CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

For the first time in over two decades, Super Bowl 58 will come and go without advertisements from America’s largest automakers. Ford, General Motors, and Stellantis, the parent company of Chrysler, are all sitting out the 2024 Super Bowl ad frenzy. Traditionally, the Detroit Three dominated Super Bowl car commercials. Not anymore. But which automakers ARE advertising in the 2024 Super Bowl? We’ve got the complete list below.

By the way, if you’re wondering how much Super Bowl commercials cost this year, the latest word on the street is somewhere north of $7 million per 30-second spot.

Toyota is all-in on the Super Bowl this year with a series of ads starring former NFL quarterback Eli Manning, YouTuber Pushing Pistons, and other big names. These ads will showcase various Toyota models, including the Supra and the all-new Land Cruiser SUV. From the teasers we have, it’s interesting to see Toyota advertising niche models rather than going for mass appeal.

Here’s another Toyota Super Bowl commercial:

Should you worry about the recent Toyota scandal? Here’s what we think.

Volkswagen is returning to Super Bowl advertising for the first time since 2014, with a focus on its electric vehicle lineup. The ad for the all-new ID Buzz all-electric van aims to highlight Volkswagen’s evolution from its iconic Beetle to today’s electric offerings. Volkswagen’s EVs have been no exception to the current ‘EV winter’, as the ongoing sales slump has been called.

See VW listings with local market data.

BMW’s advertisement highlight its new hybrid and electric models, and features actor Christopher Walken.

See this month’s best BMW deals.

Kia, on the other hand, is set to advertise its all-electric EV9 SUV. In January, the EV9 outsold the EV6 just one month after hitting the market. Finally, a somewhat affordable 3-row EV is here.

Are Kia’s New Cars and SUVs Reliable?

Could 2024 be the last time we see a meaningful number of automotive Super Bowl ads? With the price tag for a half-minute spot climbing ever higher, it’s no surprise that OEMs are turning down the opportunity in times of strong headwinds. With struggling transitions to EVs everywhere you look, automakers are likely to have plenty of reasons to spend less in the years ahead.

What we could see next year is newcomers to Super Bowl commercials. It wouldn’t surprise us if the likes of Rivian, Lucid, and even Tesla fork over $10 million for a 30-second spot in 2025. Is it a wise use of millions of dollars? That’s up for you to decide.

What do you think? Let us know in the comments below.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

As Presidents’ Day approaches, many wonder if it’s a wise time to purchase a new vehicle. Traditionally, year-end sales boast the most attractive discounts, but 2024 is close to bucking that trend. Thanks to a continuing oversupply of new cars, the enticing offers of financing, cash back, and lease deals have spilled over into February, making Presidents’ Day a great time to buy a car, but only if you’re taking advantage of this month’s promotions. Let’s take a look at the 5 best offers for drivers looking to finance, lease, or pay cash this month.

Chevrolet: Drive home a 2024 Chevrolet Silverado 1500 at just 2.9% APR for up to 72 months. This is a rare truck financing offer at today’s interest rates! Learn more.

Nissan: The 2023 Ariya EV shines with 0% APR for 72 months plus $1,000 in total savings. For truck enthusiasts, the 2023 Titan and Titan XD come with 0% APR for 60 months, coupled with $2,000 in total savings.

Hyundai: The 2024 Tucson and 2023 Santa Fe are available at 0% APR for 36 months, with an added bonus of $1,000 off MSRP.

Ford: Finance a new 2023 F-150 at 1.9% APR (exclusive CarEdge offer)

Mazda: This month, there’s a 0% APR offer for the 2024 CX-30 and a 1.9% APR offer for 60 months for the 2024 CX-50 (most trims). The 2024 CX-5 qualifies for 0.9% APR (exclusive CarEdge offer)

Subaru: 1.9% APR for 48 months: 2024 Subaru Outback

👉 Truck Deals Abound: Keep an eye out for exceptional truck offers this Presidents’ Day. Here are the best truck deals in February.

Hyundai: New Hyundais are available at invoice pricing, which means significant savings below MSRP (exclusive CarEdge offer).

Even more from Hyundai: Additionally, cash offers include $1,750 for the 2023 Sonata, $1,500 for the 2024 Tucson, and $1,750 for the 2023 Santa Fe.

GMC: The 2023 and 2024 Sierra 1500 models come with up to $3,250 cash incentive with trade-in, no payments for 90 days, plus 0.9% APR.

Ram: The 2023 Ram 1500 Classic is available at 15% below MSRP, and remaining 2023 Ram 1500s are eligible for a $4,000 discount.

Chevrolet: The 2024 Silverado 1500 offers either 2.9% APR for 72 months or a $5,000 total cash offer with a trade-in.

Jeep Compass Latitude Lux 4×4 (2024): Sign and drive lease for $399/month for 39 months, including a $1,500 loyalty incentive for returning Jeep lessees. (exclusive CarEdge offer)

Dodge Hornet R/T AWD (2024): Sign and drive lease for $449/month for 24 months, with a $4,500 loyalty incentive for returning Dodge lessees. (exclusive CarEdge offer)

Ram 1500 Quad Cab Night Edition 4×4 (2024): Sign and drive lease for $479/month for 42 months, including a $3,000 loyalty incentive for returning Ram lessees. (exclusive CarEdge offer)

Chevrolet Trax LS (2024): Sign & Drive lease for $359/month for 48 months, with a requirement of another lease in the household. (exclusive CarEdge offer)

Chevrolet Silverado 1500 2FL (2024): Sign & Drive lease for $499/month for 36 months, also requiring another lease in the household. (exclusive CarEdge offer)

In conclusion, Presidents’ Day car deals in 2024 are remarkably favorable due to the ongoing oversupply of new cars. This surplus has led to more aggressive offers from manufacturers, making it an excellent time to consider a new vehicle. Oddly enough, it seems that many of the best year-end deals have spilled over into the new year. However, if you don’t plan to take advantage of the best offers, high interest rates make this a costly time to buy.

Our team has one simple take away message for you. If you’re going to buy a car this month, take advantage of low APR offers or attractive lease deals. Don’t fall victim to interest rates at 20-year highs!

👉 See ALL of the best APR offers this month

👉 See ALL of the best lease deals in February

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

Tesla’s journey through the years has been a tapestry of innovation, disruption, and at times, controversy. Despite a mixed record of reliability, Tesla has undeniably cemented its position as a frontrunner in American EV sales, boasting 50% market share in 2024. With Tesla’s pricing becoming increasingly attractive, a new wave of drivers is exploring Tesla models for the first time. Consumer Reports, through rigorous testing and extensive surveys, offers insights into the reliability of Tesla’s lineup. But how does Tesla’s reliability stack up against other automakers? We’ll answer this question and more as we look at the most reliable Tesla models in 2024.

As of 2024, Consumer Reports ranks Tesla’s overall brand #14 of the 30 car brands that they’ve tested.

Their rankings are based on Tesla’s predicted reliability score. This time-tested method of scoring reliability includes all the vehicles within that brand for the newest three model years from the latest Consumer Reports member survey.

Here are the 10 most reliable automotive brands, according to CR.

Want to see the whole list with the finer details? Check it out here.

Surprisingly, Tesla’s two most affordable models are their most reliable, according to testing and surveys done by Consumer Reports. The most expensive Tesla models are actually the least reliable.

In 2024, the Tesla Model 3 and Model Y are the most reliable. Let’s zoom in to the details.

Price: $38,990 – $45,990

Predicted Reliability: 47/100

Overall CR Score: 71/100

The 2024 Tesla Model 3 boasts an impressive electric range of 341 miles. Tesla’s Supercharger network ensures convenience and efficiency, significantly reducing downtime during trips. The Model 3 was recently joined by the Hyundai IONIQ 6 in the club of long-range electric sedans. If recent sales trends are any indication, the Model 3 continues to be favored by more buyers. Learn more about Consumer Reports’ Tesla Model 3 reliability ratings here.

Price: $43,990 – $52,490

Predicted Reliability: 41/100

Overall CR Score: 72/100

In 2023, Tesla sold approximately 403,700 Model Ys in a record year for the company. Consumer Reports expects the 2024 Model Y to have average reliability when compared to the average new car. This prediction is based on Consumer Reports data from 2021, 2022 and 2023 models. Learn more about Consumer Reports’ Tesla reliability ratings here.

Price: $74,990 – $89,990

Predicted Reliability: 30/100

Overall CR Score: 63/100

The Tesla Model S is the original mainstream Tesla model, although mainstream only for luxury buyers. The Model S proved that electric vehicles had a future. In 2024, it remains in Tesla’s lineup as a tiny fraction of it’s previous importance to the company. Sales have dwindled as the Model 3 and Model Y have moved to the forefront.

The Model S has an electric range of 320 to 405 miles depending on the model, with a 100 kWh lithium-ion battery. It supports plug-in charging with various options, including a Supercharger at 150–250 kW DC, allowing for rapid charging. If you’re looking for an electric luxury sedan, the Model S should be on your short list. However, Consumer Reports found multiple trouble areas when reviewing the reliability of the Model S. Learn more about Consumer Reports’ Tesla Model S reliability ratings here.

Price: $79,990 – $94,990

Predicted Reliability: 27/100

Overall CR Score: 53/100

The Tesla Model X is the least reliable Tesla model, but it’s also the most expensive. Known for its distinctive gull-wing doors, the Model X offers a cargo volume ranging from 15 to 37.1 cubic feet, which expands to 91.6 to 92.3 cubic feet with the seats down. It was the sole 3-row electric SUV until the Rivian R1S and Kia EV9 were introduced. With a range of up to 335 miles, the Model X combines practicality with Tesla’s renowned electric performance. Learn more about Consumer Reports’ Tesla Model X reliability ratings here.

Price: $60,990 – $99,900+

Predicted Reliability: The Cybertruck has not yet been tested by Consumer Reports. We expect CR to test Tesla’s truck late this year.

Overall CR Score: N/A

Reviews of the Cybertruck are now available. We recommend this thorough review from Out of Spec on YouTube.

In 2024, Tesla’s reliability narrative is a blend of highs and lows, with Consumer Reports placing Tesla models below average in terms of reliability. However, the Tesla Model 3 and Model Y emerge as beacons of relative dependability within the Tesla lineup, anticipated to be the most reliable among Tesla’s offerings.

As spring car buying season approaches, the new and used car markets are ripe for deal seekers. However, knowledge is certainly power in 2024. Attractive low APR offers have continued well beyond year-end sales, making new cars a potentially better deal than used ones. Additionally, the glut in new car inventory has tilted the scales, making new vehicles more negotiable. For those not keen on long-term commitments, leasing emerges as an appealing option, thanks to favorable terms spurred by the oversupply. If you’re wondering if spring 2024 is a good time to buy a car, here are three things you should know before stepping foot on a dealership lot.

If you’re on the fence about whether it makes sense to buy new or used in spring 2024, the tie-breaker may be today’s enticing new car APR offers. 2023’s year-end deals seem to have bled over into the new year, propelled by surging new car inventory, and hundreds of thousands of unsold 2023 models.

As of the latest promos, we counted no fewer than ten 0% financing offers. When you zoom out to include deals below 1.99% APR, that number grows to 21 active offers. But if you’re not paying attention, it’s easy to fall victim to today’s overall high interest rates.

Whether you intend to buy new or used, it’s important to factor in the cost of borrowing money when budgeting for your next vehicle. Despite the great incentives available today, as of the most recent data, the average new car loan rate is 9.95% APR. Used car loan rates are even higher, closing in on 14% APR.

Insurance rates have gone up, too. In 2023, car insurance premiums climbed 24%, the quickest spike in decades. In 2024, Insurify predicts that rates will climb an additional 7%. On the bright side, the US Energy Information Administration forecasts average gas prices to remain lower than in recent years. The EIA expects US gas prices to average $3.40/gallon in 2024.

All in all, it’s smart to prepare for the total cost of owning a vehicle BEFORE you buy. Take advantage of CarEdge’s free data for detailed cost of ownership rankings, with data on maintenance, depreciation, insurance, and more.

Simply put, there’s a worsening oversupply of new cars right now. As we race towards spring car buying season, there’s no sign of the new car glut easing. As of today, there’s an 89-day supply of new cars in America. Typically, that figure is closer to 60 days. Some brands, such as Nissan, Jeep, Ram, and Ford, have nearly twice the average inventory. Nissan can’t seem to sell cars right now. Stellantis has been in the same boat for well over a year.

👉 See the latest new car inventory numbers here.

Why does inventory matter to consumers? We say it all the time: when inventory surges, deals are sure to follow. Some cars, trucks, and SUVs are more negotiable than others. Here at CarEdge, we stay on top of the latest market trends. Why do we do it? To bring you insights on where the best deals are, of course. As of today, the following new and used car segments are most negotiable, considering supply, demand, and inventory data: Electric vehicles, trucks, vans, luxury crossovers and SUVs. This is a generalization based on the model-specific inventory and deal insights available through CarEdge Data.

👉 See the specific new car models with the highest and lowest inventory here.

Used car prices are falling, albeit more so at wholesale auctions than on dealer lots. In 2023, used prices fell 7%, and are now down 21% from all-time highs in December of 2021.

Our team of CarEdge Coaches reports that used car prices are certainly more negotiable today than they were in months past, but car dealers are stubbornly resisting the downward pressure in the market, and are too often leaving price tags as-is. Don’t let that stop you from mastering car buying negotiation skills.

👉 Try Deal School, our 100% FREE car buying course!

If you don’t expect to hold on to your next vehicle for more than five years, consider leasing to avoid the massive depreciation that comes along with buying any new car. Gone are the days of selling any used car for a profit. With the ongoing oversupply of new vehicles, it’s not just APR and cash offers that are abundant right now. Leasing deals are shockingly good this month.

When a dealer leases a car, they’re technically still making a sale. It’s just that the leased car is sold to a third party who then leases it. So in other words, automakers and dealers alike love leasing a car to you, and offer sweet deals in times of high new car supply. Here are a few of the best lease deals this month:

See all of this month’s lease deals

Wondering if leasing makes sense for you? Check out CarEdge Co-Founder Ray Shefska’s guide to leasing versus buying in 2024.

The spring of 2024 offers compelling reasons for consumers to consider new vehicles, thanks to attractive APR offers and an oversupply that enhances negotiation potential. However, buyers should tread carefully, considering high loan rates and insurance premiums. For those looking for flexibility, leasing provides a viable path to bypass the steep depreciation of new car purchases. Remember, you can always see this month’s best APR, cash, and lease deals here. We update our resources as soon as the latest offers are announced.

👉 Looking for help, or simply want to hand over the keys and take the hassle out of car buying completely? Learn more about buying your next vehicle with CarEdge.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

Drivers despise haggling with salespeople. From bait-and-switch pricing to misleading online prices, there’s a lot to dislike about the whole experience. It’s no surprise that just 26% of car buyers think that the car buying process is transparent. In the age of online shopping, wouldn’t it make sense to buy your next car online? Today, there’s a better way to find the perfect vehicle at the right price. Here’s how CarEdge is taking no-haggle car buying to the next level.

Price transparency is a real problem in car buying. We hear horror stories from car shoppers all the time. It’s about time that someone did something about it. Here at CarEdge, our team set out to find a lasting solution to car buying woes. The result was the launch of a new way to buy a car: pre-negotiated, no-haggle car pricing through a network of vetted car dealers.

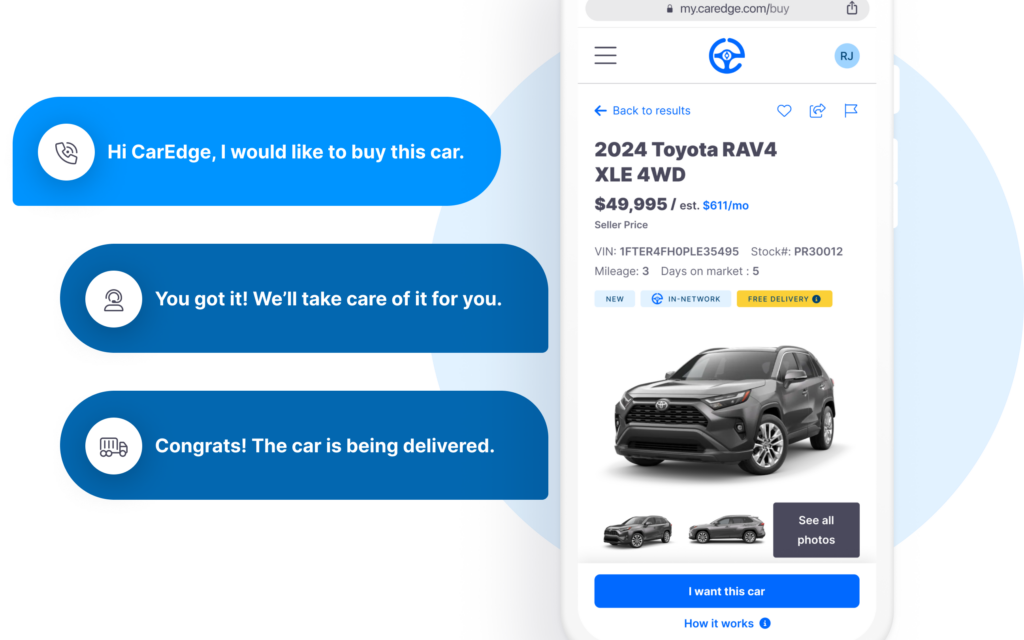

By choosing to only work with honest car dealers with stellar reputations, CarEdge is changing the way Americans buy cars. Imagine this: you browse for cars online, find the vehicle you want at a price you’re happy with, and then connect with your personal Concierge who will take it from there. Days later, your car is delivered to your driveway.

How does CarEdge work? Is there a catch? Next, we’ll lay out the entire process, from start to finish.

Buying a car through CarEdge involves a stress-free process that’s managed entirely from the comfort of your home. Here’s an overview of how it works:

👉 For more information, visit CarEdge’s How It Works page.

On average, drivers who buy with CarEdge save a few thousand dollars on their new car. In many cases, CarEdge is able to source the exact vehicle a customer wants (make, model, year, trim, and even color), for thousands of dollars less than you’ll find elsewhere. CarEdge even has below-invoice deals (that’s far below MSRP!).

We welcome you to browse hundreds of real, unfiltered CarEdge reviews at the CarEdge Community Forum. See how much you could save in time, money, and hassle!

Got questions or want more information about no-haggle car buying with CarEdge? Simply want to talk to our team of experts? We’re here to help! We’re real people here to save you real money. Feel free to reach out to us at [email protected] with any inquiries or for further assistance.