CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

In recent years, automotive recalls have become almost commonplace. Yet, when an automotive giant like Ford faces not one, but two investigations by the National Highway Traffic Safety Administration (NHTSA) into the adequacy of their recall remedies, it warrants concern. Here’s the latest on Ford’s recall investigation, and how you can check if your car is impacted.

Back in October 2018, Ford issued a massive recall for over 1.2 million 2012-18 Ford Focus sedans. The prescribed solution was for dealers to reprogram the powertrain control module and, where necessary, replace the canister purge valve.

However, a second recall was initiated in July 2019. This covered approximately 57,000 2012-14 and 2017 Focus sedans, which, although included in the 2018 recall, did not get the intended powertrain control module update.

Now, the NHTSA is probing whether Ford’s recall solutions effectively addressed the underlying problem. Auto News reports that they’ve received 98 complaints from consumers regarding failure of the canister purge valve in the 2012-18 Focus models. Some of these vehicles had already undergone the recall remedy, whereas others had never been recalled but displayed the same defect. This has raised suspicions that Ford isn’t adequately addressing recalls. Whether this has been due to Ford’s internal policy or mere accident is up for debate.

A separate investigation is now looking into the 2018-21 Ford EcoSport vehicles. This came in the wake of 95 consumer complaints about engine failures due to a sudden loss of oil pressure. In a particularly concerning report, a vehicle owner stated the oil light came on even when the oil was full, leading to engine malfunction. This isn’t a cheap fix, either. The severity of the issue is such that it often requires a complete engine replacement.

In response to the unfolding events, Ford spokesperson Maria Buczkowski assured that Ford is actively cooperating with the NHTSA’s inquiries.

Recalls, although common, are usually decisive and efficient solutions to potential safety risks. What makes this situation exceptional is the frequency of Ford’s recalls. Not only has Ford topped the recall charts for the past three years, but 2023 alone has seen the company issue 44 recalls, affecting a staggering 4.6 million vehicles.

Is Ford’s recall a big deal? This is not the first, but the second time that Ford has faced an official NHTSA recall investigation this year. Automotive News reports that in August, the NHTSA announced that it was looking into Ford’s handling of a recall for 2022 Ford Mustang Mach-E electric SUVs. The 2022 recall was meant to address sudden power loss in 50,000 Mustang Mach E’s.

These five automakers have the most recalls in 2023:

According to new NHTSA stats, Ford issued 67 recalls in 2022. In 2022, Volkswagen had the second highest number of recalls, followed by Daimler Trucks North America and Chrysler.

With recalls being a pressing issue, one has to wonder about the root cause. Ford’s CEO, Jim Farley, has not shied away from acknowledging the elephant in the room. He’s openly admitted to quality control being a significant concern and has promised to prioritize fixing these issues. Farley has been quoted saying, “Fixing quality is my No. 1 priority,” but also cautioned that resolution will be a gradual process, spanning several years.

Perhaps having not one but two open NHTSA investigations will hasten the pace of Ford’s long-term solution for the quality control that plague the company.

The average auto loan rate has reached highs not seen in 40 years. New and used car loans are becoming more expensive, and that’s not likely to change anytime soon. We’ll delve into the latest data from Cox Automotive to better understand the true cost of buying a car today, revealing some notable trends along the way.

Buying soon? Take this auto finance cheat sheet with you.

The latest numbers from Cox Automotive show just how expensive car loans have become. The average new car interest rate is now 9.95%. One year ago, this figure stood at 7%. Step back to 2021, and the average new car loan APR was around 5%.

In early 2024, new car loans with 0% APR constitute a mere 2.4% of the market, a major drop from one year prior. Low APR car loans, those with an APR under 3%, now represent 10.4% of the market. This marks a slight increase as holiday year-end car sales continue. However, low interest rate loans previously accounted for over 35% of new car loans in early 2022.

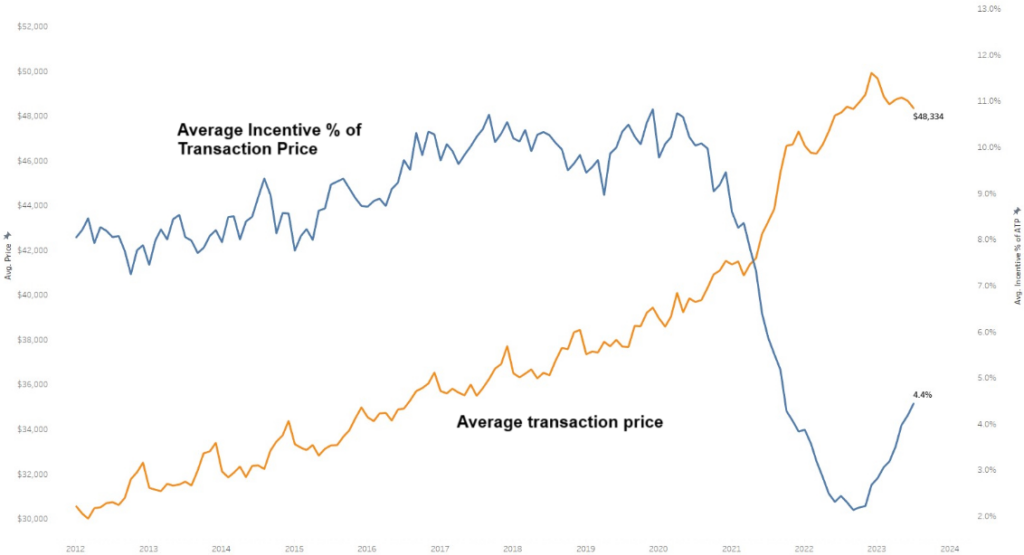

Knowing that the average transaction price of a new car sold last month was $48,451, we can calculate how much interest car buyers are signing up for when they make a purchase. This is a GREAT way to wrap your head around the TRUE cost of a car loan.

We always recommend putting 20% down when buying a car. This helps you avoid the risk of becoming ‘upside down’ on your loan, and means you’ll pay less in total interest. Let’s say today’s average buyer puts 20% down, and takes out a loan for the remaining balance ($38,761) at today’s average APR of 9.95%.

With a 60-month car loan, the average car buyer would pay a total of $10,595 in interest. In other words, the new car wouldn’t cost $48,451. After five years of payments, the car actually costs $59,046.

Pre-owned vehicles may have lower sticker prices, but the cost of financing one is much higher. In October, the average used car APR was 13.94%. That’s significantly higher than where rates stood a few years ago, when 9% APR was the norm.

Used car prices are still high. Each year, Cox Automotive tracks the annual decline in three-year-old used car values. You’d expect a 2020 model year used car to end 2023 worth a lot less than it began the year, right? Used car values have been declining more slowly than in years past. This is good news for those looking to sell their cars, but bad news for buyers.

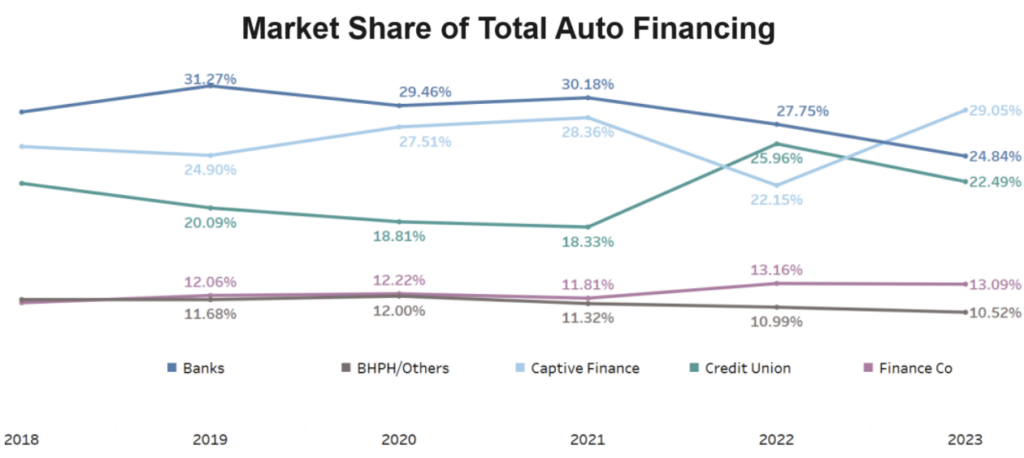

After years of surging popularity, credit unions and banks are losing auto loan market share. Car buyers are increasingly taking advantage of the best manufacturer financing incentives to secure the lowest rate. This sends more business to captive financing.

Here’s a look at how car buyers are financing in 2024, courtesy of Experian:

Captive financing is not inherently undesirable, as long as you get the best rate possible. Captive financing simply refers to loans provided by a subsidiary of the manufacturer, such as Hyundai Motor Finance, or Toyota Financial Services.

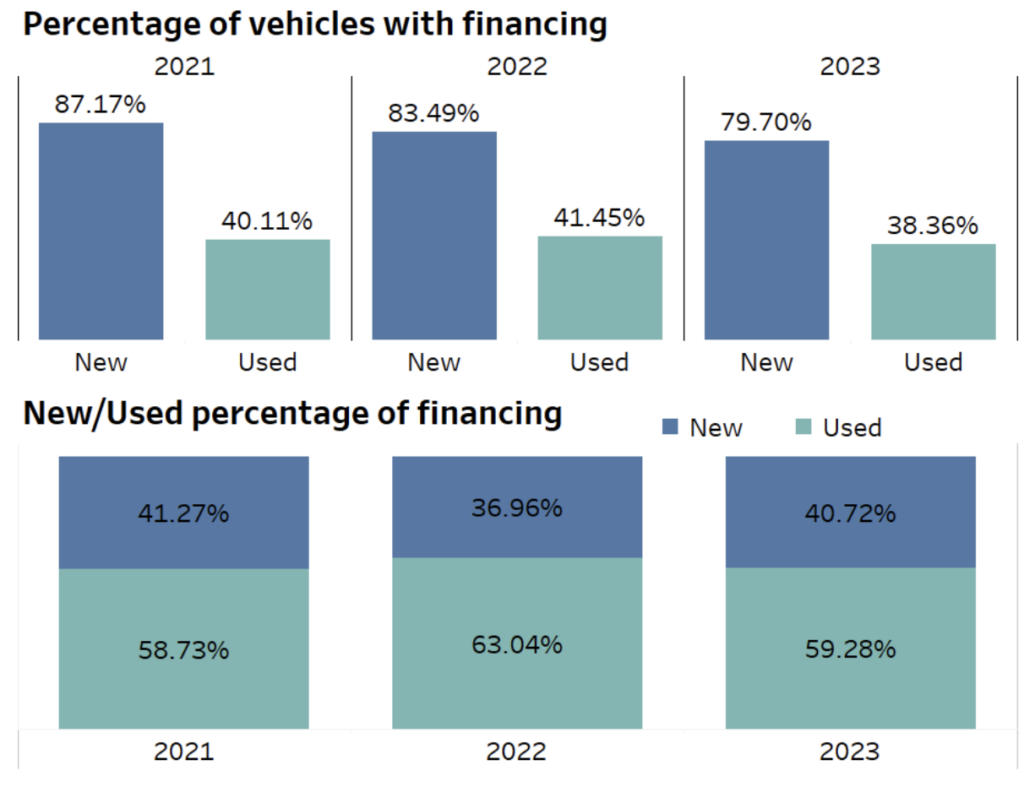

Cash is king in 2024, as it was last year. Fewer buyers are financing their cars as the cost of borrowing soars. Here’s a look at the latest stats, again courtesy of Experian:

In Q2 2023, 79.7% of new cars and 38.4% of used cars were financed. This is in comparison to last year’s figures of 83.5% for new car purchases, and 41.5% for used cars.

A concerning trend is the sidelining of consumers with lower credit scores from the used car market, largely due to persistent high auto finance rates. Subprime and deep subprime used car loans now make up just 22.04% of the market, down from 29.96% in 2020.

It’s crucial for today’s car buyers to know what they’re getting into when signing on the dotted line. Auto finance rates haven’t been this high in two decades. Many drivers are experiencing higher monthly payments driven by soaring interest rates for the first time. Those who are caught off guard are more likely to become delinquent, and may become the target of a vehicle repossession.

Stay informed and secure the best deal when you buy your next car with expert insights. Try CarEdge Data for behind the scenes market analysis. Looking for personalized help? Work 1:1 with a Car Coach to save the most, or have a quick chat when you schedule your first Consult call.

Buying a car doesn’t have to be miserable. Let us know how we can help you score big wins with your next ride!

More drivers are warming up to the idea of electric vehicles, yet, for many, the high purchase price of EVs is too much. On top of that, EVs depreciate faster than other types of cars, leaving many buyers without equity for years to come. The best electric vehicle leases provide a great way to avoid these two obstacles. By leasing, you experience the cutting-edge technology of EVs without the long-term financial commitment. By the time your lease ends, electric mobility will be miles ahead of today’s car models.

These aren’t just the cheapest EV leases available right now. Instead, we’ve curated this list of the BEST EV lease deals in April 2025. What’s the difference? All of these electric cars and SUVs offer fast charging, plenty of range, and high driver satisfaction. Note that these manufacturer lease offers exclude tax, title, and fees. The dealer sets the final price.

👉 Not sure if leasing is for you? Be sure to check out The Consumer’s Guide to Leasing.

Best Lease Deal: $179/month for 24 months with $3,999 due at signing.

The Kia EV6 is one of the fastest-charging EVs available today, period. In face, it’s the fastest-charging EV on sale in 2024 for under $50,000, on pace with the Hyundai IONIQ 5 and Tesla’s most affordable models. For those interested in buying, the EV6 is available with zero percent financing for 72 months right now.

This offer ends on 4/30/2025. See offer details.

Browse Kia EV6 listings with the power of local market data

Best Deal: $299/month for 36 months with $1,000 due at signing.

The Tesla Model 3 is still the king of EVs. Even as sales growth stalls, it’s still Tesla’s market. Legacy automakers can only hope for second place. The main Tesla advantages in 2025 are the vast Supercharger network, and the ease of over-the-air software updates for feature upgrades and recall fixes. The newly-refreshed Model Y is also available with great lease terms.

See offer details at Tesla.com.

Browse used Tesla listings before buying new

Best Lease Deal: $299/month for 24 months with $4,169 due at signing.

The Chevy Equinox EV is one of the best cheap EVs on sale in April 2025. InsideEVs recently awarded the Equinox EV with their ‘Breakthrough EV of the Year‘ award. Despite more recently arriving, the Equinox EV is outselling the Chevrolet Blazer EV by a wide margin. The Equinox EV also has 0.9% APR for 60 months for those wanting to buy.

This offer ends on 4/30/2025. See offer details.

Browse Equinox EV listings with the power of local market data

Best Lease Deal: Lease the Honda Prologue front-wheel drive Touring from $239/month for 24-36 months with just $3,199 due at signing.

Honda went from zero EV sales to having one of the top-selling models in America. This is a stark contrast with Toyota, who has struggled to sell the less impressive bZ4X electric crossover.

This offer ends on April 30, 2025. See offer details.

Browse Honda Prologue listings with the power of local market data

Leasing an EV is the best way to try out the electric vehicle lifestyle without the hefty price tag and long-term commitment. Our rundown of the top electric vehicle leases offers insights into deals that provide both value and quality.

👉 Tired of car buying hassles? Let a professional do it for you! Learn more about CarEdge Concierge, the most-trusted car buying service out there!

Stepping into a car dealership can feel like entering a high-stakes poker game, but with the right guidance, you can confidently call their bluff. CarEdge’s Ray Shefska lifts the veil on dealership tactics with secrets from his impressive 40+ year tenure in the industry. While maximizing profits is part of their playbook, you don’t have to be an unwitting participant. With CarEdge by your side, here are the pivotal questions and strategies to empower your negotiations.

Correct answer: I have a total out-the-door price in mind. I’d like to stay focused on that.

Wrong answer: Yes, I don’t want my monthly payment to be more than $700 per month.

Why: Once the dealer knows what your monthly payment goal is, they immediately start thinking about how much wiggle room they have for add-on products, incentives and other odds and ends of the deal. Once you share your desired monthly payment, you’ll be negotiating that number for the rest of the deal. This makes it alarmingly easy to lose sight of how much you’re actually paying for the car.

Correct answer: I just want to know what the out-the-door number is, can we stay focused on that for now?

Wrong answer: I think I could put between $5,000 and $10,000 down. It depends on what the price of the car is, and how much you give me for the trade-in.

Why: This question is another tactic the salesperson uses to turn you into a ‘payment buyer’. Yes, you’ll eventually have to tell them what your down payment is, but do NOT volunteer that information too early in the negotiation! Car dealership salespeople are going to.

Note: Often, the salesperson will phrase this question as if it’s coming from the bank. For example, “The bank typically wants you to put 20% cash down or more. Were you planning on doing that?” You can still refuse to answer this question early on in the conversation. Remember, you’re still trying to get the out-the-door price from them. That’s the number that matters.

Correct answer: I haven’t decided yet. Once we’ve established an out-the-door number, we can discuss things like that.

Wrong answer: Yes of course, how much can you give me for it?

Why: You should always treat buying a car and trading in as TWO separate transactions, because they truly are. See what your car is worth with offers from multiple online buyers here.

These are the questions you’re most likely to encounter at the finance office. For even more tips, examples and advice, see our Finance Office Cheat Sheet. It’s one of our many free resources!

Correct answer: I have thought about this and I’ve even been pre-approved with competitive credit unions, so I do understand what my loan terms should be in order to keep my payment affordable.

Wrong answer: No, I haven’t thought about it yet. Can you help me lower my payment even further?

Why: When you express uncertainty about your desired loan term, finance managers spot an opportunity to manipulate the loan term to make a deal appear more attractive. By extending the loan term, they can “lower” your monthly payments, even if it ends up costing you more in the long run due to interest.

Correct answer: Yes, if you can beat the rate I have on my pre-approval from the credit union, I’d consider it. The rate and the payment would need to come down enough to justify it.

Wrong answer: Sure! That sounds easier.

Why: Be sure to mention that your payment would need to come down in addition to getting a lower interest rate. Why? All too often, the finance manager can offer you a slightly lower interest rate, only to trick you into add-on products later, meaning that your monthly payment ends up the same or even higher than it was originally.

Are you interested in our tire care package for just $6 per month? Or theft protection for just $10 per month?

Correct answer: Thanks, but for each of these products, I need to see the total cost of the product, not just the monthly payment.

Wrong answer: Awesome, wow I see that this theft protection only adds $10 per month!

Why: Expect them to show you the monthly payment, not the total price of the products on their menu. You’ll have to ask for them to point out the total price. Remember this: A product that adds ‘just’ $10 to your monthly car payment over a 60-month loan term will actually cost you $600.

Would you pay $600 for something like tire protection or theft protection? Or, could you buy these products elsewhere for half the price? This is how you should think about the menu products.

The finance office is not the time to lose sight of the number that matters: the out-the-door price!

Familiarize yourself with car dealer fees and products with our complete introduction.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

Remember that when buying or leasing a car, knowledge is power!

Most car buyers don’t typically think of autumn as a great time to buy a car, but it’s the perfect time if you know where to look. Whether you’re planning to buy, hoping to sell, or are just curious about where the industry is headed, you’ve come to the right place. Buckle up as we steer you through the latest trends, from brand inventories and market conditions to financial forecasts. Let’s roll!

The new car market still hasn’t reached so-called ‘normal’. Will it ever? Only a fool would make bold predictions after what we’ve all witnessed this decade. However, let’s talk about what we do know.

This autumn, we’re seeing an increase in cars on the lot, yet a significant disparity persists between automakers in terms of inventory levels. The current industry average hovers just under 60 days in terms of Market Day Supply. Why should you care about Market Day Supply (MDS)? This metric is crucial when understanding how much bargaining power you might have at the dealership. Brands with a high MDS are more eager to shift their inventory, and therefore, more likely to negotiate on price.

In the present market, Infiniti, Chrysler, Lincoln, Ford, Dodge, Buick, and Jeep have high inventory levels. This makes them prime targets for savvy buyers looking to negotiate a better deal. Here’s a look at nationwide inventory for the most negotiable new car brands:

| Make | Market Day Supply (Nationwide 9/1/23) |

|---|---|

| Infiniti | 119 |

| Chrysler | 179 |

| Lincoln | 128 |

| Ford | 99 |

| Dodge | 190 |

| Buick | 113 |

| Jeep | 179 |

| Market Average | 72 |

As you can see, all of these brands are dealing with a surplus of new car inventory right now. The longer that a new car sits on a dealer’s lot, the more negotiable it becomes for the knowledgeable car buyer. Dealers pay ‘floorplanning costs’ to keep inventory, so every day cuts into their profit margins. Learn how to use this information to your advantage with this 100% free Car Buying Cheat Sheet.

On the flip side, if you’re looking at Kia, Honda, Subaru, Lexus, BMW, and Toyota, be prepared for a bit of a struggle. These brands are facing low inventory levels. In some instances, new arrivals are pre-sold before they even hit the lot!

Here’s nationwide inventory for these new cars:

| Make | Market Day Supply (Nationwide 9/1/23) |

|---|---|

| Kia | 35 |

| Honda | 33 |

| Subaru | 48 |

| Lexus | 50 |

| BMW | 49 |

| Toyota | 40 |

| Market Average | 72 |

See local car market data for every make and model with CarEdge Data.

Surprisingly, Subaru remains a brand that’s willing to negotiate even when their inventory is low. Let’s take a look at some examples of today’s Subaru inventory:

| Make | Model | Market Day Supply | Total For Sale |

|---|---|---|---|

| Subaru | Ascent | 66 | 6,992 |

| Subaru | Solterra | 82 | 2,092 |

| Subaru | Crosstrek | 61 | 18,096 |

| Subaru | Forester | 74 | 26,782 |

| Subaru | Outback | 80 | 24,836 |

| Subaru | Impreza | 63 | 4,031 |

| Subaru | Legacy | 58 | 3,498 |

| Subaru | WRX | 83 | 3,339 |

| Subaru | Brand Average | 71 | 89,879 |

Our Coaches frequently empower Subaru lovers with the skills to negotiate even low-inventory new and used Subaru models. Check out these success stories of what is possible!

These are the top trends that our team of Car Coaches are watching this fall season. Each of these variables has the potential to disrupt the new car market in significant ways.

Inventory Surge: The buildup of new car inventory has already begun, but the question remains, will it last into fall? With sky-high interest rates continuing to dominate buyer’s mindsets, we think it will. We predict a buildup of new vehicle inventory as we near the end of 2023, slowly but surely.

Manufacturer Incentives: Manufacturer incentive spending is at a two-year high, accounting for 4% of the transaction price on average. Brands like Ram and Jeep have recently advertised new models at 10-15% below MSRP. If manufacturers increased their incentives to pre-pandemic historical norms around 7-9%, that would entice more buyers to take action. We don’t expect automakers to raise incentives at such a rapid pace by winter, however.

The UAW Wildcard: There’s speculation of a 10-20 day UAW strike that could cause short-term hiccups. While we don’t expect this to be a game-changer, it’s something to keep an eye on. It would, however, be a bigger deal for automakers like Stellantis and General Motors. Analysts estimate that a 10-day strike would cost them about $5 billion.

CarEdge New Car Market Seasonal Rating: It’s a ‘fine’ time to buy a new car.

Better deals are anticipated this winter, but depending on what vehicle you’re in the market for, this autumn just might be the perfect time to negotiate a great deal.

While used car prices have slightly decreased, they are still far above historical averages. This means you’re unlikely to snag a bargain, especially if you’re gunning for a reliable vehicle with a clean history for under $20,000.

Pro Tip: Never enter the used car market blind. Always get a pre-purchase inspection (PPI) to understand the future maintenance needs and overall condition of the car.

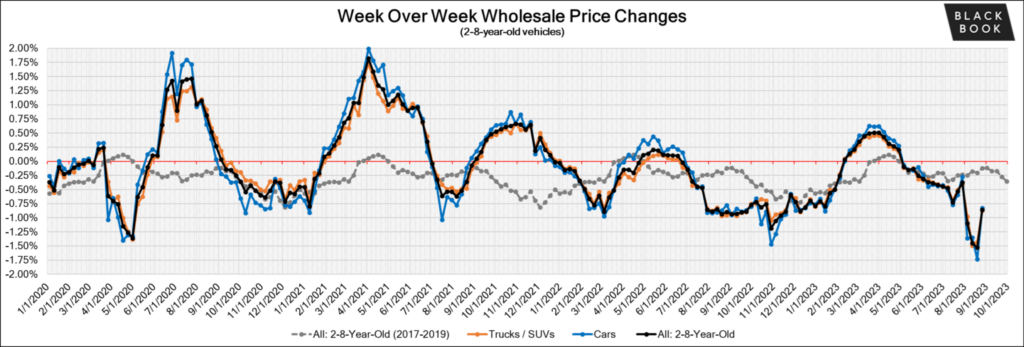

Trade-in values will continue to slowly decline as wholesale auction values are expected to keep falling. Following historically steep declines in wholesale used car prices in July and early August, we expect a more gradual decline in the fall.

Whereas used cars, trucks and SUV values were falling at a rate of -1.00% to -1.5% weekly as of last month, we expect weekly used car values to decline by around -0.5% to -0.3% for most of this season. Why? There’s no indication that a glut of used car inventory will arrive on the market any time soon to drive down values quickly.

The best used car sellers (especially those looking to trade-in) should hope for is slow but steady drops in value in September through November. You’re likely to get more for your trade-in or used car sale today than you will in a few months.

CarEdge Used Car Market Seasonal Rating: very difficult for buyers on a budget.

This is especially true if you’re looking for a vehicle of decent, reliable quality for under $20,000. Interest rates incentivize large down payments and cash buyers, but most of us don’t have the means to put $10,000 or $20,000 down.

No matter what, don’t give up. From free car buying resources to 1:1 expert help with your deal, the CarEdge team is here to help!

If you’re in the market for a new or used car, here’s our most important advice for you: Generally, say NO to market adjustments. A lot has changed since the madness and mayhem of late 2021 and early 2022. The exceptions are true specialty vehicles like Ford Bronco Raptor or Toyota RAV4 Prime, which are so in-demand that markups are almost a given.

For most new and used car models, there’s no way car dealers could justify additional markups in 2023. Staring down a tough deal? Work with a Car Coach to negotiate the BEST deal possible.

We’ll leave you with these reader favorites (100% free). Happy car shopping!