CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

The Inflation Reduction Act of 2022 has thrown a wrench in the EV buying plans of many. Just three weeks after we first heard word of this deal between two Senators, it has been signed into law. Time is of the essence if you’re on the fence about an EV purchase! But don’t run out to buy that shiny new Tesla Model Y just yet. The language of the Inflation Reduction Act’s ‘Clean Vehicle Credit’ details requirements and important dates that you need to know about before signing a contract to purchase.

If buying an EV in America is in your future, here’s what you need to know today.

These are the big changes to the EV tax credit:

These new EV tax credit eligibility requirements eliminate several of the most popular electric vehicles on sale today. Here’s our list of the winners and losers, including those that will qualify for at least half of the new credit.

If you’re considering buying a Tesla Model Y, Cadillac Lyriq or Chevrolet Bolt, wait until January 1, 2023 to make the purchase. The revised EV tax credit removes the 200,000 sale cap for automakers on January 1, 2023. The 200,000 sale cap had previously disqualified Tesla and GM EV models from the original $7,500 EV tax credit.

Why only the Model Y? The Model Y is the only Tesla that will qualify for the new tax credit because of the price caps. The revised EV tax credit caps SUV and truck prices at $80,000, and sedans at $55,000. The only Model 3 under the price cap is the rear-wheel drive Model 3, but it sources batteries from CATL in China, so it is disqualified. The Model S and Model X are far too expensive. The Model Y is the most popular EV in America, so this is still good news for Tesla.

Ford makes the Mustang Mach-E in Mexico, and that’s not an issue as the new bill requires final assembly to be in the U.S., Canada or Mexico. However, Ford has battery sourcing agreements with numerous battery suppliers, and that’s where it gets complicated.

Ford currently makes the Mustang Mach-E in Mexico with batteries from LG Chem (now LG Energy Solutions). LG manufactures these battery cells in Poland, but the battery pack assembly is in North America. It’s unclear if Ford’s battery assembly meets the 40% battery component requirement. Unfortunately, Ford just signed an agreement with Chinese battery manufacturers CATL to supply batteries for upcoming Ford Mustang Mach-E’s. This may disqualify the automaker briefly, but not for the time being. Ford has already announced plans for two battery plants in Kentucky and Tennessee.

Does the F-150 Lightning qualify for the new EV tax credit? Yes, but it depends on where exactly the batteries are sourced from. Ford has said that is sources many F-150 Lightning battery packs from SK Innovation’s factory in Georgia, USA. That’s great for eligibility. However, Ford recently shared that they are sourcing more batteries for the Lightning from Chinese automaker CATL. That could complicate eligibility.

Most F-150 Lightning trim options that include the Extended Range battery (for 320 miles of EPA-rated range) are near or over the $80,000 price cap for trucks. Check your vehicle build specs and pricing to see if your total MSRP is under the $80,000 limit.

If you secured a written binding contract to purchase before the bill was signed, you could claim the original $7,500 tax credit when you file 2022 taxes.

In summary, most Ford electric vehicles will likely qualify for at least half of the new EV tax credit, which would be $3,750. Of course, this depends on battery sourcing. It’s possible that Ford EVs could eventually qualify for the full $7,500 once we know more about where Ford’s battery suppliers source their minerals.

Many of today’s best electric vehicles are made overseas for now. The Kia EV6, Audi etron, Polestar 2, and my own Hyundai IONIQ 5 are all disqualified due to the Made-in-America requirement.

The language of the bill states that as soon as it is signed into law, EVs that do not have final assembly in the United States, Canada or Mexico will lose eligibility. The bill was signed on August 16, 2022.

See our full list of EVs that will lose eligibility, and those that will qualify.

The ‘Transition Rule’ in the new EV tax credit allows buyers to claim the original $7,500 EV tax credit if the buyer has signed a “written binding contract” BEFORE the Inflation Reduction Act of 2022 was signed into law.

Love legalese? Read the Senate’s Inflation Reduction Act’s text here.

The new bill states that the new used EV tax credit will take effect January 1, 2023 as a tax credit, and it will become refundable at the point of sale starting on January 1, 2024. There are STRICT limitations, however.

To qualify for the used EV tax credit, the vehicle must meet the following qualifications: cost less than $25,000; be at least 2 years old; and sold by a qualified dealer. Buyer income limits are an adjusted gross income of $75,000 for individual tax filers, $112,000 for head of household, and $150,000 for joint filers. Taxpayers are allowed one used EV credit every 3 years.

It’s a wild time to be in the market for an EV. Did we miss something? Let us know in the comments, or better yet chat with our EV and general car buying experts at the CarEdge Community Forum. You can also email me at [email protected]. This is an evolving situation!

Each day we get asked, “When will car prices drop?” Fortunately, today we have good news to share; used car prices are starting to fall as you’re reading this.

At wholesale auctions, used car prices have dropped for seven weeks in a row. This week’s wholesale declines were so steep that the analysts at Black Book said it was reminiscent of declines seen at the start of the pandemic. If wholesale used car prices are dropping so much, why haven’t we seen an equally steep decline in retail prices? Well, we are just starting to.

In today’s turbulent world, there’s only so much we can confidently assume when drawing connections between the automotive market of the past and present. But the data is still useful. By taking a look at similar trends from years past, we can start to understand when retail car prices are likely to drop, which vehicles are likely to drop the most, by how much, and how you can approach negotiations.

Let’s dive in.

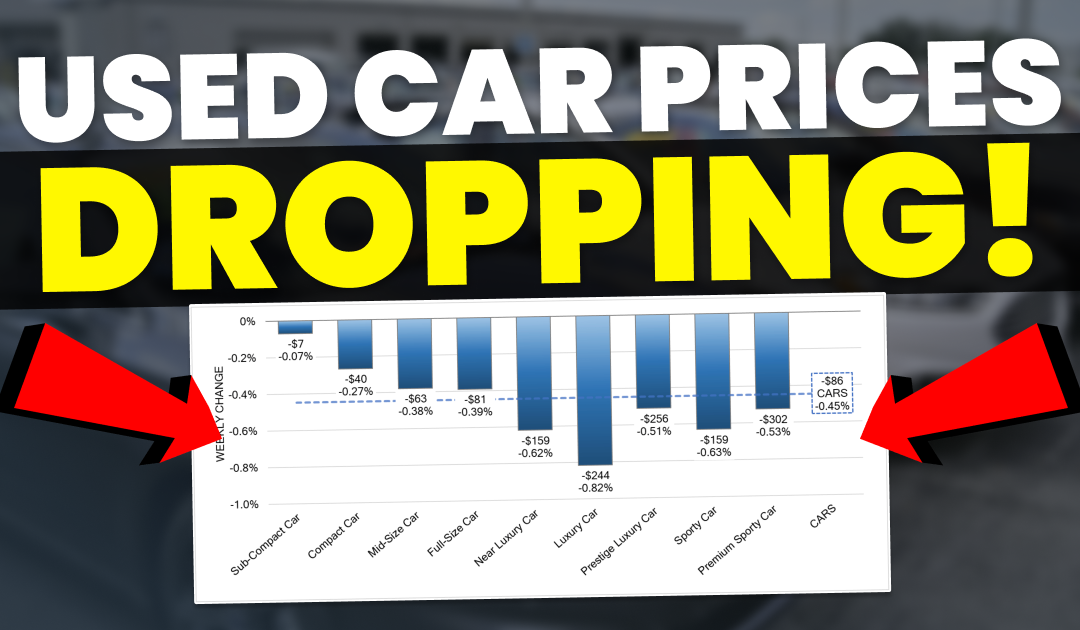

Historically, retail used car prices lag 4 to 6 weeks behind wholesale prices. We started to see significant wholesale price declines in the last week of June, and more so by mid-July. Take a look at the last 8 weeks of wholesale car prices:

+0.10% the week of June 20

-0.02% the week of June 27

-0.15% the week of July 4

-0.35% the week of July 11

-0.45% the week of July 18

-0.47% the week of July 25

-0.86% the week of August 1

-0.89% the week of August 8

Since early July, wholesale used car prices have dropped -3.19%, and some vehicle segments are down more than 5%. You may be asking why retail prices haven’t started dropping if wholesale prices started their downward trend seven weeks ago. Until the week of July 18, the wholesale declines were slight. Basically, they were within the ‘margin of error’, and the change wasn’t yet large enough to draw any big conclusions. When we started to see declines of -0.45% to -0.89% in a single week, that was the surefire indication that the price drop is real, and the bubble may even be bursting.

If used car prices are on track to follow a trajectory similar to what was seen when prices dropped in 2008 and 2020, we’d expect to see real declines 4 to 6 weeks after the start of significant declines. So when did the clock start? Conservatively, the first week of August was the first week of major declines. Wholesale used car prices dropped -0.86% last week alone. Looking ahead, we can expect retail used car prices to drop meaningfully starting in early- to mid-September. This coincides with a likely increase in repo cars that will also drive used car prices lower too.

While advertised retail prices may not be lower (why would a dealer drop their advertised price if they can find a customer willing to pay an inflated price?), we have heard more and more stories from our community of successful negotiations taking thousands of dollars off of used car deals. Negotiating on a used car is possible, and you should be encouraged to do it.

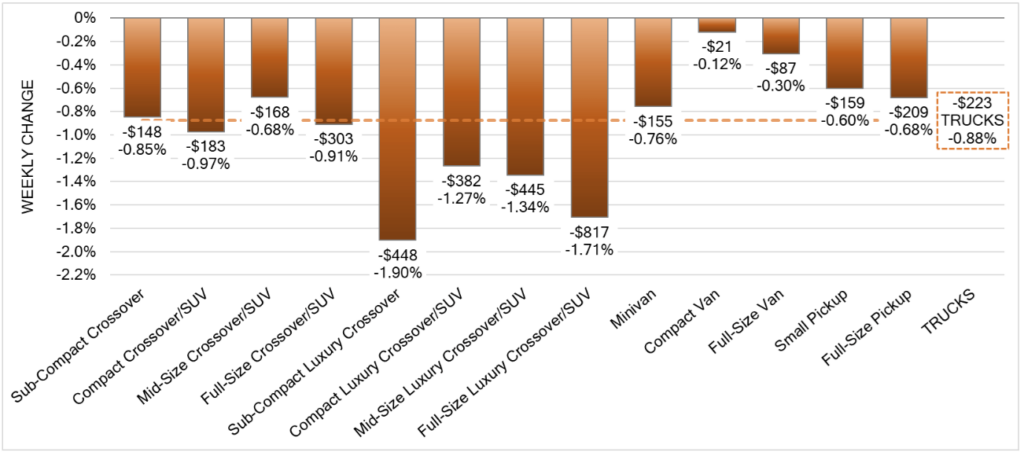

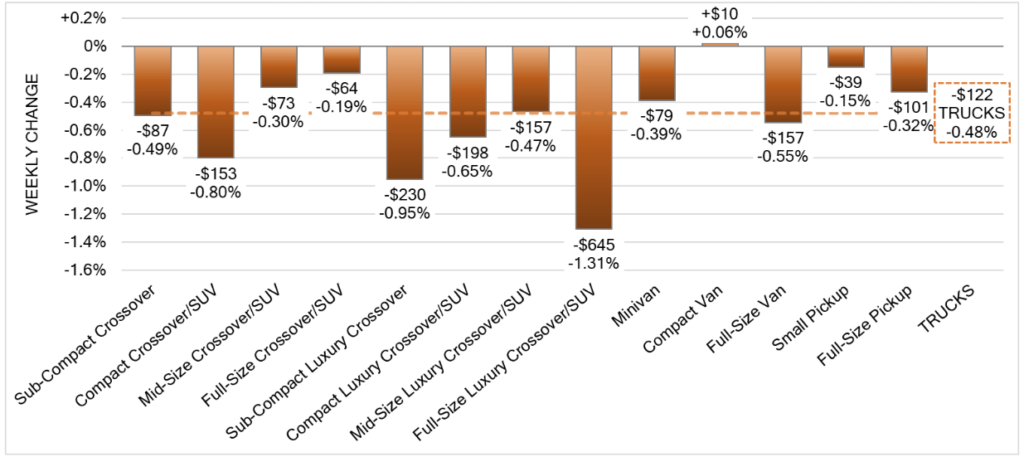

The past month of wholesale data shows that luxury vehicle and larger SUV segments are on track to see the steepest price declines. Why? Their prices have been the most inflated over the past 18 months, and consumer demand for high price vehicles is decreasing rapidly. The week of August 8, every luxury segment dropped by at least -1.24% week over week. Sub-compact and full-size luxury crossovers dropped nearly 2% in just one week. Since July 11, luxury segments have seen wholesale prices drop by -5.32%, while the overall used vehicle market dropped -3.19%.

Our very own market researcher Mario notes that some vehicle segments are softening, but mass-market sedans and trucks are holding firm. “I’m starting to see increased negotiability with late model mid-size SUVs like the Mazda CX-9 and the luxury segment (Lexus RX, Audi Q5, Acura RDX). These segments have been softening and represent some good deals. Trucks continue holding value. I haven’t seen much change on the lower end and small sedans.”

CarEdge Auto Expert Justise also emphasized more consumer negotiating power as the first sign of a softening auto market. “ Luxury and non-hybrid vehicles are already a lot more negotiable than they were last month. I am also seeing a lot more deals across the board without as many shenanigans like nitrogen tires, and fewer markups over MSRP. Even many Toyota & Hondas that are 2020-2021 model years are coming back down to Earth.”

Think about what we’ve all collectively been through over the last few years. We know better than to assume anything in this market is guaranteed! Today’s car market is unlike anything we’ve ever seen before. New car inventory remains very low, and prices are sky-high while interest rates complicate matters even more. And we haven’t even discussed inflation. So no, nothing is guaranteed, but it’s undeniable that overall market pressure is building that will most likely push dealer sales managers to adjust pricing downwards.

Another factor to take into account is that dealer sales managers are going to try their hardest to cover their losses. Those who bought severely overvalued used vehicles at auction two to six months ago are going to either stand defiantly and demand high prices, or they’ll ‘be smart about it’ and cut their losses by negotiating with prepared, knowledgeable car buyers.

See the latest NEW vehicle inventory, including days supply!

CarEdge’s own Ray Shefska said it best. “The smart dealers will take their losses, and sell what they can now. Wholesale price trends are indicating that they bought overpriced used vehicles for the past several months, and they’re losing money every day they don’t sell their inventory. This could drive prices downward sooner rather than later. Smart sales managers look at pricing weekly. If cars aren’t selling quickly like they have been, that’s a sign that the market is changing.”

How can you determine the fair market value of a car? Over the last three years, used car prices plummeted during pandemic shutdowns, only to climb a record 40% in 2021. In 2023, there are strong signals that the car price bubble is bursting.

With such volatile changes in car prices, it has never been more difficult to know the true fair market value of a car. That being said, there are ways to answer this question!

In the old days, it was impossible to know what the real fair value of a car was. Kelly Blue Book was just that, a book. Books don’t update from week to week like used car prices do, and websites like KBB are really just meant to gather leads for dealers; their valuations aren’t a true indication of “fair market value.” How we share information has changed, but so has how we buy and sell cars. Online car dealers now account for 30% of new car sales in America, and the used car market is catching up.

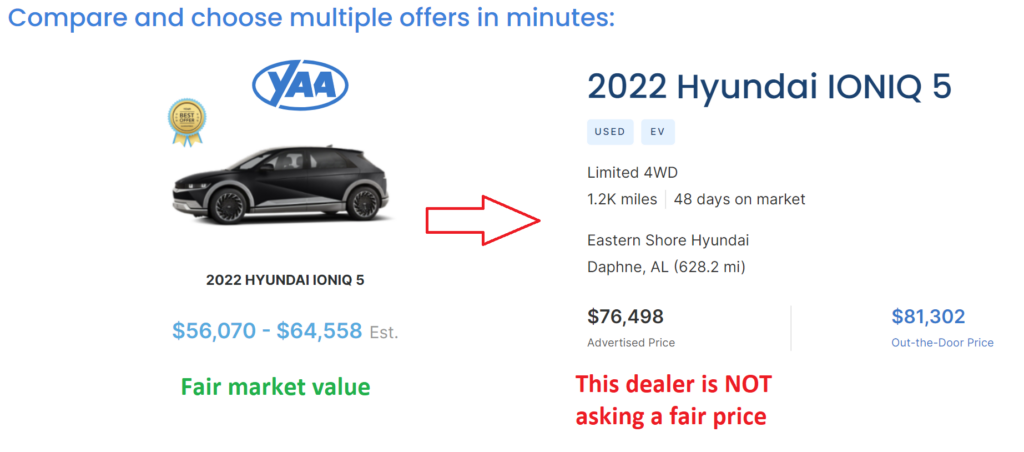

With sites like CarEdge, Carvana, Vroom, CarGurus, and others, you can see in real-time what a car dealer would pay to buy a car. This is VERY valuable information for car owners, regardless of whether or not you intend to sell. More on that below.

If you’re buying a used car, the 10% rule is a great way to see if you’re paying a fair price. We all know car dealers make money when they sell cars, but how much do dealers make? In 2023, the average total profit per vehicle is up to $5,138. That’s double what it was five years prior.

With dealer profits climbing all the time, how can you make sure they’re not paying too much for a used car? We like to think about the 10% rule. If a dealer has a used car for sale and you’re going to buy it, the price should be no more than 10% over what online car dealers would pay to buy the car. We consider that to be a fair price. If it’s more, try and negotiate.

How could you apply the 10% rule? Both new and used car listings provide the vehicle’s VIN number, mileage, trim options and condition. Using that information, you could go through the tedious process of requesting a quote from Carvana, Vroom and CarGurus. Better yet, get all the quotes in one place with CarEdge’s Valuation. Once you have an estimated value or offer, simply calculate if the value is within 10% of the dealer’s quoted price. If it is, you’re looking at a fair price. If not, it’s time to look elsewhere or put your negotiating hat on.

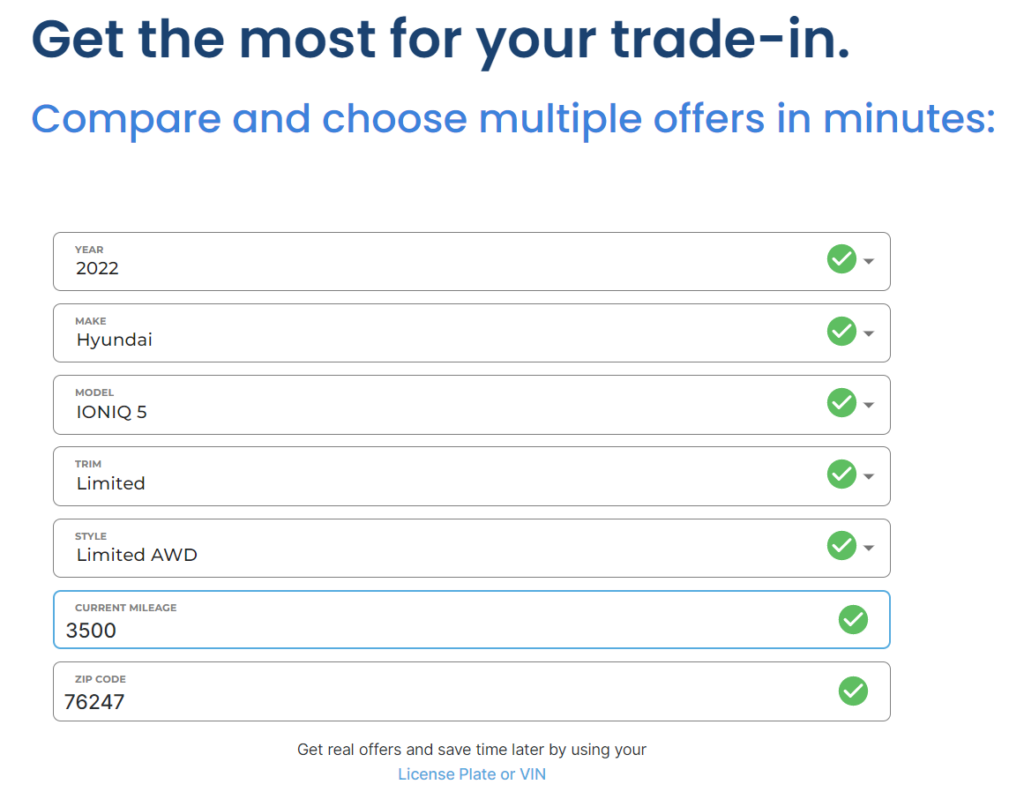

We created a new kind of online vehicle valuation tool with the goal of giving consumers a realistic, regularly updated valuation without the fluff. Our CarEdge community members tell us time and time again; drivers just want real data without gimmicks or gotchas. How does it work? CarEdge’s Vehicle Valuation takes information you share about your vehicle or a vehicle you’re shopping for, and gives you real offers from online car buyers. Using either the vehicle’s VIN number or license plate, location and your answers to simple questions about the vehicle’s condition, you get multiple offers in less time than it takes to brew a pot of coffee.

Anyone who’s traded in a vehicle knows well that dealers lowball trade-in offers so that they can turn around and sell your car for more. CarEdge’s in-house auto experts leveraged decades of dealership experience to give consumers a better way to understand what their car is worth, and how its value changes over time.

Have questions about your car’s fair market value, or perhaps you’re wondering whether a dealer is giving you a fair price? Our auto experts are ready to help you at the CarEdge Community forum. Check it out today!

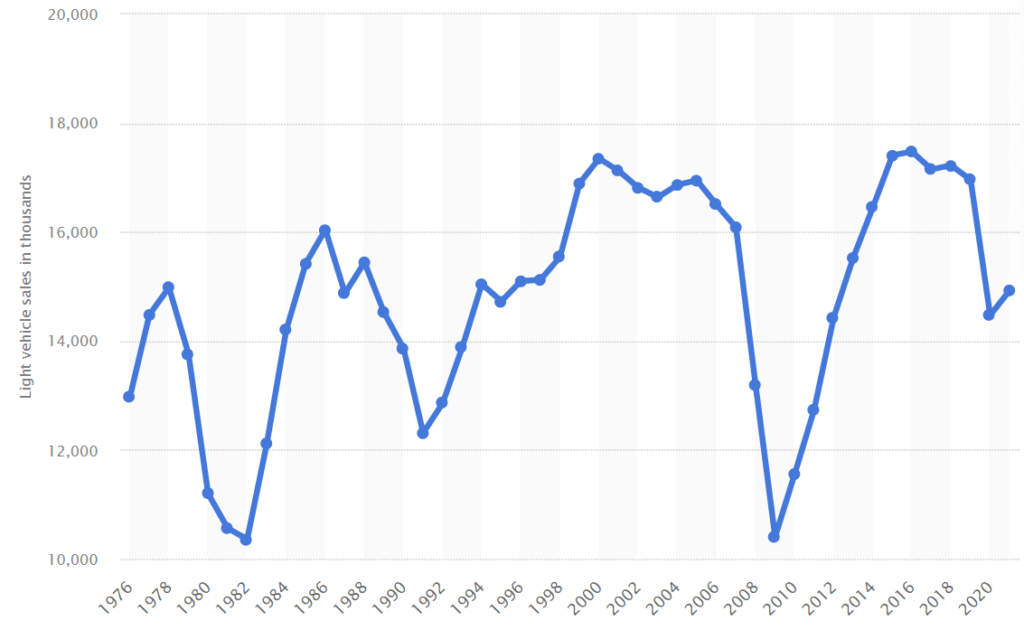

With tariffs, stubborn inflation, and stock market-selloffs, there are many factors that are dampening consumer sentiment in the United States. An economic slowdown impacts everyone, car buyers included. How will a recession impact car sales? How will car buyers be affected by a recession in 2025? Will it be the same as 2008, or are things different this time around? Let’s take a look at what history can teach us.

For most, the mere mention of a recession is cause for cutting back, saving money and spending less. Discretionary spending, essentially spending by choice rather than by need, always plummets in a recession. For some households, discretionary spending includes that shiny new car you’ve had your eye on. For others, a car is essential for work, etc. In a recession, auto sales decline significantly as many buyers back out of the market. However, a recession in 2025 is not going to be the same for car buying as it was in 2008 and 2020.

New vehicle sales in the U.S. fell nearly 40 percent during the ‘Great Recession’ of 2008. Gas-guzzlers were hit the worst, and hybrid powertrains made their big break. 2020’s pandemic-driven recession was the shortest in history, lasting just two months. Even then, auto sales were down 15 percent compared to 2019.

What’s different now? Car prices have climbed for three years straight at a pace never seen before. The result? Reluctant car buyers who are more likely to patiently seek out deals. If an economic recession begins, new car prices will be forced downward by a drop in demand. With high interest rates, car dealers lose money the longer a car sits on the lot due to floorplanning costs. Not selling is never an option, meaning that incentives will mount until buyers see value.

If you’re thinking about selling, you should decide sooner rather than later. We track used car prices weekly, and we’ve seen months of declines in both retail sales and the wholesale markets that determine trade-in values. Used car values are falling, and will continue to decline if a recession is in the cards for 2025.

The average used car listing price has fallen from an all-time high of around $28,000 in 2022 to $25,128 in March 2025. With economic worries lingering, we expect retail used car prices to fall another 3-5% through the end of the year. Those considering selling a vehicle in 2025 should assume that selling sooner will bring a high price versus waiting.

Have you ever heard of a car buying service? These ‘car concierge’ services are growing in popularity as drivers get fed up with the car dealership hassles. CarEdge Concierge is the best way to buy a car today. We’re independent from dealerships and automotive industry groups, meaning that we’re exclusively here to serve you.

It is officially safe to declare; used car prices are finally going down. Finally, we’re seeing a clear trend emerge in used car prices. Now is the time to sell a car (as we’ve seen five weeks in a row of used car price declines and trade-in values will likely drop over the coming weeks), and patience is still required if you’re looking to buy a used car (wait a few more weeks, we expect prices to decline even more).

Thanks to data from Black Book, Cox Automotive, financial institutions, and the experiences of our community, we now have enough data to feel confident in saying that used car prices are going down, and that they will continue to fall. For car buyers, patience is more important than ever. If you’re in the market to buy a car, wait a few more weeks for a better deal.

Let’s dig into what’s happening in the market, and how you can time your sale or purchase.

In 2021 we witnessed the unthinkable; used car values appreciated more than 40%. During the first quarter of 2022, we saw used car prices drop nearly 5% on the wholesale markets. By the time spring rolled around, we experienced another increase in wholesale used car prices, canceling out those previous declines.

While the wholesale market rose and fell, retail used car prices have remained high during the first half of 2022. Consequently, the average monthly car payment is over $700.

As we settle into summer, we’ve now seen five consecutive weeks of overall market softening. For the first time since the pandemic lows of 2020, used car prices are going down across all market segments.

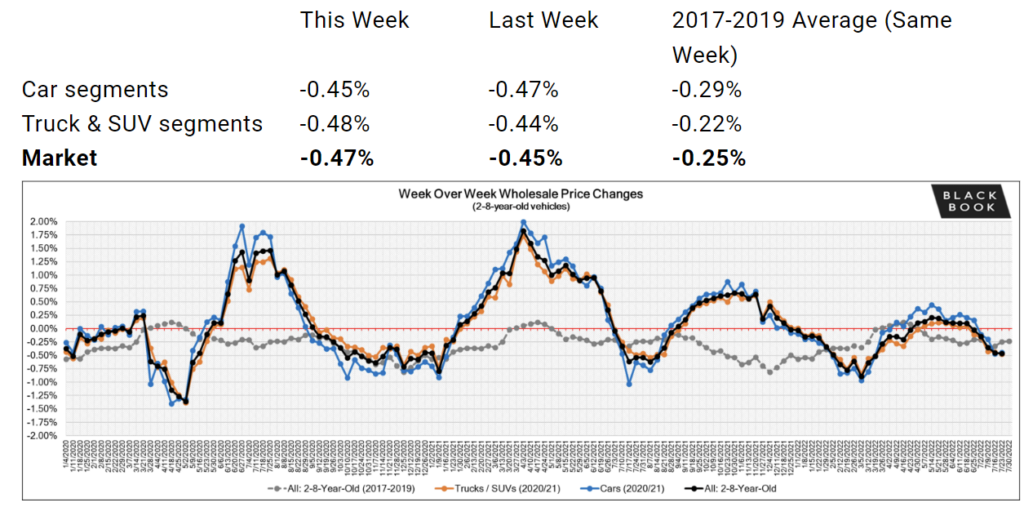

We track weekly wholesale used vehicle prices to provide you with granular market insights that will empower you to make an informed decision if you’re in the market to buy or sell. The past several weeks have brought a much-needed reprieve from month after month of record high used car prices. Notably, wholesale price declines are accelerating. Just last week, used car prices declined by -0.47%. Half of one percent may not cause alarm to some, but remember that this is across just seven days.

When we look at cumulative used car price decreases, the picture becomes more clear. These are the overall used car market price trends from the past five weeks of Black Book’s Market Pro:

-0.02% the week of June 28

-0.15% the week of July 5

-0.35% the week of July 12

-0.45% the week of July 19

-0.47% the week of July 26

That folks, is a trend. Since late June, wholesale used car prices have declined by 1.42% from all-time highs. Now that the trend is clear, our attention turns to how wholesale price declines will translate into lower used car prices for the consumer.

As we’ve heard from members of our community, used car deals can be had. Negotiating on used cars is more feasible now than before because dealers no longer have the option to simply sell a car at the auction for a profit. With wholesale prices dropping and interest rates rising, dealers are once again negotiating on used car prices.

Consumers can leverage this information (plus the likely increase in used car supply thanks to repossessions, and rising interest rates increasing dealer costs) to negotiate a more fair used car deal. Deal School 2.0 is a great free resource if you’re thinking about buying a used car anytime soon and want to save time and money.

Sadly, we don’t expect retail used car prices to plummet tomorrow. There remains a severe shortage of new cars as automakers continue to grapple with the semiconductor chip shortage, the lingering effects of international COVID shutdowns, and now the war in Ukraine. Still, there’s some good news if you’re looking to buy, and a new sense of urgency if you’re considering selling.

Used car prices are going down on wholesale markets, and now we’re anticipating a decline at the retail level. However, patience will be key. Buyers who are able to wait 60 to 90 days are very likely to save money versus buying today. It would not be out of the question to see used car prices decline 5% to 10% in just a few month’s time. This is because retail prices lag wholesale prices, plus there are a few other factors (covered below) that are impacting our forecast.

The past 18 months have been the exception to the rule. Normally, vehicles are depreciating assets. They lose value over time, and that keeps used car prices more affordable. We think days are numbered for ‘car flippers’ who buy and sell for a profit weeks or months later. Used car prices are on an accelerating downward trend, and this means that your car is likely to be worth less one month into the future.

Trade-in values are going to decline, too. Dealers have been shelling out surplus cash for trade-ins over the past year. More often than not, when you trade in a vehicle, the dealer will sell it at auction. We’re seeing wholesale auction prices decline in real time, therefore dealers will be trying to stay ahead of the downward trend by offering sellers less for their trade-in.

If you’re considering selling a vehicle, our advice would be to sell it as soon as possible. Those who wait are very likely to sell for substantially less given the current market trends.

America’s $1.3 TRILLION in auto loan debt is on the minds of financial institutions. They are aware that they just spent the past year and a half financing vehicles at greatly inflated prices, and that the bottom may fall out at any time. If this indeed is the bubble bursting, the looming threat of auto repossessions will make banks and credit unions very nervous.

If a consumer stops making payments and the repo man pays a visit, the bank will be left with an asset that is depreciating rapidly. Auto loan defaults are increasing, but remain below pre-pandemic levels. As of Q1 2022, about 4% of auto loans were 90 days past due. However, subprime borrowers are more likely to default according to the latest data. In March, 8.5% of subprime borrowers defaulted on their car loans, according to Equifax. We have heard from our community members that upcoming Q2 data from financial institutions will show 10%+ delinquency rates for subprime borrowers. We’re watching this closely.

As more repo vehicles make it to the retail market we expect used car prices to continue to soften.

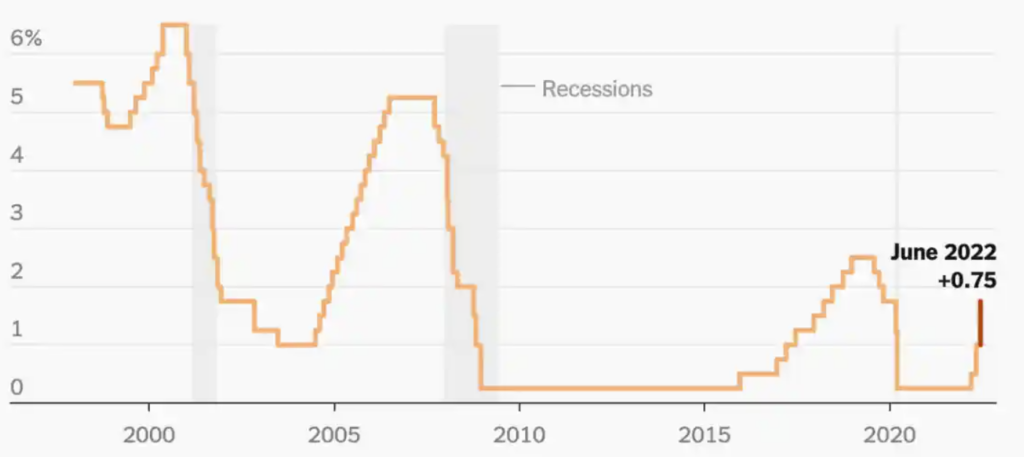

The Federal Reserve has publicly stated that it intends to continue hiking interest rates until inflation is under control. The cost of borrowing money will increase in 2022, and possibly into 2023. Car buyers in the market for higher priced vehicles will feel the effects of higher interest rates most. A 6% interest rate will result in about $6,000 in total interest paid for a $40,000 loan over 60 months, but just $2,400 for a $15,000 loan over the same term.

Just as consumers are feeling the effects of higher interest rates, dealers are too. The cost to finance dealership inventory (you read that correctly, car dealers don’t pay cash for their cars, they finance them just like you and me) is also going up.

When floorplan expenses go up, dealers are more incentivized to sell cars that have been sitting on their lot longer. This is why when you search for cars on CarEdge’s car search we show you the days on the lot. The longer a car has been sitting, the more it is costing that dealership in interest payments. As interest rates rise, dealers will be motivated to sell used cars that are sitting on their lot.

Now is the time to sell a car, and better deals are just around the corner for buyers. At the wholesale level, used car prices have dropped by 1.42% month-over-month, and price declines are accelerating. Across all segments, prices paid for used cars were down roughly half a percent in just seven days last week. We now have the confidence (backed by five weeks of data) to call this a downward trend. Sellers are more likely to get more money for their car if they sell sooner rather than later.

We haven’t seen the effects of declining wholesale prices on retail car prices yet, but we will soon. Retail prices won’t fall off an immediate cliff, but declines will be gradual. For those who can wait two to three months, used car prices are very likely going down, and better deals will finally make it to the sales floor.

What have you seen in your area? Share a comment with us below!