CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Our team of Car Coaches combines decades of experience in the automotive industry to help you, the consumer, buy a car without the hassle. That’s why we created this must-have resource for buying a new or used car at a dealership, whether in person or through the internet sales department. This car buying cheat sheet will help you negotiate car prices confidently, so you can drive away feeling proud of what you’ve accomplished.

Thank you to CarEdge’s Ray Shefska (former dealership sales manager) and Kimberly Kline (former dealership finance manager) for putting this together for car buyers everywhere!

Want to download printable versions of all CarEdge cheat sheets? Find them all here.

Use this cheat sheet to negotiate the best auto loan rates on new or used cars!

The best way to learn how to negotiate car prices effectively is to prepare for the situations and conversations you’re likely to encounter with the salesperson and finance manager. Feel free to print off this cheat sheet and bring it with you! Without further ado, here’s how an informed, prepared car buyer can expertly negotiate.

Salesperson: What do you want your monthly payment to be?

You: I’m not concerned with the monthly payment, I am only focused on the total out-the-door price.

Salesperson: So you’re paying cash?

You: I haven’t determined exactly how I plan to pay for it. I am only concerned about the total out-the-door price.

Salesperson: So you have a monthly budget in mind?

You: I have a total out-the-door price in mind, so I would only like to discuss that at the present time.

Salesperson: OK, how much cash will you be putting down?

You: I haven’t decided that yet and I won’t until we establish an acceptable total out-the-door price.

Notice a trend here? You really really want to stay laser-focused on the only number that matters this early in the game: the out-the-door price. Salespeople will try hard to learn more about how much money you’re willing to spend. If that can get you to talk about monthly payments, they immediately have an advantage over you. That gives them leverage to play with higher interest rates, longer loan terms, and lower trade-in offers. None of those are good for you, the buyer.

Salesperson: What are going to do with the car that drove here, will you be trading it?

You: I haven’t decided yet. We can discuss that as a possibility after we agree to an out-the-door price.

Salesperson: Now that we have agreed to the out-the-door price, what about the car you drove here, will you be trading that in?

You: I might, it depends on whether or not you can match or beat these written offers that I have already received.

Salesperson: Now that we have agreed to the out-the-door price and agreed to the value of your trade, what do you want your monthly payment to be?

You: I’ll only discuss that with the Finance Manager.

Salesperson: Will you be putting any cash down?

You: I’ll be more than happy to discuss all of that with the Finance Manager. If you provide me with a credit application I’ll be more than happy to fill that out for the Finance Manager.

Salesperson: The Finance Manager will be with you shortly.

Use this cheat sheet to negotiate the best auto loan rates on new or used cars!

NEW in 2024: Due to popular demand, we created this additional FREE guide: Auto Financing Cheat Sheet

Finance Manager: I assume that you have given some thought to a monthly payment and loan term that will be comfortable to you.

You: I have indeed and I have also secured a pre-approval from my credit union as a possibility for my loan.

Finance Manager: Would you consider financing through us?

You: I would assuming that you can beat the pre-approved rate that I have. Here is the pre-approval terms sheet from my credit union with all the particulars.

Finance Manager: So if I beat the rate you will finance with us?

You: Yes, if you beat it by at least ¼ of a percent. And I promise to at least listen to any finance and protection packages that are available.

Finance Manager: So you are open to some of our programs?

You: Possibly, if we can agree to a reasonable selling price on any items that I think have value. Oh, and if I do buy any products I would at least expect you to give me the buy rate from the bank on my loan. Once again though, you will need to beat my credit union rate by at least ¼ of a percent for me to even consider it.

Finance Manager: Great, let’s get started.

You: I’m all ears.

Finance Manager shares the MENU with additional products.

You: But first, before we go over product benefits, where is my base payment, amount financed, term and interest rate?

Finance Manager shows them to you.

You: Is there a prepayment penalty if I finance with you?

If there is no prepayment penalty, proceed with considering their menu options.

These are products you might see on the menu, and questions to ask:

Finance Manager shows you payments

You: (If you don’t see actual product price) Please write the actual product price next to each one.

Finance Manager: It just changes your payment by this much.

You: I see that, but I want to see the actual price of each product to help me make a good decision.

At this point, negotiate prices down on any products you want.

Finance Manager: OK, sign here and here and here.

You: Please print my Bank Contract and Purchase Order first so I can go over them.

Go over each line of your itemized Purchase Order and make sure the bottom line (amount financed) on both documents match!

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

Check us out on YouTube at the CarEdge main channel and our daily Ray and Zach LIVE SHOW.

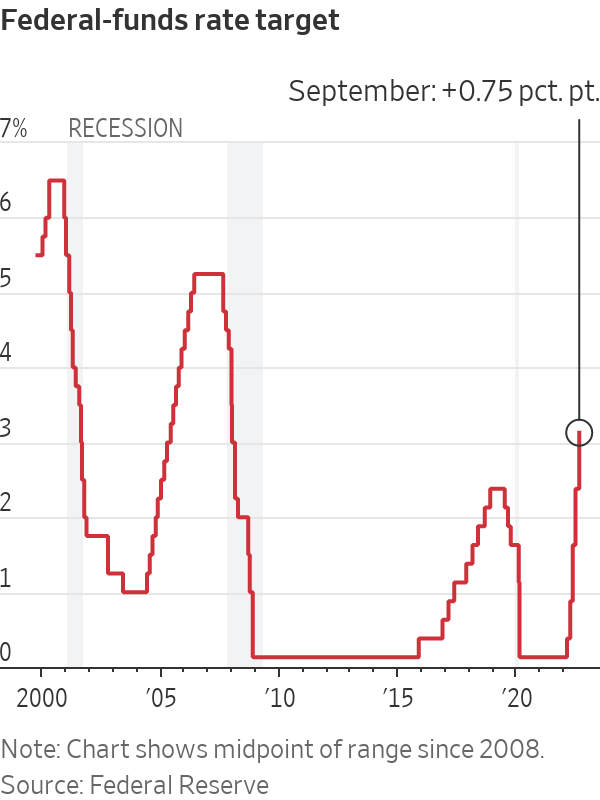

Auto loan interest rates are rising. For most of us, when buying a new or used car, agreeing on a price is only half the work (or if you have a car to sell/trade-in, a third of the work). Are you ready to go to battle for round two? That would be negotiating a fair auto loan interest rate.

Auto loan APRs are higher than they’ve been at any point in the past decade, and they’re headed even higher. How much do rising interest rates matter for today’s new and used car buyers? We crunched the numbers to find out.

What do you get when you combine interest rate hikes with the likelihood of an economic recession? It becomes a whole lot more expensive to borrow money. Whether you’re in the market for a new car or a new house, lenders seem to be increasing loan rates every other day in 2022.

According to new data from Edmunds, the average car loan interest rate (APR) on a new vehicle loan rose to 5.9% in September. That’s up 44% since December 2021. The last time auto loan rates were this high was right before the crash of 2009-2010.

What’s different this time around? Cars are 71% more expensive in 2022. Back in 2009, the average new car transaction price was $28,201. Today, it’s a bit over $48,000. Buyers are paying A LOT more interest in 2022, and monthly car payments are more akin to second mortgages.

In September 2022, the average amount that new car buyers financed was $41,347. Thinking about stretching that loan term as far out as possible? That adds up to a total of $7,849 in interest paid over 72 months. Ouch!

The average used car loan interest rate has shot up to 9.2%, adding thousands to the total cost of borrowing money to buy a car.

In September 2022, the average amount that used car buyers financed was $31,366. That adds up to a total of $9,566 in interest paid over a 72-month loan term.

What if you shop around and get pre-approved for a 7.0% APR instead of the average of 9.2%? Over 72 months, you’d SAVE a grand total of $2,429 in interest, all by simply shopping around and getting some more loan rate offers.

When ‘The Fed’ meets again in early November, they’re almost certain to announce another rate hike. Whether it amounts to 75 basis points or less is of little concern. What’s certain is that auto loan rates will continue to rise in November.

Based on our own analysis at CarEdge, we expect the average car loan interest rate to climb higher to between 6.5% (for new cars) and 10.5% (for used cars) in November.

Remember that these are expected averages, so there will be better (and worse) auto loan offers out there. Don’t settle for your first auto loan rate offer. Shop around!

Not sure where to start? See competitive loan offers with the help of CarEdge!

There are still ways to save big-time on auto loan interest. These are the biggest ways to keep more money in your pocket:

Manufacturer Incentives: The Best Auto Loan Rates Right Now (For a Limited Time)

Have you joined the FREE CarEdge Community? Tens of thousands of car buyers, sellers, and owners are harnessing the power of community to make vehicle ownership what it should have always been: hassle-free with no gimmicks. Whether you’re searching for the best way to browse car listings online or looking for a community of auto enthusiasts, we’d love to have you.

Electric trucks are not cheap, and some of them are just downright expensive. Are the fuel savings and power worth the extra cost? This resource features every electric truck’s pricing and range in 2024. Which electric pickups are you interested in? There will be more to choose from in just a few years’ time.

| Make | Model | Release Date | Starting Price | Fully-Optioned | Range |

|---|---|---|---|---|---|

| Chevrolet | Silverado EV | early 2024 | $52,000 | $106,895 | up to 450 miles |

| Ford | F-150 Lightning | available now | $49,995 | $91,995 | 240 - 320 miles |

| GMC | Hummer EV | available now | $86,645 | $112,595 | 329 miles |

| GMC | Sierra EV | early 2024 (Denali) | $52,000+ | $107,000 | up to 400 miles |

| Rivian | R1T | available now | $73,000 | $105,000 | 314 - 400 miles |

| RAM | 1500 REV | 2025 | N/A | N/A | 350-500 miles |

| Tesla | Cybertruck | 2024 | $60,990 | $99,990 | 250-340 miles |

First, here are a few things you should know about charging an electric pickup (or any EV for that matter):

| Make | Model | Fast-Charging Times | Notes |

|---|---|---|---|

| Chevrolet | Silverado EV | Add 100 miles in 10 minutes | Expect to add 300 miles of range in 30 minutes |

| Ford | F-150 Lightning | Add 200 miles in 40 minutes | The Lightning charges to 80% quickly, but slows considerably after. |

| GMC | Hummer EV | Add 100 miles in 10 minutes | Expect to add 300 miles of range in 30 minutes |

| GMC | Sierra EV | Add 100 miles in 10 minutes | Expect to add 300 miles of range in 30 minutes |

| Rivian | R1T | Add 200 miles in 35 minutes | The R1T accepts up to 220 KW of power, which is above average |

| Tesla | Cybertruck | "Recover up to 136 miles in 15 minutes" | Announced in 2019, the Cybertruck has been delayed to 2024 |

| RAM | 1500 REV | Add 110 miles in 10 minutes | 350-500 miles of range; coming late 2024 |

In 2022, the Inflation Reduction Act was signed into law, and with it came a complete revamp of federal EV incentives. Here’s a brief summary of the biggest changes to tax credits for electric trucks in 2024:

Just months after the Federal Trade Commission (FTC) took legal action against Koons Kia and Napleton dealerships, the FTC has reached a high-dollar settlement with the DC-area’s Passport Automotive Group. The FTC found evidence that Passport Auto Group dealerships were routinely deceiving consumers by forcing thousands of dollars in illegal junk fees onto car prices and for discriminating against Black and Latino consumers with higher financing costs and fees.

Passport, its president, Everett Hellmuth, and its vice president, Jay Klein, will pay more than $3.3 million to settle the FTC’s lawsuit. The settlement money will be used to refund impacted consumers.

Passport Automotive Group operates nine dealerships in 2022:

“With this action against Passport and its top executives, the Commission is continuing its crackdown on junk fees and discriminatory practices that harm Black and Latino consumers,” said Samuel Levine, Director of the FTC’s Bureau of Consumer protection. “As families struggle with rising prices, companies that think they can hit consumers with hidden fees should think again.”

The FTC has been on a roll in 2022. This summer, the FTC proposed a new set of rules that would ban specific anti-consumer sales practices that are commonly employed at car dealerships. Dealer lobbies were furious.

The FTC’s investigation found that at Passport dealerships, Black and Latino consumers paid on average $235 to $291 more in interest than non-Latino white consumers did. It also alleges that Black and Latino consumers were charged an extra fee 42 percent more often.

The FTC announced that it is taking the following enforcement actions:

The Commission vote to file the complaint was 4-1. Interestingly, one Commission member, Noah Joshua Phillips, voted no on the motion.

In 2018, the FTC alleged that Passport Auto Group issued fake “urgent recall” notices to consumers to lure them to visit dealerships. According to the FTC, the vast majority of the vehicles covered by the notices did not have open recalls.

Will Passport Auto Group’s second run-in with the FTC be enough to put an end to deceptive, anti-consumer practices? $3.3 million is quite the hefty fine.

Koons Kia Fined $1 Million by Maryland Attorney General for Fake Fees

Interest rates are rising, and inflation is at record highs, but deals can still be had when buying a new car. Every month, the team at CarEdge pores over the latest offers from every automaker. The result is a one-stop resource to share the very best new car deals with you.

Not finding what you’re looking for? We’ve included links to each automaker’s website. Check back frequently, as this living page will be updated regularly.

Check out these other CarEdge car buying resources:

The Best Auto Loan Rates Right Now

The Best Lease Deals This Months

These 5 Brands Are Negotiable Right Now

Finance Buick SUVs (Encore, Envision, Enclave) at 3.99% APR for 72 months.

Buick Encore: $179 per month for 24 months with $5,449 due at signing

Buick Envision: $279 per month for 24 months with $3,739 due at signing

Cadillac CT4: $439 per month for 36 months with $3,749 due

Cadillac XT4: $379 per month for 36 months with $3,579 due at signing

See Cadillac listings near you.

Best Chevrolet financing offer:

2.99% APR for 60 months for the Silverado 1500, Colorado and Equinox.

Chevrolet lease deals:

Chevrolet Trailblazer: $259 per month for 24 months with $3,109 due at signing

Chevrolet Blazer: $279 per month for 24 months with $2,369 due at signing

Silverado 1500 Crew Cab 4WD LT: $399 for 36 months with $3,579 due at signing

See details on Chevrolet deals.

Chrysler Pacifica Hybrid: $599 per month for 39 months with $5,499 due at signing

See details on Chrysler deals.

In February, Ford is advertising 3.9% APR for 60 months for select models

Learn more about Ford deals at Ford.com.

Best GMC financing offer:

2.99% APR for the GMC Sierra 1500

3.9% APR for the GMC Terrain

GMC lease offers:

GMC Acadia: $289 per month for 24 months with $2,309 due at signing

GMC Terrain: $279 per month for 24 months with $3,949 due at signing

Best Honda financing offers:

Honda Pilot, Passport, Ridgeline: 1.9% APR for 24 – 48 months

Best Honda lease offers:

Honda Civic: $269 per month for 36 months with $3,399 due

Honda CR-V: $349 per month for 36 months with $4,499 due

Hyundai lease offers this month are good, but the amount due at signing has increased this month.

Hyundai Venue: $151 per month with $3,281 due

Hyundai Elantra: $219 per month with $3,299 due

Hyundai Kona: $209 per month with $3,999 due

Hyundai Tucson: $279 per month with $3,999 due

Hyundai Santa Fe: $269 per month with $3,999 due

See details on Hyundai lease and finance deals.

Jeep leases are attractive in February.

Jeep Wrangler: $409 per month for 42 months with $5,099 due at signing

Jeep Compass: $347 per month for 42 months with $3,799 due at signing

Best Kia financing offer:

2.9% APR for 48 months

Kia Forte

Kia Sorento (2022)

Kia Soul

Best Kia lease offers:

Kia Sportage: $279/month for 36 months with $3,499 due

Kia Seltos: $249/month for 36 months with $3,320 due

See details on Kia deals at Kia.com.

3.49% APR for 48 months for the RX.

$2,000 lease cash for select RX styles.

ES 250 AWD: $509/month for 39 months with $3,999 due

See details on Lexus deals at lexus.com.

Best Mazda financing offer:

2.49% APR for 36 months + NO payments for 90 days

Best Mazda lease offers:

Mazda CX-30: $239 per month for 24 months with $2,999 due at signing.

Mazda CX-5: $299 per month for 33 months with $3,499 due at signing.

See details on Mazda deals at Mazdausa.com.

0.0% APR for 36 months

1.9% APR for 36 months

Nissan Altima: $199 per month for 18 months with $2,309 due

Nissan Leaf: $269 per month for 36 months with $5,259 due

Nissan Rogue (AWD): $299 per month for 36 months with $3,459 due Nissan Murano (FWD): $299/month for 24 months with $2,099 due

Learn more about Nissan deals here.

4.9% APR for 72 months and no payments for 90 days for the Ram 1500 and Ram 2500

$4,000 cash allowance for Ram 1500

Lease: Ram 1500: $309/month for 42 months, $5,499 due

Learn more about Ram deals at Ramtrucks.com.

Best Subaru financing offers:

2.9% – 3.9% APR for 48 months for these models:

The best Subaru leases:

Subaru Outback: $345 per month for 36 months with $3,515 due

Subaru Ascent: $359 per month for 36 months with $3,259 due

Best Toyota financing offers:

2.99% APR for 60 months

3.49% APR for 48 months

Toyota Corolla Cross: $331 per month for 39 months with $2,976 due

Toyota RAV4: $413 per month for 36 months with $3,063 due

Toyota Highlander: $393 per month for 39 months with $4,053 due

Learn more about Toyota deals here.

With interest rates rising and inflation putting pressure on automakers and their dealer networks, the only thing that could bring better new car deals would be plummeting demand. We’ve seen signs of weakening demand and higher new car inventory, but nothing considered drastic. Expect auto loan interest rates to climb in 2023. The best car deals in February won’t last.

These are the 5 car brands you CAN negotiate right now!

Thinking about factory ordering? These are the latest wait times our community is reporting.

These are the most marked-up new cars in 2022

Looking for something else? Visit our blog, or consult 1:1 with a real CarEdge Auto Expert to get customized help with your car deal. It could save you thousands!