CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

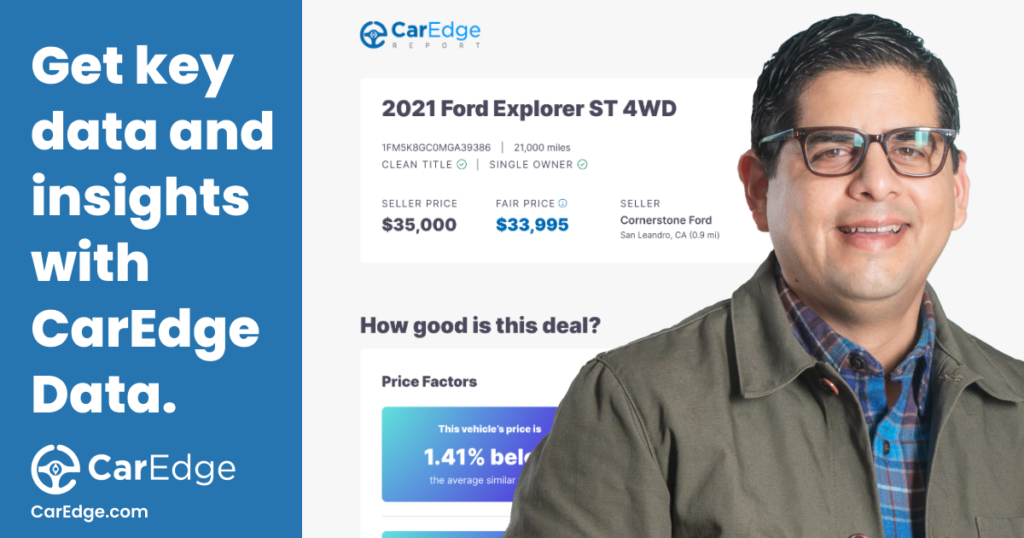

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

After bringing hybrids to the masses with the Prius over 20 years ago, Toyota resisted moving into full battery electric vehicles for as long as possible. One big competitor from Korea, however, is diving headfirst into EVs. Here’s how Hyundai is beating Toyota in one growing market segment, with the gap between the two continuing to widen.

Toyota is aiming for millions of EV sales in just six years’ time, but in 2024, the automaker has a VERY long way to go. After launching the Toyota bZ4X as the brand’s first fully-electric model in mid-2022, sales have failed to take off.

With a base MSRP of $43,070 and fully-loaded prices climbing to $53,000, prospective buyers expect few concessions with their car. But compared to the competition, the bZ4X’s range and charging speed leave much to be desired. Especially for $50,000 and no chance of a federal tax credit.

Toyota has struggled to sell over 1,000 copies of the bZ4X per month since its debut. EV market share numbers make this clear as day. For comparison, the Prius routinely logs between 4,000 and 5,000+ sales in any given month. Toyota is used to winning, but their electric offerings have come with challenges.

Similarly, the Lexus RZ, which is powered by the same powertrain, hasn’t fared much better since launching in early 2023. Sales totaled 5,386 in all of 2023. Toyota and Lexus’ twin EVs were developed in partnership with Subaru, whose Solterra has also struggled to sell. In fact, there’s a 363-day supply of new Subaru Solterras on the market today, the fifth highest in the US market.

However, not all electric vehicles are selling so poorly in 2024. To see an example of better times, we need look no further than rival Hyundai’s EV sales.

Hyundai is out-selling Toyota 3:1 in one key market segment: electric vehicles. Using CarEdge Pro, we can see that 4,445 Hyundai IONIQ 5s and 2,517 Hyundai IONIQ 6s were sold in the past 45 days, as of mid April. Toyota’s sole EV, the bZ4X, totaled just 1,066 sales in the same period. The Lexus RZ tallied 912 sales.

Looking to the most recent official OEM data, here’s how EV sales have played out for the two competitors from 2022 through Q1 of 2024:

| Make | Model | 2022 Total | 2023 Total | Q1 2024 |

|---|---|---|---|---|

| Hyundai | IONIQ 5 | 22,982 | 33,918 | 6,822 |

| Hyundai | IONIQ 6 | 0 | 12,999 | 3,646 |

| Toyota | bZ4X | 1,220 | 9,329 | 1,897 |

Sure, looks could play a part, but the driving force behind Hyundai’s EV success boils down to EV performance. Buyers spending over $40,000 on their first EV expect fast charging, long range, and an all-around special vehicle. Hyundai’s EVs check all of those boxes and more.

Here’s how the IONIQ 5 compares to Toyota’s bZ4X for the 2024 model year:

| Make | Model | Base MSRP | Average Selling Price | EPA Range | 10-80% Charge Time |

|---|---|---|---|---|---|

| Toyota | bZ4X | $43,070 | $47,641 | 222 - 252 miles | 30 - 35 min |

| Hyundai | IONIQ 5 | $41,800 | $49,226 | 220 - 303 miles | 18 minutes |

| Hyundai | IONIQ 6 | $42,450 | $45,415 | 270 - 361 miles | 18 minutes |

But there’s more to the story than the above EV performance numbers. The bZ4X features additional quirks that complicate ownership for anyone who travels long distances by car.

Can you really blame them? In 2023, Toyota’s US hybrid sales climbed to new records. 2023 electrified vehicle sales of 565,800 represented 29 percent of Toyota’s sales. With recent announcements that all versions of the 2025 Camry will be hybrids, and even the redesigned 4Runner will be available as a hybrid, Toyota is moving further in that direction. Long live the Prius.

But for those wanting a true EV, without the extra baggage of a combustion engine and the maintenance needs that come with it, Toyota is moving at a snail’s pace. Despite reiterating as recently as November that it plans to sell 3.5 million EVs annually by 2030, only one additional Toyota EV is slated to arrive anytime soon. That will be a three-row electric SUV expected to launch in 2025 at the earliest. The targeted competition? Kia’s EV9 and Hyundai’s IONIQ 7.

As far as mainstream electric crossovers, Toyota fans will have to settle for the bZ4X for the foreseeable future.

Hyundai and Toyota’s EV successes and failures highlight that in the EV market, charging, range, and overall value are paramount to buyers cross-shopping today’s electric offerings. But make no mistake: this is a story of differing priorities at the corporate level.

As Hyundai continues to refine its EV offerings, Toyota continues to prioritize hybrid models. And if Toyota’s past sales are any indication, it could be a smart move for their overall business growth in North America. Hyundai, on the other hand, is driving full speed ahead into a fully-electric future. Which will ultimately come out on top? 2024’s sales numbers will shed light on that.

Are you a bigger fan of Toyota’s hybrids, or Hyundai’s EVs? Let us know in the comments below.

![Tesla Cancels $25,000 Model 2 Plans, Shifts Focus to Robotaxis [Updated: Musk Responds]](https://caredge.com/wp-content/uploads/2024/02/Tesla-logo.png)

In a startling turn of events, Reuters reports that Tesla has abandoned its plans to launch a $25,000 electric vehicle, a project that is integral to the company’s strategy for making electric vehicles more accessible and expanding its EV market domination. This move has sent ripples through the auto industry and financial markets. Here’s what we know about this developing story.

Update: Multiple outlets are reporting that Tesla CEO Elon Musk has responded to Reuter’s report, refuting the claims made in the article. More updates to come!

According to breaking news reported by Reuters, the word among Tesla leadership is that all work on the $25,000 Tesla in development is halted, effective immediately. Tesla had previously indicated in January that production of the affordable model, often referred to as the Model 2, would commence at its Texas factory in the second half of 2025.

However, the company is now shifting its focus towards developing robotaxis, despite the greater engineering and regulatory challenges this entails. This pivot was revealed in a late February meeting attended by numerous Tesla employees, where Elon Musk’s directive to prioritize robotaxis was communicated.

The decision to cancel the Model 2 project has left industry analysts questioning Tesla’s ability to meet its ambitious sales targets. Elon Musk had aspired for Tesla to sell 20 million vehicles by 2030, a goal that now seems more elusive with the affordable car’s cancellation.

The company’s current cheapest model, the rear-wheel drive Model 3 sedan, is priced at around $39,000 in the U.S., well above the intended price point of the Model 2. Federal tax credits have contributed to Tesla’s sales growth, but have been reduced or eliminated for some Tesla models in recent months.

Tesla’s shift in strategy comes amid intense competition, particularly from Chinese electric vehicle manufacturers who have successfully entered the market with significantly lower-priced models. This competitive pressure appears to have influenced Tesla’s strategic redirection.

The move comes less than a week after Tesla began a ‘free’ Full Self-Driving trial for all Tesla drivers with capable hardware. It remains to be seen if Tesla’s biggest FSD promo to date will drive conversions towards the $12,000 add-on.

As Tesla discontinues its plans for the Model 2, the company’s focus on robotaxis and high-end models like the Cybertruck continues. However, this approach has raised concerns about Tesla’s market positioning and long-term profitability, given the rapid growth and pricing strategies of competitors, particularly in the burgeoning electric vehicle market in China.

This development is a significant deviation from Tesla’s long-standing goal of making electric vehicles more affordable and widely accessible, a vision that has been central to its brand and business model. The cancellation of the affordable Tesla model and the company’s recalibrated focus on robotaxis and higher-end vehicles mark a critical juncture in its journey, with potential implications for its competitive edge and market share.

As Tesla navigates these strategic shifts and market dynamics, the automotive industry and investors are keenly watching to see how these changes will affect the company’s trajectory and the broader electric vehicle landscape. This is a developing story, and further updates are anticipated as more information becomes available.

As new cars fill dealership lots, OEMs are lowering prices to sell cars. From Jeep to Ford, and even Mazda’s new flagship SUV, price drops have already arrived. However, as we’re about to see, there are several other models that are in desperate need of MSRP reductions given today’s oversupply and weak sales. Don’t pay a dollar over MSRP for these new cars, trucks, and SUVs that are primed for price cuts in 2024. Especially when you have the power of CarEdge Pro at your fingertips.

Let’s dive into the details.

Base MSRP: $27,140

Average Selling Price: $30,463

Current Market Day Supply: 198 days

After decades leading Nissan sales forward, the Altima will be discontinued in 2025. It’s true that the Altima has become the butt of jokes in car culture in recent times, but its absence will be immediately felt by those who simply need an affordable ride.

But Nissan has its reasons. Altima sales have been in decline, dropping 8.5% in 2023 while most of the rest of Nissan’s lineup saw modest gains. There remains a 198-day supply in America today. With the looming discontinuation on the horizon, it’s prime time for a price drop.

Browse Nissan Altima Listings | See Consumer Reports Ratings

Base MSRP: $32,995

Average Selling Price: $41,905

Current Market Day Supply: 646 days

The Dodge Hornet is facing a surplus, with the third-highest inventory among all new cars as of April 2024. This equates to nearly two years of supply if production were to cease today.

Why are buyers balking at the Hornet? For one thing, there are 4 recalls for the Hornet as of early 2024. Consumer Reports rates it at 55 out of 100 overall, with average reliability but above-average owner satisfaction scores. However, it’s full of compromises, too many perhaps. It’s not as spacious as competing crossovers, but it’s bigger than a sedan. Fuel economy is among the worst in the compact crossover segment at 24 miles per gallon in combined driving. There is a plug-in hybrid version that fares much better.

Browse Dodge Hornet Listings | See Consumer Reports Ratings

Base MSRP: $93,945

Average Selling Price: $101,667

Current Market Day Supply: 240 days

Jeep’s Grand Wagoneer, despite being the brand’s priciest model, is overdue for a price cut. Jeep has already reduced prices on other models in 2024, from the Wrangler to the Gladiator.

With stagnant sales, Stellantis already announced a pivot away from earlier plans of turning Wagoneer into a luxury spinoff. Simply put, the market is ripe for price negotiations on this model. Even with major discounts, are you willing to spend $100,000 on a Jeep? Believe it or not, that’s about how much these luxury Jeeps cost.

Browse Grand Wagoneer Listings | See Consumer Reports Ratings

Base MSRP: $48,050

Average Selling Price: $56,022

Current Market Day Supply: 287 days

The Nissan Titan, with its price hiked by $5,000 for the 2024 model year, contrasts starkly against its modest sales figures, selling just 19,189 units in 2023. This lack of market traction, especially compared to giants like Ford’s F-Series, suggests that the Titan could see significant price negotiations or cuts to align with its market performance, making it an attractive option for truck buyers looking for value.

If Nissan truly wants to grab truck market share, they’re going to have to work for it with aggressive pricing. Don’t pay a dollar over MSRP for a new Titan in 2024.

Browse Nissan Titan Listings | See Consumer Reports Ratings

Base MSRP: $46,340

Average Selling Price: $50,103

Current Market Day Supply: 363 days

Performance-wise, the Solterra just isn’t worth the high price tag. But I may change my thinking if Subaru takes cues from the sluggish market and drops prices by $5,000. The Subaru Solterra, already experiencing price cuts in Australia, faces slow sales in North America and even slower charging speeds.

Its strengths? High ground clearance and futuristic Subaru looks are two that come to mind. With sales failing to take off more than 18 months after launch and plenty of 2023 Solterras STILL sitting on the lot, it’s past time for a big price cut for this EV.

Browse Subaru Solterra Listings | See Consumer Reports Ratings

Base MSRP: $54,895

Average Selling Price: $58,658

Current Market Day Supply: 425 days

Volvo’s EV sales have yet to take off. With stiff competition from the likes of Tesla, the German luxury brands, and even Hyundai Motor Group, it’s not clear that they ever will. The C40 isn’t a bad car by any measure. It’s luxurious, great for urban tight spaces, and can go 297 miles on a charge.

But the price is a bit higher than many similar offerings in today’s market. Today, there’s a 425-day supply of Volvo C40s. That’s 8x the typical market average. Will Volvo take cues from today’s EV buyers and lower prices? We hope so.

Browse Volvo C40 Listings | See Consumer Reports Ratings

While these six models have not yet seen the price cuts that other vehicles have in 2024, their high inventory and slow sales make them prime candidates for negotiation. Keeping an eye on these models could lead to significant savings, but only if you’re patient.

Even before OEMs announce revised pricing, these six models are highly negotiable, especially if you are equipped with these insights and local market data. Don’t forget that we have not one, not two, but SEVEN free car buying cheat sheets available for download. Get your free resources here.

The good news is that some automakers are already making moves and lowering prices.

Diving into the world of car ownership can lead you into murky waters, especially when grappling with negative car equity. Imagine owing more on your car loan than the vehicle is worth – a situation many Americans face today. This comprehensive guide illuminates the shadowy depths of negative equity: exploring its causes, the impact of recent economic trends, and, most importantly, effective strategies to steer clear of or manage it if you’re already caught in its grip.

Negative equity, often described as being “upside-down” on a car loan, occurs when the loan balance surpasses the vehicle’s current market value. This financial quagmire can ensnare car owners due to:

Understanding these factors is key to avoiding or mitigating negative equity and ensuring a financially stable ownership experience.

The phenomenon of negative car equity has been escalating, with recent Edmunds data revealing that 1 in 5 trade-ins have negative equity. The situation has become particularly pronounced in the new car market, where 20.4% of trade-ins are underwater, marking a significant jump from 14.9% in Q4 of 2021.

The average negative equity on car loans has surged to $6,054, setting a new record. This increase is partly attributed to the economic fluctuations during the pandemic when many consumers purchased vehicles at higher prices, leading to loans that exceeded the depreciating value of their cars. Consequently, drivers who bought cars during the pandemic are now facing the brunt of this financial imbalance.

Having negative equity on a car loan is more than just a numerical imbalance. It’s a predicament that can have lasting financial repercussions. Negative equity limits the owner’s flexibility, complicating efforts to sell or trade in the car without incurring losses.

For those looking to buy a new vehicle, negative equity means that the debt from the current car can roll over into the new loan. This leads to a cycle of increased debt that never seems to go away. Moreover, negative equity can affect credit scores and future loan conditions.

To combat these implications, car buyers should prioritize loan repayment strategies that target the principal amount. Also, consider shorter loan terms to align with the depreciation of the vehicle, and stay informed about the car’s current market value to make timely financial decisions. If you’d rather avoid the risk altogether, leasing is also an option.

Navigating out of negative equity requires a proactive and strategic approach. Here are comprehensive steps and solutions to help you manage or eliminate negative car equity:

By employing these strategies, you can tackle negative equity head-on and work towards a more stable financial situation with your vehicle. Each approach has its considerations, so it’s important to evaluate your financial circumstances and car value carefully before deciding on the best course of action.

(Related) 👉 Check out this guide to navigating the finance office like a pro!

GAP (Guaranteed Asset protection) insurance is indeed related to the topic of negative equity in car loans. Thus kind of insurance is designed to cover the difference between the actual cash value of a vehicle and the balance still owed on the financing (loan or lease) in the event that the car is totaled or stolen. Here’s how it connects to negative equity:

In the context of managing negative equity, GAP insurance doesn’t reduce the loan balance or directly help in getting out of negative equity. However, it provides financial protection against the consequences of having negative equity in the event of an accident or theft.

Learn more about GAP insurance with this in-depth guide

Negative car equity, while daunting, is manageable with smart decisions and strategic actions. Understanding its roots and applying tailored strategies can lead car owners from the depths of financial strain to the clearer waters of financial stability and equity.

Want to learn more about how your particular situation may impact your ability to buy or sell? Chat with a CarEdge expert today. We’re here to help!

Welcome to your go-to guide for March’s end-of-month car specials. Learn the art of deal hunting with free resources like cheat sheets and strategy cards, and deepen your knowledge with our free Deal School course. We’ll also share the top 5 car deals right now. With the quarter ending and market dynamics in play, now is a prime time to find your perfect car and save A LOT of money. Let us help you navigate the deals and drive home happy.

At CarEdge, we want to help ALL car buyers save money and avoid the hassle that usually comes with car buying. Core to that goal is providing both free and premium resources for all. As you head out to find the best car deals, we want to equip you with these tools.

You won’t find these anywhere else!

The Overall Best Finance, Cash, and Lease Deals This Month

The Best Lease Deals This Month

If you’re interested in taking your car buying skills AND savings to the next level, we have options for every budget…

Looking for advanced behind-the-scenes insights? Try CarEdge Data. See local price and inventory metrics that typically only the dealers have. It’s empowered car buying for all!

Not sure if you’re getting a good deal? Chat with a CarEdge Coach! We have options to fit every budget. Learn more about how we can help.

The Best Offer: Salem Ford in New Hampshire has remaining 2023 F-150s discounted between $2,450 and $4,900 off of MSRP. This is BEFORE any rebates or incentives. Free shipping is available within 700 miles.

Better yet, Ford is offering 1.9% APR for 72 months, plus NO payments for 90 days.

The Best Offer: Key Hyundai is discounting their 4 remaining 2023 Santa Fe’s by $3,400 to $4,500 off of MSRP. Free shipping is available within 700 miles.

On top of the MSRP discount, Hyundai is offering 0% APR for remaining 2023 Santa Fe Hybrids.

The Best Offer: Ford is offering huge discounts and incentives on the Mustang Mach-E electric crossover. Reviewers love it, but the previously high price kept many customers away. Now, it’s more affordable than ever.

Cash Discount: 0% APR for 72 months + $3,000 off MSRP + No payments for 90 days

The Best Offers: Right Now, Mazda is offering 0% APR for 36 months for the 2024 CX-50 and 2024 CX-30. Also, the 2024 CX-5 is available for 0.9% APR. With the average new car loan rate near 10% APR right now, these deals could save you thousands of dollars over the life of your loan. We have pre-negotiated prices secured to take the hassle out of buying your Mazda.

See these listings (with FREE home delivery available in select regions)

The Best Offer: $1,000 below MSRP for 2024 Toyota RAV4s. This is one of the best deals we’ve negotiated through our CarEdge Network of dealers. After all, the RAV4 is the best-selling crossover in America!

FREE home delivery is available in select regions.

Interested in this exclusive RAV4 deal? Let us know here, and we’ll get in touch.

The end of March is also the end of the quarter for automakers and car dealers. That means they’re particularly eager to sell cars at a discount to boost their numbers. Plus, with the Baltimore Bridge collapse threatening the auto industry, now is the time to buy for drivers who are in need of a car.

However, if you’re in no rush to drive home a new set of wheels, the end of the year is almost always the all-around best time of the year to buy. Waiting for year-end deals is always a good idea for those who can.

Need car buying advice, or perhaps your own deal coach? Learn more about how CarEdge can help you save more and stress less.

We’re real people helping you save real money!