CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

It seems like there’s finally some good news on the horizon for potential car buyers. The latest car market data indicates a promising downward trend in new car prices. Let’s dig into what’s happening and why it might be the perfect time to consider that new car purchase.

New data from Cox Automotive confirms that new car prices are dropping this spring, a trend that’s likely to continue into summer. For the first time in nearly two years, new-vehicle average transaction prices have dipped to their lowest, standing at $47,218 in March. This is down 1% from last March and a substantial 5.4% from the market peak in December 2022. It seems like the relentless price surge is taking a breather, giving buyers a much-needed respite.

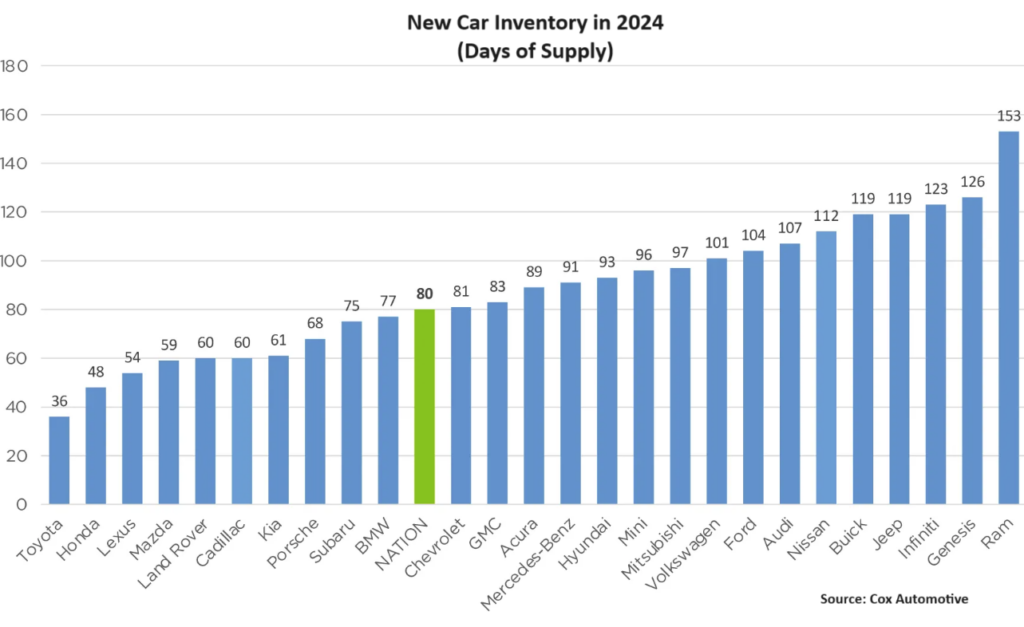

Several factors are driving falling car prices. A significant recovery in new-vehicle supply has bolstered sales results. Inventory levels at the start of March were about 2.7 million units, showing a 52% increase year over year. More cars on lots mean more competitive pricing and better deals for consumers.

Incentives are also playing a big role. The average incentive spend from manufacturers increased 11% to $3,121, reaching the highest level since May 2021. With incentives accounting for 6.6% of the average selling price, it’s clear manufacturers are keen to move cars off lots.

Take a look at the best offers this month to see just how motivated OEMs are to sell

Interestingly, even with slightly lower prices, affordability remains a hurdle due to historically high interest rates. The typical new vehicle loan interest rate now sits at 10.47%. Surprisingly, the average monthly payment is down by 1.2% to $744. That’s still up 40% from 2019, when the average monthly car payment was $533.

When you combine car loan interest rates with the modern era’s high MSRPs, the result is massive interest payments. At today’s average APR of 10.47% and an average selling price of $47,218, a 72-month loan would result in about $15,000 in interest over the 6-year loan term.

How can car buyers avoid interest charges? Here are a few foolproof ways to lower your interest payments.

Automakers always aim to make more money, even if that means alienating some of their customer base. In recent years, this has meant abandoning low-margin affordable models, and replacing them with luxury cars and trucks that are more profitable.

For example, Nissan is discontinuing the Altima next year, yet continues to push $60,000 EVs that are selling poorly.

The shift towards luxury vehicles and higher-priced models complicates car buying for the average consumer. According to Cox Automotive, out of approximately 275 new-vehicle models available in the U.S., only eight had average transaction prices below $25,000, and only two were under $20,000—namely, the discontinued Kia Rio and Mitsubishi Mirage. Contrast this with March 2021, when over 20 vehicles routinely transacted below $25,000.

Additionally, the number of vehicles transacting at prices over $100,000 has increased significantly, with 30 different models in this bracket last month alone.

With prices down, incentives up, and a decent dip in monthly payments, this could be a strategic time to consider a purchase, especially if you’ve been on the fence. Our team of experts is confident that this summer will be a better time to buy, if you’re patient. And if you can wait even longer, year-end deals are always the best.

With interest rates still high, insurance premiums climbing, and selling prices averaging over $47,000, it’s crucial to calculate your finances carefully. Remember, it’s a lot more difficult to find a new car for under $25,000 than in years past. Budget for ALL expenses that come with a new or used vehicle, from payments to fuel, maintenance, and insurance.

Dive deeper into real-time market data with CarEdge Pro and consider using our free car buying cheat sheets to navigate these changing tides.

Stay tuned to CarEdge for the latest in car buying tips and market trends. We’re here to keep you ahead of the curve!

As truck prices have skyrocketed, outpacing the broader auto market, buyer resistance is mounting. Bloated inventories, ever-climbing MSRPs, and high interest rates are just some of the challenges buyers face today. But truck deals are out there, if you’re a smart buyer. Here’s the latest truck market update, and our thoughts on where truck prices are headed in 2024.

What do you do when truck sales slow? Make more of them, of course! At least that’s what Ford is doing. Reuters reports that Ford is shipping 144,000 F-150 and Ranger pickup trucks to North American dealers. This move is critical for Ford to meet its 2024 revenue goals and could significantly influence truck market dynamics. The company has also restarted shipments of the F-150 Lightning electric trucks, with some variants seeing price cuts of up to $5,500.

Ford’s initiative to reduce its 2023 model inventory has paid off, with the market day supply for the Ford F-150 now down to 109 days, a decrease highlighted by CarEdge Pro. This reduction in inventory levels suggests dealers may be more open to negotiation, potentially benefiting buyers.

Among the big 3 in the market, the Chevrolet Silverado 1500 currently has the highest lot inventory this spring, with 113 days of supply and 101,000 new trucks for sale. Most of these are new 2024 models, so Chevy’s low APR offers must be moving the needle. In contrast, the Ram 1500 presents a lower supply with just 93 days of market supply, indicating a tighter availability which may affect pricing and bargaining power.

Looking elsewhere, the Nissan Titan seems to be seriously falling out of favor. With 265 days supply yet only 5,600 new Titans on dealer lots, who is buying these trucks right now? If you don’t mind a Nissan full-size truck, a new Titan is certainly the most negotiable new truck today. See truck market conditions in your neck of the woods with CarEdge Pro.

👉 Become a Pro Negotiator with these FREE cheat sheets.

Just want the best deals of the month? See the 5 Best Truck APR, Cash, and Lease Deals

Significant regional differences exist in pricing, with the average selling price for a new F-150 standing at $58,433 nationally. In Texas, the average price is slightly lower at $57,199, while in New York, it is higher at $59,707, demonstrating the influence of local market conditions on pricing strategies.

Here are the differences in truck selling prices in 5 markets where pickups are popular. These selling prices exclude taxes and fees.

| State | Ford F-150 | Ram 1500 | Chevy Silverado 1500 |

|---|---|---|---|

| Texas | $57,199 | $60,689 | $54,743 |

| California | $58,883 | $61,544 | $55,278 |

| Florida | $56,773 | $59,289 | $51,086 |

| Michigan | $58,658 | $58,304 | $53,183 |

| Arizona | $57,343 | $60,776 | $55,076 |

👉 Wondering what trucks sell for in your ZIP code? Unlock ALL of the premium car market data with CarEdge Pro

With the arrival of 2024 models and the presence of numerous 2023 models still on dealer lots, it’s likely that truck prices will continue to decline in the coming months. It’s finally a buyers market, at least for educated truck shoppers.

We forecast new truck prices to fall another 3-5% this summer. For the F-150 in particular, average selling prices are likely to slide closer to $56,000 by July, down about $2,000 from where they stand today.

But the deals won’t fall into your hands. Expect better deals when you show the salesperson that you understand today’s truck market. Nevertheless, 2024 presents a valuable opportunity for buyers to leverage high inventory levels to negotiate better deals.

For those considering a truck purchase, staying informed about these trends is crucial. Using resources like CarEdge’s 100% FREE car buying cheat sheets and printable strategy card can significantly enhance your negotiating position and help you secure the best possible deal.

Keep an eye on CarEdge for continuous updates and expert advice to navigate the ever-changing truck market. We are here to help you make informed decisions so you can get the BEST deal on your next truck, no matter what you’re in the market for.

If you’re in the market for a new set of wheels, you might want to hold off on signing any papers just yet. Historical data and current trends both suggest that waiting until the end of the year can save you a lot of money. Here’s why delaying your purchase until December is worth considering.

Car sales, much like other retail sectors, experience seasonal fluctuations, and timing your purchase can make a big difference. While autumn might offer some discounts, waiting until December is likely to result in more widespread car deals. As the year comes to a close, dealerships are eager to clear out inventory to make room for new models, leading to more aggressive pricing and incentives.

Additionally, the pressure to meet year-end sales targets often motivates sellers to offer steeper discounts. By December, you’re not just benefiting from seasonal trends but also capitalizing on a perfect storm of factors that can lead to significant savings.

Currently, the automotive market is navigating through a difficult phase characterized by high interest rates. These rates affect the cost of floorplanning—the method dealerships use to finance their inventory of vehicles. Believe it or not, car dealers don’t own their lot inventory outright.

As a result, holding onto large volumes of new cars becomes increasingly costly for dealers. To mitigate this financial strain, dealerships are expected to become more aggressive in selling new cars as the year progresses.

Right now, new car dealers are already grappling with shockingly high inventories. Check out the slowest (and fastest) cars to sell today.

The push to offload new cars at lower prices sets off a chain reaction in the entire market. Lower new car prices put downward pressure on used car values. Used car prices had been steadily falling, only to rise slightly in the past month.

There needs to be a reasonable price difference between new and used cars to attract buyers toward older models, and as prices for new vehicles drop, so too must the prices of used ones. This ensures that both segments of the market adjust to maintain consumer interest across the board.

Simply put, as new car incentives get better, used car prices tend to fall as sellers try to attract buyers. You, as the buyer, can take advantage of that in the months ahead.

Overall, the end of the year is always the best time to shop for car. During the coming months, dealerships are keen to clear out existing inventory to make room for the new model year vehicles arriving daily. This urgency is reflected in the kinds of incentives they offer: deeper discounts, more attractive financing options, and generous trade-in values.

These new car incentives also translate to lower used car prices. So no matter what type of vehicle you are in the market for, lower prices and better APR offers are just a few months ahead.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

At CarEdge, we dedicate ourselves to helping people navigate the car market, whether they’re buying or selling, with the ultimate goal of saving money, time, and hassle. This week, we’ve tapped into the expertise of CarEdge Co-Founder Ray Shefska to uncover the three biggest blunders you can make when purchasing a used car. If you like saving more and stressing less, you’ll want to avoid these costly mistakes!

Think about the little routines that keep you safe every day—like double-checking that your door is locked before you leave the house. It’s a simple step, but one that saves a lot of headaches later. Buying a used car should be approached with the same level of caution, which is why a pre-purchase inspection (PPI) is critical.

What exactly is a PPI? It’s a thorough mechanical evaluation performed before you finalize a vehicle purchase. Although there isn’t a universal checklist, your mechanic will typically examine:

Each mechanic may have a slightly different process, but it’s likely they’ll identify at least one issue. It’s then up to you to decide how much maintenance you’re willing to take on post-purchase.

👉 Learn more about pre-purchase inspections and why they’re essential.

In 2023, auto insurance rates in the U.S. saw a staggering 24% increase, reaching an all-time high. This surge was fueled by escalating repair costs, more frequent natural disasters, and an uptick in car accidents, all contributing to significant losses for insurers. And the costs are not expected to plateau—projections indicate a further 7% rise in rates for 2024.

However, there’s a silver lining for used car buyers: auto insurance rates typically decrease by 3.4% for each year a vehicle ages. But given the sharp increases in recent years, it’s crucial to check how much insuring a particular vehicle will cost you before making a purchase.

How do you check? It’s simple. Contact your insurance provider, provide the make and model or even the VIN of the vehicle you’re considering, and request a quote. This will ensure you have a complete understanding of the ongoing costs associated with the vehicle.

👉 Learn about the factors driving up car insurance rates and how to manage them.

Timing is everything in the used car market. We track weekly used car price updates, and it’s clear that volatility continues. But there’s hope on the horizon for deal seekers.

Historically, we start to see wholesale values for used cars decline between April and June, a trend that typically carries over to the retail market soon after.

If you’re not in a hurry, consider timing your purchase to take advantage of market trends. Retail prices for used cars tend to decrease during late spring and summer. This is often due to several factors, including increased incentives on new cars—such as APR offers, cash back, and lease deals—which attract buyers to new vehicles and can lower demand in the used market.

As dealers face high interest rates and the costs of maintaining large inventories (known as floorplanning costs), they become more aggressive in selling new cars. This in turn puts downward pressure on used car prices to maintain a reasonable price differential between new and used vehicles.

The best times to buy are typically July through August and at the end of the year when dealers are eager to meet their sales targets and offer substantial deals.

👉 We track the best NEW car deals monthly here

Avoiding these three pitfalls can make a significant difference in your used car buying experience. At CarEdge, we’re committed to making your car buying journey as smooth and beneficial as possible. To further enhance your buying strategy, we invite you to download our CarEdge Car Buying Cheat Sheets. These free resources are packed with tips and insights to help you negotiate better deals, understand market trends, and ultimately make informed decisions.

Download your free CarEdge Car Buying Cheat Sheets today and get equipped to navigate the car market with confidence!

The latest Consumer Price Index (CPI) report for March has thrown cold water on any hopes of a decrease in car loan interest rates for the remainder of 2024. With inflation surging unexpectedly to 3.5% year-over-year, the financial landscape is bracing for continued high interest rates. And for car buyers, that means auto loan rates are unfortunately going to remain high.

However, there was some good news for drivers in the latest report. Let’s dive into the details.

The increase from February’s 3.2% inflation rate to March’s 3.5% signifies the highest annual gain seen in the last six months, underscoring a stubbornly high cost of living. Chances are you’ve felt it in your own day to day expenses. This uptick, fueled by rising gas prices and enduring high costs for mortgages and rent, suggests a challenging path ahead for reducing inflation. Consequently, the Federal Reserve is likely to maintain higher interest rates to combat these pressures.

Just how likely is a June rate cut at this point? Market predictions in favor of a Fed rate cute plummeted from 73% to a mere 21%. Following the CPI report, the picture is clear: interest rates are set to remain elevated.

Buried in the U.S. Bureau of Labor Statistic’s data-heavy CPI Report is a glimmer of good news for car buyers. Year-over-year, used car prices are down 2.2%. We’ve seen similar trends at wholesale markets. For new cars, there’s less to rejoice about. New car prices are essentially flat, falling just 0.1% in the past 12 months.

For car buyers, relief is slipping out of view. Today’s inflation report means that more of the same can be expected for the next several months. According to Experian’s most recent State of the Automotive Finance Market report, today’s average car loan rates stand at 7.18% for new cars and a staggering 11.93% for used cars.

These rates are significantly impacted by the Fed’s monetary policy stance, and with the central bank likely to forgo rate cuts, we can expect these high-interest rates to continue.

However, it’s not all doom and gloom for car buyers. The silver lining lies in today’s new car inventory numbers. With new car inventories higher than in recent years, manufacturers are offering more enticing incentives to attract buyers. These incentives include lower APRs, cash incentives, and great lease deals. These OEM incentives provide a rare opportunity to secure more favorable loan terms, even in 2024’s prevailing high-rate environment.

As of April,5 manufacturers are offering zero percent financing for select models, and four more are offering 0.9% APRs. Several additional OEMs feature APR offers under 5% right now. With the average new car selling for over $46,000, this adds up to thousands in savings over time.

👉 See the best new car offers this month

In essence, while the broader economic indicators point towards continued high-interest rates for auto loans, market-driven factors like increased new car inventories and subsequent manufacturer incentives could offer some relief to car buyers. But there’s no hiding the fact that broader economic inflation continues to hit us all, even as policymakers play down the impacts.

The next CPI Report is scheduled to be released on May 15, 2024. That’s our next best look at when auto loan rates could finally be set to drop.