CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

When shopping for a new car, many buyers look for a balance between safety and reliability—but these two factors don’t always go hand in hand. The latest 2025 car safety ratings from the Insurance Institute for Highway Safety (IIHS) reveal a surprising disconnect between crash-test performance and long-term dependability. While 48 models earned IIHS Top Safety Pick (TSP) or Top Safety Pick+ (TSP+) ratings, many of these “safest” cars come with questionable reliability based on the latest ratings from Consumer Reports. Here’s what drivers should know about reliability and safety before buying a car in 2025.

In 2025, the IIHS awarded far fewer Top Safety Picks than the previous year—just 48, compared to 71 in 2024. This year’s safest vehicles are dominated by import brands, with only five American-made models making the cut: the Chevrolet Traverse, Lincoln Nautilus, Ford Mustang Mach-E, Rivian R1S, and Rivian R1T.

Surprisingly, many of the best-selling cars and trucks in the U.S. did not receive Top Safety Pick ratings, including the five most popular vehicles in America: the Ford F-150, Chevrolet Silverado, Toyota RAV4, Honda CR-V, and Tesla Model Y.

Out of the 25 best-selling cars in the United States last year, only five made the IIHS Top Safety Pick list for 2025:

While a high safety rating might seem like a green light for purchase, it doesn’t always mean the car will be dependable. Consumer Reports’ 2025 reliability predictions show a concerning trend: some of the safest cars on the road today are among the least reliable. These ratings are based on vehicle powertrain history, recalls, and real-world consumer complaints.

Here are five of the biggest disconnects between safety and reliability for 2025:

To give you a complete view, here is the full list of 2025 Top Safety Pick and Top Safety Pick+ models, along with their Consumer Reports reliability ratings. This data highlights the wide range of reliability scores among the safest vehicles available today:

| Model Year | Make | Model | IIHS Rating (2025) | CR Reliability Rating |

|---|---|---|---|---|

| 2025 | Subaru | Forester | Top Safety Pick | 98 / 100 |

| 2025 | Lexus | NX | Top Safety Pick | 77 / 100 |

| 2025 | Mazda | 3 Sedan | Top Safety Pick+ | 72 / 100 |

| 2025 | Mazda | 3 Hatchback | Top Safety Pick+ | 72 / 100 |

| 2025 | Honda | HR-V | Top Safety Pick+ | 71 / 100 |

| 2025 | Honda | Accord | Top Safety Pick+ | 64 / 100 |

| 2025 | Mazda | CX-30 | Top Safety Pick+ | 64 / 100 |

| 2025 | BMW | X5 | Top Safety Pick+ | 61 / 100 |

| 2025 | Audi | Q7 | Top Safety Pick+ | 61 / 100 |

| 2025 | Honda | Civic Sedan | Top Safety Pick | 59 / 100 |

| 2025 | Honda | Civic Hatchback | Top Safety Pick+ | 59 / 100 |

| 2025 | Honda | Pilot | Top Safety Pick | 59 / 100 |

| 2025 | Toyota | Camry | Top Safety Pick+ | 56 / 100 |

| 2025 | Acura | Integra | Top Safety Pick | 55 / 100 |

| 2025 | Infiniti | QX60 | Top Safety Pick | 55 / 100 |

| 2025 | Hyundai | Tucson | Top Safety Pick+ | 54 / 100 |

| 2025 | Chevrolet | Traverse | Top Safety Pick | 52 / 100 |

| 2025 | Genesis | GV80 | Top Safety Pick+ | 51 / 100 |

| 2025 | Hyundai | IONIQ 6 | Top Safety Pick+ | 50 / 100 |

| 2025 | Subaru | Ascent | Top Safety Pick | 50 / 100 |

| 2025 | Hyundai | Kona | Top Safety Pick+ | 49 / 100 |

| 2025 | Genesis | GV60 | Top Safety Pick+ | 47 / 100 |

| 2025 | Mazda | CX-50 | Top Safety Pick+ | 47 / 100 |

| 2025 | Mercedes-Benz | C-Class | Top Safety Pick+ | 46 / 100 |

| 2025 | Acura | MDX | Top Safety Pick | 46 / 100 |

| 2025 | Genesis | G90 | Top Safety Pick | 45 / 100 |

| 2025 | Ford | Mustang Mach-E | Top Safety Pick+ | 43 / 100 |

| 2025 | Hyundai | Santa Fe | Top Safety Pick+ | 42 / 100 |

| 2025 | Kia | EV9 | Top Safety Pick+ | 42 / 100 |

| 2025 | Kia | Telluride | Top Safety Pick+ | 42 / 100 |

| 2025 | Volvo | XC90 | Top Safety Pick+ | 42 / 100 |

| 2025 | Subaru | Solterra | Top Safety Pick+ | 38 / 100 |

| 2025 | Nissan | Pathfinder | Top Safety Pick+ | 38 / 100 |

| 2025 | Genesis | GV70 | Top Safety Pick+ | 35 / 100 |

| 2025 | Genesis | Electrified GV70 | Top Safety Pick+ | 35 / 100 |

| 2025 | Toyota | Tundra | Top Safety Pick+ | 32 / 100 |

| 2025 | Hyundai | IONIQ 5 | Top Safety Pick+ | 30 / 100 |

| 2025 | Mercedes-Benz | GLC | Top Safety Pick+ | 30 / 100 |

| 2025 | Mercedes-Benz | GLE | Top Safety Pick+ | 30 / 100 |

| 2025 | Infiniti | QX80 | Top Safety Pick+ | 30 / 100 |

| 2025 | Mazda | CX-70 | Top Safety Pick+ | 29 / 100 |

| 2025 | Mazda | CX-90 | Top Safety Pick+ | 29 / 100 |

| 2025 | Lincoln | Nautilus | Top Safety Pick+ | 24 / 100 |

| 2025 | Rivian | R1T | Top Safety Pick | 20 / 100 |

| 2025 | Mazda | CX-70 PHEV | Top Safety Pick+ | 15 / 100 |

| 2025 | Mazda | CX-90 PHEV | Top Safety Pick+ | 15 / 100 |

| 2025 | Rivian | R1S | Top Safety Pick+ | 9 / 100 |

| 2025 | Volvo | XC90 Plug-In Hybrid | Top Safety Pick | N/A |

A car’s safety rating is crucial, but it’s only half the picture. Vehicles with high crash-test scores but poor reliability can lead to frustrating ownership experiences, costly repairs, and potential long-term headaches. Before making a purchase, it’s essential to consider both safety and reliability rankings, along with real-world owner feedback.

At CarEdge, we help car shoppers make informed decisions with data-driven insights. Whether you’re searching for a vehicle that’s safe, reliable, or both, our tools and expert guidance ensure you drive away with confidence.

Explore CarEdge’s Free Buyer’s Guide to compare the latest safety, reliability, and cost-of-ownership data on your next vehicle.

Spring is shaping up to be an interesting season for new car buyers. Tax refunds are giving consumers extra cash to put toward a purchase, yet overall consumer confidence has dipped as tariffs make headlines. Meanwhile, inventory levels continue to climb, and new car prices are on a downward trend. For car buyers looking to get the best deal this spring, knowing which brands have the most and least inventory is crucial.

Here’s where the car market stands as buyers head out for test drives this spring.

As of March 2025, the total U.S. supply of unsold new vehicles stood at 2.99 million units, marking a 12.8% increase in inventory year over year. Cox Automotive’s latest Data Point reports that February’s new car sales pace picked up by 13.6% compared to January and 5.9% year over year. The latest car buying report shows that buyers are still making moves despite sliding consumer sentiment.

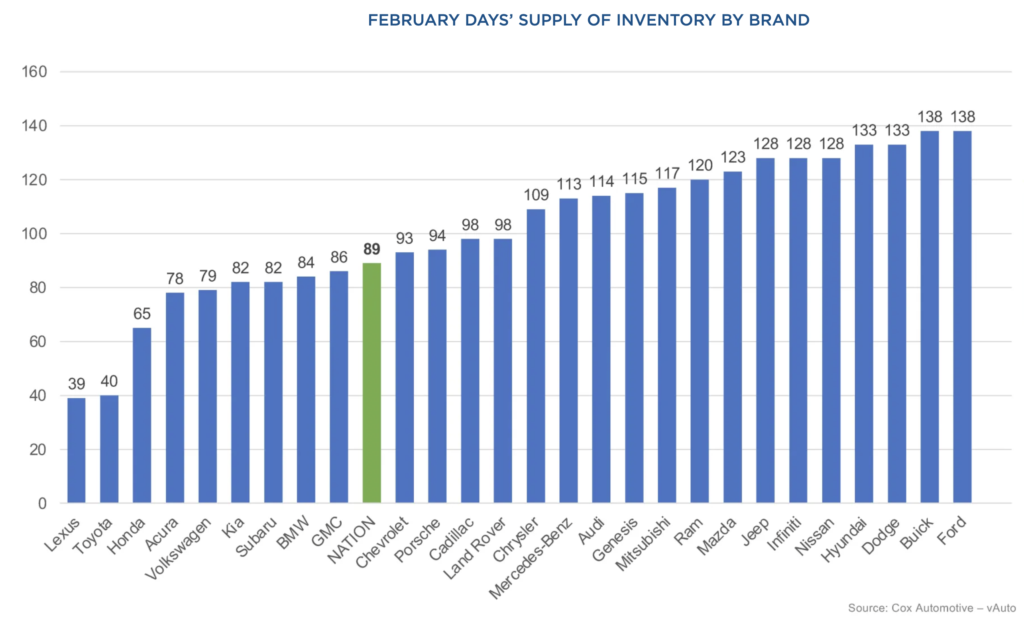

Overall inventory levels remain high, with an 89-day supply of new cars at the start of March. That’s a notable 10% drop from February but still well above pre-pandemic levels. The takeaway? There are more cars on dealer lots, giving buyers better negotiating power. It’s officially a buyer’s market. Incentives will be on the rise as April new car deals are announced in the weeks ahead.

It’s important for spring car buyers to know that the deals are in the details. The new cars with the biggest discounts and highest negotiability are those with a growing oversupply. Fortunately, online car buying tools make it possible to find the most negotiable cars and trucks, all from the comfort of your home.

Not all brands are facing the same inventory trends. Hyundai inventory has risen the most, up 38 days year over year, while Jeep and Ram have declined the most, down 54 and 56 days, respectively. Among top-selling brands, Ford has the most inventory in March, with 138 days of supply sitting on dealer lots. In other words, it would take over four months to sell Ford’s lot inventory at today’s selling rates. This fictional scenario would be without any new deliveries from the factory.

Here’s a look at how all of the major OEMs in America stack up in terms of today’s supply of new cars. For context, anywhere from 60 to 90 days of supply is generally considered ‘normal’ in today’s auto market.

Despite falling inventory, Jeep, Ram, and other Stellantis brands remain near the top of the list. Automakers with greater than 120 days of market supply are going to consistently have the best new car deals this spring. Buyers looking for a Ford, Hyundai, Nissan, or Jeep are likely to have the upper hand in car price negotiations. This is especially true when using car buying tools to find aging inventory that has been on the market for longer.

In Spring 2025, the average new vehicle listing price now sits at $48,316. In the post-pandemic K-shaped economic recovery that has continued, buyers of ultra-luxury models continue to thrive, while budget-conscious drivers struggle with a lack of options.

Cox Automotive noted that luxury sales are thriving, despite waning consumer sentiment. “Through the end of February, more than 52,000 new vehicles transacted at prices above $100,000, up from 46,000 in the first two months of 2024. Five years ago, in January and February of 2020, just over 12,000 six-figure vehicles were sold.”

The best-selling car brands in America do share something in common: relative affordability.

The six best-selling brands — Toyota, Ford, Chevrolet, Honda, Hyundai, and Kia — offered an average price of $42,524, making them more affordable than the overall market.

For budget-conscious buyers, the market for sub-$20,000 vehicles is shrinking fast. Available inventory in this segment dropped 17% month over month, leaving the Mitsubishi Mirage as the last new car routinely selling for under $20,000. The Nissan Versa ($20,149 average listing price) and Kia Forte ($22,085 average listing price) remain some of the most affordable options still widely available. The Kia Forte has been replaced by the Kia K4 for 2025, and unsurprisingly, comes with a higher price tag.

In 2025, the auto market has seen a 9% increase in vehicles priced over $80,000. More than 75,000 new vehicles are now listed at over $100,000, compared to fewer than 50,000 a year ago. Clearly, the luxury car market is growing, while those who rely on affordable transportation options are priced out of the market entirely.

With incentives holding steady at 7.1% of the average transaction price ($3,392), buyers can still find opportunities this spring. Higher inventory levels mean dealers are more motivated to negotiate, especially for brands with surplus stock like Ford, Hyundai, Nissan, and Jeep. However, potential policy changes, including the impacts of tariffs, could impact pricing later in the year as 2026 models are unveiled.

March and April of 2025 present a mixed bag for car buyers. If you’re looking for a deal, focus on automakers with higher inventory levels. Find aging new car inventory that’s primed to sell at a discount. These will always be the most negotiable cars. If possible, take advantage of the best financing, cash, and lease incentives of the month. If you don’t see what you’re looking for, consider waiting for April’s best car deals to be announced. Deals change often, and you could end up saving thousands of dollars.

With negotiation know-how and familiarity with your local car market, you’ll be prepared to drive home a deal you can be proud of in no time.

The Ford F-150, America’s best-selling truck, could be facing significant price hikes in 2025 due to increased tariffs on aluminum and steel. The Trump administration has implemented a 25% tariff on all aluminum and steel imports, creating cost pressures for automakers that rely heavily on these materials. Here’s how Ford’s production lines will be impacted, and how consumers may end up paying more for the F-150 in 2025.

On March 13, a 25% tariff on all aluminum and steel imports went into effect. This follows the 2018 tariffs imposed by President Trump, which included a 25% tariff on steel and a 10% tariff on aluminum imports. This time, the impact on vehicle prices could be greater.

Automakers have grown more reliant on aluminum in recent years, particularly for trucks like the F-150 and Super Duty models, which use extensive aluminum in their bodies, hoods, and beds. According to Barclays research reported in the Wall Street Journal, these tariffs could add an average of $400 in material costs per vehicle—a cost that will likely be passed on to consumers.

Ford has been working with suppliers to stockpile aluminum as trade uncertainties linger. However, a Ford spokesperson acknowledged that shifting to U.S.-sourced aluminum would take years. While Ford sources 90% of its steel domestically, most high-quality automotive aluminum originates from Canada.

Sales of Ford’s F-Series trucks have declined slightly over the past five years, dropping from 896,526 units sold in 2019 to 834,641 in 2024. At the same time, base prices have surged by 30%, while prices for the popular Lariat trim have jumped by 55%. Whether F-150 buyers will tolerate additional price increases remains uncertain.

Ford is one of the automakers with the highest car price inflation in recent years. Other truck-focused OEMS, like Stellantis and General Motors, have also raised prices more than competitors.

Adding to the complexity, inventory levels are unusually high, with 145 days of market supply nationwide for the F-150 in March 2025. This oversupply could act as a deterrent to further price hikes—at least for now. However, if production costs continue rising due to tariffs, automakers may still decide to pass some of these costs onto buyers.

Aluminum-intensive vehicles like the F-150 and Super Duty pickups are at particular risk of cost inflation. The auto industry has increased aluminum usage by 30% over the past decade, primarily to improve fuel efficiency and reduce weight. However, U.S. aluminum production has declined, making imports more essential than ever.

The last time similar tariffs were imposed in 2018, Ford and General Motors both reported billion-dollar losses due to rising material costs. Spot prices for steel hit a decade-high before demand collapsed, leading to steel industry cutbacks. Automakers are concerned about a repeat scenario, where higher prices could hurt sales and profitability.

The best strategy for F-150 shoppers in 2025 is to identify aging inventory. These trucks will always be the most negotiable, as dealership floorplanning costs add up in today’s high-interest rate environment. Online tools make it easier than ever to find the most negotiable new and used vehicles for sale. With negotiation know-how, truck buyers can walk away with thousands of dollars in savings.

Drivers who are tired of haggling and dealership visits can even have a pro negotiate your deal. There’s no excuse for overpaying for a truck in 2025!

Auto industry leaders have voiced concerns over the lack of domestic aluminum supply, noting that Canada supplies 75% of the U.S.’s primary aluminum. Alcoa, the world’s 8th-largest aluminum exporter, has pushed for Canadian exemptions, arguing that domestic production cannot meet demand.

Jean-Marc Germain, CEO of aluminum roller Constellium, told the Wall Street Journal that he supports long-term tariffs. However, he warns that imposing a 50% levy on Canada would only drive more imports from other countries.

With these tariffs in place, Ford and other automakers will have to adjust their pricing strategies in 2025 and beyond. F-150 buyers should brace for higher costs in the near future if tariffs continue.

Also: Here’s every car and truck built in Canada, Mexico, and China for sale in the U.S.

Some of the best SUVs, electric vehicles, and full-size trucks are available with steep discounts in March. Automakers are ramping up discounts to combat sluggish sales, with cash incentives reaching as high as $10,000 off MSRP. We’ve rounded up the 10 best cash discounts available this month, with savings that could make a serious dent in your out-the-door price. Keep in mind that most of these offers expire at the end of March, so if you see something you like, act fast.

Don’t shop without your personal buyer’s guide (100% Free)

March Savings: Up to 20% off MSRP

Offer valid through: 3/31/2025

Jeep Gladiator Base MSRP: $53,590

Estimated Price with Savings: $43,000

If you’ve been eyeing a Jeep Gladiator, now is the time to buy. Jeep is slashing 20% off MSRP for the 2024 Gladiator Rubicon 4×4. The reason is simple: 2024 inventory is lasting deep into 2025, and it’s time to clear out last year’s Jeeps before summer arrives.

Compare Jeep Gladiator depreciation, cost of ownership, and more

March Savings: $10,000 Customer Cash

Offer valid through: 4/30/2025

Kia EV6 Base MSRP: $42,600

Estimated Price with Savings: $32,600

Kia is offering a massive $10,000 cash discount on its much-loved EV6 crossover. The 2025 EV6 is almost here, and will arrive with a minor facelift. However, this model refresh presents a big opportunity for savings. If you’re looking for an electric vehicle with 300 miles of range, fast-charging (10-80% in as little as 20 minutes), and a futuristic interior, the 2024 Kia EV6 is one of the best deals available.

See Kia EV6 listings in your city

March Savings: $10,000 off MSRP

Offer valid through: 4/30/2025

Kia EV9 Base MSRP: $54,900

Estimated Price with Savings: $44,900

Kia isn’t stopping at the EV6—its three-row EV9 is also getting a $10,000 customer cash discount. This all-electric SUV offers spacious seating, cutting-edge tech, and up to 304 miles of range. The only 3-row SUVs on the market today are the Tesla Model X, Rivian R1S, Volkswagen ID.Buzz, and the Kia EV9. Among these, the EV9 charges the fastest AND has the lowest price tag.

See discounted Kia EV9 listings in your city

March Savings: Up to $10,000 on the 2024 Hornet R/T eAWD

Offer valid through: 3/31/2025

Dodge Hornet Base MSRP: $41,400

Estimated Price with Savings: $31,400

The Dodge Hornet has been struggling to sell, and Stellantis is now offering a variety of stacked incentives to move inventory. With up to $10,000 in potential savings, including lease loyalty bonuses, it’s a great time to grab this performance-focused compact SUV. A plug-in hybrid powertrain comes standard with the Hornet R/T.

Compare Dodge Hornet listings in your city

March Savings: Up to $7,000 off MSRP, or $10,500 in lease incentives

Offer valid through: 3/31/2025

Jeep Wrangler 4xe Base MSRP: $50,695

Estimated Price with Savings: $43,695

Wrangler fans take note: Jeep is offering $7,000 in cash savings on the 2025 Wrangler Sahara 4xe. If leasing is your preference, you can qualify for up to $10,500 in lease bonus cash. The Wrangler 4xe is a rare blend of off-road ability and electrification, and these incentives make it more affordable than ever.

Compare Jeep Wrangler depreciation, cost of ownership, and more

March Savings: $9,000 off MSRP

Offer valid through: 3/31/2025

Jeep Grand Cherokee Base MSRP: $36,495

Estimated Price with Savings: $27,495

Jeep is pushing hard to sell its remaining 2024 Grand Cherokees with a $9,000 cash bonus for current FCA lessees. This is a great opportunity to drive home a legendary midsize SUV with a refined interior and modern tech, now with a huge discount.

Compare Jeep Grand Cherokee depreciation, cost of ownership, and more

March Savings: Up to $7,850

Offer valid through: 3/31/2025

GMC Sierra 1500 w/ TurboMax Base MSRP: $44,895

Estimated Price with Savings: $37,045

GMC is offering up to $7,850 in total savings on the 2025 Sierra 1500, including a $6,500 purchase allowance and an engine credit. With truck prices remaining high, this March discount helps offset the cost of a well-equipped full-size pickup.

Compare GMC Sierra 1500 depreciation, cost of ownership, and more

March Savings: $7,500 off MSRP

Offer valid through: 3/31/2025

Nissan Ariya Base MSRP: $39,590

Estimated Price with Savings: $32,090

Nissan is compensating for the Ariya’s lack of a federal EV tax credit with a $7,500 customer cash incentive. It may not be the fastest-charging electric crossover in 2025, but with this cash discount, it’s an attractive bargain, especially for city driving.

See Nissan Ariya listings in your city

March Savings: $7,500 off MSRP

Offer valid through: 3/31/2025

Chrysler Pacifica PHEV Base Price: $51,055

Estimated Price with Savings: $43,555

Minivan buyers can take advantage of a $7,500 customer cash offer on the plug-in hybrid Pacifica, with additional tax incentives available. This is a great chance to drive home a fuel-efficient, family-friendly hybrid minivan at a major discount.

Compare Chrysler Pacifica depreciation, cost of ownership, and more

March Savings: $6,500 off MSRP

Offer valid through: 3/31/2025

Ram 1500 Lone Star Crew Cab Base Price: $45,230

Estimated Price with Savings: $38,730

Ram’s $6,500 cash allowance on the 2025 1500 Lone Star Crew Cab 4×2 includes multiple stackable incentives. In March 2025, Ram buyers can take advantage of National Retail Consumer Cash ($4,000), National Bonus Cash ($1,500), National Truck Month Bonus Cash ($1,000). This is the best deal on a 2025 model year truck right now.

Compare Ram 1500 depreciation, cost of ownership, and more

March is turning out to be a great time to save big on a new car or truck. The hefty cash discounts this month aren’t just random generosity from automakers. A few key factors are driving these deep price cuts:

At CarEdge, we help you make the most of these discounts. Before you buy, check out our real-time market insights, depreciation forecasts, and cost-of-ownership analysis to ensure you’re getting the best deal possible. Plus, we can connect you with local inventory and expert guidance to help you negotiate even more savings.

These March deals won’t last forever, so if you see a car you like, act fast and let CarEdge help you buy smart!

Spring car buying season is here, and many shoppers are heading to dealerships with their tax refunds in hand, ready to make a down payment on a used car. According to a recent survey by Talker Research, Americans expect to receive an average refund of $1,700 this year. With the average price of a used car sitting at $25,128 in March 2025, a solid down payment can help offset high borrowing costs.

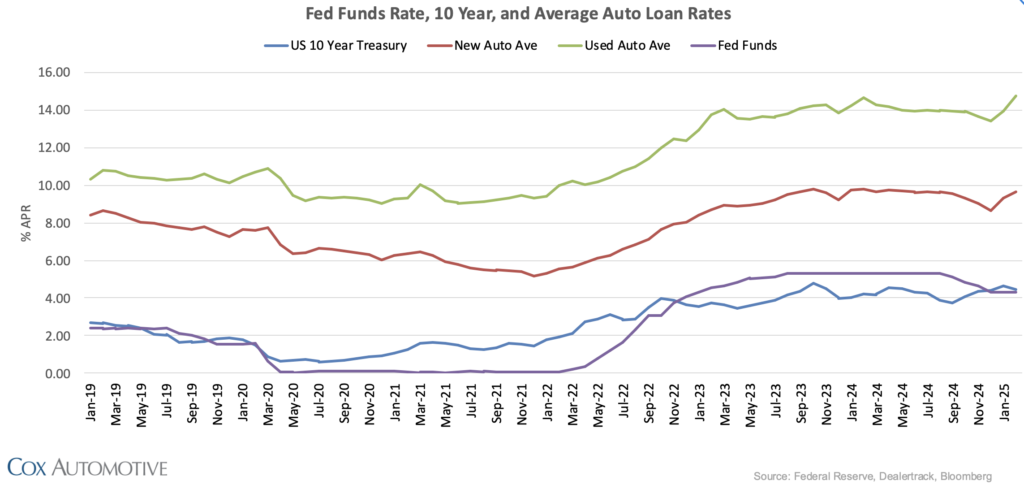

However, used car shoppers are facing an unpleasant reality: the highest used car loan rates in over 40 years. Rising interest rates are making monthly payments significantly more expensive in 2025, tightening budgets for many buyers. Before financing a used car this spring, it’s crucial to understand how today’s high APRs will impact your loan – and what steps you can take to minimize costs. Here’s what to expect and how to protect your wallet.

Over the past year, used car prices have fluctuated but have generally trended lower. While this is good news for buyers, the cost of financing remains a major hurdle. Used car loan rates have surged to levels not seen since the early 1980s.

After a brief dip in December, interest rates jumped sharply in January and February. According to Cox Automotive, the average used car loan rate in March 2025 is now 14.73% APR. For comparison, new car rates sit at 9.69% APR on average.

For buyers with lower credit scores, the situation is even worse. Many subprime borrowers are being offered rates close to 20% APR – adding thousands of dollars in interest over the life of a loan.

It’s hard to fathom just how much high interest rates can quickly add up, adding thousands of dollars to the total cost of owning a car. Consider the following real-world example: A $25,000 used car loan financed for 72 months at a 15% APR interest rate will accumulate $13,000 in total loan interest over 72 months. For buyers with bad credit, a 20% APR loan rate would push the interest paid above $18,000 for the same loan amount. Buying a car at all starts to lose its appeal with rates at these levels.

Several factors are keeping borrowing costs elevated in 2025:

While the overall rate environment isn’t favorable, car buyers can take steps to secure the best financing possible. Here’s how:

Check Your Credit Score Before Shopping: Your credit score plays a major role in determining your interest rate. Scores above 700 typically secure the best rates, while subprime borrowers (below 600) face the steepest costs. Your debt-to-income ratio is also a key consideration.

Get Pre-Approved by a Credit Union or Local Bank: Credit unions often offer lower rates than dealership financing. Getting pre-approved also gives you negotiating power when discussing financing options with dealers.

Make a Larger Down Payment: The more cash you put down, the less you have to borrow – reducing your interest charges over time. With tax refunds arriving, consider using that money to increase your down payment.

Choose a Shorter Loan Term: A 36- or 48-month loan will come with a lower interest rate than a 72- or 84-month loan. While monthly payments will be higher, you’ll save money on interest in the long run.

Avoid Add-Ons That Increase Loan Costs: Extended warranties, service contracts, and dealer add-ons can be financed into your loan, but this increases the total amount borrowed – and the interest you’ll pay.

👉 Before you commit to a used car with a high APR, drivers with good credit should check out the Best New Car Financing Incentives This Month. For well-qualified buyers, there are plenty of low-APR and even zero percent APR deals out there!

Take our free car buyer’s guide with you to save more and buy with confidence.

With used car loan rates at historic highs, some drivers may be better off repairing their current vehicle rather than financing a new one.

If your car is paid off or close to being paid off, investing in repairs can be far cheaper than taking on a high-interest loan. Consider getting a repair estimate before deciding whether to trade in or keep your car.

Always consider the total cost of ownership before buying any car. Use these free cost of ownership tools to see the numbers – you might be shocked at what you find!

👉 The Best Used Cars Under $10,000

Used car prices are coming down slowly, but financing costs remain a major challenge in 2025. With average used car loan rates nearing 15% APR for the first time in 40 years, shoppers need to be strategic about where they finance and how much they borrow.

If you’re planning to buy a used car this spring, use tools like CarEdge’s Free Car Buying Guide to compare financing options and find the most negotiable deals. Knowledge is your best tool to fight back against high borrowing costs. Don’t head to the dealership without a plan!