CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Used car prices have increased more than 50% in 2021. Historically, used cars decrease in value. You know the old saying about buying a new car? “The moment you drive off the lot, it’s worth 20% less.” Well, in today’s crazy market, the moment you drive a new car off the dealer’s lot it might actually be worth 20% more!

The ongoing chip shortage and undersupply of new vehicles is driving used car prices higher. Rental car companies, car dealers, and consumer demand are keeping prices elevated. Until new car inventories rebound to pre-pandemic levels, we’ll see elevated used car pricing.

With more and more consumers not returning their leases, fewer quality used cars are making it to the market. If your lease is coming due, please do not just return it to the dealer, instead, sell it for a profit. You would be leaving money on the table!

Each month we update you on the latest trends in used car prices. Last month’s data can be found here: https://caredge.com/guides/used-car-prices-november-2021/

We also track new car prices and inventory levels. Our hope is that we can help you make an informed decision when it comes time to purchase your next vehicle.

This page will be updated weekly with new data from Black Book, Cox Automotive, and other sources.

If you have specific questions about used car prices please ask them on the CarEdge Community Forum.

To get the Black Book value of your vehicle you can do that here: https://app.CarEdgemember.com/trade-in

Let’s dive in.

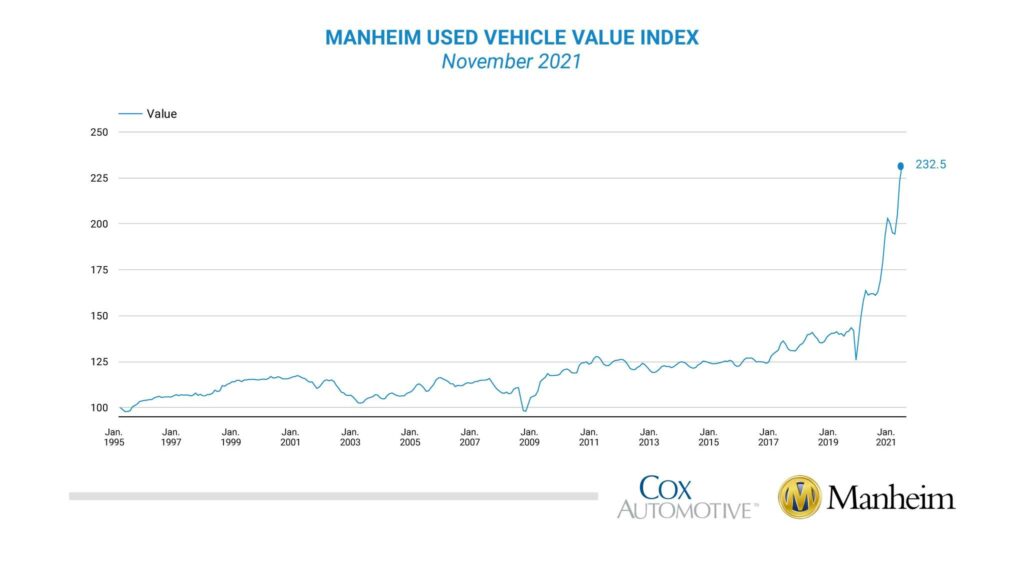

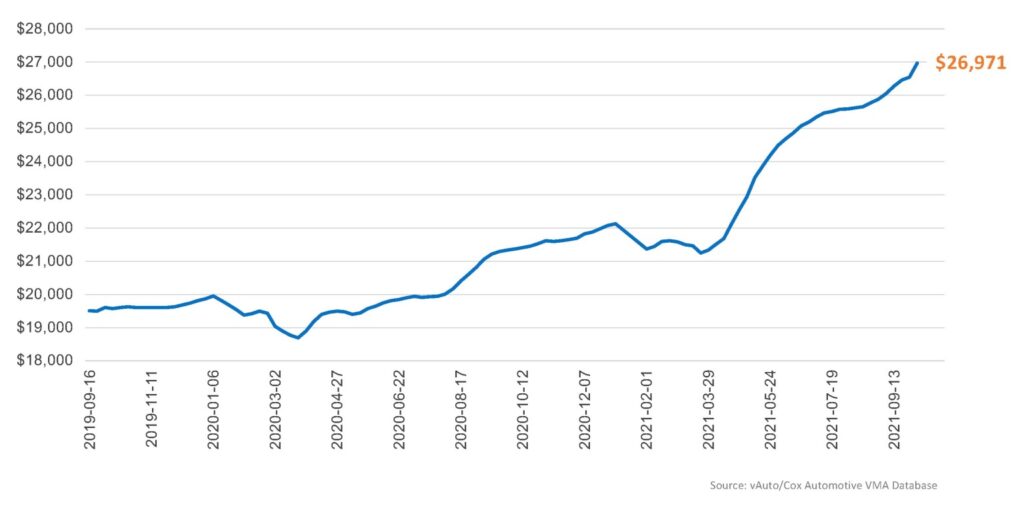

Wholesale used car price increases show no signs of slowing down. The latest data from Manheim and Black Book show wholesale and retail used car prices hitting all-time record highs. Manheim’s used vehicle value index chart paints and eery picture; the data almost looks fake.

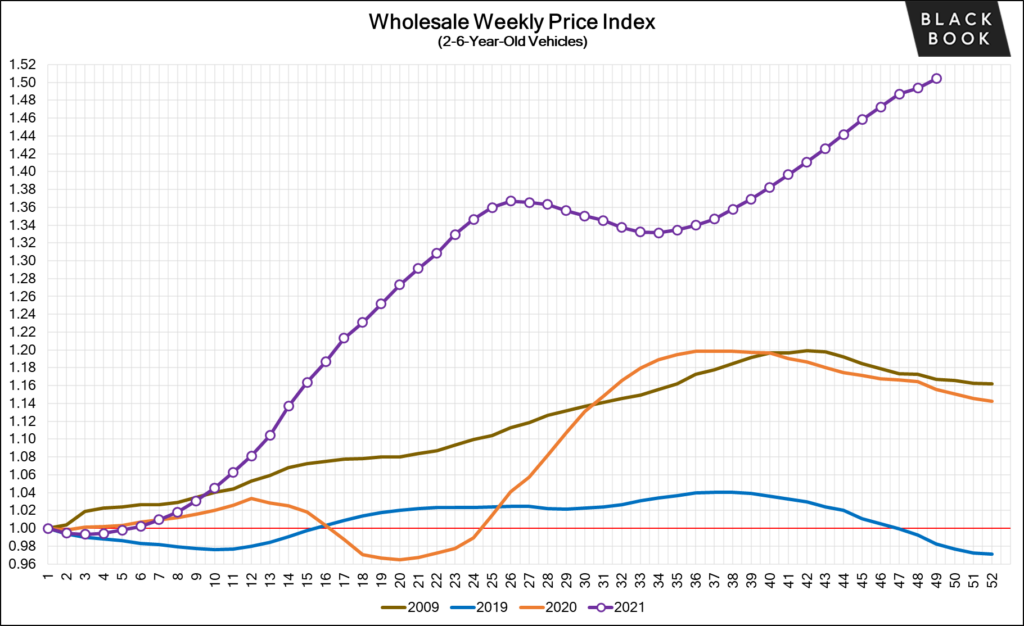

Data from Black Book suggests that wholesale used car prices have increased more than 50% since the beginning of this year. The purple line shows 2021 used car price changes. The blue line represents 2019. The differences are stunning.

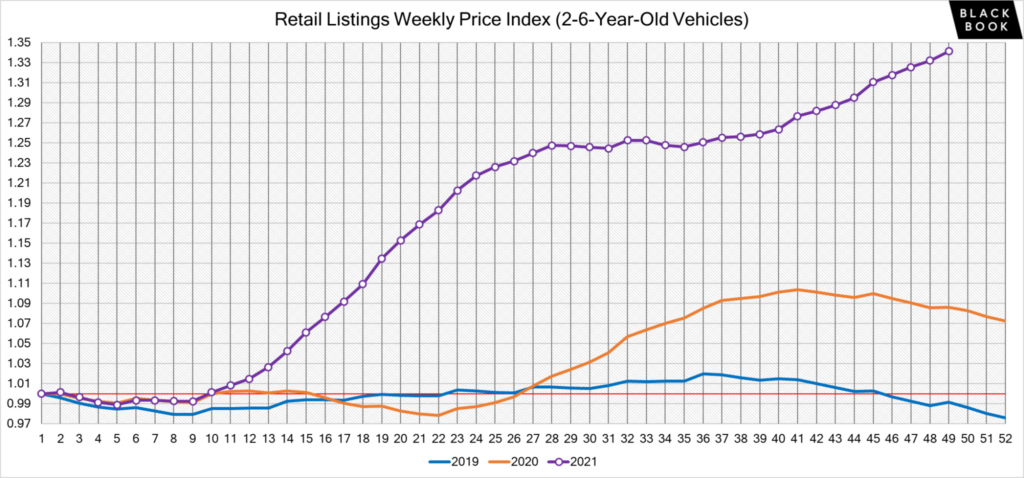

Wholesale prices are not the only ones going up. Used car retail prices are also hitting all-time highs. Black Book data shows retail used car prices have increased nearly 35% since the beginning of the year. Traditionally the end of the calendar year is when used car prices decrease. That is not the case right now.

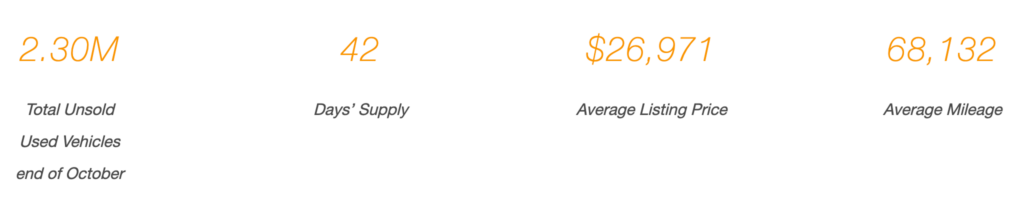

One positive indication in the data comes from Cox Automotive. They reported that inventory levels in October were up 20,000 units from September. September ended with 2.28 million used vehicles in inventory, while October ended with 2.30 million. October’s supply was still about 8% lower than 2020.

Cox also estimates that the days supply of used car inventory is at 42. Their data suggests that about 1.65 million used vehicles were sold in October 2021, up 40,000 units from the 1.61 million sold in September. October sales ran about 7% below the same year-ago period.

Both Cox and Black Book show retail used car prices hitting all-time highs. Cox has the average listing price for used vehicles at a new record of $26,971. That’s a $400 increase from September ($26,548).

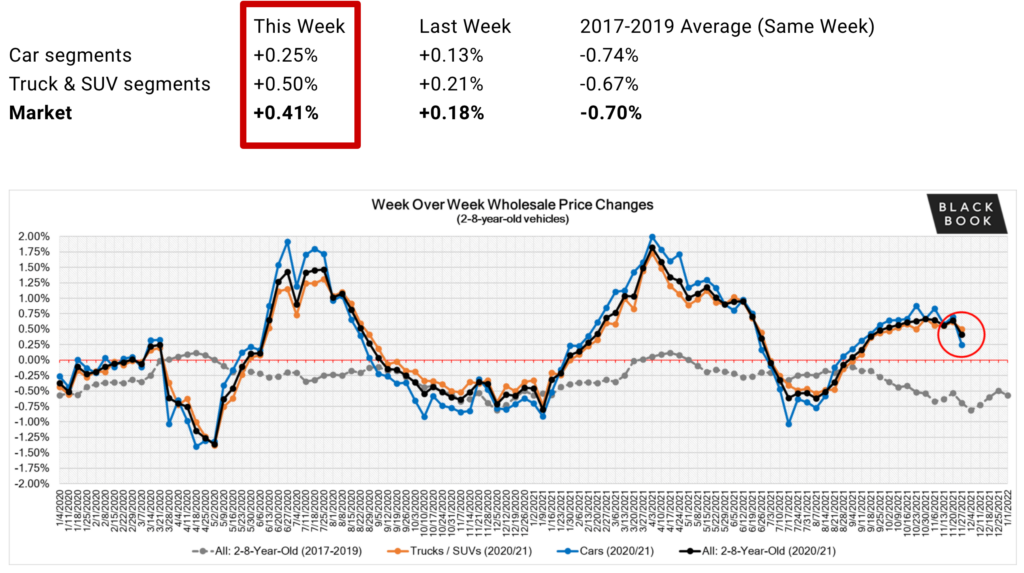

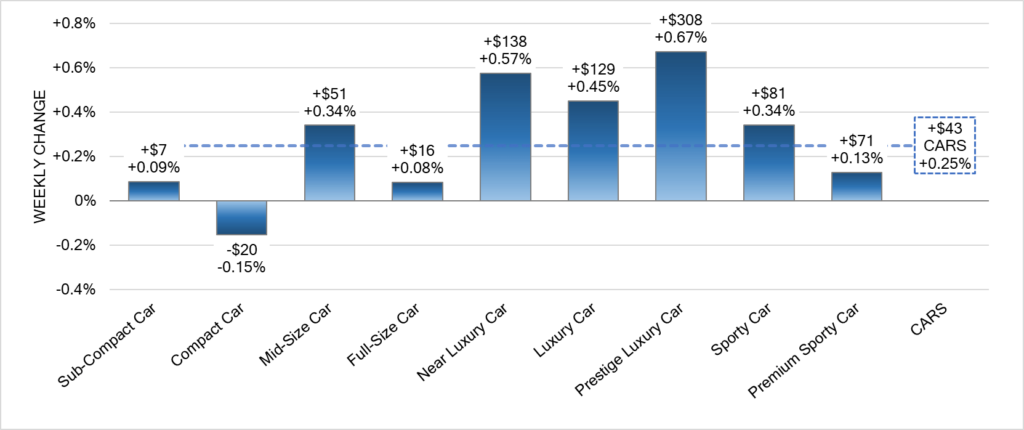

Week-over-week Black Books has reported another increase in wholesale used car, truck, and SUV prices. The latest weekly increase was .41%. The price increase among trucks, SUVs, and vans was greater than car price increases.

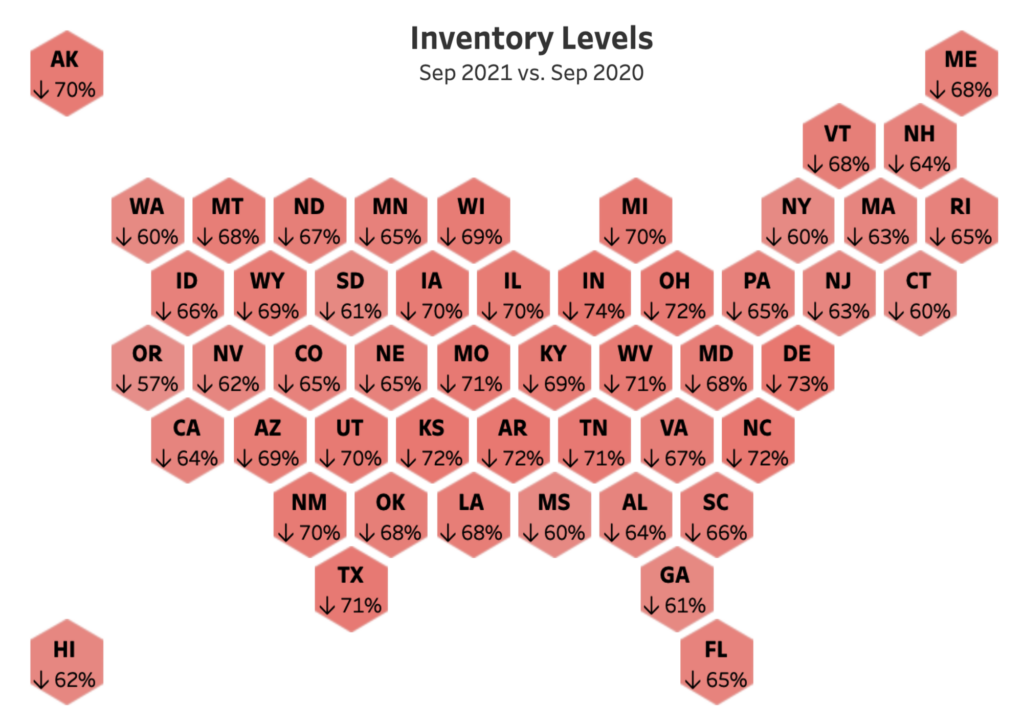

Used car prices will continue to appreciate as long as automakers are struggling to produce enough new vehicles. We track new car inventory levels monthly. The latest new car inventory data for December is not promising.

That being said, many manufactures, including Toyota have signaled that the worst of the chip shortage is behind them. Other manufacturers, such as General Motors, are removing core features from their new vehicles in an effort to ship them to their dealers.

It’s unclear whether we’re “on the other side” of the chip shortage yet, and our expectation is that used car prices will continue to rise until it is more clear that the new car shortage is alleviated.

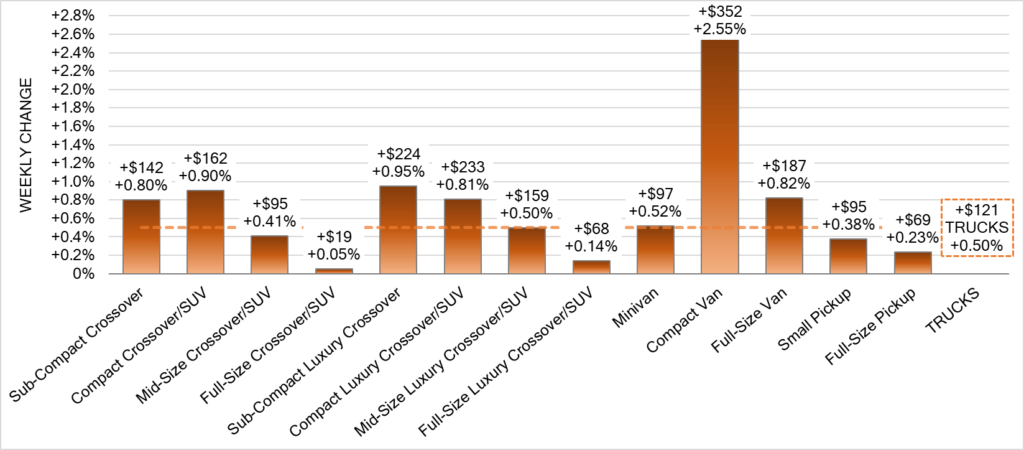

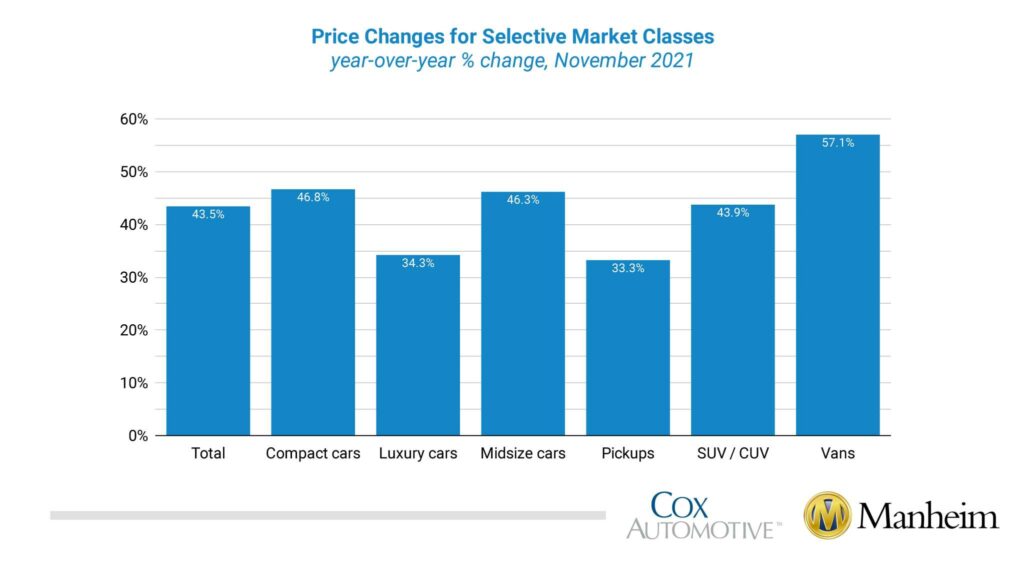

Not all used cars are appreciating equally. Used trucks, SUVs, and especially vans are increasing at rapid (and unbelievable) rates. Look at the data provided by Manheim and Black Book below.

Black Book data shows that just last week used compact van prices increased over 2.5%. That’s UNHEARD of. These are your Ford Transit Connects, Mercedes-Benz Metris, Ram ProMaster City, and Nissan NV200.

Compact and sub-compact crossovers increased nearly 1% week-over-week.

As you can see, the data from Manheim also shows vans leading the way in terms of price increase.

Certain used cars are increasing in value more rapidly than others. For example near luxury cars (think your Genesis and Acuras) are increasing rapidly week-over-week. The same goes for prestige luxury cars like your BMWs, Mercedes-Benz, and Audis.

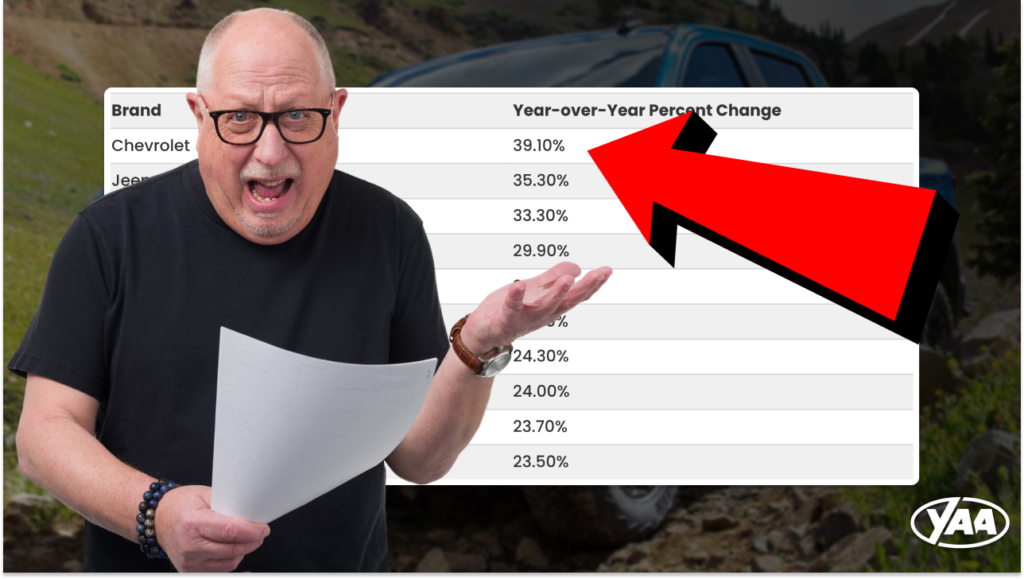

We recently published data on which brands have seen their new and used prices increase the most (and least) year-over-year: https://caredge.com/guides/which-brands-prices-have-increased-the-most-least-in-2021/

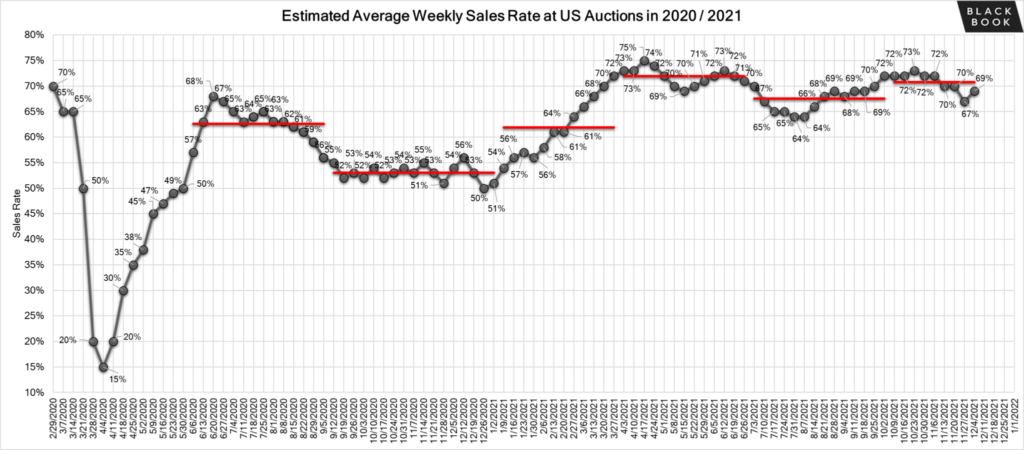

Black Book provides “sales rate” data from the wholesale used car auctions.

Directly from Black Book:

The weekly estimated average sales rate has remained stable at the 70% mark for the 2nd week in a row. This time last year, the estimated average weekly sales rate was around 51%, so while floor prices continue to rise, buyers continue to purchase vehicles at auction at a higher rate.

Typically the holiday season signals an increase in newer used vehicles. This is because of lease returns and rental vehicles coming to the auction. This year that is not happening to previously expected levels. While there was a slight uptick in newer model year vehicles rolling across the lane this past week, a significant portion of vehicles are arriving damaged.

Franchise car dealers are grounding lease returns and not sending them to auction. Fierce competition at the auctions can be mostly attributed to large independent dealerships and rental companies. Because of inventory scarcity, we have seen bidding wars across the country. Wholesale values and floors continue to increase and give no indication of slowing down.

We’ve heard stories from our community of similar experiences at the auction, and it appears that rougher and rougher vehicles are crossing the auction block at this time.

No. From all of the data we’ve been able to get our hands on, it looks like there isn’t a single style of vehicle or particular nameplate that is not increasing in value right now. We know that certain vehicles are appreciating less than others, however all vehicles are increasing in value right now.

Luxury vehicles, and in particular luxury SUVs are appreciating much less rapidly than other vehicles. Take for example the Mercedes-Benz GLC, it has only appreciated 8% year over year. This further reinforces the theory for why the Mirage has increased in value nearly 50%; consumers need affordable and attainable used cars, not expensive and luxurious ones.

Although our crystal ball has been notoriously cloudy here at CarEdge, we feel confident in saying that used car prices will continue to increase well into 2022. Even when automakers get production back up to speed for new vehicles, there will be lingering effects from this period of time where they have not been able to produce at expected capacity.

Also, the price to produce new vehicles has gone up. As a result of the chip shortage (and other supply chain issues), we expect MSRP on new vehicles to be considerably higher than before. Why? Because the manufacturers costs are increasing, and they will likely pass that along to the consumer. As a result, the demand for used cars will continue to be high because used cars (especially vehicles like the Mitsubishi Mirage) will be the only “attainable” price point vehicles for many people.

For these reasons, we think week over week, and month over month used car price increases will continue for at least another 12 months.

If used car prices are likely going to continue to appreciate, it would make sense to hold onto your used vehicle and wait to sell it. That being said, our best recommendation is to track the value of your used vehicle weekly. To do this we encourage you to use the “value my vehicle” section of your CarEdge account. You should also get quotes from Carvana, Vroom, CarMax, etc.

There may be small fluctuations in price from week to week, but we expect the price of your vehicle to gradually increase overtime. The indicator for when to sell will be when you see week over week declines in the value of your vehicle.

Our recommendation has been, and will continue to be to stop buying cars! We’re so passionate about this that we even made a website: http://stopbuyingcars.com/

However, if you need to buy a used car right now, here’s what you need to remember.

The only way to know if you’re getting a fair deal is to get the out-the-door price from the seller and then compare that to the vehicle’s value. To get the out-the-door price follow this guide:

To know if the vehicle’s price is fair, we encourage you to run the VIN through the CarEdge vehicle valuation page and to also get a quote from Carvana to see what they would pay to buy the car right now. If the Carvana quote is close to what you are paying for the vehicle, then it’s likely a pretty fair deal.

In today’s market, with “rougher” used cars for sale it is critically important that you get a pre-purchase inspection done on the vehicle you are thinking of purchasing. We have heard too many horror stories of people buying used cars “as-is” and then getting stuck with a piece of junk. Avoid that, and get a PPI!

Last but not least, consider getting an extended warranty on your used vehicle. CarEdge partnered with AUL Corporation to sell extended warranties with a flat markup, transparent pricing, and free consultations with an Auto Advocate. If we can help you protect your use car, we want to. More on that here: https://caredge.com/extended-warranty/ and request a free quote here: https://app.CarEdgemember.com/service-contract

Each month we have been tracking new car inventory levels. Traditionally the end of the year is the best time to buy a car. This is because automakers provide large incentives to their dealers to sell as many cars as possible before the year-end. 2021 is very different.

Current new car inventory levels declined to new lows in December. With a lack of inventory, there will be no incentives or bonus programs for dealers this year. Why would there be? There are not enough cars to sell!

Below we breakdown the inventory levels of all of the major automakers we are able to source data on. You will see which cars have the highest inventory levels right now (an indicator that you may be able to negotiate the price of the car), and those that have the least inventory right now.

To view November’s new car inventory data, click here.

You can access all of the data here: https://docs.google.com/spreadsheets/d/1sDB4ybm8F6VQotMS-HyjWv9n5IdQjTF6mbw8RwbbYXo/edit?usp=sharing

Days supply: Number of days needed to sell all vehicles in inventory, based on the previous month’s daily selling rate

Inventory: Unit count of vehicles on hand at dealerships, factory lots, ports of entry and in transit on a specific date

Based on days supply, here are the top eight vehicles with the most inventory:

| Inventory Units (December) | Inventory Units (November) | Inventory Units (October) | Inventory Change (November to December) | Days Supply on Dec 1 | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change (November to December) | |

| EcoSport | 12,100 | 6,900 | 6,500 | 5,200 | 164 | 133 | 90 | 31 |

| E-series van | 6,600 | 7,300 | 7,400 | -700 | 57 | 48 | 57 | 9 |

| Fusion | 8,500 | 100 | 100 | 8,400 | 55 | 82 | 60 | -27 |

| Mustang | 8,500 | 5,900 | 6,000 | 2,600 | 54 | 52 | 55 | 2 |

| Transit | 9,700 | 9,300 | 11,900 | 400 | 51 | 32 | 30 | 19 |

| Maverick | 5,300 | 2,700 | 3,900 | 2,600 | 49 | 18 | 193 | 31 |

| 60 series | 1,600 | 1,700 | 1,600 | -100 | 42 | 44 | 37 | -2 |

| Expedition | 7,800 | 6,900 | 7,900 | 900 | 41 | 33 | 34 | 8 |

Based on solely the number of units available, here are the top ten vehicles with the most inventory:

| Inventory Units (December) | Inventory Units (November) | Inventory Units (October) | Inventory Change (November to December) | |

| Total Toyota | 97,900 | 112,800 | 83,200 | -14,900 |

| F series | 84,300 | 95,000 | 94,200 | -10,700 |

| Toyota trk | 73,000 | 73,100 | 66,600 | -100 |

| Total Honda | 66,300 | 60,900 | 65,800 | 5,400 |

| Explorer | 26,500 | 24,700 | 23,400 | 1,800 |

| Toyota car | 24,900 | 22,200 | 16,600 | 2,700 |

| Total Kia Motors | 24,000 | 23,000 | 32,000 | 1,000 |

| Total Lexus | 18,300 | 17,500 | 24,900 | 800 |

| Total Hyundai | 17,100 | 19,900 | 26,700 | -2,800 |

| Kia trk | 14,000 | 15,000 | 19,000 | -1,000 |

You can check the current inventory levels of a particular vehicle in your market by running a free market price report in your CarEdge account.

See your local inventory levelsBased on days supply, here are the cars, trucks, and SUVs with the lease inventory right now:

| Inventory Units (December) | Inventory Units (November) | Inventory Units (October) | Inventory Change (November to December) | Days Supply on Dec 1 | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change (November to December) | |

| Subaru trk | 5,700 | 4,500 | 6,400 | 1,200 | 5 | 4 | 5 | 1 |

| SUBARU OF AMERICA | 7,400 | 6,000 | 8,100 | 1,400 | 5 | 4 | 5 | 1 |

| Subaru car | 1,700 | 1,500 | 1,700 | 200 | 6 | 5 | 6 | 1 |

| Mazda trk | 4,800 | 6,000 | 10,100 | -1,200 | 7 | 10 | 13 | -3 |

| MAZDA NA | 6,000 | 7,500 | 12,400 | -1,500 | 7 | 10 | 13 | -3 |

| Insight | 200 | 700 | 1,100 | -500 | 8 | 9 | 14 | -1 |

| Hyundai car | 3,900 | 6,200 | 11,700 | -2,300 | 9 | 9 | 15 | 0 |

| Hyundai trk | 13,200 | 13,700 | 15,000 | -500 | 9 | 10 | 11 | -1 |

| Total Hyundai | 17,100 | 19,900 | 26,700 | -2,800 | 9 | 11 | 12 | -2 |

| Mazda car | 1,200 | 1,500 | 2,300 | -300 | 9 | 10 | 13 | -1 |

While Subaru’s days supply of inventory increased (from 4 units to 5) this month, they still have an incredibly limited number of vehicles on dealer’s lots. Mazda’s day supply decreased considerably from 10 to 7 this month as well.

Based on the total number of available units, here are the cars with the least inventory:

| Inventory Units (December) | Inventory Units (November) | Inventory Units (October) | Inventory Change (November to December) | |

| Clarity | 100 | 100 | 200 | 0 |

| 90 series | 100 | 100 | 100 | 0 |

| Insight | 200 | 700 | 1,100 | -500 |

| XC40 | 600 | 800 | 1,500 | -200 |

| TLX | 800 | 1,400 | 2,000 | -600 |

| Navigator | 1,000 | 1,300 | 1,400 | -300 |

| ILX | 1000 | 400 | 100 | 600 |

| Mazda car | 1,200 | 1,500 | 2,300 | -300 |

| Aviator | 1,600 | 1,800 | 1,800 | -200 |

| 60 series | 1,600 | 1,700 | 1,600 | -100 |

These are the vehicles with the lowest days supply of inventory right now, which means you shouldn’t expect to get a “deal” on any of these cars. The dealership knows they have very limited inventory and they likely won’t be getting new cars from the manufacturer anytime soon. Negotiating on these cars will likely yield frustration.

Learn more about the chip shortage. Read: The How We Ran out of Cars in the US

| Inventory Units (December) | Inventory Units (November) | Inventory Units (October) | Inventory Change (November to December) | Days Supply on Dec 1 | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change (November to December) | |

| Fusion | 8,500 | 100 | 100 | 8,400 | 55 | 82 | 60 | -27 |

| Mustang | 8,500 | 5,900 | 6,000 | 2,600 | 54 | 52 | 55 | 2 |

| Bronco | 7,800 | 6,200 | 5,000 | 1,600 | 23 | 23 | 37 | 0 |

| Bronco Sport | 6,700 | 15,400 | 12,600 | -8,700 | 14 | 45 | 27 | -31 |

| E-series van | 6,600 | 7,300 | 7,400 | -700 | 57 | 48 | 57 | 9 |

| EcoSport | 12,100 | 6,900 | 6,500 | 5,200 | 164 | 133 | 90 | 31 |

| Edge | 13,000 | 16,900 | 12,800 | -3,900 | 33 | 49 | 47 | -16 |

| Escape | 10,400 | 14,800 | 14,500 | -4,400 | 26 | 30 | 32 | -4 |

| Expedition | 7,800 | 6,900 | 7,900 | 900 | 41 | 33 | 34 | 8 |

| Explorer | 26,500 | 24,700 | 23,400 | 1,800 | 35 | 32 | 29 | 3 |

| F series | 84,300 | 95,000 | 94,200 | -10,700 | 33 | 38 | 37 | -5 |

| Maverick | 5,300 | 2,700 | 3,900 | 2,600 | 49 | 18 | 193 | 31 |

| Mustang Mach-E | 4,000 | 5,600 | 5,000 | -1,600 | 31 | 53 | 79 | -22 |

| Ranger | 8,900 | 10,500 | 10,100 | -1,600 | 27 | 39 | 49 | -12 |

| Transit | 9,700 | 9,300 | 11,900 | 400 | 51 | 32 | 30 | 19 |

| Transit Connect | 3,200 | 2,200 | 1,500 | 1,000 | 29 | 41 | 98 | -12 |

| Continental | – | 100 | 179 | 0 | ||||

| Aviator | 1,600 | 1,800 | 1,800 | -200 | 23 | 23 | 26 | 0 |

| Corsair/MKC | 2,000 | 2,200 | 2,500 | -200 | 34 | 23 | 31 | 11 |

| Nautilus/MKX | 2,400 | 4,100 | 3,500 | -1,700 | 25 | 45 | 33 | -20 |

| Navigator | 1,000 | 1,300 | 1,400 | -300 | 25 | 29 | 29 | -4 |

| FORD MOTOR CO | 221,800 | 239,800 | 232,100 | -18,000 | 34 | 37 | 37 | -3 |

Ford invoice pricing can be found here: https://caredge.com/guides/ford-invoice-price/

| Inventory Units (December) | Inventory Units (November) | Inventory Units (October) | Inventory Change (November to December) | Days Supply on Dec 1 | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change (November to December) | |

| ILX | 1000 | 400 | 100 | 600 | 34 | 46 | 5 | -12 |

| NSX | – | – | – | 16 | 10 | |||

| RLX | – | – | – | 45 | 67 | |||

| TLX | 800 | 1,400 | 2,000 | -600 | 17 | 27 | 26 | -10 |

| MDX | 2,200 | 1,900 | 1,100 | 300 | 15 | 16 | 13 | -1 |

| RDX | 2,500 | 3,600 | 4,000 | -1,100 | 15 | 18 | 21 | -3 |

| Total Acura | 6,500 | 7,300 | 7,200 | -800 | 17 | 19 | 19 | -2 |

| Inventory Units (December) | Inventory Units (November) | Inventory Units (October) | Inventory Change (November to December) | Days Supply on Dec 1 | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change (November to December) | |

| Accord | 8,200 | 9,500 | 6,900 | -1,300 | 13 | 17 | 14 | -4 |

| Civic | 10,800 | 6,800 | 8,200 | 4,000 | 20 | 14 | 13 | 6 |

| Clarity | 100 | 100 | 200 | 0 | 20 | 35 | 49 | -15 |

| Fit | – | – | 70 | – | 70 | |||

| Insight | 200 | 700 | 1,100 | -500 | 8 | 9 | 14 | -1 |

| CR-V | 11,600 | 9,200 | 14,800 | 2,400 | 13 | 10 | 21 | 3 |

| HR-V | 11,700 | 13,400 | 13,900 | -1,700 | 27 | 31 | 28 | -4 |

| Odyssey | 1,700 | 1,300 | 2,400 | 400 | 18 | 13 | 11 | 5 |

| Passport | 3,700 | 2,400 | 4,500 | 1,300 | 32 | 17 | 19 | 15 |

| Pilot | 8,700 | 6,900 | 11,100 | 1,800 | 27 | 20 | 23 | 7 |

| Ridgeline | 3,100 | 3,300 | 2,700 | -200 | 22 | 27 | 25 | -5 |

| Total Honda | 66,300 | 60,900 | 65,800 | 5,400 | 19 | 17 | 19 | 2 |

| Inventory Units (December) | Inventory Units (November) | Inventory Units (October) | Inventory Change (November to December) | Days Supply on Dec 1 | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change (November to December) | |

| Genesis car | 2,900 | 3,500 | 4,100 | -600 | 39 | 49 | 68 | -10 |

| Genesis trk | 2,600 | 3,000 | 3,700 | -400 | 19 | 24 | 28 | -5 |

| Total Genesis | 5,500 | 6,500 | 7,800 | -1,000 | 26 | 33 | 40 | -7 |

| Inventory Units (December) | Inventory Units (November) | Inventory Units (October) | Inventory Change (November to December) | Days Supply on Dec 1 | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change (November to December) | |

| Hyundai car | 3,900 | 6,200 | 11,700 | -2,300 | 9 | 9 | 15 | 0 |

| Hyundai trk | 13,200 | 13,700 | 15,000 | -500 | 9 | 10 | 11 | -1 |

| Total Hyundai | 17,100 | 19,900 | 26,700 | -2,800 | 9 | 11 | 12 | -2 |

| Inventory Units (December) | Inventory Units (November) | Inventory Units (October) | Inventory Change (November to December) | Days Supply on Dec 1 | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change (November to December) | |

| Kia car | 10,000 | 8,000 | 13,000 | 2,000 | 12 | 9 | 13 | 3 |

| Kia trk | 14,000 | 15,000 | 19,000 | -1,000 | 14 | 15 | 17 | -1 |

| Total Kia Motors | 24,000 | 23,000 | 32,000 | 1,000 | 13 | 12 | 15 | 1 |

| Inventory Units (December) | Inventory Units (November) | Inventory Units (October) | Inventory Change (November to December) | Days Supply on Dec 1 | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change (November to December) | |

| Mazda car | 1,200 | 1,500 | 2,300 | -300 | 9 | 10 | 13 | -1 |

| Mazda trk | 4,800 | 6,000 | 10,100 | -1,200 | 7 | 10 | 13 | -3 |

| MAZDA NA | 6,000 | 7,500 | 12,400 | -1,500 | 7 | 10 | 13 | -3 |

| Inventory Units (December) | Inventory Units (November) | Inventory Units (October) | Inventory Change (November to December) | Days Supply on Dec 1 | Days Supply on Nov 1 | Days Supply on Oct 1 | |

| Subaru car | 1,700 | 1,500 | 1,700 | 200 | 6 | 5 | 6 |

| Subaru trk | 5,700 | 4,500 | 6,400 | 1,200 | 5 | 4 | 5 |

| SUBARU OF AMERICA | 7,400 | 6,000 | 8,100 | 1,400 | 5 | 4 | 5 |

| Inventory Units (December) | Inventory Units (November) | Inventory Units (October) | Inventory Change (November to December) | Days Supply on Dec 1 | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change (November to December) | |

| Lexus car | 5,200 | 4,700 | 5,900 | 500 | 31 | 29 | 29 | 2 |

| Lexus trk | 13,100 | 12,800 | 19,000 | 300 | 21 | 19 | 27 | 2 |

| Total Lexus | 18,300 | 17,500 | 24,900 | 800 | 23 | 21 | 27 | 2 |

| Inventory Units (December) | Inventory Units (November) | Inventory Units (October) | Inventory Change (November to December) | Days Supply on Dec 1 | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change (November to December) | |

| Toyota car | 24,900 | 22,200 | 16,600 | 2,700 | 19 | 20 | 11 | -1 |

| Toyota trk | 73,000 | 73,100 | 66,600 | -100 | 17 | 21 | 18 | -4 |

| Total Toyota | 97,900 | 112,800 | 83,200 | -14,900 | 17 | 21 | 18 | -4 |

| Inventory Units (December) | Inventory Units (November) | Inventory Units (October) | Inventory Change (November to December) | Days Supply on Dec 1 | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change (November to December) | |

| 60 series | 1,600 | 1,700 | 1,600 | -100 | 42 | 44 | 37 | -2 |

| 90 series | 100 | 100 | 100 | 0 | 28 | 42 | 34 | -14 |

| XC40 | 600 | 800 | 1,500 | -200 | 12 | 10 | 18 | 2 |

| XC60 | 3,700 | 4,100 | 4,200 | -400 | 29 | 37 | 33 | -8 |

| XC90 | 2,000 | 2,000 | 2,700 | 0 | 20 | 21 | 23 | -1 |

| VOLVO CAR USA | 8,000 | 8,700 | 10,100 | -700 | 25 | 27 | 27 | -2 |

| Inventory Units (December) | Inventory Units (November) | Inventory Units (October) | Inventory Change (November to December) | Days Supply on Dec 1 | Days Supply on Nov 1 | Days Supply on Oct 1 | Days Supply Change (November to December) | |

| Fusion | 8,500 | 100 | 100 | 8,400 | 55 | 82 | 60 | -27 |

| Mustang | 8,500 | 5,900 | 6,000 | 2,600 | 54 | 52 | 55 | 2 |

| Bronco | 7,800 | 6,200 | 5,000 | 1,600 | 23 | 23 | 37 | 0 |

| Bronco Sport | 6,700 | 15,400 | 12,600 | -8,700 | 14 | 45 | 27 | -31 |

| E-series van | 6,600 | 7,300 | 7,400 | -700 | 57 | 48 | 57 | 9 |

| EcoSport | 12,100 | 6,900 | 6,500 | 5,200 | 164 | 133 | 90 | 31 |

| Edge | 13,000 | 16,900 | 12,800 | -3,900 | 33 | 49 | 47 | -16 |

| Escape | 10,400 | 14,800 | 14,500 | -4,400 | 26 | 30 | 32 | -4 |

| Expedition | 7,800 | 6,900 | 7,900 | 900 | 41 | 33 | 34 | 8 |

| Explorer | 26,500 | 24,700 | 23,400 | 1,800 | 35 | 32 | 29 | 3 |

| F series | 84,300 | 95,000 | 94,200 | -10,700 | 33 | 38 | 37 | -5 |

| Maverick | 5,300 | 2,700 | 3,900 | 2,600 | 49 | 18 | 193 | 31 |

| Mustang Mach-E | 4,000 | 5,600 | 5,000 | -1,600 | 31 | 53 | 79 | -22 |

| Ranger | 8,900 | 10,500 | 10,100 | -1,600 | 27 | 39 | 49 | -12 |

| Transit | 9,700 | 9,300 | 11,900 | 400 | 51 | 32 | 30 | 19 |

| Transit Connect | 3,200 | 2,200 | 1,500 | 1,000 | 29 | 41 | 98 | -12 |

| Continental | – | 100 | 179 | 0 | ||||

| Aviator | 1,600 | 1,800 | 1,800 | -200 | 23 | 23 | 26 | 0 |

| Corsair/MKC | 2,000 | 2,200 | 2,500 | -200 | 34 | 23 | 31 | 11 |

| Nautilus/MKX | 2,400 | 4,100 | 3,500 | -1,700 | 25 | 45 | 33 | -20 |

| Navigator | 1,000 | 1,300 | 1,400 | -300 | 25 | 29 | 29 | -4 |

| FORD MOTOR CO | 221,800 | 239,800 | 232,100 | -18,000 | 34 | 37 | 37 | -3 |

| ILX | 1000 | 400 | 100 | 600 | 34 | 46 | 5 | -12 |

| NSX | – | – | – | 16 | 10 | |||

| RLX | – | – | – | 45 | 67 | |||

| TLX | 800 | 1,400 | 2,000 | -600 | 17 | 27 | 26 | -10 |

| MDX | 2,200 | 1,900 | 1,100 | 300 | 15 | 16 | 13 | -1 |

| RDX | 2,500 | 3,600 | 4,000 | -1,100 | 15 | 18 | 21 | -3 |

| Total Acura | 6,500 | 7,300 | 7,200 | -800 | 17 | 19 | 19 | -2 |

| Accord | 8,200 | 9,500 | 6,900 | -1,300 | 13 | 17 | 14 | -4 |

| Civic | 10,800 | 6,800 | 8,200 | 4,000 | 20 | 14 | 13 | 6 |

| Clarity | 100 | 100 | 200 | 0 | 20 | 35 | 49 | -15 |

| Fit | – | – | 70 | – | 70 | |||

| Insight | 200 | 700 | 1,100 | -500 | 8 | 9 | 14 | -1 |

| CR-V | 11,600 | 9,200 | 14,800 | 2,400 | 13 | 10 | 21 | 3 |

| HR-V | 11,700 | 13,400 | 13,900 | -1,700 | 27 | 31 | 28 | -4 |

| Odyssey | 1,700 | 1,300 | 2,400 | 400 | 18 | 13 | 11 | 5 |

| Passport | 3,700 | 2,400 | 4,500 | 1,300 | 32 | 17 | 19 | 15 |

| Pilot | 8,700 | 6,900 | 11,100 | 1,800 | 27 | 20 | 23 | 7 |

| Ridgeline | 3,100 | 3,300 | 2,700 | -200 | 22 | 27 | 25 | -5 |

| Total Honda | 66,300 | 60,900 | 65,800 | 5,400 | 19 | 17 | 19 | 2 |

| Genesis car | 2,900 | 3,500 | 4,100 | -600 | 39 | 49 | 68 | -10 |

| Genesis trk | 2,600 | 3,000 | 3,700 | -400 | 19 | 24 | 28 | -5 |

| Total Genesis | 5,500 | 6,500 | 7,800 | -1,000 | 26 | 33 | 40 | -7 |

| Hyundai car | 3,900 | 6,200 | 11,700 | -2,300 | 9 | 9 | 15 | 0 |

| Hyundai trk | 13,200 | 13,700 | 15,000 | -500 | 9 | 10 | 11 | -1 |

| Total Hyundai | 17,100 | 19,900 | 26,700 | -2,800 | 9 | 11 | 12 | -2 |

| Kia car | 10,000 | 8,000 | 13,000 | 2,000 | 12 | 9 | 13 | 3 |

| Kia trk | 14,000 | 15,000 | 19,000 | -1,000 | 14 | 15 | 17 | -1 |

| Total Kia Motors | 24,000 | 23,000 | 32,000 | 1,000 | 13 | 12 | 15 | 1 |

| Mazda car | 1,200 | 1,500 | 2,300 | -300 | 9 | 10 | 13 | -1 |

| Mazda trk | 4,800 | 6,000 | 10,100 | -1,200 | 7 | 10 | 13 | -3 |

| MAZDA NA | 6,000 | 7,500 | 12,400 | -1,500 | 7 | 10 | 13 | -3 |

| Subaru car | 1,700 | 1,500 | 1,700 | 200 | 6 | 5 | 6 | 1 |

| Subaru trk | 5,700 | 4,500 | 6,400 | 1,200 | 5 | 4 | 5 | 1 |

| SUBARU OF AMERICA | 7,400 | 6,000 | 8,100 | 1,400 | 5 | 4 | 5 | 1 |

| Lexus car | 5,200 | 4,700 | 5,900 | 500 | 31 | 29 | 29 | 2 |

| Lexus trk | 13,100 | 12,800 | 19,000 | 300 | 21 | 19 | 27 | 2 |

| Total Lexus | 18,300 | 17,500 | 24,900 | 800 | 23 | 21 | 27 | 2 |

| Toyota car | 24,900 | 22,200 | 16,600 | 2,700 | 19 | 20 | 11 | -1 |

| Toyota trk | 73,000 | 73,100 | 66,600 | -100 | 17 | 21 | 18 | -4 |

| Total Toyota | 97,900 | 112,800 | 83,200 | -14,900 | 17 | 21 | 18 | -4 |

| 60 series | 1,600 | 1,700 | 1,600 | -100 | 42 | 44 | 37 | -2 |

| 90 series | 100 | 100 | 100 | 0 | 28 | 42 | 34 | -14 |

| XC40 | 600 | 800 | 1,500 | -200 | 12 | 10 | 18 | 2 |

| XC60 | 3,700 | 4,100 | 4,200 | -400 | 29 | 37 | 33 | -8 |

| XC90 | 2,000 | 2,000 | 2,700 | 0 | 20 | 21 | 23 | -1 |

| VOLVO CAR USA | 8,000 | 8,700 | 10,100 | -700 | 25 | 27 | 27 | -2 |

| TOTAL | 478,800 | 490,000 | 483,600 | -11,200 | 17 | 18 | 20 | -1 |

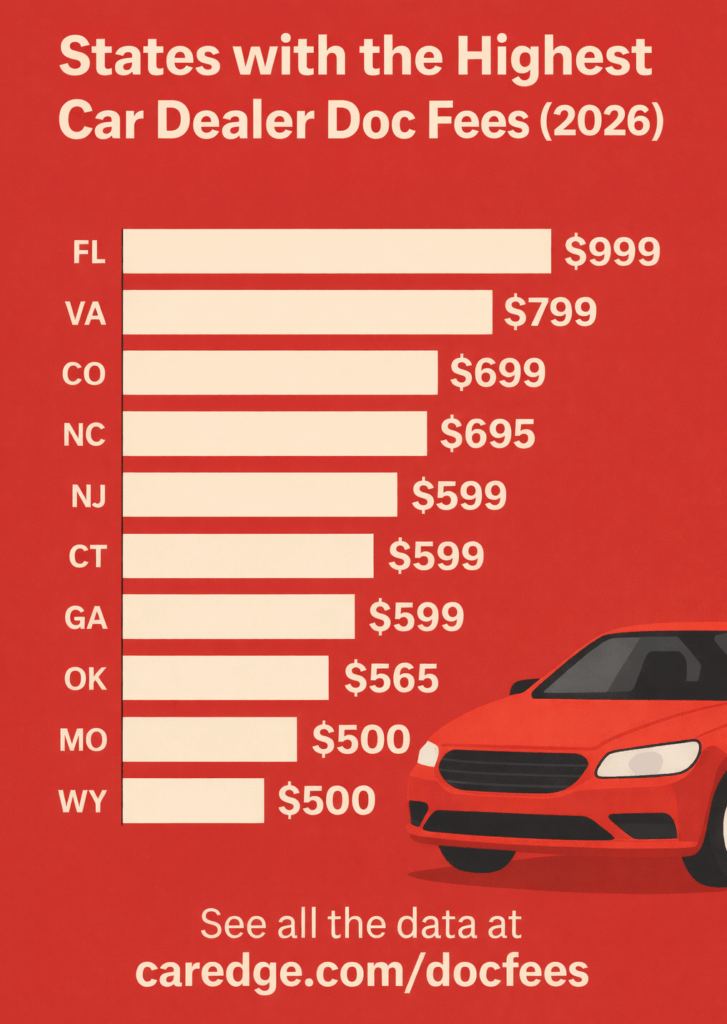

Through the ups and downs of the auto market, one thing remains the same: every state has a documentation fee. Also known as a doc fee, this isn’t like the other fees you’ll encounter. Be sure to familiarize yourself with what car dealer fees you should and shouldn’t pay.

The price of a car is never what it seems. There’s the selling price, the fees, the add-ons, and taxes. When it’s all said and done, you end up with the out-the-door price, and one of the line items you’ll see on your purchase agreement is a “doc fee”. Car dealer doc fees show up on EVERY car deal, and on this page we’ve aggregated all the car dealer doc fees by state for 2026.

Some states (like California and New York) cap the dealer doc fee. Others, such as Florida, don’t cap the doc fee. We’ve gathered the average doc fee that you should expect a dealership to charge in every state. If a dealer is charging more, you should try to negotiate the price down. Download this FREE negotiation cheat sheet!

We’ve also included the average title and registration fee you should expect to pay in each state.

| State | Average Doc Fee | Title Fee | Total Registration Fees | More Info |

|---|---|---|---|---|

| AK | $299 | $15 | $245 | More info |

| AL | $489 | $18 | $393 | More info |

| AR | $129 | $10 | $28 | More info |

| AZ | $499 | $4 | $564 | More info |

| CA | $85 | $25 | $524 | More info |

| CO | $699 | $7 | $595 | More info |

| CT | $599 | $25 | $180 | More info |

| DC | $300 | $26 | $185 | More info |

| DE | $475 | $35 | $45 | More info |

| FL | $999 | $75 | $297 | More info |

| GA | $599 | $18 | $20 | More info |

| HI | $395 | $5 | $78 | More info |

| IA | $180 | $25 | $333 | More info |

| ID | $399 | $14 | $126 | More info |

| IL | $347 | $155 | $151 | More info |

| IN | $199 | $15 | $38 | More info |

| KS | $499 | $10 | $80 | More info |

| KY | $450 | $6 | $26 | More info |

| LA | $425 | $77 | $64 | More info |

| MA | $459 | $75 | $60 | More info |

| MD | $499 | $100 | $187 | More info |

| ME | $499 | $33 | $40 | More info |

| MI | $260 | $15 | $128 | More info |

| MN | $125 | $8 | $69 | More info |

| MO | $565 | $9 | $57 | More info |

| MS | $425 | $8 | $719 | More info |

| MT | $299 | $12 | $237 | More info |

| NC | $699 | $56 | $370 | More info |

| ND | $299 | $5 | $123 | More info |

| NE | $299 | $10 | $83 | More info |

| NH | $375 | $25 | $51 | More info |

| NJ | $695 | $60 | $271 | More info |

| NM | $339 | $3 | $60 | More info |

| NV | $499 | $20 | $49 | More info |

| NY | $175 | $50 | $146 | More info |

| OH | $250 | $15 | $31 | More info |

| OK | $599 | $11 | $100 | More info |

| OR | $250 | $106 | $169 | More info |

| PA | $449 | $58 | $39 | More info |

| RI | $399 | $53 | $58 | More info |

| SC | $400 | $15 | $40 | More info |

| SD | $200 | $10 | $122 | More info |

| TN | $499 | $14 | $29 | More info |

| TX | $150 | $33 | $74 | More info |

| UT | $299 | $6 | $57 | More info |

| VA | $799 | $15 | $36 | More info |

| VT | $200 | $35 | $78 | More info |

| WA | $199 | $15 | $73 | More info |

| WI | $299 | $165 | $85 | More info |

| WV | $250 | $15 | $52 | More info |

| WY | $500 | $15 | $616 | More info |

In today’s market you will likely not be able to negotiate the dealer doc fee. That being said, we have this complete guide to car dealer fees you should never pay.

You can find this data incorporated into our out the door price (OTD) calculator. When you are shopping for a new or used car it is important that you understand the total “out the door” price that you will be paying. Dealers like to get you to talk about monthly budget, however the most important things is to negotiate the OTD price.

Registration fees and taxes are generally paid in the state where you reside and where the vehicle will be titled and registered. If you buy from a dealership, they may collect your home state’s taxes and registration fees at the time of purchase and handle the paperwork for you. This saves you lots of time and hassle. If the dealer doesn’t handle it, you’ll need to register the vehicle yourself at your local Department of Motor Vehicles (DMV) or equivalent agency. Unfortunately, vehicle registration fees are not negotiable, and are set by state law.

Here’s a look at vehicle registration fees by state as of 2026:

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

Can a car dealer charge you more than the manufactures suggested retail price (MSRP)? If you live in the United States, the answer is yes.

W,e’ll walk you through the laws that allow car dealers to sell their inventory priced over MSRP. We’ve included a bonus “craziest markups” section at the bottom of this post to give you some context as to how out of control new car pricing currently is.

In this post we’ll also give you some suggestions for how you can find dealers that are not marking their new cars over MSRP, as well as the “word tracks” you can use when trying to negotiate with a salesperson or sales manager.

Let’s dive in!

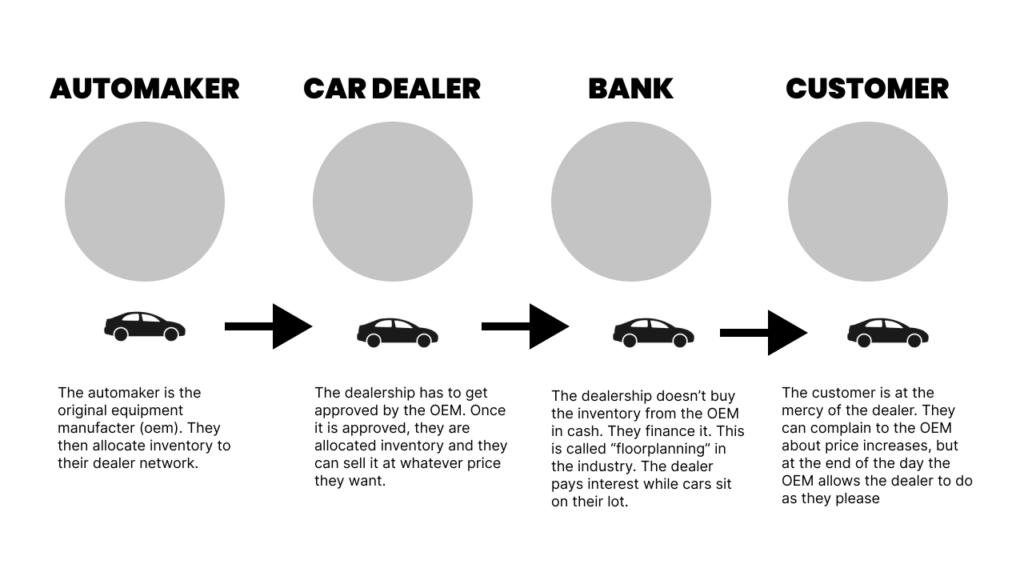

Many goods are sold by manufacturers through their network of dealers or agents. Think about insurance as an example. Many insurance products are sold by an agent, who is simply a licensed producer that represents an insurer. Could you buy insurance directly from the insurer? Sure, some companies allow for that, but not all. Many insurance companies don’t want to have to deal with selling their own product. As strange as that sounds, it’s pretty common, and instead of selling directly to consumers they employ agents to do that for them.

The same dynamic applies in retail automotive. Can you buy a car directly from a manufacturer? Yes. Do most manufacturers not sell directly to consumers because they don’t want to deal with all that it entails? YES. The hassle of dealing with customers, plus franchise dealer laws in all 50 states make it an easy decision for automakers to leverage their dealer partners to sell cars. The exception in 2025 and beyond is with direct-to-consumer automakers like Tesla, Rivian, and Lucid.

So long as most new cars are sold through dealers, the dealers will have their discretion to price their inventory however they’d like. MSRP does stand for manufacturers suggested retail price after all. At the end of the day, the franchise dealer model is simple:

The automaker is responsible for producing the vehicle. The dealer is responsible for selling the vehicle. The bank is responsible for financing the purchase of inventory for the dealer. The customer is responsible for negotiating and purchasing the vehicle.

Within the franchise agreements that dealers sign with their OEMs they do not have rules that prevent them from marking up vehicles beyond the suggested retail price. If automakers wanted to be consumer advocates and cap the price of their vehicles, they could do this by simply adding and enforcing a price cap rule with their dealer body.

This will likely never happen. Why? Because gross profit on new cars has never been higher, and automakers and dealers alike are enjoying this new reality. If automakers attempted to stop their dealers from selling above MSRP they would be picking a fight with their best customer (remember, the dealer buys the inventory from them!).

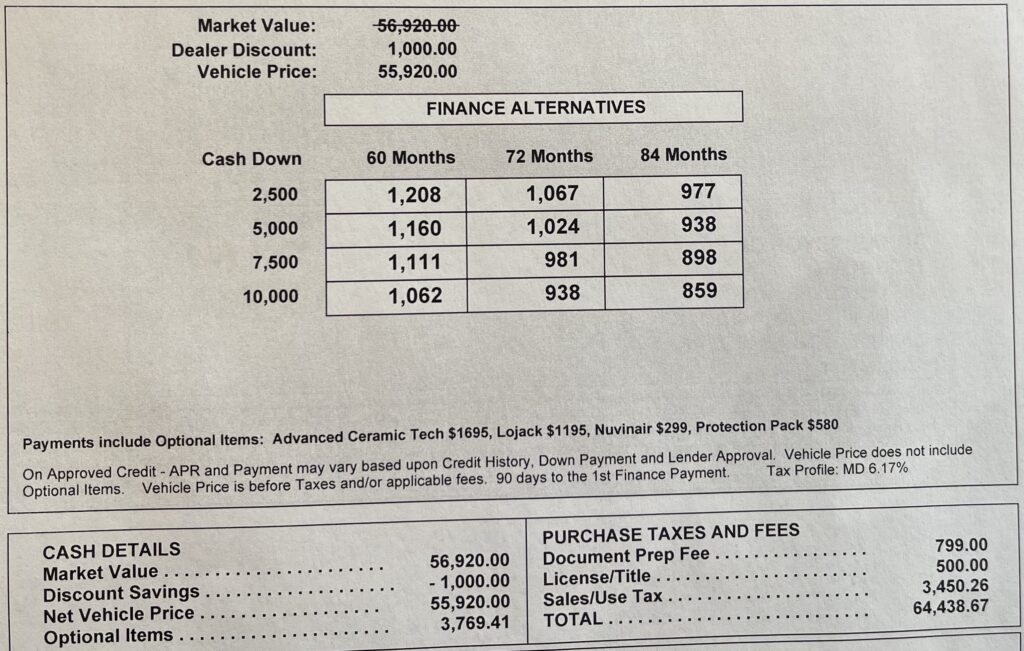

Some dealerships refuse to sell their cars for more than MSRP. That’s great. The issue is that they add all sorts of add-ons and accessories to a vehicle that you didn’t ask for. Here’s a perfect example of that from a Land Rover dealership:

In this case the dealer discounted their price by $1,000. That’s awesome! Then they added $3,769.41 in accessories and add-ons…

The accessories they added are:

Our recommendation in this case (and in the current market) would be to negotiate the cost of the accessories down to the dealer’s cost. The dealership incurs a cost to their service department to install these products. That cost is likely a few hundred dollars (refer to the table below). With that in mind, you’ll want to ask for the RO (repair order) they issued for the installation of the accessories.

| Item | Cost to Dealer | Retail Price | Dealer profit |

| Interior protection | $50 | $500 | $450 |

| Paint protection | $100 | $850 | $750 |

| Undercoating | $200 | $700 | $500 |

| Rustproofing | $50 | $800 | $750 |

| Car alarm | $300 | $800 | $500 |

| VIN etching | $75 | $400 | $325 |

| Lojack | $325 | $1,000 | $675 |

| Nitrogen-filled tires | $35 | $250 | $215 |

| Window tinting | $25 | $300 | $275 |

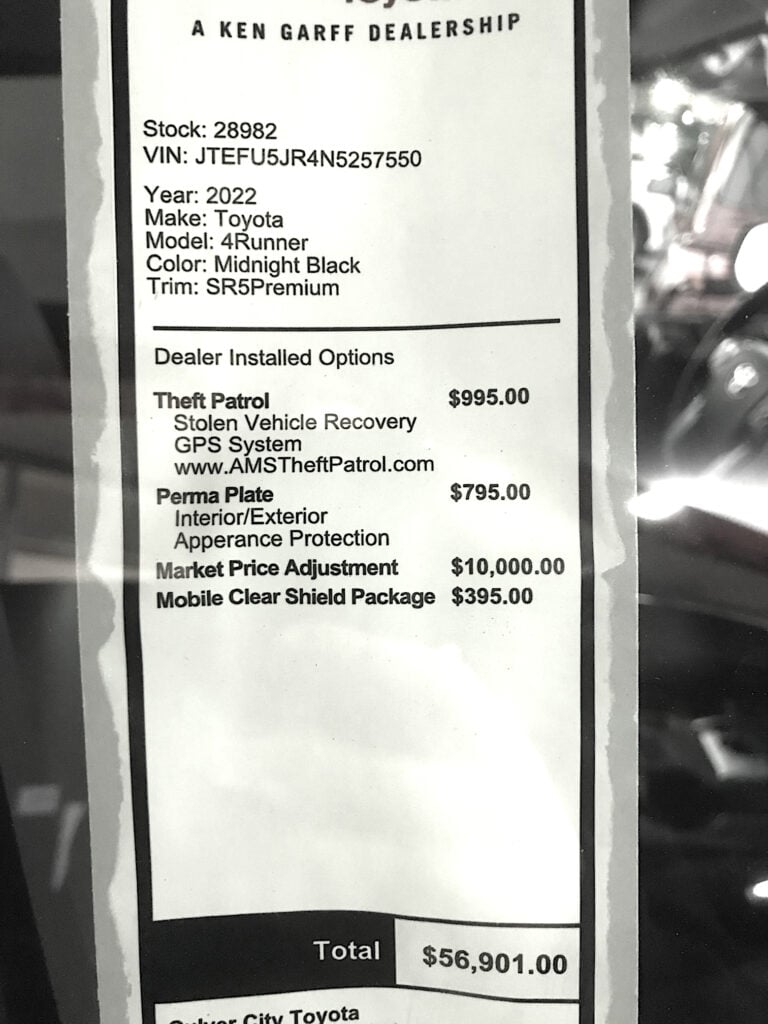

Many car dealerships are selling their new cars above MSRP, and they aren’t shy about it. Every new car comes with a window sticker, also known as a Monroney Label. Many dealers are adding additional stickers to new cars with their additional dealer markup. Here’s an example:

In this case the dealership added both add-ons (Theft Patrol, Perma Plate, and Mobile Clear Shield Package), and a “Market Price Adjustment” of $10,000. The market adjustment is additional dealer markup. You get nothing in exchange for having paid an additional $10,000. It is pure profit for the dealership.

What can you do when a new car is for sale over MSRP? How can you negotiate a lower price? Well, as always, remember “if it’s taxable, it’s negotiable.” That means if it’s taxed on the bill of sale, you can negotiate its price.

As a refresher, here are the fees that you can and cannot negotiate on.

When it comes to additional dealer markup and add-ons we encourage you to not settle for what the dealer is asking for. Dig your heels in a bit and try and get some money back in your pocket. Just because they are asking for $10,000 in additional markup doesn’t mean they won’t accept $5,000.

If the dealer is adamant about their pricing and won’t budge, consider factory ordering a new vehicle. When you factory order you can get a legally binding signed buyers order for the agreed upon selling price at the time you place the order.

If you found this article helpful, you’ll love what we have in store for you at CarEdge. From free car buying guides to expert negotiation help, we’re proud to make car buying easy for every shopper. Check us out!

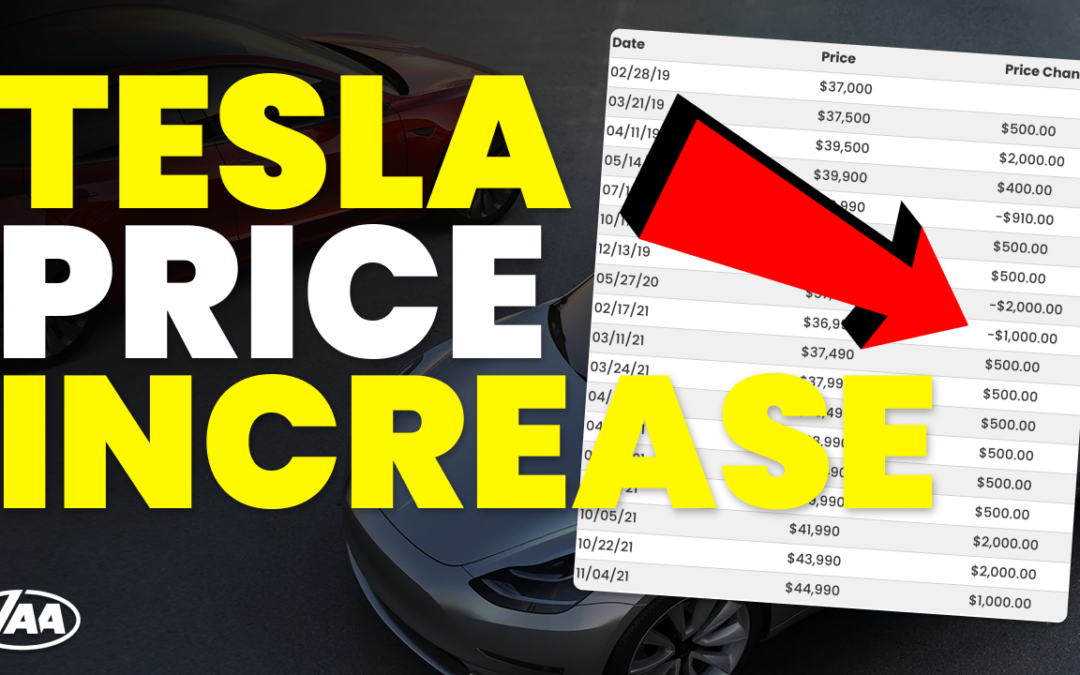

Tesla price increases used to be a somewhat infrequent and relatively innocuous occurrence. Not anymore. So far in 2021 the Model 3 has increased in price (MSRP) 23%. The Model Y is not far behind at a 20% price hike!

What’s behind the Tesla price increases? Should we expect to see more? Does this effect existing orders? Are other automakers increasing their prices this much? Let’s address this and more below!

First, let’s start by simply looking at the data.

Tesla has not been shy about increases the price of their most affordable vehicle (the Model 3). Below is a table of Model 3 Standard Range Plus (SR+) base MSRP from February of 2019 to today.

| Date | Price | Price Change |

| 02/28/19 | $37,000 | |

| 03/21/19 | $37,500 | $500.00 |

| 04/11/19 | $39,500 | $2,000.00 |

| 05/14/19 | $39,900 | $400.00 |

| 07/15/19 | $38,990 | -$910.00 |

| 10/17/19 | $39,490 | $500.00 |

| 12/13/19 | $39,990 | $500.00 |

| 05/27/20 | $37,990 | -$2,000.00 |

| 02/17/21 | $36,990 | -$1,000.00 |

| 03/11/21 | $37,490 | $500.00 |

| 03/24/21 | $37,990 | $500.00 |

| 04/08/21 | $38,490 | $500.00 |

| 04/22/21 | $38,990 | $500.00 |

| 05/06/21 | $39,490 | $500.00 |

| 05/21/21 | $39,990 | $500.00 |

| 10/05/21 | $41,990 | $2,000.00 |

| 10/22/21 | $43,990 | $2,000.00 |

| 11/04/21 | $44,990 | $1,000.00 |

Since February of 2019 there have been 18 MSRP changes for the Model 3 SR+. 3 have been price decreases, 15 have been price increases. As you can see, just in the past few months the Model 3 has increased in price by $5,000.

This may have something to do with the fact that new EV tax credits are likely to increase consumer demand in 2022.

Tesla’s Model Y was first available for purchase in March of 2019. Since then the most common version, the LR-AWD (long range all wheel drive) trim has seen its price increase considerably.

| Date | Price | Price Change |

| 03/15/19 | $51,000 | |

| 03/24/19 | $52,000 | $1,000.00 |

| 01/29/20 | $52,990 | $990.00 |

| 07/11/20 | $49,990 | -$3,000.00 |

| 02/21/21 | $48,990 | -$1,000.00 |

| 03/11/21 | $49,900 | $910.00 |

| 04/08/21 | $50,490 | $590.00 |

| 04/22/21 | $50,990 | $500.00 |

| 05/06/21 | $51,490 | $500.00 |

| 05/21/21 | $51,990 | $500.00 |

| 06/09/21 | $52,490 | $500.00 |

| 06/25/21 | $52,990 | $500.00 |

| 07/22/21 | $53,990 | $1,000.00 |

| 10/05/21 | $54,990 | $1,000.00 |

| 10/22/21 | $56,990 | $2,000.00 |

| 11/04/21 | $57,990 | $1,000.00 |

| 11/11/21 | $58,990 | $1,000.00 |

Similarly to the Model 3, the Model Y has seen both price decreases (2) and price increases (14). The Model Y has increased in price more than $5,000 in the past few months. This is likely due to the imminent EV tax credits that will be passed as part of the Build Back Better bill.

No! While we expect automakers to increase their base MSRPs considerably in 2022, we have yet to see any other manufacturer increase them as much as Tesla.

Toyota has come closest with their nearly 20% price increase for the newly redesigned 2022 Toyota Tundra, however that is a brand new redesign. No other automakers has increased their mid-year production models MSRP anywhere near as much as Tesla has.

There are two primary factors as to why Tesla is increasing their MSRP so aggressively right now. The first relates to ongoing supply chain disruptions and the chip shortage. The second has to do with new EV tax credits that will most certainly drive an increase in Tesla demand.

The ongoing chip shortage has impacted all automakers, and Tesla has not been immune to it. While their production numbers have been healthy (especially relative to peers), Tesla has struggled to produce vehicles to their specifications. Earlier in 2021 Tesla silently began removing some features and functionality from their vehicles because of a lack of chips.

There is obviously a “supply side” issue thanks to global supply chain struggles and the chip shortage, but what about demand?

Demand for new Teslas has been healthy, and it should only increase in 2022. New EV tax credits will increase Tesla demand. Previous EV tax credits no longer apply to Tesla, however the credits that will be available in 2022 will. It makes sense that Tesla is increasing their prices right now, because when consumers get $7,500 (or more) in tax credits from the government, they’ll still feel like they’re getting a great deal.

Pair a decreasing supply with an increase in EV demand, and you can start to see why Tesla is proactively raising their prices. Not to mention there is higher inflation than prior years, and you can begin to fully comprehend why we’ve seen Tesla prices increase as much as they have.