CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Buying a car is tricky. After negotiating a fair selling price, you need to be ready to go to battle for round two; negotiating a fair auto loan rate. Many car buyers think, “I’ll negotiate the selling price of the vehicle, and then I am all set!” This couldn’t be further from the truth.

Most don’t realize that they can negotiate the interest rate on a car loan. You DON’T have to take the financing offer from the dealership. Consumer Reports recently published an in depth investigative piece on auto loans and how they take advantage of consumers.

Today we’re going to walk you through how you can get a lower auto loan rate. No gimmicks, no ads, no BS, just the information you need to be informed the next time you finance a car purchase.

Looking for the best auto loan offers right now? Check out our list, updated every month.

When you buy a car you have many options for how you pay for it. Some people (if they have the means for it) like to pay in cash. Others (on new vehicles) like to lease. Most of us will end up financing the purchase of a vehicle.

This means we take out an auto loan. The bank pays the seller, and we then pay the bank for a set period of time. The bank makes money by charging you (the customer) an interest rate. On each of your monthly payments for the loan you are paying down the principal (the total loan amount) and interest (the money the bank makes).

Thinking about buying an extended warranty? Get a free quote from CarEdge first!

That’s a super simplified view of financing a car. Let’s focus our attention on what options you have to secure the BEST auto loan rate.

One option is to take the financing offer a dealership provides you with. This may not be your best option. If you’ve bought a car before you know at a certain point the salesperson is going to ask you to fill out a credit application. By filling out their credit application you’re giving the dealership the opportunity to contact multiple financial institutions to see what loans they can get you approved for.

This practice of sending your information out to many banks is sometimes referred to as “shotgunning”.

The dealership’s finance manager will see what you got approved for and then likely “mark up” the interest rate. Remember, the interest rate is the profit the bank makes for having made the loan. Well, the dealership can make money too by increasing the interest rate above what the bank approved you for.

This is sometimes referred to as “holding points”. If you get a financing offer from a car dealership, and it is not a special rate from the manufacturer (i.e. zero percent financing), then it likely is a marked up interest rate. Remember, this is likely NOT the best auto loan rate you can secure.

Coming into a car dealership with a pre-approval from a bank or credit union for your car loan is a smart decision. In advance of purchasing your vehicle you can contact your local bank or credit union to see what financing offers they can provide you with.

Credit unions are known for having very competitive used card loan interest rates. You should get a quote from an outside financial institution before going to the dealership.

You can even get a quote from a credit union through us. Check it out!

More and more frequently, especially as the chip shortage has drastically reduced new car inventories, we have heard from CarEdge Community members that dealerships are saying “You have to finance through us if you want to buy this car.” While this isn’t illegal, it certainly is unethical. That being said, as consumers we have a way to combat it.

To get the lowest auto loan rate possible, it may make sense to take the dealership’s finance offer and then immediately pay off, or refinance the car loan.

If you are going to do this, do not tell the dealership. The dealership will receive a chargeback on the loan they placed (aka it will cost them money), however you are well within your right to refinance your loan as quickly as you’d like.

The steps to refinance a car loan are quite simple. There are more and more companies that have entered the refinance space. It’s important that you understand how refinancing companies make money so that you can be informed as you go through the process.

Refinance companies do not make money by placing you in a loan. Instead, refinance companies make money by selling their customers ancillary products (think extended warranties, insurance policies, etc.)

If you’re going to refinance your car loan, then be aware that the refinance company will try to sell you their insurance products. As always, be sure to negotiate the price of those products if they interest you, and get a quote from CarEdge for the extended warranty so that you have leverage.

You can get a refinance quote with us. No strings attached, and no markups!

That’s a great question! We have an entire resource dedicated to helping those that have subprime (or no) credit. Take a look at that here: https://caredge.com/guides/how-to-buy-a-car-with-no-credit/

If you have questions, please post them on the forum. We’re here to help!

General Motors reported net income that was 40% lower than the same period last year. Ford’s net income was off 24%, and Volkswagen’s fell 12%. As you know by now, no automaker has been able to sidestep the effects of the ongoing chip crisis. Every automaker has faced production challenges, with many OEMs shutting down their manufacturing plants for weeks at a time.

Which automakers have been hit the hardest from the chip shortage? With Q3 results in hand, and a myriad of other data sources to draw from, it becomes clear who is faring the best and who is faring the worst. Since GM, Ford, and Volkswagen all reported their third quarter earnings this week, we’ll focus our attention on them.

Let’s dive in.

General Motors’ Q3 results were disappointing. Compared to their peers, net income fell more than expected (down 40% year-over-year). That’s not what is most concerning for the company. It appears as if GM is having an identity crisis. The brand, once known and revered for its American made qualities, is now struggling with how to become an electric vehicle manufacturer.

CEO Mary Barra is demonstrating a masterclass is projecting confidence, however when you take a peek “under the hood” it becomes clear that GM is struggling. First and foremost they were hit the hardest and caught most off guard by the chip shortage.

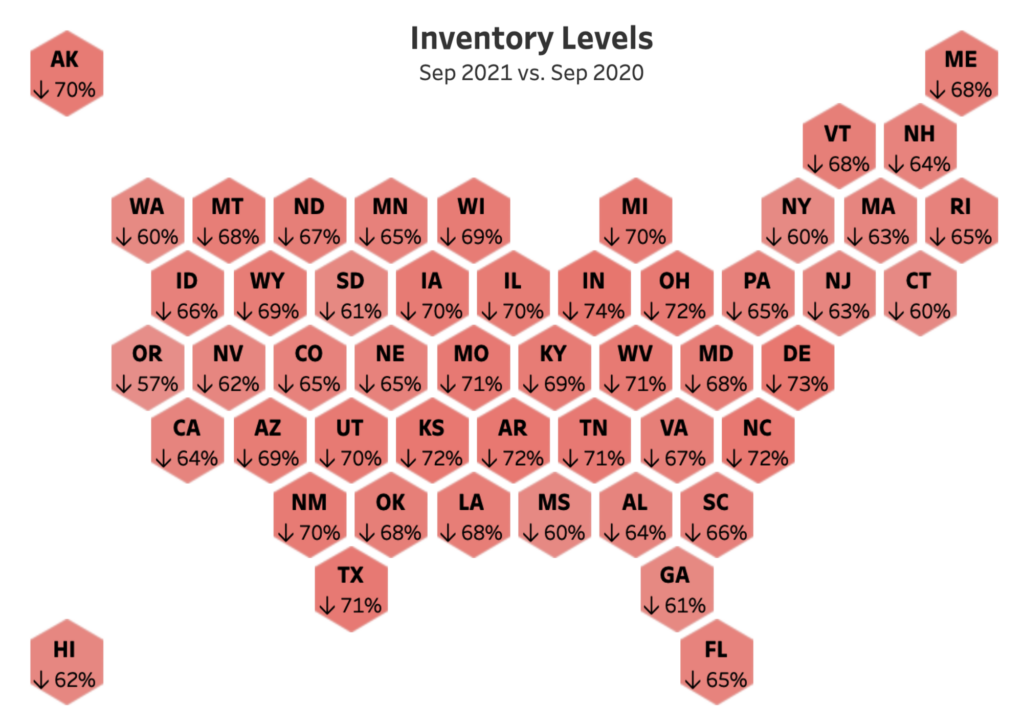

Inventory of GM products (Chevrolet, Buick, GMC, and Cadillac) has suffered more than their peers so far in 2021. For example, in Texas Chevy inventories are down 80% year-over-year, whereas Ford is (only) down 66%. You can explore and drill down on state-by-state inventory levels by brand here.

General Motor’s plant utilization was just 60 percent in the third quarter. This is down from 112 percent a year earlier. At that time, multiple plants were running on overtime to make up for the shutdowns at the start the global pandemic. For the year, GM’s capacity utilization rate is 81 percent, down from 85 percent through three quarters of 2020.

GM recently reported that they have received enough chips to finish production of their partially built 2021 model year inventory. This is a good thing, however one challenge the automaker (and their dealer network) may face is “lot rot” associated with those vehicles that had been siting for 6+ months waiting for their final modules to be installed. GM has plenty of challenges in front of them.

Thinking about buying an extended warranty? Get a free quote from CarEdge first!

Recently GM announced a massive investment in electric charging stations. The automaker appears to be going all in on electric vehicles. With this announcement, plus bringing back the Hummer in electric form, GM is certainly in a period of transformation. Will they come out on the other side as a better and stronger company? Only time will tell, however, if their recent performance is any indicator of what the future holds, I wouldn’t be holding my breathe.

If there is an automaker who is trying to make GM feel better, it would be Ford. Their struggles have been well documented so far in 2021. They too were caught off guard by the chip shortage, and their response was not much better. Couple this with a slew of quality control issues, and you have a recipe for poor earnings!

Ford’s Q3 net income dropped 24% year-over-year. We can again look at our state-by-state dataset to see that their inventory levels nationwide are down considerably. We also have access to market days supply data from Ford.

Nationally, inventory levels are off ~66% from where they typically would be.

There is light at the end of the tunnel for Ford though. At the beginning of Q3, Ford had approximately 70,000 unfinished vehicles waiting for chips. Ford CFO, John Lawler said they ended the quarter with 27,000 partially-built vehicles, and that the number should drop below 5,000 at the end of the year.

Ford, just like GM is investing mightily in becoming an electric vehicle company.

VW Group’s net income dropped 12% in Q3 year-over-year, a much more modest decline than their American peers. VW, just like GM and Ford has struggled to produce enough vehicles to meet consumer demand. To preserve profit margin, VW has allocated resources towards the production of higher profit vehicles (Audi and Porsche).

What does that mean in practice? Well, at VW’s main factory in Wolfsburg, Germany they currently have an order backlog of more than 130,000 Golf models. That equals roughly four months of production and comes on top of 110,000 orders for the brand’s best-selling Tiguan SUV that are also on backorder.

VW Groups global deliveries were down 24%, and inventory levels of their more affordable brands have seen the biggest declines.

On Monday October 25th, Hertz announced their intention to purchase 100,000 Teslas, worth an estimated $4.2B to electrify their rental car fleet. The company partnered with Tom Brady to announce the launch.

As you may remember, Hertz nearly went bankrupt earlier in 2021 as the rental car company sold off its fleet in an attempt to stay solvent. Now, the company, on the other side of bankruptcy is betting big on electric vehicles.

With their order from Tesla, Hertz’ rental car fleet will now be 20% electric vehicles globally. Hertz is also investing to install thousands of EV chargers nationwide. Hertz customers that rent a Tesla Model 3 will have access to Tesla’s supercharging network, however Tesla Supercharger Idle Fees are not included in Hertz rental car payments.

Hertz first introduced EVs in their rental car fleet in 2011. They were the first rental car company to add EVs to their fleet.

The Tesla Model 3 Standard Range Plus costs $41,990. This suggests that Hertz has paid near list price for their 100,000 vehicle order. This doesn’t come as too much of a surprise as we expect all manufacturers will increase their base MSRP for the next model year because of myriad production issues. If Hertz did pay 2021 MSRP for their order that may actually represent a significant discount relative to the price increase we expect to see next year for the Model 3.

Hertz has also now recently announced deals with Carvana and Uber to provide short-term leases of their Tesla fleet as well as to sell them once Hertz is done with them. More on that here:

Which brands retain the most customers? When it comes to car buyers, loyalty is a fierce competition. BMW vs. Mercedes-Benz, Toyota vs. GM, the list goes on and on. Which automakers have the most and least loyal customers? Well, Experian has the answer.

Their latest Q3 United States automotive loyalty rankings were recently released, and the results were interesting to say the least. Which brand retains the most customers? Which automaker performs the worst? Let’s dive in and find out.

Before we do, it’s important to understand that the percentages we refer to below represent the percent of consumers who own that brand of vehicle and return to buy another from the same manufacturer. We do not have data for Tesla at this time.

| Brand | Current Year Loyalty | Previous Year Loyalty | YOY Change |

| Ferrari | 71.4% | 66.7% | 4.7% |

| Hyundai | 66.8% | 67.8% | -1.0% |

| Honda | 66.4% | 68.6% | -2.2% |

| Kia | 66.0% | 68.2% | -2.2% |

| Toyota | 65.6% | 63.6% | 2.0% |

| Subaru | 65.0% | 73.2% | -8.2% |

| BMW | 64.1% | 66.7% | -2.6% |

| Ford | 62.1% | 73.1% | -11.0% |

| RAM | 61.9% | 62.7% | -0.8% |

| Chevrolet | 61.8% | 66.4% | -4.6% |

The automaker that retains the most customers is Ferrari, with 71.4% of their owners returning to buy another Ferrari. They are the only brand to crack the 70% threshold. After Ferrari is Hyundai, with an astounding 66.8% loyalty rate. As far as mass market brands go, Hyundai is in first place, with Honda and Kia right behind them at 66.4% and 66% respectively. Toyota and Subaru round out the top five “attainable” brands, with BMW, Ford, RAM, and Chevrolet following next.

You can see the year-over-year change for each automaker as well. Subaru and Ford have both struggled mightily to retain their brand loyalty levels. This is likely in part due to the chip shortage, and their inability to produce enough vehicles to keep up with consumer demand.

Ferrari and Toyota are the only two brands that saw their loyalty ratings increase year-over-year.

| Brand | Current Year Loyalty | Previous Year Loyalty | YoY Change |

| FIAT | 7.2% | 8.3% | -1.1% |

| Chrysler | 24.4% | 22.9% | 1.5% |

| Dodge | 27.5% | 23.9% | 3.6% |

| Jaguar | 29.0% | 36.3% | -7.3% |

| Lamborghini | 37.8% | 59.0% | -21.2% |

| INFINITI | 40.3% | 45.5% | -5.2% |

| MINI | 40.4% | 41.9% | -1.5% |

| Alfa Romeo | 42.1% | 48.2% | -6.1% |

| Rolls-Royce | 42.7% | 44.1% | -1.4% |

| Land Rover | 44.4% | 52.0% | -7.6% |

How is FIAT still in business? Last quarter they sold 401 total units, and their brand loyalty is an industry worst 7.2%. Why the heck are they still in existence in the United States?

Chrysler comes in second to last at 24.4%, with Dodge and Jaguar right behind them. Lamborghini is a surprising entrant in the “least” loyal list, especially with Ferrari (their most direct competitor) being at the top of the overall rankings.

Infiniti and Mini are not surprising, both with nearly 40% brand loyalty. Alfa Romeo, Rolls-Royce, and Land Rover round out the top ten brands with the least loyalty.

| Brand | Current Year Loyalty | Previous Year Loyalty | YoY Change |

| Aston Martin | 57.6% | 40.0% | 17.6% |

| Genesis | 49.1% | 36.1% | 13.0% |

| Mitsubishi | 47.3% | 36.8% | 10.5% |

| Buick | 56.9% | 51.2% | 5.7% |

| Ferrari | 71.4% | 66.7% | 4.7% |

Aston Martin improved their brand loyalty by 17.6% in 2021. This may in part be due to the recent launch of the first ever Aston Martin SUV. Genesis, who has received rave reviews for their latest line of vehicles saw their loyalty increase by double digits as well. Mitsubishi’s loyalty increased by over 10% too. Buick and Ferrari round out the top five.

| Brand | Current Year Loyalty | Previous Year Loyalty | YoY Change |

| Lamborghini | 37.8% | 59.0% | -21.2% |

| Lincoln | 55.2% | 67.4% | -12.2% |

| Mercedes-Benz | 57.0% | 68.8% | -11.8% |

| Ford | 62.1% | 73.1% | -11.0% |

| Subaru | 65.0% | 73.2% | -8.2% |

Lamborghini lost 21.2% on their loyalty ranking. This is likely due to the fact that the brand brought in a lot of new buyers with their SUV, and many of those buyers are not loyal to the brand (yet). Lincoln and Ford are both in the top 5 brands that lost the most loyalty in 2021. This isn’t too much of a surprise since both are struggling with quality control issues and production problems. Mercedes-Benz is a bit of a surprise entrant on this list, however it’s no wonder BMW is on pace to attain the number one selling luxury brand in 2021. Subaru’s brand loyalty dropped a bit more than 8%, another indication of what happens when automakers can’t produce enough vehicles.

| Brand | Current Year Loyalty | Previous Year Loyalty | YoY Change |

| Acura | 56.0% | 60.2% | -4.2% |

| Alfa Romeo | 42.1% | 48.2% | -6.1% |

| Aston Martin | 57.6% | 40.0% | 17.6% |

| Audi | 54.1% | 57.3% | -3.2% |

| Bentley | 57.5% | 57.5% | 0.0% |

| BMW | 64.1% | 66.7% | -2.6% |

| Buick | 56.9% | 51.2% | 5.7% |

| Cadilac | 59.1% | 61.1% | -2.0% |

| Chevrolet | 61.8% | 66.4% | -4.6% |

| Chrysler | 24.4% | 22.9% | 1.5% |

| Dodge | 27.5% | 23.9% | 3.6% |

| Ferrari | 71.4% | 66.7% | 4.7% |

| FIAT | 7.2% | 8.3% | -1.1% |

| Ford | 62.1% | 73.1% | -11.0% |

| Genesis | 49.1% | 36.1% | 13.0% |

| GMC | 54.7% | 54.8% | -0.1% |

| Honda | 66.4% | 68.6% | -2.2% |

| Hyundai | 66.8% | 67.8% | -1.0% |

| INFINITI | 40.3% | 45.5% | -5.2% |

| Jaguar | 29.0% | 36.3% | -7.3% |

| Jeep | 51.4% | 53.3% | -1.9% |

| Kia | 66.0% | 68.2% | -2.2% |

| Lamborghini | 37.8% | 59.0% | -21.2% |

| Land Rover | 44.4% | 52.0% | -7.6% |

| Lexus | 56.3% | 59.8% | -3.5% |

| Lincoln | 55.2% | 67.4% | -12.2% |

| Mazda | 58.4% | 61.3% | -2.9% |

| Mclaren | 48.8% | 52.7% | -3.9% |

| Mercedes-Benz | 57.0% | 68.8% | -11.8% |

| MINI | 40.4% | 41.9% | -1.5% |

| Mitsubishi | 47.3% | 36.8% | 10.5% |

| Nissan | 60.8% | 60.9% | -0.1% |

| Porsche | 55.4% | 60.0% | -4.6% |

| RAM | 61.9% | 62.7% | -0.8% |

| Rolls-Royce | 42.7% | 44.1% | -1.4% |

| Subaru | 65.0% | 73.2% | -8.2% |

| Toyota | 65.6% | 63.6% | 2.0% |

| Volkswagen | 56.3% | 60.8% | -4.5% |

As if the auto industry needed another issue … After nearly a year of dealing with a chip shortage, automakers are on the precipice of dealing with a potentially even more crippling shortage: magnesium. The magnesium shortage has recently been reported by the Financial Times and Bloomberg. What’s going on? How will it effect car production? And most importantly, what do you need to know? We’ve got your covered.

Let’s dive in.

Magnesium is used in a variety of products. In cars, magnesium can be found in gearboxes, front end and IP beams, steering columns, driver’s air bag housings, steering wheels, seat frames and fuel tank covers. Magnesium is useful in these applications because it is lighter than alternative materials (steel and aluminum).

The International Magnesium Association (yes, that exists) has a great webpage dedicated to the history and use cases of magnesium in cars, trucks, and SUVs. The long and short of it is that magnesium has been used in automobiles since the 1920’s, and a lot of it is used in nearly every vehicle.

Automakers have been struggling to produce vehicles throughout all of 2021. An ongoing shortage of integrated circuits, also commonly referred to as “chips” has cost the auto industry more than 10 million vehicles so far in 2021 alone. More than 3,000 days of production time have been lost because of the chip shortage. Another shortage, especially a shortage of a material as important as magnesium, could be a worst case scenario for automakers that are already struggling.

Bloomberg said it best, the situation “threatens to worsen a supply squeeze that already has pushed U.S. prices close to all-time highs.”

The Financial Times reported, “The world’s largest carmakers could face a potentially crippling shortage of aluminum, as China’s power crisis threatens supplies of a key component used to make the lightweight metal.” Magnesium is used in the production of aluminum alloys.

Most of the world’s magnesium supply comes from China. For context, the association representing Germany’s metals industry warned its government in a letter Tuesday that “the current magnesium inventories in Germany and respectively in the whole of Europe will be exhausted by the end of November 2021.” This is a direct result of the fact that China accounts for 95% of Europe’s magnesium supply.

| Country | Magnesium production (thousand tonnes) |

| 800 | |

| 65 | |

| 50 (est) | |

| 25 | |

| 23 | |

| 19 | |

| 15 | |

| 10 | |

| 10 | |

| 5 |

What is the “power crisis” that The Financial Times is alluding to? It’s a perfect storm … Literally.

Flooding across key coal producing provinces in China, an increasing domestic and international demand for Chinese goods in the wake of pandemic easing, and extreme market distortions, including power rationing and price controls, have all contributed to the power crisis currently occurring in China.

Power is currently being rationed across most all Chinese provinces. It is unknown when those measures will be discontinued. There are people much smart and well-versed in this field documenting this: https://supchina.com/2021/09/28/the-three-causes-of-chinas-power-outages/

We have yet to hear from any major automaker about the magnesium shortage, however as third quarter earnings kick into high gear we would not be surprised to hear more about how the magnesium shortage is effecting production. As we get more information about the magnesium shortage we will update this page.