CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Spring car buying season kicks off with more zero-down lease deals than we normally see this time of year. We’ve gathered every single $0-down lease available in March 2026. Ford continues to shine with no-money-down lease options for popular trucks and SUVs. Even Tesla is now getting in on the action with unheard-of lease offers.

As always, buyers with good credit and stable income are most likely to be eligible for the best deals.

Best Deal: $499/month for 36 months with $499 due at signing. It’s rare to see any luxury brand offering a zero-down lease deal, so this one is special.

Browse local Lincoln listings, or see offer details.

Best Deal: $499/month for 36 months with $499 due at signing

Browse local F-150 listings, or see Ford offer details.

Best Deal: $399/month for 36 months with $399 due at signing.

Browse local Bronco Sport listings, or See Ford offer details.

Best Deal: $499/month for 36 months with $499 due at signing

Browse Ford Ranger listings with CarEdge, or see Ford offer details.

Best Deal: $499/month for 36 months with $499 due at signing

Avoid depreciation on an F-150 Lightning by leasing it for no money down instead. The Lightning is still the best-selling electric truck in America. See Ford offer details.

See Ford F-150 Lightning deals with CarEdge

Best Deal: Lease the Model Y Rear-Wheel Drive from $547/month for 36 months with $0 due at signing. The Premium All-Wheel Drive and Performance are also eligible for this zero-down offer.

Best Deal: Lease the Model 3 Rear-Wheel Drive from $540/month for 36 months with $0 due at signing. The Premium All-Wheel Drive is also eligible for this zero-down offer.

Keep more cash in your bank account with these hard-to-beat $0-down leases, many of which are available on popular 2026 models. With set monthly payments and nothing down, you can drive away in a newer vehicle and ace your car budget for the next several years.

As with any manufacturer incentive, only those with good credit (or better) are likely to qualify for these zero-down car deals.

Prefer to have a seasoned pro negotiate your deal? Have your person Concierge handle all aspects of your deal.

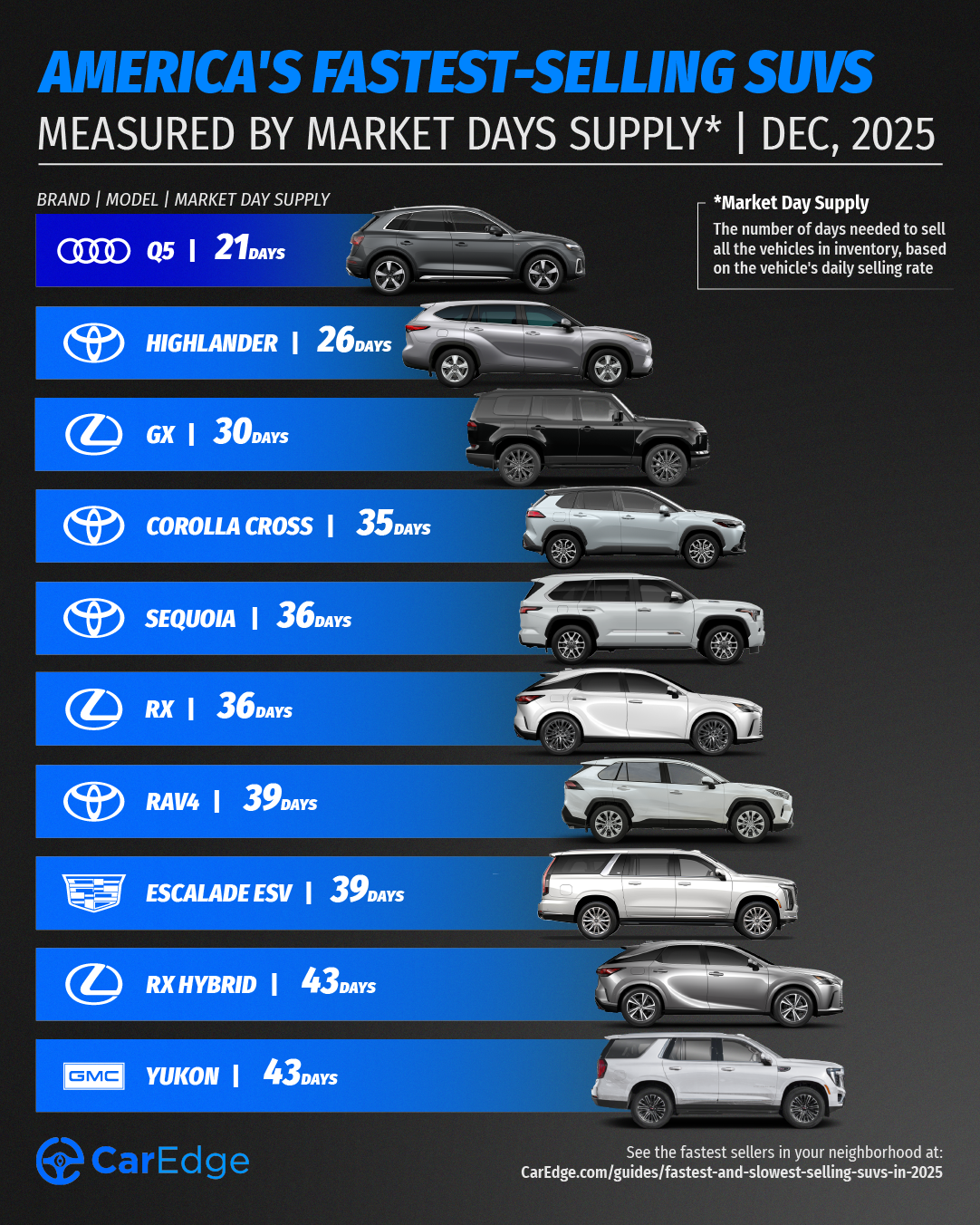

In 2025, some SUVs and crossovers are being scooped up as soon as they hit the lot, while others are sitting unsold for more than six months. Whether you’re a buyer looking for a deal or a seller trying to time the market, understanding which SUVs are moving (or not) is essential.

We analyzed December car market data to find the SUVs with the lowest and highest market day supply (MDS). MDS is a measure of how many days it would take to sell through current inventory at the current sales pace. Here are the winners and losers in 2025’s SUV market.

These are the SUVs and crossovers with the lowest market day supply as of December 2025. That means they’re in high demand right now, and are likely harder to negotiate on due to limited availability.

| Make | Model | Market Day Supply | Total For Sale | 45-Day Sales | Average Selling Price |

|---|---|---|---|---|---|

| Audi | Q5 | 21 | 546 | 1,198 | $59,913 |

| Toyota | Highlander | 26 | 5,408 | 9,238 | $52,294 |

| Lexus | GX | 30 | 2,505 | 3,708 | $80,358 |

| Toyota | Corolla Cross | 35 | 15,932 | 20,331 | $31,303 |

| Toyota | Sequoia | 36 | 4,269 | 5,375 | $83,585 |

| Lexus | RX | 36 | 7,307 | 9,189 | $59,257 |

| Toyota | RAV4 | 39 | 69,716 | 80,310 | $37,424 |

| Cadillac | Escalade ESV | 39 | 1,713 | 1,987 | $126,778 |

| Lexus | RX Hybrid | 43 | 6,381 | 6,725 | $63,418 |

| GMC | Yukon | 43 | 5,393 | 6,118 | $88,398 |

Source: CarEdge Pro

In an unusual hiccup, the Audi Q5 is the fastest-selling SUV this month. Audi is selling down the 2025 Q5 with compelling incentives as dealers prepare for incoming 2026 models. We don’t expect the Q5 to be on this list much longer.

Seven of the top 10 fastest-selling SUVs in 2025 are Toyota or Lexus models. With Consumer Reports naming Toyota as the most-reliable brand (again), more shoppers are flocking to their lineup. No one wants a $50,000 car that lacks in reliability. Car buyers are valuing reliability and affordability above all else right now, and the latest data reflects that.

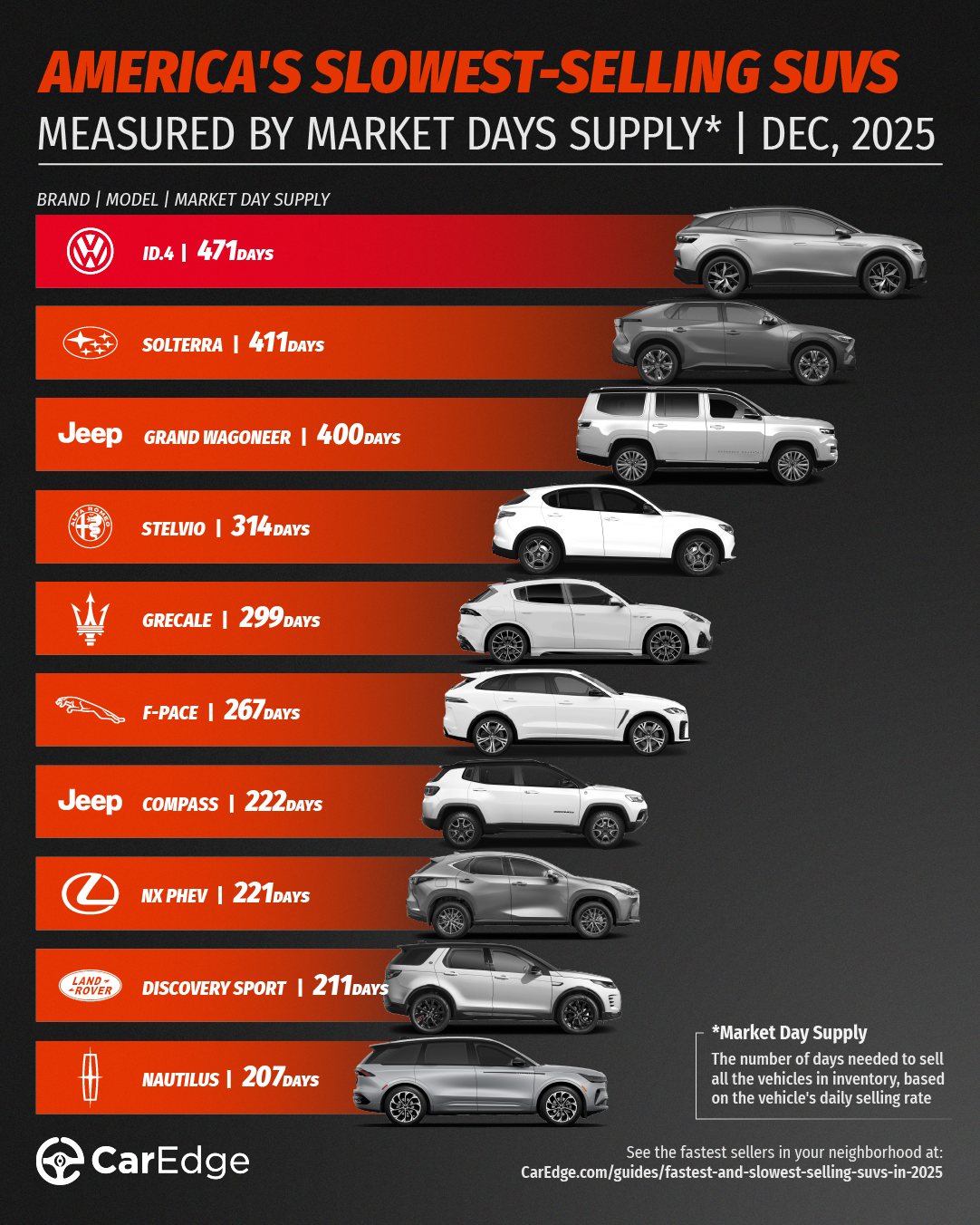

These SUVs have the highest market day supply, which means they’re sitting unsold for longer. Buyers may be able to score better deals on these slowest-selling SUVs in December, especially with this new AI negotiator doing the work for you.

| Make | Model | Market Day Supply | Total For Sale | 45-Day Sales | Average Selling Price |

|---|---|---|---|---|---|

| Volkswagen | ID.4 | 471 | 1,371 | 131 | $48,036 |

| Subaru | Solterra | 411 | 868 | 95 | $41,463 |

| Jeep | Grand Wagoneer | 400 | 1,254 | 141 | $96,557 |

| Alfa Romeo | Stelvio | 314 | 886 | 127 | $57,297 |

| Maserati | Grecale | 299 | 672 | 101 | $82,381 |

| Jaguar | F-PACE | 267 | 2,136 | 360 | $70,204 |

| Jeep | Compass | 222 | 26,303 | 5,320 | $31,805 |

| Lexus | NX PHEV | 221 | 2,112 | 430 | $67,380 |

| Land Rover | Discovery Sport | 211 | 641 | 137 | $53,008 |

| Lincoln | Nautilus | 207 | 13,629 | 2,963 | $62,969 |

Source: CarEdge Pro

With the federal EV tax credit now over, the Volkswagen ID.4 and Subaru Solterra have jumped to the top of the list, with well over one year of supply. Several of the others fall into the luxury segment. With recent inflation and persistently high interest rates, buyers are thinking twice about buying luxury vehicles in 2025.

Four Stellantis models are in the bottom 10 this month. Jaguar’s F-PACE has been a slow-selling model for all of 2025, despite being the top model by volume for the British automaker.

For any of these slow-selling SUVs, prices will be more flexible if you come equipped with negotiation know-how.

If you’re looking for a deal, start with the slowest sellers this month. High inventory levels mean dealers are likely motivated to talk pricing if you negotiate with confidence. It’s always best to take a look at the best incentives of the month, too.

“If you’re shopping for a slow-selling SUV, the ball is in your court,” says auto industry veteran Ray Shefska. “Dealers know those vehicles aren’t moving, and that gives you the upper hand in price negotiations.”

Shopping Toyota, Honda, or Lexus? Expect tighter inventory and less room for negotiation. You may need to move quickly if you find the right trim. However, this is no reason to pay for unwanted add-ons or dealer markups!

With CarEdge Concierge, our experts do the legwork for you, from researching inventory to negotiating with dealers. Already know what you want? Use our AI Negotiation Expert service and have CarEdge AI negotiate with car dealers anonymously!

Explore more free tools and resources with car buying guides, cost of ownership comparisons, and downloadable cheat sheets. There’s no reason to shop unprepared in 2025.

CarEdge is a trusted resource for car buyers, offering data-backed insights, negotiation tools, and expert guidance to help consumers save time and money. Since 2019, CarEdge has helped hundreds of thousands of drivers navigate the car-buying process with confidence. Learn how to buy a car the easy way at CarEdge.com.

Year-end sales are officially here, and automakers are throwing everything they have at 2025 sales numbers. With inventory levels running higher than expected and 2026 models arriving on lots, manufacturers are rolling out their most aggressive incentives of the year. These are the top 10 year-end car deals in the first week of 2026. If you’ve been waiting for the right moment to buy, this is it.

Best Deal: $0-down lease, $350/month for 36 months

The Civic remains one of the best values in the compact car segment, and this zero-down lease makes it even more accessible. No upfront cash means you can drive home in a reliable, fuel-efficient sedan without draining your savings account.

This offer expires on January 5, 2026. See offer details.

Browse Honda Civic listings with the power of local market data

Best Deal: 0% APR for 72 months on 2025 models, or 0% APR for 60 months on 2026 models

Ram is offering interest-free financing on both outgoing 2025s and brand-new 2026 models. That’s six full years without paying a dime in interest if you go with the 2025. For buyers who prefer the latest model year, the 2026 still gives you five years at zero percent. Either way, you’re saving thousands compared to typical loan rates.

This offer expires on January 5, 2026. See offer details.

Browse Ram 1500 listings with the power of local market data

Best Deal: $0-down lease, $419/month for 36 months

Volkswagen is making it easy to get into a well-equipped compact SUV with no money down. The Tiguan SE comes with a solid feature set, including all-wheel drive in most configurations, making this one of the better no-commitment deals of the season.

This offer expires on January 2, 2026. See offer details.

Browse Volkswagen Tiguan listings with the power of local market data

Best Deal: $0-down lease, $479/month for 36 months

The best-selling vehicle in America is now available with no money down. Ford’s zero-down lease on the F-150 STX is one of the most competitive truck offers this December, especially considering the STX trim comes well-equipped with features like the 2.7-liter turbocharged V6 engine.

This offer expires on January 5, 2026. See offer details.

Browse Ford F-150 listings with the power of local market data

Best Deal: $0-down lease, $499/month for 36 months

Ford’s three-row SUV is getting the zero-down treatment for year-end. The Explorer Active comes with rugged styling and standard all-wheel drive, making it a solid choice for families who need space without the commitment of a large down payment.

This offer expires on January 5, 2026. See offer details.

Browse Ford Explorer listings with the power of local market data

Best Deal: $4,000 cash back (up to 13% off MSRP)

If you prefer to buy rather than lease, the Escape is delivering serious cash savings. With $4,000 in rebates available, you’re looking at up to 13% off the sticker price on select trims. That’s one of the deepest discounts we’ve seen on a compact SUV this year.

This offer expires on January 5, 2026. See offer details.

Browse Ford Escape listings with the power of local market data

Best Deal: $6,500 cash offer (equal to 15% off MSRP)

Infiniti is offering the single largest cash incentive on our list. A $6,500 discount equals roughly 15% off the MSRP, putting this luxury compact SUV within reach of buyers who might otherwise shop mainstream brands. If you’ve been considering a step up to a premium vehicle, this is your opportunity. But it’s also your last chance to own this model. The QX50 will be discontinued in 2026.

This offer expires on January 2, 2026. See offer details.

Browse Infiniti QX50 listings with the power of local market data

Best Deal: 0% APR for 48 months, or lease from $499/month for 36 months with just $499 due at signing

Lincoln is giving buyers flexibility with two strong offers. Take the zero-percent financing for four years if you’re buying, or go with the ultra-low $499 down lease if you prefer lower commitment. Either way, you’re getting into a luxury SUV with minimal financial strain.

This offer expires on January 5, 2026. See offer details.

Browse Lincoln Corsair listings with the power of local market data

Best Deal: Lease from $179/month for 39 months with $3,999 due at signing

Toyota’s most affordable lease of the season lands on the redesigned 2026 Corolla SE. At just $179 per month, this is one of the lowest payments you’ll find on any new car right now. The upfront cost is higher than some competitors, but the monthly savings add up quickly.

This offer expires on January 5, 2026. See offer details.

Browse Toyota Corolla listings with the power of local market data

Best Deal: 0% APR for 60 months, or lease from $279/month for 36 months with $4,489 due at signing

Nissan is bringing back zero-percent financing on the Rogue for year-end. Five years interest-free is hard to beat, especially on a redesigned model with fresh styling and updated tech. If you prefer to lease, the $279 monthly payment on the all-wheel drive SV trim is competitive for a well-equipped compact SUV.

This offer expires on January 5, 2026. See offer details.

Browse Nissan Rogue listings with the power of local market data

December is always the best time to buy a car, and 2025 was no exception. But if you’re a little late to the game, most of these sales are good through January 5, 2026. Automakers are under pressure to sell remaining 2025 models, and in early 2026, that pressure translates into savings for you.

Tired of the car buying hassle? CarEdge Concierge handles the entire process for you, from finding the right vehicle to negotiating the best price. Or, if you prefer a DIY approach with professional tools, CarEdge Pro gives you insider data and an AI agent to negotiate on your behalf.

We’re here to help!

![Every Cyber Monday 0% APR Offer [2025]](https://caredge.com/wp-content/uploads/2025/06/2025-Subaru-Outback-deals-1080x675.jpg)

Cyber Monday marks a turning point in year-end car sales. Most November deals last through December 1, meaning that Cyber Monday is your last chance to take advantage of today’s best incentives. But on the other hand, fresh sales will arrive this week. If you see the deal you’ve been hunting for, there’s no reason to wait. It’s officially the best time of the year to buy a car, so manufacturers are bringing their best incentives. Knowledgeable shoppers can take advantage of this buyer’s market.

The CarEdge Team dug through every automaker’s Cyber Monday new car sales to find the best deals. Here’s the complete rundown of every zero-percent offer live for well-qualified buyers right now.

The Silverado 1500 and two popular crossovers are eligible for three years of interest-free financing for Cyber Monday 2025. Chevy’s electric models continue to feature zero percent financing. See Chevrolet offer details.

It’s late 2025, yet Dodge is still advertising sales for a 2024 model. The Hornet is consistently one of the slowest-selling cars in America. Of course, the 2025 Charger Daytona is also eligible. See Dodge offer details.

The F-150 Lightning qualifies for the soon-to-expire $7,500 federal tax credit for EVs. Zero percent financing is also a huge incentive. See Ford offer details.

The GV60 is the luxury sibling to the top-selling Hyundai IONIQ 5. It’s now available with interest-free financing for five years. See Genesis offer details.

GMC is offering 0% APR financing for the popular Sierra 1500 this month, although this incentive is limited to 36 months. See GMC offer details.

Honda’s only zero percent financing offer is for the 2025 Honda Prologue. As a top-selling brand with rapid inventory turnover, don’t expect Honda to offer 0% financing often. See Honda offer details.

Hyundai is aggressively heading into Cyber Monday with zero percent financing. It’s not just EVs this time—the Santa Fe and Tucson also qualify. See Hyundai offer details.

Jeep’s Cyber Monday sale brings zero percent financing for the 2025 Jeep Grand Cherokee, the brand’s top-selling model. See Jeep offer details.

Kia is offering several zero percent financing deals right now, including some of the best offers of the month. See Kia offer details.

You know it’s a buyer’s market when Lexus is offering zero percent financing. That’s virtually unheard of. The all-electric Lexus RZ can be financed free of interest for six years. On a cautionary note, be wary of steep depreciation! See Lexus offer details.

Lincoln doesn’t offer 0% financing often, and nor do any other luxury brands. But as luxury sales slow, automakers are bringing out the ‘big guns’ to sell cars. See details from Lincoln.

Mitsubishi is offering zero percent financing for ALL 2025 inventory. This deal isn’t just for Cyber Monday, it’s valid through the end of the year. See offer details from Mitsubishi.

Nissan continues to offer competitive financing deals, especially on their electric and crossover models. See Nissan offer details.

The best Cyber Monday truck offer is this exceptional zero percent financing deal for 72 months for the 2025 Ram 1500. The 2026 model is also eligible for five years of interest-free financing. It’s free money! Ford and Chevy can’t match that, although the F-150 is available to lease for under $1,000 down. See the best truck deals of the month here.

The 2025 Outback is now advertised with three years of interest-free financing. The 2025 Solterra’s 72-month offer continues as most buyers await the refreshed 2026 model. See offer details.

Volkswagen is offering zero percent financing for the Taos, and the all-electric ID.4. See other VW sales, including zero-down leases.

Cyber Monday marks the beginning of 2025’s year-end sales. Smart shoppers have been waiting all year for this, so expect the best deals to sell out quickly (especially for in-demand Toyota, Honda, and specialty models). This is a fleeting opportunity to save. Cars won’t be getting any cheaper once 2026 rolls around. We can already see that reflected in 2026 model pricing.

Tired of car buying hassles? Let AI negotiate for you! Learn more about CarEdge’s NEW AI Negotiator, recently featured in Fortune!

Year-end car deals aren’t just for new cars and trucks – smart shoppers in the used car market can leverage new car specials for big savings. Used car prices have been steadily declining, and the timing couldn’t be better to secure a great deal. Here’s how to use market trends and negotiation tools to your advantage this December.

Year-end car buying season is well-known for flashy new car promotions, but the holidays also create opportunities for used car buyers. With dozens of 0% APR financing offers and competitive lease deals pulling buyers to new car lots, demand for used vehicles has softened.

For used car buyers, that means one thing: leverage.

However, new car offers are so great that it’s totally reasonable for many would-be used car buyers to check them out first:

👉 42 offers of 0% APR financing. These deals won’t last!

👉 Up to $11,500 off MSRP on full-size trucks

Check out ALL of the best year-end deals at the CarEdge Deal Hub

1. A Pre-Approval Letter for Competitive Financing

Arrive at the dealership armed with a pre-approval letter from a credit union, bank, or online lender. Not only does this save you time at the dealership, but it also provides leverage if the dealership’s financing offers can’t match or beat your pre-approved rate. Credit unions often have the best rates for used car buyers.

👉 How to finance a car like a pro (free guide)

2. Black Book Value for the VIN You’re Interested In

Knowledge is power in any negotiation, and knowing the true value of the car you’re eyeing is key. It’s best to check the value using multiple online tools, particularly KBB, Edmunds, and CarEdge. Before heading to the lot, check the value for the specific VIN to ensure the asking price is fair—or to use as leverage if it’s not.

3. Days on the Lot, and Other Market Data

Dealerships want to move older inventory, and vehicles that have been sitting on the lot for a long time are prime for negotiation. Use CarEdge Pro to find out how long the car has been on the lot. If it’s been sitting for 60 days or more, you have a better chance of negotiating a lower price.

Some used cars have been on the lot for 6 months or longer, and are HIGHLY negotiable. However, don’t expect the car salesperson to volunteer this information!

4. Free Car Buying Cheat Sheets

A car buying cheat sheet is your go-to guide for navigating the deal. Know what’s fair, identify unnecessary add-ons to avoid, and recognize when it’s time to walk away from a deal. The more informed you are, the less likely you are to overpay. Download your negotiation cheat sheets, and take them with you to the dealership!

Tired of car buying hassles? You’re in the right place. CarEdge was founded in 2019 to level the playing field and make buying a vehicle more fair, more transparent, and less stressful. 👉 Learn how we can make car buying EASY.

👉 Ask these questions when buying a car!

As the year comes to a close, the combination of falling used car prices and lower demand creates the perfect storm for savings. By coming prepared with the tools and insights you need, you’ll have everything you need to negotiate the best possible deal.

For more real-time market insights and negotiation tools, learn more about CarEdge Pro. With CarEdge by your side, you’re sure to drive home the car you want—at the price you deserve.