CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

If you’re in the market for a new car and considering a factory order, you may want to think twice before committing. A recent survey of nearly 3,000 car buyers shows that more buyers are canceling their factory orders, with over one-third of orders being canceled in recent months. Greedy dealers who force add-ons and last-minute price hikes are among the reasons why buyers are canceling, leaving many factory-ordered vehicles searching for a new buyer. Let’s take a look at this trend, and how it affects car prices for the rest of us.

Also: Factory Ordering a Car? These Are Wait Times We’re Seeing in 2023

We asked the CarEdge YouTube Community what happened to their factory-ordered vehicles in recent months. Here’s what 2,900 respondents had to say about their recent factory orders:

I took delivery = 22%

I canceled my order = 37%

I’m still waiting for my order to arrive = 30%

Other = 11%

That’s right, well over one-third of new car orders are being canceled in recent months. Those factory ordered vehicles are still manufactured, and now they need to find a new buyer.

Among the respondents who selected the “other” option, these were some of the common themes shared:

The car market is still out of whack, and car buyers haven’t forgotten the normalcy of pre-pandemic car buying. “I canceled my factory order because I figured being debt free and driving a clunker bunker that is safe and still runs a much better option in this market.”

Clearly, when automakers take too long to deliver on a promise, the excitement that typically comes along with purchasing a shiny new vehicle often dies. “After waiting almost 2 years for my Bronco, the love affair kind of died. Decided to use the money on a new house.” We don’t blame you!

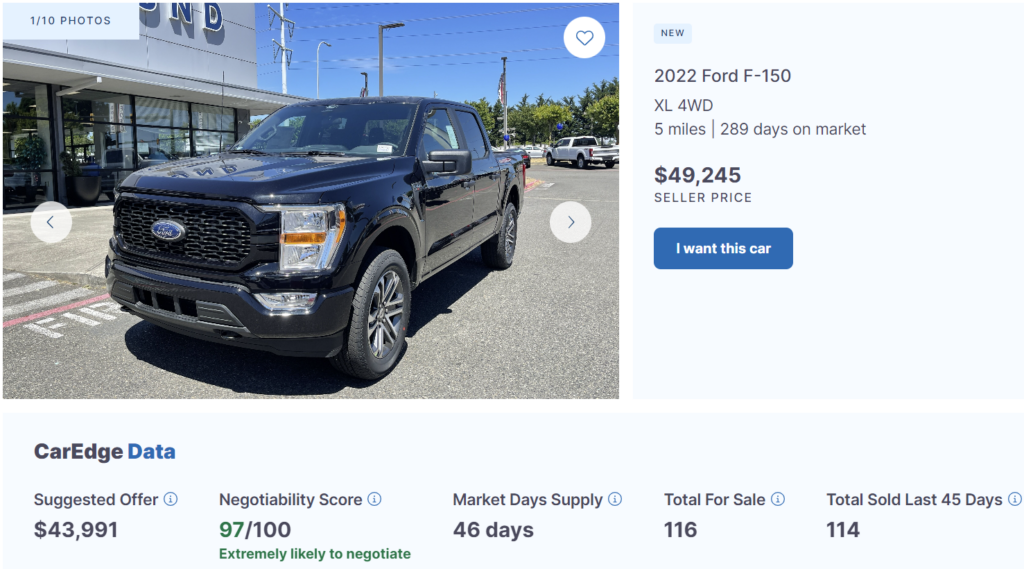

The high rate of factory order cancellations means there are more cars available on dealership lots, which gives car buyers who are willing to forgo a factory order more room for negotiation. Dealerships will be eager to sell these vehicles. They may be more willing to negotiate on price and add-ons, especially if the cars have been on the lot for an extended period of time. This situation puts car buyers in a better position to secure a good deal, as long as they do their research and are prepare to negotiate.

Negotiate Like a PRO With This Cheat Sheet Made By a Former Dealer

In conclusion, the new car market is facing a new wave of disruption as thousands of canceled factory-ordered vehicles flood dealership lots nationwide. As more and more car buyers opt for factory orders, dealerships and manufacturers must ensure transparency, fair pricing, and timely delivery to avoid losing customers. With the evolving market conditions, it is crucial to keep up with consumer expectations and deliver quality service to maintain a loyal customer base.

If you’re in the market for a new car, make sure to do your research and leverage the current state of the market to negotiate better deals. Be aware of current factory order wait times. For additional insights on car buying like negotiability data, suggested offer, and local market availability, check out CarEdge Data. We’re here to help car buyers stay in the driver’s seat of their deal. Car buying, the way it should have always been.

If you’re planning to buy a new car, it’s important to consider the depreciation rate of the vehicle you’re interested in. Depreciation is the loss of value that occurs over time, and some cars lose their value faster than others. At CarEdge, we’ve analyzed millions of car listings and other automotive data points to provide you with proven data on the cars, SUVs, and trucks with the worst resale value in 2023. Don’t forget to check out the models and brands with the best resale value.

73.74% resale value after 5 years

After 5 years, Buick vehicles lose around 26% of their original value, making them one of the worst brands for resale value. The Buick Encore and Enclave are among the worst models for resale value, with both retaining only around 74% of their original value after 5 years.

Here’s a 2020 Buick Enclave that has lost 44% of its original value in less than three years. On top of that, it’s been sitting on the lot for 112 days. High depreciation can be a huge benefit to used car buyers. This Buick is highly negotiable.

See days on the market, local supply, negotiability score, suggested offer and more for every new and used vehicle listing with CarEdge Data.

74.06% resale value after 5 years

With a resale value of only 74.06% after 5 years, Chrysler is among the worst brands for retaining value. The Chrysler 300 is one of the worst models for resale value, with only around 74% of its original value retained after 5 years.

This 2020 Chrysler Voyager sold for nearly $10,000 more just a few years ago. However, due to ongoing minivan shortages, it’s still tough to negotiate. Days’ supply remains below average for most vans.

75.60% resale value after 5 years

Ram trucks have a resale value of only 75.60% after 5 years, making them a poor choice for those concerned about retaining value. The Ram 1500 is one of the worst models for resale value, with only around 75% of its original value retained after 5 years.

Ram can’t sell trucks right now. In fact, Ford and GM can’t either. We recently took a close look at the oversupply of trucks in America. It’s a startling contrast with the shortage of affordable new car models. Depreciation is definitely something to consider when buying a new Ram truck. This 5-year old Ram 1500 Limited with a clean record and 97,000 miles on the odometer has lost 42% of its value already.

See days’ supply, negotiability scores and recommended offers for every new and used car on the market at CarEdge Car Search.

75.77% resale value after 5 years

After 5 years, Jeep vehicles lose around 24% of their original value, putting them among the worst brands for resale value. The Jeep Grand Cherokee and Cherokee are among the worst models for resale value, with both retaining only around 72% of their original value after 5 years.

This 2020 Jeep Grand Cherokee with a clean record and just 42,000 miles on the odometer has lost 30% of its original value in three years. It’s negotiable!

77.84% resale value after 5 years

Nissan vehicles have a resale value of only 77.84% after 5 years, making them one of the worst brands for retaining value. The Nissan Armada and LEAF are among the worst models for resale value, with both retaining only around 68% of their original value after 5 years.

This 2018 Nissan Altima SR lost 32% of its value in 5 years, and that’s with a clean record and low mileage for a vehicle of that age.

Crunch the numbers with this car depreciation calculator.

Of the more than 400 models on sale in North America, these are the 20 with the highest depreciation, and the quickest to lose resale value.

| Model | 5-Year Depreciation |

|---|---|

| GMC Yukon XL | 68.38% |

| Nissan Armada | 68.80% |

| GMC Sierra 2500HD | 71.30% |

| Chevrolet Suburban | 71.86% |

| Jeep Cherokee | 72.28% |

| Kia Sorento | 72.48% |

| Nissan LEAF | 72.55% |

| Jeep Grand Cherokee | 72.70% |

| Ford Escape | 73.00% |

| Chevrolet Tahoe | 73.12% |

| Buick Enclave | 73.21% |

| Ford Expedition | 73.35% |

| Nissan Altima | 73.90% |

| Nissan Titan | 74.04% |

| Chrysler 300 | 74.06% |

| Buick Encore | 74.26% |

| Chevrolet Spark | 74.62% |

| Nissan Maxima | 75.00% |

| GMC Yukon | 75.31% |

| Ram 1500 | 75.60% |

As you can see, some models lose more than 30% of their value after just five years. Buying a car with a low resale value can cost you thousands of dollars in the long run. This is especially true if you are likely to sell your car within the next decade. So, before you make a purchase, be sure to research the resale value of the vehicle you’re interested in.

Compare depreciation between models, all in one spot.

At CarEdge, we provide you with the data you need to make informed decisions. With CarEdge Data, you can access valuable market data, including Black Book valuations, CarEdge Suggested Offer, Negotiability Score, CarEdge Recommendation, and local Days Supply in your region. With this information, you can negotiate better deals and avoid being taken advantage of by car dealerships.

Don’t get caught off guard with high depreciation. Unlock behind-the-scenes insights that will inform your car buying decisions today. And if you’re looking for 1:1 help with your deal, partner with a car buying pro with years of experience with CarEdge Coach. We’re real people helping drivers everywhere save real money. Check out these uplifting success stories to see how much you could save!

Are you in the market for a new car? If so, it’s important to consider the depreciation rate of the vehicle you’re interested in. Depreciation in vehicles is inevitable, but some cars hold their value better than others. At CarEdge, we’ve analyzed millions of car listings and other automotive data points to provide you with proven data that you can rely on to make informed decisions. Let’s take a closer look at the cars, SUVs and trucks with the best resale value.

Volkswagen: 85.53% resale value after 5 years

Even though they finally had to re-retire the Beetle, Volkswagen scored in the top half of vehicle manufacturers for value retention after 3, 5, and 7 years. See Volkswagen depreciation by model year.

Subaru: 84.41% resale value after 5 years

The low-inventory king is known for reliable all-weather capability at an affordable price. The Forester (#4), Legacy (#20), Crosstrek (#30) and Outback (#36) are all in the top 50 models for resale value. Despite keeping low inventory on dealership lots, Subaru maintains a great reputation for resale value.

Honda: 83.60% resale value after 5 years

The Civic, Accord and redesigned CR-V were all best-sellers in 2022. It’s no coincidence that these same models are in the top resale value rankings. Honda cars and SUVs are known for their longevity, reliability and strong resale value. As Honda finally enters the EV segment later this year with the all-new Honda Prologue, we wonder if their electric vehicles will earn the same great reputation.

Mazda: 83.29% resale value after 5 years

Mazda’s resale values have improved, relative to their peers, and their rankings have climbed to the Top 5 range at all three time intervals. Mazda’s U.S. market share has been steadily rising for years. The Mazda 3, MX-5 Miata, and CX-5 all rank in the top 50 models for resale value.

Toyota: 83.09% resale value after 5 years

Toyota as a brand, does very well in maintaining its value, consistently ranking at the top of popular brands. The Toyota Tacoma, Highlander, 4Runner, Prius and Sequoia all have better-than-average resale value. Compare Toyota resale values here.

Check out this depreciation calculator

| Rank | Model | 3 Year Residual Value |

|---|---|---|

| 1 | Subaru Forester | 96.40% |

| 2 | Chevrolet Silverado 3500HD | 96.28% |

| 3 | Ford F-450 Super Duty | 95.47% |

| 4 | GMC Sierra 3500HD | 95.44% |

| 5 | Mitsubishi Mirage | 95.26% |

| 6 | Honda Ridgeline | 94.22% |

| 7 | Subaru Crosstrek | 94.00% |

| 8 | Dodge Charger | 93.78% |

| 9 | GMC Sierra 1500 | 93.41% |

| 10 | Jeep Compass | 93.24% |

| 11 | Chevrolet Traverse | 93.23% |

| 12 | Chevrolet Spark | 93.00% |

| 13 | Dodge Durango | 92.51% |

| 14 | Subaru Legacy | 92.49% |

| 15 | Toyota Tacoma | 92.47% |

| 16 | Ford Explorer | 92.00% |

| 17 | Honda Accord | 92.00% |

| 18 | Chevrolet Silverado 2500HD | 91.97% |

| 19 | Ram 2500 | 91.78% |

| 20 | Nissan Altima | 91.62% |

Source: CarEdge Depreciation Data

| Rank | Model | 5 Year Residual Value |

|---|---|---|

| 1 | Nissan Frontier | 88.55% |

| 2 | Honda Accord | 88.00% |

| 3 | Toyota Tacoma | 87.58% |

| 4 | Subaru Forester | 87.09% |

| 5 | Ford F-250 Super Duty | 87.00% |

| 6 | Volkswagen Tiguan | 87.00% |

| 7 | Ford F-350 Super Duty | 86.95% |

| 8 | Ford F-150 | 86.75% |

| 9 | Mazda 3 | 86.13% |

| 10 | Honda Civic | 86.00% |

| 11 | Kia Rio | 86.00% |

| 12 | Honda Pilot | 85.95% |

| 13 | Mazda MX-5 Miata | 85.80% |

| 14 | Toyota Highlander | 85.77% |

| 15 | GMC Canyon | 85.33% |

| 16 | Nissan Versa | 85.03% |

| 17 | Toyota 4Runner | 85.00% |

| 18 | Toyota Prius | 85.00% |

| 19 | GMC Sierra 1500 | 84.80% |

| 20 | Subaru Legacy | 84.73% |

Source: CarEdge Depreciation Data

Compare depreciation between models, all in one spot.

Depreciation in the value of cars is an inevitable reality, and it can significantly affect a vehicle’s overall cost. Therefore, it’s crucial to consider resale value when buying a car. CarEdge data shows that brands like Volkswagen, Subaru, Honda, Mazda, and Toyota have the best resale value after five years, and they maintain their great reputation for reliability, longevity, and value retention. This information is helpful to make informed decisions while purchasing a vehicle.

Love the data? We do too. That’s why we’ve created CarEdge Data, where you will find behind-the-scenes insights to inform your car buying decisions. With CarEdge Data, you unlock valuable market data:

✅ Black Book valuations: Get insider trade-in values from dealer auctions

✅ CarEdge Suggested Offer: Know the fair market value of every car on the market

✅ Negotiability Score: Discover the likelihood of negotiating based on market data

✅ CarEdge Recommendation: Get actionable next steps to buy a car

✅ Days Supply in your region

Looking for 1:1 help with your deal? Learn more about how you can partner with a car buying pro with years of experience with CarEdge Coach.

We’re here to help!

When it comes to purchasing a new or used car, the state you’re in can make a significant difference in terms of taxes, fees, and available inventory. We’ll take a look at the best and worst states to buy a car in 2025, focusing on factors like sales tax, insurance costs, documentation fees, and overall car supply. Let’s dive in and see how your state stacks up.

First, let’s explore the states that offer the most advantages when it comes to car buying. States like Alaska, Montana, Oregon, Delaware, and New Hampshire stand out due to their lack of statewide sales tax, as well as generally low fees when buying and registering a car. South Dakota and Iowa are close behind.

Several other states have low state sales tax rates, but many have higher fees that keep them out of our top rankings: Alabama (2%), Colorado (2.9%), Hawaii (4%), Louisiana (4%), Missouri (4.23%), New Mexico (4%), New York (4%), North Carolina (3%), Oklahoma (3.25%), South Dakota (4%), and Virginia (4.15%). However, local taxes can drive costs higher, especially in big cities and affluent suburbs.

Dealerships charge a documentation fee, or “doc fee,” to cover the cost of preparing and filing a sales contract. Many states don’t regulate doc fees, and the amount varies from state to state. In many cases, state taxes and registration fees can outweigh the advantages of low doc fees.

These states have the lowest doc fees in 2025, and as a result, are better states to buy a car in: Minnesota ($75), Arkansas ($110), Oregon ($115), South Dakota ($115), Iowa ($135), Texas ($150), Washington ($150), Indiana ($150). California is also on the list with a very low average doc fee of $85, but the high sales tax and low supply of new cars keeps it far off of the list of best states to buy a car in.

Now, let’s take a look at the states you might want to avoid when purchasing a vehicle. Documentation fees can be particularly high in Florida, Alabama, Virginia, and North Carolina, with fees ranging from $485 to $995. Florida stands out as one of the worst states for new car purchases, with no cap on doc fees (averaging $995). When it comes to vehicle registration, a few states stand out with costly fees:

Alabama, North Carolina, Iowa, and Florida aren’t far behind with registration fees all averaging over $300.

It’s important to point out that taxes and fees are only part of the picture. The existing supply of new cars in each state is also critically important. Nationwide, there’s an 83-day supply of new cars as of late May 2025. However, some states have might tighter supply. These are the states with the lowest supply of new cars in 2025:

With doc fees, registration fees, sales tax, and new car inventory all taken into consideration, it’s safe to say that the worst states to buy a car are: Mississippi, Florida, California, and North Carolina.

However, Florida’s abundant used car market can make it a better choice for used car buyers, thanks to the state’s older population. On the other hand, flood cars are a much bigger risk in Florida’s used car market.

Ready to outsmart the dealerships? With CarEdge Negotiation Expert, we’ll negotiate your car price to lock in big savings. Looking for a DIY path to savings? Shop confidently with CarEdge Pro, our most affordable option for empowered car buying. Looking to lease? We can help with that too!

Learn more about CarEdge’s car buying help →

Are you in the market for a new or used car? If so, you’re probably wondering about the latest auto loan rates and how to qualify for the lowest APR. Whether you’re a first-time buyer or an experienced shopper, understanding auto loan rates is essential to making a smart financial decision. Let’s take a look at current car loan rates this month by credit score. Plus, we’ll go over how to qualify for the lowest APR.

Before we dive into the details, it’s important to know that auto loan rates vary based on several factors, including the loan term, the type of car (new or used), and, most importantly, your credit score. To give you an idea of what to expect, we’ve put together a table template that breaks down the average auto loan rates by credit score for both new and used cars.

First, here’s a reminder of how credit scores are categorized for car loans:

| Credit Score Category | Score Range |

| Super Prime | 781 – 850 |

| Prime | 661 – 780 |

| Nonprime | 601 – 660 |

| Subprime | 501 – 600 |

| Deep Subprime | 300 – 500 |

These are the latest car loan APRs by credit score:

| Credit Score | New Car Average APR | Used Car Average APR |

| Super Prime | 4.75% | 5.99% |

| Prime | 5.82% | 7.83% |

| Nonprime | 8.12% | 12.08% |

| Subprime | 10.79% | 17.46% |

| Deep Subprime | 13.42% | 20.62% |

**Please note that the rates provided in this table represent general market data and will vary based on individual circumstances.

Now that you have a better understanding of auto loan rates by credit score, let’s explore some strategies to help you qualify for the lowest rates:

Shop around: One of the best ways to secure a low auto loan rate is by shopping around and comparing offers from multiple lenders. This will help you find the most competitive rates and terms for your specific needs. See your lowest rate from trusted credit unions, with no hit to your credit score until you choose to finalize your offer.

Opt for a shorter loan term: Although a longer loan term may result in lower monthly payments, it will also lead to higher overall interest payments. By choosing a shorter loan term, you can save money on interest and pay off your loan faster.

Make a larger down payment: By making a larger down payment, you can reduce the amount you need to borrow, which may help you qualify for a lower interest rate.

Improve your credit score: Your credit score plays a significant role in determining the interest rate you’ll receive on an auto loan. By improving your credit score, you can potentially save thousands of dollars in interest payments over the life of your loan. Start by checking your credit report for errors, paying your bills on time, and reducing your overall debt.

Here are some general tips for raising your credit score, and keeping it in excellent shape:

Be sure to check out our in-depth guide on how to save on auto loan interest.

In conclusion, staying informed about the latest auto loan rates and understanding how they can vary based on factors such as credit score and loan term is crucial when shopping for a new or used car. By following these tips, staying on top of the latest market trends, and working to improve your credit score, you’ll be better positioned to secure the best auto loan rates available.

Ready to find the best auto loan rates for your needs? Compare offers from trusted credit unions with CarEdge Finance today. Our platform makes it easy to find competitive rates, ensuring that you get the best deal possible on your auto loan.

Ready for expert car buying help? Our team of auto industry pros is ready to help you negotiate the best deal with the lowest rate. Check out our services below.