CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

It goes without saying that there are many different sources you can use to buy a used car. From Carvana, to CarMax, to the dealer down the street, used cars are everywhere, but one often forgotten source of used cars are rental vehicles. Should you buy a rental car, and if you do, what do you need to know beforehand?

We’ll explore those topics (and more) below. Please bear in mind that I have never worked for a rental car company before. I have, however, spent 43 years in the retail automotive industry having sold hundreds of millions of dollars in new and used cars over my career.

It comes as little surprise that rental car companies sell portions of their fleet annually. The rental car business (especially pre-pandemic) was a fierce business that required rental car companies to primarily cater to business travelers (with the exception of economy rental car companies). This meant that companies like Hertz, Avis, and Enterprise needed to find competitive advantages that would sway business travellers to rent their cars instead of someone else’s.

This competition led to the practice of rental car companies cycling their fleet every two to three years. Customers would always be in a relatively “new” model year vehicle, and the rental company could also sell the car near the end of the manufacturer’s warranty period. This was a win-win for rental companies, and it also supports the fleet sales operations of major automotive manufacturers.

From a consumer perspective, it can be hard at first glance to know if you are inquiring about a rental car or not. Knowing if you should buy a rental car first means you need to confirm if a used car was previously titled as one!

There are two ways you can confirm if a vehicles you’re interested in is a rental car:

I highly recommend you review the CarFax (not the AutoCheck) of the vehicle to confirm it was a previous rental car.

Now, if you’re purchasing the vehicle directly from a rental car company (Hertz Auto Sales, for example), then you don’t have to worry if you’re dealing with a rental car or not — obviously you are!

As with any used car purchase, there are a few general “rules of thumb” you should follow. When you’re thinking about buying a rental car in particular there are two things you should “look out for” during your due diligence.

If you’re buying directly from a rental car sales department, ask for the vehicle’s service record. This record will show you every single service and maintenance the vehicle has undertaken, and there is no acceptable reason why the seller should not share this information with you.

If you are buying from a dealership that purchased the rental vehicle at auction, then they may not have the full service history of the vehicle. If that’s the case, then you need to ask for …

If you’re buying from a dealer that bought the vehicle from auction, then you’ll want to ask for documentation about what reconditioning they did on the vehicle and all applicable repair orders they filed. Dealers will typically be thrilled to show you this information, because it helps “seal the deal,” and the truth is, it certainly can help.

In order to sell a used vehicle (rental or not), a dealer must ensure that the vehicle passes state inspection. State inspections vary from state to state, however some requirements are the same across the board (ie tread depth on the tires, brake pads, etc.)

With this in mind, if you are able to review the reconditioning purchase orders and repair orders for the vehicle, you’ll have some immediate insight into what you are potentially getting yourself into.

Generally speaking, yes. Rental cars have a stigma attached to them, and because of that they have a lower selling price than other (comparable) vehicles. As an example, this includes service loaners (essentially rental cars that the dealer uses for customers whose cars are being serviced). A service loaner will have a higher asking price than a rental car (it should also have less miles than a rental car), and this is because there is less of a stigma associated with service loaners than there is with rental cars.

If you’re thinking about buying a car, you might enjoy this article: How Much Do Dealers Markup Used Cars?

It’s important to recognize that rental cars will always have a lower resale value because of this stigma. The cheaper deal you are getting by buying a used rental car means that if you go to sell it in a few years it will be worth less than a comparable vehicle with the same amount of miles that was not a rental car.

As long as you understand this upfront, you should be a-okay.

As you can see, there are a lot of factors to consider when contemplating if you should buy a rental car. I would highly recommend you consider rental cars if they fit into your budget, but be sure to secure a pre purchase inspection of any used vehicle you consider buying (unless it is certified pre-owned).

I’ve bought service loaners in the past, but never a rental car. If the CarFax looks good, the dealership can show you the repair orders, and the price is fair, I think buying a rental car can make a lot of sense for you.

There are so many moving pieces involved in a car deal, the price of the car, the taxes, the fees, what about your trade-in? The list goes on and on. Knowing what you can negotiate when buying a car is easier said than done.

Fortunately for you, after spending 43 years in the car business, I know the items you can (and can’t) negotiate when buying a car. This list is long, but then again, like I said before, there are a lot of moving pieces in a car deal!

Let’s jump in.

No! The Manufacturer’s Suggested Retail Price (MSRP) is not negotiable. This is the factory’s recommended selling price for a vehicle. The actual selling price (as discussed below) is negotiable, but the MSRP, the suggested value the manufacturer sets for their vehicle, is not negotiable.

No! The destination charge is not negotiable, it is a component of the MSRP. The manufacturer charges the dealership a fee (that you will see on the monroney label), and this fee is non negotiable.

Sometimes, but most likely not. If a dealer needs to dealer trade to get the vehicle you want to purchase, odds are they are going to charge you an additional fee for the transport of that vehicle. In some cases they won’t (if it’s local), but if the transport is substantial, don’t be surprised if the dealer adds a charge to your buyer’s order. That being said, is this negotiable? You can try, but nine times out of ten, the dealer will stick with the fee.

Yes, absolutely! The selling price is entirely negotiable, and you should read some of our guides on how we negotiate the best price possible on a car.

Dealers do not expect to sell most of their vehicles for MSRP, instead most expect their vehicles to sell considerably below that. Your negotiating skills will determine how low you’re able to get the dealer to go.

Yes! You can negotiate what the selling price for a lease is (known as the capitalized cost). My recommendation is to negotiate the selling price of the vehicle and then let the dealer know you want to lease instead of buy. This way you have already negotiated a fair selling price and there is less likelihood of “games” being played.

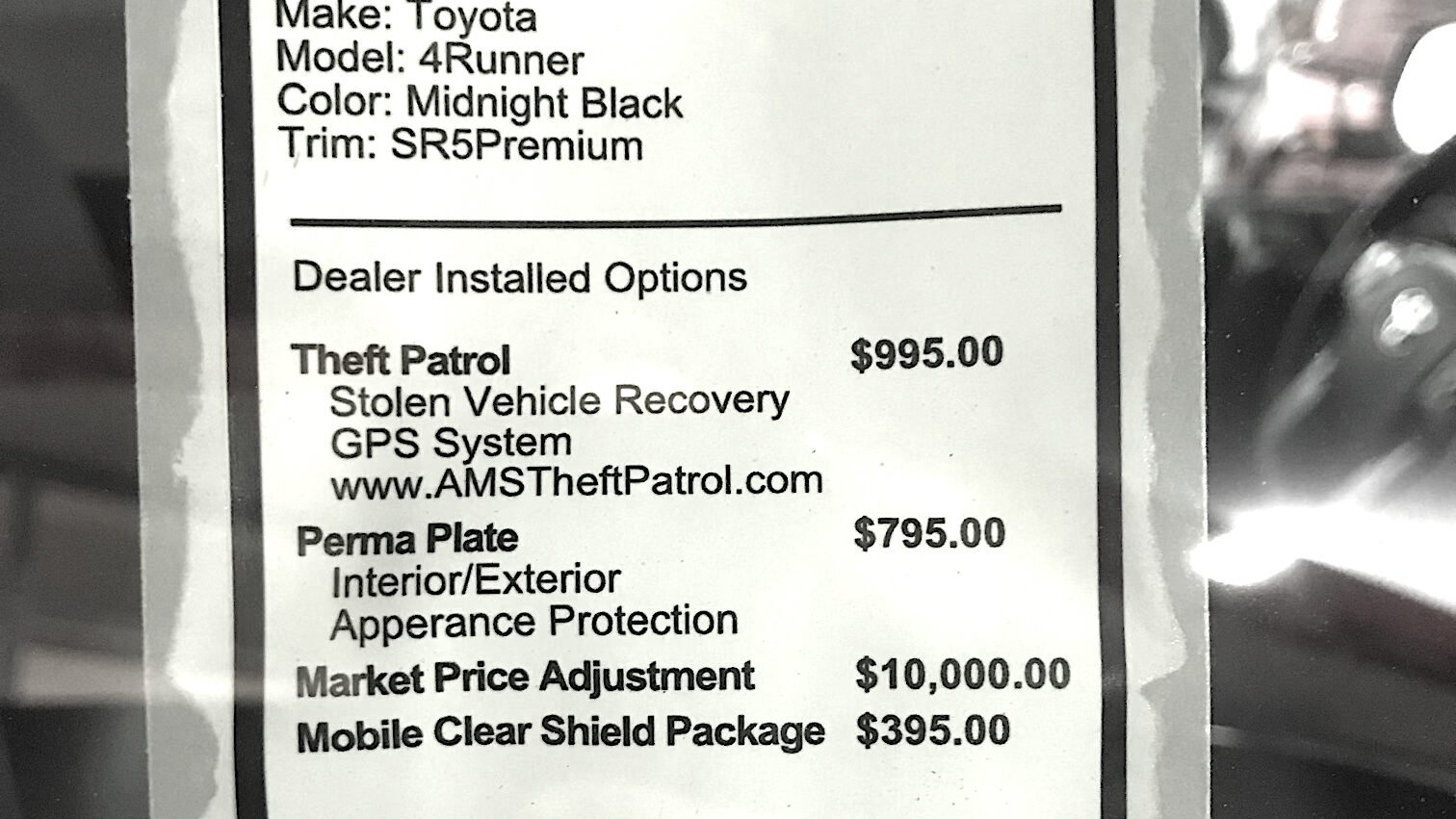

Yes! Additional dealer markup is absolutely negotiable. If a vehicle is in short supply, or in high demand, dealers may increase the selling price of a vehicle above and beyond the MSRP. When dealers do this, they are essentially selling “air.” I mean that in the sense that they are charging more for nothing, except for the scarcity of the vehicle.

ADM will be shown on an addendum sticker attached to the vehicle, and if you aren’t visiting a dealership in person, you can ask for the addendum sticker in addition to the monroney label via email. The dealer will share it with you.

Yes! Dealers install accessories on nearly all of their inventory in an effort to increase the amount of profit per vehicle. If you’ve ever had a dealer tell you, “We add LoJack to every car. Sorry, we can’t take it off yours.” That may be true (that they install it on every car), but that doesn’t mean you must pay for it. You can, and should negotiate accessories.

Dealers do not expect all of their sales to include the full selling price of each accessory. With that in mind, you can play hardball on accessories, and work to get them to discount, or remove the line items from the buyers order all together.

Yes … sort of! Doc and processing fees are negotiable in the sense that you can get the dealer to remove their value from the selling price of the vehicle, but they will not actually remove (or discount) the line item from the buyer’s order. When asking “What can you negotiate when buying a car?”, doc fees are a bit of a gray area.

It’s odd, but for legal reasons dealers will not entirely remove (or even discount) a doc or processing fee for any customer. However, sometimes you can get them to negotiate the value of the doc fee off of the selling price.

No! State and local taxes are not negotiable. Dealers can’t “mark up” these line items, and unless you know someone in your local government, you’ll be hard pressed to negotiate these!

See the best and worst states to buy a car, taxes, fees and all.

No! Title and registration fees are set by the state and are not negotiable.

No, but also maybe! I say no because in every dealership I have ever worked in, we simply charged the customer the flat fee. In theory though, a dealer could mark this up, and in that case you can consider negotiating it down. However, like I said before, I have never seen that in practice.

Yes! It’s well known in the industry that dealers add “pack” or “margin” into interest rate quotes for customers. Ask the dealer if you are getting the “buy rate.” Always be prepared to go with outside financing if the dealer doesn’t want to negotiate the rate.

Yes! Money factor (the interest rate you pay on a lease) is negotiable as well. Again, ask for the “buy rate” when talking to the dealer.

Yes! If a dealer runs your credit and it comes back at tier 3 you can try and get a “tier bump” up to tier 2. This is entirely dependent on the relationship the Finance Manager has with the lender, and how hard they want to try to get you to the next tier.

Yes! All of the products sold in the F&I office are negotiable. Extended warranties, tire and wheel protection, etc, etc. Each of these items is negotiable. If a Finance Manager shows you a price of $2,500 for an extended warranty, do not hesitate to offer less than that.

Finance Managers, just like Sales Managers, have volume incentives. That means Finance Managers may take a “short deal” to hit their monthly incentive threshold.

Like I said at the beginning of this article, answering the “What can you negotiate when buying a car?” Question is easier said than done! It’s my hope that now you feel more confident negotiating the best possible car deal with the dealer.

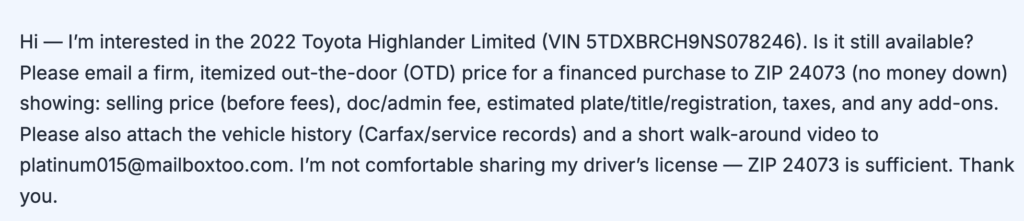

Buying a car online is more common today than ever before. As such, a lot of people ask us, “How do you negotiate a car deal over email?” Or, “How do you negotiate a car deal without going into the dealership?”

Those are two great questions, and today I thought we’d share exactly how we do it with you. Below you’ll find templates you can use for your own email outreach, and above you’ll find a video where we explain exactly what steps we take to negotiate a car deal via email, and how you can do the same.

Without further ado, let’s dive in!

The 5 Car Brands You Can Negotiate Right Now

If you’re thinking about buying a car, you might enjoy this article if you haven’t read it already: How Much Do Dealers Markup Used Cars?

Here is the initial email template we use when we negotiate a car by email.

[NAME],

Good morning,

My name is [name] and I am in the market for a car. I have been coached by Ray Shefska of CarEdge. Here is a link to their website: https://caredge.com/. This will give you a little insight into how much I understand about the process. I want nothing from your dealership other than a competitive price and an ease of doing business.

My zip code is 08054, and I am looking to purchase the following:

2023 Honda Odyssey in the Touring Trim. My preferred color is Red Scarlet Pearl but the Platinum White Pearl is also acceptable. I presently own a 2011 Accord and a 2016 Pilot, so I will qualify for Honda Owner Loyalty. I am prepared to pay cash but would entertain financing if that would offer a better out the door price. I am looking to take delivery by month end at the latest. I would move sooner if the deal warrants it.

Please provide me with your best detailed out the door price including all fees and please be competitive as I am contacting several dealers on his behalf within a 75 mile radius.

Thanks so much and I look forward to hearing back from you.

All the best,

[name]

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

Click here to calculate your out-the-door price with our free calculator!

Understanding the true cost of a car can be challenging, but the key lies in knowing the out-the-door price, which includes all additional fees and charges. To ensure you have a clear understanding of the total cost, familiarize yourself with the concept of the out-the-door price, and use our free calculator to estimate the final amount.

The out-the-door price is more than just the sticker price—it includes the vehicle’s selling price, taxes, title, registration, doc fees, and any dealer add-ons or accessories. By focusing on this comprehensive price, you can avoid unexpected charges and negotiate better deals with dealerships.

CarEdge is here to help you navigate the car buying process with ease. Check out our free out-the-door price calculator to estimate the true cost of your next vehicle purchase and ensure you’re getting the best deal possible.

Read on to learn more about what all is factored into the OTD price.

Imagine you were buying your groceries and when you went to checkout the cashier told you that the strawberries were $4, but that the container they came in was an additional $1, and there was a “grocer fee” for stocking the strawberries of an additional $.25. Your $4 strawberries just became $5.25 strawberries.

If that was reality, you’d probably be pretty frustrated with the grocery store. “Why didn’t they just advertise the price as $5.25, instead of $4.”

Welcome to the world of buying a car! Dealerships for decades have advertised prices for cars that simply aren’t true. The total cost to purchase a vehicle is its out-the-door price, and the components that make up an OTD price are as follows.

The selling price of a vehicle is the first piece to our “out-the-door” puzzle. The selling price is the amount both parties (customer and salesperson) have agreed to in order to make a transaction happen.

For example, if you see an SUV online listed for $39,900, and you contact the dealer and negotiate the price to $37,750, that would be your agreed to selling price.

This is not the total out-the-door price.

In most states (with the exception of Delaware, Montana, New Hampshire, and Oregon) your purchase will be subject to sales tax. Sales tax is calculated on the zipcode level, because in many locales there are state sales taxes and then also county sales tax. There are also some regions that charge an additional vehicle tax (Arizona, for example).

Every dealership has software that allows them to calculate what the total tax amount will be on your purchase. Ask the dealer for this amount, as it is the second component of our out-the-door price. Even if you are buying a car out of state, you can still have the dealer run your taxes for your home state, most have the software to do that.

If you’re purchasing a car in the United States, and you want to own it legally, you need it to be titled in your name. Each state charges a fee when you request a title. Although it is usually nominal (in most states just a few dollars), it is another charge you need to be aware of to calculate your total out-the-door price.

Keep in mind that our free Out-the-Door Price Estimator will tell you what your state’s title fee is. I recommend referencing that when you review what the dealership shares with you.

Another fee from your state government is the registration fee, which is a charge to register your vehicle in your name. Registration fees vary greatly from state to state, with some states charging a flat fee, and others basing their charge on the weight, age, or even horsepower that your vehicle produces.

The registration fee typically includes license plates (sometimes referred to as “tags”). There should not be a separate “tag” fee in most states.

A dealer fee that is never disclosed until you ask for the out-the-door price is the documentation fee. This fee is a pure profit center for dealers, but one you’ll be hard pressed to get them to remove.

Doc fees are not mandatory, but all dealers charge them. In many states they are capped. In California, the doc fee is capped at $80, but in Florida, doc fees can be over $1,000. Each dealer sets their own doc fee amount, and it is a major contributor to your total OTD price.

Be sure to check your state’s doc fee here.

Frustratingly, many dealers add accessories to their inventory and then try and sell those to their customers. If you’ve ever had a dealer tell you “we tinted the windows, so that’ll be $995,” you’ve experienced this.

These may not be included in the price you initially negotiated, but they absolutely will be in the out-the-door price.

Now that you know what makes up the OTD price, it’s important to understand how to effectively use it.

When you negotiate the price on any car deal it is important to ask the dealer for the OTD price. Many dealers will list their lowest price so that they show up on the first page of websites like CarGurus and Autotrader, but then they’ll surprise you with massive doc fees and other accessories.

A dealership that shows up as a “bad deal” on CarGurus might actually have the better OTD price, and for that reason it’s always of the utmost importance that you focus your negotiating efforts on the out-the-door number and nothing else, since the internet price is really BS.

I wish I was kidding, but this is the sad reality of the industry, the price simply isn’t the price.

Purchasing a vehicle often includes a critical, yet confusing step: signing the vehicle purchase agreement. This document outlines your purchase price, fees, financing details, trade-in terms, taxes, and more. Dealerships review these contracts daily, but most car buyers only encounter them once every few years. That’s why understanding every line item is essential.

In this guide, we’ll explain each section of the contract—from the Truth-in-Lending disclosures to your trade-in certification and warranty disclaimers—so you can sign with confidence and avoid surprises.

The first thing you will see on your new car purchase contract will be information required by the federal Truth-in-Lending Act – or “TILA” for short. This information will not be present on your contract if you are not financing your purchase.

There are four key pieces of information that must be included in the Truth-in-Lending Disclosure:

By law the dealership must review each of these four components of your purchase with you. Savvy finance managers will circle the boxes on the contract with the back of their pen so that it leaves a mark on the carbon copy of the contract as “proof” that they reviewed the document with the client.

Below this you will find details about your payment schedule. At this stage in the process, nothing should be foreign here; this should show the agreed-to loan financing option you selected.

Below that, you’ll notice a few disclaimers. One of importance is the prepayment notice. If you pay off your loan early you will not be subject to any penalty. Always keep this in mind when you are financing a vehicle purchase.

Next comes a list of all components of the contract broken out in an itemized fashion. This section of the contract is intended to make it clear to you what you are purchasing and how much you are financing to make the purchase. For many people this section of the contract gets confusing, but it doesn’t have to be. Let’s break it down line by line.

The first item you see in the itemized section of the contract is the cash price, also referred to as the selling price of the vehicle. This amount, plus the doc fee total the entire cash price or selling price of your purchase.

The down payment section refers to any money you put down on the purchase. If you are trading in a vehicle this will include (like the example above does) a trade in allowance, payoff, and net trade in. If you owe more than your current car is worth, you will see a negative value on line 2C. If you were to put cash down for your purchase that would show on line D, and if you have any incentives or rebates that go towards your down payment those would show on line E.

This is simply the cash price minus the down payment amount.

As it sounds, this section refers to any fees being paid to other parties on your behalf. In the example above you see “N/A” everywhere. That means the customer did not roll their taxes, title, and registration into the loan for their purchase. Instead, they paid those fees out of pocket when they went to register the car in their name. This section will typically be full of numbers that vary from state to state (since each state has different sales tax, title fees, and registration fees). If specific insurance coverages were purchased (which very few people purchase nowadays), and they were rolled into your loan, you would see those amounts in lines E, F, and G. The same goes for lines H through P.

The total amount financed is the sum of section 3 and section 4. The unpaid cash balance, plus the amount paid to others on your behalf.

Believe it or not, everything we’ve reviewed thus far is actually not the vehicle purchase agreement, it is the retail contract required for finance purchases. If you aren’t financing your vehicle purchase you won’t be reviewing a document like the one above. Instead you’ll see something similar to what we’re about to cover, the real purchase agreement.

The purchase agreement restates everything on the retail contract (just on slightly different parts of the page) and includes a few other important items, two worth calling out specifically:

This section of the vehicle purchase agreement only comes into play if you are trading a vehicle in during your purchase. When you sign the contract you certify that:

If any of these conditions are not met, or you do not disclose them to the dealer, they can void the transaction. As with all situations, honesty is the best policy, so be sure to tell the truth before signing the dotted line!

The final section to make you aware of on the vehicle purchase agreement is the warranty disclaimer and doc fee notice.

The warranty disclaimer makes it clear that the purchase is being made “as-is,” with no additional warranties (from the dealer). As the disclaimer states, any warranties from the manufacturer are not “party” to the dealer, and you can leverage them anywhere the manufacturer supports, not just the dealership where you are making your purchase.

Then, below that is the documentary fee notice. This states the reason why you see a “doc fee” on the purchase of your vehicle. Doc fees vary from state to state, and as we’ve written about before, you’ll never be able to get a dealer to remove a doc fee from their contract, but you can get them to discount a vehicle the amount of the fee.

Remember, always ask questions when you’re not sure about something. If there is something that you don’t understand, seek clarification. Never sign a document if you are not 100% sure what you are signing.

Q: What is included in the Truth-in-Lending disclosure?

A: The disclosure must detail the Annual Percentage Rate (APR), total finance charge, amount financed, and total of payments. By law, dealers must review these figures with you before you sign.

Q: Are doc fees negotiable?

A: Doc fees vary by state and are often non-negotiable. But you can negotiate the vehicle price down by the amount of the doc fee to keep overall cost neutral.

Q: What does “as-is” mean in the warranty disclaimer?

A: “As-is” indicates the dealer is not providing any additional warranty. Only manufacturer warranties apply. For added protection, you can purchase aftermarket warranties, but they’re not required.

Q: What should I check in the trade-in certification?

A: Verify statements about your trade-in’s title status (non-salvage), emissions system, airbag functionality, and odometer accuracy. Incorrect certifications can void the sale.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

CarEdge is a trusted resource for car buyers, offering data-backed insights, negotiation tools, and expert guidance to help consumers save time and money. Since 2019, CarEdge has helped hundreds of thousands of drivers navigate the car-buying process with confidence. Learn more at CarEdge.com.