CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

As 2023 comes to a close, the new car market is brimming with opportunities for big savings. With an increase in inventory and the arrival of 2024 models, Mazda and Subaru dealers, along with their manufacturers, are feeling an increased urgency to sell off their current stock. Here, we’ve highlighted the best year-end deals for Mazda and Subaru in 2023, with the spotlight on low APR SUVs available for a limited time.

Starting MSRP: $29,300

Current Market Day Supply: 115 days

Negotiability Score: High

0% APR for 60 months + No payments for 90 days (ends 1/2/24)

The CX-5 comes with standard all-wheel drive, a rarity outside of Subaru. 2024 model year CX-5s have recently arrived at dealership lots, and with zero percent financing, it’s clear that Mazda is looking to sell them immediately. Mazda also has several models at 0.9% to 1.9% APR in December, including the popular CX-30, CX-50, and the large CX-90.

2024 Mazda CX-5 dealer inventory is down slightly over the past month, from 144 days of supply to 115 days of supply. That’s still twice the market norm of roughly 60 days. This indicates that Mazda dealers should be willing to negotiate, at least before the end of 2023. Dealers and salespeople are eager to meet year-end sales targets.

See 2024 Mazda models at $500 below invoice, and 2023 Mazda models at $1,000 below invoice!

2024 Mazda CX-90

Starting MSRP: $39,595

Current Market Day Supply: 135 days

Negotiability Score: High

0% APR for 36 months + No payments for 90 days (ends 1/2/24)

This Mazda offer applies to the Turbo Select, Turbo Preferred, Turbo Preferred Plus, Turbo Premium, or Turbo Premium Plus trims only. The 3-row CX-90 is Mazda’s largest model, with 74.3 cubic feet of cargo volume with the seats down. It comfortably seats 7 passengers. Reviewers agree that the all-new CX-90 is a shockingly luxurious mid-size SUV, and represents incredible value at the price point.

With so many CX-90s shipped to dealer lots, inventory is currently very high at 135 days. With a financing offer like this, we’re left wondering why more SUV buyers aren’t taking advantage of this deal.

See Mazda CX-90 inventory priced at $500 below invoice!

Learn more about offer details.

2023 Mazda CX-30

Starting MSRP: $22,950

Current Market Day Supply: 32 days

Negotiability Score: Low

0% APR for 36 months + No payments for 90 days (ends 1/2/24)

The 2024 CX-30 gets a $2,000 price increase for 2024, so buyers are taking advantage of great financing offers for remaining 2023 CX-30 inventory. With standard all-wheel drive, 191 horsepower and combined 29 miles per gallon, this crossover is a compromise that simply works.

There are only 2,000 2023 CX-30s remaining nationwide, so this deal won’t last.

See Mazda CX-30 inventory priced at $1,000 below invoice!

Learn more about offer details.

Subaru is ending the year with a rare offer for its second most popular model, the Outback. If you haven’t sat in an Outback for several years, you’d be surprised how far this model has come. Featuring modern tech that perfectly compliments the Outback’s beloved all-terrain capability, this financing offer is one to get excited about.

2024 Subaru Outback

Starting MSRP: $28,895

Current Market Day Supply: 85 days

Negotiability Score: Above Average

1.9% APR for 48 months (ends 1/2/24)

Currently, there are nearly 27,000 Outbacks sitting on dealer lots, of which 26,000 are new 2024 models. With 85 days of market supply, there are more Outbacks available than normal. Negotiability is possible, but not what we’d consider likely. Dealers know the Outback is popular, and may be willing to hold on to them into the new year.

See Subaru Outback inventory with local market data.

For new car shoppers considering Subaru and Mazda, December 2023 is an exceptional time to find the year’s most attractive deals. With a range of incentives, the year-end rush to sell, and the availability of 2023 Subaru and Mazda models, holding off until 2024 might mean missing out on current opportunities.

The situation in the used car market, however, is less clear-cut. Recent trends indicate a drop in prices, but the full impact of these changes and their duration remains to be seen. Particularly for Subaru and Mazda used cars, the market’s fluctuating dynamics make predicting the best time to buy in 2024 somewhat uncertain. See our December used car market update here.

Free Car Buying Help Is Here

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

CarEdge is offering $200 off of mechanical and electronics warranties through the end of March. Better yet, CarEdge’s extended warranties are the exact same coverage that you get at dealerships, but for hundreds of dollars less. Here’s everything you need to know about the best extended warranty deal today.

With CarEdge’s $200 off warranty discount, you can get an extended warranty for several hundred dollars less than at the dealerships.

Why are CarEdge’s extended warranties so affordable? It’s simple: there’s a set, small markup to help the company keep the lights on, with no gimmicks or commissions. While most car dealers mark up warranties by several hundred dollars, CarEdge keeps just a fraction of that.

Under Mechanical Warranty coverage, CarEdge offers exclusionary coverage for most vehicles. This is insurance industry jargon that means your vehicle is covered from “bumper-to-bumper” for everything but normal wear and tear, routine maintenance, and anything that is explicitly listed in the contract. Learn more about what’s covered.

CarEdge also offers an Electronics Warranty, which protects your wallet from costly electronics repairs. Your car is a rolling computer, so why risk being on the hook for hundreds of dollars in repairs, if not more? View a sample contract to learn more about what’s covered.

Have additional questions? Give us a call at 800.674.5042 for immediate assistance.

Stay safe when you’re on the road with 24/7 towing (up to 150 miles) with no out of pocket cost. We’ll put a spare on for you, jump your battery, or assist with key lockout. CarEdge warranties are built on trust, something that’s hard-earned but easily lost. We won’t let you down.

Save $200 on Electronic and Mechanical Warranties through March 31, 2024. Get your free quote in just a few minutes.

Our plans are managed by AUL Corporation, a nationally-recognized, award-winning plan administrator with over 30 years of dealership experience and an A+ rating from the Better Business Bureau. AUL works with hundreds of the largest auto dealers in America, and is backed by an “A” rated carrier with over $32 billion in assets.

In the era of auto warranty scams and annoying robocalls, CarEdge set out to do things differently. Over the past three years, CarEdge has earned the trust of thousands of drivers nationwide by making a simple promise: no robocalls, no spam, ever.

The proof is in the pudding. Check out these 100% authentic CarEdge reviews.

These savings run out on March 31, 2024. Get a free, no-hassle quote in minutes at CarEdge.com/extended-warranty.

We’re here to help!

In 2023, the automotive market continues to navigate the unpredictable seas of supply and demand. A lingering used car shortage from previous years is causing 2-3-year-old in-demand models to skyrocket in price, while new car inventories are bloating due to overproduction. What does this mean for you, the savvy car shopper? Let’s dive in.

The latest data from Cox Automotive shows that in many cases, there’s a shortage of 2-3 year old used cars. For in-demand models that are just a few years old, demand far exceeds supply. Dealers are using this to their advantage (to the surprise of no one…) and are marking them up severely. For the brands we’ll talk about below, 2-3 year-old used cars often cost nearly the same as a brand-new car. There’s a totally opposite situation for NEW cars. For many makes and models, there’s now an oversupply of new cars in 2023, just two years after the car shortages of 2021.

New car available supply (total vehicles on the lot) is up 71% since last year, and dealerships are finding their lots chock-full of shiny new cars.

In terms of days’ supply, today’s market is up 47% since spring 2022. Days’ supply is a common auto industry metric that is calculated by dividing the total number of available vehicles by the average daily sales number from the last 45 days. It’s one of many available insights for every new and used listing with CarEdge Data.

790,000 more vehicles on sale today compared to May 2022 means dealers are more motivated than ever to cut deals and move inventory. However, despite this surge in supply, the average listing price for a new car is still 5% higher than last year.

On the flip side, used car inventory is 13% lower compared to last year. High prices have led buyers to say NO to used cars, resulting in a 4% drop in sales rates and listing prices. However, these prices remain stubbornly above 2021 levels.

With brands like Toyota, Lexus, Kia, Honda, Subaru, Hyundai, BMW, and Land Rover, new car supply shortages are making used models a more attractive option than their new counterparts. How so? Dealers continue to markup these cars in many markets.

On the other hand, brands like Ford, Lincoln, Dodge, Ram, Chrysler, Jeep, and Buick are dealing with a glut of new cars, making new vehicles especially negotiable today, and offering more value than used inventory at nearly the same price AFTER negotiation.

Based on the latest new car inventory, these brands are most negotiable in 2023:

Nationally, these automakers all have current new car inventory well above the historical norm of 60 days’ supply. See local days’ supply for models you’re interested in with CarEdge Data on Car Search.

Using the tools available through CarEdge Data, we analyzed new car inventory by brand in the three largest markets across the nation. Some notable differences are seen across California, Texas, and Florida.

| Brand | Days' Supply (CA) | Days' Supply (TX) | Days' Supply (FL) |

|---|---|---|---|

| Toyota | 39 | 43 | 38 |

| Kia | 44 | 46 | 41 |

| Honda | 46 | 47 | 43 |

| Lexus | 45 | 50 | 45 |

| BMW | 53 | 67 | 57 |

| Land Rover | 70 | 65 | 64 |

| Subaru | 59 | 53 | 55 |

| Hyundai | 66 | 53 | 56 |

| Volkswagen | 63 | 63 | 56 |

| Cadillac | 60 | 57 | 63 |

| Chevrolet | 68 | 64 | 68 |

| Nissan | 65 | 59 | 54 |

| Mercedes | 73 | 68 | 69 |

| Porsche | 82 | 61 | 72 |

| Mazda | 62 | 68 | 68 |

| GMC | 77 | 72 | 73 |

| Audi | 89 | 72 | 62 |

| Acura | 72 | 81 | 60 |

| Genesis | 96 | 95 | 87 |

| Mitsubishi | 91 | 65 | 65 |

| Mini | 81 | 94 | 92 |

| Ford | 80 | 71 | 67 |

| Dodge | 101 | 84 | 92 |

| Lincoln | 104 | 72 | 72 |

| Ram | 147 | 116 | 132 |

| Infiniti | 94 | 88 | 73 |

| Chrysler | 106 | 86 | 87 |

| Jeep | 126 | 103 | 119 |

| Jaguar | 101 | 90 | 81 |

| Buick | 100 | 106 | 84 |

Hyundai, Nissan, Mitsubishi and Audi have much higher inventory on the West Coast, while Toyota, Kia and Honda have higher new car inventory in Texas. Be sure to check local market supply in your area to get the best sense of negotiability.

In terms of segments, compact cars, midsize cars, subcompact cars, compact crossover/SUVs, minivans, and full-size crossover/SUVs are experiencing a supply shortage.

Conversely, full-size pickup trucks, high-end luxury cars, electric vehicles, full-size cars, and uber luxury vehicles are enjoying a much higher days’ supply than average.

New car segments like vans, mid-size SUVs, most luxury cars and traditional hybrids have roughly average inventory right now.

Right now is a great time to be in the market for a new EV. Across all brands, there’s a nearly 90-day supply of new electric vehicles. This can be seen in models such as the Ford Mustang Mach-E, which now has over 150 days’ supply. That’s up over 100% since last year.

Tesla keeps lowering prices, and with the Model Y, has severely undercut prices for the following popular competitors:

In other words, there’s finally serious competition in the EV landscape. Is it a price war? So far, Tesla’s competitors have not fired back with steep price cuts of their own. We’ll see if that changes this summer. However, used Tesla prices have fallen drastically this year.

Remember, the EV tax credit landscape has changed in the past several months. Popular EVs from Hyundai, Kia, Audi and others no longer qualify due to made-in-America requirements. However the most popular electric vehicles in America, which are of course those bearing the Tesla badge, once again do qualify for the first time since 2019. Here’s an updated summary of where things stand with the EV tax credits.

Whether it’s better to buy new or used in 2023 largely depends on the brand and type of car you’re interested in. Industry-wide, new cars are looking better than they have in years. Popular brands are facing an oversupply, and with that comes greater negotiation power.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

With fluctuating inventories and prices, it’s crucial to stay informed and flexible. Use CarEdge Car Search to check the local days’ supply of the makes and models you’re interested in, and make sure to stay updated with the latest market trends to snag the best deal.

Purchasing a new or used car can be an exciting experience. It can also be miserable. When you set out to secure a great deal on your next car, it’s essential to be well-informed about the auto financing process to avoid costly mistakes. To help you navigate the often complex world of car loans and financing, we have compiled a comprehensive guide to auto financing that covers ten essential steps and tips for success, including:

2. Considering down payment options

3. Shopping around for financing

4. Determining the right loan term

5. Understanding manufacturer incentives

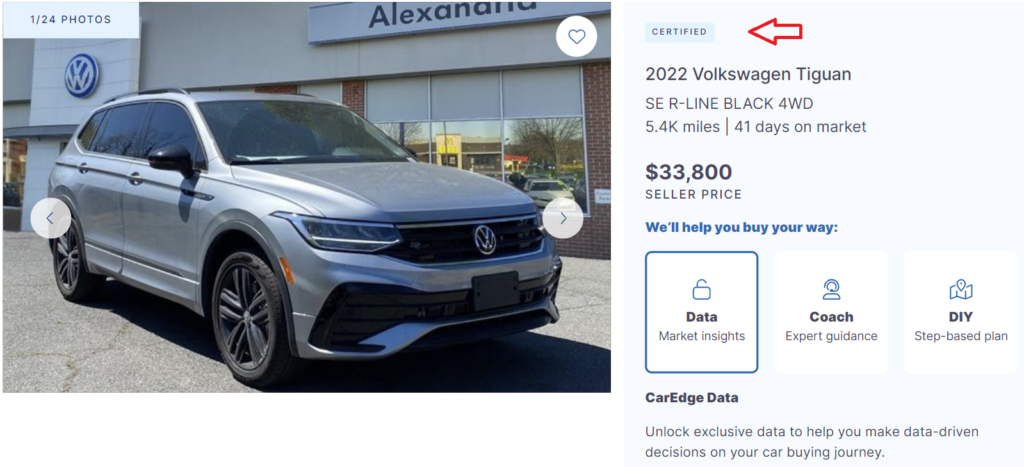

6. Exploring Certified Pre-Owned Vehicles

To illustrate how to effectively employ these strategies, we have also created an example conversation between an empowered car buyer and a car dealership Finance Manager. This detailed script guides you through the entire financing process, from the initial introduction to signing the paperwork. By following this example and implementing the advice provided, you’ll be better equipped to secure a favorable loan, save money, and drive away in the car of your dreams.

Your Path to Auto Loan Savings: Credit Scores, Down Payments, and Savvy Financing Strategies

Let’s dive into valuable tips and expert advice from myself, CarEdge Finance and Insurance Specialist Kimberly Kline, and automotive industry veteran and CarEdge co-founder Ray Shefska. We’ll explore the key factors that influence your loan costs, such as credit score, down payment, and loan term, as well as some lesser known considerations that can save you big bucks at the finance office. Study this auto finance cheat sheet before you head to the dealership!

👉 The basics of auto lending: There are three things that lenders look at when determining whether to approve a customer for a loan. Those three things are 1) ability, 2) stability and 3) willingness.

Ability: do you have the ability to actually make the payments? Will your income support the payment? Based on your debt-to-income ratio, do you fall into the guidelines that the banks use to make this determination?

Stability: how long have you been doing what you do? How long have you been on your job, at your address? Do you job hop or move frequently? Have you shown the requisite stability within your field to satisfy the bank’s lending policies?

Willingness: how have you handled your past credit obligations? Have you handled them in a timely manner or have you sometimes fallen behind? In other words, have you shown a willingness to pay your bills in a timely fashion?

If you can satisfy those three criteria, then you should be approved for a loan at a good interest rate.

Now, we’ll walk you through the key factors you need to consider when applying for a car loan (with the goal of securing a great rate).

Your credit score plays a significant role in determining your auto loan interest rate. Before shopping for a car, check your credit score and work on improving it. For example, pay off outstanding debts, make timely payments, and keep your credit utilization low. Be cautious of applying for multiple credit cards or loans in a short period, as this may negatively impact your score. Monitor your credit report for errors and dispute them promptly.

👉 Pro Tip: Always let the dealership Finance Manager know that YOU know your credit well! This puts you in a more controlling position.

Aim for a down payment of at least 20% of the car’s purchase price to minimize interest costs and potentially qualify for a lower rate. For instance, on a $30,000 car, a 20% down payment would be $6,000. By saving more for your down payment, you can reduce the loan amount, lower monthly payments, and decrease the likelihood of being upside down on your loan.

👉 Pro Tip: Banks and credit unions like to see a healthy loan-to-value ratio. This means that a higher down payment is always a good thing.

Don’t limit yourself to dealership financing. Once you know your credit score, search online for reputable credit unions that operate in your state (start here with CarEdge). Most credit unions publish their new and used auto loan rates on their website. This gives you an excellent idea of what the best current interest rates are. This arms you with knowledge when it comes to speaking with the Finance Manager. If you find a great deal, speak to the loan officer, and consider applying for a car loan. Even if you decide to finance with the dealership, this pre-approval will come in handy in the dealership finance office. Consider working with CarEdge-approved credit unions for excellent rates, and top-tier customer service.

👉 Pro Tip: protect your credit. Don’t aimlessly apply to credit unions online but if you find one with great rates, always speak with a loan officer first, get all your questions answered on their process and then apply.

While longer loan terms may have lower monthly payments, they also mean you’ll pay more interest over the life of the loan. Opt for a shorter loan term if it fits your budget to save on interest costs. For example, choosing a 48-month loan term instead of a 72-month term on a $25,000 loan at a 5% interest rate can save you over $1,500 in interest payments.

Automakers often offer special financing deals or cash rebates to encourage new car sales. Keep an eye out for these incentives, such as low or 0% APR financing, which can significantly reduce your overall interest costs. Be sure to read the fine print and weigh the pros and cons of these offers before deciding. We keep track of the best manufacturer incentives here.

👉 Pro Tip: Don’t expect the dealership finance manager to advertise the manufacturer promotion. Do your research online before shopping.

If you’re buying a used car, consider a manufacturer-certified Certified Pre-Owned (CPO) vehicle. Manufacturer CPO programs have stricter guidelines and typically offer enhanced warranty coverage. Stay away from third-party CPOs, at least if you’re looking for better rates. Browse certified pre-owned (CPO) car listings at CarEdge Car Search to find the perfect vehicle with local market data.

👉 Pro Tip: Let the dealership Finance Manager know that YOU know there are often APR Incentive rates for manufacturer CPO’s. So speak their language and ask them to “check their rate sheet for subvented rates on the CPO”.

If you are stuck with a higher-than-ideal rate, consider refinancing to save on interest costs and potentially lower your monthly payment. Refinancing involves taking out a new loan to pay off your existing loan, ideally with a lower interest rate. Refinancing matters more today than it has in the recent past. With rates being so high right now, even half of a point could save you big money over the life of the loan! This can be a smart move if your credit score has improved since you initially took out the loan or if you discovered in hindsight that the dealership put you in a higher interest loan.

👉 Pro Tip: When refinancing, check to see if the bank or credit union has any incentives (such as for automatic withdrawals, or career-based incentives for teachers, first responders, military and more).

Dealerships may add a markup to the interest rate they offer on car loans, pocketing the difference as profit. Be aware of this practice and ask for the ‘Buy Rate’ to see how much the dealership is marking up the loan. If you have a pre-approval from a credit union, use it as leverage to negotiate the best rate with the dealer. It’s smart to understand how dealers make money before negotiating.

We’ll explain exactly how to negotiate marked-up interest rates in the next section. Stay tuned!

If your car loan allows for early repayment without penalties, consider making extra payments towards “principal only” to pay the loan off ahead of schedule.

👉 Pro Tip: Use an amortization schedule to see how fast you’ll pay down your loan!

This can save you a significant amount of money on interest charges over the life of the loan. Just be sure to double-check your loan agreement for any prepayment penalties before proceeding.

Now, let’s go over a real-world scenario that will be VERY similar to what you’ll encounter at the dealership. It’s time to apply your knowledge!

Check out our series of car buying roleplay videos for unbeatable insights into what it’s like to make a deal!

The best way to learn how to effectively negotiate in the finance office is to prepare for the situations and conversations you’re likely to encounter. What better way to do that than creating a real-world script with the help of dealership professionals who’ve been through this hundreds of times? The following is an example conversation between an empowered, prepared car buyer and a car dealership auto Finance Manager. Don’t forget to check out the original CarEdge Cheat Sheet to Car Buying for more word-for-word car buying help!

Finance Manager: Hi, I’m the finance manager here at the dealership. I understand you’re interested in purchasing a car today. Is that correct?

You: Yes, that’s correct. I’ve already chosen the car I want, and now I’m looking to finalize the financing.

Finance Manager: Great, let’s start by filling out a credit application.

(Note: The dealership is going to need to run a credit report and will insist on doing so in order to determine what interest rates you may qualify for. People usually only know their overall credit score and not their auto credit score which by its nature is what banks need.)

You: I know my credit well and I have Tier One credit.

👉 Pro Tip: If you have a lower credit score, you can ask for a ‘tier bump’ at this point. A tier bump is essentially when the dealership finance manager would call the lender to ask for a higher rate, despite the buyer’s lower credit.

Finance Manager: That’s a decent score. Now let’s discuss financing options. We have some deals available through our dealership.

You: Thanks, but I’ve already shopped around for financing and have already spoken with my credit union loan officer and I will qualify for their best rate. I’d like to see how your dealership’s rates compare before making a decision. Also, I’ve been approved for a lower rate with a credit union. Can you beat that rate?

👉 Pro Tip: If you’re borrowing over $30,000, consider asking about a ‘large loan discount’, which is sometimes an option for higher borrowing amounts. See the video we shared in Scene One for more information!

Finance Manager: We’ll certainly do our best to match or beat the rate you’ve received from the credit union. Let me check our current offers. Based on your credit score, we can offer you a 60-month loan at an interest rate of 4.5%.

You: I appreciate the offer, but I’d prefer a shorter loan term of 48 months to save on interest costs over the life of the loan. Can you provide a quote for that term and see if you can match or beat the rate I received from the credit union?

Finance Manager: Sure, let me recalculate the rates for a 48-month term and see if we can match or beat your credit union’s rate. Give me a moment.

Alright, I’ve looked into our current offers for a 48-month loan term. We can offer you a 48-month loan at an interest rate of 0.5% lower than the offer from your credit union.

You: That’s great! I appreciate you working with me to secure a better rate. I think I’ll go with this financing option from the dealership. Interest adds up!

Finance Manager: How much do you plan on putting down as a down payment?

You: I’m prepared to make a down payment of 20% of the car’s purchase price to minimize interest costs and avoid the need for GAP insurance. Can you double check if there are any additional manufacturer incentives or offers available that could get me an even lower rate?

You: I noticed that the car I’m interested in is a Certified Pre-Owned (CPO) vehicle. Please check your “rate sheet” for subvented rates on the CPO. Does that qualify me for a lower interest rate?

👉 Pro Tip: It will go a long way to show that you’re familiar with dealership terms like the ones we’ve included here. Don’t miss this FREE resource: The Car Buyer’s Glossary of Terms

Finance Manager: Yes, CPO vehicles typically do qualify for lower rates due to their lower risk. With that in mind, I can offer you a 3.9% interest rate for a 48-month loan with the manufacturer incentive.

You: I appreciate the offer, but what is the rate on my approval that you received? I’d like to see a direct quote from the lender.

(Note: You can ask to see the direct quote from the lender, but know that since this is indirect lending with the dealership acting as an intermediary, they are not required to share that information with you. Their answer simply may be, “this is the rate that I can offer you”.)

Finance Manager: You received a subvented rate of 3.9%.

You: Is that the Buy Rate?

Finance Manager: No, we mark it up by a point.

You: I would really love that Buy Rate. I know my credit union offered 4.0%, but if you can give me 3.5%, I won’t refinance the loan immediately.

Finance Manager: Okay, I can do that.

👉 Pro Tip: The Finance Manager always wants to avoid the charge-back on the refinance. Basically, if you refinance right away, they’re not making any money from selling you the loan.

Finance Manager: Before we finalize the paperwork, I’d like to go over a few additional products we offer that could save you money in the long run. First, we have a Theft protection Package that will reimburse you in case your car is stolen.

You: Thanks for mentioning it, but I’ve already researched that option and I don’t think it’s necessary for my situation. I’ll pass on the Theft protection Package.

Finance Manager: Alright, that’s fine. Another package I’d recommend is our Tire Care Package. It covers tire replacements and rotations, ensuring your tires are always in great condition.

You: I appreciate the suggestion, but I’ve budgeted for tire maintenance separately and will handle it on my own. I won’t be needing the Tire Care Package.

Finance Manager: No problem, I understand. Lastly, we offer an Extended Warranty that covers any unexpected repairs or breakdowns after the manufacturer’s warranty expires. It’s a great way to protect your investment. I can offer this coverage to you for $30/month.

👉 Pro Tip: Finance Managers will not give you the actual price unless you ask for it. They prefer to tell you the monthly payment to downplay the cost.

You: I’ve actually already looked into extended warranties, and I found the same exact coverage through CarEdge for hundreds of dollars less. I’ll be purchasing their warranty instead.

Finance Manager: Alright, I respect your decision. Let’s move forward and finalize the paperwork for your new car!

(Note: If the finance manager attempts to force you to purchase any of their add-on products, demand to see the contract. Every product includes a contract, and on there, it will clearly state that the product is not required to secure financing.)

👉 Pro Tip: The purchase of products in the finance office cannot be tied to your interest rate. For example, a Finance Manager cannot say “if you get the extended warranty, you’ll get a lower interest rate”.

You can say “No” to everything if you want and sign a Declination Disclosure. However, it is part of Compliance that the Finance Manager lets you know the additional products that are available to 100% of the buyers, 100% of the time.

The Complete List: Never Pay These Fake Dealership Fees

Finance Manager: Here’s your base payment at 3.5% for 48 months. Are you ready to proceed with this offer?

You: Yes, that sounds great. Let’s finalize the paperwork and complete the purchase.

By employing the expert advice provided in the previous responses, the car buyer in this example has successfully navigated the auto financing process, and secured a great deal. Despite the initial offer from the dealership being substantially higher interest rate, the buyer used their knowledge of auto financing to get a better rate. By showing that they understand the process through questioning every aspect of the deal and speaking dealership language, the buyer stayed in control, ultimately saving hundreds to thousands of dollars over the life of the loan.

Check out CarEdge Dealer Reviews to see what deals are near you!

With these car loan tips in hand, you’re well on your way to making the best possible auto financing decisions. But don’t stop there! Join the 100% FREE CarEdge Community to connect with our Car Coaches and thousands of drivers like yourself. Looking for expert tools and assistance? CarEdge Data and CarEdge Coach offer expert guidance and personalized support throughout the car buying process. Our experienced professionals will help you save money, avoid costly mistakes, and achieve your car buying goals.

Don’t go through the car buying process alone – let CarEdge empower you with industry-leading tools and expert coaching. Try CarEdge Data and CarEdge Coach today and drive away with confidence.

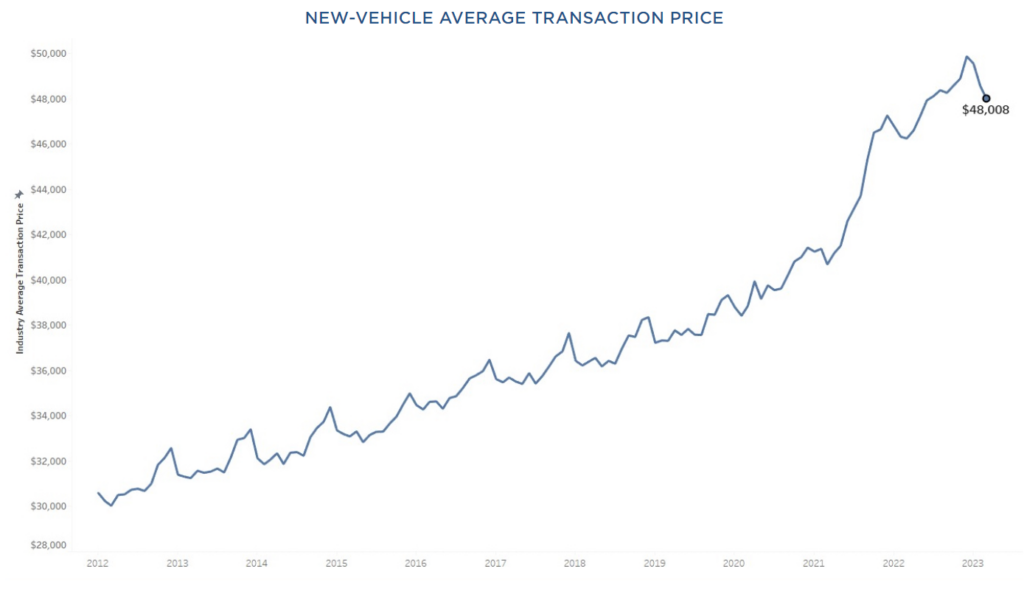

Dealer lot inventory is on the rise, but where are the deals at?! As we move further into 2023, many potential car buyers are wondering, “is now a good time to buy a car?” and “will car prices go down in 2023?” The good news is that recent market trends indicate that the tide is starting to turn, with car prices slowly beginning to decrease and negotiability on the rise. However, there are big differences between the new and used car markets today. Let’s take a closer look at the details.

According to CarEdge’s Ray Shefska, recent trends suggest that there’s good news for car buyers, with prices gradually decreasing and more room for negotiation on the horizon.

Ray notes that “March broke a string of 20 straight months where the average new car prices transacted at above MSRP, in March the average price paid was $171 below MSRP.”

“Although this drop might not seem significant, it’s a noteworthy development, indicating that dealerships are becoming more open to selling cars at lower prices,” he explained. Car manufacturers are increasing incentives to attract more buyers to the market, ultimately benefiting car shoppers.

CarEdge’s Car Coaches note that patience will be rewarded as we head into the summer 2023 car buying season. “Consumers who are patient will find themselves in a much better position as negotiability should increase as we get into the summer months.”

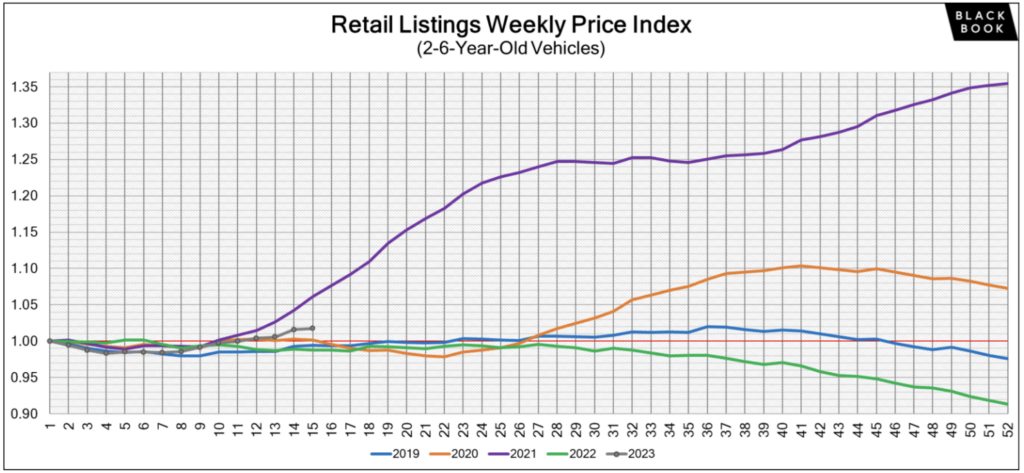

It’s important to note that there are considerable differences between the new and used car markets. New car transaction prices are steadily dropping as dealers try to move more inventory after years of nearly vacant lots. On the other hand, used car prices are increasing as of spring 2023. The latest used car price data from Black Book shows that after 30 weeks of wholesale price declines, used car prices have actually increased for the past several weeks. In April, used car prices increased at the retail level too.

CarEdge’s Car Coaches don’t expect rising used car prices to become a new long-term trend like we saw in 2021 and early 2022. However, there could be a month or two of additional slight price hikes.

We track used car prices weekly here.

How do rising interest rates affect car buying? Of course, buyers who finance are going to pay more in interest, no matter their credit score. But other things change too. Despite higher APRs, there can be benefits for buyers. Car dealers pay interest on lot inventory until it is sold. Think of dealer floor plan financing almost like a credit card made solely for purchasing vehicle inventory. When the federal reserve raises the cost of borrowing money, all kinds of credit will become more expensive, and that includes car lot floor-planning.

With higher floor plan costs, rising lot inventories and incentive spending on the rise, dealers will be motivated to negotiate. Therefore, the longer you can wait to buy a car in 2023, the more likely you’ll be able to negotiate thousands off of your deal.

See the best manufacturer incentives this month (updated)

Furthermore, Ray predicts that it will be a lot easier to secure a deal below MSRP as we get deeper into summer. In fact, the latest data from Kelly Blue Book shows that for the first time in two years, new-vehicle transaction prices fell below MSRP in March. The CarEdge Coaches expect that trend to continue.

Sadly, you and I are well aware that cars are far from cheap these days. The average price paid for a new car is still around $48,000. If you’re looking to go electric, expect to pay 20% more. Even in this market, our Coaches have proven even the toughest new and used cars are negotiable. Check out these success stories from happy drivers around the nation. CarEdge Coaches have even negotiated thousands of dollars off of EV prices in 2023.

We’re real people empowering you to save real money on your next auto. How can we help? Check out hundreds of 100% free resources, great YouTube videos, and the fastest-growing online auto forum today, the CarEdge Community. We just launched Dealer Reviews, where you can see nearly 3,000 crowdsourced car dealer and deal reviews.

Looking for behind-the-scenes auto market data to inform your buying decisions? That’s exactly why we created CarEdge Data. Unlock the Black Book car valuations that dealers use, CarEdge negotiation scores, official recommendations, and local market data for every car on CarEdge Car Search with CarEdge Data.

Ready for expert 1:1 help with your deal? Our Car Coaches are ready to work with you to secure the best deal on out-the-door prices, financing, and more. Learn more about our CarEdge Coach unlimited access plan. We look forward to meeting you.