CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

As we navigate the new year, the automotive industry is showing signs of recovery, with new car sales expected to lift slightly in Q1 2023. In a recent press release, automotive research firm Edmunds shared its predictions for the industry, highlighting the potential for growth in sales volume. We’ll dive into the key findings from the press release, and summarize the standout data to provide a clear outlook on what’s in store for the car market.

According to Edmunds, new vehicle sales in the first quarter of 2023 are expected to reach approximately 3.9 million units, a 0.6% increase compared to Q1 2022. This growth is an encouraging sign for the automotive industry, which has faced numerous challenges over the past couple of years, including supply chain disruptions, inventory shortages, and fluctuating consumer demand.

Edmunds’ predictions also shed light on the performance of various vehicle segments in Q1 2023. SUVs and trucks continue to dominate the market, with the SUV segment expected to account for 54.5% of new vehicle sales. Trucks follow closely, comprising 21.7% of the market share, while passenger cars trail behind at 23.8%. This trend highlights the ongoing consumer preference for SUVs and trucks, which offer more space, versatility, and capabilities compared to traditional passenger cars.

Back in 2021, SUVs held 52.5% of U.S. market share, trucks were 23.4%, and sedans were 24.1% of total light-duty sales. As we can see, vehicle sales by segment are holding relatively steady following the rapid rise of crossover SUVs in the past decade.

Edmunds also provides a breakdown of market share by manufacturer, with the top three spots held by General Motors (16.6%), Toyota (14.3%), and Ford (13.5%). These industry giants continue to lead the pack, benefiting from strong brand recognition, diverse vehicle lineups, and loyal customer bases. It’s important to note that these figures could still fluctuate, depending on factors such as production capabilities, consumer demand, and inventory availability.

In Summary: Q1 2023 New Vehicle Sales Predictions

Total Q1 2023 Sales: 3.9 million units (0.6% increase from Q1 2022)

SUVs: 54.5% market share

Trucks: 21.7% market share

Passenger Cars: 23.8% market share

General Motors: 16.6% market share

Toyota: 14.3% market share

Ford: 13.5% market share

The Q1 2023 new vehicle sales predictions from Edmunds paint an optimistic picture for the automotive industry, as sales are expected to lift slightly compared to the previous year. The data also highlights the ongoing dominance of SUVs and trucks in the market, as well as the strong positions held by major manufacturers like General Motors, Toyota, and Ford. As we move further into 2023, it will be interesting to see how these predictions pan out and whether the industry continues on its road to recovery.

As always, CarEdge will keep you updated on the latest trends and insights in the automotive world, helping you make informed decisions on your car-buying journey. Check out the different ways we can help you buy your next car for less. We’re real people helping drivers save real money! The proof is in the pudding: these success stories show how much the CarEdge Community saves every day.

In 2024, it’s tough finding a cheap new car. Just a decade ago, buying a new car for $30,000 was the norm. Fast forward to today, and the average price has skyrocketed by 60%, sitting at about $47,000. Despite this surge, there’s still hope for budget-conscious buyers. Below, we’ve compiled all you need to know about the three cheapest new cars on sale in 2024.

Starting Price: $17,820 with destination charges

Fully-Loaded Price: $24,000+

For those searching for the cheapest new cars in 2024, the Nissan Versa stands out as a prime candidate with a starting price of only $17,820 with Nissan’s expensive destination charges included. The Versa boasts a 5-star safety rating and an impressive 35 MPG, making it not only economical but also safe and efficient. Plus, the Versa is all-around better rated than the #2 cheapest car in America, the Mitsubishi Mirage (starting at $17,450).

See Nissan Versa listings with the power of local market data

Starting Price: $18,015 with destination charges

Fully-Loaded Price: $20,215+

The 2024 Mitsubishi Mirage is one of the last subcompact hatchbacks available, with a starting price under $20,000. It offers a lengthy list of standard features, including automatic climate control, a forward collision warning system, and a touchscreen infotainment system with Apple CarPlay and Android Auto. However, the Mirage’s slow performance, lack of comfort, and cheap interior won’t brighten your day. The slightly cheaper Nissan Versa is all-around a better option.

See Mitsubishi Mirage listings with the power of local market data

Starting Price: $21,275 with destination charges

Fully-Loaded Price: $24,525+

The 2024 Hyundai Venue might be the last new SUV with an MSRP under $20,000, but even the required delivery fees push it over the top. At a starting price of $21,275 with delivery, this is the cheapest crossover on sale. The cargo volume of the Hyundai Venue is just 32 cubic feet with the back seats folded, which is less than half of what you get with the larger Hyundai Tucson and Santa Fe.

Although the Hyundai Venue is technically the most affordable crossover, the only true SUV benefits you get are a rear hatch instead of a trunk and a higher ceiling for hauling.

Fuel economy is merely okay at 29 city / 33 highway, and NHTSA safety ratings are average at 4-stars overall.

See Hyundai Venue listings with the power of local market data

Finding the cheapest cars in 2024 may seem like a daunting task given the rising prices in the auto market. However, with options like the Mitsubishi Mirage, Nissan Versa, and Hyundai Venue, budget-friendly cars are still within reach. These vehicles not only offer affordability but also provide efficiency, safety, and value for their price.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

For the past few years, electric vehicles have sold for about $10,000 more than combustion-powered counterparts on average. That’s not good for the consumer, and it’s not helping EV adoption. However, the market is changing. In 2024, you CAN negotiate electric car prices, at least for some of the most popular models. Here’s where the market stands, and how to negotiate a better price when you head to the dealership to buy your next EV.

The EV supply shortage is well behind us, and the legacy automakers are busy playing catch-up. It’s not all about Tesla anymore. Mainstream automakers like GM, Ford, Toyota and Honda are introducing their own budget-minded EVs in 2024 and 2025. On top of that, EV tax credits were revamped to remove the previous sales cap, and introducing new limitations.

Demand for electric vehicles remains high, and more than two-thirds of American drivers are at least somewhat interested in owning an EV in the future. What’s changing is the supply of new and used EVs on the market.

Little by little, electric vehicles are becoming a mainstay on dealer lots. Five years ago, Tesla, Chevrolet and Nissan were the few known for their electric offerings. Today, every automaker has jumped on the electric bandwagon.

Electric car prices remain higher than the overall industry average. The average new EV sold for $56,648 in 2024. That’s over $8,000 more than the overall average new car price of $48,401. This is an improvement over where EV prices were about two years ago when the average transaction price was about $64,000.

So yes, electric cars, SUVs and trucks remain expensive overall. However, for the determined and knowledgeable buyer, savings can be had when negotiating EV prices. Let’s dig into the details.

Are you shopping new or used? You can’t negotiate prices for a new Tesla Model Y or any other new Tesla. That’s because Tesla sells direct-to-consumer (learn more about the trend toward DTC sales here). The price you see on tesla.com is the price you pay.

Buying a used Tesla is an entirely different story.

Tesla commands about half of the EV market in America. So when Tesla discounts new models, the effects will spread throughout the new AND used EV markets soon after. In 2023 and 2024, Tesla discounted prices for the Model 3 and Model Y heavily. Why did Tesla drop prices? The answer is simple: to spur interest in its vehicles.

The result is much more affordable NEW Tesla models, and a glut of used Tesla cars on the market. Fewer buyers are opting to buy used at a time when brand-new Tesla models are heavily discounted. Consequently, the market for used Tesla EVs has crashed. You can most definitely negotiate a better deal on a used Tesla today.

Long gone are the days of used Teslas selling for more than new ones.

Before heading to the dealership to negotiate a used Tesla, prepare for the messy market in 2024. Here’s what you need to keep in mind when pursuing a deal on a used Tesla:

Several factors make all EVs more negotiable in 2024, not just used Teslas:

After what we’ve all been through a few years ago, it’s fair to be weary of good news. But deals on EVs are attainable. Zero percent financing abounds! Here are three recent EV success stories from the CarEdge community.

“Thanks to the guidance from CarEdge, I was able to get a 23′ Ioniq 5. I negotiated all of the dealer extras off of the out-the-door price and $4,000 off of the market adjustment. Could’ve gotten the SEL trim for under MSRP, but had my heart set on the Limited.

Really happy with CarEdge, it made all the difference. Hated to pay any market adjustment but the Limited trims are in pretty high demand with limited inventory so I felt good about it. Thanks crew!!”

– Eric, 2023 Hyundai IONIQ 5 Limited

“I purchased a new Kia EV6 from Sterling Kia in Lafayette, LA. I emailed the dealer the evening of 10/21 after hours inquiring if they had a Wind RWD available. Matthew called me the next morning stating the car was available. Before the end of the day, I purchased the EV6 at MSRP with no dealer add ons.”

– Howard, 2023 Kia EV6

“I called a dealer about a Chevy Bolt 2LT, that according to CarEdge’s VIN tracker has been on the lot for 3 weeks 🤯. Salesperson said no markup, $2500 in add-ons, but they said it was negotiable.

I came in and negotiated off all the options except for permaplate. They even gave me the California Clean Fuel rebate, which I wasn’t expecting since California said they paused that rebate.

I learned so much from the CarEdge Community. I came with a check-ready loan. They beat my APR by .1% 👍. I told them I would rather custom order without accessories, they said they would but I would have to wait. When I said I would wait, the manager took off that last option.”

– Stefan, 2022 Chevrolet Bolt

There are many more examples of great car price negotiation wins over at the CarEdge Community. Today, it’s totally possible to negotiate the price of a new or used EV, especially if you’re willing to learn negotiation tactics that are proven to be effective.

Check out this 100% FREE car buying cheat sheet. You’ll know exactly what to say at the dealership to keep your best interests front and center.

Love free stuff? We do too. Search through hundreds of free car buying guides, and don’t forget to check out our help and market update videos on YouTube.

Have you checked your Carvana offers lately? You may be in for a welcome surprise. Used car prices are trending upward in early 2023, and if you’re thinking about selling your car, now might be the time! After seven months of steady price declines, January saw a return to higher appreciation.

To test this hypothesis, we crowdsourced data from CarEdge community members like yourself to figure out just how much cash offers from Carvana, CarMax, Vroom, and others have increased.

What’s driving used car price trends, and how are wholesale markets translating to trade-in values and Carvana offers? When is the best time to sell a used car? We’ll dive into that and more.

According to the latest data from Cox Automotive, wholesale used car prices increased month-over-month in January. From December 2022 to January 2023, seasonally-adjusted used car prices at wholesale auctions rose 2.5%, but remained 12.8% lower than one year before. Only part of January’s rising car prices can be attributed to typical seasonal trends. According to Cox Automotive’s Manheim Used Vehicle Value Index, the non-adjusted used car prices were up 1.5% in January, showing that factors other than seasonality are at play here.

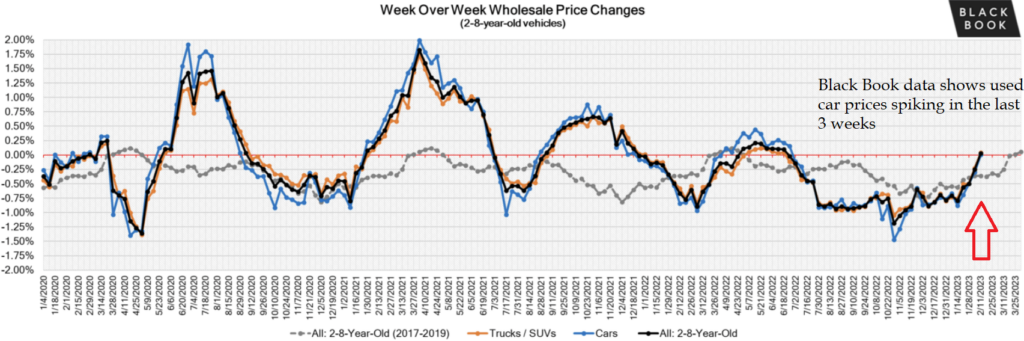

Black Book data shows a similar trend across the broader market. For the first time in nearly 8 months, used car prices increased at wholesale auctions.

“The overall market moved back into positive territory last week for the first time since the middle of June of last year. The newer, 0-to-2-year-old units experienced even larger increases than the 2-to-8-year-old units that are typically featured in our report. The overall market for the younger units increased +0.12%, compared with the 2-to-8-year olds that increased +0.03%. Older model years, 8-to-16-year-old units, increased only slightly less than the newest model years, with an uptick of +0.10%.” – Black Book Market Pro – 2/14/2023

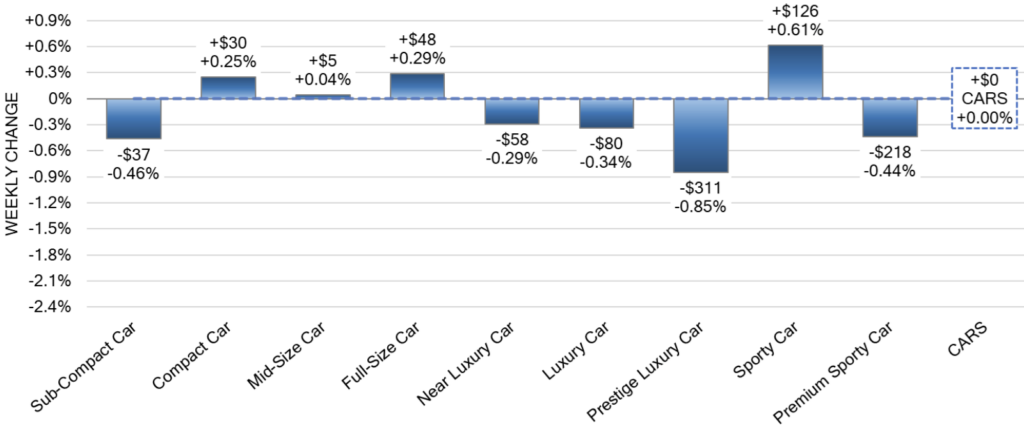

Used car depreciation is slowing down, although the extent varies from one vehicle segment to another.

Seasonal factors are increasing demand as we get closer to spring buying season, but CarEdge’s Ray Shefska thinks there’s more to the story here. “There’s a shortage of the preferred used cars: 2-6 year old cars with lower mileage. Dealers are still willing to fork over more cash at auctions for the used cars that sell quicker. They anticipate a coming shortage of inventory in the warmer months, and are willing to pay more to get cars on their lots today.”

Fears of a recession are subsiding somewhat, and that’s contributing to dealers raising their expectations for the health of the used car market this spring and summer.

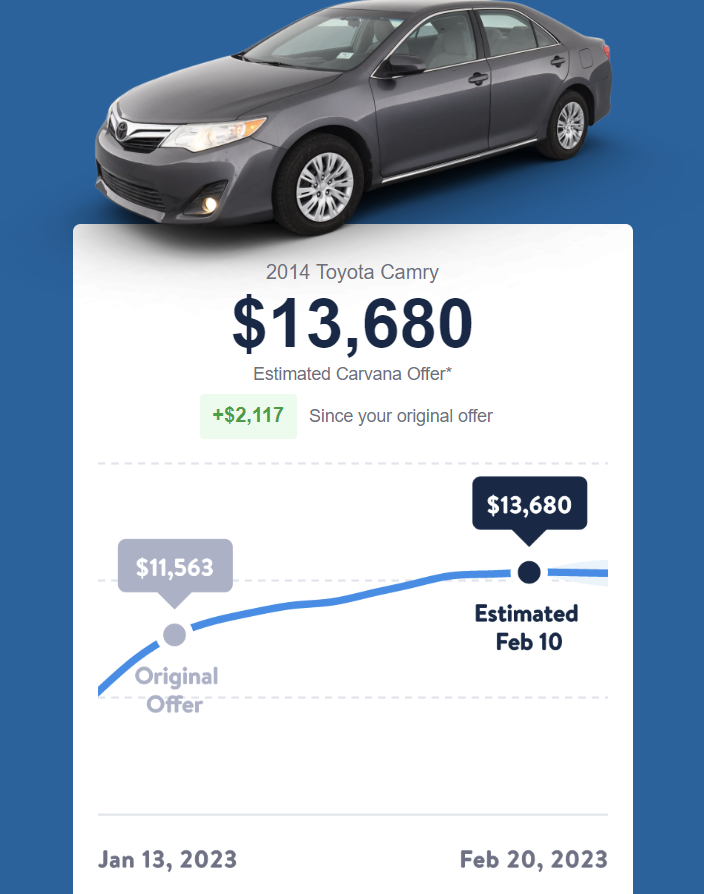

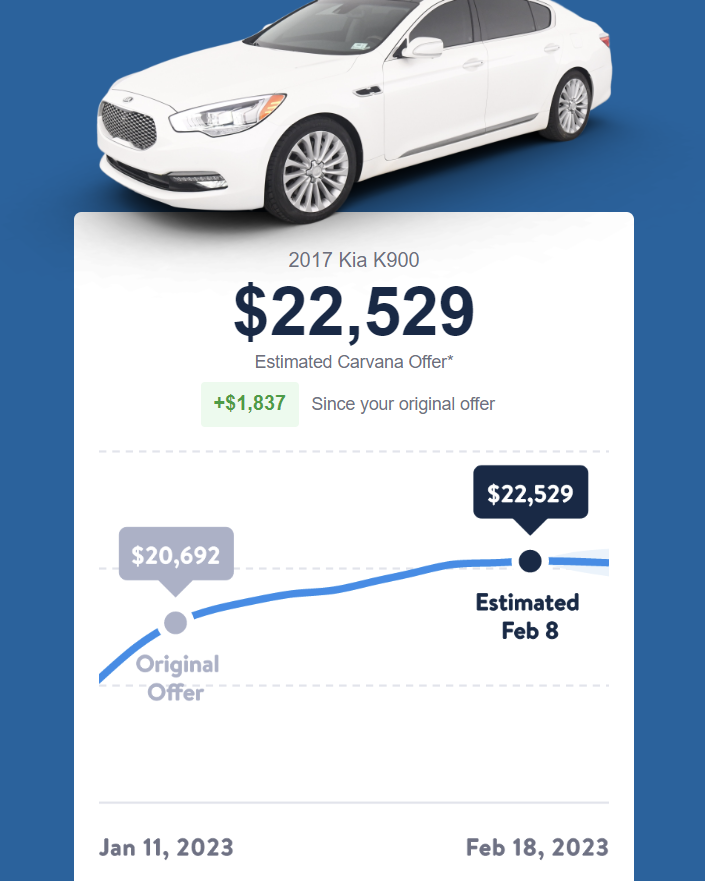

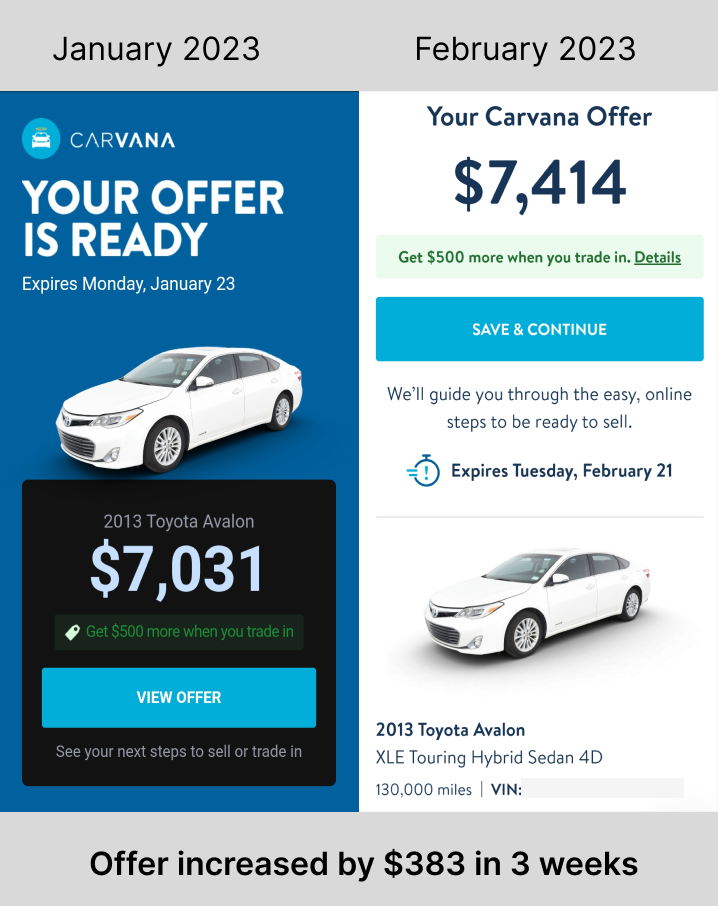

Typically, car market trends at the wholesale level take months to translate to retail prices. That’s not the case this time around. Here are some before and after comparisons of Carvana offers received by CarEdge Community in recent weeks.

We were shocked to find that Carvana’s offer for this 2014 Toyota Camry had increased by $2,117 in just four weeks.

Carvana’s offer for this 2017 Kia K900 increased by $1,837 in about one month.

This 2017 Toyota Avalon gained $383, or about $125 per week over the past month.

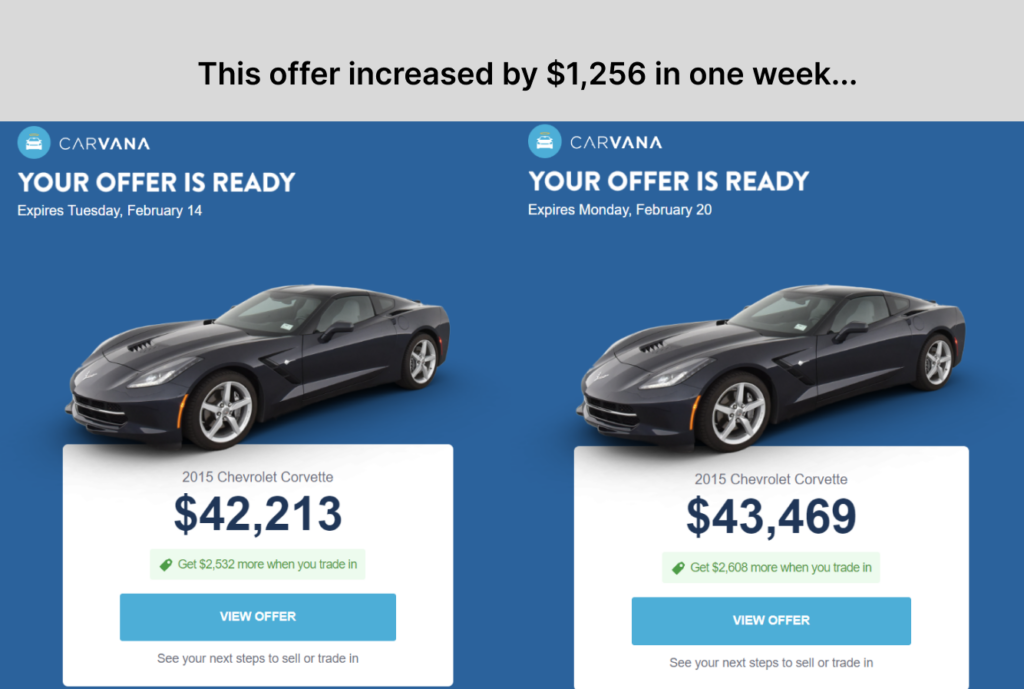

Ready for a real shocker? This 2015 Chevrolet Corvette gained $1,256 in just seven days.

This is especially noteworthy since sporty and luxury cars have depreciated faster than any other vehicle segment in recent months. Now, they’re quickly gaining value. Thank you to our CarEdge Community for sharing these offers with us.

Even if you checked your offers from online car buyers just days ago, we recommend seeing your updated offers with CarEdge. Your car has likely gained value in the past week. Compare multiple quotes without annoying phone calls.

Your car is worth more than it will be in a few months. It’s tax season, and car buyers are about to have a chunk of cash in hand. The increased demand isn’t ubiquitous, at least not yet. Newer, mainstream brands are appreciating more than luxury cars right now.

Ford CEO Jim Farley told investors that Ford expects overall transaction prices to fall by about five percent. “You think about that as a combination of incentives and lower dealer margins. We’re starting to see dealer margins come down now as demand from the industry is easing a bit,” said Farley.

Interest rates remain high, and may climb further. Will the Federal Reserve continue to raise the cost of borrowing money at the next meetings in March and May? Most analysts expect at least one more 25 basis point hike in the near future. With that said, the cost of financing is likely to become an even greater burden to car shoppers in the months ahead, and that could soften the market yet again.

If you’re considering selling or trading-in your vehicle, you’re likely to get the best deal in February and March.

The used car market has changed a lot in recent weeks. Even if you’ve recently received online offers from Carvana, Vroom, or others, you’ll want to see your car’s updated offer. It’s likely that your car’s value has risen.

Sadly, most popular online car buyers and quote tools make money by selling your information to third parties. CarEdge will never sell your data. Get the best offer when you sell your car, WITHOUT giving your data away. Compare quotes from CarMax, CarGurus, EchoPark and others with CarEdge, and get your offers in minutes.

Has your car’s value gone up in recent weeks? Let us know in the comments below, or join the internet’s fastest-growing automotive forum, the CarEdge Community.

In the market to buy? We’re here to help you take control of your deal and save money. Whether you’re looking for some 1:1 help with negotiating thousands off your deal, or are simply ready to hand over the keys and let a pro do the negotiating on your behalf, CarEdge Car Coaches are ready to assist. We have options for every budget. Check out plans and benefits today!

We track new car inventory monthly, and it’s been encouraging to see automakers like Ford and Toyota having more cars shipped to dealers. Still, automakers are selling every car they can make. With that said, more drivers are placing factory orders for vehicle builds that might not arrive until well into next year, or worse. Here’s how long car buyers are waiting for the vehicle they want. We want to send a special thank you to CarEdge Coach Mario for sharing this update with our audience!

Important note: These times are strictly for factory ordered cars. Many of these models are now available on dealer lots.

Hyundai Motors owns 51% of Kia, and the two Korean automakers have grown increasingly close over the past decade. Today, many of their vehicles share components, and therefore have been similarly impacted by supply chain constraints.

These are the factory order wait times our team of Car Coaches is hearing in 2025:

Right now, buyers placing orders for a Subaru are regularly being told that the wait time for delivery will be between one and four months, and in some cases longer. Subaru was hit hard by the chip shortage, and has yet to pull out of the slump.

In general, 2-3 months wait can be expected for any custom-ordered Subaru in 2025. Here are some additional details from what CarEdge Coaches are seeing:

How long you should expect to wait depends on the Toyota model and spec that you want. For Toyota deliveries, you’ll be looking for an available allocation rather than a custom order. For Toyota hybrids and plug-in hybrids, wait times are generally much longer.

In 2025, most Toyota models no longer have long waitlists for an available allocation, with the exceptions being the Prius, GR86, GR Corolla, Grand Highlander Hybrid, Land Cruiser, Sienna, Supra M/T and Spec Edition TRD Pro. For these models, you can expect to wait 3-4 months for an allocation that’s not already spoken for.

It is worth noting that more Toyota hybrid models may start seeing longer wait times as demand increases during summer buying season.

On average, Honda factory orders (or allocations) placed today can expect a short wait before delivery, generally less than two months. The only remaining Honda models with inventory constraints are the Civic Si and Civic Type R.

Otherwise, these are the Honda factory order wait times we’re seeing in 2025:

Accord: Immediate

Civic: 1-2 months

CR-V: 1-2 months

CR-V Hybrid: 2-3 months

Odyssey: 1-2 months

Pilot: 1-2 months

Ridgeline: Immediate

For Jeep and Ram factory orders, wait times depend on what model and trim you want. Don’t forget that these two brands have the highest new car inventory in the industry right now, so lot inventory is especially negotiable. Don’t expect the same negotiability with Ram and Jeep factory orders.

These are the Ram truck factory wait times our team is encountering in 2025:

Ram 1500: 2-3 months

Ram Super Duty: 3-5 months

Jeep factory orders: 8 – 10 weeks

These are the Ford factory order wait times we’re seeing this year:

Bronco: 6-9 months

Ford F-150: 5-6 month wait time for higher trims (King Ranch, Tremor, Platinum), less than 3 months on XL, XLT and Lariat

F-250: 2-3 months

F-350: 2-3 months

Mustang: 3 months

Tesla regularly updates wait times for the Model Y, Model 3, Model S and Model X. As of 2025, here are Tesla wait times as shared on Tesla.com. Note that there are many possible configurations that affect estimated delivery dates, so check Tesla’s configurator for the most accurate estimate.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!