 over a four-year loan. That’s not a small amount of money that could otherwise be in your pocket.

This practice is called packing or loading payments, and it’s a hard practice to detect.

If you do end up agreeing to the packed loan, you better believe they’ll pull out any other tricks they have to squeeze you out of every dime. It’s better to push back and be firm on how much you will pay, and please, don’t be afraid to walk away from the dealer. You always have the option of walking away from a situation where it feels like they’re taking advantage of you.

Your best defense against having packed payments is to secure your financing from your bank or credit union. Other than that, you can also do plenty of research before you visit the dealership so that you know what your payments should be.

Leases are an essential revenue stream for most car dealerships. Always selling new cars is their primary revenue source, but the margins are tight, so they often opt to urge people to lease instead.

Sometimes, a dealership will attempt to coerce you into leasing instead of buying through dishonest practices. Typically, a car dealership will quote you high prices on purchasing a new car and then give you the much lower lease price that seems like a steal. The salesperson will make it seem like leasing is the best way to get the car you’re after. They might even make false promises about the lease, which can veer into illegal scam territory.

We have nothing against leases, but if you’re going to a car dealership to buy a car and the salesperson tries to push a lease on you, leave that dealership.

If you owned a car dealership and had no moral compass, how would you make a quick profit without doing anything? Add a fee to every vehicle you sell. Just like that, you’re making an extra $500 to $1,000 per vehicle without any added effort.

That’s what prep fees are. Even above-the-board car dealerships have been known to do this. They’ll disclose the fee and say that it’s part of preparing your vehicle for you. Doing this almost seems fair at first glance.

What does a prep fee cover?

Some things it might cover include: peeling off plastic covering, vacuuming the interior, and adding fluids to the car. It’s about 2 hours of work, but they want you to pay $500 (and they’re probably paying the person that’s doing the prepping minimum wage).

Prep fees are entirely legal. The only thing you can do is ask that they credit you back the prep fee. That’s right; refuse to pay it. Get up and walk out if you need to. An extra $500 fee for adding oil to your engine just isn’t worth it!

Let’s say you finance through the dealership, and the lender approves you at a 7% APR. However, you don’t know the exact number; it’s all done behind closed doors. After some waiting, the salesperson comes back and says they got you a 10% APR.

It’s a little higher than you had hoped, but you go for it. You sign with the lender for a 10% APR. Guess who gets that extra 3%? The dealership, through a payment from the lender.

This practice is known as an auto loan kickback. It’s one of the worst unethical car dealer practices because it can boost your monthly payments beyond what you had planned.

How do you protect against it? Get pre-approved for a loan through your bank or credit union. Doing so wholly avoids this unethical practice. If that isn’t an option, do plenty of research about what kind of an APR someone with your credit history should be getting. If they come back with a number higher than what you expected, say no.

Not everything unethical is illegal. However, we can safely say that everything illegal is also unethical. As such, we absolutely must inform you about illegal fraud that some dealerships try to get away with:

If you catch a dealership doing any of the above, they may be violating various consumer protection laws. We are not qualified to give legal advice, but we do believe you should seek a lawyer if you’ve been involved with any of these practices.

You can do two things to protect yourself against unethical car dealer practices: arm yourself with information and be open to different vehicles.

The first one is this article’s purpose; to inform you about specific practices that car dealers try to get away with. The second is up to you. If you are less committed to one particular vehicle, especially a specific VIN, then it’ll be easier to walk away if you believe there is something unethical happening.

Unfortunately, you have to keep your head on a swivel to avoid being taken advantage of. Research loans and car values before you visit a dealership, and you’ll be in an excellent position to prevent these practices.

Buying a General Motors certified pre-owned vehicle allows you to get a stable, warrantied car for a fraction of the price of a new car. We always steer people towards a CPO vehicle over a used car whenever we can.

We’re about to go over the General Motors certified pre-owned warranty, the inspection process, and other bonuses. We’ll give you our thoughts along the way so that you can evaluate whether their program is worth your money.

TLDR; General Motors provides an average warranty with their certified pre-owned cars. The bumper-to-bumper warranty is longer than some competitors, while the powertrain warranty is shorter than most competitors. However, their inspection process is quite thorough, and we like that they investigate vehicle history as part of it. While the perks they give you are nice, we don’t think they should persuade you to buy a General Motors certified pre-owned vehicle.

Warranties are half of the reason we always recommend a certified pre-owned vehicle over an ‘off the street’ used car. The other half is due to the inspection. Between the warranty and the inspection, you know that you’re getting a reliable vehicle and that the manufacturer has you covered if any issues should occur.

Every General Motors certified pre-owned vehicle includes two warranties:

Bumper-to-Bumper Limited Warranty:

Powertrain Limited Warranty:

The General Motors certified pre-owned warranties are average compared to industry standards. The bumper-to-bumper warranty is longer than some competitors, but the powertrain limited warranty is also shorter than some competitors.

We appreciate that there isn’t a deductible for covered repairs. Other automakers have deductibles, so it’s nice to see that General Motors is not taking part in this trend.

General Motors certified pre-owned vehicles come with two warranties that have different durations:

Bumper-to-Bumper Limited Warranty:

Powertrain Limited Warranty:

Being able to transfer the warranty is a nice feature. Imagine being able to sell a used car with a warranty; the new owner will love that. Not having to pay a transfer fee is also excellent, as some automakers do have a transfer fee.

We aren’t pleased with the warranty durations, although their bumper-to-bumper warranty is four times longer than Dodge. A longer powertrain warranty would put General Motors on par with other car manufacturers.

The inspection is an essential part of any CPO program. It’s how you know the vehicle will be reliable, and the warranty provides some peace of mind. General Motors conducts a thorough 172-point inspection of all cars before they are certified. You can view the complete checklist on their website, but we’ll cover the main points below:

Again, we appreciate their inspection because a vehicle history investigation is included. While we can assume other manufacturers do this, too, we like seeing it on the checklist.

Automakers like to include perks with their CPO programs, and General Motors is no different. Every General Motors certified pre-owned vehicle comes with a handful of bonuses:

These perks are pretty average. However, one that stands out is the two complimentary scheduled maintenance visits. Some other competitors provide one visit, while most give no free maintenance visits. The OnStar trial is also an excellent perk, and may come in handy in the event of an accident.

We aren’t particularly impressed by the General Motors certified pre-owned program, but we aren’t disappointed in it either. It’s quite an average program, which isn’t a bad thing. They would impress us a bit more by extending their powertrain warranty. We do like how many inspection points are checked during their inspection process, though. Overall, we’re neutral towards this program.

All around the world, BMW has a specific reputation for providing quality, luxurious cars. However, buying a brand-new BMW is quite costly. That’s why we recommend going for the BMW certified pre-owned vehicle program. You can get into a BMW that’s been inspected and has a warranty without paying new car prices.

TLDR; We like the BMW certified pre-owned program. Although, the lack of a separate powertrain warranty does bring down the entire program. Most other programs include a powertrain warranty. We do appreciate that they add the CPO warranty to the end of the New Vehicle warranty. Their inspection process is thorough, and they offer great perks. The BMW CPO program is a great way to get into a BMW.

BMW says their CPO program is “selective from the start.” While that’s an excellent sales pitch, what does it mean? Here’s what we’ve gathered:

The lack of a specific age range is a bit concerning, but with a 60,000-mile maximum, most vehicles will only be a few years old. We love the program criteria because they require an up-to-date maintenance history for the car, which is not standard for other CPO programs.

Every BMW certified pre-owned vehicle includes comprehensive coverage that kicks in after the New Vehicle warranty expires. We love to see automakers add a new warranty to the end of the New Vehicle warranty instead of replacing it.

The CPO warranty has the same coverage as the New Vehicle warranty, described as “specific defects in materials and workmanship.” They also include a complete breakdown of what is not covered:

While this might seem like a long list of what they don’t cover, it’s all relatively standard for CPO programs. Most CPO programs are a little more specific about what they will cover. Based on our interpretation, BMW will cover repairs if they are related to a manufacturer defect.

The warranty may be transferred to a new party, which significantly increases your resale value.

Every BMW certified pre-owned vehicle comes with whatever is remaining on the New Vehicle Warranty, if anything, which lasts for four years and 50,000 miles. After that warranty expires, the CPO warranty kicks in, which provides one year of coverage with unlimited mileage.

Since one of the requirements to be in the BMW certified pre-owned program is to have less than 60,000 miles, it is possible to buy a CPO vehicle with a New Vehicle warranty that has already expired. Fortunately, you’ll still be covered by the new warranty. Although, this does mean you would benefit from buying a newer CPO vehicle, if possible.

You may purchase extended protection at any point during the warranty to extend your coverage. BMW offers a few different types of extended warranties that you can view on their website.

BMW performs a thorough inspection of every vehicle before it’s certified. Unlike almost every other automaker, they don’t talk about how many inspection points they have. Instead, they call it a “360-degree vehicle inspection.” Even on their inspection checklist, they don’t number the inspection points. So, what are they inspecting? Let’s take a look:

Something that jumps out about their inspection process is that their checklist has a section for “comments.” Most automakers have a simple “pass” or “fail” checklist. BMW may include this section for many possible reasons, but we like to think it was so they could more accurately describe the component’s condition.

Most automakers provide perks with every CPO vehicle they sell, and BMW is no different. Here are the bonuses you can expect if you buy a BMW certified pre-owned vehicle:

Some of these perks are standard, while others go above and beyond what is par for the course. Providing loaner cars directly from the dealership is a unique benefit and prevents the hassle of having to deal with a rental car business or going through the reimbursement process. We also appreciate the trip interruption perk.

We recommend the BMW certified pre-owned program. They provide a thorough vehicle inspection, although they don’t use the point-based system other automakers use. We do wish they offered a specific extended powertrain warranty. They make up for this lack of warranty with their other offerings, but overall the absence of a powertrain warranty does bring the program down. Ultimately, it’s an excellent program for someone looking to get into a BMW who doesn’t want to go for a brand-new car.

Buying a Ford certified pre-owned vehicle is a fantastic way to own a relatively new Ford that comes with a warranty and has been inspected. You don’t need to pay new car prices to have a car with a warranty. We often advise people to go for a CPO vehicle over a Craigslist used car since you know the vehicle you’re buying has been inspected and comes warrantied.

We’re about to dive deep into the Ford CPO program, where we’ll discuss the warranty, inspection process, and go over the perks they offer.

TLDR; Ford’s warranty is unimpressive, but it’s also not disappointing. They are offering an industry-standard warranty. Their inspection process, while thorough, is also industry standard. There’s nothing that jumps out as unique or exciting about the Ford CPO program. If you’re a fan of Ford, it’s still worth buying a Ford CPO over a generic used Ford off the side of the road.

The Ford certified pre-owned program includes two warranties that are on par with the industry standard. They don’t rise above the average, but they also don’t fall below it. To be eligible for the Ford CPO program, a car must meet the following criteria:

The mileage requirement is slightly higher than other automakers, who generally set the bar at 50,000 miles.

When you buy a Ford certified pre-owned vehicle, you’ll receive two warranties that cover different parts of your car.

Comprehensive Limited Warranty which covers over 1,000 components including:

Ford also provides a Powertrain Limited Warranty, which covers:

Both of these warranties are offering industry standard coverage. This can be considered a good thing since they aren’t dipping below the industry standard. However, we would like to see more components covered in the Comprehensive Limited Warranty.

The Ford certified pre-owned program provides two warranties of different lengths:

Both of these warranties are fully transferable to new owners with no transfer fee, enhancing your resale value.

Ford also offers Extended Service Plans, which cover more areas of the vehicle and have varying durations. These plans are available at a Ford dealer, and they do not post any information about them on their website.

It’s important to note that Ford does not explicitly mention what happens when you buy a CPO car that still has the New Vehicle Warranty. They should state whether or not that warranty will carry over, and if the CPO warranty kicks in after it expires. Perhaps it means you won’t be receiving a CPO warranty. This policy needs to be stated directly.

Both of their warranty durations are relatively standard for the auto industry. The Comprehensive Limited Warranty duration is the same as most other competitors, while the Powertrain Limited Warranty is slightly lower than others, as some offer ten years.

Every Ford certified pre-owned vehicle has been through a rigorous 172-point inspection. You can view the complete inspection checklist on their website, but we’ll go over the significant points:

Providing a 172-point inspection is more thorough than some competitors, but not by much. It is an average amount of inspection points. We’re unimpressed by their inspection process, but still, we aren’t disappointed in it.

We should highlight that this is Ford’s internal inspection. You should still have your own pre-purchase inspection done.

Every Ford certified pre-owned vehicle comes with many perks. Ford provides these perks both as a ‘thank you’ and to persuade you to buy a Ford CPO vehicle. The perks are:

This perk offering is pretty small as compared to other automakers. We’re a little surprised since Ford is such a big name in the auto world. Perhaps it’s for this reason that they don’t feel the need to offer too many perks?

Overall, the Ford certified pre-owned program is average in every way. They only fall below average with their perk offering, but that’s not as important. The critical aspects of a CPO vehicle are the warranty and inspection, and they’re perfectly average in those regards. Being average is certainly better than being subpar. We recommend this program for fans of Ford. If you are looking for a reliable certified pre-owned vehicle, Ford is an acceptable way to go, but there are other automakers with better programs.

You’ve heard us say it before, and you’ll hear us say it again; December is the best month to buy a new or used vehicle. End of year sales promotions are typically the most aggressive of the year, dealerships are determined to hit their month-end, quarter-end, and year-end volume-based sales objectives, and manufacturer’s budget their largest share of dollars to go towards December marketing activities. December is the best month to buy a car, truck, or SUV, but that doesn’t necessarily mean every “deal” on a dealers lot is a good one.

This year we commissioned our first ever CarEdge research project, the 2020 Negotiability Report. With our data partner MarketCheck, we analyzed nearly 2 million vehicle listing pages to determine which vehicles dealers should be desperate to sell in the ten largest cities, and Detroit (because if it has to do with automotive, then you have to include Detroit, it’s a rule).

The results were interesting. It’s incredibly clear that there is an oversupply of some vehicles in certain areas, while there is a lack of supply in others. Take for example in the Chicago, IL region. We found that half of the most negotiable new cars in Chicago are Audi’s. Could that have something to do with the fact that there are 7 Audi dealerships in the city, and maybe that is causing a bit of an oversupply? Sure. What does that mean for you if you’re in that area? Go get yourself a great deal on an Audi!

The methodology for this research project was simple. Just like we have a Negotiability Score in the CarEdge app, we calculated the same score across all vehicles in each of the eleven regions to determine what their score is. We then ranked the top ten for new and used in each region. If you’re unfamiliar with the Negotiability Score, it is a 0 to 100 score we assign to any vehicle identification number (VIN), and it is calculated by analyzing a vehicle’s “time on lot” (how long it has been listed for sale by a dealership), and the local area’s market days supply (an industry metric to determine how “in demand” a vehicle is).

To access the full report, please click here: https://caredge.com/negotiability-report-december-2020/

For links to each specific region, refer here:

New York: https://caredge.com/negotiability-report-december-2020/#Most_Negotiable_Vehicles_in_New_York

Los Angeles: https://caredge.com/negotiability-report-december-2020/#Most_Negotiable_Vehicles_in_Los_Angeles

Chicago: https://caredge.com/negotiability-report-december-2020/#Most_Negotiable_Vehicles_in_Chicago

Houston: https://caredge.com/negotiability-report-december-2020/#Most_Negotiable_Vehicles_in_Houston

Washington, DC: https://caredge.com/negotiability-report-december-2020/#Most_Negotiable_Vehicles_in_Washington_DC

Miami: https://caredge.com/negotiability-report-december-2020/#Most_Negotiable_Vehicles_in_Miami

Philadelphia: https://caredge.com/negotiability-report-december-2020/#Most_Negotiable_Vehicles_in_Philadelphia

Atlanta: https://caredge.com/negotiability-report-december-2020/#Most_Negotiable_Vehicles_in_Atlanta

Phoenix: https://caredge.com/negotiability-report-december-2020/#Most_Negotiable_Vehicles_in_Phoenix

Detroit: https://caredge.com/negotiability-report-december-2020/#Most_Negotiable_Vehicles_in_Detroit