CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

2023 Update: Major revisions to the EV tax credit were signed into law as part of the Inflation Reduction Act of 2022.

Here’s what you need to know about the latest EV tax credit revision proposal:

As you can see, the EV tax credit is becoming a lot more complicated.

All 755 pages of the Inflation Reduction Act can be read here. The EV tax credit begins on page 381.

The EV tax credit update is not all good news. Several popular electric models would be kicked out of the tax credit until assembly, battery production and raw materials sourcing happens in North America.

These are electric vehicles that would not qualify for the tax credit under the proposed revision:

Official eligibility is a moving target it seems. We recommend checking the latest updates directly from the U.S. government at fueleconomy.gov for a list of eligible vehicles.

But don’t forget about state incentives…

See the states with the BEST EV incentives, from sales tax exemptions to generous rebates!

In 2023, current EV tax credits are nonrefundable, meaning the best you can get from the current EV tax credit is cancelling out other federal income taxes you owe, with no refund beyond that. The revised electric vehicle tax credits will become refundable beginning in 2024, meaning you could potentially get money back from the government for simply buying an EV.

Thinking about buying an extended warranty? Get a free quote from CarEdge first!

Let’s break down the proposed 2022 EV tax credits. Don’t forget to check out the best state-level EV incentives too.

The Build Back Better Act would have increased the maximum electric vehicle tax credit to $12,500, however it was defeated in Congress. The BBB EV tax credit provisions controversially included an additional $4,500 incentive for EVs assembled at unionized plants.

The original EV tax credit in place from 2009 to August 2022 took away the incentive once an automaker sold 200,000 EVs or PHEVs. For this reason, Tesla and GM had lost eligibility, but are now getting it back (as long as vehicles remain under the price caps).

The new clean vehicle credit establishes the following income caps based on adjusted gross income (AGI):

Great news for Model Y buyers, but bad news for fans of the IONIQ 5, EV6 and several other foreign-made electric cars. The Inflation Reduction Act’s Clean Vehicle Credit returns incentives to some, and takes incentives away from others.

See the FULL list of qualifying electric vehicles here.

This page will update as we learn more about proposed updates to EV tax credits in 2022.

Carvana (allegedly) sold someone a stolen truck. Yes, you read that correctly. A viral video on TikTok from a woman named Erin Stitt depicts the saga her and her boyfriend went through buying a 2018 Chevy Silverado Midnight Edition from Carvana, only to be stopped by six police cars and have the truck they just bought towed away.

Here’s what we know, and what you need to be aware of before you buy a car from Carvana, Vrooom, or any car dealer.

Let’s dive in.

Erin’s story is an unfortunate case of VIN cloning. This is where thieves steal a car (or in this case a truck) and cover up the vehicle’s VIN plates with a different VIN number. Criminals do this to obfuscate the true identity of the vehicle.

The procedure involves replacing the serial plate of a stolen or salvage repaired vehicle with a plate containing the number of a validly registered vehicle of similar make, model and year from another state, province or country.

VIN cloning is more rampant than you would have thought. For example, there was one case from Tampa, Florida, where the FBI found more than 1,000 cloned cars were sold across 20 different states. The most unfortunate aspect of this is that the purchaser is still be responsible for any outstanding loans, even though they didn’t realize they purchased a “cloned” car.

Erin posed this question in her TikTok video, “How did a stolen truck pass state inspection?” That’s a great question, however it’s not too difficult to understand once you dig into the state inspection requirements for many of the 50 states. Most don’t require a VIN inspection, and heck, even if they do, there’s a good chance the inspector will not notice the fake VIN plates.

More on state inspection requirements can be found here: https://insurify.com/blog/car-insurance/state-vehicle-inspection/

What steps can you take as a car buyer to avoid being in Erin’s situation? There are a few things you can do:

VIN cloning is common (sadly), and another form of deception that criminals use from time to time is called title washing. We have an entire article on title washing that I encourage you to read here: https://caredge.com/guides/title-washing/

Used and new car prices are climbing through the roof, and the rapidly increasing “destination charge” could be the culprit. The increase in destination charges, also known as “shipping” or “freight” charges has increased so rapidly that three class action lawsuits are currently being litigated.

Here’s how much major automakers have increased their destination charges since 2017.

| 2021 Model year avg. | Change from 2017 model year | |

| BMW | $973 | –17% |

| Ford | $1,393 | 29% |

| GM | $1,242 | 21% |

| Honda | $1,204 | 23% |

| Hyundai/Kia | $1,104 | 23% |

| Mercedes-Benz | $1,097 | 18% |

| Nissan | $1,236 | 24% |

| Porsche | $1,350 | 29% |

| Stellantis | $1,573 | 16% |

| Subaru | $996 | 18% |

| Tata | $1,195 | 20% |

| Tesla | $1,200 | 5.9% |

| Toyota | $1,127 | 15% |

| Volkswagen | $1,207 | –0.3% |

| Industry average | $1,220 | 12% |

The destination charge, also sometimes portrayed online as a shipping fee, are hidden from online advertised prices, however every buyer pays for them. Heck, even the dealership where you buy the car pays a destination fee, they simply pass that along to the end buyer.

The destination charge is a line item on the manufacturer’s invoice for a vehicle. It is a fee that the automaker sets. There is a retail price for it, and a wholesale price for it. The dealer pays a wholesale price, the consumer pays a retail price. In many cases the price is actually the same.

Destination charges are set by the manufacturer and are non-negotiable, since they are part of the vehicle’s MSRP. The manufacturer’s suggested retail price is non-negotiable (it is set by the manufacturer), however you can (and should!) negotiate your total out-the-door price (which includes a hopefully discounted selling price).

It is well known in the automotive industry that manufactures make a profit on their destination charges. Currently there are 3 active class action lawsuits against GM, Ford, and Stellantis for “deceptive” delivery fees.

From the GM lawsuit:

The lawsuit, filed in the Southern District of California, involves two plaintiffs who allege they were not aware that GM made a profit off of the destination fees it charges customers. According to Car Complaints, the plaintiffs are California resident Robert Romoff, who recently purchased a new 2021 Chevrolet Equinox with a $1,195 destination charge, and New Jersey resident Joe Siciliano, who purchased a new 2019 Cadillac Escalade with a $995 destination charge.

Stellantis, formerly Fiat Chrysler has increased their destination charges the most. Consumer Reports found Stellantis’ destination charges increased an average of 90 percent for Chrysler, Dodge and Jeep from 2011 to 2020, and 74 percent for Ram over the same period. And, even though no one buys them, Stellantis increased Fiat’s destination charge by 114 percent since 2012.

Surprising to many is the fact that domestically produced vehicles are also getting hit with VERY high destination charges. Take for example the new Jeep Grand Wagoneer which is built in Michigan. It comes with a $2,000+ destination charge.

What’s frustrating about the increase in destination fees is that it is yet another “black box” in the car buying process. Not only do we (consumers) have to deal with BS and bogus fees from the dealership, we also have to simply “accept” theses hidden profit fees from the manufacturers.

Updated April 2022

Automakers are in a pickle: delay production of cars because of a lack of chips, or produce cars, trucks, and SUVs missing some features customers have come to expect? It’s fascinating to see how different automakers are handling this once in a lifetime supply chain conundrum!

Ford, for example, just announced that they will ship and sell vehicles without chips controlling non-safety critical features. Yes, you read that right. It’s 2022, and Ford is getting even more desperate for semiconductors. It’s doubtful that there are any optimists left with regards to the auto industry supply shortage.

Ford isn’t the only manufacturer that is struggling to produce vehicles with all of their standard equipment. Let’s break down who is doing what, and which features consumers should and shouldn’t expect in their new car.

In March 2022, Ford told dealers that the chip shortage is getting worse, and that they’re going to need dealer’s help to sort things out. Automotive News reports that Ford executives told dealers that the automaker will have to enact a worst-case scenario plan that was floated last summer. Ford’s plan is to ship new vehicles to dealers without many of the semiconductor chips that are essential for features like auto stop-start, heated seats, and certain infotainment functions.

Ford spokesman Said Deep told Automotive News Ford would build Explorers without rear seat heat controls that could be added later. Ford already offers customers the option to order F-150s without the auto stop-start feature. Deep told Automotive News that in the case of the Explorers, buyers will receive a price reduction for the change, and Ford will restore rear seat passenger control of heating and air conditioning for free at a later date.

On the hunt for the elusive Ford Bronco? Thousands were recently seen waiting for parts outside of a production plant in Michigan. Patience and compromise will go a long way for car shoppers in 2022.

General Motors has seemingly been hit the hardest by the ongoing chip shortage. While the company tries to move forward, many core features and functionalities have been removed from their lineup.

General Motors made headlines late on Friday, November 12th when they announced that beginning on Monday, November 15th they would stop production of most of their vehicles with heated and ventilated seats, as well as heated steering wheels.

The effected vehicles include:

General Motors has not signaled when the vehicles would be produced with their previously expected equipment. GM has said that effected customers will be eligible for a $150 to $500 credit.

Earlier this year, GM removed climate control digital temperature displays, side blind zone alert and Super Cruise driver-assist technology on certain 2022 vehicles. Fortunately, now those features are available.

Update 11/22/21

On Friday November 19th, in a memo to their dealers, GM announced that they will reduce the credit given to customers who do not receive vehicles with heated seats. Instead of a credit up to $500, GM will credit customers up to $50. Correct, $50 for losing heated seats in their car. That’s crazy.

GM also instructed dealers that they think they will be able to retrofit vehicles with heated and ventilated seats by mid-2022. GM told dealers that heated steering wheels cannot be retrofitted, so vehicles missing that feature will still be discounted by $150.

Earlier in 2021, GM said it would eliminate the HD radio option because of a lack of semiconductors. Both 2021 Chevrolet Silverado 1500s and GMC Sierra 1500s, as well as 2022 model year 2500 and 3500 heavy-duty pickups were impacted. All trim levels were affected, and GM is offering buyers of a $50 credit.

Also earlier this year, GM announced that wireless charging pads would not make it into many of its vehicles. The 2021 Chevy Tahoe, Suburban, and GMC Yukon SUVs as well as the 2022 Buick Enclave, Chevy Traverse, and Cadillac XT5 and XT6 were all impacted by this decision.

Vehicles for sale without the charging pad will get a $75 credit.

Two core features that help make GM trucks more fuel efficient have gone missing: auto stop-start, and cylinder deactivation. In June, GM said the 2021 Silverado 1500 and the GMC Sierra 1500 would not come with stop-start technology. Customers who miss out on this feature are entitled to another $50 credit.

Even earlier this year, GM announced that some 2021 Chevy Silverado and GMC Sierra models would use more gas because they would not have their cylinder-deactivation systems. The impact? The trucks would increase their fuel usage by one mile per gallon.

A brand new BMW X7 SUV has an MSRP of upwards of $100,000. At that price, you’d expect to get any feature or option you could possibly imagine. Buy a new car in 2021 and you’ll notice a piece of equipment nearly as ubiquitous as the seatbelt, however in your new $100,000 X7 you won’t have it; a touchscreen.

The effected vehicles include:

BMWs that were also ordered with the Parking Assistant package will now lose BMW’s Backup Assistant technology.

Earlier this Spring, Porsche told its U.S. dealers that their 18-way adjustable seat option (part of a $2,090 upgrade) would not be available. It appears that today the option is back for the Macan.

Another feature temporarily missing from some new Porsches is the electric steering column adjustment. Earlier this month, Porsche spokesperson Christian Weiss said that Porsche has been in communication with customers who have ordered cars with this feature, and said it will deliver vehicles with a manual steering column adjustment for the time being. Once available, the electric version will be retrofitted.

Even thought hey have raised their MSRP by 20%+ in 2021, Tesla has not been immune from chip shortage challenges. Earlier this year in May, Tesla removed lumbar support from the front passenger seat in the Model 3 and Model Y EVs.

Recently, another feature was silently deleted, USB-C ports in the rear of the center console of the Model 3 and Model Y.

Used car prices have ben skyrocketing for the past year. With new car production unable to keep up with demand, we have seen wholesale and retail used car prices set all-time highs. Frequently we are seeing used cars sell for more than their original MSRP.

Interestingly, with new vehicles being sold without all of their standard features, we wouldn’t be surprised if there is even more upward pressure on newer model year used vehicles. Would a consumer pay a premium for a used 2020 or 2021 that has all of the functionality they’ve come to expect, or wait for a factory order that may or may not have the features they expect? We think consumer demand for new user vehicles will continue to drive used car prices up.

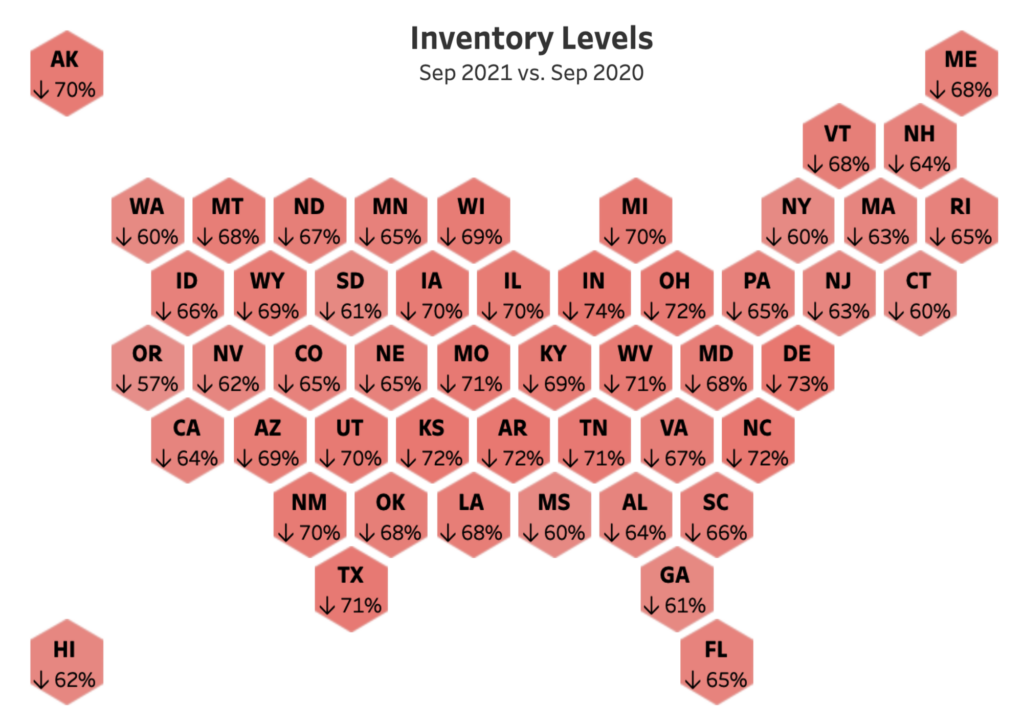

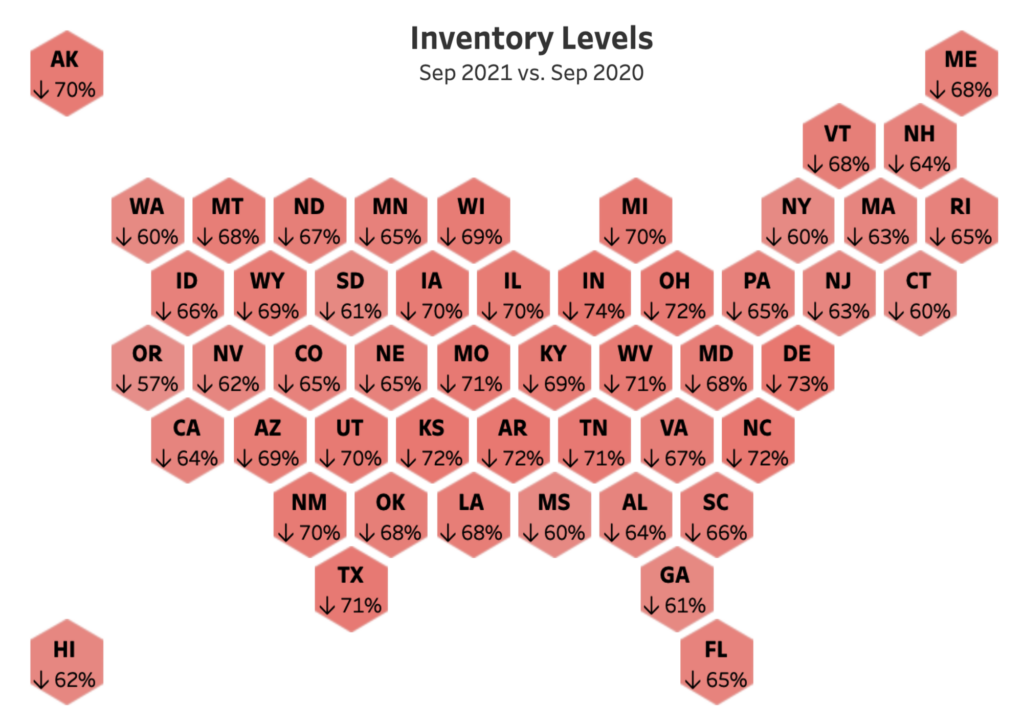

If you’re looking to buy a new car anytime soon, you’re in for a rude awakening … Finding a new car for sale right now in the United States is borderline impossible. Typically, manufacturers stock their dealers with a nearly 100 day supply of inventory. Right now, the industry is running at an 18 days supply. That being said, the total number of new cars in inventory ticked up 1.3% this month as compared to last.

To view last month’s new car inventory data, click here.

Each month we capture new data on industry-wide new car inventory levels. We have compiled the most up-to-date information here for you. Click below to jump to a particular manufacturer. Please note that we are not able to get vehicle specific inventory data for many of the manufacturers. This is something we hope to be able to provide in the near future.

You can access all of the data here: https://docs.google.com/spreadsheets/d/1sDB4ybm8F6VQotMS-HyjWv9n5IdQjTF6mbw8RwbbYXo/edit?usp=sharing

Days supply: Number of days needed to sell all vehicles in inventory, based on the previous month’s daily selling rate

Inventory: Unit count of vehicles on hand at dealerships, factory lots, ports of entry and in transit on a specific date

Based on days supply, here are the top ten vehicles with the most inventory:

| Inventory Units (November) | Inventory Units (October) | Inventory Change | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change | |

| EcoSport | 6,900 | 6,500 | 400 | 133 | 90 | 43 |

| Fusion | 100 | 100 | 0 | 82 | 60 | 22 |

| Mustang Mach-E | 5,600 | 5,000 | 600 | 53 | 79 | -26 |

| Mustang | 5,900 | 6,000 | -100 | 52 | 55 | -3 |

| Edge | 16,900 | 12,800 | 4,100 | 49 | 47 | 2 |

| Genesis car | 3,500 | 4,100 | -600 | 49 | 68 | -19 |

| E-series van | 7,300 | 7,400 | -100 | 48 | 57 | -9 |

| ILX | 400 | 100 | 300 | 46 | 5 | 41 |

| Bronco Sport | 15,400 | 12,600 | 2,800 | 45 | 27 | 18 |

| Nautilus/MKX | 4,100 | 3,500 | 600 | 45 | 33 | 12 |

Based on solely the number of units available, here are the top ten vehicles with the most inventory:

| Inventory Units (November) | Inventory Units (October) | Inventory Change | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change | |

| F series | 95,000 | 94,200 | 800 | 38 | 37 | 1 |

| Toyota trk | 73,100 | 66,600 | 6,500 | 21 | 18 | 3 |

| Explorer | 24,700 | 23,400 | 1,300 | 32 | 29 | 3 |

| Toyota car | 22,200 | 16,600 | 5,600 | 20 | 11 | 9 |

| Edge | 16,900 | 12,800 | 4,100 | 49 | 47 | 2 |

| Bronco Sport | 15,400 | 12,600 | 2,800 | 45 | 27 | 18 |

| Kia trk | 15,000 | 19,000 | -4,000 | 15 | 17 | -2 |

| Escape | 14,800 | 14,500 | 300 | 30 | 32 | -2 |

| Hyundai trk | 13,700 | 15,000 | -1,300 | 10 | 11 | -1 |

| HR-V | 13,400 | 13,900 | -500 | 31 | 28 | 3 |

You can check the current inventory levels of a particular vehicle in your market by running a free market price report in your CarEdge account.

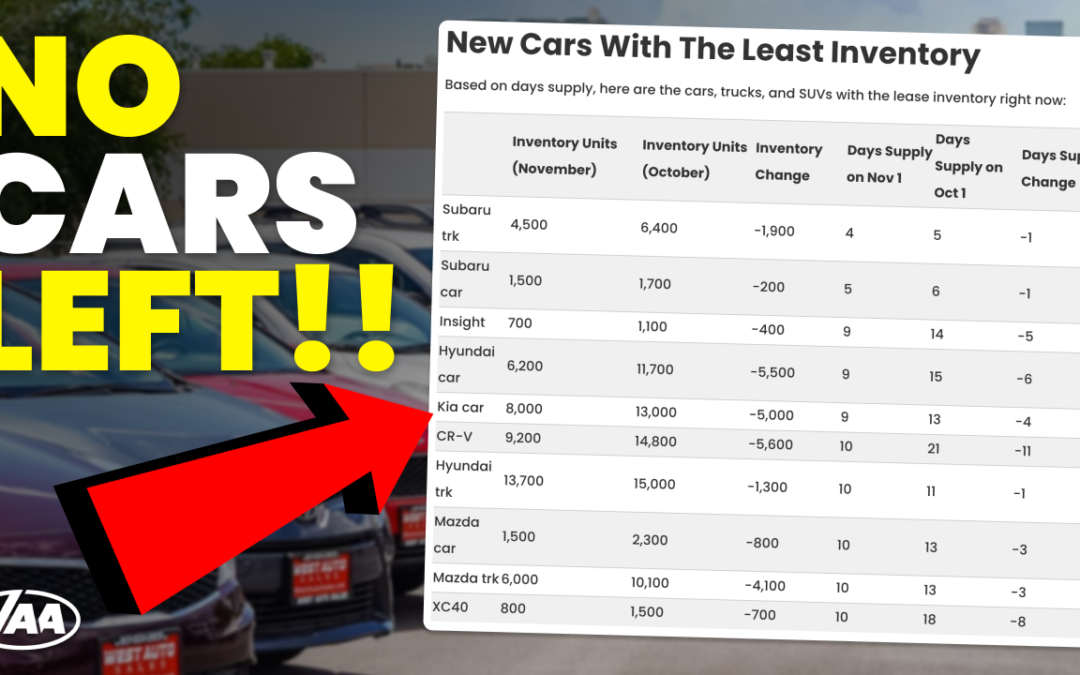

See your local inventory levelsBased on days supply, here are the cars, trucks, and SUVs with the lease inventory right now:

| Inventory Units (November) | Inventory Units (October) | Inventory Change | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change | |

| Subaru trk | 4,500 | 6,400 | -1,900 | 4 | 5 | -1 |

| Subaru car | 1,500 | 1,700 | -200 | 5 | 6 | -1 |

| Insight | 700 | 1,100 | -400 | 9 | 14 | -5 |

| Hyundai car | 6,200 | 11,700 | -5,500 | 9 | 15 | -6 |

| Kia car | 8,000 | 13,000 | -5,000 | 9 | 13 | -4 |

| CR-V | 9,200 | 14,800 | -5,600 | 10 | 21 | -11 |

| Hyundai trk | 13,700 | 15,000 | -1,300 | 10 | 11 | -1 |

| Mazda car | 1,500 | 2,300 | -800 | 10 | 13 | -3 |

| Mazda trk | 6,000 | 10,100 | -4,100 | 10 | 13 | -3 |

| XC40 | 800 | 1,500 | -700 | 10 | 18 | -8 |

Based on the total number of available units, here are the cars with the least inventory:

| Inventory Units (November) | Inventory Units (October) | Inventory Change | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change | |

| Fusion | 100 | 100 | 0 | 82 | 60 | 22 |

| Clarity | 100 | 200 | -100 | 35 | 49 | -14 |

| 90 series | 100 | 100 | 0 | 42 | 34 | 8 |

| ILX | 400 | 100 | 300 | 46 | 5 | 41 |

| Insight | 700 | 1,100 | -400 | 9 | 14 | -5 |

| XC40 | 800 | 1,500 | -700 | 10 | 18 | -8 |

| Navigator | 1,300 | 1,400 | -100 | 29 | 29 | 0 |

| Odyssey | 1,300 | 2,400 | -1,100 | 13 | 11 | 2 |

| TLX | 1,400 | 2,000 | -600 | 27 | 26 | 1 |

| Mazda car | 1,500 | 2,300 | -800 | 10 | 13 | -3 |

These are the vehicles with the lowest days supply of inventory right now. Don’t expect to get a “deal” on any of these vehicles, because the dealership knows they have very little inventory.

Learn more about the chip shortage. Read: The How We Ran out of Cars in the US

| Inventory Units (November) | Inventory Units (October) | Inventory Change | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change | |

| Fusion | 100 | 100 | 0 | 82 | 60 | 22 |

| Mustang | 5,900 | 6,000 | -100 | 52 | 55 | -3 |

| Bronco | 6,200 | 5,000 | 1,200 | 23 | 37 | -14 |

| Bronco Sport | 15,400 | 12,600 | 2,800 | 45 | 27 | 18 |

| E-series van | 7,300 | 7,400 | -100 | 48 | 57 | -9 |

| EcoSport | 6,900 | 6,500 | 400 | 133 | 90 | 43 |

| Edge | 16,900 | 12,800 | 4,100 | 49 | 47 | 2 |

| Escape | 14,800 | 14,500 | 300 | 30 | 32 | -2 |

| Expedition | 6,900 | 7,900 | -1,000 | 33 | 34 | -1 |

| Explorer | 24,700 | 23,400 | 1,300 | 32 | 29 | 3 |

| F series | 95,000 | 94,200 | 800 | 38 | 37 | 1 |

| Maverick | 2,700 | 3,900 | -1,200 | 18 | 193 | -175 |

| Mustang Mach-E | 5,600 | 5,000 | 600 | 53 | 79 | -26 |

| Ranger | 10,500 | 10,100 | 400 | 39 | 49 | -10 |

| Transit | 9,300 | 11,900 | -2,600 | 32 | 30 | 2 |

| Transit Connect | 2,200 | 1,500 | 700 | 41 | 98 | -57 |

| Continental | – | 100 | 179 | -179 | ||

| Aviator | 1,800 | 1,800 | 0 | 23 | 26 | -3 |

| Corsair/MKC | 2,200 | 2,500 | -300 | 23 | 31 | -8 |

| Nautilus/MKX | 4,100 | 3,500 | 600 | 45 | 33 | 12 |

| Navigator | 1,300 | 1,400 | -100 | 29 | 29 | 0 |

| FORD MOTOR CO | 239,800 | 232,100 | 7,700 | 37 | 37 | 0 |

Ford invoice pricing can be found here: https://caredge.com/guides/ford-invoice-price/

| Inventory Units (November) | Inventory Units (October) | Inventory Change | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change | |

| ILX | 400 | 100 | 300 | 46 | 5 | 41 |

| NSX | – | 16 | 10 | 6 | ||

| RLX | – | 45 | 67 | -22 | ||

| TLX | 1,400 | 2,000 | -600 | 27 | 26 | 1 |

| MDX | 1,900 | 1,100 | 800 | 16 | 13 | 3 |

| RDX | 3,600 | 4,000 | -400 | 18 | 21 | -3 |

| Total Acura | 7,300 | 7,200 | 100 | 19 | 19 | 0 |

| Inventory Units (November) | Inventory Units (October) | Inventory Change | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change | |

| Accord | 9,500 | 6,900 | 2,600 | 17 | 14 | 3 |

| Total Civic | 6,800 | 8,200 | -1,400 | 14 | 13 | 1 |

| Clarity | 100 | 200 | -100 | 35 | 49 | -14 |

| Fit | – | – | ||||

| Insight | 700 | 1,100 | -400 | 9 | 14 | -5 |

| CR-V | 9,200 | 14,800 | -5,600 | 10 | 21 | -11 |

| HR-V | 13,400 | 13,900 | -500 | 31 | 28 | 3 |

| Odyssey | 1,300 | 2,400 | -1,100 | 13 | 11 | 2 |

| Passport | 2,400 | 4,500 | -2,100 | 17 | 19 | -2 |

| Pilot | 6,900 | 11,100 | -4,200 | 20 | 23 | -3 |

| Ridgeline | 3,300 | 2,700 | 600 | 27 | 25 | 2 |

| Total Honda | 60,900 | 65,800 | -4,900 | 17 | 19 | -2 |

| Inventory Units (November) | Inventory Units (October) | Inventory Change | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change | |

| Genesis car | 3,500 | 4,100 | -600 | 49 | 68 | -19 |

| Genesis trk | 3,000 | 3,700 | -700 | 24 | 28 | -4 |

| Total Genesis | 6,500 | 7,800 | -1,300 | 33 | 40 | -7 |

| Inventory Units (November) | Inventory Units (October) | Inventory Change | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change | |

| Hyundai car | 6,200 | 11,700 | -5,500 | 9 | 15 | -6 |

| Hyundai trk | 13,700 | 15,000 | -1,300 | 10 | 11 | -1 |

| Total Hyundai | 19,900 | 26,700 | -6,800 | 11 | 12 | -1 |

| Inventory Units (November) | Inventory Units (October) | Inventory Change | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change | |

| Kia car | 8,000 | 13,000 | -5,000 | 9 | 13 | -4 |

| Kia trk | 15,000 | 19,000 | -4,000 | 15 | 17 | -2 |

| Total Kia Motors | 23,000 | 32,000 | -9,000 | 12 | 15 | -3 |

| Inventory Units (November) | Inventory Units (October) | Inventory Change | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change | |

| Mazda car | 1,500 | 2,300 | -800 | 10 | 13 | -3 |

| Mazda trk | 6,000 | 10,100 | -4,100 | 10 | 13 | -3 |

| MAZDA NA | 7,500 | 12,400 | -4,900 | 10 | 13 | -3 |

| Inventory Units (November) | Inventory Units (October) | Inventory Change | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change | |

| Subaru car | 1,500 | 1,700 | -200 | 5 | 6 | -1 |

| Subaru trk | 4,500 | 6,400 | -1,900 | 4 | 5 | -1 |

| SUBARU OF AMERICA | 6,000 | 8,100 | -2,100 | 4 | 5 | -1 |

| Inventory Units (November) | Inventory Units (October) | Inventory Change | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change | |

| Lexus car | 4,700 | 5,900 | -1,200 | 29 | 29 | 0 |

| Lexus trk | 12,800 | 19,000 | -6,200 | 19 | 27 | -8 |

| Total Lexus | 17,500 | 24,900 | -7,400 | 21 | 27 | -6 |

| Inventory Units (November) | Inventory Units (October) | Inventory Change | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change | |

| Toyota car | 22,200 | 16,600 | 5,600 | 20 | 11 | 9 |

| Toyota trk | 73,100 | 66,600 | 6,500 | 21 | 18 | 3 |

| Total Toyota | 112,800 | 83,200 | 29,600 | 21 | 18 | 3 |

| Inventory Units (November) | Inventory Units (October) | Inventory Change | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change | |

| 60 series | 1,700 | 1,600 | 100 | 44 | 37 | 7 |

| 90 series | 100 | 100 | 0 | 42 | 34 | 8 |

| XC40 | 800 | 1,500 | -700 | 10 | 18 | -8 |

| XC60 | 4,100 | 4,200 | -100 | 37 | 33 | 4 |

| XC90 | 2,000 | 2,700 | -700 | 21 | 23 | -2 |

| VOLVO CAR USA | 8,700 | 10,100 | -1,400 | 27 | 27 | 0 |

| Inventory Units (November) | Inventory Units (October) | Inventory Change | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change | |

| Fusion | 100 | 100 | 0 | 82 | 60 | 22 |

| Mustang | 5,900 | 6,000 | -100 | 52 | 55 | -3 |

| Bronco | 6,200 | 5,000 | 1,200 | 23 | 37 | -14 |

| Bronco Sport | 15,400 | 12,600 | 2,800 | 45 | 27 | 18 |

| E-series van | 7,300 | 7,400 | -100 | 48 | 57 | -9 |

| EcoSport | 6,900 | 6,500 | 400 | 133 | 90 | 43 |

| Edge | 16,900 | 12,800 | 4,100 | 49 | 47 | 2 |

| Escape | 14,800 | 14,500 | 300 | 30 | 32 | -2 |

| Expedition | 6,900 | 7,900 | -1,000 | 33 | 34 | -1 |

| Explorer | 24,700 | 23,400 | 1,300 | 32 | 29 | 3 |

| F series | 95,000 | 94,200 | 800 | 38 | 37 | 1 |

| Maverick | 2,700 | 3,900 | -1,200 | 18 | 193 | -175 |

| Mustang Mach-E | 5,600 | 5,000 | 600 | 53 | 79 | -26 |

| Ranger | 10,500 | 10,100 | 400 | 39 | 49 | -10 |

| Transit | 9,300 | 11,900 | -2,600 | 32 | 30 | 2 |

| Transit Connect | 2,200 | 1,500 | 700 | 41 | 98 | -57 |

| Continental | – | 100 | 179 | -179 | ||

| Aviator | 1,800 | 1,800 | 0 | 23 | 26 | -3 |

| Corsair/MKC | 2,200 | 2,500 | -300 | 23 | 31 | -8 |

| Nautilus/MKX | 4,100 | 3,500 | 600 | 45 | 33 | 12 |

| Navigator | 1,300 | 1,400 | -100 | 29 | 29 | 0 |

| FORD MOTOR CO | 239,800 | 232,100 | 7,700 | 37 | 37 | 0 |

| ILX | 400 | 100 | 300 | 46 | 5 | 41 |

| NSX | – | 16 | 10 | 6 | ||

| RLX | – | 45 | 67 | -22 | ||

| TLX | 1,400 | 2,000 | -600 | 27 | 26 | 1 |

| MDX | 1,900 | 1,100 | 800 | 16 | 13 | 3 |

| RDX | 3,600 | 4,000 | -400 | 18 | 21 | -3 |

| Total Acura | 7300 | 7,200 | 100 | 19 | 19 | 0 |

| Accord | 9,500 | 6,900 | 2,600 | 17 | 14 | 3 |

| Total Civic | 6,800 | 8,200 | -1,400 | 14 | 13 | 1 |

| Clarity | 100 | 200 | -100 | 35 | 49 | -14 |

| Fit | – | – | ||||

| Insight | 700 | 1,100 | -400 | 9 | 14 | -5 |

| CR-V | 9,200 | 14,800 | -5,600 | 10 | 21 | -11 |

| HR-V | 13,400 | 13,900 | -500 | 31 | 28 | 3 |

| Odyssey | 1,300 | 2,400 | -1,100 | 13 | 11 | 2 |

| Passport | 2,400 | 4,500 | -2,100 | 17 | 19 | -2 |

| Pilot | 6,900 | 11,100 | -4,200 | 20 | 23 | -3 |

| Ridgeline | 3,300 | 2,700 | 600 | 27 | 25 | 2 |

| Total Honda | 60,900 | 65,800 | -4,900 | 17 | 19 | -2 |

| Genesis car | 3,500 | 4,100 | -600 | 49 | 68 | -19 |

| Genesis trk | 3,000 | 3,700 | -700 | 24 | 28 | -4 |

| Total Genesis | 6,500 | 7,800 | -1,300 | 33 | 40 | -7 |

| Hyundai car | 6,200 | 11,700 | -5,500 | 9 | 15 | -6 |

| Hyundai trk | 13,700 | 15,000 | -1,300 | 10 | 11 | -1 |

| Total Hyundai | 19,900 | 26,700 | -6,800 | 11 | 12 | -1 |

| Kia car | 8,000 | 13,000 | -5,000 | 9 | 13 | -4 |

| Kia trk | 15,000 | 19,000 | -4,000 | 15 | 17 | -2 |

| Total Kia Motors | 23,000 | 32,000 | -9,000 | 12 | 15 | -3 |

| Mazda car | 1,500 | 2,300 | -800 | 10 | 13 | -3 |

| Mazda trk | 6,000 | 10,100 | -4,100 | 10 | 13 | -3 |

| MAZDA NA | 7,500 | 12,400 | -4,900 | 10 | 13 | -3 |

| Subaru car | 1,500 | 1,700 | -200 | 5 | 6 | -1 |

| Subaru trk | 4,500 | 6,400 | -1,900 | 4 | 5 | -1 |

| SUBARU OF AMERICA | 6,000 | 8,100 | -2,100 | 4 | 5 | -1 |

| Lexus car | 4,700 | 5,900 | -1,200 | 29 | 29 | 0 |

| Lexus trk | 12,800 | 19,000 | -6,200 | 19 | 27 | -8 |

| Total Lexus | 17,500 | 24,900 | -7,400 | 21 | 27 | -6 |

| Toyota car | 22,200 | 16,600 | 5,600 | 20 | 11 | 9 |

| Toyota trk | 73,100 | 66,600 | 6,500 | 21 | 18 | 3 |

| Total Toyota | 112,800 | 83,200 | 29,600 | 21 | 18 | 3 |

| 60 series | 1,700 | 1,600 | 100 | 44 | 37 | 7 |

| 90 series | 100 | 100 | 0 | 42 | 34 | 8 |

| XC40 | 800 | 1,500 | -700 | 10 | 18 | -8 |

| XC60 | 4,100 | 4,200 | -100 | 37 | 33 | 4 |

| XC90 | 2,000 | 2,700 | -700 | 21 | 23 | -2 |

| VOLVO CAR USA | 8,700 | 10,100 | -1,400 | 27 | 27 | 0 |

| TOTAL | 490,000 | 483,600 | 6,400 | 18 | 20 | -2 |