CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Wondering which SUVs will hold their value best in today’s unpredictable car market? The latest CarEdge Research update reveals the 2025 SUVs with the best resale value, based on total cost of ownership, projected depreciation, and real-world market data. Whether you’re buying new or used, these models are the smart picks for long-term value.

Predicted Depreciation: 25% over 5 years

5-Year Resale Value: $46,648

The Toyota 4Runner continues its reign as one of the top SUVs for resale value. When buying new, the 4Runner is expected to retain 75% of its original value after five years of ownership, assuming typical driving habits. With a market day supply of 71 days, it’s moderately negotiable if you’re buying new.

If you buy a 4Runner that is two years old, you could save $11,361 compared to buying new. When buying a two-year old 4Runner, expect only $4,105 in depreciation over the first three years of ownership. That’s not bad at all.

In 2025, the average price for a three-year-old 4Runner is $41,978.

👉 See the complete Toyota 4Runner resale value and cost of ownership analysis

Predicted Depreciation: 31% over 5 years

5-Year Resale Value: $26,223

The Toyota RAV4 is still one of the most dependable crossovers on the road, something Toyota fans have bragged about for years. In addition to excellent reliability, the RAV4 holds its value surprisingly well. With typical driving habits, the RAV4 is expected to retain 69% of its original value after five years.

What if you buy used? Buying a two-year-old RAV4 could save you $6,000 versus new. This assumes a selling price of $37,774 when new.

Used three-year-old RAV4s sell for $28,876 on average in 2025. But if you’re eyeing a new one, good luck negotiating—market supply sits at just 31 days.

👉 See the complete Toyota RAV4 resale value and cost of ownership analysis

Predicted Depreciation: 31% over 5 years

5-Year Resale Value: $16,590

The Hyundai Venue might be a budget-friendly SUV, but it still holds value well. When buying a new Venue, you can expect it to retain 69% of its value after five years. With a 98-day supply, there’s room to negotiate if buying new.

If you go used, a two-year-old Venue can save you about $5,000 over buying new, and your depreciation over the next three years is just $2,253—hard to beat. Three-year-old Venues sell for around $17,826 in 2025.

👉 See the complete Hyundai Venue resale value and cost of ownership analysis

Predicted Depreciation: 32% over 5 years

5-Year Resale Value: $21,218

With Honda’s reputation for reliability, the HR-V is a solid choice for long-term ownership. On average, buying a gently used HR-V saves you $5,655, and depreciation over three years lands just above $4,000.

Used three-year-old HR-Vs sell for about $21,519. New models are not very negotiable, with a 59-day market supply. For comparison, the overall auto market averages 83 days of market supply right now.

👉 See the complete Honda HR-V resale value and cost of ownership analysis

Predicted Depreciation: 32% over 5 years

5-Year Resale Value: $21,278

The Corolla Cross is a newer addition to Toyota’s SUV lineup, and it’s already proving to be a leader in SUV resale value. It’s popular for many reasons, including affordability, safety, and high fuel economy to name a few. With a tight 33-day supply, you won’t find many bargains on new inventory. The Corolla Cross is manufactured in Alabama, so it’s likely to avoid direct impacts for auto tariffs.

Three-year-old models sell for an average price of $24,024 in 2025. For some, it may be worth it to buy new with such low depreciation.

👉 See the complete Toyota Corolla Cross resale value and cost of ownership analysis

Predicted Depreciation: 32% over 5 years

5-Year Resale Value: $32,949

A newcomer to the Toyota SUV lineup, the Crown Signia shows early signs of holding its value well. The Crown Signia is the larger sibling to the Toyota Crown, which replaced the Avalon a few years back. Used pricing isn’t widely available yet, but new models are in high demand with a 31-day supply.

👉 See the complete Toyota Crown Signia resale value and cost of ownership analysis

Predicted Depreciation: 32% over 5 years

5-Year Resale Value: $37,545

One of Toyota’s most family-friendly options, the Grand Highlander blends space, reliability, and excellent resale value. New supply is limited with just 34 days of market supply. It will be tough to negotiate Grand Highlander prices in 2025, but markups are uncommon.

Buying a gently used Grand Highlander (about two years old) should save you nearly $12,000. Over the next three years, depreciation would be about $5,613 when buying used.

👉 See the complete Toyota Grand Highlander resale value and cost of ownership analysis

Predicted Depreciation: 32% over 5 years

5-Year Resale Value: $42,074

Back after a short hiatus, the new Toyota Land Cruiser is already holding value like a champ. The Land Cruiser is forecast to retain 68% of its original value after five years. With a 45-day supply, there’s modest room for negotiation if buying new. It’s not cheap, however. The 2025 Land Cruiser starts at $58,150 with mandatory destination fees. That makes it one of the most expensive Toyota models on sale today.

👉 See the complete Toyota Land Cruiser resale value and cost of ownership analysis

Predicted Depreciation: 33% over 5 years

5-Year Resale Value: $54,387

The Toyota Sequoia is the most expensive SUV on this list—but it still manages to retain value impressively well. Looking to spend less? Buy it two years old and save about $11,000 on average. If you go this route, expect $15,746 in depreciation if you own it for three years.

New models are moderately negotiable with a 49-day supply. That’s far below the industry average of 83 days of supply, but is decently high for a Toyota.

👉 See the complete Toyota Sequoia resale value and cost of ownership analysis

Predicted Depreciation: 33% over 5 years

5-Year Resale Value: $26,527

The Honda CR-V remains one of the best-selling SUVs in America, and for good reason. Its strong resale value reflects consistent reliability, broad appeal, and efficient performance. With just 33% depreciation forecasted over the first five years of ownership, it holds its own in today’s market.

However, don’t expect huge discounts on a new CR-V. With 41 days of market supply in 2025, it’s tough to negotiate this popular crossover—unless you find highly negotiable inventory that’s been sitting on the dealership lot for many months.

👉 See the complete Honda CR-V resale value and cost of ownership analysis

If you’re shopping for an SUV in 2025, don’t just consider price—resale value matters more than ever. Every SUV on this list ranks among the top in CarEdge’s total cost of ownership data, helping you to avoid unexpected depreciation. Buying a car is never an investment, but it’s smart to know what to expect.

Explore resale value and cost of ownership comparisons at CarEdge Research

Selling your car online has never been easier, thanks to instant cash offers (ICOs) from companies like CarMax, Carvana, and EchoPark. But not all offers are equal—some look great at first glance but come with hidden fees, inconvenient conditions, or last-minute price changes. If you’re considering selling your car, here’s what you need to know to get the best deal.

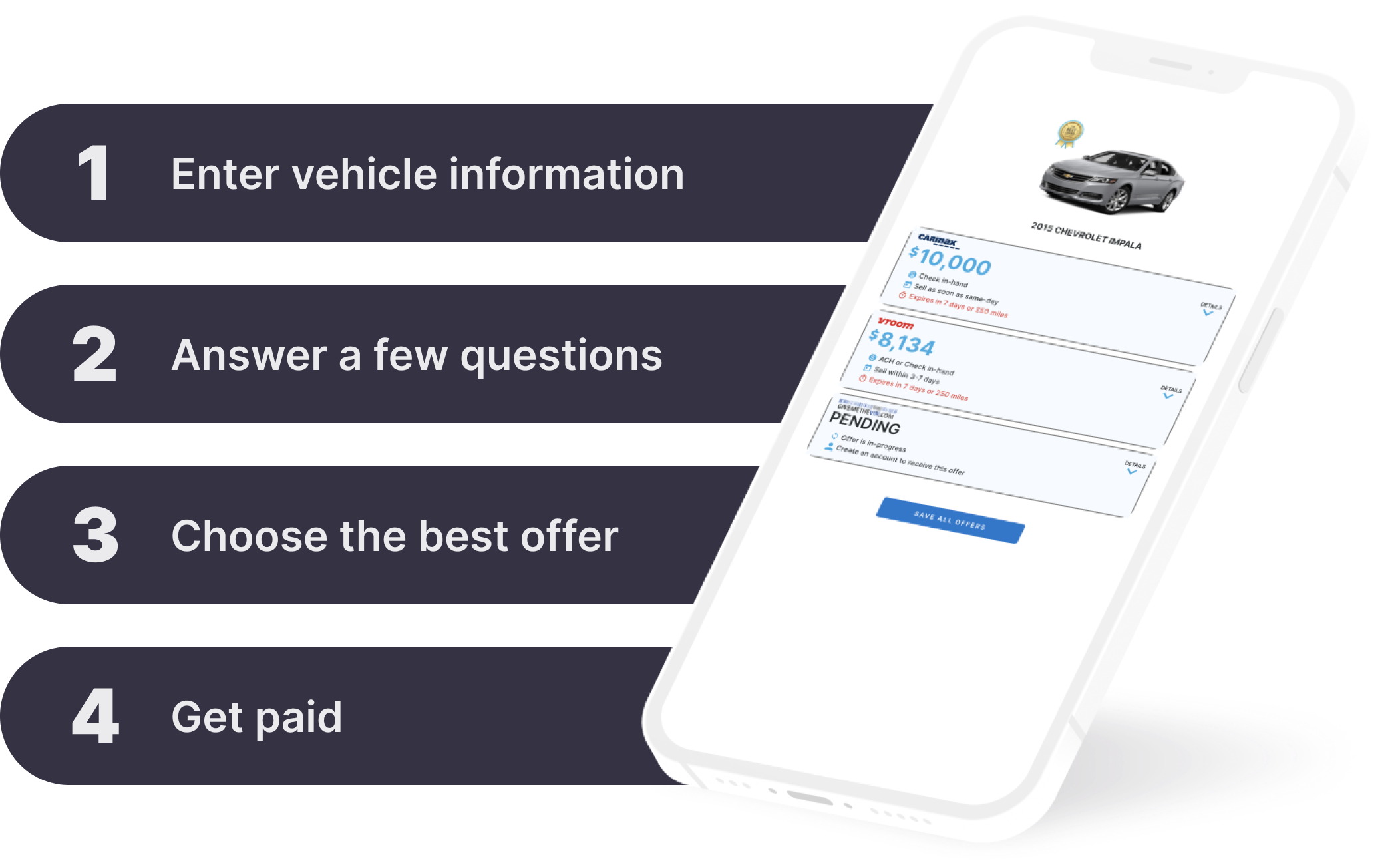

The biggest mistake car sellers make is accepting the first offer they receive without checking other options. Instant cash offers can vary widely depending on the buyer, and some companies may offer significantly more for your car than others. The best way to get an accurate comparison is to request quotes from multiple online buyers on the same day. Market values fluctuate frequently, so comparing offers within a short timeframe ensures you’re getting a fair and competitive price. Here’s the easiest way to compare offers.

With this critical step covered, let’s talk about what sellers should do to ensure they’re getting the most money possible when selling a car online.

Most instant cash offers are only valid for a limited time—some for 7 days, while others expire in 24-48 hours. A shorter window might pressure you into accepting an offer before comparing other options. If possible, get multiple offers on the same day to ensure an accurate comparison.

Some online car buyers reduce their offer after an in-person inspection, citing previously unmentioned damages or wear and tear. Others may charge processing fees, title transfer fees, or towing costs. Be sure to ask about any potential deductions before finalizing the sale.

Many instant offers are based on self-reported vehicle condition—but companies may have different standards for what qualifies as “excellent” or “good” condition. Some buyers are more lenient with minor cosmetic damage, while others use it as a reason to lower their offer during the final inspection.

The value of your car can change daily based on market demand. Seasonal trends, fuel prices, and overall supply can all impact how much your car is worth. For the best results, compare offers on the same day rather than over several weeks.

Not all buyers value your car the same way. Some companies purchase cars at wholesale prices to resell at auctions, while others aim for retail resale. Large dealerships or national online retailers often provide better offers than local dealers relying on auction pricing.

Some services make selling your car simple, while others require extra effort. Consider factors like:

Choose a buyer that offers a smooth, hassle-free process.

If your car still has a loan balance, find out whether the buyer will handle the payoff directly or if you’ll need to settle it first. Also, ensure the buyer provides clear title transfer documentation to avoid future liability issues.

Before accepting an offer, check online reviews to see if other sellers have had good experiences. Some companies are known for bait-and-switch tactics, while others have a strong reputation for fair pricing and fast transactions.

Some dealerships offer higher instant cash offers if you’re trading in rather than selling outright. If you plan to buy another car soon, check if a trade-in deal can get you more value.

Instant cash offers can be a great way to sell your car quickly, but taking the time to compare them properly can save you hundreds or even thousands of dollars. By considering offer expiration dates, potential deductions, and how the sale is handled, you can ensure you’re getting the best deal possible. Compare offers with CarEdge in minutes — no commitment required!

Reviewed: 5 Best Instant Cash Offer Sites to Sell Your Car [2025]

If you’re looking to buy a used car, you may want to rethink your purchasing timeline. April is likely to be the worst month of the year to do so. Used car prices remain high, and are likely headed even higher as seasonal influences drive up demand. Heres what buyers and sellers should consider before entering the used car market in April 2025.

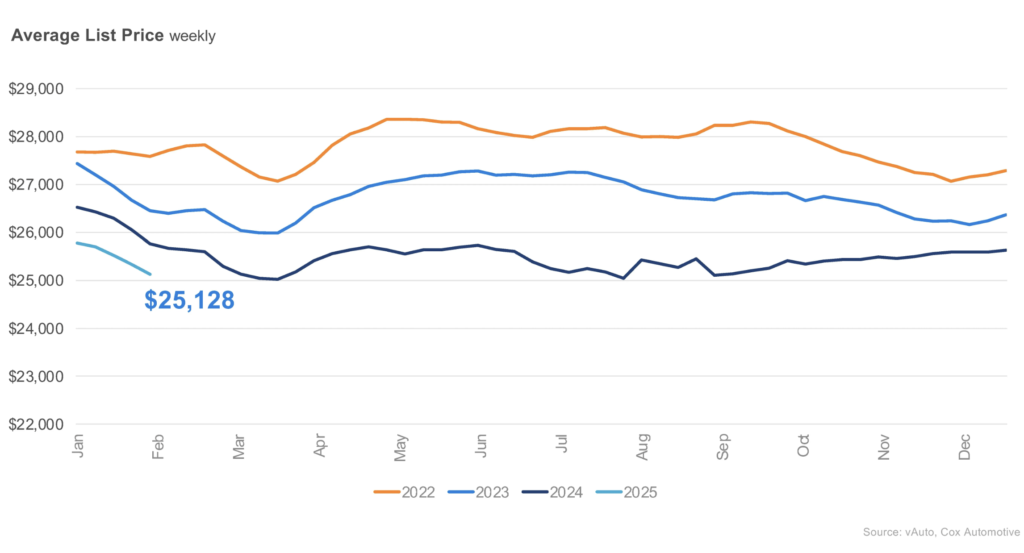

In spring of 2025, the average used car price is $25,128. Unfortunately, prices are expected to climb even higher in April. Why? It’s a perfect storm of factors: tax refunds are hitting bank accounts, spring fever is in the air, and summer road trips are on the horizon. The demand for used cars surges every April, making it a tough time for buyers looking for a deal.

The biggest headwind for used car buyers in April? Seasonality. As the above graph of used car prices shows, prices rise like clockwork each April. Warmer weather (and Uncle Sam’s paychecks) bring buyers out in full force each year as winter comes to an end.

Adding fuel to the fire, the lingering effects of the pandemic-era production shortages are still impacting the market. Between 2020 and 2023, 19.6 million vehicles were never built due to supply chain disruptions. That’s nearly 20 million fewer used cars making their way into the market over time, and the reduced supply continues to push prices higher.

Recent data from Black Book shows that used car prices are climbing sharply.

“The market gained momentum last week, recording the largest single-week increase since early April of last year. Bidder activity was strong nationwide, driven by discussions about tariffs—despite the one-month reprieve for the auto industry—and typical signs of a robust spring buying season, resulting in larger-than-usual increases.”

At wholesale auctions, Black Book’s latest weekly report continues notable trends we’ve seen over the past month:

Previous weeks have shown similar trends in the wholesale used car market. This tells us that newer, low-mileage used cars are getting more expensive, while older, higher-mileage vehicles remain more negotiable. If you’re set on buying a used car this spring, consider expanding your search to older models with more miles to avoid the sharpest price increases.

While the overall used car market is tough for buyers, there are a few segments where deals still exist:

Financing a used car in 2025 is no bargain either. The Federal Reserve’s 2024 rate cuts did little to ease auto loan rates. It’s crucial for drivers to consider the impact of today’s loan rates before setting a budget. You may be shocked by how much your payment increases with APRs this high. The average used car loan APR is 14%, but if you have poor credit, you could see rates closer to 20% APR.

To put that into perspective, let’s say you finance $25,000 over 72 months at 14% APR. Over the life of the loan, you’ll pay $12,090 in interest alone—raising your total cost of ownership by nearly 50%.

If you have good credit, you might be better off considering a new car with a low APR offer. Right now, there are 34 models available with 0% financing and dozens more with rates under 3% APR. Even though new cars cost more upfront, lower interest rates could save you thousands over time.

If you’re thinking about selling or trading in your car, April is one of the best times to do it. Rising used car prices mean you’ll get top dollar, especially for low-mileage models that are in high demand. Take advantage of the seasonal market trends and get the most money for your vehicle while demand is strong.

Compare Instant Cash Offers in Seconds — No Commitment, No Phone Calls, Just Cash!

For most buyers, waiting until after the spring price surge cools down is the best strategy. If you have to buy now, consider shopping for older, high-mileage cars or highly-rated used EVs, and compare APR offers carefully to avoid overpaying on interest.

For sellers, the time is now. April’s used car prices will offer your best bet to maximize resale value before the market levels off later in the year.

Thinking about buying or selling? Use CarEdge Pro to track market trends and find the best deal possible. We’re consumer advocates on your side!

If you’re looking to sell your car quickly and hassle-free, getting an instant cash offer for a car can be one of the easiest ways to do it. Instead of haggling with private buyers or trading in for a low-ball offer, these online platforms provide an upfront price based on your vehicle’s details. But which services are worth considering? We’ve reviewed five of the best options to help you get the most for your car in 2025.

Summary: CarEdge provides a transparent process for selling your car by offering market-based pricing insights and connecting you with vetted buyers. With a data-driven approach, CarEdge ensures you get a competitive instant cash offer while giving you the tools to make an informed decision.

CarEdge’s instant cash offer is sourced from three trusted partners: Peddle, givemethevin.com, and webuyanycar.com.

Pro:

Cons:

The Verdict: CarEdge is a great choice for sellers who want a transparent, data-driven approach to getting the best instant cash offer for their car.

Summary: CarMax is a well-known brand that offers a straightforward process for selling your vehicle. By entering your car’s details online, you’ll receive an instant cash offer that you can redeem at any of the 253 CarMax locations nationwide. The offer is valid for seven days, giving you time to compare deals.

Pro:

Cons:

The Verdict: CarMax is a great option for those who prefer an established company and don’t mind visiting a physical location to complete the sale. However, it can come with the unpleasant dealership experience that most drivers prefer to avoid.

Summary: Carvana provides a completely online selling experience. You enter your car’s details, receive an offer, and if you accept, Carvana will pick up your vehicle and issue payment, with no need to visit a dealership. Note that Carvana’s instant cash offers are known to fluctuate from day to day.

Pro:

Cons:

The Verdict: Carvana is a good option for sellers who want a fully digital, contact-free process. However, sellers should be aware that offers can fluctuate wildly day to day, depending on market conditions. Compare quotes from other instant cash buyers before you commit.

Summary: Kelley Blue Book (KBB) provides a tool that generates an instant cash offer based on your car’s details and market value. This offer can be redeemed at participating dealerships after an inspection.

Pro:

Cons:

The Verdict: KBB Instant Cash Offer is a great option for those who prefer to sell their car through a well-known website with multiple dealership options. It’s not recommended for sellers who prefer to stay away from the dealership experience.

Summary: EchoPark provides an instant cash offer online, valid for seven days or 500 miles. If you sell your car to EchoPark within 48 hours of receiving the offer, they’ll add an extra $250 to your payment. However, you must bring your car to an EchoPark location to finalize the deal.

Pro:

Cons:

The Verdict: EchoPark is a strong option for sellers who live near one of its locations and want to maximize their offer with the $250 bonus incentive.

The best option depends on your priorities. If you want the best offer without dealership hassles, CarEdge is a great option. With CarEdge’s car value tracking tool, you can see your car’s value change in real time. This makes it easier to decide when to sell. If you prefer a traditional dealership experience, CarMax or KBB Instant Cash Offer could work better. For those near an EchoPark location, the extra $250 incentive makes it a great pick.

Ultimately, all sellers should compare offers from each of these online car buyers to see where the best deal is. Instant cash offers for cars can vary widely from one buyer to the next.

Spring is just around the corner, and if you’re in the market for a used car, you might want to think strategically about when to buy. The worst time to purchase a used car is fast approaching, as prices historically rise in April and early May when demand surges. On the flip side, if you’re thinking about selling, spring is the perfect time to get the most for your car.

Here’s everything you need to know about where the used car market stands heading into spring 2025.

While used car prices have come down from their record highs in 2022, they’re still well above historical norms. As of March 2025, the average used car selling price is $25,128. That’s $5,000 higher than just five years ago. However, our weekly used car price updates show that selling prices have been slowly falling in early 2025. As we head into spring, seasonal trends are on track to send prices the other direction. With spring car-buying season ahead, prices are about to climb higher,

Several factors are expected to drive used car prices higher for spring 2025:

Tax Refund Season Fuels Demand – Many buyers use tax refunds for down payments, creating a rush of demand in April and May.

Lower Inventory at Affordable Price Points – Used cars under $15,000 are in short supply, with only a 35-day supply on the market. That’s nine days lower than last year, according to Cox Automotive.

New Car Prices Keep Climbing – As automakers continue to push new car prices higher, more drivers are shopping used car lots in search of affordability. As preowned lots get crowded with shoppers, negotiations become more challenging.

Top Brands Are the Most Competitive – Used Ford, Chevrolet, Toyota, Honda, and Nissan models made up 51% of all used cars sold last month. Because these brands are in high demand, prices are expected to rise the most in the spring.

Here’s a look at the average selling prices of the top 10 used cars in America in 2025, courtesy of CarEdge Pro:

| Make | Model | Average Selling Price (Used) | Days of Supply (Used) |

|---|---|---|---|

| Ford | F-150 | $29,591 | 61 |

| Chevrolet | Silverado 1500 | $29,212 | 60 |

| Toyota | RAV4 | $23,794 | 52 |

| Tesla | Model Y | $30,999 | 37 |

| Honda | CR-V | $20,010 | 50 |

| Ram | 1500 | $29,500 | 64 |

| GMC | Sierra 1500 | $33,500 | 60 |

| Toyota | Camry | $20,589 | 58 |

| Nissan | Rogue | $19,498 | 59 |

| Honda | Civic | $16,495 | 55 |

Although used car and truck prices have fallen from recent highs, they still remain far above historical norms. Car prices have exceeded the rate of inflation over the past 5 years, adding insult to injury for household finances.

Today’s used car buyers are unsurprisingly finding the best deals on higher mileage vehicles. As drivers hold on to vehicles longer, the odometer readings continue to creep higher. The average used car on sale in the U.S. has 70,000 miles on the odometer, a new all-time high. It’s more important than ever to get an independent Pre-Purchase Inspection on ANY used car before buying.

👉 Get Your FREE Used Car Buying Toolkit – Window Sticker and All!

Another reason prices will keep rising? There simply aren’t enough used cars on the market.

Total used car inventory is down 3% year-over-year. There are currently 2.23 million used cars for sale in the U.S., compared to 2.5 million three years ago. The lingering effects of pandemic-era production shutdowns continue to impact supply, with fewer used cars available today.

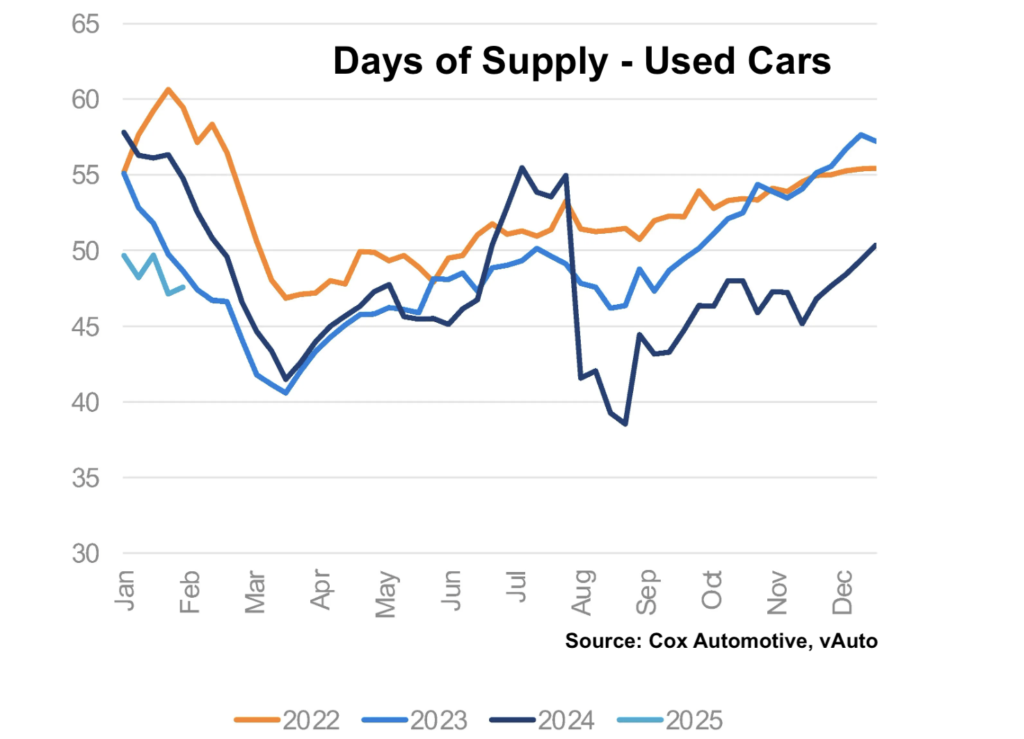

Days of supply shows a tightening market. Right now, the market has a 48-day supply of used cars, down from 56 days at this time last year. With demand about to spike, this will shrink further, making it harder to find the right car at a great price.

If you’re shopping for a used car, expect inventory to tighten and prices to rise as we enter spring. Basic supply and demand principles lend themselves to higher used car prices in April through early May.

Financing a used car in 2025 comes with a major challenge: high interest rates. The average used car loan rate is still hovering around 14% APR, making it tougher for buyers to afford monthly payments. Even those with excellent credit are struggling to find rates below 7% APR, even when financing through credit unions and local banks.

Unfortunately, relief isn’t on the horizon. The Federal Reserve has signaled that future interest rate cuts are on hold due to persistent inflation. That means used car loan rates are likely to remain elevated for the next several months.

💡 CarEdge Tip: If you need to finance a used car, shop around for the best rates before stepping foot in a dealership. Comparing offers from multiple lenders—especially local credit unions—can help you secure the lowest possible rate.

While buyers face a more competitive market, April 2025 is an excellent time to sell a used car or trade one in.

More buyers = better offers – With demand increasing, used car sellers will have more negotiating power, whether selling to a private buyer or trading in at a dealership. Sellers who are familiar with seasonal trends in used car prices are more likely to get a fair offer.

Higher trade-in values – As dealers have a harder time sourcing inventory, trade-in offers will be more competitive, especially for popular brands like Toyota, Honda, Subaru, and Ford.

If you need a car soon – Act fast before prices climb higher. If you’re set on buying this spring, compare listings now and lock in a deal before demand spikes.

⏳ If you can wait 90 days – Consider holding off until late May or early summer, when the spring surge settles and inventory stabilizes.

🚗 If you’re selling – Spring is the time! Take advantage of high demand and strong trade-in values before the market shifts come summer.

👉 Get Your FREE Used Car Buying Toolkit – Featuring Target Price, Window Sticker and More!

Being upside-down on a car loan, also known as having negative equity, is a stressful situation. It means you owe more on your car loan than your car’s current market value. This can happen due to factors like rapid depreciation, unfavorable loan terms, or rolling over previous negative equity into your current loan.

For example, if your car is worth $15,000 but you still owe $20,000, you’re upside-down by $5,000. As distressing as negative equity loans can be, it’s not uncommon. CarEdge’s recent Negative Equity Report found that more than one-third of drivers who financed have underwater auto loans.

The good news is that there are several strategies you can use to part ways with your underwater loan as quickly as possible. We’ll explore practical ways to get rid of a car with negative equity, helping you make an informed decision each step of the way.

Looking to sell your car with negative equity as soon as possible? Here are a few proven strategies to consider, depending on your financial situation and goals.

If you’re serious about getting rid of your car, it is possible to sell a car with negative equity. If you’re looking to sell your car without trading it in at a car dealership, you’ll need to pay the difference between the sale price and your loan balance to settle your current loan when you sell your car. Check out our Complete Guide to Selling a Car with a Loan.

You’ve got a few options for selling your car, even if you have negative equity.

Selling privately often yields a higher price than trading in at a dealership. However, you’ll need to pay off your existing loan before selling. Most of us don’t have that much cash on hand, but luckily there’s still a way to make it work. If you have great credit and proven income, you may be able to obtain a personal loan to pay off the loan balance. After the car is sold, you can use the proceeds from the sale to immediately pay off your personal loan.

Private sales offer an advantage for older cars or vehicles with higher mileage because you can often command a higher selling price with a private buyer than what a dealership would offer. Remember that dealerships are likely to wholesale these types of vehicles, as they may not be able to retail them on their lot due to higher reconditioning costs and lack of financing options for these vehicles.

Newer late-model, low mile vehicles are difficult to sell to private party buyers because they don’t usually have the cash on hand to make large ticket purchases and will need to rely on financing options that are more readily available at licensed dealerships.

👉 Pro Tip: To determine the selling price for a used vehicle in a private party sale, have an appraisal done in person at Carmax and then add $2,000 to $2,500 to the written offer.

You can sell to online car buyers like Carvana, CarMax, and AutoNation, and Driveway without being required to purchase a vehicle from their store. These large Auto Groups will quickly appraise your vehicle (online or in person) and provide a conditional cash offer. While this option is highly convenient, understand that you’re unlikely to get as much for your car as you would with a private sale. If you’re deeply underwater, online buyers may either require you to pay the difference between the loan balance and sale price, or they may refuse to buy your car. However, this is a solid option for many.

Late-model, low-mileage cars in top condition are attractive to dealerships because they will retail them on their lot and be able to offer financing and other warranty products to maximize their return. However, to secure a fair market value, you need to shop around for the best offer.

Compare online offers with CarEdge!

When shopping for a replacement vehicle at a licensed dealership, you may have the option to roll any negative equity into the balance of the new loan, provided that the loan-to-value ratio meets the lender’s requirements. ⚠️ Beware, car buyers who roll over negative equity into a new loan are likely to end up in a similar situation in the future.

👉 Pro Tip: It’s fine to mention that you might have a trade-in during the negotiation of your replacement vehicle’s selling price. However, to maximize your trade allowance, avoid sharing detailed information with the dealership until you have 1) obtained an appraisal from a reputable brick-and-mortar store like Carmax, and 2) have first finalized the selling price of the replacement vehicle.

Pro of Selling Your Car:

Cons of Selling Your Car:

👉 Compare offers from online car buyers in minutes with CarEdge

If you can’t afford to pay off the gap between your loan balance and the car’s resale value, but you’re determined to sell, rolling over your loan is an option if you’ll be needing another vehicle. Rolling over negative equity involves trading in your car and adding the remaining loan balance to your next loan. While this solves the immediate issue, it often leads to a cycle of debt. It can be a viable option if your next vehicle is much more affordable (and with more affordable payments) than the car you’re coming out of.

Pro:

Cons:

If you’re deeply underwater on your auto loan, must get rid of your car, but can’t afford to pay the difference between the car’s value and the loan balance, surrendering the car to repossession by the lender is an option as a last resort.

You’re probably familiar with involuntary repossession from TV shows. It can get ugly and uncomfortable for all involved. However, voluntary repossession is different. You simply make arrangements to hand over the vehicle to a representative of the lender who holds the lien on your vehicle. You’re not selling the car, so you’re not getting paid. But if you need a way out of your car loan and burdensome payments, it’s an option.

All repossession, including voluntary car repossession, will hurt your credit score. Your score will see a sharp hit immediately, and the even will remain on your credit report for up to 7 years. Make sure you understand how having a lower credit score could impact your future before following through with repossession.

Consider paying extra each month toward the principal balance. Most auto loans do not have prepayment penalties in 2025, but it’s best to check with your lender to confirm. Making extra payments reduces your auto loan balance faster, closing the gap between what you owe and your car’s value.

Pro and cons of making extra car payments

Pro:

Cons:

If you don’t need to sell or trade the car, the simplest option is to keep making payments until the loan is paid off or the car’s value exceeds the loan balance.

Depreciation is the root cause of most cases of negative equity. The good news is that depreciation slows tremendously after the first three years of vehicle ownership. If you can afford to keep making payments with your current loan, you will eventually be out of negative equity, guaranteed.

Pro:

Cons:

Navigating the complexities of negative equity and car buying doesn’t have to be stressful. With CarEdge’s free tools and expert services, you can make informed decisions:

👉 CarEdge Pro: Get real-time market data to understand your car’s value and local car market trends.

👉 Dealer Invoice Pricing: Negotiate the best price on your next car with this FREE tool.

👉 Car Buying Concierge: Let our experts handle every step of the buying, leasing, or selling process for you. Looking to get the most for your underwater trade-in? We can help!

Ready to take control of your car ownership journey? Visit CarEdge.com and start saving today!